Tocvan Ventures Corp (TOC:CSE) is pleased to announce the company has completed all necessary due diligence and has finalized their option agreement dated September 22nd with Colibri Resource Corp. The agreement allows Tocvan to acquire up to 100% interest in the Pilar project located in Sonora Mexico. The Pilar project is located within the historic Sonora gold district within the Sierra Madre Occidental geological province, host to epithermal gold-silver and porphyry copper deposits. Pilar is accessible by road and is geographically located 140km south-east of the city of Hermosillo.

Under the terms of the agreement Tocvan has now advanced the first year’s cash payment of $125,000 to Colibri and issued 2,000,000 common shares of Tocvan to Colibri Resource corp. Under the terms of the agreement Tocvan must now complete $2,000,000 of exploration on the property over five years, advance Colibri an additional $275,000 over the 5-year period with $50,000 due on the 1st anniversary date of the agreement and $75,000 due on the 3rd, 4th and 5th anniversary dates. Tocvan will also issue an additional 1,000,000 shares of the corporation to Colibri on the 3rd, 4th and 5th anniversary dates. Once the above is satisfied Tocvan will have earned a 51% interest in the property and have the option to acquire the additional 49% interest by making a further $2,000,000 payment to Colibri Resource Corp. within in 6 months of fulfilling the obligations listed above.

During the due diligence period management analyzed all available data collected to date, met with former exploration managers, completed a detailed search of tenure on concessions, and conducted a thorough site visit. Management now believe firmly that the Pilar property represents tremendous potential for a proven economic resource in the short term and the host the potential for a multimillion- ounce discovery.

Mark Smethurst, a Director of Tocvan, commented:

“This is one of the more exciting properties I’ve come across in my career. The Pilar property has the right features and system to allow for great potential in defining a multimillion-ounce property.”

About the Pilar Project

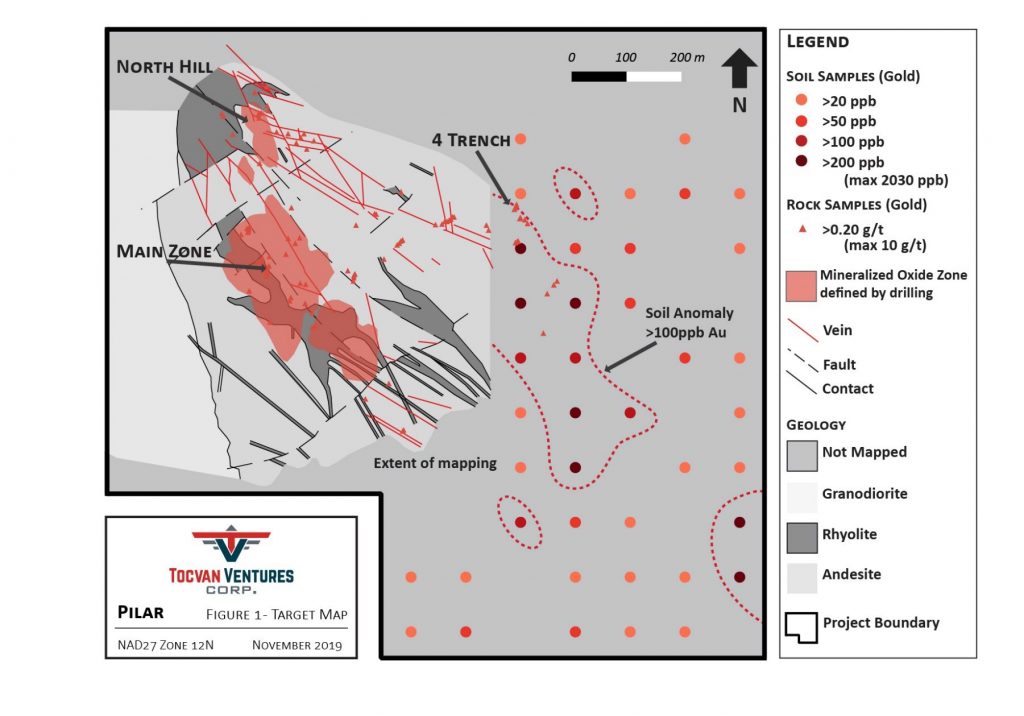

The Pilar Gold Project consists of low-sulfidation epithermal mineralization in oxidized rhyolite and andesite host rock. Three zones of mineralization have been identified from surface work and drilling and are referred to as the Main Zone, North Hill and 4 Trench (Figure 1). Soil sampling along trend of the three known zones indicates a continuation of mineralization to the southeast (Figure 1).

Key Points on Pilar:

- 17,700m of Core & RC drilling. Highlights shown in Table 1.

- 2,650m of surface and trench

channel sampling. Highlights include:

- 55g/t Au over 3m

- 28.6g/t Au over 6m

- 3.39 g/t Au over 50m

- Up to 92% recovery of oxide gold from preliminary metallurgical studies;

- Soil sampling in undrilled areas indicating mineralization southeast of Main Zone and 4 Trench.

Figure 1. Project map of Pilar showing mineralized oxide zones defined by drilling and soil sample results.

Table 1. Drill highlights from the oxide gold mineralization zones at Pilar. Intervals are length-weighted and uncapped. Intervals are calculated based on gold equivalent cut-off and less than 5 meters of dilution below the cut-off grade. Gold equivalent (AuEq) is calculated based on $1250/oz gold and $16/oz silver.

| Target | Hole ID | From (m) | To (m) | Width* (m) | Au (g/t) | Ag (g/t) | AuEq (g/t) | AuEq Cut-off | AuEq x Width (g/t x m) |

2018 Drilling Highlights

| Main Zone | JES-18-3 | 117.0 | 130.5 | 13.5 | 5.64 | 21.5 | 5.91 | 0.2 | 79.8 |

| Incl. | 117.0 | 118.5 | 1.5 | 33.40 | 49.9 | 34.04 | 10 | 51.1 | |

| Main Zone | JES-18-19 | 43.5 | 73.5 | 30.0 | 0.91 | 2.1 | 0.94 | 0.2 | 28.2 |

| Main Zone | JES-18-24 | 34.5 | 82.5 | 48.0 | 0.87 | 1.5 | 0.89 | 0.2 | 42.5 |

| Incl. | 57.0 | 58.5 | 1.5 | 17.30 | 0.9 | 17.31 | 10 | 26.0 | |

| Main Zone | JES-18-25 | 72.0 | 75.0 | 3.0 | 5.40 | 3.0 | 5.44 | 0.2 | 16.3 |

2010-2013 Drilling Highlights

| 4 Trench | JESP-18 | 19.80 | 50.30 | 30.50 | 0.69 | NA | 0.69 | 0.2 | 21.0 |

| North Hill | JESP-21 | 1.50 | 13.70 | 12.20 | 0.83 | NA | 0.83 | 0.2 | 10.1 |

| Main Zone | JESP-12-3 | 10.67 | 33.53 | 22.86 | 0.31 | 0.4 | 0.32 | 0.2 | 7.3 |

| and | 71.63 | 92.96 | 21.33 | 0.46 | 0.5 | 0.47 | 0.2 | 10.0 | |

| Main Zone | JESP-12-4 | 15.24 | 35.05 | 19.81 | 0.90 | 0.6 | 0.91 | 0.2 | 18.0 |

| and | 54.86 | 62.48 | 7.62 | 1.45 | 2.8 | 1.49 | 0.2 | 11.3 | |

| Incl. | 56.39 | 57.91 | 1.52 | 5.89 | 2.9 | 5.93 | 5 | 9.0 | |

| Main Zone | JESP-13-08 | 52.50 | 85.50 | 33.00 | 0.35 | 8.5 | 0.46 | 0.2 | 15.1 |

| Main Zone | JESP-13-09 | 54.00 | 76.50 | 22.50 | 0.65 | 2.0 | 0.67 | 0.2 | 15.2 |

| Main Zone | JESP-13-15 | 40.50 | 75.00 | 34.50 | 1.27 | 9.4 | 1.39 | 0.2 | 48.1 |

| Incl. | 42.00 | 45.00 | 3.00 | 9.52 | 27.5 | 9.87 | 5 | 29.6 | |

| and | 84.00 | 105.00 | 21.00 | 0.83 | 1.1 | 0.85 | 0.2 | 17.8 | |

| Incl. | 91.50 | 93.00 | 1.50 | 7.36 | 1.4 | 7.38 | 5 | 11.1 |

1996-1997 Drilling Highlights**

| Main Zone | P-8 | 4.5 | 69.0 | 64.5 | 0.51 | 5.2 | 0.58 | 0.2 | 37.1 |

| Incl. | 67.5 | 69.0 | 1.5 | 12.86 | 200.0 | 15.42 | 10.0 | 23.1 | |

| Main Zone | P-9b | 57.0 | 69.0 | 12.0 | 7.75 | 35.3 | 8.21 | 0.5 | 98.5 |

| Incl. | 58.5 | 66.0 | 7.5 | 12.41 | 56.4 | 13.13 | 5.0 | 98.5 | |

| Main Zone | PP-8c | 6.0 | 22.5 | 16.5 | 0.91 | 0.8 | 0.92 | 0.2 | 15.1 |

| and | 33.0 | 58.5 | 25.5 | 1.13 | 1.8 | 1.16 | 0.2 | 29.5 | |

| Incl. | 33.0 | 42.0 | 9.0 | 2.78 | 2.6 | 2.81 | 0.5 | 25.3 | |

| Main Zone | R-8 | 19.5 | 25.5 | 6.0 | 2.19 | 14.8 | 2.38 | 0.5 | 14.3 |

| and | 46.5 | 60.0 | 13.5 | 3.06 | 29.4 | 3.43 | 0.2 | 46.4 | |

| Incl. | 46.5 | 52.5 | 6.0 | 6.60 | 62.8 | 7.40 | 0.5 | 44.4 | |

| Incl. | 48.0 | 51.0 | 3.0 | 10.93 | 116.5 | 12.42 | 5.0 | 37.3 | |

| North Hill | S-10 | 48.0 | 69.0 | 21.0 | 38.17 | 38.1 | 38.66 | 0.2 | 811.9 |

| Incl. | 52.5 | 58.5 | 6.0 | 131.09 | 118.7 | 132.61 | 10.0 | 795.6 | |

| 4 Trench | K-16 | 0.0 | 7.5 | 7.5 | 3.31 | 31.3 | 3.71 | 0.5 | 27.8 |

*Drill widths are reported as drilled thicknesses. Due to varying drill hole orientations, true widths of mineralized intervals are between

30 and 100% of the reported lengths. ** No historic core or chips are available to confirm the results

from drilling between 1996 and 1997. Original assay

forms were used to confirm

the grades and widths reported by Santa Cantalina Mining.

About Tocvan Ventures Corp. Tocvan is a well-structured exploration mining company. Tocvan was created in order to take advantage of the prolonged downturn the junior mining exploration sector, by identifying and negotiating interest in opportunities where management feels they can build upon previous success. Tocvan Ventures Currently has approximately 10.8 million shares outstanding and is earning into two exiting opportunities. The Pilar Gold project in the Sonora state of Mexico and the Rogers Creek project in Southern British Columbia, Management feels both opportunities represent tremendous opportunity.

The technical information in this news release has been prepared or approved by Mark Smethurst, P.Geo., Independent Director, of the Company, and a “qualified person” within the meaning of National Instrument 43-101 – Standards of Disclosure for Mineral Projects.

Cautionary Statement Regarding Forward Looking Statements

This news release contains “forward-looking information” which may include, but is not limited to, statements with respect to the activities, events or developments that the Company expects or anticipates will or may occur in the future. Forward-looking information in this news release includes statements regarding the use of proceeds from the Offering. Such forward-looking information is often, but not always, identified by the use of words and phrases such as “plans”, “expects”, “is expected”, “budget”, “scheduled”, “estimates”, “forecasts”, “intends”, “anticipates”, or “believes” or variations (including negative variations) of such words and phrases, or state that certain actions, events or results “may”, “could”, “would”, “might” or “will” be taken, occur or be achieved.

These forward-looking statements, and any assumptions upon which they are based, are made in good faith and reflect our current judgment regarding the direction of our business. Management believes that these assumptions are reasonable. Forward-looking information involves known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements of the Company to be materially different from any future results, performance or achievements expressed or implied by the forward-looking information. Such factors include, among others, risks related to the speculative nature of the Company’s business, the Company’s formative stage of development and the Company’s financial position.

Forward-looking statements contained herein are made as of the date of this news release and the Company disclaims any obligation to update any forward-looking statements, whether as a result of new information, future events or results, except as may be required by applicable securities laws. There can be no assurance that forward-looking information will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on forward-looking information.

For more information please contact:

Derek Wood

President/CEO

Tocvan Ventures Corp.

800-825 8th Ave SW

Calgary AB T2P 2T3

O 403-668-7855

C 403-200-3569

[email protected]

www.tocvan.ca

Original Article: https://tocvan.com/wp-content/uploads/2019/11/TOCVAN-Ventures-Corp_NR_20191126-004.pdf