Vancouver, British Columbia –TheNewswire –November 7, 2019 – Vizsla Resources Corp. (TSXV:VZLA)(“Vizsla” or the “Company“) is pleased to announce the first results from the recently acquired Panuco precious metals district in Sinaloa, Mexico. Initial sampling has returned two significant intercepts over 1,000 grams per tonne silver equivalent. The sampling locations are underground at the San Carlos mine, directly beside the El Coco Mill, which is under option to the Company.

Sampling, as part of an overall mapping program, was undertaken as part of the Company’s due diligence in connection with the recently completed acquisition. This sampling was done on the most accessible area and provides the first set of results to come from the project. The results come from a small portion of the >75 kilometres of cumulative vein extent on the project over which the Company believes that there may be multiple high-grade mineralized zones.

Sampling Highlights

- – 612.3 grams per tonne (g/t) silver and 5.65 g/t gold, or 1,064 g/t silver equivalent over 6 metres on development level 4 including;

- – 1,120.0 g/t silver and 10.50 g/t gold, or 1,960 g/t silver equivalent over 3 metres

- – 516.7 g/t silver and 2.55 g/t gold, or 721 g/t silver equivalent over 4.5 metres on development level 5 including;

- – 721.0 g/t silver and 3.51 g/t gold, or 1,002 g/t silver equivalent over 3 metres

- – 298.3 g/t silver and 2.12 g/t gold, or 468 g/t silver equivalent over 5.5 metres on development level 4 including;

- – 591.0 g/t silver and 3.76 g/t gold, or 892 g/t silver equivalent over 1.5 metres

Note: All numbers are rounded. Silver equivalent (AgEq) is calculated by multiplying the gold grade by 80 and adding it to the silver grade. This calculation estimates 100% recovery

“We are very impressed by these initial first high-grade silver and gold sampling results from San Carlos which highlight the potential of the Panuco district. The sampling at San Carlos reveals what could be an attractive drill target with a mineralized vein evident in the lowest development level, just above the water table”commented Michael Konnert, President and Chief Executive Officer of Vizsla. “These workings represent only one of the 31 known past and current operating mines in the Panuco district that Vizsla has optioned. We continue to build on the high-grade potential of this district-scale opportunity.”

Click Image To View Full Size

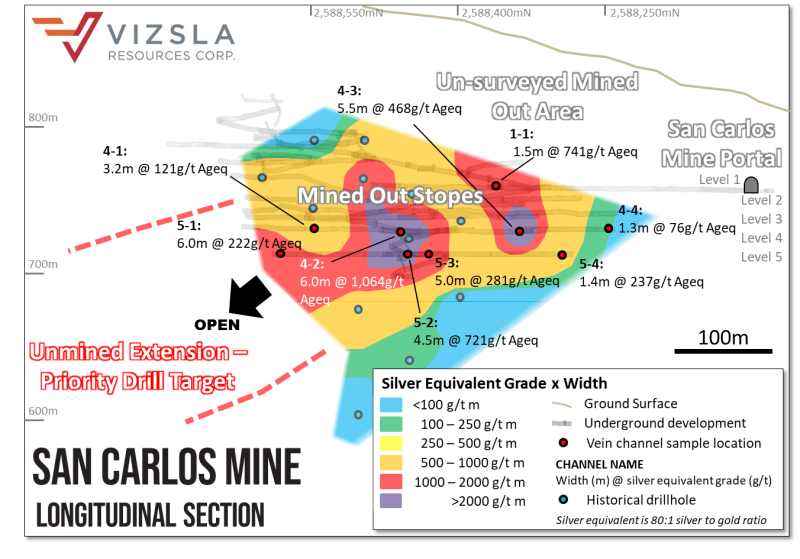

Figure 1: Longitudinal Section from the San Carlos mine with due diligence sampling results displayed and contoured by silver equivalent grade multiplied by width.

Click Image To View Full Size

Table 1: San Carlos due diligence sample results. Widths are considered true width intervals.

Due Diligence Program

The Company, through its wholly-owned subsidiary Canam, commenced a mapping and sampling program to better understand mineralization at Panuco. The program commenced at San Carlos with geological mapping and limited systematic sampling of the underground workings and is currently being extended across the property. Areas of interest, such as San Carlos, will be the focus of more systematic sampling ahead of a maiden drill program.

The San Carlos mine is located immediately east of the El Coco mill along the Animas vein trend. The mine has development on multiple levels over approximately 100 vertical metres with production ceasing beneath development level five due to the water table. Development levels extend for over 500 metres north-south and appear to be centred on a 50-100m long, moderate 50-60-degree westerly dipping, apparently northly plunging blow-out in the vein.

Both footwall and hanging wall is mapped as moderately to strongly, propylitically altered dacite with localised silicification. A clay altered fault with milled fragments of vein and wallrock runs the length of the developments and controls the emplacement of two phases of quartz veining. A generally lower grade white quartz vein with banded epithermal textures and a later grey breccia phase associated with high grades of silver and gold mineralization associated with argentite, acanthite, pyrite, lead and less common sphalerite and chalcopyrite.

Drilling was undertaken at San Carlos in the mid-2000’s by a subsidiary of Capstone Mining Corp. The significant additional mining that has been completed since this work has allowed more systematic sampling that suggests the drill target plunges more shallowly to the north where it remains open (Figure 1).

These historical assay results have not been verified by a qualified person and the company considers them superseded by the due diligence sampling reported in this release.

Figure 2: Plan map of development level 5 with geology and sample intersections plotted.

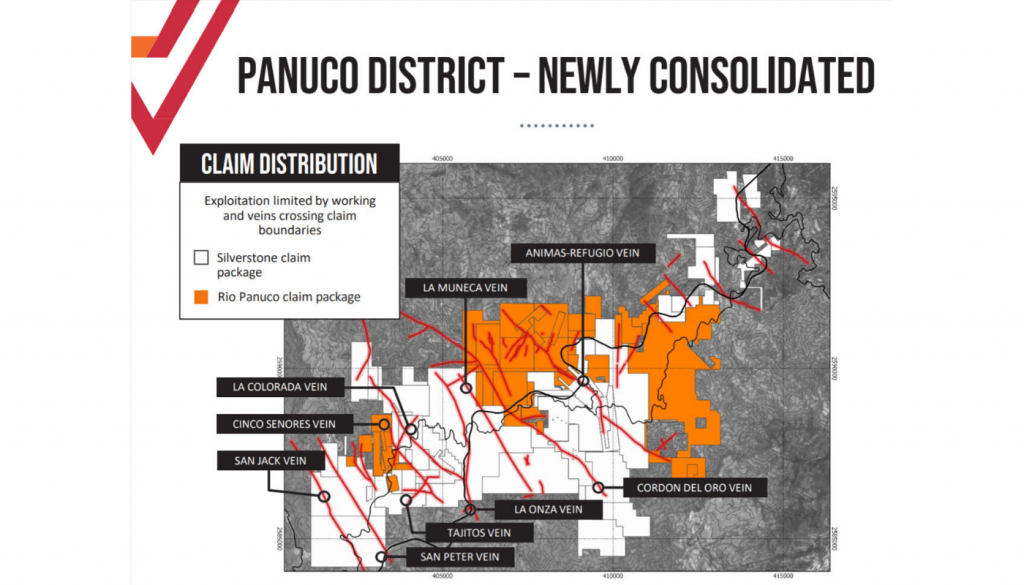

About the Panuco project

Vizsla has an option to acquire 100% of the newly consolidated 9,386.5 Ha Panuco district in southern Sinaloa, Mexico, in the Municipio of Concordia. The property covers the historic Panuco-Copala silver and gold mining district that has been in production for over 450 years. The option allows for the acquisition of a mill, mines, tailings facilities, roads, power and permits.

The district contains intermediate to low sulfidation epithermal silver and gold deposits related to siliceous volcanism and crustal extension in the Oligocene and Miocene. Host rocks are mainly continental volcanic rocks correlated to the Tarahumara Formation.

Qualified Person

The scientific and technical information in this news release has been prepared in accordance with the Canadian regulatory requirements set out in National Instrument 43-101 (Standards of Disclosure for Mineral Projects) and reviewed and approved on behalf of the Company by Michelle Robinson, MASc. P.Eng. a Qualified Person as defined by NI 43-101 (the “Qualified Person“).Rock samples discussed in this New Release were cut across oriented structures using a hammer and chisel onto a drop-bag. On the drop-bag, samples were crushed to about minus 1 inch between a pair of rock hammers, then rolled and quartered. Two to four kg of roughly homogenized material was collected in a double-plastic bag with the sample tag between bags with the number facing outwards. The bags were then sealed with zip ties. Information including the strike and dip of any structure (right-hand rule), width in decimeters, host rock type and alteration minerals/assemblages were recorded. If significant quartz textures and/or sulfides were present, these were noted. Maximum sample width was 1.5 meters. The samples were packed intorice bags and control samples including field duplicates, pulp duplicates, standard reference pulps and blanks were inserted into the sample stream. The samples were stored in a secure building in Concordia until enough samples were collected to form a batch. When a batch was prepared and tagged for shipping, these were sent via a commercial courier to the ALS sample preparation laboratory in Zacatecas. It is the opinion of the Qualified Person that the sampling methods, preparation and security are adequate.

ALS has a quality management system that meets all requirements of International Standards ISO/IEC 17025:2017 and ISO 9001:2015. At ALS, samples were dried, weighed and logged in, then crushed to 70% passing -2 mm. The sample was then split, and 250 grams were crushed until more than 85% was smaller than 75 microns. Prepared pulps were sent to the laboratory in North Vancouver, Canada for analysis. A 30 gram charge of the pulp was analyzed for gold using a fire assay with an AAS finish (Au-AA23). Detection limits for this method are between 0.005 ppm and 10 ppm. Samples with more than 10 ppm gold were re-assayed using a gravimetric finish (Au-GRA21). Other elements and silver were analyzed using a 0.25 gram charge of pulp digested in 4 acids (ME-ICP61). This method measures silver values between 0.5 and 100 ppm, and base metals between 2 and 10000 ppm. Samples with more than 100 ppm silver, or more than 10000 ppm Cu, Pb or Zn were reanalyzed using four acid overlimit methods (OG62). This method has an upper limit of 1500 ppm for silver. Samples with more than 1500 ppm Ag are re-analyzed using a fire assay of 30 grams of pulp with a gravimetric finish (Ag-GRA21). It is the Qualified Person’s opinion that the analytical procedures used are adequate.

The Qualified Person has checked the blank analyses and certified that no contamination between samples has occurred. Most gold and silver analyses from the standard pulps are within one standard deviation of the mean value, and all are within two standard deviations of the mean value. It is the Qualified Person’s opinion that the accuracy of the laboratory analyses is adequate. Analyses of field and pulp duplicates are mostly within 10%, but some show a larger variation due to the “nugget effect”, a phenomenon where a very small particle of precious metal-rich material can create a large variance in the assay result.

Contact Information:For more information and to sign-up to the mailing list, please contact:

Michael Konnert, President and Chief Executive Officer

Tel: (604) 838-4327

Email: [email protected]

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

SPECIAL NOTE REGARDING FORWARD LOOKING STATEMENTS

This news release includes certain “Forward-Looking Statements” within the meaning of the United States Private Securities Litigation Reform Act of 1995 and “forward-looking information” under applicable Canadian securities laws. When used in this news release, the words “anticipate”, “believe”, “estimate”, “expect”, “target”, “plan”, “forecast”, “may”, “would”, “could”, “schedule” and similar words or expressions, identify forward-looking statements or information. These forward-looking statements or information relate to, among other things: the development of Panuco including potential drill targets; existence of multiple high-grade mineralized zones; anticipated timing of future press releases; future mineral exploration, development and production including the commencement of drilling; timing of completion of a maiden drilling program and a maiden resource; liquidity, enhanced value and capital markets profile of Vizsla; future growth potential for Vizsla and its business; estimates regarding future production and future profitability; and completion of financing.

Forward-looking statements and forward-looking information relating to any future mineral production, liquidity, enhanced value and capital markets profile of Vizsla, future growth potential for Vizsla and its business, and future exploration plans are based on management’s reasonable assumptions, estimates, expectations, analyses and opinions, which are based on management’s experience and perception of trends, current conditions and expected developments, and other factors that management believes are relevant and reasonable in the circumstances, but which may prove to be incorrect. Assumptions have been made regarding, among other things, the price of silver, gold and other metals; costs of exploration and development; the estimated costs of development of exploration projects; Vizsla’s ability to operate in a safe and effective manner and its ability to obtain financing on reasonable terms.

These statements reflect Vizsla’s respective current views with respect to future events and are necessarily based upon a number of other assumptions and estimates that, while considered reasonable by management, are inherently subject to significant business, economic, competitive, political and social uncertainties and contingencies. Many factors, both known and unknown, could cause actual results, performance or achievements to be materially different from the results, performance or achievements that are or may be expressed or implied by such forward-looking statements or forward-looking information and Vizsla has made assumptions and estimates based on or related to many of these factors. Such factors include, without limitation: satisfaction or waiver of all applicable conditions to closing of the Acquisition including, without limitation, receipt of all necessary approvals or consents and lack of material changes with respect to Vizsla and Canam and their respective businesses, all as more particularly set forth in the Acquisition agreement; the synergies expected from the Acquisition not being realized; business integration risks; fluctuations in general macro-economic conditions; fluctuations in securities markets and the market price of Vizsla’s common shares; and the factors identified under the caption “Risk Factors” in Vizsla’s management discussion and analysis. Readers are cautioned against attributing undue certainty to forward-looking statements or forward-looking information. Although Vizsla has attempted to identify important factors that could cause actual results to differ materially, there may be other factors that cause results not to be anticipated, estimated or intended. Vizsla does not intend, and does not assume any obligation, to update these forward-looking statements or forward-looking information to reflect changes in assumptions or changes in circumstances or any other events affecting such statements or information, other than as required by applicable law.

NOT FOR DISTRIBUTION TO UNITED STATES NEWSWIRE SERVICES OR FOR DISSEMINATION IN THE UNITED STATES