Pre-Tax NPV (8%) of US$2.3 Billion, After-Tax NPV (8%) of US$1.2 Billion

Pre-Tax IRR of 23.0% After-Tax IRR of 17.3%

Average annual copper production of 292 M lb per year over first 5 years of full production

VANCOUVER, CANADA, October 17th, 2023 – Oroco Resource Corporation. (“Oroco” or the “Company”) (TSXV: OCO; OTCQB: ORRCF, BF: OR6) is pleased to announce a Preliminary Economic Assessment (“PEA”) and updated Mineral Resource Estimate (“MRE”) for the North Zone and South Zone of its Santo Tomas Porphyry Copper Project (“Santo Tomas” or the “Project”) in Sinaloa State, Mexico. The PEA results support a staged open pit mine and processing plant starting at 60,000 tonnes per day (“t/d”) in year 1 of production, expanding to 120,000 t/d in year 2 over a 20.1-year Life of Mine (“LOM”). Production is preceded by two years of construction and pre-stripping. The PEA has been prepared by Ausenco Engineering USA South Inc. (“Ausenco”). The updated MRE and geologic model were prepared by SRK Consulting (US), Inc. of Denver, Colorado and SRK Consulting (Canada), Vancouver, BC (“SRK”). SRK (Canada) was responsible for geotechnical modeling. The mine planning and mine costs components of the PEA were prepared by Mining Plus Canada Consulting Ltd. (“Mining Plus”).

Highlights of the Santo Tomas PEA include:

- US$2.33 billion pre-tax NPV (8%) and US$1.24 billion after-tax NPV (8%)

- 23.0% pre-tax IRR; 17.3% after-tax IRR.

- Total LOM payable copper production of 4,749 M lb.

- Pre-tax payback of 4.1 years; after-tax payback of 5.0 years from first concentrate production.

- Initial capital costs estimated at US$1,339.9 million; sustaining and expansion capital costs estimated at US$1,134.5 million.

- Average annual LOM C1 Cash Cost of US$1.66/lb Cu on by-product basis.

- An ultimate pit design constrained resource of 388 Mt of Indicated and 460 Mt of Inferred material.

Commenting on the PEA, Richard Lock stated: “This is a significant start to the process of evaluating Santo Tomas. The PEA firmly demonstrates the economic viability of the Santo Tomas Project and justifies its continued development. The combination of excellent infrastructure, simple metallurgy, a cohesive and consistent grade distribution, and a low strip ratio, along with the identification of several existing opportunities for resource expansion, provide additional strength and certainty to the Project. We have also identified a high probability of additional upside in Project economics through the future application of mine and process design improvements, all of which confirm that we have a substantial resource at Santo Tomas. In summary, the Santo Tomas Project clearly has robust potential for the development of a large, low-cost open-pit, copper mining operation.”

Santo Tomas Project PEA Overview

The Santo Tomas property comprises 9,034 ha of mineral concessions encompassing significant porphyry copper mineralization in northern Sinaloa and southwest Chihuahua, Mexico. The Project is located in the Santo Tomas Porphyry District, which extends from Santo Tomas northward to the Jinchuan Group’s Bahuerachi Project located approximately 14 km to the north-northeast. The PEA was conducted using data (including 27,382 Cu assays) from 68 diamond drill holes (43,063 m) drilled by the Company and 90 legacy reverse circulation and diamond drill holes (21,075 m, for a total of 64,138 m in 158 drill holes) in the Project’s North Zone and South Zone. The data from the seven exploration diamond drill holes in Brasiles Zone and the single geotechnical hole (GT001) drilled by the Company were excluded from consideration in the MRE and PEA. Oroco’s entire updated drill hole database (including PEA excluded holes) contains 166 new and legacy drill holes totaling 69,556 m with lithological logging data and 29,992 Cu assays.

The commodity price assumptions for the Discounted Cash Flow (“DCF”) analysis are presented in Table 1. Key results are presented in Tables 2 & 3.

Table 1: PEA DCF Price Assumptions

| Commodity | Unit | Price |

| Cu | US $ / lb | 3.85 |

| Mo | US $ / lb | 13.50 |

| Au | US $ / t.oz | 1,700 |

| Ag | US $ / t.oz | 22.50 |

*Cash flow model assumptions only

Table 2: Mining and Production – Key Results

| Key Assumptions | Unit | LOM |

| Exchange Rate | MXN / US$ | 19.76 |

| Fuel Price | MXN / L | 20.41 (US$1.03) |

| Production Profile | Unit | LOM |

| Total Open Pit Tonnage | Mt | 1,831 |

| Total Open Pit Mineralized Material Mined | Mt | 848 |

| Open Pit Strip Ratio | Waste : mill feed | 1.16 |

| Daily Throughput (Year 1 // Year 2 on) | kt/d | 60 // 120 |

| LOM concentrate production) | Years | 20.1 |

| Copper in Mill Feed | M lb | 5,920 |

| Molybdenum in Mill Feed | M lb | 141.7 |

| Gold in Mill Feed | koz Au | 747.3 |

| Silver in Mill Feed | koz Ag | 54,998 |

| LOM mill feed (Indicated // Inferred) | Mt | 388 // 460 |

| Average Cu payable / year – LOM | M lb | 236 |

| Average Cu payable / year – First 5 Years (1) | M lb | 281 |

| Payable (2) Copper LOM (in concentrate) | M lb | 4,749 |

| Payable Molybdenum LOM (in concentrate) | M lb | 82.6 |

| Payable Silver LOM (min 30 g/t payable in Cu Concentrate) | koz | 26,330 |

| Payable Gold LOM (min 1 g/t payable in Cu Concentrate) | koz | 331.9 |

| Operating Costs (US$/lb.) | Unit | LOM |

| C1 Cash Costs Copper (By-Product Basis) (3) | US$/lb | 1.66 |

| C3 Cash Costs Copper (By-Product Basis) (4) | US$/lb | 2.00 |

| Capital Expenditures (5) | Unit | LOM |

| Initial Capital (6) | US$M | 1,339.9 |

| Sustaining and Development Capital (6) | US$M | 1,134.5 |

| Closure Costs (5 years, year 20 – 24) | US$M | 209.2 |

| Estimated Salvage Value | US$M | 0 |

Notes:

- First 5 Years at full production, starting year 2.

- Payable metals consider mining dilution, concentrator recoveries and Treatment Charges/Refining Charges (TC/RC).

- C1 Cash Costs consist of mining costs, processing costs, mine-level G&A and transportation costs net of by-product credits.

- C3 Cash Costs includes C1 Cash Costs plus sustaining and expansion capital, royalties, and closure costs and excludes expansion capital.

- All capital expenditures are inclusive of contingency provisions to allow for uncertain cost elements, which are predicted to occur but are not included in the cost estimate.

- Net of leasing capital deferment and leasing costs.

Table 3: Key Financial Results and Costs

| Economics | Unit | LOM |

| NPV at 8% (pre-tax // post-tax) | US$M | 2,328.9 // 1,237.6 |

| IRR (pre-tax // post-tax) | % | 23.0 // 17.3 |

| Payback (pre-tax // post-tax) | Years | 4.1 // 5.0 |

| Revenue over LOM | US$M | 20,553 |

| Initial Capital | ||

| Mining Pre-Stripping (Capitalized Opex) | US$M | 183.5 |

| Mining Capital Equipment (1) | US$M | 328.9 |

| Total Mining (1) | US$M | 512.4 |

| Processing | US$M | 976.1 |

| Total Initial Capital (1) | US$M | 1,488.5 |

| Total Initial Capital Net of Leasing (2) | US$M | 1,339.9 |

| Sustaining Capital | ||

| Mining Equipment (3) | US$M | 203.5 |

| Processing | US$M | 72.9 |

| Total Sustaining Capital (3) | US$M | 276.4 |

| Total Sustaining Capital Net of Leasing (2) | US$M | 467.5 |

| Expansion Capital – Processing (year 2) | US$M | 667.0 |

| Operating Costs | ||

| Mining Cost per tonne mined (4) | US$ / t | 2.30 |

| Mining Cost per tonne milled (4) | US$ / t | 4.77 |

| Processing Cost per tonne milled | US$ / t | 4.25 |

| G&A Cost per tonne milled | US$ / t | 0.67 |

| Total Operating Cost (3) | US$ / t | 9.68 |

Notes:

- Includes the full mining capital cost without deferral of capital attributable to leasing in the amount of M$191.1 from initial capital to sustaining capital. Excludes leasing costs in the amount of M$42.4 incurred prior to production.

- Supplier-sourced leasing terms from October 2023 are used in the DCF model mine fleet cost calculations that include a 5-year lease period with 10.3% interest, 0.5% upfront fee, and no residual payment.

- Includes sustaining capital mining equipment without inclusion of costs attributable to the deferral of initial mining equipment in the amount of M$191.1.

- Excludes leasing costs.

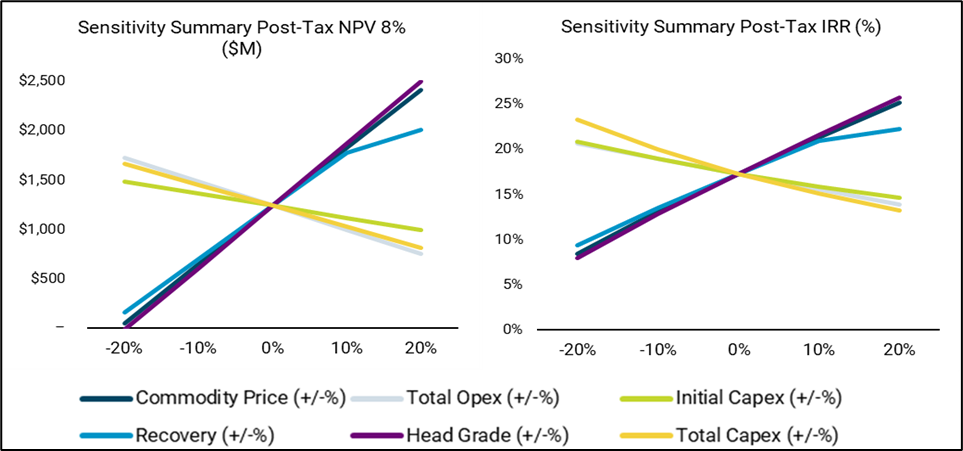

PEA Economic Sensitivities

Project economics and cash flows are most sensitive to changes in the price of copper (Figure 1). Mined grade and recovery sensitivity is high and future studies will seek to optimize these parameters. However, the highest potential for change in economics is anticipated to result from future changes in copper pricing.

PEA Mineral Resources

The PEA MRE prepared by SRK Consulting (U.S.), Inc. in accordance with the Canadian Institute of Mining, Metallurgy, and Petroleum (“CIM”) Definition Standards (the “CIM Standards”) incorporated by reference in National Instrument 43-101 (“NI 43-101”), with an effective date of October 11, 2023. The technical report will be prepared and released by the Company and will be available at www.orocoresourcecorp.com and on SEDAR (www.sedarplus.ca) under the Company’s profile, within 45 days of this news release.

The mineral resource estimation process includes updated structural, lithologic, and mineralization models, though the PEA MRE has not materially changed from the previous study, effective April 27, 2023, due to the inclusion of two additional drill holes in the North Zone and updated economic assumptions based on the PEA study. The Company provided SRK with an updated exploration database including drill hole collar and downhole survey data, geological logging, assay, specific gravity, geotechnical classification, and associated information.

The resource estimation methodology involved the following procedures:

- Database compilation and verification,

- Construction of wireframe models for the major structures, lithotypes, and controls on mineralization,

- Definition of resource domains using a combination of lithotypes, structure, and mineralization grade shells,

- Data conditioning (compositing and capping) for statistical and geostatistical analyses,

- Determination of spatial continuity through variography within the estimation domains,

- Block modeling and grade interpolation for all key economic variables (Cu, Mo, Ag, Au, and Sulfur [S]) and secondary variables (arsenic [As], calcium [Ca], potassium [K], lead [Pb], and zinc [Zn]),

- Block model validation,

- Resource classification,

- Assessment of “reasonable prospects for eventual economic extraction” (“RPEEE”) using a constraining economic pit shell and selection of an effective cut-off grade (“CoG”), and

- Preparation of the updated mineral resource statement.

SRK undertook the geological modeling and mineral resource estimate using Seequent Leapfrog Geo and Leapfrog Edge, respectively. The procedure involved construction of wireframe models for structural geology controls, key geological and mineralization domains, data conditioning (compositing and capping) for statistical analysis, variography, block modeling and grade interpolation followed by block model validation. Grade was estimated using a combination of ordinary kriging and inverse distance weighting cubed estimates for copper, molybdenum, gold, and silver. Sulfur grades are estimated using inverse distance weighting squared (“IDW2”) and bulk density is estimated using a combination of simple kriging and IDW2. Grade estimation was based on block dimensions of 50 m x 50 m x 10 m for the PEA model (unchanged from the previous 2023 study). The block size reflects current data spacing across the Project while considering a likely open pit mining method. Classification of mineral resources considers the geological complexity (structure, lithology, alteration, and mineralization), spatial continuity of mineralization, data quality, and spatial distribution of drilling conducted at the Project.

The PEA MRE is supported by 64,138 m of drilling in 158 holes. The drilling data represents a combination of holes completed by Oroco from 2021 to 2023 and historical drill holes but excludes drilling at Brasiles Zone and one geotechnical hole.

The PEA MRE includes the two primary mineralization zones identified at Santo Tomas: North Zone and South Zone. These zones display similar mineralization styles but are physically separated by localized post-mineralization faults and material currently defined as waste due to a lack of drilling. Consistent with the previous study, the MRE is not constrained by the location of the Huites Reservoir. Mineral resources are reported above an effective cut-off grade (CoG) of 0.15% Cu and constrained by an economic pit shell (see Table 4).

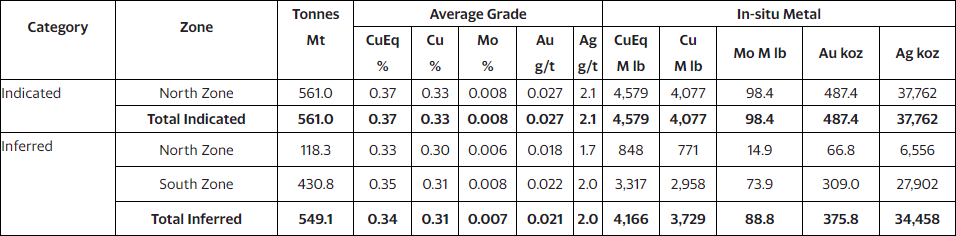

Table 4: Mineral Resource Statement for the Santo Tomas Project, effective October 11, 2023

Notes:

- Mineral resources are not mineral reserves and do not have demonstrated economic viability.

- Table abbreviations include: % = percent, g/t = grams per metric tonne, Mlb = million pounds, Koz = thousand troy ounces.

- The mineral resources are reported at an effective cut-off grade (CoG) of 0.15% Cu.

- All figures are rounded to reflect the relative accuracy of the estimates. Totals in the above table may not sum or recalculate from related values in the table due to rounding of values in the table, reflecting fewer significant digits than were carried in the original calculations.

- The mineral resources exclude identified oxide mineralization due to a lack of confidence in recovery assumptions of oxidized tonnages at this phase of the Project.

- Metal assays are capped where appropriate. At the PEA level of the Project, it is the Company’s opinion that all the elements included in the copper equivalent calculation have a reasonable potential to be recovered and sold.

- All dollar amounts are presented in U.S. dollars.

- Bulk density is estimated on a block basis using specific gravity data collected on diamond drill core.

- Reasonable prospects of eventual economic extraction (RPEEE) are demonstrated through use of an economic pit shell based on long-term copper price of $4.00/lb, molybdenum price of $13.50/lb, a gold price of $1,700/oz, and a silver price of $22.50/oz. Metal recovery factors used in the determination of CoG and economic pit shell for Cu, Mo, Au, and Ag have been applied based on metallurgical recovery calculations based on average feed grade. A 45-degree slope angle was applied.

- The Huites Reservoir boundary was ignored for the purposes of mineral resource determination. This is consistent with the previous study.

- The economic CoG was calculated to be 0.11% Cu but for consistency with the previous study, Oroco has elected to use an effective CoG at 0.15% Cu. CoG assumptions include a copper price of $4.00/lb., mining cost of $2.27/t, processing costs of $4.23/t, G&A costs at $0.65/t, mine recovery at 98%, mean Cu recovery at 83.7%, and royalties at 1.5%, have been applied in consideration of the RPEEE.

- Equivalent Copper (CuEq) percent is calculated with the formula CuEq% = ((Cu grade * Cu recovery [83.7%] * Cu price) + (Mo grade * Mo recovery [59.1%] * Mo price) + (Au grade * Au recovery [58.6%] * Au price) + (Ag grade * Ag recovery [54.2%] * Ag price)) / (Cu price * Cu recovery [83.7%]). It assumed that the Santo Tomas Project would produce a conventional (flotation) copper concentrate product based on metal recoveries indicated by PEA metallurgical test work and mean Indicated Resource feed grades.

- Reported contained individual metals in the table above represent in-situ metal, calculated on a 100% recovery basis, except for CuEq% which applies mean recovery assumptions (see Note 12).

Mineralization has been identified outside the current economic pit shell. The PEA highlights the potential to define additional mineral resources on the property. There is identified exploration potential for additional mineralization in the southeastern and southwestern portions of the South Zone based on observations from drilling and surface outcrops in the area.

PEA Mine Design

The PEA Mine Design, prepared by Mining Plus, contemplates open pit development that ensures no incursion upon the Huites Reservoir, maintaining a 100 m berm between the reservoir high water mark and the pit limit thereby remaining outside of CONAGUA’s (Mexican water authority) jurisdiction boundary (the “CONAGUA limit”). These constraints were selected by the Company. Avoiding the CONAGUA limit and applying a series of pit slope constraints derived from preliminary geotechnical domains defined by SRK from Phase 1 drilling on the Project, a Mineral Resource within the ultimate pit design (by classification and grades) for this PEA has been defined as shown in Table 5.

Table 5: Pit Constrained Resource: Mining-Plus

| INDICATED | INFERRED | |

|---|---|---|

| IN-PIT RESOURCE(1) MT | 387.98 | 459.70 |

| COPPER % | 0.340 | 0.297 |

| MOLYBDENUM % | 0.008 | 0.008 |

| GOLD G/T | 0.033 | 0.023 |

| SILVER G/T | 2.101 | 1.948 |

Notes:

- The Mill Feed Tonnes and Grade are Mineral Resources, not Mineral Reserves, but form part of the potential economic viability analysis.

- All dollar amounts are presented in U.S. dollars (Note 3, below).

- The marginal CoG was calculated to be 0.14% CuEq (Cut off NSR = 7 $/t). CoG parameters include a copper price of $3.80/lb., molybdenum price of $12.00/lb., gold price of $1650/oz., silver price of $22.0/oz., processing costs of $6.00/t, G&A costs at $1.00/t, mine recovery at 98%, developed metallurgical recovery formulas, and royalties at 1.5%. CuEq is calculated the formula CuEq% = [Cu grade * Cu recovery * (Cu price – Selling cost Cu) + Mo grade * Mo recovery *(Mo Price – selling cost Mo) + Au grade * Au recovery * (Au Price – selling cost Au) + Ag grade * Ag recovery* (Ag Price – selling cost Ag)] / [(Cu Price – selling cost) * Cu recovery].

- Metallurgical recovery formulas were obtained from Ausenco’s “Oroco Resource Corp. Santo Tomas Project Metallurgical Testwork Review June 9, 2023” report.

The Mine Design proposes a standard open-pit, truck and shovel operation with 10-meter bench intervals. Haul trucks with a capacity of 194 tonnes will be used for hauling mineralized material to the mineral processing plant, stockpile facilities and the waste rock storage facility (“WRSF”). Mining operations will use large-scale mining equipment including 20 cm diameter blast hole drills, 29 m3 hydraulic shovel, 22 m3 front end loader, and 194 tonne capacity haul trucks. Supplier-sourced capital costs from October 2023 are used in the mine fleet cost calculations.

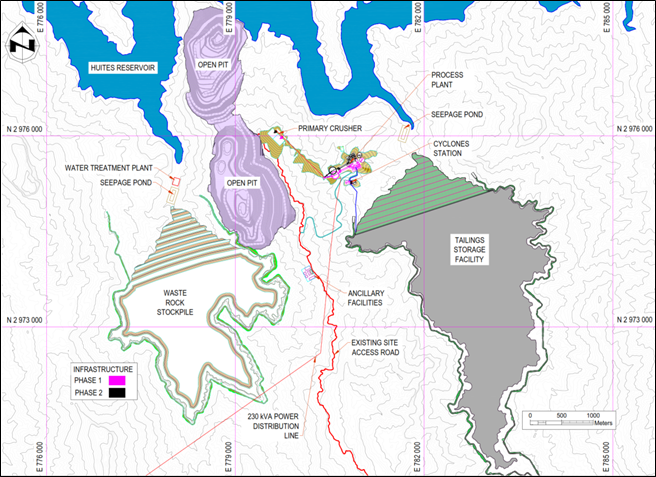

The mine is divided into two zones, the higher-grade North Zone, which is the initial focus of mine development, and the lower-grade South Zone, which requires pre-stripping ahead of mine development. The North Zone pit is approximately 1,850 m long (N-S) and 1,000 m wide (E-W) with a depth of 680 m and the South Zone pit is 2,050 m long and 1,080 m wide with a depth of 780 m.

The mining sequence consists of four phases. The first and second phases define the North Pit, and the successive two phases define the South Pit.

The Project has an operational LOM of 22.1 years, which includes two years of pre-stripping. The pit constrained resource contains 388 million tonnes of indicated and 460 million tonnes of inferred resource and 983.6 million tonnes of waste is removed, resulting in a strip ratio of 1.16 over the life of the mine.

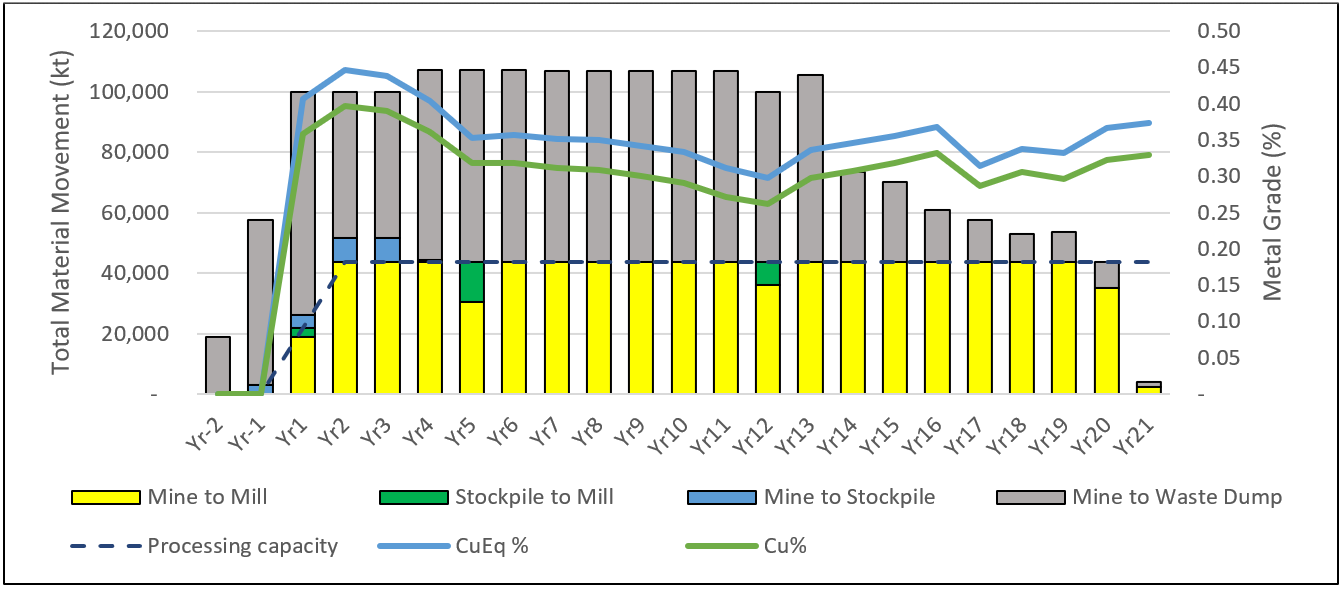

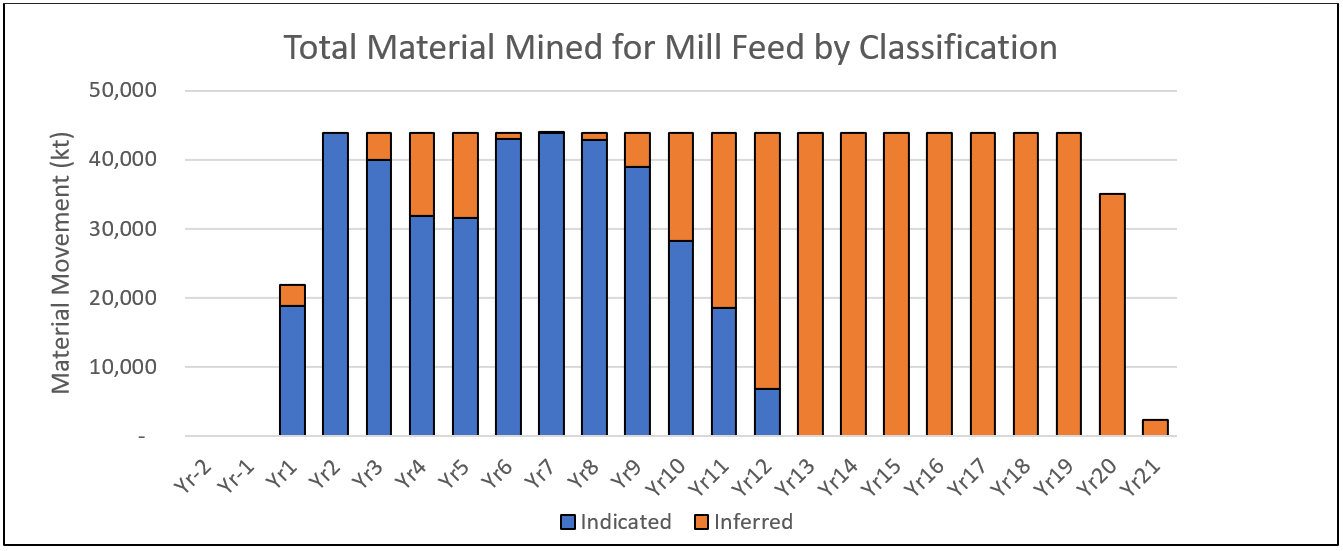

Mining operations will be carried out on a 24-hour per day, 365 days per year schedule. Milling will start at 60 kt/d in the first year of production, expanding to 120 kt/d in the second year.

Mill feed tonnages and corresponding resource classification are shown in Figures 2 and 3.

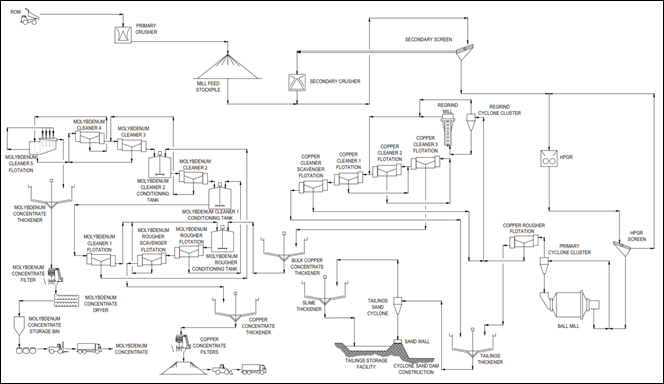

Process Design & Plant Infrastructure

The Q2 2022 metallurgical test work program demonstrated the ability to produce a marketable copper concentrate using a conventional flotation process flowsheet. Levels of molybdenum in bulk concentrates were sufficient to produce a marketable molybdenum concentrate using conventional Cu-Mo separation flotation techniques. For purposes of the PEA, logarithmic regression analysis was performed on the flotation test work results to develop metallurgical process recoveries as a function of head grade. Based on these formulas, Ausenco forecasts the following mean recoveries for copper, molybdenum, silver, and gold at 83.3%, 59.2%, 53.9%, and 53.2%, respectively. Results from comminution test work on nine variability samples returned elevated hardness properties for some of the mineralized materials (e.g. Axb & ball mill work index of 30 and 18.3 kWh/tonne, respectively). Given these measurements and high throughputs, High Pressure Grinding Rolls (“HPGR”) crushing was considered over conventional SAG milling. Figure 4 illustrates the simplified overall process flowsheet developed for the Project.

The primary crusher is located at the north-east end of the South Pit (see Figure 5). Coarse crushed material is transported to a stockpile facility to the west of the process plant via an overland conveyor. An alternative to this design would involve the construction of conveyance tunnels and in-pit crushers in both the North and South pits feeding the stockpile. Material from the primary crusher is further reduced in size via secondary crushing and HPGR before feeding into twin ball mills. Ground material at a sizing of 80% passing 150 µm then advances to the flotation circuit to produce a bulk rougher product that is subsequently reground to 23 µm P80 prior to cleaner circuit upgrading. The bulk cleaner concentrate advances to copper-molybdenum separation to recover a molybdenum concentrate. Gold and silver report to the copper concentrate. The tailings are thickened and pumped to the tailings storage facility (“TSF”). Copper and molybdenum concentrates are dewatered prior to shipment.

Concentrates are trucked using the sealed containerized method to the Port of Topolobampo situated on the Gulf of California for transport to overseas smelters. The containerized method removes the capital expense of a concentrate storage facility at the port and loss of concentrate to the environment. The proximity of rail infrastructure to the Project could offer an alternative mode of concentrate transport.

Some infrastructure design includes expansion capacity design features (e.g. overland conveyor, powerline and water supply) during the initial phase so as to not interfere with production during the expansion phase.

Tailings and Waste Rock Storage Facilities

Both the waste-rock storage facility (“WRSF”) and the TSF are designed in accordance with national and international standards and constructed in valleys west and east of the resource, respectively (see Figure 5). The TSF has a rock fill with upstream composite liner system for a starter embankment that transitions to a cycloned sand centerline dam for the LOM with a seepage collection system in the downstream foundation. Ditches and berms have been designed to capture non-contact water above the facility and divert it around to reduce water management in the TSF. The WRSF will be constructed from the bottom up in thick lifts and contact water from the facility will be captured with a water treatment facility at the toe of the facility prior to release. Ditches and berms direct non-contact water above the facility and divert it around.

Power Infrastructure and Water Supply

Electrical supply is either from the Huites hydroelectric plant down-stream from the Project or via built for purpose combined cycle gas turbine plant tentatively located close to the Huites power station and the Texas-Sinaloa natural gas pipeline. Both options represent low carbon footprint power sources for the estimated power requirements at similar costs. A 230-kVA power line trace from Huites Station to the Project has been laid out and costed, as has the main mine access route.

A make-up process water supply source is from wells located within 25 km of the Project and follow a gravel valley well source configuration similar to that employed during mine operations at the El Sauzal Mine site located 45km upstream of the Project and the historic Reforma Mine located 7 km to the north.

Geology and Mineralization

Porphyry Cu (Mo‐Au‐Ag) mineralization on the Santo Tomas property is closely associated with intrusives linked to the Late Cretaceous to Paleocene (90 to 40 Ma) Laramide orogeny. Santo Tomas and most of the known porphyry copper deposits in Mexico lie along a 1,500 km‐long, NNW trending belt sub-parallel to the west coast, extending from the southwestern United States through to the state of Guerrero in Mexico.

In the Santo Tomas area, Mesozoic‐aged country rocks comprising limestone, minor sandstones, conglomerates, shales, and a thick succession of andesitic volcanics were intruded by a range of Laramide age intrusions related to the Late Cretaceous Sinaloa‐Sonora Batholith. Multiple phases are recognized ranging from dioritic to monzonitic in composition.

Mineralization is strongly structurally controlled by the Santo Tomas fault and fracture zone which provided a pathway to quartz monzonite dikes, associated hydrothermal alteration, hydrothermal breccias, and sulfide mineralization. Sulfide minerals are dominated by chalcopyrite, pyrite and molybdenite with minor bornite, covellite, and chalcocite. Sulfides occur as fracture fillings, veinlets, and fine disseminations together with potassium feldspar, quartz, calcite, chlorite, and locally, tourmaline. Chalcopyrite is the main copper mineral with minor copper oxides near surface.

Community and Environment

Oroco maintains an environment and social plan for the Project which provides a framework for its community outreach efforts focused on education, ongoing employment, indigenous engagement and community mapping. Oroco strives to maintain the support of the community, local municipal leaders and state regulators and governments in Sinaloa and Chihuahua. Oroco maintains its exploration permits and approvals in good standing.

Additional baseline studies and initiatives in key subject areas related to environmental, socio-economic, cultural, and community engagement are planned. These studies and activities will be necessary advance the project and provide a strong basis for the preparation of future environmental studies and permitting.

Project Enhancement Opportunities

Several further opportunities to improve the Project have been identified during the PEA Study. These include but are not limited to:

- The application of sulfide leaching on lower grade chalcopyrite resources currently assigned to waste. Preliminary studies have commenced, and results are expected in Q4 2023. CAPEX/OPEX costs for an SX/EW facility are developed but are not considered in this PEA.

- Fully evaluate oxide copper resources that are currently carried as waste in combination with sulfide leaching using available data from surface sampling and drilling.

- Optimize mine plan around larger loading and haulage equipment.

- Optimize mobile mining fleet considering mixed fuel and or electrified options.

- Infill resource drilling in the area between North and South zones: additional resource in that area would improve optimized pit development and reduce mining costs.

- Additional comminution studies and variability testing to better constrain recoveries across the full range of expected mill feed grades based on rock and alteration types.

- Consider relocation of the primary crushing facility closer to the pit(s) via in-pit crushing stations and conveyance via tunnels from both North and South pits to the mill feed stockpile.

- Investigate coarse particle flotation to reduce comminution costs and improve factors of safety on TSF design.

- Drill hydrogeological test wells at the north end of the North Pit to better define pit inflow and pit dewatering costs.

- Drill selected geotechnical holes to optimize pit slope angles and reduce mining of waste.

- Optimize heavy equipment leasing terms.

A geological-geochemical conceptual model will inform the ongoing development and refinement of geochemical and mine rock management plan for the site. The predicted occurrence of large volumes of net neutralizing mine waste materials to be mined in early years will be confirmed, as the buffering characteristics of these waste materials can be effectively utilized as part of the overall waste rock management strategy. Additional geochemical assessment of the acid rock drainage / metal leaching risk for the Project will be implemented to provide additional test work and sampling coverage, and to confirm preliminary study findings.

Cautionary Notes to Investors

PEA

The reader is cautioned that the PEA is preliminary in nature, and that it includes inferred mineral resources that are considered too speculative geologically to have the economic considerations applied to them that would enable them to be categorized as mineral reserves, and there is no certainty that the preliminary economic assessment will be realized.

Mineral Resource and Reserve Estimates

In accordance with applicable Canadian securities laws, all Mineral Resource estimates of the Company disclosed or referenced in this news release have been prepared in accordance with the disclosure standards of NI 43-101 and have been classified in accordance with the CIM Standards. Mineral Resources that are not Mineral Reserves do not have demonstrated economic viability. The estimate of mineral resources may be materially affected by environmental, permitting, legal, title, socio-political, marketing, or other relevant issues. In particular, the quantity and grade of reported inferred mineral resources are uncertain in nature and there has been insufficient exploration to define these inferred mineral resources as an indicated or measured mineral resource. It is uncertain in all cases whether further exploration will result in upgrading the inferred mineral resources to an indicated or measured mineral resource category.

Qualified Persons

The PEA for the Project summarized in this news release was prepared by Ausenco with input from SRK and Mining Plus, and will be incorporated in a technical report prepared in accordance with NI 43-101 which will be available under the Company’s SEDAR profile at www.sedarplus.ca and on the Company’s website within 45 days of this news release. The affiliation and areas of responsibility for each of the Qualified Persons involved in preparing the PEA, upon which the technical report will be based, are as follows:

Table 6: Qualified Persons for PEA

| Qualified Persons | Qualification | Company (location) | Position / Oversight |

| James Norine | P.E. | Ausenco Engineering USA South Inc. (Tucson) | Vice President, Southwest USA / PEA |

| Shaida Miranda | MSc, MAusIMM (CP), Mining Engineer | Mining Plus SAC (Lima) | Senior Mining Consultant / Mine Plan, Mining CAPEX + OPEX |

| Ron Uken | PhD, PrSciNat | SRK Consulting (Canada), Inc. (Vancouver) | Principal Structural Geologist / Geology |

| Scott Burkett | RM-SME | SRK Consulting (U.S.), Inc. (Denver) | Principal Consultant / Resource Geology |

| Andy Thomas | MEng, BE, P.Eng., EGBC | SRK Consulting (Canada), Inc. (Vancouver) | Principal Rock Mechanics Engineer / Geotechnical (Preliminary) |

| Peter Mehrfert | P. Eng. | Ausenco Engineering Canada Inc. (Vancouver) | Principal Process Engineer / Metallurgy |

| James Millard | M. Sc, P. Geo. | Ausenco Sustainability Inc. (Victoria) | Director, Strategic Projects / Environmental, Social, Permitting |

| Scott Elfen | P.E. | Ausenco Engineering Canada Inc. (Vancouver) | Global Lead Geotechnical Services / TSF & WRSF design + geotechnical |

Each QP has reviewed and verified the content of this news release.

About OROCO

The Company holds a net 85.5% interest in those central concessions that comprise 1,173 hectares “the Core Concessions” of The Santo Tomas Project, located in northwestern Mexico. The Company also holds an 80% interest in an additional 7,861 hectares of mineral concessions surrounding and adjacent to the Core Concessions (for a total Project area of 9,034 hectares, or 22,324 acres). The Project is situated within the Santo Tomas District, which extends up to the Jinchuan Group’s Bahuerachi Project, approximately 14 km to the northeast. The Project hosts significant copper porphyry mineralization defined by prior exploration spanning the period from 1968 to 1994. During that time, the Project area was tested by over 100 diamond and reverse circulation drill holes, totalling approximately 30,000 meters. Commencing in 2021, Oroco conducted a drill program (Phase 1) at Santo Tomas, with a resulting total of 48,481 meters drilled in 76 diamond drill holes. In May of 2023, the Company completed a Mineral Resource Estimate for the Core Concessions that identified Indicated and Inferred resources of 487 Mt @ 0.36% CuEq and 600 Mt @ 0.36% CuEq respectively. This news release updates that resource identifying Indicated and Inferred resources of 561 Mt @ 0.37% CuEq and 549 Mt @ 0.34% CuEq respectively.

The Project is located within 160 km of the Pacific deep-water port at Topolobampo and is serviced via highway and proximal rail (and parallel corridors of trunk grid power lines and natural gas) through the city of Los Mochis to the northern city of Choix. The property is reached, in part, by a 32 km access road originally built to service Goldcorp’s El Sauzal Mine in Chihuahua State.

Additional information about Oroco can be found on its website at www.orocoresourcecorp.com and by reviewing its profile on SEDAR at www.sedarplus.ca.

For further information, please contact:

Richard Lock, CEO

Oroco Resource Corp.

Tel: 604-688-6200

Email: info@orocoresourcecorp.com

www.orocoresourcecorp.com

Cautionary Note Regarding Forward-Looking Information

This news release contains “forward-looking information” within the meaning of applicable Canadian securities legislation based on expectations, estimates and projections as at the date of this news release. Forward-looking information involves risks, uncertainties and other factors that could cause actual events, results, performance, prospects and opportunities to differ materially from those expressed or implied by such forward-looking information. All statements other than statements of fact included in this document constitute forward-looking information, including, but not limited to, objectives, goals or future plans, statements regarding anticipated exploration results and exploration plans, Oroco’s expectations regarding the future potential of the Santo Tomas deposits, its plans for additional drilling and other exploration work on the Santo Tomas deposits and the potential to advance or improve the PEA study.

Forward-looking information is not, and cannot be, a guarantee of future results or events. Forward-looking information is based on, among other things, opinions, assumptions, estimates and analyses that, while considered reasonable by the Corporation at the date the forward-looking information is provided, inherently are subject to significant risks, uncertainties, contingencies and other factors that may cause actual results and events to be materially different from those expressed or implied by the forward-looking information.

Factors that could cause actual results to differ materially from such forward-looking information include, but are not limited to, capital and operating costs varying significantly from estimates; the preliminary nature of metallurgical test results; delays in obtaining or failures to obtain and comply with required governmental, environmental or other Project approvals; uncertainties relating to the availability and costs of financing needed in the future; changes in equity markets; inflation; fluctuations in commodity prices; delays in the development of the Project; COVID-19 and other pandemic risks; those other risks involved in the mineral exploration and development industry; and those risks set out in the Company’s public documents filed on SEDAR at www.sedarplus.ca.

Should one or more risk, uncertainty, contingency or other factor materialize or should any factor or assumption prove incorrect, actual results could vary materially from those expressed or implied in the forward-looking information. Accordingly, you should not place undue reliance on forward-looking information. Oroco does not assume any obligation to update or revise any forward-looking information after the date of this news release or to explain any material difference between subsequent actual events and any forward-looking information, except as required by applicable law.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this news release. No stock exchange, securities commission or other regulatory authority has approved or disapproved the information contained herein.

Original Article: https://orocoresourcecorp.com/news/oroco-announces-23-billion-pre-tax-npv-in-a-pea-for-the-santo-tomas-project