(All amounts expressed in U.S. Dollars unless otherwise stated)

TORONTO, Jan. 14, 2021 (GLOBE NEWSWIRE) — Today, Torex Gold Resources Inc. (the “Company” or “Torex”) (TSX: TXG) provides 2021 operational guidance.

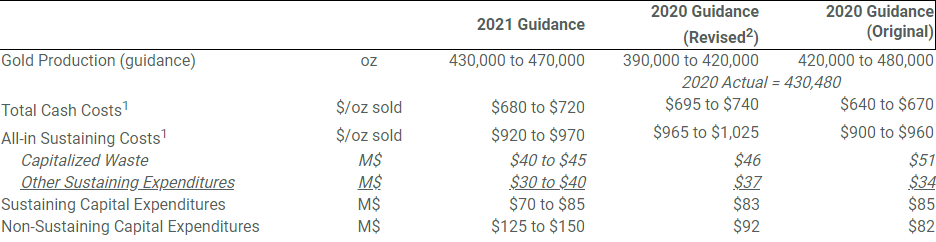

2021 OPERATIONAL OUTLOOK

1 Refer to “Non-IFRS Financial Performance Measures” in the Company’s September 30, 2020 MD&A for further information and a detailed reconciliation.

2 Operational guidance for 2020 was revised on August 5, 2020 following the impact of the mandated shutdown of operations by the Government of Mexico to mitigate the risk of COVID-19 in the country.

Jody Kuzenko, President and CEO of Torex, stated:

“As we continue our pattern of consistent and reliable operational performance on the heels of a guidance beat in 2020, we expect another year of strong cash flow in 2021. The strength of our underlying business will enable us to continue to execute on our plan – fully repay project debt and continue to strengthen our balance sheet, de-risk and advance Media Luna, and invest in other value accretive opportunities.

“2021 is all about setting the foundation for our future. As expected, our guidance for production, cash costs and sustaining capital is similar to years prior. The guided increase in non-sustaining capital expenditures year-over-year reflects strategic investments, including Media Luna, expanded development and exploration at ELG underground, a scoping-level study for a layback within the El Limón open pit, and ongoing field testing of Muckahi. Investment in Media Luna in 2021 is key to de-risking and delivering on the project schedule, as the early work of accessing the deposit, the feasibility study, and permitting activities continue to advance.

“Exploration will also be a key focus this year. At ELG underground, we are investing additional dollars to accelerate exploration as we look to extend the life of the ELG underground beyond the timeframe implied by current mineral reserves. At Media Luna, the infill drill program has been expanded with a view to increasing the proportion of mineral resources in the measured and indicated categories. We will also test several high priority targets within the broader Morelos land package as we look to find our next mine.

“We are working the plan to optimize and extend ELG into 2024 in order to create overlap with Media Luna coming into production in Q1 2024. With momentum on production, robust cashflow and an excellent plan for value creation in front of us, 2021 promises to be another exceptional year for Torex – both for our Company and our shareholders.”

2021 PRODUCTION OUTLOOK

Gold production in 2021 is expected to be between 430,000 ounces and 470,000 ounces, with the mid-point representing an increase over the 430,480 ounces delivered in 2020, which included an interruption in production in Q2 due to the COVID-19 pandemic. The mid-point of 2021 guidance is in line with original 2020 guidance and 2019 performance of 454,810 ounces.

The production outlook is provided in the context of COVID-19 developments in Mexico. At the mine site, the enhanced COVID-19 protocols that have been implemented and multi-layered approach to screening has helped mitigate the impact of COVID-19 on our operations, our workforce, and the surrounding communities to date. The same protocols will remain in place until the risks associated with the pandemic are fully resolved.

2021 COST OUTLOOK

Total cash costs and all-in sustaining cash costs are expected to be in-line with the levels delivered in 2020, with the difference relative to original 2020 guidance reflecting the impact of the higher revenue on employee profit sharing and government royalties, and the impact of higher gold prices on established land use agreements. Operational guidance in 2021 is predicated on an average gold price of $1,700 per ounce while 2020 original guidance was predicated on $1,400 per ounce. The assumption of a $300 per ounce higher gold price impacts costs by approximately $35 per ounce in 2021.

The strip ratio for 2021 is expected to be 7.6:1 versus the 2020 actual result of 6.7:1. Of the amount of waste mined during the year, approximately 35% will be capitalized with the remainder expensed.

2021 CAPITAL EXPENDITURE OUTLOOK

Sustaining capital expenditures are guided at $70 million to $85 million, of which $40 million to $45 million is related to capitalized waste. The midpoint of sustaining capital guidance for 2021 is relatively in line with the levels delivered in 2020. Sustaining capital expenditures are related to ongoing development of the ELG underground, rebuilding of the open pit fleet, and other projects to maintain and improve the efficiency of the processing plant.

Non-sustaining capital expenditures are guided at $125 million to $150 million, with the year-over-year increase primarily driven by additional investment in Media Luna. The remainder of guided expenditures are earmarked for ELG, including completion of Portal 3, ongoing development of the ELD deposit, field testing Muckahi, and exploration.

Investment in Media Luna is guided between $90 million and $100 million. A majority of the guided spend ($60 million to $65 million) relates to a full year of development of the 7 kilometre long Guajes tunnel (including development, equipment purchases and other infrastructure) and commencement of the South Portal, which allows for access to the upper portions of the deposit from the south side. These two projects are key for delivering first production in Q1 2024. An additional $14 million will be invested in an expanded infill drill program and a further $12 million to advance the feasibility study. The remaining spend relates to environmental and permitting costs. Spending on Media Luna will increase in 2022 and peak in 2023, with a moderate spend in 2024 to finalize construction and commissioning.

Investment in Muckahi field testing is guided at $8 million. Upon completion of testing, we expect to have feasibility quality data relating to expected increased production rates and reduced unit costs.

2021 CASH FLOW SEASONALITY

The Company does not anticipate any significant seasonality in production in 2021, with any minor quarter-over-quarter deviations driven by the natural variability of skarn-hosted deposits.

However, given timing of payments, we expect cash flow from operations to be weighted towards the second half of the year as was the case in 2020. Cash flow from operations in Q1 will be impacted by payment of the Mexican based Mining Tax (accrued throughout the year and paid out the following March) as well as Corporate Income Tax owing at year-end, after accounting for monthly installments made during 2020. Taxes paid will be reflected in cash flow from operations prior to changes in non-cash working capital. In Q2, we expect cash flow from operations after changes in non-cash working capital to be impacted by payment of our employee profit sharing, which is accrued through the year and paid out in full by May the following year.

ABOUT TOREX GOLD RESOURCES INC.

Torex is an intermediate gold producer based in Canada, engaged in the mining, developing and exploring of its 100% owned Morelos Gold Property, an area of 29,000 hectares in the highly prospective Guerrero Gold Belt located 180 kilometres southwest of Mexico City. The Company’s principal assets are the El Limón Guajes mining complex (“ELG” or the “ELG Mine Complex”), comprising the El Limón, Guajes and El Limón Sur open pits, the El Limón Guajes underground mine including zones referred to as Sub-Sill and ELD, and the processing plant and related infrastructure, which commenced commercial production as of April 1, 2016, and the Media Luna deposit, which is an early stage development project, and for which the Company issued an updated preliminary economic assessment in September 2018 (the “Technical Report”). The property remains 75% unexplored.

FOR FURTHER INFORMATION, PLEASE CONTACT:

TOREX GOLD RESOURCES INC.

Jody Kuzenko, President and CEO

Direct: (647) 725-9982

jody.kuzenko@torexgold.com

Dan Rollins, Vice President, Corporate Development & Investor Relations

Direct: (647) 260-1503

dan.rollins@torexgold.com

QUALIFIED PERSON

Scientific and technical information contained in this news release has been reviewed and approved by Clifford Lafleur, P.Eng., Director, Resource Management and Mine Engineering of Torex and a Qualified Person under NI 43‑101.

CAUTIONARY NOTES

MUCKAHI MINING SYSTEM

The Technical Report includes information on Muckahi. It is important to note that Muckahi is experimental in nature and has not yet been tested in an operating mine. Since the date of the Technical Report, the majority of the components of the Muckahi system have been tested by Torex and their functionality demonstrated. Although, the components have not yet been tested together as a system to demonstrate the rates per day in which tunnels can be excavated and material removed from long hole open stopes. This final stage of testing is underway and will be completed in the coming months. Drill and blast fundamentals, standards and best practices for underground hard rock mining are applied in the Muckahi system as described in of the Technical Report, where applicable. The proposed application of a monorail system for underground transportation for mine development and production mining is unique to underground hard rock mining. There are existing underground hard rock mines that use a monorail system for transportation of materials and equipment, however not in the capacity of Muckahi which is described in detail the Technical Report. The mine design, equipment performance and cost estimations involving Muckahi in the Technical Report are conceptual in nature, and do not demonstrate technical or economic viability.

FORWARD LOOKING INFORMATION

This news release contains “forward-looking statements” and “forward-looking information” within the meaning of applicable United States and Canadian securities legislation. Forward-looking information also includes, but is not limited to: expectation of a continued pattern of consistent and reliable operational performance; expectation of another year of strong cash flow in 2021; expectation that the strength of the underlying business will enable the Company to execute on its plan as set out in the news release; setting the foundation for the Company’s future; guidance for 2021 production, cash costs and sustaining capital; the guided increase in non-sustaining capital expenditures year-over-year reflects strategic investments as set out in the news release; expectation that the investment in Media Luna in 2021 is key to de-risking and delivering on the project schedule as the early work of accessing the deposit, the feasibility study, and permitting activities advance; plans for exploration will also be a key focus this year; plans to invest additional dollars at the ELG underground to accelerate exploration as we look to extend the life of the ELG underground beyond the timeframe implied by current mineral reserves; the planned expansion of the Media Luna the infill drill program with a view to increasing the proportion of mineral resources in the measured and indicated categories; plans to test a number of high priority targets within the broader Morelos land package as the Company looks to find the next mine; plans to optimize and extend ELG into 2024 in order to create overlap with Media Luna coming into production in Q1 2024; expectation of momentum on production, robust cashflow and the plan for organic value creation in front of the Company; expectation that 2021 promises to be another exceptional year for Torex and its shareholders; gold production in 2021 is expected to be between 430,000 ounces and 470,000 ounces; plans to continue with the same COVID-19 protocols, as described in the news release, until the risks associated with the pandemic are fully resolved; total cash costs and all-in sustaining cash costs are expected to be in-line with the levels delivered in 2020, with the difference relative to original 2020 guidance reflecting the impact of the higher revenue on employee profit sharing, government royalties and land use agreements; operational guidance in 2021 predicated on an average gold price of $1,700; the strip ratio for 2021 is expected to be 7.6:1; expectation that approximately 35% of waste mined in 2021 will be expensed with the remainder capitalized; sustaining capital expenditures are guided at $70 million to $85 million, of which $40 million to $45 million is related to capitalized waste; the anticipated sustaining capital expenditures as described in the news release; non-sustaining capital expenditures are guided at $125 million to $150 million; expectation that the guided non-sustaining capital expenditures will be spent as described in the news release; investment in Media Luna is guided between $90 million and $100 million; the expectation that a such investment will be spent as described in the news release; expectation that spending on Media Luna will increase in 2022 and peak in 2023, with a moderate spend in 2024 to finalize construction and commissioning; investment in Muckahi field testing is guided at $8 million; the expectation that the Company will have feasibility quality data on Muckahi relating to increased production rates and reduced unit costs, upon completion of testing; and, no expectation of any significant seasonality in production in 2021, with quarter-over-quarter deviations driven by the natural variability of skarn-hosted deposits; and, expectation that cashflow from operations will be weighted towards the second half of 2021 and in Q1 2021, will be impacted by the payments described in the news release. Generally, forward-looking information can be identified by the use of forward-looking terminology and phrases such as “plans”, “expects”, “believes”, “future”, “intends”, “look to”, “view to”, “promises to be”, “guided”, “earmarked”, “timeline”, “schedule” or variations of such words and phrases or state that certain actions, events or results “will” or “will not” occur. Forward-looking information is subject to known and unknown risks, uncertainties and other factors that may cause the actual results, level of activity, performance or achievements of the Company to be materially different from those expressed or implied by such forward-looking information, including, without limitation, the inability of the Company’s mining and exploration operations to operate as intended due to shortage of skilled employees, shortages in supply chains, inability of employees to access sufficient healthcare, significant social upheavals, government or regulatory actions or inactions, and those risk factors identified in the Technical Report and the Company’s annual information form and management’s discussion and analysis or other unknown but potentially significant impacts. Notwithstanding the Company’s efforts, there can be no guarantee that the Company’s measures to protect employees and surrounding communities from COVID-19 during this period will be effective. Forward-looking information are based on the assumptions discussed in the Technical Report and such other reasonable assumptions, estimates, analysis and opinions of management made in light of its experience and perception of trends, current conditions and expected developments, and other factors that management believes are relevant and reasonable in the circumstances at the date such information is made. Although the Company has attempted to identify important factors that could cause actual results to differ materially from those contained in the forward-looking information, there may be other factors that cause results not to be as anticipated. There can be no assurance that such information will prove to be accurate, as actual results and future events could differ materially from those anticipated in such information. Accordingly, readers should not place undue reliance on forward-looking information. The Company does not undertake to update any forward-looking information, whether as a result of new information or future events or otherwise, except as may be required by applicable securities laws.

Original Article: https://www.globenewswire.com/news-release/2021/01/14/2158463/0/en/Torex-Gold-Provides-2021-Operational-Outlook.html