The Company is fully funded to continue target development on the property.

Vancouver, British Columbia–(Newsfile Corp. – February 8, 2024) – Silver Dollar Resources Inc. (CSE: SLV) (OTCQX: SLVDF) (FSE: 4YW) (“Silver Dollar” or the “Company”) announces that it has acquired a 100% interest in Canasil Resources Inc.’s (“Canasil“) Nora property located in Durango State, Mexico pursuant to the terms of the Nora option agreement (the “Nora Option Agreement“), previously announced on April 20, 2023.

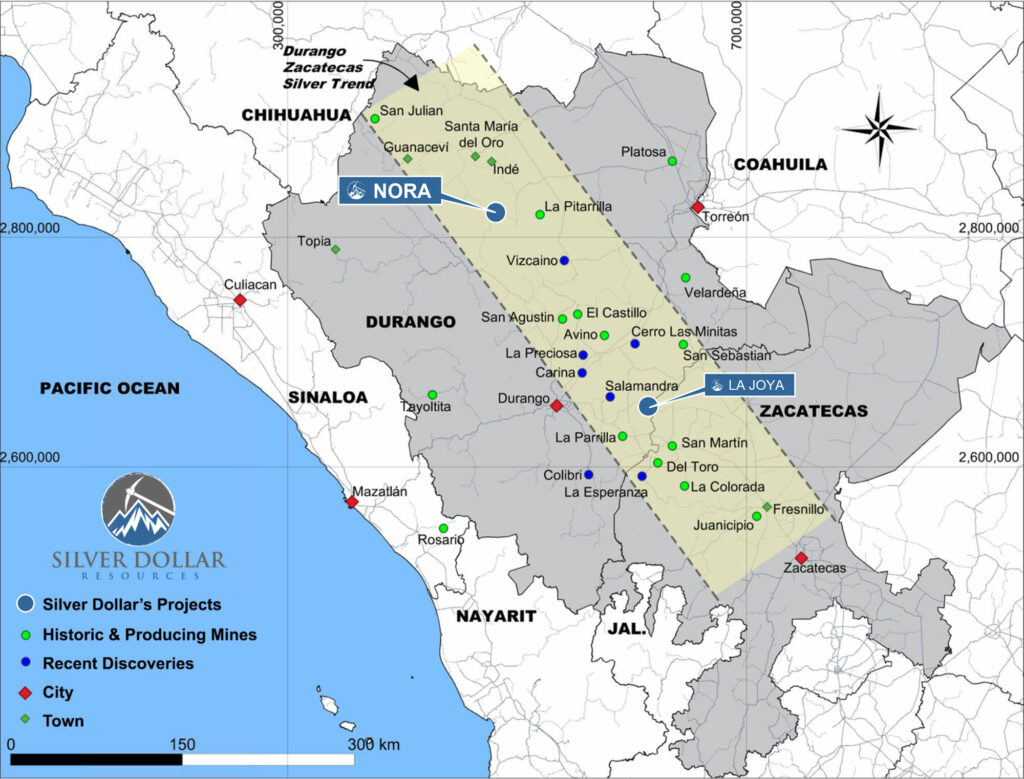

The Nora property is situated in the Eastern Sierra Madre sub-province, in the transition to the high plateau of Mexico, the property lies centrally within the “Silver Trend” that runs from the northwest to the southeast through Durango State. Significant deposits in the region include Endeavour Silver’s Guanaceví mine and Fresnillo’s San Julián mine on-trend to the northwest, with Endeavour Silver’s Pitarrilla Project approximately 50 kilometres (km) to the east. Pitarrilla is one of the largest undeveloped silver deposits in the world and was discovered by Perry Durning and Frank (Bud) Hillemeyer, who serve as Silver Dollar’s technical advisors.

In connection with the acquisition of the Nora property, Canasil waived certain obligations of Silver Dollar under the Nora Option Agreement on the basis that Silver Dollar encountered certain unresolved discrepancies in verifying the 2020 and 2021 drill results Canasil reported on the Nora property.

While analyzing and relogging drill core as part of its drill target development, Silver Dollar re-assayed select core intervals from Canasil’s previous drilling. A total of 161 core samples, plus 16 standards and blanks, were submitted to ActLabs in Zacatecas. This included 157 duplicates of the original core samples from drill holes NRC-20-01, NRC-20-04, NRC-20-06, NRC-21-09, NRC-21-10, NRC-21-11, and NRC-21-12. The ActLabs check assay values received for lead, zinc and copper closely mirror the original assay values Canasil received from ALS Global in Vancouver; however, the gold and silver values are significantly lower as follows:

For gold: of the 157 samples duplicated, Canasil reported 42 samples >1 g/t Au (1.23 – 43.7 g/t) including 18 samples >5 g/t (5.3 – 43.7 g/t), whereas Silver Dollar’s re-assaying yielded only three samples >1 g/t Au (1.04, 1.75, and 2.30 g/t).

For silver: of the 157 samples duplicated, Canasil reported 44 samples >200 g/t Ag (133 -1,924 g/t) including 19 samples >500 g/t Ag (504 – 1,925 g/t), whereas Silver Dollar’s re-assaying yielded only three samples >100 g/t Ag (129, 158, and 448 g/t).

The QPs from both companies discussed the situation and recommended a further analytical program be carried out to provide some insight into what may have caused the assay discrepancies. However, Canasil did not have the financial resources to contribute to the recommended program and alternatively offered to waive certain of Silver Dollar’s consideration obligations under the Nora Option Agreement and transfer 100% ownership of the Nora property to Silver Dollar for the consideration that has been provided to date (as detailed below), subject to a 2% net smelter returns royalty (the “Royalty”) with Silver Dollar having the right to buy back 1% of the Royalty for $1,000,000. As of the date hereof, Silver Dollar has incurred a total of approximately $134,779 in exploration expenditures on the Nora property, as full consideration for the acquisition thereof. Silver Dollar is not required to provide any further consideration to Canasil to complete the acquisition and the transfer of the Nora concessions to Silver Dollar has been initiated.

The Company previously reported selected highlights from Canasil’s 2020 and 2021 drilling programs on the Nora property, which included the discrepancies noted above, in its news releases of May 24, 2023, June 20, 2023, and August 1, 2023, on its website, in its material change report dated April 20, 2023, and its Management’s Discussion and Analysis of May 31, 2023. In addition to containing discrepancies, the Company has determined that the disclosure did not conform to National Instrument 43-101 standards and should not be relied upon. Accordingly, the Company retracts the non-compliant prior disclosure of results from Canasil’s 2020 and 2021 drilling programs in respect of the Nora property from its disclosure record.

“Although the assay discrepancies from the Candy vein drill core are puzzling, the Nora property has other priority exploration targets that we intend to follow up on while we take a closer look at the Candy vein structure,” said Michael Romanik, president of Silver Dollar.

Mike Kilbourne, P.Geo., an independent Qualified Person (QP) as defined in NI 43-101, has reviewed and approved the technical contents of this news release on behalf of the Company. The QP and the Company have not completed sufficient work to verify the information on the Nora property, particularly regarding historical exploration, neighbouring companies, and government geological work.

About Silver Dollar Resources Inc.

Silver Dollar is a mineral exploration company that is fully funded to execute its near-term exploration plans having closed its last financing with lead orders from billionaire mining investor Eric Sprott and NYSE-listed First Majestic Silver. The Company’s primary projects lie within Mexico’s prolific Durango-Zacatecas silver-gold belt and include the flagship La Joya silver (Cu-Au) property and the Nora silver-gold property. Management has an aggressive growth strategy and is actively reviewing potential acquisitions with a focus on drill-ready projects in mining-friendly jurisdictions.

For additional information, you can download our latest presentation by clicking here and you can follow us on Twitter by clicking here.

ON BEHALF OF THE BOARD

Signed “Michael Romanik”

Michael Romanik,

President, CEO & Director

Silver Dollar Resources Inc.

Direct line: (204) 724-0613

Email: mike@silverdollarresources.com

179 – 2945 Jacklin Road, Suite 416

Victoria, BC, V9B 6J9

Forward-Looking Statements:

This news release contains “forward-looking information” and “forward-looking statements” within the meaning of applicable securities legislation (collectively, “forward-looking statements”). The forward-looking statements herein are made as of the date of this news release only, and the Company does not assume any obligation to update or revise them to reflect new information, estimates or opinions, future events or results or otherwise, except as required by applicable law. Often, but not always, forward-looking statements can be identified by the use of words such as “plans”, “expects”, “is expected”, “budgets”, “scheduled”, “estimates”, “forecasts”, “predicts”, “projects”, “intends”, “targets”, “aims”, “anticipates” or “believes” or variations (including negative variations) of such words and phrases or may be identified by statements to the effect that certain actions “may”, “could”, “should”, “would”, “might” or “will” be taken, occur or be achieved. These forward-looking statements include the fact that the Company intends to continue fieldwork on the Nora property and follow up on other priority exploration targets on the Nora property; and that the Company intends to take a closer look at the Candy vein structure. Such forward-looking statements are based on a number of assumptions of management, including, without limitation, that the Company’s cost and timing expectations are accurate; that Canasil will be able to successfully transfer the claims comprising the Nora property to Silver Dollar; that the Company will be successful in the deployment of its resources and personnel; that the Company will be able to obtain and maintain all permits, licenses and approvals required to complete its planned exploration activities; that management has accurately predicted how the regulatory environment will impact its business and the transfer of the claims comprising the Nora property; and that the Company will have access to sufficient funds to finance its business activities and plans. Additionally, forward-looking statements involve a variety of known and unknown risks, uncertainties and other factors which may cause the actual plans, intentions, activities, results, performance or achievements of the Company to be materially different from any future plans, intentions, activities, results, performance or achievements expressed or implied by such forward-looking statements. Such risks include, without limitation: that Canasil may fail to successfully transfer the claims comprising the Nora property to Silver Dollar; that the Nora property is ceased in connection with bankruptcy or insolvency proceedings; that the Nora property becomes the subject of litigation, bankruptcy or insolvency proceedings, or other regulatory or civil proceedings; the Company’s operations could be adversely affected by possible future government legislation, policies and controls or by changes in applicable laws and regulations; political instability; unexpected exploration challenges; unanticipated costs; the Company could fail to obtain the permits, licenses or approvals required to conduct its planned exploration activities; and the loss of key personnel. The forward-looking statements contained in this news release represent management’s best judgment based on information currently available. No forward-looking statement can be guaranteed and actual future results may vary materially. Accordingly, readers are advised not to place undue reliance on forward-looking statements.

The Canadian Securities Exchange (operated by CNSX Markets Inc.) has neither approved nor disapproved of the contents of this news release.

SOURCE: Silver Dollar Resources Inc.

Original Article: https://www.newsfilecorp.com/release/197171