Vancouver, British Columbia – Silver Bull Resources, Inc. (OTCQB: SVBL, TSX: SVB) (“Silver Bull”) is pleased to provide a corporate update on the Sierra Mojada project and announce the imminent start of an 8,000 meter surface drill program to target a series of the sulphide extension at depth of the main deposit already defined at Sierra Mojada as well as a series of never before tested targets within the wider area.

The start of this drill program caps off an extremely successful 2018 for Silver Bull which was marked by a number of key milestones. A summary of the key highlights for 2018 are outlined below:

South32 Joint Venture Option: In June 2018 Silver Bull signed an agreement with a wholly owned subsidiary of South32 Limited (ASX/JSE/LSE: S32) (“South32”) whereby Silver Bull has granted South32 an option to form a 70/30 joint venture with respect to the Sierra Mojada Project. To maintain the option in good standing, South32 must contribute minimum exploration funding of US$10 million (“Initial Funding”) during a 4 year option period with minimum aggregate exploration funding of US$3 million, US$6 million and US$8 million to be made by the end of years 1, 2 and 3 of the option period respectively. South32 may exercise its option to subscribe for 70% of the shares of Minera Metalin S.A. De C.V. (“Metalin”), the wholly owned subsidiary of Silver Bull which holds the claims in respect of the Sierra Mojada Project, by contributing US$100 million to Metalin for Project funding, less the amount of the Initial Funding contributed by South32 during the option period.

NI43-101 Resource update: In October 2018, Silver Bull announced an updated NI43-101 resource on the significant oxide mineralization already defined at Sierra Mojada. This resource update was done using a silver price of US$15/oz and a zinc price of US$1.20/lb and brought the resource into line with the current metal prices.

Highlights of the resource update include;

- An open pittable, measured and indicated “High Grade Zinc Zone” of 13.5 million tonnes at an average grade of 11.2% Zinc at a 6% cutoff for 3.336 billion pounds of zinc.

- An open pittable, measured and indicated “High Grade Silver zone” of 15.2 million tonnes at an average grade of 114.9 g/t at a 50g/t cutoff for 56.3 million ounces of silver.

- Total Measured & Indicated Global Resource of 70.4 million tonnes at 38.6 g/t Ag and 3.4% Zn that contain 5.354 billion pounds Zn and 87.4 million ounces Ag

- The updated resource was modelled using a silver price of US$15 per ounce, and a zinc price of US$1.20 per pound.

Financing: In August 2018 Silver Bull closed a two tranche private placement for cumulative gross proceeds of US$3,788,000, ensuring the company is in a strong financial position.

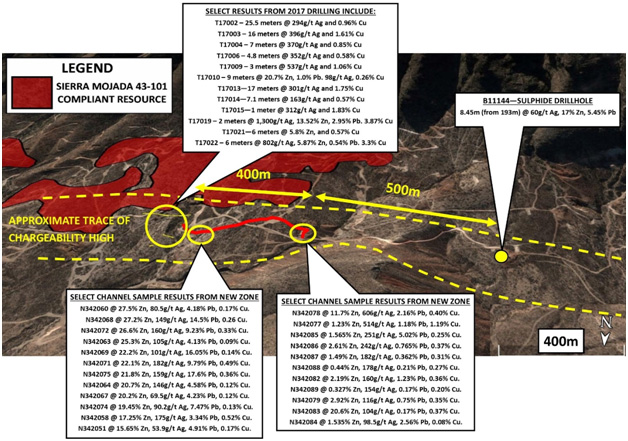

Drill Program: In late 2017 and early 2018 Silver Bull completed an extremely successful 1,500m underground drill and channel sampling program targeting the sulphide extension of the oxide mineralization already defined at Sierra Mojada at the western end of deposit. Drilling and sampling highlighted a 900 meter long trend of high grade sulphide mineralization shown in the figure below

Highlight drillhole intercepts from this program include:

- T17002 – 25.5 meters @ 294g/t Ag and 0.96% Cu

- T17003 – 16 meters @ 396g/t Ag and 1.61% Cu

- T17004 – 7 meters @ 370g/t Ag and 0.85% Cu

- T17006 – 4.8 meters @ 352g/t Ag and 0.58% Cu

- T17009 – 3 meters @ 537g/t Ag and 1.06% Cu

- T17010 – 9 meters @ 20.7% Zn, 1.0% Pb. 98g/t Ag, 0.26% Cu

- T17013—17 meters @ 301g/t Ag and 1.75% Cu

- T17014—7.1 meters @ 163g/t Ag and 0.57% Cu

- T17015—1 meter @ 312g/t Ag and 1.83% Cu

- T17019 – 2 meters @ 1,300g/t Ag, 13.52% Zn, 2.95% Pb. 3.87% Cu

- T17021—6 meters @ 5.8% Zn, and 0.57% Cu

- T17022 – 6 meters @ 802g/t Ag, 5.87% Zn, 0.54% Pb. 3.3% Cu

Fieldwork and re-interpretation of the Geology: Since the signing of the joint venture with South32 in June 2018, a significant work program has been underway to outline drill targets across a series of prospects in the area. To this purpose the following work has been ongoing:

- Geophysics: A 5,297 line kilometer helicopter-borne Versatile Time Domain Electro Magnetic (VTEM) and Magnetic Geophysical Survey was flown over the project and has aided considerably in the re-interpretation and targeting of the drill holes in the up and coming drill program

- Mapping and Sampling: A full remapping and reinterpretation of the geology on the property has been completed. Over 50 kilometers of the San Marcos fault and the surrounding geology has been remapped. To aid in this Silver Bull brought in the services and expertise of Archer, Cathro & Associates (1981) Limited.

- Underground Surveying: A program to survey, map and sample all historical underground workings spread over 4 separate prospects has been completed and has provided invaluable information of the potential geometry of mineralization in these areas.

2019 Exploration drill program: The company has signed a drill contract with Major Drilling De Mexico S.A de C.V to conduct an 8,000 meter drill program initially targeting 4 historic mining areas within the Sierra Mojada property. Drilling is expected to commence in early March with the granting of the appropriate drill permits from the Mexican Government.

About Silver Bull: Silver Bull is a well-financed mineral exploration company whose shares are listed on the Toronto Stock Exchange and trade on the OTCQB in the United States, and is based out of Vancouver, Canada. The Sierra Mojada Project is located 150 kilometers north of the city of Torreon in Coahuila, Mexico, and is highly prospective for silver and zinc.

About the Sierra Mojada deposit: Sierra Mojada is an open pittable oxide deposit with a NI43-101 compliant measured and indicated “global” resource of 70.4 million tonnes grading 3.4% zinc and 38.6g/t silver at a $13.50 NSR cutoff giving 5.35 billion pounds of zinc and 87.4 million ounces of silver. Included within the “global” resource is a measured and indicated “high grade zinc zone” of 13.5 million tonnes with an average grade of 11.2% zinc at a 6% cutoff, giving 3.336 billion pounds of zinc, and a measured and indicated “high grade silver zone” of 15.2 million tonnes with an average grade of 114.9g/t silver at a 50g/t cutoff giving 56.3 million ounces of silver. Mineralization remains open in the east, west, and northerly directions. Approximately 60% of the current 3.2 kilometer mineralized body is at or near surface before dipping at around 6 degrees to the east.

The technical information of this news release has been reviewed and approved by Tim Barry, a Chartered Professional Geologist (CPAusIMM), and a qualified person for the purposes of National Instrument 43-101.

On behalf of the Board of Directors

“Tim Barry”

Tim Barry, CPAusIMM

Chief Executive Officer, President and Director

INVESTOR RELATIONS:

+1 604 687 5800

info@silverbullresources.com

Cautionary Note to U.S. Investors concerning estimates of Measured, Indicated, and Inferred Resources: This press release uses the terms “measured resources”, “indicated resources”, and “inferred resources” which are defined in, and required to be disclosed by, NI 43-101. We advise U.S. investors that these terms are not recognized by the United States Securities and Exchange Commission (the “SEC”). The estimation of measured, indicated and inferred resources involves greater uncertainty as to their existence and economic feasibility than the estimation of proven and probable reserves. U.S. investors are cautioned not to assume that measured and indicated mineral resources will be converted into reserves. The estimation of inferred resources involves far greater uncertainty as to their existence and economic viability than the estimation of other categories of resources. U.S. investors are cautioned not to assume that estimates of inferred mineral resources exist, are economically minable, or will be upgraded into measured or indicated mineral resources. Under Canadian securities laws, estimates of inferred mineral resources may not form the basis of feasibility or other economic studies.

Disclosure of “contained ounces” in a resource is permitted disclosure under Canadian regulations, however the SEC normally only permits issuers to report mineralization that does not constitute “reserves” by SEC standards as in place tonnage and grade without reference to unit measures. Accordingly, the information contained in this press release may not be comparable to similar information made public by U.S. companies that are not subject NI 43-101.

Cautionary note regarding forward looking statements: This news release contains forward-looking statements regarding future events and Silver Bull’s future results that are subject to the safe harbors created under the U.S. Private Securities Litigation Reform Act of 1995, the Securities Act of 1933, as amended (the “Securities Act”), and the Securities Exchange Act of 1934, as amended (the “Exchange Act”), and applicable Canadian securities laws. Forward-looking statements include, among others, statements regarding mineral resource estimates, timing of expected drilling and receipt of drill permits. These statements are based on current expectations, estimates, forecasts, and projections about Silver Bull’s exploration projects, the industry in which Silver Bull operates and the beliefs and assumptions of Silver Bull’s management. Words such as “expects,” “anticipates,” “targets,” “goals,” “projects,” “intends,” “plans,” “believes,” “seeks,” “estimates,” “continues,” “may,” variations of such words, and similar expressions and references to future periods, are intended to identify such forward-looking statements. Forward-looking statements are subject to a number of assumptions, risks and uncertainties, many of which are beyond our control, including such factors as the results of exploration activities and whether the results continue to support continued exploration activities, unexpected variations in ore grade, types and metallurgy, volatility and level of commodity prices, the availability of sufficient future financing, and other matters discussed under the caption “Risk Factors” in our Annual Report on Form 10-K for the fiscal year ended October 31, 2018, as amended, and our other periodic and current reports filed with the SEC and available on www.sec.gov and with the Canadian securities commissions available on www.sedar.com. Readers are cautioned that forward-looking statements are not guarantees of future performance and that actual results or developments may differ materially from those expressed or implied in the forward-looking statements. Any forward-looking statement made by us in this release is based only on information currently available to us and speaks only as of the date on which it is made. We undertake no obligation to publicly update any forward-looking statement, whether written or oral, that may be made from time to time, whether as a result of new information, future developments or otherwise.