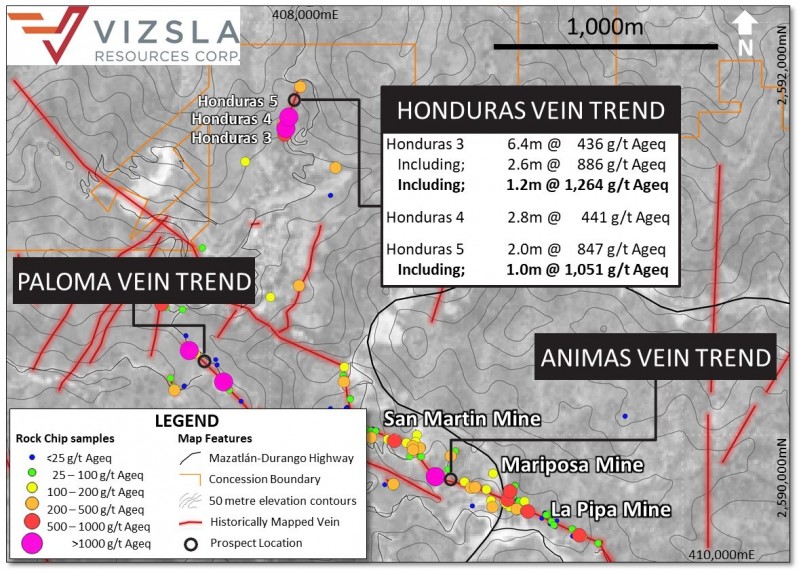

VANCOUVER, Feb. 4, 2020 /CNW/ – Vizsla Resources Corp. (TSX-V: VZLA) (“Vizsla” or the “Company“) is pleased to announce further surface sampling results from exploration in the Panuco silver-gold district in Mexico. Recent surface sampling of the new Honduras vein has returned high grades above minor historical workings over a 250-metre strike length. The vein trends northerly beneath younger cover rocks concealing its true length. The results make this an attractive target for the current 14,500 metre drilling program in progress.

Sampling Highlights

- 664 g/t silver equivalent (508.0 g/t silver and 1.95 g/t gold) over 2.0 metres at Honduras 5 – Honduras Vein including;

- 1,051 g/t silver equivalent (801.0 g/t silver and 3.12 g/t gold) over 1.0 metres

- 1,051 g/t silver equivalent (801.0 g/t silver and 3.12 g/t gold) over 1.0 metres

- 436 g/t silver equivalent (287.7 g/t silver and 1.86 g/t gold) over 6.4 metres at Honduras 3 – Honduras Vein including;

- 886g/t silver equivalent (580.5 g/t silver and 3.82 g/t gold) over 2.6 metres including;

- 1,264 g/t silver equivalent (784.0 g/t silver and 6.00 g/t gold) over 1.2 metres

| Note: All numbers are rounded. Silver equivalent (AgEq) is calculated by multiplying the gold grade by 80 and adding it to the silver grade. This calculation estimates 100% recovery of both metals. Widths are estimated to represent true widths. Equivalents are calculated using gold and silver grades and do not contain base metals. |

“Vizsla continues to deliver new high-grade veins across the district. We are conducting first pass drilling on multiple veins at Panuco to establish priorities for possible resource definition drilling. While that program proceeds, we are mapping and sampling the many veins in the district. That mapping continues to reveal areas of high-grade mineralization previously not known to us. The Honduras vein is one such locality.” President and CEO, Michael Konnert commented.

Charles Funk, VP Exploration stated “Mining on the Honduras vein appears to have been limited to 30-60 vertical metres depth due to ground water conditions. It is another vein that has never been drilled. We plan to add Honduras to the list of veins being tested in the drilling program that re-commenced in January.”

The Honduras vein was found during detailed mapping of northern extensions to the Animas vein corridor. The vein trends north-south and is near vertical. It is likely a splay splitting off the main Animas – Refugio structure. Historic mining from the late 1800’s exploited the vein over a vertical range of 30-60 metres, above the level of an active stream. Production to depth was limited by the surface water flow. An existing dirt road climbs up the hill to the east of the vein and appears to be well placed to locate drill pads.

The re-brecciated center of the vein is 0.4 to 1.0 metres wide and is composed of a grey quartz matrix and some grey quartz clasts. This is flanked by both massive vein quartz and a breccia phase with a white quartz matrix that again ranges from 1.0 to 4.0 metres wide. Local splays strike off the main vein into horse tail structures that trend some 10 to 20 metres into the wallrock. The intersections of these splays with the northwesterly veins are typically locations of higher-grade mineralization.

Sampling results along the Honduras Vein

| Vein | Prospect | Location | Width (m) | Silver (g/t) | Gold (g/t) | Silver Equivalent (g/t) |

| Honduras | Honduras 1 | Surface | 3.00 | 272.1 | 0.49 | 310.9 |

| Incl. | 1.50 | 454.0 | 0.65 | 505.6 | ||

| Honduras 2 | Surface | 2.60 | 137.7 | 0.43 | 172.1 | |

| Honduras 3 | Surface | 6.40 | 287.7 | 1.86 | 436.3 | |

| Incl. | 2.60 | 580.5 | 3.82 | 886.2 | ||

| Incl. | 1.20 | 784.0 | 6.00 | 1,264.0 | ||

| Honduras 4 | Surface | 2.80 | 324.4 | 1.46 | 440.8 | |

| Honduras 5 | Surface | 2.00 | 508.0 | 1.95 | 664.1 | |

| Incl. | 1.00 | 801.0 | 3.12 | 1,050.6 | ||

| Honduras 6 | Surface | 0.80 | 238.0 | 1.02 | 319.6 | |

| Honduras 7 | Surface | 3.30 | 91.7 | 0.45 | 128.0 | |

| Honduras 8 | Surface | 1.6 | 75.9 | 0.85 | 144.1 |

Table 1: Channel sample results from the Honduras Vein at Panuco. Silver equivalent (AgEq) is calculated by multiplying the gold grade by 80 and adding it to the silver grade. This calculation estimates 100% recovery of both metals. Widths are estimated to represent true widths.

Drill Campaign Update

Drilling is underway along the Animals-Refugio corridor. The Company has completed a total of three drill holes and is expecting assays back in March, 2020.

About the Panuco project

Vizsla has an option to acquire 100% of the newly-consolidated 9,386.5 Ha Panuco district in southern Sinaloa, Mexico, near the city of Mazatlán. The option allows for the acquisition of over 75 km of total vein extent, a 500 tpd mill, 35 kms of underground mines, tailings facilities, roads, power and permits.

The district contains intermediate to low sulfidation epithermal silver and gold deposits related to siliceous volcanism and crustal extension in the Oligocene and Miocene. Host rocks are mainly continental volcanic rocks correlated to the Tarahumara Formation.

Qualified Person

Michelle Robinson, MASc. P.Eng, is the Company’s designated Qualified Person within the meaning of National Instrument 43-101 Standards of Disclosure for Mineral Projects and has reviewed and approved its scientific and technical content on behalf of Vizsla.

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

SPECIAL NOTE REGARDING FORWARD LOOKING STATEMENTS

This news release includes certain “Forward‐Looking Statements” within the meaning of the United States Private Securities Litigation Reform Act of 1995 and “forward‐looking information” under applicable Canadian securities laws. When used in this news release, the words “anticipate”, “believe”, “estimate”, “expect”, “target”, “plan”, “forecast”, “may”, “would”, “could”, “schedule” and similar words or expressions, identify forward‐looking statements or information. These forward‐looking statements or information relate to, among other things: the development of Panuco, including potential drill targets; future mineral exploration, development and production including the identification of drill targets and commencement of drilling; and completion of a maiden drilling program.

Forward‐looking statements and forward‐looking information relating to any future mineral production, liquidity, enhanced value and capital markets profile of Vizsla, future growth potential for Vizsla and its business, and future exploration plans are based on management’s reasonable assumptions, estimates, expectations, analyses and opinions, which are based on management’s experience and perception of trends, current conditions and expected developments, and other factors that management believes are relevant and reasonable in the circumstances, but which may prove to be incorrect. Assumptions have been made regarding, among other things, the price of silver, gold and other metals; costs of exploration and development; the estimated costs of development of exploration projects; Vizsla’s ability to operate in a safe and effective manner and its ability to obtain financing on reasonable terms.

These statements reflect Vizsla’s respective current views with respect to future events and are necessarily based upon a number of other assumptions and estimates that, while considered reasonable by management, are inherently subject to significant business, economic, competitive, political and social uncertainties and contingencies. Many factors, both known and unknown, could cause actual results, performance or achievements to be materially different from the results, performance or achievements that are or may be expressed or implied by such forward‐looking statements or forward-looking information and Vizsla has made assumptions and estimates based on or related to many of these factors. Such factors include, without limitation: satisfaction or waiver of all applicable conditions to closing of the Acquisition including, without limitation, receipt of all necessary approvals or consents and lack of material changes with respect to Vizsla and Canam and their respective businesses, all as more particularly set forth in the Acquisition agreement; the synergies expected from the Acquisition not being realized; business integration risks; fluctuations in general macro‐economic conditions; fluctuations in securities markets and the market price of Vizsla’s common shares; and the factors identified under the caption “Risk Factors” in Vizsla’s management discussion and analysis. Readers are cautioned against attributing undue certainty to forward‐looking statements or forward-looking information. Although Vizsla has attempted to identify important factors that could cause actual results to differ materially, there may be other factors that cause results not to be anticipated, estimated or intended. Vizsla does not intend, and does not assume any obligation, to update these forward‐looking statements or forward-looking information to reflect changes in assumptions or changes in circumstances or any other events affecting such statements or information, other than as required by applicable law.