Vancouver, British Columbia (June 22, 2021) – Vizsla Silver Corp. (TSX-V: VZLA) (OTCQB: VIZSF) (Frankfurt: 0G3) (“Vizsla” or the “Company”) is pleased to provide the results of an additional fourteen drill holes from the Napoleon prospect at the Panuco silver-gold project (“Panuco” or the “Project”) in Mexico.

Highlights

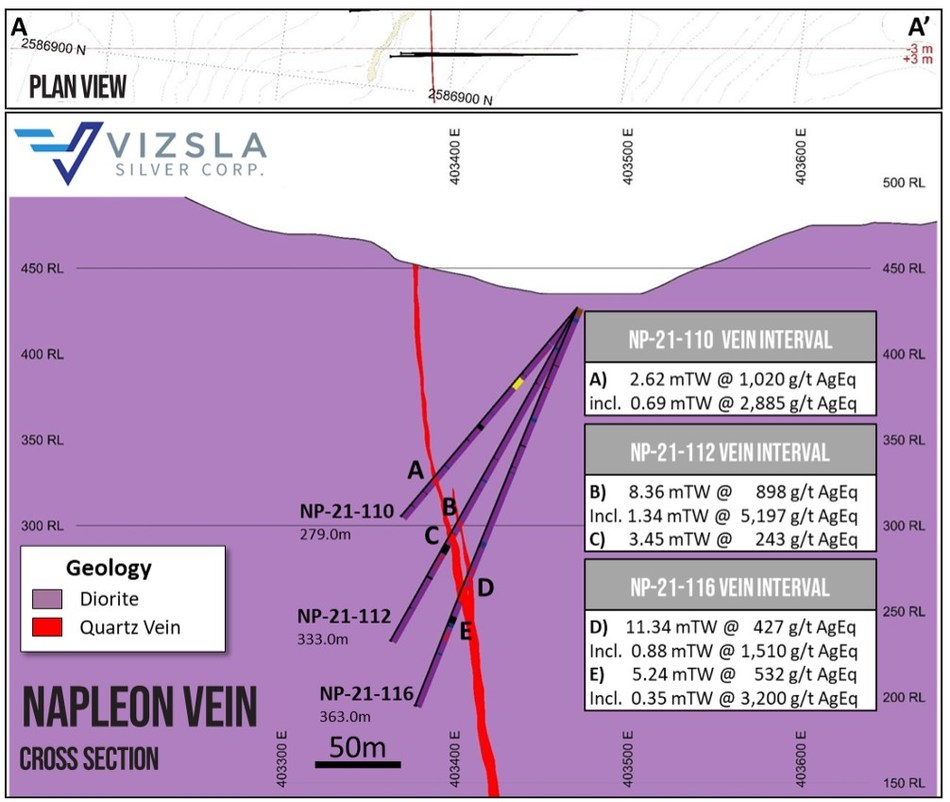

- Three holes completed 50 metres to the south of previous drilling average 7.44 metres true width (mTW) with a weighted average grade of 673 grams per tonne (g/t) silver equivalent

- Hole NP-21-112 returns 898 g/t silver equivalent over 8.36 mTW from 142.55 m including;

- 5,197 g/t silver equivalent over 1.34 mTW from 142.55 m

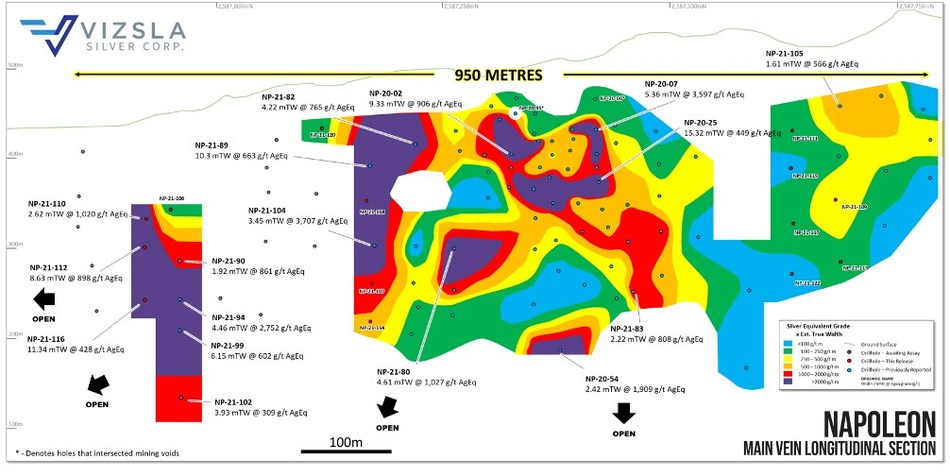

- Napoleon extended to over 950 m of continuous mineralization. Open to the south and at depth

Vizsla President and CEO, Michael Konnert, commented: “The southern end of Napoleon is proving to be consistently higher grade and wider than any part of the mineralized zone. Geological information suggests this may be the true core of the mineralization and it remains open to the south and at depth where the Company is actively drilling to further expand this large panel of mineralization. Current dimensions are 950 metres of strike by 350 metres deep and the zone forms part of the larger three-kilometre-long Napoleon Corridor that the Company is drilling. Vizsla is in the best shape since its inception and is continuing to deliver at the two areas of resource drilling, Napoleon and Tajitos, and other targets in the district including Cordon del Oro and the Animas Corridor. The Company is well-funded with over $89,000,000 in the bank and is moving to 10 drill rigs to continue to rapidly assess the growing potential of this high-grade silver-gold district.”

Napoleon Drilling Details

Drilling has almost infilled the two gap zones in the mineralized area at Napoleon and is defining an over 950m long panel of mineralization that appears to be shallowly plunging to the south. Drilling at the southern end of mineralized zone has extended the vein over 100m south, to 950m of strike, and assays received to date show consistent very high grades in this area.

The mineralization in the southern half of the zone generally displays better developed epithermal textures including colloform and cockade banding and rare quartz after bladed calcite. The presence of adularia, a consistently wide vein and a higher gold to silver ratio suggest this is the core of the mineralized zone.

An additional 15 holes have been completed in this mineralized panel and assays will continue to be reported as received. The Company intends to complete the 50 metre spaced drilling down to approximately 350 metres of depth to define the plunge of mineralization and then will continue with deeper holes to define the full extent of mineralization.

Drilling remains ongoing with five rigs continuing resource drilling and three rigs undertaking exploration. Assays are pending for five new targets across four vein corridors.

Complete table of Napoleon drill hole intersections

Note: All numbers are rounded. Silver equivalent is calculated using the following formula: Silver-equivalent = ((Au_g/t x 52.48) + (Ag_g/t x 0.5289) + (Pb_ppm x 0.0013) + (Zn_ppm x 0.0013)) / 0.5627. Metal price assumptions are $17.50 oz silver, $1,700 oz gold, $0.75 pound lead and $0.85 pound zinc, recoveries assumptions are 96% gold, 94% silver, 78% lead and 70% zinc based on similar deposit types.

Drill Collar Information

Stock Options

The Company would like to announce that it has granted a total 4,150,000 options to directors, officers, employees and consultants at a strike price of $2.31. They are exercisable for a period of five years and they will vest over the next two years. They are subject to the policies of the TSX Venture Exchange.

About the Panuco project

Vizsla has an option to acquire 100% of the newly consolidated 9,386.5-hectare Panuco district in southern Sinaloa, Mexico, near the city of Mazatlán. The option allows for the acquisition of over 75 kilometres of total vein extent, a 500 ton per day mill, 35 kilometres of underground mines, tailings facilities, roads, power and permits.

The district contains intermediate to low sulfidation epithermal silver and gold deposits related to siliceous volcanism and crustal extension in the Oligocene and Miocene. Host rocks are mainly continental volcanic rocks correlated to the Tarahumara Formation.

Quality Assurance / Quality Control

Drill core and rock samples were shipped to ALS Limited in Zacatecas, Zacatecas, Mexico and in North Vancouver, Canada for sample preparation and for analysis at the ALS laboratory in North Vancouver. The ALS Zacatecas and North Vancouver facilities are ISO 9001 and ISO/IEC 17025 certified. Silver and base metals were analyzed using a four-acid digestion with an ICP finish and gold was assayed by 30-gram fire assay with atomic absorption (“AA”) spectroscopy finish. Over limit analyses for silver, lead and zinc were re-assayed using an ore-grade four-acid digestion with AA finish.

Control samples comprising certified reference samples, duplicates and blank samples were systematically inserted into the sample stream and analyzed as part of the Company’s quality assurance / quality control protocol.

Qualified Person

The Company’s disclosure of technical or scientific information in this press release has been reviewed and approved by Martin Dupuis, P.Geo., Vice President of Technical Services for Vizsla Silver. Mr. Dupuis is a Qualified Person as defined under the terms of National Instrument 43-101.

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

SPECIAL NOTE REGARDING FORWARD LOOKING STATEMENTS

This news release includes certain “Forward–Looking Statements” within the meaning of the United States Private Securities Litigation Reform Act of 1995 and “forward–looking information” under applicable Canadian securities laws. When used in this news release, the words “anticipate”, “believe”, “estimate”, “expect”, “target”, “plan”, “forecast”, “may”, “would”, “could”, “schedule” and similar words or expressions, identify forward–looking statements or information. These forward–looking statements or information relate to, among other things: the development of Panuco, including drilling programs and mobilization of drill rigs; future mineral exploration, development and production; and completion of a maiden drilling program.

Forward–looking statements and forward–looking information relating to any future mineral production, liquidity, enhanced value and capital markets profile of Vizsla, future growth potential for Vizsla and its business, and future exploration plans are based on management’s reasonable assumptions, estimates, expectations, analyses and opinions, which are based on management’s experience and perception of trends, current conditions and expected developments, and other factors that management believes are relevant and reasonable in the circumstances, but which may prove to be incorrect. Assumptions have been made regarding, among other things, the price of silver, gold and other metals; no escalation in the severity of the COVID-19 pandemic; costs of exploration and development; the estimated costs of development of exploration projects; Vizsla’s ability to operate in a safe and effective manner and its ability to obtain financing on reasonable terms.

These statements reflect Vizsla’s respective current views with respect to future events and are necessarily based upon a number of other assumptions and estimates that, while considered reasonable by management, are inherently subject to significant business, economic, competitive, political and social uncertainties and contingencies. Many factors, both known and unknown, could cause actual results, performance or achievements to be materially different from the results, performance or achievements that are or may be expressed or implied by such forward–looking statements or forward-looking information and Vizsla has made assumptions and estimates based on or related to many of these factors. Such factors include, without limitation: the Company’s dependence on one mineral project; precious metals price volatility; risks associated with the conduct of the Company’s mining activities in Mexico; regulatory, consent or permitting delays; risks relating to reliance on the Company’s management team and outside contractors; risks regarding mineral resources and reserves; the Company’s inability to obtain insurance to cover all risks, on a commercially reasonable basis or at all; currency fluctuations; risks regarding the failure to generate sufficient cash flow from operations; risks relating to project financing and equity issuances; risks and unknowns inherent in all mining projects, including the inaccuracy of reserves and resources, metallurgical recoveries and capital and operating costs of such projects; contests over title to properties, particularly title to undeveloped properties; laws and regulations governing the environment, health and safety; the ability of the communities in which the Company operates to manage and cope with the implications of COVID-19; the economic and financial implications of COVID-19 to the Company; operating or technical difficulties in connection with mining or development activities; employee relations, labour unrest or unavailability; the Company’s interactions with surrounding communities and artisanal miners; the Company’s ability to successfully integrate acquired assets; the speculative nature of exploration and development, including the risks of diminishing quantities or grades of reserves; stock market volatility; conflicts of interest among certain directors and officers; lack of liquidity for shareholders of the Company; litigation risk; and the factors identified under the caption “Risk Factors” in Vizsla’s management discussion and analysis. Readers are cautioned against attributing undue certainty to forward–looking statements or forward-looking information. Although Vizsla has attempted to identify important factors that could cause actual results to differ materially, there may be other factors that cause results not to be anticipated, estimated or intended. Vizsla does not intend, and does not assume any obligation, to update these forward–looking statements or forward-looking information to reflect changes in assumptions or changes in circumstances or any other events affecting such statements or information, other than as required by applicable law.

Original Article: https://static1.squarespace.com/static/5e3853a120a02d4977c6db91/t/60d1da377bc67d02f44cfc59/1624365624404/2021-06-22_Napoleon+widens+to+south_V6.pdf