VANCOUVER, BC – January 11, 2021 – Orla Mining Ltd. (TSX: OLA; NYSE: ORLA) (“Orla” or the “Company”) is pleased to provide the results of an updated Feasibility Study and mineral reserve estimate on its Camino Rojo Oxide Gold Project (the “Project” or “Camino Rojo”) located in Zacatecas, Mexico. The updated Feasibility Study highlights a 54% increase in contained gold mineral reserves and a 3.5-year extension to the mine life of the Project, which is currently in construction. The estimated Project after-tax net present value (“NPV”) (5% discount rate) is now $452 million with an after-tax internal rate of return (“IRR”) of 62% at a gold price of $1,600 per ounce.

“The updated Feasibility Study for the Camino Rojo Oxide Project demonstrates an increase in recovered gold, mine life, and cash flows,” stated Jason Simpson, President and Chief Executive Officer of Orla. “An already excellent project has been improved due to the hard work of the entire Orla team and I thank them for their efforts. We are pleased to announce this important enhancement and we will continue to optimize this asset as we move through construction and into production.”

Key Updated Feasibility Study Highlights:

Table 1: Feasibility Study Highlights

| Units | Values | |

| Throughput Rate per Day | tonnes | 18,000 |

| Total Ore to Leach Pad | M tonnes | 67.4 |

| Gold Grade (Average) | g/t | 0.73 |

| Silver Grade (Average) | g/t | 14.5 |

| Contained Gold | ounces | 1,588,000 |

| Contained Silver | ounces | 31,506,000 |

| Average Gold Recovery | % | 62% |

| Average Silver Recovery | % | 20% |

| Recovered Gold | ounces | 980,000 |

| Recovered Silver | ounces | 6,189,000 |

| Mine Life | years | 10.4 |

| Average Annual Gold Production | ounces | 94,000 |

| Strip Ratio | waste : ore | 0.92 |

| Initial Capex | US$ million | $134 |

| Avg. Life of Mine Operating costs | $/t ore processed | $8.17 |

| Total Cash Cost (net of by-product credits)1 | $/oz Au | $490 |

| All-In Sustaining Cost (“AISC”)1 | $/oz Au | $543 |

| Pre -Tax – NPV (5% discount rate) | US$ million | $668 |

| Pre-Tax IRR | % | 82% |

| After-Tax – NPV (5% discount rate) | US$ million | $452 |

| After-Tax IRR | % | 62% |

| Payback | years | 1.5 |

1 Total cash cost and AISC are non-GAAP measures and are net of silver credits and includes royalties payable. See reference below regarding non-GAAP measures.

* All dollar amounts in US dollars

The updated Feasibility Study reflects some of the benefits resulting from a pit expansion made possible through the completion of the layback agreement with Fresnillo Plc (“Fresnillo”) announced on December 21, 2020 (the “Layback Agreement”). Closing of the Layback Agreement is subject to receipt of Mexican antitrust approval from the Federal Competition Commission (Comisión Federal de Competencia Económica or “COFECE”).

The Layback Agreement allows Orla to expand the north wall of the oxide pit onto the Fresnillo property immediately adjacent to Orla’s mineral concession. This expansion will increase oxide ore available for extraction on Orla’s property below the pit outlined in the previous feasibility study dated June 25, 2019 (“2019 Feasibility Study”). The increase in mineral reserves in the updated Feasibility Study is derived from the conversion of measured and indicated mineral resources located solely on Orla’s concession. There has been no change to the mineral resource estimate dated effective June 7, 2019.

The Layback Agreement also provides Orla with the right to mine from Fresnillo’s mineral concession, and recover for Orla’s account, all oxide and transitional material amenable to heap leaching that is within an expanded open pit. Results from holes drilled on Fresnillo’s concession in close proximity to the most northern holes on the Orla property appear to be consistent with projections of the geological and oxidation models created from Orla’s data and assay results. Additional work is required to bring material on the Fresnillo concession to the measured and indicated mineral resource categories. Therefore, in the updated Feasibility Study, all material to be mined on the Fresnillo concession is classified as waste. Upon the completion of a confirmatory drill program on Fresnillo’s concession by Orla, and integration of Fresnillo’s drill database, a subsequent mineral reserve update is expected which would include all economic oxide and transitional material from the expanded pit.

The updated Feasibility Study continues to support a technically simple open pit mine and heap leach operation but improves upon the economics outlined in the 2019 Feasibility Study. The main notable physical changes from the 2019 Feasibility Study are an increase in the size of the open pit, heap leach pad, and mine waste dump as a result of the Layback Agreement, all of which were anticipated in the initial design. The majority of the infrastructure will remain as presented in the 2019 Feasibility Study and as being currently constructed.

The updated Feasibility Study was conducted using a gold price of $1,600 per ounce and a silver price of $20 per ounce and is expressed in U.S. dollars.

The new mineral reserve estimate at Camino Rojo includes proven and probable mineral reserves of 67.4 million tonnes at a gold grade of 0.73 grams per tonne (“g/t”) and a silver grade of 14.5 g/t, for total mineral reserves of 1.59 million ounces of gold and 31.5 million ounces of silver. All mineral reserves are contained within Orla’s mineral concession. Approximately two-thirds of the mineral reserves are within the currently permitted mine plan. The remaining portion will require a Cambio de Uso de Suelo (“CUS”) and related permit amendments for an expanded pit; approval of the Layback Agreement from COFECE and subsequent transfer of surface rights. These permit amendments and approvals are expected to be received in a reasonable time frame.

Measured and indicated mineral resources are unchanged at 353.4 million tonnes at 0.83 g/t gold and 8.8 g/t silver, resulting in an estimated 9.46 million ounces of gold and 100.4 million ounces of silver. Inferred mineral resources are 60.9 million tonnes at 0.87 g/t gold and 7.4 g/t silver, resulting in an estimated 1.70 million ounces of gold and 14.5 million ounces of silver. Mineral resources are inclusive of mineral reserves.

Further details on the mineral resource and mineral reserve estimates are provided below.

Camino Rojo Updated Feasibility Study

The Camino Rojo updated Feasibility Study considers open pit mining of 67.4 million tonnes of oxide and transitional ore at a rate of 18,000 tonnes per day. Ore from the pit will be crushed to 80% passing 28 mm, conveyor stacked onto a heap leach pad and leached using a low concentration sodium cyanide solution. Pregnant solution from the heap leach will be processed in a Merrill-Crowe recovery plant where gold and silver will be precipitated and doré will be produced. The site’s proximity to infrastructure, low stripping ratio, compact footprint, and flat pad location all contribute to the Project’s simplicity and low estimated AISC of $543 per ounce of gold.

The updated Feasibility Study was prepared by a team of independent industry experts led by Kappes Cassiday and Associates (“KCA”) and supported by Independent Mining Consultants (“IMC”), Resource Geosciences Incorporated (“RGI”), John Ward Groundwater Consultant, Barranca Group LLC, Piteau Associates Engineering Ltd. and HydroGeoLogica Inc (“HGL”).

The updated Feasibility Study incorporates geological, assay, engineering, metallurgical, geotechnical, environmental, and hydrogeological information collected by Orla and previous owners since 2007, including 370,566 metres of drilling in 911 holes. Predicted average gold recoveries of 62% are based on results from 85 column tests.

Operating costs are based on contract mining with all other mine components being owned and operated by Orla. Approximately 58% of capital costs are based on purchase orders and updated firm proposals for equipment, material, and construction contracts from ongoing EPCM and site activities. For capital items not yet purchased, budgetary supplier quotes were used.

Table 2 presents the key assumptions and detailed results of the updated Feasibility Study:

Table 2: Summary of Key Assumptions and Economics of the Camino Rojo Feasibility Study

| Production Data | Units | Values |

| Life of Mine | tears | 10.4 |

| Mine Throughput | tonnes/day | 18,000 |

| Mine Throughput | tonnes/year | 6,570,000 |

| Total Tonnes to Crusher | tonnes | 67,363,000 |

| Gold Grade (Average) | g/t | 0.73 |

| Silver Grade (Average) | g/t | 14.5 |

| Contained Gold | ounces | 1,588,000 |

| Contained Silver | ounces | 31,506,000 |

| Average Gold Recovery | % | 62% |

| Average Silver Recovery | % | 20% |

| Average Annual Gold Production | ounces | 94,000 |

| Average Annual Silver Production | ounces | 597,000 |

| Total Gold Produced | ounces | 980,000 |

| Total Silver Produced | ounces | 6,189,000 |

| Life of Mine Strip Ratio | waste : ore | 0.92 |

| Operating Costs (Average LOM) | ||

| Mining (mined) | /tonne mined | $1.75 |

| Mining (processed) | /tonne processed | $3.37 |

| Processing & Support | /tonne processed | $3.20 |

| General & Administrative | /tonne processed | $1.60 |

| Total Operating Cost | /tonne processed | $8.17 |

| Total Cash Cost (net of by-product credits)1 | /ounce Au | $490 |

| AISC1 | /ounce Au | $543 |

| Capital Costs (Excluding value added tax) | ||

| Initial Capital2 | US$ million | $134 |

| Life of Mine Sustaining Capital | US$ million | $24 |

| Life of Mine Capital | US$ million | $158 |

| Working Capital & Initial Fills | US$ million | $10 |

| Closure Costs | US$ million | $29 |

| Financial Evaluation | ||

| Gold Price Assumption | $/ounce | $1,600 |

| Silver Price Assumption | $/ounce | $20 |

| Average Annual Cashflow (Pre-Tax) | US$ million | $106 |

| Average Annual Cashflow (After-Tax) | US$ million | $79 |

| IRR, Pre-Tax | % | 82% |

| IRR, After-Tax | % | 62% |

| NPV @ 5% (Pre-Tax) | US$ million | $668 |

| NPV @ 5% (After-Tax) | US$ million | $452 |

| Pay-Back Period (After-Tax) | years | 1.5 |

1 Total cash cost and AISC are non-GAAP measures and are net of silver credits and includes royalties payable. See reference below regarding non-GAAP measures. Updated Feasibility Study economics include a 2% net smelter royalty (“NSR”) and assumes a USD:MXN exchange rate of 19.3.

2 Includes sunk capital costs to date.

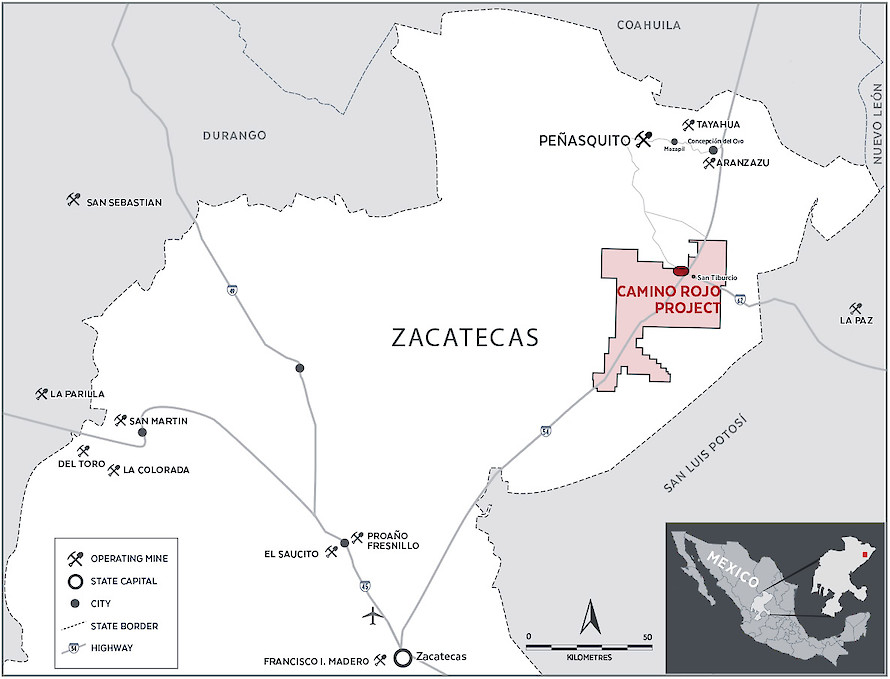

The proposed mine is located three kilometres from a paved four-lane highway and approximately 190 kilometres from the city of Zacatecas. The area is flat and there are no known social or environmental impediments to mining at this time. There are no residents within the area of development. The town of San Tiburcio is located four kilometres to the east of the development. Orla has a Collaboration and Social Responsibility Agreement with Ejido San Tiburcio and a 30-year temporary occupation right with an expropriation right over the 2,497 hectares covering the portion of the proposed pit that is on the Orla concession and the location of all infrastructure. Subject to receipt of approval from COFECE and subsequent transfer of surface rights, the Layback Agreement provides reasonable expectation that all surface and mineral rights required to develop the Project as described in the updated Feasibility Study will be secured. Orla has sufficient water concessions and existing wells produce in-excess of the average 24 litres per second of water required for the Project.

The key permits and requirements for mining and exploration activities in Mexico are the Manifesto de Impacto Ambiental (“MIA”) and the CUS, supported by an Estudio Tecnico Justificativo. Orla received the CUS in December 2019 and the MIA in August 2020 for the project constrained by the Orla concession boundary that is described in the 2019 Feasibility Study. Permit amendments will be required for the larger project described in the updated Feasibility Study, including the expanded pit and the eventual increase in the heap leach and mine waste dump. There are no impediments to construction, mining, and processing activities on the Orla concession while these permit modifications are in the application process.

Orla has an active community and social program in San Tiburcio and other nearby communities of El Berrendo and San Francisco de los Quijano.

Sensitivity to Gold Price

Table 3: Project Economics Sensitivities to Gold Price

| Gold Price ($/oz) | $1,250 | $1,425 | $1,600 | $1,775 | $1,950 |

| After-tax NPV 5% ($M) | $288 | $370 | $452 | $534 | $616 |

| After-tax IRR (%) | 44% | 53% | 62% | 70% | 78% |

| Payback (years) | 2.0 | 1.7 | 1.5 | 1.3 | 1.2 |

Opportunities

In the updated Feasibility Study, all material mined on the Fresnillo concession is currently classified as waste. The Layback Agreement will provide Orla the right to mine and recover gold from heap leachable material located on the Fresnillo concession within the expanded pit. Further work is required to bring mineralized material on the Fresnillo concession into the measured and indicated mineral resource categories so that it can be included in an updated mine plan and mineral reserve estimate. While the overall open pit will be limited by the Layback Agreement and will not increase in size, any material from the Fresnillo concession located within the layback area that can be economically processed will improve overall Project economics.

The updated Feasibility Study only considers oxide and transitional material as testing shows that the heap leaching method cannot economically recover gold from the sulphide material. Orla is actively working on studies to investigate economic opportunities that may exist within the 7.3 million ounces of gold contained within the sulphide measured and indicated mineral resource peripheral to and below the oxides.

Orla has title to mineral concessions covering a large area around the Camino Rojo deposit. While overburden can make exploration challenging, the discovery in 2007 of mineralization that is incorporated within the updated Feasibility Study and mineral resource estimate demonstrates that shallow cover can hide very large near-surface deposits. Additional oxide material in the vicinity of the planned development would leverage the mine infrastructure outlined in the updated Feasibility Study. Any additional sulphide material could add to the long-term potential of the property.

Capital and Operating Costs

Initial capital expenditures or pre-production capital for the Camino Rojo Project is estimated at $134 million. Camino Rojo benefits from flat terrain and simple infrastructure, limiting the amount of earthworks required during construction. Total capital for the life of the Project, including sustaining and working capital is estimated at $167 million. Table 4 provides a breakdown of the capital costs for the Project. All costs related to Project development, including those already spent as of the date of this Feasibility Study, are included in the total initial capital costs.

The total capital cost estimate excludes payments to Fresnillo as part of the Layback Agreement as they are considered property purchase payments. Pursuant to the Layback Agreement, an aggregate US$62.8 million is payable to Fresnillo through a staged payment schedule.

Table 4: Capital Cost Summary (excl. value added tax)

| Description | Cost (US$ ‘000s) |

| Pre-Production Capital Costs | $91,552 |

| Indirect Costs | $2,181 |

| Other Owner’s Costs | $15,904 |

| EPCM | $8,020 |

| Contingency | $13,822 |

| Mining Contractor Mobilization & Preproduction | $2,577 |

| Total Initial Capital | $134,056 |

| Working Capital & Initial Fills | $9,845 |

| Sustaining Capital – Mine & Process | $23,565 |

| Total LOM Capital (incl. working capital) | $167,467 |

| Closure Costs | $28,581 |

In the 2019 Feasibility Study, Project economics assumed a two-year construction period and all cash flows were discounted to year -2. However, Orla has already begun construction activities and committed $78 million in total capital and the Company estimates that there is approximately one year remaining until first production, placing the Project within year -1 of the life of mine plan. In the updated Feasibility Study, NPV is discounted to year -1 and those costs already expended are included but not discounted. This provides the most reasonable and accurate estimate of the Project NPV and IRR based on the date of the study within the context of the life of mine plan.

The average life of mine operating cost for the Project is estimated at $8.17 per tonne of ore processed. Operating costs were estimated from first principles with Project specific staffing, quoted contract mining costs, unit consumptions of materials, supplies, power, water, and delivered supply costs being considered.

Table 5 summarizes the different components of the operating costs:

Table 5: Life of Mine Operating Cost Summary

| Description | LOM Costs | LOM Costs |

| $/t | $/oz | |

| Mining | $3.37 | $232 |

| Process | $3.20 | $220 |

| G&A | $1.60 | $110 |

| Total Operating Costs | $8.17 | $562 |

| Refining & Transport | — | $9 |

| Royalties | — | $43 |

| By-product Credits | — | -$124 |

| Total Cash Costs (net of by products)1 | — | $490 |

| Sustaining Capital | — | $24 |

| Reclamation | — | $29 |

| AISC1 | — | $543 |

1 Total cash cost and AISC are non-GAAP measures and are net of silver credits and includes royalties payable. See reference below regarding non-GAAP measures.

The estimated capital and operating costs are considered to have an accuracy of +/-15%.

Camino Rojo Oxide Project Construction Update

Detailed engineering of the Project described in the 2019 Feasibility Study is over 90% complete and procurement is 85% complete. The start of earthworks was announced on November 26, 2020 and since that time, 230 hectares have been cleared for construction activities with over 20,000 cubic metres of topsoil being removed and stockpiled. A total of 3,703 plants have been rescued as part of flora and fauna relocation. The 44-kilometre, 33-kV power line is 49% complete. Equipment deliveries to site commenced in December 2020. A total of $78 million of the total Project capital has been committed through purchase orders and contracts. The mining contract is being finalized and expected to be in place early in the first quarter of 2021.

First gold production is planned for late 2021.

Next Steps

Orla will begin working on a Change of Land Use permit amendment for the expanded pit and other permitting requirements for the increased tonnes planned to be mined as a result of the Layback Agreement.

Additional work is required to bring material on the Fresnillo concession to the measured and indicated mineral resource category which will then facilitate a mineral reserve update. Work required includes an estimated 2,500 metres of drilling, detailed QA/QC, and integration of Orla’s geological and resource models with Fresnillo’s drill data.

Mineral Reserves

Camino Rojo comprises intrusive related, sedimentary strata hosted, polymetallic gold, silver, arsenic, zinc, and lead mineralization. The mineralized zones correspond to zones of sheeted sulphidic veins and veinlet networks, creating a bulk-mineable style of gold mineralization. Mineralization is almost completely oxidized to a depth of approximately 120 metres and then variably oxidized below (transitional to sulphide). The mineral resource estimate was divided into oxide, high and low transitional and sulphide material. Only the oxide and transitional material are considered in the updated Feasibility Study for heap leach extraction.

The mineral reserve estimate for Camino Rojo is based on an open pit mine plan and mine production schedule developed by IMC. All mineral reserves are located on Orla’s concessions. A portion of the waste mining will be conducted on land controlled by Fresnillo as per the Layback Agreement between Fresnillo and Orla.

The following table presents the mineral reserve estimation for the Camino Rojo Oxide Project. Proven and probable mineral reserves amount to 67.4 million tonnes at 0.73 g/t gold and 14.5 g/t silver for 1.59 million contained gold ounces and 31.5 million contained silver ounces. The mineral reserve was estimated based on a gold price of $1,250 per ounce and a silver price of $17.00 per ounce. Measured mineral resource in the mine production schedule was converted to proven mineral reserve and indicated mineral resource in the schedule was converted to probable mineral reserve.

Table 6: Camino Rojo Mineral Reserves

| Reserve Category | 000’s | Gold | Silver | Gold | Silver |

| tonnes | (g/t) | (g/t) | (koz) | (koz) | |

| Proven Mineral Reserve | 18,069 | 0.802 | 15.4 | 466 | 8,949 |

| Probable Mineral Reserve | 49,296 | 0.708 | 14.23 | 1,122.80 | 22,555 |

| Total Proven & Probable Reserve | 67,365 | 0.734 | 14.55 | 1,588.70 | 31,503 |

Notes:

1. The Mineral Reserve estimate has an effective date of January 11, 2021 and was prepared using the CIM Definition Standards.

2. Columns may not sum exactly due to rounding.

3. Mineral Reserves are based on prices of $1250/oz gold and $17/oz silver.

4. Mineral Reserves are based on NSR cut-offs that vary by time period to balance mine and plant production capacities. They range from a low of $4.93/t to a high of $12.00/t.

5. NSR value for leach material is as follows:

Kp Oxide: NSR ($/t) = 27.37 x gold (g/t) + 0.053 x silver (g/t), based on gold recovery of 70% and silver recovery of 11%

Ki Oxide: NSR ($/t) = 21.90 x gold (g/t) + 0.073 x silver (g/t), based on gold recovery of 56% and silver recovery of 15%

Tran-Hi: NSR ($/t) = 23.46 x gold (g/t) + 0.131 x silver (g/t), based on gold recovery of 60% and silver recovery of 27%

Tran-Lo: NSR ($/t) = 15.64 x gold (g/t) + 0.165 x silver (g/t), based on gold recovery of 40% and silver recovery of 34%

6. Please see Forward-Looking Statements below regarding mineral resource and mineral reserve estimates and footnote 14 of Table 7

Approximately two-thirds of the mineral reserves are within the currently permitted mine plan. The remaining portion will require a CUS and related permit amendments for an expanded pit; approval of the Layback Agreement from COFECE and subsequent transfer of surface rights.

Mineral Resources

No update to the mineral resource estimate was made as part of this updated Feasibility Study. The mineral resource estimate dated June 7, 2019 remains current. Mineral resources are divided between oxide and transitional material that could possibly be extracted by open pit mine and processed in a heap leach operation (“Leach Resource”) and sulphide material that could possibly be extracted by open pit and processed in a mill (“Mill Resource”). For the Mill Resource, estimates are made for contained gold, silver, lead and zinc. As lead and zinc would not be recovered in a heap leach operation, only gold and silver were estimated for the Leach Resource. Tables 7 and 8 summarize the mineral resource estimate.

Table 7: Mineral Resource Estimate – Gold & Silver

| Resource Type by Category | 000’s | Gold | Silver | Gold | Silver |

| tonnes | (g/t) | (g/t) | (koz) | (koz) | |

| Leach Resource: | |||||

| Measured Mineral Resource | 19,391 | 0.77 | 14.9 | 482.3 | 9,305 |

| Indicated Mineral Resource | 75,249 | 0.7 | 12.2 | 1,680.70 | 29,471 |

| Meas./Ind. Mineral Resource | 94,640 | 0.71 | 12.7 | 2,163.00 | 38,776 |

| Inferred Mineral Resource | 4,355 | 0.86 | 5.6 | 119.8 | 805 |

| Mill Resource: | |||||

| Measured Mineral Resource | 3,358 | 0.69 | 9.2 | 74.2 | 997 |

| Indicated Mineral Resource | 255,445 | 0.88 | 7.4 | 7,221.40 | 60,606 |

| Meas./Ind. Mineral Resource | 258,803 | 0.88 | 7.4 | 7,295.60 | 61,603 |

| Inferred Mineral Resource | 56,564 | 0.87 | 7.5 | 1,576.90 | 13,713 |

| Total Mineral Resource | |||||

| Measured Mineral Resource | 22,749 | 0.76 | 14.1 | 556.5 | 10,302 |

| Indicated Mineral Resource | 330,694 | 0.84 | 8.5 | 8,902.10 | 90,078 |

| Meas./Ind. Mineral Resource | 353,443 | 0.83 | 8.8 | 9,458.60 | 100,379 |

| Inferred Mineral Resource | 60,919 | 0.87 | 7.4 | 1,696.70 | 14,518 |

Table 8: Mineral Resource Estimate – Zinc & Lead

| Resource Type by Category | 000’s | Lead | Zinc | Lead | Zinc |

| tonnes | (%) | (%) | (M lbs) | (M lbs) | |

| Mill Resource: | |||||

| Measured Mineral Resource | 3,358 | 0.13 | 0.38 | 9.3 | 28.2 |

| Indicated Mineral Resource | 255,445 | 0.07 | 0.26 | 404.3 | 1,468.70 |

| Meas./Ind. Mineral Resource | 258,803 | 0.07 | 0.26 | 413.6 | 1,496.80 |

| Inferred Mineral Resource | 56,564 | 0.05 | 0.23 | 63.1 | 290.4 |

Notes:

1. The mineral resource has an effective date of June 7, 2019. The mineral resources are classified in accordance with the CIM Definition Standards in accordance with the disclosure requirement of NI 43-101.

2. Columns may not sum exactly due to rounding.

3. Mineral resources that are not mineral reserves do not have demonstrated economic viability.

4. Mineral resources for leach material are based on prices of $1,400/oz gold and $20/oz silver.

5. Mineral resources for mill material are based on prices of $1,400/oz gold, $20/oz silver, $1.05/lb lead, and $1.20/lb zinc.

6. Mineral resources are based on net smelter return cut-off of $4.73/t for leach material and $13.71/t for mill material.

7. Includes 2% royalty and an USD:MXN exchange rate of 19.3.

8. Operating costs for Leach resource – mining $1.65/t mined; process $3.41/t processed; G&A $1.32/t processed; Operating costs for Mill resource – mining $1.65/t mined; process $12.50/t processed; G&A $1.20/t processed.

9. Leach resource payable – Au 100%; Ag 100%; Mill resource payable – Au 95%, Ag 95%, Pb 95%, Zn 85%.

10. Leach resource refining costs – Au $5.00/oz; Ag $0.50/oz; Mill resource refining costs – Au $1.00/oz; Ag $1.50/oz; Pb $0.194/lb; Zn $0.219/lb.

11. The mineral resource estimate assumes that the floating pit cone used to demonstrate reasonable prospects for eventual economic extraction extends onto land held by the Fresnillo. Any potential development of the Camino Rojo Project that includes an open pit encompassing the entire mineral resource estimate would be dependent on obtaining an agreement with Fresnillo (or subsequent owner).

12. Mineral resources are inclusive of mineral reserves.

13. An Inferred Mineral Resource has a lower level of confidence than that applying to an indicated mineral resource and must not be converted to a mineral reserve. It is reasonably expected that the majority of inferred mineral resources could be upgraded to indicated mineral resources with continued exploration.

14.Please see Forward-Looking Statements below regarding mineral resource and mineral reserve estimates. Please also refer to the Camino Rojo Technical Report dated June 25, 2019 for further details regarding the key assumptions, parameters, and methods used in the mineral resource estimate (including risk factors).

All the mineralization comprised in the mineral resource estimate with respect to the Project are contained on mineral titles controlled by Orla. However, the mineral resource estimate assumes that the north wall of the conceptual floating pit cone used to demonstrate reasonable prospects for eventual economic extraction extends onto lands where mineral title is held by Fresnillo, and that waste would be mined on Fresnillo’s mineral titles. The Layback Agreement allows Orla to extend the north pit wall onto Fresnillo’s mineral titles to gain access to the oxide and transitional heap leachable mineral resources at depth on Orla’s mineral property.

The existing agreement with Fresnillo is only with respect to the portion of the heap leach material included in the mineral reserve. As such, any potential development of the Camino Rojo property that includes an open pit encompassing the Mill Resource included in the mineral resource estimate is dependent on entering into an additional agreement with Fresnillo (or any potential subsequent owner of the mineral titles). It is estimated that approximately two-thirds of the Mill Resource estimate and one quarter of the Leach Resource are dependent on an additional agreement being entered into with Fresnillo. The Leach Resource dependent on the additional agreement is mainly comprised of less oxidized transitional material with the lowest predicted heap-leach recoveries. The mineral resource estimate has been prepared based on the Qualified Person’s reasoned judgment, in accordance with Canadian Institute of Mining, Metallurgy and Petroleum (CIM) Best Practices Guidelines and his professional standards of competence, that there is a reasonable expectation that all necessary permits, agreements and approvals will be obtained and maintained, including the additional agreement with Fresnillo to allow mining of waste material on its mineral concessions. In particular, when determining the prospects for eventual economic extraction, consideration was given to industry practice, and a time frame of 10-15 years.

Delays in, or failure to obtain, an additional agreement with Fresnillo would affect the development of a significant portion of the mineral resources of the Camino Rojo property that are not included in the updated Feasibility Study mine plan, in particular by limiting access to significant mineralized material at depth. There can be no assurance that Orla will be able to negotiate such additional agreement on terms that are satisfactory to Orla or that there will not be delays in obtaining the necessary agreement.

Project Risks

The Project is subject to similar risks as comparable projects, however, Orla believes it has mitigated many of those risks by early engagement with the stakeholders involved in the Project, including government permitting agencies, local land holders, including the Ejidos and Fresnillo, and the advanced stage of activities around mine construction and long-lead time mine equipment. Purchase and construction of required process and other infrastructure is already underway under the plan outlined in the 2019 Feasibility Study. Permits for the Project currently being built were received and the expanded Project requires comparatively minor permit additions and amendments. Construction and operation of the permitted portion of the Project can continue unaffected as additional permitting requirements are met. Completion of the Layback Agreement remains subject to COFECE approval. The Feasibility Study detailed herein assumes receipt of COFECE approval and subsequent transfer of surface rights.

In recent years, some mining projects in Mexico have suffered development delays or production stoppages as a result of community interference. Orla has an active community relations and social program and strives to maintain constructive relationships with local communities. Management believes that maintaining a robust community relations program can reduce and mitigate social risks and improve overall operational sustainability.

Under Mexico’s current COVID-19 legislation, mining and construction are permitted economic activities and the Camino Rojo Project site is operating in compliance with the Mexican Health Authority and Company requirements. Orla has implemented a strict COVID-19 protocol, including rigorous screening and testing programs to support the health of Orla’s employees and local communities. The Company is closely monitoring the potential impacts from the pandemic on areas including equipment delivery and logistics, materials for construction and operation, other necessities, as well as construction costs and schedule, and community and government relations. While some delays to construction and permit amendments may occur due to the COVID-19 pandemic, Orla has taken steps to minimize potential impacts to the overall Project including additional costs related to COVID-19 safety measures.

The Feasibility Study and the Camino Rojo Project may be subject to legal, political, environmental or other risks that could materially affect the development of the Camino Rojo Project which are unknown at this time but could materialize in the future.

Data Verification

The sampling data used for the mineral reserve and mineral resource estimate was verified by IMC and RGI. A substantial portion of the database was compared with original assay certificates. There were no limitations on the verification process. IMC and RGI are of the opinion that the database is acceptable for the purpose of this updated Feasibility Study, including the mineral reserve and mineral resource estimation. The Orla sampling data used for the mineral reserve and mineral resource estimate was verified by RGI.

KCA checked the metallurgical test procedures and results to ensure they met industry standards. Metallurgical sample locations were reviewed to ensure that there was material from throughout the resource area and that samples were reasonably representative of the material planned to be processed so as to support the selected process method and assumptions regarding recoveries and costs. Additional data verification information can be found in the Camino Rojo Technical Report dated June 25, 2019 and will be incorporated in the new Camino Rojo Technical Report that will be filed within 45 days of this release. Additional supporting details regarding the information in this release, will be provided in the new Camino Rojo Technical Report available on SEDAR within 45 days of this release, including all qualifications, assumptions and exclusions that relate to the Feasibility Study. The Camino Rojo Technical Report is intended to be read as a whole, and sections should not be read or relied upon out of context.

Qualified Persons

The updated Feasibility Study was overseen by KCA of Reno, NV. The mineral resource and mineral reserve estimates were conducted by IMC of Tucson, AZ, under the direction of Michael G. Hester, FAusIMM. Mr. Hester was also responsible for the mining components of the updated Feasibility Study. KCA, under the direction of Carl Defilippi, RM SME was responsible for the metallurgy, process, general and administration and economic components of the updated Feasibility Study. Matthew Gray, Ph.D., C.P.G. (AIPG), of Resource Geosciences Incorporated of Rio Rico, AZ was responsible for the property, geology, and environmental components of the updated Feasibility Study. John Ward, Registered Geologist (AZ, CA), C.P.G. (AIPG) was responsible for the hydrogeology model. Each of Messrs. Hester, Defilippi, Gray and Ward is a Qualified Person for their respective sections of the updated Feasibility Study and each of whom is Independent of Orla under the definitions of National Instrument 43-101 (“NI 43-101”). An independent technical report prepared in accordance with the requirements of NI 43-101 will be available under Orla’s profile on SEDAR within 45 days of this news release.

Hans Smit, P.Geo., a consultant with Orla, has reviewed and verified all technical and scientific information contained in this news release and is a Qualified Person within the meaning of NI 43-101.

The scientific and technical information in this news release has also been reviewed and approved by Michael G. Hester, FAusIMM, Carl Defilippi, RM SME, Matthew Gray, Ph.D., C.P.G (AIPG), and John Ward, Registered Geologist (AZ, CA), C.P.G. (AIPG), each of whom is an Independent Qualified Person under NI 43-101.

Conference Call

Orla will host a conference call on January 12, 2021 at 10:00 a.m. eastern time, to discuss the results of the updated Feasibility Study:

| Toll-free dial-in number: | (833) 499-1157 |

| International dial-in number: | (236) 712-2875 |

| Conference ID: | 5662098 |

| Webcast: | https://www.orlamining.com/investors/presentations-and-events/ |

Orla is developing the Camino Rojo Oxide Gold Project, an advanced gold and silver open-pit and heap leach project, located in Zacatecas State, Central Mexico. The project is 100% owned by Orla and covers over 160,000 hectares. The technical report for the 2019 Feasibility Study entitled “Feasibility Study, NI 43-101 Technical Report on the Camino Rojo Gold Project — Municipality of Mazapil, Zacatecas, Mexico” dated June 25, 2019 is available on SEDAR at www.sedar.com under the Company’s profile as well as on Orla’s website at www.orlamining.com. An updated independent technical report for the updated Feasibility Study on the Camino Rojo Oxide Gold Project prepared in accordance with the requirements of NI 43-101 will be available under Orla’s profile on SEDAR within 45 days of this news release. Orla also owns 100% of the Cerro Quema Project located in Panama which includes a near-term gold production scenario and various exploration targets. The Cerro Quema Project is a proposed open pit mine and gold heap leach operation. Please refer to the “Cerro Quema Project – Pre-feasibility Study on the La Pava and Quemita Oxide Gold Deposits” dated August 15, 2014, which is also available on SEDAR at www.sedar.com.About Orla Mining Ltd.

Forward-looking Statements

This news release contains certain “forward-looking information” and “forward-looking statements” within the meaning of Canadian and United States securities legislation, including, without limitation, statements with respect to the feasibility study and economic results thereof, including timing for anticipated production and cost estimates, the mineral resource and mineral reserve estimates, the expansion of the Camino Rojo oxide pit, expectations regarding the optimization of the oxide deposit and increase in mineral reserves, the expected additional material to be included in a future mine plan, timeline for receipt of Mexican antitrust (COFECE) approval and other amended permits, and the Company’s development, as well as its objectives and strategies. Forward-looking statements are statements that are not historical facts which address events, results, outcomes or developments that the Company expects to occur. Forward-looking statements are based on the beliefs, estimates and opinions of the Company’s management on the date the statements are made and they involve a number of risks and uncertainties. Certain material assumptions regarding such forward-looking statements are discussed in this news release, including without limitation, assumptions that all amended permits and approvals will be obtained; that all conditions of the Layback Agreement, as well as the Company’s credit facility will be met; the Company’s activities will be in accordance with the Company’s public statements and stated goals; that there will be no material adverse change affecting the Company or its properties; that all required approvals, including Mexican antitrust (COFECE) approval, will be obtained; that political and legal developments will be consistent with current expectations; that currency and exchange rates will be consistent with current levels; and that there will be no significant disruptions affecting the Company or its properties. Consequently, there can be no assurances that such statements will prove to be accurate and actual results and future events could differ materially from those anticipated in such statements. Forward-looking statements involve significant known and unknown risks and uncertainties, which could cause actual results to differ materially from those anticipated. These risks include, but are not limited to: delays in or failure to receive Mexican antitrust (COFECE) approval, risks related to uncertainties inherent in the preparation of feasibility studies, including but not limited to, assumptions underlying the production estimates not being realized, changes to the cost of production, variations in quantity of mineralized material, grade or recovery rates, geotechnical or hydrogeological considerations during mining differing from what has been assumed, failure of plant, equipment or processes, changes to availability of power or the power rates, ability to maintain social license, changes to interest or tax rates, cost of labour, supplies, fuel and equipment rising, changes in project parameters, delays and costs inherent to consulting and accommodating rights of local communities, environmental risks, title risks, commodity price and exchange rate fluctuations, risks relating to COVID-19, delays in or failure to receive amended permits, including CUS, risks inherent in the estimation of mineral reserves and mineral resources, including but not limited to, risks that the interpreted drill results may not accurately represent the actual continuity of geology or grade of the deposit, bulk density measurements may not be representative, interpreted and modelled metallurgical domains may not be representative, and metallurgical recoveries may not be representative; and risks associated with executing the Company’s objectives and strategies, including costs and expenses, as well as those risk factors discussed in the Company’s most recently filed management’s discussion and analysis, as well as its annual information form dated March 23, 2020, available on www.sedar.com. Except as required by the securities disclosure laws and regulations applicable to the Company, the Company undertakes no obligation to update these forward-looking statements if management’s beliefs, estimates or opinions, or other factors, should change.

Non-GAAP Measures

The Company has included certain non-GAAP performance measures as detailed below. In the gold mining industry, these are common performance measures but may not be comparable to similar measures presented by other issuers and the non-GAAP measures do not have any standardized meaning. Accordingly, it is intended to provide additional information and should not be considered in isolation or as a substitute for measures of performance prepared in accordance with IFRS.

CASH COSTS PER OUNCE —

The Company calculated total cash costs per ounce by dividing the sum of operating costs, royalty costs, production taxes, refining and shipping costs, net of by-product silver credits, by payable gold ounces. While there is no standardized meaning of the measure across the industry, the Company believes that this measure is useful to external users in assessing operating performance.

ALL-IN SUSTAINING COSTS (“AISC”) —

The Company has provided an AISC performance measure that reflects all the expenditures that are required to produce an ounce of gold from operations. While there is no standardized meaning of the measure across the industry, the Company’s definition conforms to the all-in sustaining cost definition as set out by the World Gold Council in its guidance dated June 27, 2013. Orla believes that this measure is useful to external users in assessing operating performance and the Company’s ability to generate free cash flow from current operations. Subsequent amendments to the guidance have not materially affected the figures presented.

FREE CASH FLOW —

Free Cash Flow is a non-GAAP performance measure that is calculated as cash flows from operations net of cash flows invested in mineral property, plant and equipment and exploration and evaluation assets. Orla believes that this measure is useful to the external users in assessing the Company’s ability to generate cash flows from its mineral projects.

Cautionary Note to U.S. Readers

The disclosure in this release uses mineral reserve and mineral resource classification terms that comply with reporting standards in Canada, and mineral reserve and mineral resource estimates are made in accordance with Canadian NI 43-101 and the Canadian Institute of Mining, Metallurgy and Petroleum — CIM Definition Standards on Mineral Resources and Mineral Reserves, adopted by the CIM Council May 10, 2014, as amended (the “CIM Definition Standards”). NI 43-101 establishes standards for all public disclosure an issuer makes of scientific and technical information concerning mineral projects. These standards differ significantly from the mineral reserve disclosure requirements of the United States Securities Exchange Commission (the “SEC”) set forth in Industry Guide 7. Consequently, information regarding mineralization contained in this release is not comparable to similar information that would generally be disclosed by U.S. companies in accordance with the rules of the SEC. In particular, the SEC’s Industry Guide 7 applies different standards in order to classify mineralization as a reserve. As a result, the definitions of proven and probable reserves used in NI 43-101 differ from the definitions used by the SEC in Industry Guide 7. Under SEC standards, mineralization may not be classified as a “reserve” unless the determination has been made that the mineralization could be economically and legally produced or extracted at the time the reserve determination is made. Among other things, all necessary permits would be required to be in hand or issuance imminent in order to classify mineralized material as reserves under the SEC standards. Accordingly, mineral reserve estimates contained in this release may not qualify as “reserves” under SEC standards. In addition, this release uses the terms “measured mineral resources,” “indicated mineral resources” and “inferred mineral resources” to comply with the reporting standards in Canada. The SEC does not currently recognize mineral resources and U.S. companies are generally not permitted to disclose mineral resources of any category in documents they file with the SEC. Investors are specifically cautioned not to assume that any part or all of the mineral deposits in these categories will ever be converted into mineral reserves as defined in NI 43-101 or Industry Guide 7. Further, “inferred mineral resources” have a great amount of uncertainty as to their existence and as to whether they can be mined legally or economically. Therefore, investors are also cautioned not to assume that all or any part of an inferred resource could ever be mined economically. It cannot be assumed that all or any part of “measured mineral resources,” “indicated mineral resources,” or “inferred mineral resources” will ever be upgraded to a higher category. Investors are cautioned not to assume that any part of the reported “measured mineral resources,” “indicated mineral resources,” or “inferred mineral resources” in this release is economically or legally mineable. The SEC has adopted amendments to its disclosure rules to modernize the mineral property disclosure requirements for issuers whose securities are registered with the SEC under the Securities Exchange Act of 1934 (“Exchange Act”). These amendments became effective February 25, 2019 (the “SEC Modernization Rules”) and, following a two-year transition period, the SEC Modernization Rules will replace the historical property disclosure requirements for mining registrants that were included in SEC Industry Guide 7. Following the transition period, as a foreign private issuer that files its annual report on Form 40-F with the SEC pursuant to the multi-jurisdictional disclosure system, the Company is not required to provide disclosure on its mineral properties under the SEC Modernization Rules and will continue to provide disclosure under NI 43-101. If the Company ceases to be a foreign private issuer or lose its eligibility to file its annual report on Form 40-F pursuant to the multi-jurisdictional disclosure system, then the Company will be subject to the SEC Modernization Rules which differ from the requirements of NI 43-101. The SEC Modernization Rules include the adoption of terms describing mineral reserves and mineral resources that are “substantially similar” to the corresponding terms under the CIM Definition Standards. As a result of the adoption of the SEC Modernization Rules, the SEC now recognizes estimates of “measured mineral resources”, “indicated mineral resources” and “inferred mineral resources”. In addition, the SEC has amended its definitions of “proven mineral reserves” and “probable mineral reserves” to be “substantially similar” to the corresponding CIM Definitions. U.S. investors are cautioned that while the above terms are “substantially similar” to CIM Definitions, there are differences in the definitions under the SEC Modernization Rules and the CIM Definition Standards. Accordingly, there is no assurance any mineral reserves or mineral resources that the Company may report as “proven mineral reserves”, “probable mineral reserves”, “measured mineral resources”, “indicated mineral resources” and “inferred mineral resources” under NI 43-101 would be the same had the Company prepared the reserve or resource estimates under the standards adopted under the SEC Modernization Rules. U.S. investors are also cautioned that while the SEC will now recognize “measured mineral resources”, “indicated mineral resources” and “inferred mineral resources”, investors should not assume that any part or all of the mineralization in these categories will ever be converted into a higher category of mineral resources or into mineral reserves. Mineralization described using these terms has a greater amount of uncertainty as to its existence and feasibility than mineralization that has been characterized as reserves. Accordingly, investors are cautioned not to assume that any measured mineral resources, indicated mineral resources, or inferred mineral resources that the Company reports are or will be economically or legally mineable. Further, “inferred mineral resources” have a greater amount of uncertainty as to their existence and as to whether they can be mined legally or economically. Therefore, U.S. investors are also cautioned not to assume that all or any part of the “inferred mineral resources” exist. Under Canadian securities laws, estimates of “inferred mineral resources” may not form the basis of feasibility or pre-feasibility studies, except in rare cases. For the above reasons, information contained in this release containing descriptions of our mineral reserve and mineral resource estimates is not comparable to similar information made public by U.S. companies subject to the reporting and disclosure requirements of the SEC.

For further information, please contact:

Jason Simpson

President & Chief Executive Officer

Andrew Bradbury

Director, Investor Relations