VANCOUVER, BC, Oct. 5, 2022 /PRNewswire/ – Tarachi Gold Corp. (CSE: TRG) (OTCQB: TRGGF) (Frankfurt: 4RZ) (“Tarachi” or the “Company“) is pleased to release the final metallurgy results for its Magistral Mill and Tailings Project (“Magistral” or “Project“) in Mexico. The final stages of metallurgical test work, to support engineering and design of the planned modifications to the existing Magistral Mill, were completed at SGS Lakefield (“SGS“) and Base Metallurgy Labs (“Base Met“). Results include the expected copper, silver, gold, zinc and mercury recovery efficiencies under various parameters and composition of final concentrate products. The final testing report was received from SGS on September 30th.

Highlights:

- Up to 99.9% of copper in solution precipitated into high-grade SART concentrate.

- More gold expected to report to Merrill-Crowe circuit for greater metal value payability compared to assumptions used in PEA.

- Lower mercury CN-solubility than previously assumed and potential for 2-stage SART process to remove mercury from concentrate.

“We are excited to have completed the testing phase at Magistral and are very pleased with the results of the SART work,” commented Cameron Tymstra, CEO. “These results demonstrate the ability of the planned SART circuit to remove the copper from the Project’s pregnant leach solution so that the gold can be recovered using the mill’s existing Merrill-Crowe system. With the metallurgy work behind us, our team now has the data necessary to proceed with final engineering and design of the planned Magistral mill additions.”

SART Testing Procedures

The test work completed at SGS is specific to the SART (sulphidation, acidification, recycling and thickening) circuit that Tarachi intends to add to the existing facility at Magistral, which is consistent with the development plan outlined in the Preliminary Economic Assessment (“PEA“) (see press release dated Dec. 13th, 2021). The SART circuit is intended to remove copper, mercury and silver from the pregnant leach solution to allow the gold to be recovered downstream in the existing Merrill-Crowe system. Metals precipitated out during the SART process are expected to be collected as a high-grade copper concentrate to be sold as a by-product revenue stream for the project.

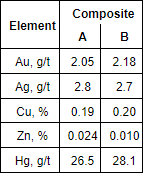

Pregnant cyanide leach solution was first produced by leaching 10kg charges of the composite tailings material for 48 hours at 40% solids, pH of 11.5 and a cyanide concentration of 2 g/L NaCN. Two sets of pregnant leach solution were generated, each from a different composite sample. Head assays of the tailings composites are shown in Table 1. Composite material was ground to a target P80 grind size of 75μm.

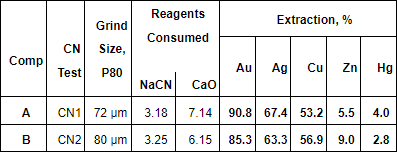

Metal extraction and reagent consumption from the cyanide leaching of the two composites can be found in Table 2. These results are consistent with previous leaching test work completed in 2021.

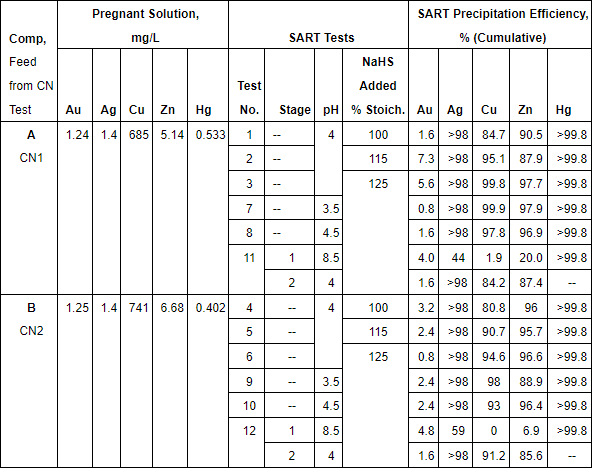

SART testing on the pregnant leach solution was conducted at ambient temperatures with a retention time of 20 minutes. Individual SART tests were run at various pH levels and NaHS additions to determine optimal levels for copper, silver, zinc, and mercury precipitation. Two-stage precipitation with a higher pH primary stage and lower pH secondary stage was also tested and determined that all of the mercury could be precipitated out in the first stage, to produce a cleaner final copper concentrate in the second stage.

SART Testing Results

The SART test work has demonstrated that up to 99.9% of the copper in Composite A and 98% of the copper in Composite B could be precipitated out of solution in ideal conditions. For project planning purposes it will be assumed that a pH of 4.5 and NaHS addition of 125% would result in copper precipitation of 95.4%. Tests #1-10 were single-stage SART tests and tests #11-12 were two-stage SART tests. Results of the individual tests are in Table 3.

Test data also showed that 2% of gold in solution is expected to precipitate out into the SART concentrate, significantly less than the 8.9% assumed in the PEA. This is expected to result in more gold reporting to the Merrill-Crowe circuit where it can ultimately be sold with stronger payability as doré than in concentrate.

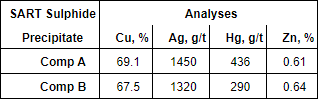

The small masses of precipitates generated from SART tests 1-10 were combined and submitted for analysis of key elements, the results of which are in Table 4.

Mercury Solubility

Additional assays on the previous tailings composite heads and tails after cyanide leaching were performed with an average mercury recovery in solution of 22%. This is a significant reduction compared to the 50% mercury-solubility assumed in the PEA. Lower mercury solubility is expected to result in lower Hg content of the final SART copper concentrate and lower smelter penalties.

Solid-Liquid Separation

Dynamic thickening tests were performed on the tailings composites to determine the underflow densities that could be expected from Magistral’s existing thickeners in the counter-current decantation (“CCD“) circuit. This test work was conducted at BaseMet. Underflow densities achieved were slightly less than the figures assumed in the PEA, resulting in expected CCD recovery efficiency of 92.6% compared to CCD efficiency of 95.7% used in the PEA. The net result is a small reduction in global gold recovery to 78.2% compared to 80.7% in the PEA. Some of the project revenue reduction expected from lower total gold production is expected to be offset by lower mercury smelter penalties and higher gold payability with a greater share of gold production in doré.

About Tarachi Gold

Tarachi Gold is a Canadian-listed junior gold exploration company focused on exploring and developing projects in Mexico. Tarachi acquired the Magistral Mill and tailings project in Durango, Mexico in 2021. Magistral includes a 1,000 tpd mill and access to a tailings deposit with Measured and Indicated resources of 1.26 million tonnes at a grade of 1.93g/t Au (December 2021 PEA, NI 43-101 compliant). The Company expects to bring the asset into production in early 2023.

The Company is also exploring on their highly prospective mineral concessions in the Sierra Madre gold belt of Sonora, Mexico in close proximity to Alamos Gold’s Mulatos mine and Agnico Eagle’s La India mine.

Qualified Person

Lorne Warner, P.Geo, VP Exploration and Director of the Company is a qualified person as defined by National Instrument 43-101 and has reviewed and approved the scientific and technical disclosure in this news release.

SPECIAL NOTE REGARDING FORWARD LOOKING STATEMENTS

This news release includes certain “Forward–Looking Statements” within the meaning of the United States Private Securities Litigation Reform Act of 1995 and “forward–looking information” under applicable Canadian securities laws. When used in this news release, the words “anticipate”, “will”, “believe”, “estimate”, “expect”, “hope”, “target”, “plan”, “forecast”, “may”, “would”, “could”, “schedule”, “potential” and similar words or expressions, identify forward–looking statements or information. These forward–looking statements or information relate to, among other things: the receipt of lab results, design and engineering schedules, future production, future cashflows, future mill performance, development of mining assets, securing project funding, securing off-take partners, acquisition of additional assets, and the submission of permits.

Forward–looking statements and forward–looking information relating to any future mineral production, liquidity, timing of completion of reports and studies, enhanced value and capital markets profile of Tarachi, future growth potential for Tarachi and its business, and future exploration plans are based on management’s reasonable assumptions, estimates, expectations, analyses and opinions, which are based on management’s experience and perception of trends, current conditions and expected developments, and other factors that management believes are relevant and reasonable in the circumstances, but which may prove to be incorrect. Assumptions have been made regarding, among other things, the price of silver, gold and other metals; no escalation in the severity of the COVID-19 pandemic; costs of exploration and development; the estimated costs of development of exploration projects; Tarachi’s ability to operate in a safe and effective manner and its ability to obtain financing on reasonable terms.

These statements reflect Tarachi’s respective current views with respect to future events and are necessarily based upon a number of other assumptions and estimates that, while considered reasonable by management, are inherently subject to significant business, economic, competitive, political and social uncertainties and contingencies. Many factors, both known and unknown, could cause actual results, performance or achievements to be materially different from the results, performance or achievements that are or may be expressed or implied by such forward–looking statements or forward-looking information and Tarachi has made assumptions and estimates based on or related to many of these factors. Such factors include, without limitation: the Company’s dependence on one mineral project; precious metals price volatility; risks associated with the conduct of the Company’s mining activities in Mexico; regulatory, consent or permitting delays; risks relating to reliance on the Company’s management team and outside contractors; risks regarding mineral resources and reserves; the Company’s inability to obtain insurance to cover all risks, on a commercially reasonable basis or at all; currency fluctuations; risks regarding the failure to generate sufficient cash flow from operations; risks relating to project financing and equity issuances; risks and unknowns inherent in all mining projects, including the inaccuracy of reserves and resources, metallurgical recoveries and capital and operating costs of such projects; contests over title to properties, particularly title to undeveloped properties; laws and regulations governing the environment, health and safety; the ability of the communities in which the Company operates to manage and cope with the implications of COVID-19; the economic and financial implications of COVID-19 to the Company; operating or technical difficulties in connection with mining or development activities; employee relations, labour unrest or unavailability; the Company’s interactions with surrounding communities and artisanal miners; the Company’s ability to successfully integrate acquired assets; the speculative nature of exploration and development, including the risks of diminishing quantities or grades of reserves; stock market volatility; conflicts of interest among certain directors and officers; lack of liquidity for shareholders of the Company; litigation risk; and the factors identified under the caption “Risk Factors” in Tarachi’s management discussion and analysis. Readers are cautioned against attributing undue certainty to forward–looking statements or forward-looking information. Although Tarachi has attempted to identify important factors that could cause actual results to differ materially, there may be other factors that cause results not to be anticipated, estimated or intended. Tarachi does not intend, and does not assume any obligation, to update these forward–looking statements or forward-looking information to reflect changes in assumptions or changes in circumstances or any other events affecting such statements or information, other than as required by applicable law.

SOURCE Tarachi Gold Corp.

Original Article: https://www.prnewswire.com/news-releases/tarachi-receives-final-metallurgy-results-for-magistral-301641454.html