Prismo Samples 930 g/t Silver and 10.55 g/t gold at Palos Verdes (2,605 g/t AgEq*)

Vancouver, British Columbia–(Newsfile Corp. – February 6, 2024) – Prismo Metals Inc. (CSE: PRIZ) (OTCQB: PMOMF) (“Prismo” or the “Company“) is pleased to provide an update for its exploration program at the Palos Verdes property located in the Panuco district in Mexico. Following the completion of its third drill campaign with 2,923 meters drilled in 15 holes, and in preparation of the upcoming expanded drill program to be drilled from Vizsla Silver Corp. (TSXV: VZLA) (“Vizsla”) concessions adjacent to the Palos Verdes concession, the Company completed an alteration and geochemical study over the Palos Verdes property. This study was recommended by the Joint Prismo/Vizsla Technical Committee which is comprised of Prismo’s CEO Dr. Craig Gibson, Vizsla Silver’s VP Exploration Dr. Jesus Velador and Dr. Peter Megaw.

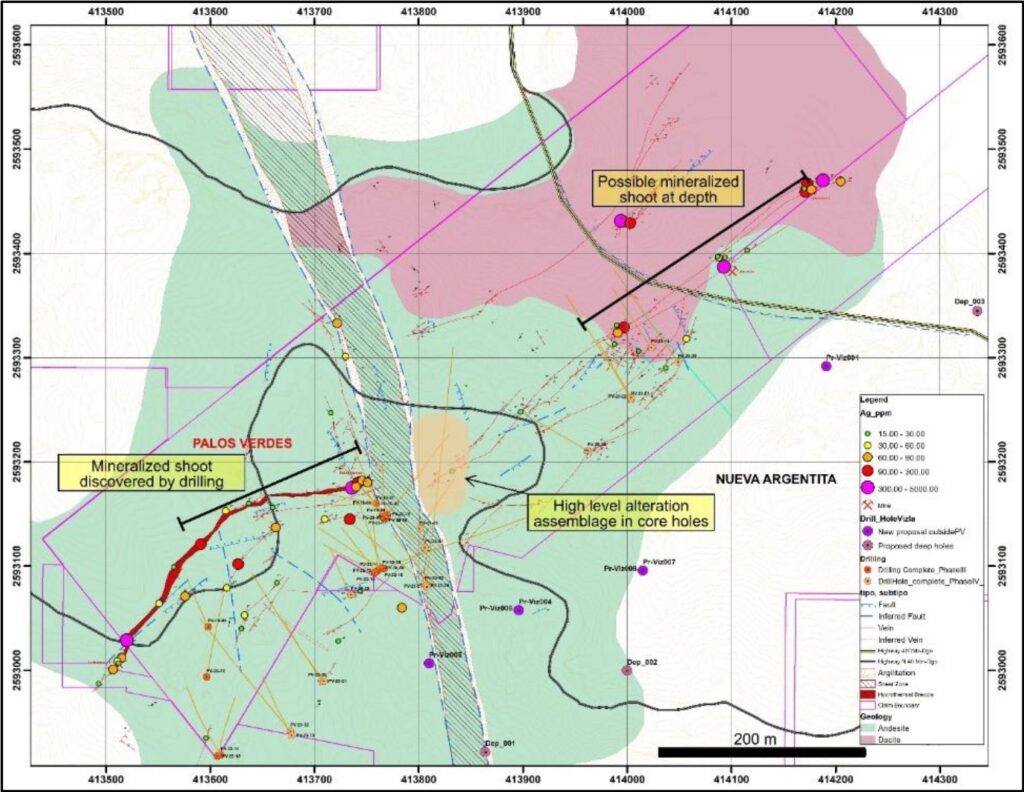

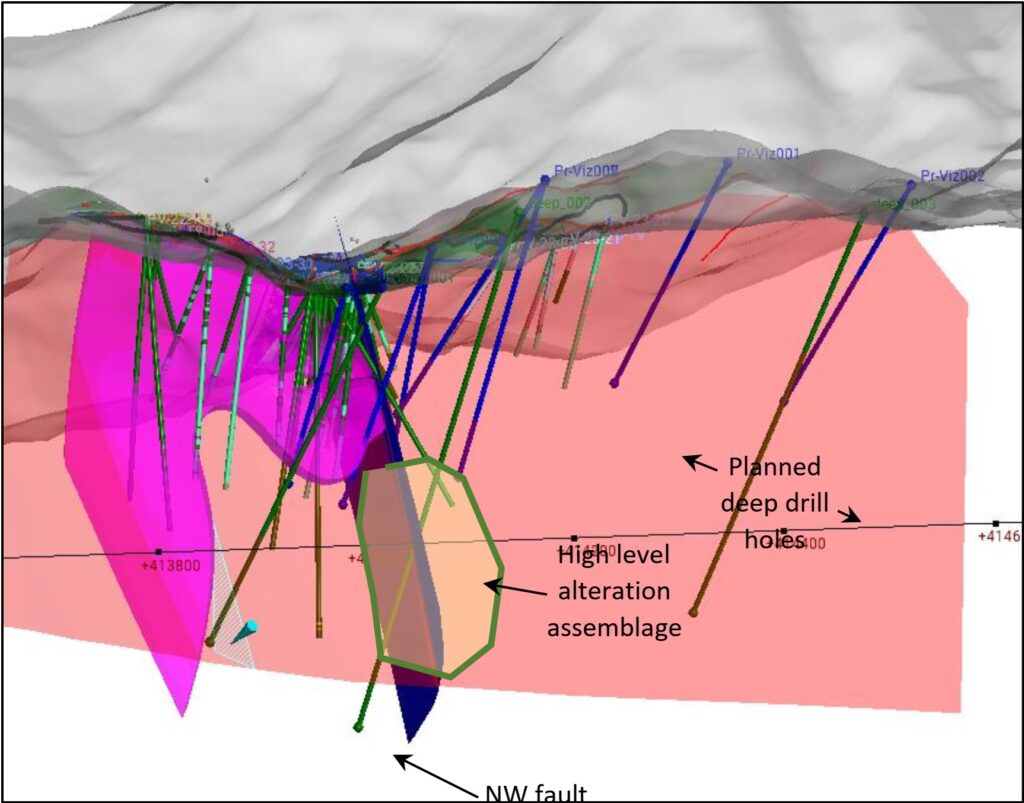

The results of this work indicate the possibility that the mineralized shoot defined by drilling to date on the west side of the property may be truncated and offset downward along a cross fault, and that a second blind mineralized shoot may exist to the northeast along the Palos Verdes vein.

Dr. Craig Gibson, President and CEO of the Company, stated, “The alteration study provides further evidence that our hypothesis for a downward offset of the northeastern portion of the Palos Verdes vein is correct. Our drilling has shown that the large high-grade mineralized shoot identified on the vein terminates abruptly against this northeast structure, indicating that mineralization was cut by it and offset to deeper levels. The deep drilling to be conducted from our Strategic Partner Vizsla Silver’s ground is designed in part to explore this concept and will target the Palos Verdes vein at depth. We deeply appreciate our Partner’s willingness to allow the drilling from their ground.”

“In addition to giving strong indications of where the eastern end of the Palos Verdes vein lies, demonstrating that the NW-trending structure offsets one vein stage, while hosting mineralization and alteration itself is potentially important confirmation of multiple mineralization stages in this part of the district,” said Dr. Peter Megaw, Prismo Exploration Advisor. “Finding blind veins is perhaps even more exciting as that mirror several of the discoveries Vizsla Silver, our Joint Exploration Committee partners have made in the western part of the district.”

The alteration study was carried out using a field portable Terraspec Halo near-infrared spectrometer to identify mica and clay minerals that make up the wall rock alteration assemblage surrounding the mineralized veins in surface exposures and drill core. Clay minerals typically found at high structural levels in low sulfidation vein systems provide evidence that the northeastern portion of the property has been down-dropped, probably along the northerly trending cross structure previously identified.

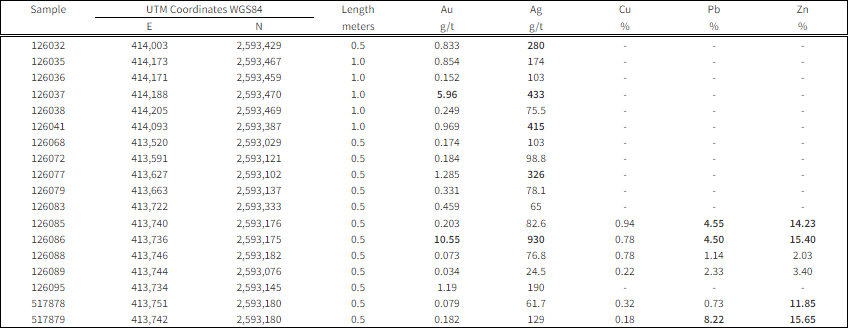

A geochemical sampling program focused on narrow and most strongly mineralized portions of the vein was conducted along the exposed strike length of the Palos Verdes vein system. The best sample from this program assayed 930 g/t silver and 10.55 g/t gold with 15.4% zinc and 4.5% lead (2,605 g/t Ag/Eq) over 0.5 meters. Strongly anomalous values of precious metal and indicator elements occur above the mineralized shoot identified during drilling and also along the vein system further to the northeast. This area may indicate the presence of a second blind mineralized shoot that will also be tested by the deep drilling from Vizsla ground.

Table 1. Assay highlights for Palos Verdes sampling program.

The Company completed its third drill campaign last year with 2,923 meters drilled in 15 holes with high grade mineralization encountered in several holes. Assays previously reported from this program include the highest-grade intercept recorded at the project in hole PV-23-25 with 102 g/t gold, 3,100 g/t silver and 0.26% zinc over 0.5 meters, or 11,520 g/t silver equivalent (see News Release of July 27, 2023). The last eight drill holes in the program, PV-23-26 to PV-23-33 were drilled to test the limits of the mineralized shoot in the western portion of the vein at depth and to the east of the NW fault.

Holes PV-23-27 and PV-23-29 to PV-23-33 tested the mineralized shoot to define the limits of mineralization and cut variably mineralized vein material (Table 1). The angle of inclination of several holes was very steep at -75 degrees, and drilling from the Vizsla Silver ground will provide more useful information.

Holes PV-23-26 and PV-23-28 explored to the east of the NW fault and did not cut significant mineralization but provided valuable information for the next holes that need to be drilled deeper from the adjoining Vizsla Silver ground.

2023 Drilling Highlights

PV-23-25:

- This hole intersected 11,520 g/t Ag equivalent over 0.5 meters (3,100 g/t Ag, 102 g/t Au and 0.26% Zn)

- This intercept is part of a wider mineralized interval with 4,311 g/t Ag equivalent over 1.35 meters (1157 g/t Ag, 38 g/t Au and 0.1% Zn)

- A second interval higher in the hole yielded 512 g/t Ag equivalent over 0.3 meter (384 g/t Ag, 1.36 g/t Au and 0.27% Zn).

- PV-23-24:

- This hole intercepted 1,234 g/t g/t Ag equivalent over 0.7 meter (60 g/t Ag, 11.9 g/t Au and 3.9% Zn)

- This interval is within a wider 2.6-meter interval with 384 g/t Ag equivalent (32 g/t Ag, 3.3 g/t Au and 1.57% Zn)

- A second interval higher in the hole yielded 302 g/t Ag equivalent over 1.2. meters (95 g/t Ag, 1.84 g/t Au and 1.2% Zn).

PV-23-20:

- This hole intercepted 189 g/t g/t Ag equivalent over 0.9 meters (58 g/t Ag and 1.58 g/t Au) and is the first mineralized intercept in the northeastern portion of the concession.

PV-23-32:

- This hole intersected 450.2 g/t Ag equivalent over 0.3 meters (45 g/t Ag, 0.83 g/t Au, 0.43% Pb, and 0.47% Zn) as part of a larger zone of 2.2 meters with 115 g/t Ag equivalent.

- A second interval deeper in the hole yielded 391.5 g/t Ag equivalent over 0.4 meters (17 g/t Ag, 3.56% Pb, 6.03%Zn) within a larger interval of 5.55 meters with 103.8 g/t Ag equivalent.

PV-23-33:

- This hole intersected 112.7 g/t Ag equivalent over 0.35 meters (37 g/t Ag, 0.489 g/t Au, 0.36% Pb, and 0.56% Zn)

- A second interval deeper in the hole yielded 105.6 g/t Ag equivalent over 0.3 meters (20 g/t Ag, 0.22% Pb, 1.79% Zn).

- A third interval contained 382.2 g/t Ag equivalent over 0.45 meters (144 g/t Ag, 0.45% Pb, 5.12% Zn) within a 0.75-meter interval of 253.4 g/t Ag equivalent (95 g/t Ag, 0.31% Pb, 3.39% Zn)

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/7434/196931_012a0fd7648fe8be_0002full.jpg

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/7434/196931_012a0fd7648fe8be_003full.jpg

Table of drill highlights for the previously unreported holes at the Palos Verdes Project

| Hole | From (m) | To (m) | Width (m) | Est True width (m) | Au (g/t) | Ag (g/t) | Cu (%) | Pb (%) | Zn (%) | *Ag eq (g/t) |

| PV-27 | 0.90 | 1.30 | 0.40 | 0.10 | 0.216 | 107 | – | 0.02 | 0.02 | 126.2 |

| PV-32 | 109.40 | 111.60 | 2.20 | 1.41 | 0.16 | 17.5 | 0.27 | 0.92 | 1.30 | 115.4 |

| 111.30 | 111.60 | 0.30 | 0.19 | 0.83 | 45.0 | 0.68 | 4.32 | 4.67 | 333.9 | |

| 150.10 | 155.65 | 5.55 | 3.57 | 0.20 | 20.7 | 0.16 | 0.61 | 1.09 | 103.8 | |

| 155.25 | 155.65 | 0.40 | 0.26 | 0.04 | 17 | 0.21 | 3.56 | 6.03 | 391.5 | |

| PV-33 | 225.65 | 226.40 | 0.75 | 0.26 | 0.03 | 94.8 | 2.28 | 0.31 | 3.39 | 253.4 |

| 225.95 | 226.40 | 0.45 | 0.14 | 0.04 | 144 | 3.65 | 0.45 | 5.12 | 382.2 |

*Silver equivalent values are calculated using the following metals prices: Au, US$1,750/oz, Ag, $21.24/oz, Pb, $0.97/lb and Zn, $1.34/lb. Cu was not used in the calculation, and metallurgical recoveries were not considered as there is no data available for the Palos Verdes vein. True width estimated from hole inclination and estimated vein dip, where known.

Table of drill hole data for holes not previously released.

| Hole | Target | Easting | Northing | Elev | Azim | Incl | Depth (m) |

| PV-23-26 | NW fault | 413,807 | 2,593,082 | 1,236 | 10 | -45 | 327.00 |

| PV-23-27 | PV vein | 413,814 | 2,593,082 | 1,226 | 320 | -75 | 234.00 |

| PV-23-28 | NW fault | 413,801 | 2,593,136 | 1,244 | 35 | -60 | 117.00 |

| PV-23-29 | SW PV gap | 413,735 | 2,593,073 | 1,216 | 330 | -75 | 183.00 |

| PV-23-30 | SW PV gap | 413,707 | 2,592,990 | 1,202 | 330 | -50 | 180.00 |

| PV-23-31 | SW PV gap | 413,709 | 2,592,990 | 1,200 | 330 | -75 | 246.00 |

| PV-23-32 | SW PV gap | 413,677 | 2,592,942 | 1,211 | 315 | -50 | 199.50 |

| PV-23-33 | SW PV gap | 413,678 | 2,592,938 | 1,216 | 330 | -75 | 250.50 |

Coordinates in UTM WGS84 using handheld Garmin GPS.

QA/QC

Samples taken by Prismo are analyzed by multielement ICP-AES and MS methods internationally recognized analytical service providers. Certified Reference Materials including standard pulps and coarse blank material are inserted in the sample stream at regular intervals. Dr. Craig Gibson, PhD., CPG., a Qualified Person as defined by NI-43-01 regulations and President, CEO and a director of the Company, has reviewed and approved the technical disclosures in this news release.

Video Interview commenting on today’s news release:

You can watch our President & CEO and Executive Chairman Alain Lambert discuss today’s news at:

About Palos Verdes

The Palos Verdes project is located in the historic Panuco-Copala silver-gold district in southern Sinaloa, Mexico, approximately 65 kilometers NE of Mazatlán, Sinaloa, in the Municipality of Concordia. The Palos Verdes concession (claim) covers 700 meters of strike length of the Palos Verdes vein, a member of the north-easterly trending vein family located in the eastern part of the district outside of the area of modern exploration. Shallow drilling (<100m) conducted in 2018 on the Palos Verdes Vein was targeted 30 to 50 meters beneath largely barren vein outcrops and cut a well mineralized multistage vein two to seven metres wide with narrow intervals of high-grade precious metal values and subordinate base metals (see table of intercepts at www.prismometals.com). This mineralization is open in all directions and the currently planned drilling program is designed to follow it along strike and to depth.

About Prismo

Prismo (CSE: PRIZ) is mining exploration company focused on two precious metal projects in Mexico (Palos Verdes and Los Pavitos) and a copper project in Arizona (Hot Breccia).

Please follow @PrismoMetals on Twitter, Facebook, LinkedIn, Instagram, and YouTube

Prismo Metals Inc.

1100 – 1111 Melville St., Vancouver, British Columbia V6E 3V6

Contact:

Craig Gibson, President & Chief Executive Officer craig.gibson@prismometals.com

Jason Frame, Manager of Communications jason.frame@prismometals.com

Neither the Canadian Securities Exchange accepts responsibility for the adequacy or accuracy of this release.

Cautionary Note Regarding Forward-Looking Statements

This press release contains forward-looking statements and forward-looking information (collectively, “forward-looking statements”) within the meaning of applicable Canadian securities legislation. All statements other than statements of historical fact, including without limitation, statements regarding the anticipated content, commencement and exploration program results, the ability to complete future financings, required permitting, exploration programs and drilling, and the anticipated business plans and timing of future activities of the Company, are forward-looking statements. Forward-looking statements are typically identified by words such as: believe, expect, anticipate, intend, estimate, postulate and similar expressions, or are those, which, by their nature, refer to future events. Although the Company believes that such statements are reasonable, it can give no assurance that such expectations will prove to be correct.

The Company cautions investors that any forward-looking statements by the Company are not guarantees of future results or performance, and that actual results may differ materially from those in forward looking statements as a result of various factors, including, but not limited to, the state of the financial markets for the Company’s equity securities, the state of the commodity markets generally, variations in the nature, the analytical results from surface trenching and sampling program, including diamond drilling programs, the results of IP surveying, the results of soil and till sampling program. the quality and quantity of any mineral deposits that may be located, variations in the market price of any mineral products the Company may produce or plan to produce, the inability of the Company to obtain any necessary permits, consents or authorizations required, including CSE acceptance, for its planned activities, the inability of the Company to produce minerals from its properties successfully or profitably, to continue its projected growth, to raise the necessary capital or to be fully able to implement its business strategies, the potential impact of COVID-19 (coronavirus) on the Company’s exploration program and on the Company’s general business, operations and financial condition, and other risks and uncertainties. All of the Company’s Canadian public disclosure filings may be accessed via www.sedar.com and readers are urged to review these materials, including the technical reports filed with respect to the Company’s mineral properties.

SOURCE: Prismo Metals Inc.

Original Article: https://www.newsfilecorp.com/release/196931/Prismo-Metals-To-Resume-Drilling-at-Palos-Verdes