VANCOUVER, BC / ACCESSWIRE / August 28, 2023 / Southern Empire Resources Corp. (“Southern Empire”; TSX-V:SMP) announces that it has entered into an agreement (the “Agreement”) with Cuprum Mining Corporation (“Cuprum”), an arm’s length private Canadian company, that grants Southern Empire the opportunity to acquire up to a one hundred percent (100%) interest in the share capital of Cuprum, and thereby a 100% beneficial interest in Cuprum’s Suaqui Verde Copper Project (“Suaqui Verde” or the “Project”) that comprises certain mineral tenements located in the mining-friendly State of Sonora in northwestern México.

Suaqui Verde Copper Project and Agreement Highlights:

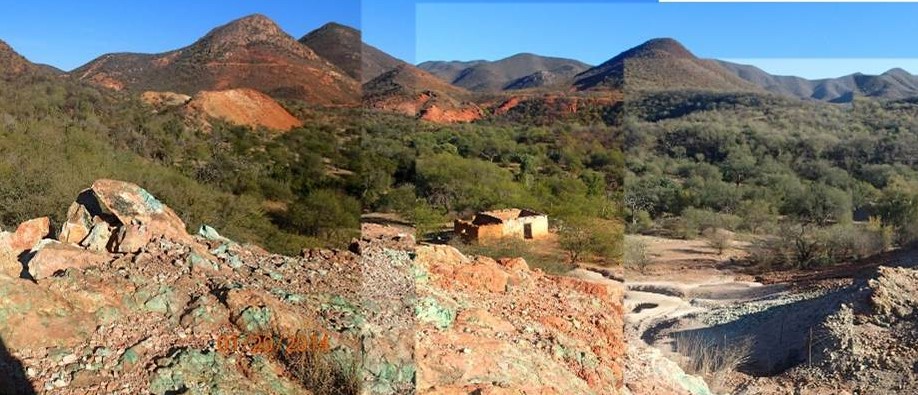

- The Suaqui Verde copper deposit comprises oxide copper and secondarily enriched copper sulphide mineralization that outcrops at surface and is outlined by approximately 106 historical Reverse Circulation (“RC”) and core drill holes

- The Suaqui Verde copper deposit is within the world-class Sonora-Arizona porphyry copper province

- Cuprum’s mineral concessions cover approximately 1,952 hectares (“ha”; ~4,823 acres) of Suaqui Grande Municipality in the mining-friendly State of Sonora in northwestern México

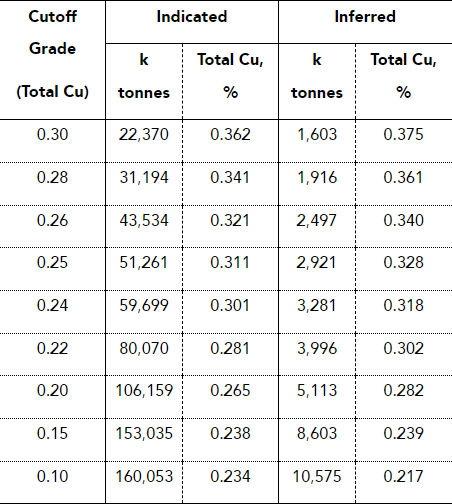

- The Suaqui Verde copper deposit has been the subject of a series of unpublished, historical open pit mineral resource estimates, the most recent prepared by Independent Mining Consultants, Inc. (“IMC”) of Tucson, Arizona (see Table 1 and the Cautionary Notice Regarding the Suaqui Verde Copper Project Historical Resource Estimate, below)

- The Agreement provides for water usage rights and unfettered access to the ranch land surface rights that cover the immediate area of the Suaqui Verde copper deposit

- There is good access to the Project area, ~140 kilometres (“km”; 87 miles) southeast of the city of Hermosillo (metropolitan population ~ 850,000) and 116 km (~72 miles) from the port city of Guaymas

- Local infrastructure and workforce is available in the nearby town of Suaqui Grande (8 km; 5 miles)

- Potential development scenarios may include lower-cost open pit mining and bulk heap leaching, or alternatively, in-situ leaching; both possibilities potentially leading to cathode copper production through solvent extraction-electro winning SX/EW processing methods

Dale Wallster, CEO of Southern Empire, stated: “With Suaqui Verde, I believe that our team can create significant near-term value for Southern Empire shareholders. Copper, which has just been added to the U.S. Department of Energy’s List of Critical Materials, is now often referred to as the ‘new green metal’ as the electrification and decarbonisation of the world will not happen without it. Suaqui Verde presents an exciting opportunity for Southern Empire to enter the green metals arena by acquiring a little-known copper oxide deposit in mining-friendly Sonora.Southern Empire will be able to immediately capitalize on the substantial investments of previous operators as we investigate the significant exploration potential to expand the Suaqui Verde copper deposit at depth. The case for future development is very compelling, especially with the possible implementation of either conventional heap leach processing or innovative in-situ leaching processing.“

Geology and Copper Mineralization of the Suaqui Verde Area

The Suaqui Verde Copper Project area covers an outcropping, oxidized porphyry copper deposit located in the world-class Sonora-Arizona porphyry copper province (also known as the “Laramide” or the “Southwestern North America” porphyry copper province) where more than twenty porphyry copper-molybdenum deposits have been mined for decades.

Porphyry copper provinces are time-space clusters of porphyry copper deposits. The Sonora-Arizona porphyry copper province comprises adjacent parts of the American states of Arizona, New Mexico and Texas, and the Mexican states of Sonora, Chihuahua, northern Sinaloa, and Baja California. This province contains the world’s second largest copper endowment; an estimated total (production + reserves + resources) of 295 million tonnes, 96% of which is in deposits of Laramide age (∼80-45 million years; “Ma”). The province was particularly fertile between 69 and 54 Ma, bracketing the Suaqui Verde deposit mineralization, which is dated at 57.0 ±0.3 Ma (Barra et al, 2005).

The Suaqui Verde copper deposit area has been explored by minor underground development and about 150 historical, mostly vertical RC and core drill holes completed by companies including: American Smelting and Refining Company (ASARCO in the 1940s; now part of Grupo México, S.A.B. de C.V.); Industrias Peñoles, S.A.B. de C.V. (in 1964); Minera Constelación, S.A. de C.V. (Cominco Ltd. in 1971-1972; now Teck Resources Limited); Duval Corp.; Azco Mining Inc. (“AZCO” in 1991); Cambior Inc. (“Cambior” in1992-1994; now Iamgold Corporation); Phelps Dodge Corporation (“Phelps Dodge” in 1996; now Freeport-McMoRan Inc.) and Minera Corum S.A. de C.V. (“Minera Corum” in 2006-2007; now Cuprum). Overburden is generally shallow and the first 50 meters of the copper mineralized zone often returns poor drill recoveries. Copper mineralized zones are known to continue laterally beyond the drill-defined limits of the deposit and only a few Phelps Dodge drill holes started to explore the copper potential at depth.

The geology of the Suaqui Verde project area is similar to other calc-alkaline porphyry-style copper deposits of the region, featuring a multi-phase intermediate (silicic) Laramide age intrusive complex intruding Cretaceous andesitic rocks of the Tarahaumara formation.

Supergene oxidation, leaching and enrichment have modified the character and position of Suaqui Verde copper mineralization creating an irregular zone of copper oxides, which may reach depths of up to 350 meters. Supergene copper mineralization consists of a mix of chrysocolla ((Cu,Al)2H2Si2O5(OH)4·nH2O), chalcocite (Cu2S), brochantite (Cu4SO4(OH)6) and minor malachite (Cu2CO3(OH)2) and libethenite (Cu2PO4OH). Chrysocolla and chalcocite are regarded as the most desired mineral species for potential extraction of copper by leach processes. Limonitic copper minerals include cupro-hematite and other metallic gangue minerals include hematite, goethite, jarosite and the manganese oxide, neotocite.

Hypogene mineralization comprises pyrite (FeS2), chalcopyrite (CuFeS2), and molybdenite (MoS2). Gypsum is common along fractures especially near sulphide-bearing areas.

Historical metallurgical test work indicates that Suaqui Verde copper mineralization should be amenable to either conventional open pit mining and heap leach copper extraction, or alternatively, in-situ leaching. If either of these operational methods were to be implemented, they would produce a copper-enrichedsolution from which high-purity cathode copper could subsequently be produced by SX-EW (solvent extraction-electrowinning) processing.

In 2008, an independent, historical open pit mineral resource estimate was prepared as an internal report for Cuprum by Independent Mining Consultants, Inc. (“IMC”) of Tucson, Arizona. IMC’s unpublished, historical open pit mineral resource estimate, at selected cut-off grades and based on 106 total drill holes completed between 1991 and 2007, is set out in Table 1.

Table 1: IMC’s Suaqui Verde Historical (2008) Open Pit Mineral Resource Estimates at Selected Cutoff Grades:

Please refer to the “Cautionary Notice Regarding the Suaqui Verde Copper Project Historical Resource Estimate” below.

Geological mapping and structural interpretation, drilling and satellite alteration mapping (ASTER) suggest the Suaqui Verde copper porphyry system has been structurally tilted to the northeast, supporting the potential for deeper sulphide zones extending at depths below historical drilling.

Location, Access and Infrastructure

Suaqui Verde is in the Municipality of Suaqui Grande approximately 140 km southeast of the city of Hermosillo, the capital city of Sonora, México (metropolitan area population ~880,000). The deep water port city of Guaymas is approximately 116 km from the Project.

Suaqui Grande is a town located 8 km (5 miles) west of Suaqui Verde that was founded in 1620 by the Spanish missionary Martín Burgencio. Access to Suaqui Grande is by national paved highway from Hermosillo. The Suaqui Verde mineral tenements are accessible throughout by a network of unimproved roads. Given the arid local climate and minimal annual rainfall, these gravel roads remain in good condition year-round.

Suaqui Grande can provide all basic infrastructure required for project assessment, including electricity, water, housing, office and secure core storage facilities and internet communications.

Material Terms of Southern Empire’s Agreement to Acquire up to One Hundred Percent of Cuprum

The Agreement and the obligations of Southern Empire pursuant to the Agreement shall be subject to:

- acceptance by the TSX Venture Exchange (the “Exchange”) of any and all filings required to be made with the Exchange in respect of the Option and/or the herein subject matter;

- receipt of a title opinion showing that, unless specifically acknowledged and accepted otherwise by SMP, the mineral concessions that comprise the Suaqui Verde Copper Project are free and clear of all charges, encumbrances and claims;

- there being no adverse environmental liabilities or reclamation costs regarding the Suaqui Verde Copper Project unless specifically acknowledged and accepted by SMP;

- if necessary, the entry into an agreement required by the laws of Mexico in connection with the Option or ownership of the Suaqui Verde Copper Project; and

- the approval of the board of directors of SMP

Southern Empire will give notice to Cuprum of its intention to proceed on the date that it satisfies the foregoing conditions precedent (the “Completion Date”).

Pursuant to the Agreement and subsequent to the Completion Date, Southern Empire, at its sole election, may exercise the Option to acquire up to a one hundred percent (100%) shareholding in Cuprum as follows:

- Southern Empire may acquire a ten percent (10%) interest in Cuprum by:

- paying CAD $500,000 pro-rata to the Cuprum Shareholders, within 90 days of the Completion Date.

- issuing 7,500,000 common shares in the capital of SMP, pro-rata to the Cuprum Shareholders, within 90 days of the Completion Date;

- Southern Empire may acquire an additional ten percent (10%) interest in Cuprum (being an aggregate twenty percent (20%) interest in Cuprum) by:

- paying an additional CAD $250,000 pro-rata to the Cuprum Shareholders on, or before, 15 months of the Completion Date;

- issuing an additional 7,500,000 common shares in the capital of SMP, pro-rata to the Cuprum Shareholders on, or before, 15 months of the Completion Date;

- incurring CAD $750,000 of Exploration Expenditures within 15 months of the Completion Date.

- Southern Empire may acquire an additional ten percent (10%) interest in Cuprum (being an aggregate thirty percent (30%) interest in Cuprum) by:

- Paying an additional CAD $500,000 pro-rata to the Cuprum Shareholders, on, or before, 30 months of the Completion Date;

- incurring another CAD $750,000 of Exploration Expenditures (being a total of CAD $1,500,000 of Exploration Expenditures) within 30 months of the Completion Date.

- Southern Empire may acquire an additional ten percent (20%) interest in Cuprum (being an aggregate fifty percent (50%) interest in Cuprum) by:

- paying an additional CAD $500,000 pro-rata to the Cuprum Shareholders, on, or before, 45 months of the Completion Date;

- incurring another CAD $750,000 of Exploration Expenditures (being a total of CAD $2,250,000 of Exploration Expenditures) within 45 months of the Completion Date.

- Southern Empire may acquire an additional forty percent (50%) interest in Cuprum (being an aggregate one hundred percent (100%) interest in Cuprum) by:

- paying an additional CAD $750,000 pro-rata to the Cuprum Shareholders, on, or before, 60 months of the Completion Date;

- incurring another CAD $1,000,000 of Exploration Expenditures (being a total of CAD $3,250,000 of Exploration Expenditures) within 60 months of the Completion Date.

Southern Empire may extend the date to incur any of the above-noted Exploration Expenditures by six months by making a payment of US$100,000.

During the term of the Agreement, Southern Empire will act as operator.

A Net Smelter Return Royalty of up to 2% may be payable subsequent to commercial production being achieved on the Suaqui Verde Copper Project.

Work planned for the Suaqui Verde Copper Project includes additional drilling, sampling and metallurgical analysis, re-assaying samples of historical drill core intervals (if available), resurveying drill hole collar locations, claims and surface lands, reviews of historical drill core logs and a check of original assay certificates against the reported assays and drill hole database.

Qualified Person (QP)

The scientific and technical information contained in this news release has been prepared, reviewed and approved by David Tupper, P.Geo. (British Columbia), Southern Empire’s VP Exploration and a Qualified Person (QP)within the context of Canadian Securities Administrators’ National Instrument 43-101; Standards of Disclosure for Mineral Projects (NI 43-101).

About Southern Empire Resources Corp.

Southern Empire is engaged in the acquisition, exploration and development of metals and minerals deposits in the American southwest and northern México; particularly focused on those that are amenable to lower-cost metal extraction methodologies such as heap leaching. To achieve its goals, Southern Empire has assembled a board of directors, all veterans in mine and corporate finance, exploration, permitting, development, and operations that will guide the future growth of the company.

In the Cargo Muchacho mountains of Imperial County, California, Southern Empire’s wholly-owned Oro Cruz Project has the potential to re-establish gold production from a moderate tonnage oxide gold deposit located approximately 22.5 kilometres (14 miles) southeast of the operating Mesquite gold mine of Equinox Gold Corp., which has now produced more than five million ounces. At Oro Cruz, extensive historical drilling and large-scale open-pit and underground mining of the American Girl, Padre y Madre, Queen and Cross oxide gold deposits by the American Girl Mining Joint Venture (AGMJV) of MK Gold Company and Hecla Mining Company occurred between 1987 and 1996. During that time, gold was recovered by heap leaching of lower-grade ores and milling of higher-grade ores. Following significant definition drilling and underground development, the Oro Cruz open-pit and underground mines operated successfully for only one year (producing about 61,000 ounces of gold) AGMJV operations ceased in late 1996 as collapsing gold prices caused the entire operation to be shuttered and decommissioned, leaving the Oro Cruz property with many gold exploration targets in addition to a historical inferred resource estimate, reported In 2011 by Lincoln Mining Corp., totalling 341,800 ounces gold based on 4,386,000 tonnes averaging 2.2 grams gold per tonne at a cut-off grade of 0.68 g/t Au (4,835,000 tons at 0.07 ounce gold per ton; please refer to the Cautionary Notice Regarding the Oro Cruz Property Historical Resource Estimate below). Although no surface facilities remain, the underground infrastructure at Oro Cruz (including a 2.4 kilometre haulage ramp, sublevels and draw points) remains in excellent condition and the open pit was abandoned just after stripping was completed prior to the start of Stage II pit expansion.

Southern Empire is currently finalizing federal, state and county permitting that will allow for up to 65 exploration, confirmation and metallurgical drill hole sites at Oro Cruz to support a new resource estimate, and to also test the potential of waste rock and decommissioned heap leach piles to yield residual gold production.

In northern México (Sonora, Chihuahua, and Durango), Southern Empire has a leachable copper prospect and three gold projects having bulk-tonnage potential. Our Mexican gold projects are:

- Centauro Gold Project, Escalón, Chihuahua;

- Pedro Gold Project, Mapimí, Durango; and,

- La Loma Gold Project, Nazas, Durango.

These gold projects are located along what Southern Empire is calling the Mapimí Gold Corridor, a 150-kilometre, southeast-trending Oligocene tectonostratigraphic belt, the regional geological setting of which, together with numerous coincident geological, mineralogical and geochemical characteristics as observed at Centauro, Pedro and La Loma, strongly supports the proposition that the Mapimí Gold Corridor has significant potential to host bulk-mineable, low sulfidation epithermal and/or Carlin-style gold deposits.

For more information on Southern Empire, its people and its projects, please visit our website: www.smp.gold.

On behalf of the Board of Directors of Southern Empire Resources Corp.,

Dale Wallster, CEO and Director

For further information on Southern Empire please visit both www.smp.gold and SEDAR+ or contact: Lubica Keighery, (778) 889-5476, lubica@smp.gold.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the Exchange) accepts responsibility for the adequacy or accuracy of this release.

Cautionary Notice on Forward-Looking Information and Forward-Looking Statements

Information provided in this news release may contain forward-looking information or forward-looking statements that are based on assumptions as of the date of this news release. Such information or statements reflect management’s current estimates, beliefs, intentions and expectations and are not guarantees of future performance. Southern Empire cautions that all forward-looking statements are inherently uncertain and that actual performance may be affected by a number of material factors, many of which are beyond its respective control. Such factors include, among other things: risks and uncertainties relating to Southern Empire’s limited operating history, the need to comply with environmental and governmental regulations, results of exploration programs on its projects and those risks and uncertainties identified in its annual and interim financial statements and management discussion and analysis. Accordingly, actual and future events, conditions and results may differ materially from the estimates, beliefs, intentions and expectations expressed or implied in the forward-looking information. Except as required under applicable securities legislation, Southern Empire undertakes no obligation to publicly update or revise forward-looking information.

Cautionary Notice Regarding the Suaqui Verde Copper Project Historical Resource Estimate

The unpublished, historical resource estimate regarding the Suaqui Verde Copper Project set forth in this news release was prepared for Cuprum Mining Corporation in an internal report dated June 10, 2008 by Independent Mining Consultants, Inc. (“IMC”) of Tucson, Arizona. A National Instrument 43-101F1 Technical Report was not filed in connection with this historical resource estimate. Although the IMC historical resource estimate outlined “Indicated Resources” and “Inferred Resources”, the historical estimate was completed prior to, and is not in compliance with, current Canadian Institute of Mining, Metallurgy and Petroleum (“CIM”) Definition Standards on Mineral Resources and Mineral Reserves as adopted in 2014. IMC’s historical resource estimate is based on 106 total drill holes completed between 1991 and 2007 as follows: AZCO, 43 holes in 1991; Cambior, 18 holes in 1993; Phelps Dodge, 15 holes in 1997; and Minera Corum, 30 holes in 2006-2007. In calculating the historical resource estimate, a three-year trailing average copper price of $2.95/lb, mining costs of US $1.40 and $1.80 per tonne (“t”) for overburden and rock respectively, process and G&A costs of $4.50 per tonne, pit slope angles of 38o, and total copper (“TCu”) recoveries of 75%, 65% and 45% for oxide, mixed and sulphide materials respectively, were used.

Southern Empire considers the IMC historical resource estimate relevant as it represents the main target for exploration and development work on the Suaqui Verde Copper Project. A Qualified Person has not done sufficient work to classify the IMC historical estimate as a current mineral resource and Southern Empire is not treating the historical resource estimates as current mineral resources. Southern Empire intends to confirm the reliability of the IMC historical resource estimate and the information supporting the historical resource estimate. Southern Empire is not treating the historical resource as a current mineral resource.

Cautionary Notice Regarding the Oro Cruz Project Historical Resource Estimate

The historical resource estimate outlined above is disclosed in a technical report dated April 29, 2011, prepared for Lincoln Mining Corp. by Tetra Tech, Inc. and filed on Canadian Securities Administrators’ System for Electronic Document Analysis and Retrieval (SEDAR+). It is termed an inferred mineral resource, which is a category set out in NI 43-101. It was based on historical reverse circulation and core drill hole sample, underground channel sample, and blasthole sample assay results and calculated using ordinary kriging to estimate gold grades in 10-foot-by-10-foot-by-five-foot blocks. Accordingly, Southern Empire considers this historical estimate reliable as well as relevant as it represents key targets for future exploration work. However, a QP has not done sufficient work to verify or classify the historical estimate as a current mineral resource and Southern Empire is not treating this historical estimate as current mineral resources.

SOURCE: Southern Empire Resources Corp.

Original Article: https://www.accesswire.com/777609/Southern-Empire-Pursues-the-Suaqui-Verde-Copper-Deposit-in-Northwestern-Mxico