This report is a follow up to our first 66-page report published on Odyssey Marine Exploration (OMEX) October 31, 2013 and an introduction to our findings on Oceanica, the full reports can be found at www.omextruth.com.

In a new 22 page report dedicated to OMEX’s Oceanica project we highlight numerous risk factors that OMEX has not disclosed to the public.

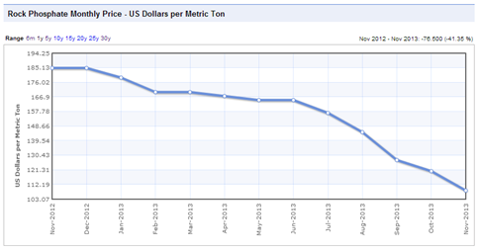

1) Phosphate commodity prices have declined 44% in the last year and 35% since June 2013 when Mako last invested by exercising its options (then at a 50% discount rate).

(click to enlarge)

2) This mining concession is not new, the area has been tested before numerous times (including fairly recently) and has never proven viable. OMEX itself makes no claims of new proprietary technology that would change the cost structure significantly.

3) The environmental permitting process is extraordinarily difficult to pass through in general and there are a number of specific hurdles for the region where Oceanica is located, including a direct conflict of interest with the large local fishing industry, that we believe will make it impossible.

We predict that Mako will not exercise its options at $2.50 (per Oceanica share). Instead of being forthright with investors, OMEX might be thinking about extending the life of the options and increasing the price to spin it as a positive. OMEX can unilaterally grant new options after these expire Dec 31st with any arbitrary length or price they want just as investors can demand an arbitrary discount (50% in June before phosphate prices declined 35%…). We would note that granting options is a value transfer and needs to be booked as a liability (calculated by Black-Sholes value) and OMEX would need to receive commensurate value in return for new options if it were a truly arms-length economic transaction.

Since our initial report on Odyssey Marine Oct 31st, we have continued to dig deeper and posted three reports without response from the company:

1) We uncovered and confirmed via FOI that the UK Government is investigating OMEX re: HMS Victory related to violations of the MMO from multiple potentially unauthorized activities over the last several years including last summer (not from 2008 as some message board posters such as “Green River” have attempted to misconstrue).[1]

2) We obtained evidence that the “commodity shipwrecks” are likely to be the “Blackade Runners” containing Nazi German war cargo where we believe there are likely to be a significant legal challenges in asserting a claim to the cargo[2].

3) Among other things, in OMEX’s most recent 10-Q filed Nov 12th, it appears that Neptune Minerals Inc. lost $25mm in its most recent fiscal year ended June 30, 2013 – bringing cumulative losses of that enterprise to $49mm, FAR more than OMEX’s previous disclosure just 3 months prior that “we believe their cumulative loss for their fiscal year end June 30, 2013 will be several million dollars.” OMEX further lent $500,000 to Neptune in Q3 but it appears to now be insolvent[3].

As we have exposed each hollow “opportunity”, investors who desperately want to believe have dug their heels in to the idea that Oceanica is the great opportunity that it is worth multiples of the current market cap, still at nearly $200mm. While at some level, we are impressed at OMEX’s ability to assemble a shareholder base with the loyalty of Heaven’s Gate, we believe this is loyalty in the absence of merit and shareholders deserve the truth and responses to this and previous questions.

Oceanica Summary

We have conducted substantial due diligence on OMEX’s Oceanica phosphate mining project with available public information as well as information we received from a team of environmentalists in Mexico who have been following the project. This report is a compilation of questions that we believe that any investor in either OMEX stock or Oceanica directly as well as some of our findings. Acting as a fiduciary, we would hope that Mako Resources LLC, would have performed similar diligence. It could be argued that OMEX is not legally required to disclose the numerous risk factors with this project (as it has not) as it carries the project at $0 on its SEC filed financial statements.

We hope Mako Resources LLC, which is listed in its SEC filings as being run by Neptune Minerals Inc.’s VP of Finance out of a one bedroom Manhattan residential apartment, has complied with its legal obligation to its investors to disclose the pertinent risk factors associated with this project. Regardless, we believe this is the first time that OMEX shareholders have been given detailed insight into this project and we are disappointed that it did not come first from OMEX management. As we noted in a study referenced in our second report, when management makes claims of a “world class” mineral asset, the statistics are not favorable. 53 of 54 examples of stocks we found that made this claim declined in value and 47 of 54 declined by more than 50%; and 30 of 54 declined over 90% (!) following this “world class” asset claim. It is an empty term that statistically foreshadows dilution and significant stock declines.

After an in depth investigation of “Oceanica”, we have uncovered numerous risks and do not believe this project is viable and is likely worthless. As always, we have included our references and encourage investors to do their own independent research. We present the following facts and question OMEX management for spending shareholder capital on a project while not disclosing the numerous risk factors associated with it.

1. The “Oceanica” area has been a failure for many “world class” companies for decades going back to the 1960s with multiple other investors before OMEX and Innophos.

a. Well-funded partnerships including the Mexican government (without permitting issues or strong environmental opposition Odyssey faces) all looked at phosphate mining in the area and all of them failed. Rofomex explored the entire area and chose to attempt a project south of Oceanica at Magdalena Bay, presumably in the area richest in phosphate, which included shallow water dredging but encountered an unexpected subsurface layer of calcium carbonate repeatedly breaking expensive diamond drill bits and ultimately abandoning the project entirely.

Q: Have Mako investors contacted the Mexican geologists involved in these old projects to verify Odyssey’s promotional claims?

Q: Do public OMEX shareholders understand the long history of failure in this area?

Q:Why do investors believe the Mexican government gave these concessions away so cheaply in the concession auction to begin with?

2. We believe Innophos, a nearly $1bb annual revenue, experienced global phosphate leader, is a partner in this or an adjacent concession area and appears to have abandoned the project. Innophos publicly stated they had an exploration option on an offshore concession in Baja Mexico and the only offshore concessions in Baja are Oceanica, and the smaller questionably overlapping, concessions.

a. Innophos has been involved in the Oceanica area for years before Odyssey and has close ties to the Mexican government.

Q: If the offshore area was truly superior to the beach concession why did Innophos ignore the offshore concession when it became available?

Q: If “Oceanica” offshore concession was viable, why has Innophos (with far more phosphate knowledge than OMEX) shown zero interest in it since their very short disclosure made in 2009.

3. Surprisingly, using Mexican Government mining documents we discovered “Oceanica” overlaps other company owned mineral concessions and potentially that of local seafloor fisherman as well. The legal ownership questions created by these overlapping rights would indicate that, if it passes the environmental permitting stage, ownership will be disputed in Mexican court. We believe any legal disputes in Mexican court will not go well for a foreign firm like Odyssey seeking to extract their local resources while providing few jobs and potentially permanently destroying their ecosystem. Pictures and documentation of these concessions as well as Mexican government websites you can use for verification are in the full report.

Q: Why hasn’t Odyssey management disclosed and discussed these overlaps and how do they plan to deal with the legal questions this creates? Is Odyssey even aware of these overlaps that we easily uncovered with public information?

Q: What other investors are involved in these other company concessions and are there conflicts of interest involved?

Q: Have these other companies evaluated this concession area and already chosen the highest quality areas leaving Odyssey shareholders with inferior concessions?

Q: After the “Black Swan” debacle didn’t Odyssey management assure shareholders they would not pursue projects where legal ownership was in question?

4. Even using optimistic production cost estimates from the management of past proposed offshore phosphate projects in the Oceanica area, the project appears non-economic.

a. GreenRiver Asset Management’s $17-18 per ton cost estimates seem to be taken from a Phosmex presentation where he cherry picks cost estimates from 30 years ago! Curiously, that same page of the same presentation goes on to list 2011 production cost estimates of $90/ton. This $90/ton estimate is 5x higher than the $18/ton estimate proposed publicly by GreenRiver. This Phosmex presentation is included in the full report.

b. This $90/ton estimate was also made years ago and the cost of mining globally has increased since then. Even more surprising, this $90/ton estimate was made for an area 10 miles offshore and in 125 feet of water. Greenriver assumes Oceanica will be 20-30 miles offshore and in much deeper water, increasing costs as a result. This $90/ton estimate also ignores the recent dramatic increase in mining taxes in Mexico proposed. With these issues and phosphate prices at ~$100/ton it seems obvious the Oceanica project is not economic.

c. This $90/ton estimate is also taken directly from a management team promoting offshore mining in this area. Many mining cost estimates for projects that have never been attempted end up being far too low as the history of mining is littered with the carcasses of investors who blindly trusted management estimates in speculative mining ventures. We encourage investors to do their own work and not listen to management.

Q; Has Odyssey contracted any independent third party mining experts to analyze the theoretical production cost of this area?

Q: Have Mako investors independently verified their own estimates of production costs through discussion with any of the Mexican geologists involved in any past phosphate mining projects in this area?

5. Every major environmental group, the head of the commercial fishing organizations, the land developers, tour operators and the local community are all well aware of the details of the “Oceanica” project, are upset and all plan to fight this Oceanica project as long as necessary. The odds of “Oceanica” quietly receiving permits in Mexico City without fierce opposition is zero. Nobody in the Commondu area of Mexico, including heads of local government permitting offices, indicated they had ever been contacted by Odyssey or anyone from Oceanica.

a. We have been contacted by people involved including environmentalists who have personally discussed this project at great length with every stakeholder possible and we are confident that the best case scenario involves years of expensive legal battles, public humiliation and permitting issues.

Q: Has Odyssey honestly discussed this project with any of the local stakeholders and community?

Q: Why is the Mexican business structure of Oceanica apparently domiciled in Mexico City instead of anywhere in the Commondu municipality that the Oceanica project actually is proposed in? Was Odyssey hoping to get their environmental permit in a distant region to avoid a fair public hearing of local environmental interests?

Q: Why did Odyssey keep all details including the location of this project hidden, not even disclosing Oceanica’s location or information in their SEC filings? We were easily able to obtain this public information with the Mexican mining authorities.

6. The Environmental permitting stage stops nearly all mining projects in Mexico and for “Oceanica” there is formidable opposition waiting by many organizations who have, for decades, been successfully stopping projects less destructive than “Oceanica” proposed by companies far stronger than Odyssey.

a. The list of projects stopped by locals in the immediate area after years of failed permit applications and public humiliation include such global powerhouses as Mitsubishi, as well as pure mining companies Vista Gold and the Cabo Pulma project, which received so much public humiliation the president of Mexico himself announced denial of the permit on national TV.

b. Oceanica is just south of a UNESCO world heritage site and overlaps multiple environmental concerns that some environmentalists have been fighting all their life to protect.

c. Stating “our consultant partner has 100% success rate in permitting” are classic last words in Mexican mining as most permits are never formally denied, instead they linger in legal limbo until investors run out of money. This claim is analogous to a hospital claiming “100% patient cure rate” because they deny all difficult cases entry.

Q: Has Odyssey had an honest discussion with shareholders or Mako investors about what percent of environmental impact reports submitted in Baja Sur ever result in actual mineral production?

Q: Has Odyssey disclosed and discussed true permitting risks and expected project opposition with shareholders or Mako investors?

7. We have been told there are local groups who are very concerned about the questions proposed about who invested in the Oceanica project, why “DNA ltd inc” is an opaque structure that may be using proxy directors to hide identities as well as exactly how and where the $10m+ Odyssey claims to have “invested” in Oceanica was spent. We have been told locals who are experts on how mining projects get done in Mexico will be closely examining all financial aspects of this project. If anything serious is uncovered the consequences could be severe for all involved as well as likely stopping the Oceanic project dead in its tracks.

Q: Given the serious questions raised in our initial report why has Odyssey Still not released any information outlining where and how this money was spent?

Q: What exactly is Fauzi Hamdan Amad and DNA’s involvement in Oceanica?

8. Lastly, the political climate for Mexico mining is deteriorating as taxes for Oceanica appear set to increase dramatically and the global phosphate market is rapidly deteriorating.

a. Phosphate prices are now down 44% from this time last year when Odyssey likely began analyzing this project. Costs in mining are typically fixed, so small changes in commodity prices have enormous impacts on project viability.

b. At the same time the environment for mining in Mexico has taken a decided turn for the worse with a dramatic increase in taxation on all mines in Mexico proposed.

Q: Why has Odyssey never discussed with investors that, even ignoring all these other serious problems, just the simultaneous decline in phosphate prices and increase in mining taxes has very likely rendered Oceanica unviable?

We Believe Oceanica is Not Viable and is Worthless

After performing detailed investigative research into Oceanica, including talking to many people very close to the situation in Mexico, it is clear to us any chance of success for this project is beyond unlikely.

Concession ownership itself is very unclear and concerning, likely to result in expensive and drawn out court battles in Mexico. The local Baja environmental community will fight this tooth and nail. The local Mexican fishing industry is upset and will never allow this risk to be taken with their livelihood without a fight while we believe that land developers will sue Odyssey to defend their interests. Even using optimistic management guidance on this exact area, “Oceanica” appears uneconomic based on cost estimates from previous projects by more experienced operators. All of this occurring while Mexico mining taxes are increasing and the global phosphate market is collapsing.

Perhaps most alarmingly, the Oceanica asset has been vetted many times and passed on by multiple “world class” phosphate companies with more knowledgeable than Odyssey.

We believe these issues are why Odyssey has been so sparse about the details of Oceanica, instead falling back into their routine of making grandiose and vague promises, only to once again disappoint investors while personally profiting to the tune of millions of dollars per year.