4.86 g/t Au, 43.6g/t Ag, 1.27% Zn, 0.44% Pb, 0.09% Cu, (6.25 g/t AuEq) over 11.7 m,

incl. 28.6 g/t Au, 224g/t Ag, 4.35% Zn, 2.89% Pb, 0.29% Cu, (34.4 g/t AuEq) over 1.7 m

10.3 g/t Au, 37.8 g/t Ag, 3.81% Zn, 0.08% Pb, 0.12% Cu (12.7 g/t AuEq) over 5.6 m,

incl. 17.8 g/t Au, 71.0 g/t Ag, 7.19% Zn, 0.15% Pb, 0.17% Cu (22.3 g/t AuEq) over 2.9 m

VANCOUVER, BC, Feb. 22, 2024 /CNW/ – Orla Mining Ltd. (TSX: OLA) (NYSE: ORLA) (“Orla” or the “Company”) is pleased to provide an update on its exploration activities on the extension of the Camino Rojo deposit (“Camino Rojo Extension”) in the second half of 2023. These recent exploration results emphasize that the Camino Rojo deposit remains open and has substantial upside potential.

Camino Rojo Extension (Mexico) Summary

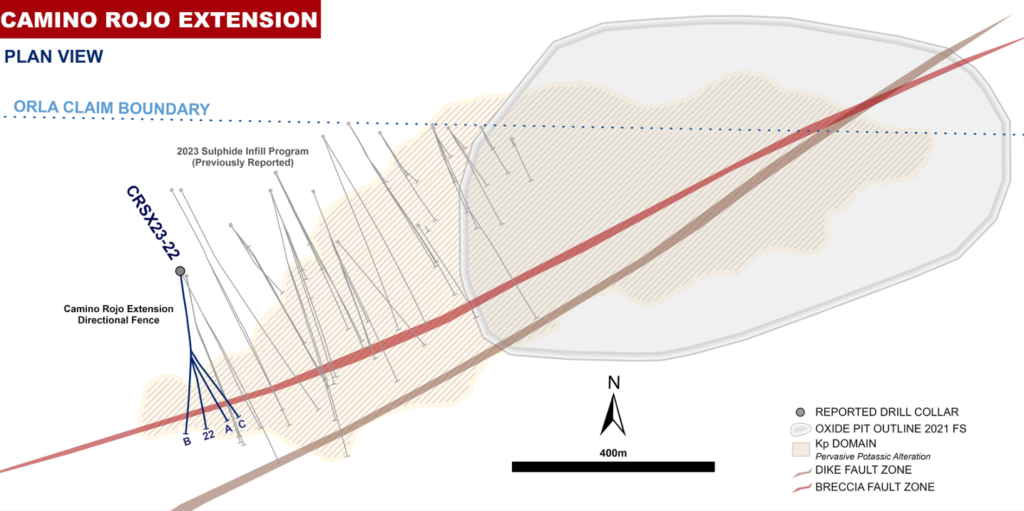

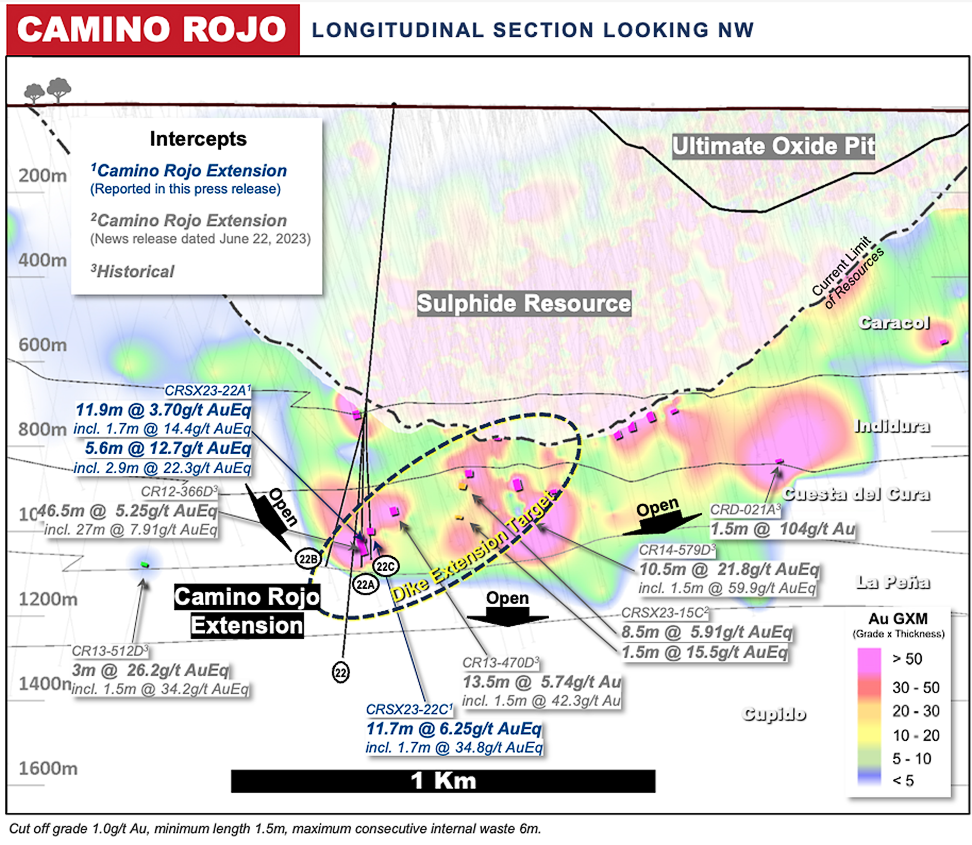

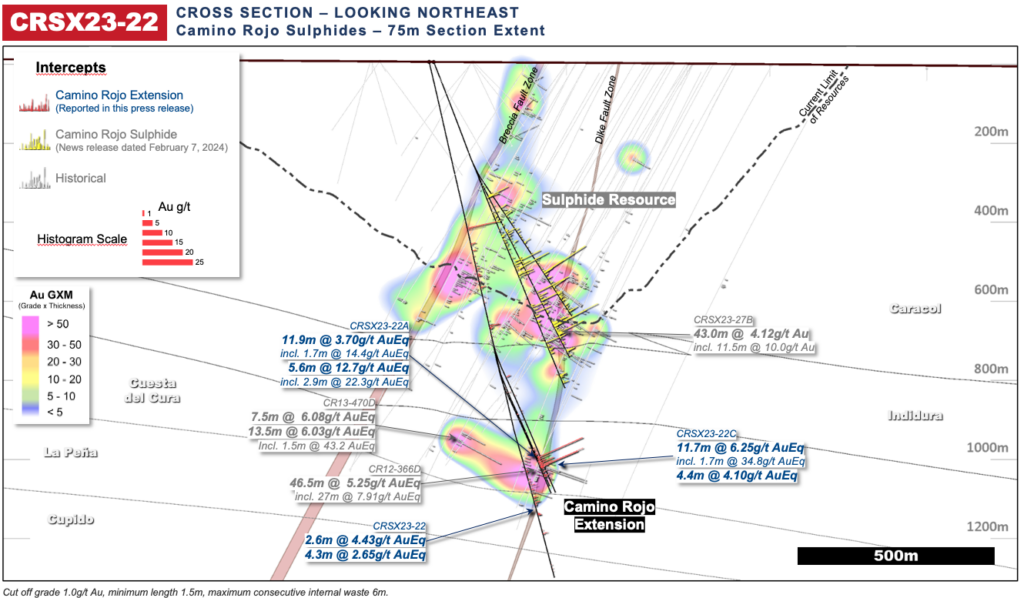

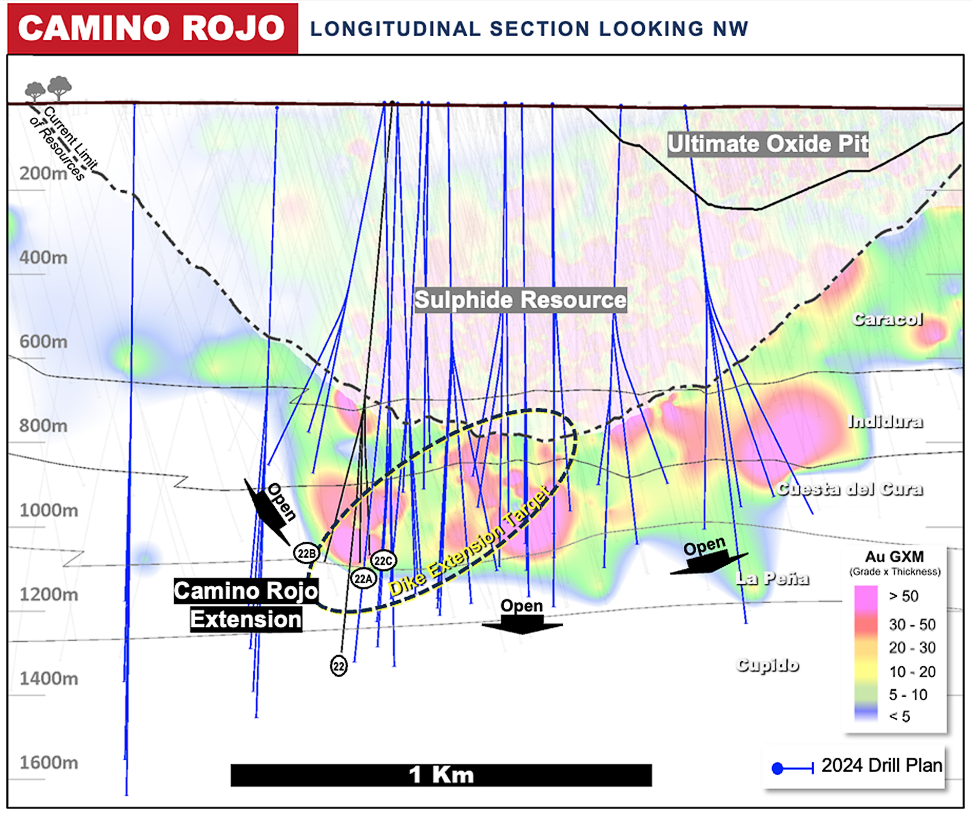

Historical and recent exploration drilling targeted lower stratigraphy, beneath the existing resources. In 2023, a drill section was completed 450 metres down-plunge from the current mineral resources and revealed significant intersections of high-grade polymetallic (Au-Ag-Zn) semi-massive to massive replacement-style mineralization (Figure 1). Recent drilling shows that the Camino Rojo mineral system extends beyond the current mineral resource envelope, presenting a considerable opportunity for resource expansion.

- 2023 Program: The 2023 Camino Rojo Extension drill program involved extending selected infill drillholes beyond the currently defined mineral resources and completing a down-plunge drill section to explore the distal extension into lower stratigraphy; 2,607 metres of drilling across four drill holes. Drill results reported in this press release have returned mineralized intercepts up to 450 metres down plunge of the existing open pit mineral resource boundaries.

- Initial Metallurgy: The initial carbon-in-leach (CIL) bottle roll testing within the Camino Rojo Extension on material from CRSX-22-07 and CRSX-22-08C resulted in impressive gold recoveries between 81-96%. Flotation testing on the CRSX-22-07 material produced a gold concentrate with 85-88% gold recovery and a zinc concentrate with zinc grades of 52% and over 85% zinc recovery, for the polymetallic replacement-style mineralization.

- 2024 Program: The Company plans to complete a 30,000-metre drill program in 2024 with two objectives: 1) to infill the down-plunge geometry, continuity, and endowment potential of mineralization along the projection of the Dike Zone, and 2) to step out broadly and further assess the extensive upside potential of this open mineralized system.

“The recent drilling results have added a new dimension to our near-mine exploration program, unveiling an exciting new mineralization style in previously disregarded host rocks. With promising initial metallurgical results and substantial upside extension potential, we are committed to driving Orla’s 2024 exploration efforts towards expansion drilling as we look to unlock the full potential of the growing Camino Rojo deposit.”

– Sylvain Guerard, Orla’s Senior Vice President, Exploration

New polymetallic sulphide replacement style mineralization

Orla Mining has confirmed and encountered sulphide mineralization extending beyond the established open pit mineral resource boundaries at Camino Rojo (Table 1). This drilling and mineralization is building on an updated geological model and the success of the previously reported CRSX22-15C hole drilled 200 metres down-plunge from the existing resources (see Table 2 and the Company’s June 22, 2023 news release).

The impressive intercepts, both historical and recent, justified the execution of a new drill section in 2023, targeting 450 metres down-plunge from the existing resources, along the dike zone structure (Figures 2-4). This significant step-out drilling initiative consisted of drilling 2,400 metres, targeting the area around the positive historical intercept in hole CR12-366D (15.7 g/t Au, 29.0 g/t Ag, 0.73% Zn, 0.10 % Pb, 0.08% Cu (19.6 g/t AuEq) over 4.5 metres. This new drill section confirmed the presence of significant polymetallic semi-massive to massive sulphide mineralization (Figure 4). Significant results from this drill section are shown in Table 1.

Table 1: Camino Rojo Extension Significant Intersections

| HOLE-ID | From (m) | Core Length (m) | Au g/t | Ag g/t | Zn % | Pb % | Cu % | AuEq g/t |

| CRSX23-22A | 1047.9 | 11.9 | 2.48 | 34.2 | 1.34 | 0.16 | 0.09 | 3.70 |

| incl. | 1058.1 | 1.7 | 8.23 | 125.0 | 8.32 | 0.91 | 0.28 | 14.35 |

| and | 1066.4 | 5.6 | 10.30 | 37.8 | 3.81 | 0.08 | 0.12 | 12.73 |

| incl. | 1066.4 | 2.8 | 17.82 | 71.0 | 7.19 | 0.15 | 0.17 | 22.34 |

| CRSX23-22C | 1044.9 | 11.7 | 4.86 | 43.6 | 1.27 | 0.44 | 0.08 | 6.25 |

| incl. | 1044.9 | 1.7 | 28.60 | 224.0 | 4.35 | 2.89 | 0.29 | 34.75 |

| and | 1063.6 | 4.4 | 3.02 | 27.0 | 1.28 | 0.03 | 0.10 | 4.10 |

| incl. | 1066.5 | 1.5 | 6.50 | 19.5 | 2.92 | 0.02 | 0.07 | 8.20 |

Metal prices used in gold equivalent calculation: Au = $1,750/oz, Ag = $21 / oz, Zn = $1.20/lb, Pb = $0.90/lb, Cu = $3.50/lb. All prices in USD. No recovery factor was used in calculation of gold equivalent.

Positive Initial Metallurgical Results

Orla completed an initial metallurgical testing program in 2023, using drill core material from holes CRSX22-07 and CRSX22-08C (see Table 2) which intersected polymetallic replacement-style mineralization during the 2022 program. The metallurgical results on material from CRSX-22-07 and CRSX-22-08C were positive with high gold recovery reported in both CIL bottle roll tests between 81-96% and rougher flotation on the CRSX-22-07 material produced a gold concentrate with 85-88% gold recovery. Open-circuit zinc cleaner tests on material from CRSX-22-07 produced a zinc concentrate with zinc grades of 52% and over 85% zinc recovery. These results suggest this new style of mineralization may be amenable to both standard cyanide processing and flotation. Orla plans to further explore these promising results through additional metallurgical test work in 2024.

Background

Historical context: Wide-spaced drill intersections of polymetallic (Au-Ag-Zn) replacement-style mineralization were encountered in historical holes beneath the Caracol formation, but the relationship between these intersections and the Camino Rojo sulphides deposit was uncertain, partly due to the lack of a comprehensive geological model for the deeper part of the mineralized system.

2022 program: Part of the 2022 infill program targeted deeper parts of the mineral resource hosted within the upper Indidura formation. This drilling intersecting polymetallic (Au-Ag-Zn) mineralization, similar to the wide-spaced historical intercepts, up to 50 metres below the contact between Caracol and Indidura formations. These results provided confidence that the mineralized system likely continued lower.

2024 Drill Program

The 2024 Camino Rojo Extension drill program commenced on January 9th with six drill rigs currently operational. This program (Figure 5) is comprised of 15,000 metres dedicated to the dike extension target, focusing on the 500-metre spanning between the current mineral resource and the CRSX23-22 series of drill holes. An additional 15,000 metres are allocated to testing open mineralized trends and historical high-grade intersections, aiming to assess the broader potential of the growing Camino Rojo Deposit.

Full drill results are available in the Appendix to this news release and are available at www.orlamining.com.

All metres reported above are down-hole intervals, with true width estimates ranging from 72-88% of the reported interval. See Table 1 in the Appendix to this news release for estimated true widths of individual composites. A standard sampling length of 1.5m is used with a minimum of 0.5m when required based on geologic contacts. All drill core is HQ diameter. The reported composites were not subject to “capping,” however a preliminary analysis suggests that only 1 out of 972 samples from the reported holes exceeded the potential capping level of 27.0 g/t Au. This sample assayed 28.6 g/t Au. Orla believes that applying a top cut would have a negligible effect on overall grades. Composites for the sulphide drilling were calculated using 1 g/t Au cut-off grade and maximum 6 metres consecutive waste.

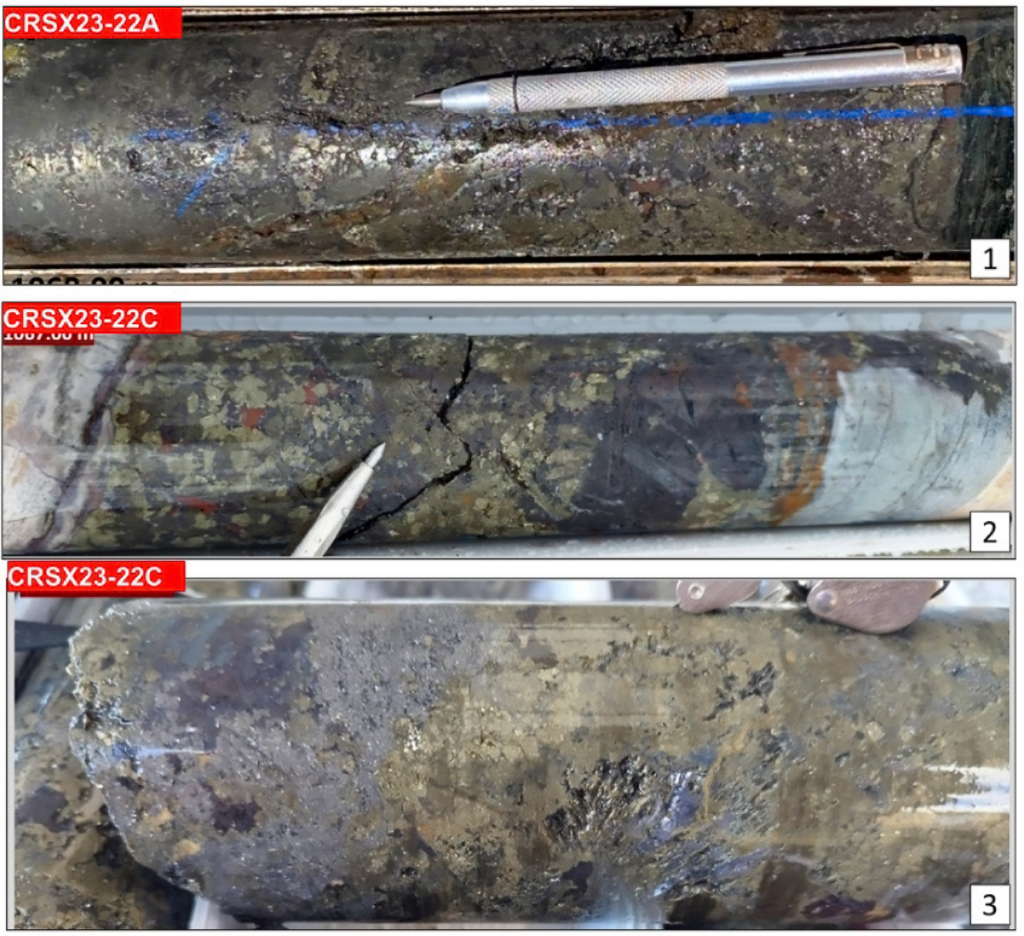

Photo 1: CRSX23-22A, 1068.0 m, HQ core. Chalcopyrite – pyrite – pyrrhotite – sphalerite massive sulphide replacement mineralization (manto-type), hosted in limestone of Cuesta del Cura formation. Assay returned 20.6 g/t Au, 103 g/t Ag, 7.7% Zn, 0.2% Pb, 0.2% Cu over 1.7 m.

Photo 2: CRSX23-22C, 1066.8 m, HQ core. Arsenopyrite – pyrrhotite – pyrite – sphalerite massive sulphide replacement mineralization (manto-type) with euhedral crystals of sphalerite, hosted in limestone of Cuesta del Cura. Assay returned 6.50g/t Au, 20g/t Ag, 2.9% Zn, 0.02% Pb, 0.07% Cu over 1.5m.

Photo 3: CRSX23-22C, 1045.4 m, HQ core. Coarse grained galena – pyrrhotite – pyrite – arsenopyrite – sphalerite massive sulphide mineralization, hosted in limestone of Cuesta del Cura. Assay returned 28.6g/t Au, 224g/t Ag, 4.4% Zn, 2.9% Pb, 0.3% Cu over 1.7m.

Table 2: Previously reported and historical intercepts, Camino Rojo Extension

| HOLE-ID | From (m) | Core Length (m) | Au g/t | Ag g/t | Zn % | Pb % | Cu % | AuEq g/t |

| Orla Previously Reported Significant Results from Lower Stratigraphy | ||||||||

| CRSX22-07 | 777.6 | 22.9 | 4.02 | 12.2 | 1.52 | 0.02 | 0.04 | 4.95 |

| incl. | 777.6 | 6.0 | 9.30 | 18.8 | 3.44 | 0.05 | 0.05 | 11.23 |

| CRSX22-08C | 858.4 | 9.1 | 2.50 | 8.2 | 0.94 | 0.01 | 0.05 | 3.11 |

| CRSX23-20B | 834.0 | 11.5 | 4.08 | 35.8 | 0.18 | 0.02 | 0.09 | 4.73 |

| CRSX23-20F | 1062.8 | 5.2 | 2.69 | 10.0 | 3.88 | 0.03 | 0.04 | 4.70 |

| CRSX23-25C | 922.4 | 0.5 | 13.30 | 21.3 | 12.95 | 0.02 | 0.09 | 19.78 |

| CRSX23-25C | 949.1 | 2.0 | 9.20 | 13.0 | 2.99 | 0.01 | 0.03 | 10.81 |

| Orla Hole CRSX23-15C Drilled 200m from Resources | ||||||||

| CRSX23-15C | 965.5 | 8.5 | 3.52 | 26.2 | 3.64 | 0.02 | 0.26 | 5.91 |

| and | 994.5 | 3.3 | 4.54 | 6.7 | 5.49 | 0.01 | 0.06 | 7.28 |

| incl. | 995.4 | 1.2 | 8.00 | 7.6 | 12.50 | 0.01 | 0.11 | 14.13 |

| and | 1048.5 | 1.5 | 15.35 | 6.7 | 4.39 | 0.00 | 0.04 | 17.55 |

| Historical Hole CR12-366D Drilled on same section than Holes CRSX-23-22, A, B, C | ||||||||

| CR12-366D | 1122.0 | 46.5 | 4.04 | 33.5 | 1.27 | 0.05 | 0.14 | 5.25 |

| incl. | 1122.0 | 27.0 | 6.26 | 42.6 | 2.05 | 0.07 | 0.11 | 7.91 |

| and incl. | 1122.0 | 4.5 | 15.65 | 29.0 | 7.30 | 0.10 | 0.08 | 19.58 |

| and incl. | 1128.0 | 1.5 | 31.50 | 94.0 | 6.55 | 0.13 | 0.10 | 35.89 |

| Other Selected Historical Intersection Highlights | ||||||||

| CR13-451D | 941.0 | 16.5 | 3.01 | 8.6 | 0.82 | 0.01 | 0.04 | 3.55 |

| CR13-455D | 956.0 | 21.0 | 6.12 | 7.4 | 0.05 | 0.02 | 0.08 | 6.35 |

| CR14-579D | 1081.5 | 10.5 | 18.83 | 6.6 | 6.02 | 0.01 | 0.06 | 21.82 |

| CR13-454D | 723.5 | 51.0 | 2.11 | 11.8 | 0.39 | 0.03 | 0.04 | 2.50 |

| incl. | 770.0 | 4.5 | 6.72 | 2.6 | 0.06 | 0.00 | 0.02 | 6.81 |

| CRD-021A | 865.5 | 4.5 | 10.70 | 2.7 | 0.02 | 0.00 | 0.01 | 10.75 |

| incl. | 915.0 | 1.5 | ##### | 54.0 | 0.00 | 0.06 | 0.02 | 104.70 |

| CR13-507DB | 756.5 | 55.5 | 3.08 | 7.4 | 0.22 | 0.02 | 0.03 | 3.32 |

| incl. | 789.5 | 16.5 | 7.05 | 1.8 | 0.21 | 0.02 | 0.02 | 7.25 |

| CR13-453D | 855.5 | 27.0 | 3.62 | 9.2 | 0.28 | 0.04 | 0.03 | 3.91 |

| incl. | 878.0 | 4.5 | 11.19 | 28.0 | 0.66 | 0.16 | 0.06 | 11.98 |

| and | 894.5 | 33.0 | 1.84 | 30.8 | 0.11 | 0.01 | 0.08 | 2.38 |

| incl. | 911.0 | 1.5 | 9.00 | 421.0 | 0.13 | 0.09 | 0.17 | 14.38 |

| CR14-597DG | 724.5 | 25.5 | 3.68 | 33.6 | 0.30 | 0.70 | 0.02 | 4.49 |

| incl. | 744.0 | 6.0 | 11.49 | 14.6 | 0.47 | 0.03 | 0.03 | 11.94 |

Trace indicates base metal assay results are less than 0.01%.

Metal prices used in gold equivalent calculation: Au = $1,750/oz, Ag = $21 / oz, Zn = $1.20/lb, Pb = $0.90/lb, Cu = $3.50/lb. All prices in USD. No recovery factor was used in calculation of gold equivalent.

Qualified Persons Statement

The scientific and technical information in this news release has been reviewed and approved by Mr. Sylvain Guerard, P Geo., SVP Exploration of the Company, who is the Qualified Person as defined under the definitions of National Instrument 43-101 (“NI 43-101”).

To verify the information related to the 2022 and 2023 drilling programs at the Camino Rojo property, Mr. Guerard has visited the property in the past year; discussed logging, sampling, and sample shipping processes with responsible site staff; discussed and reviewed assay and QA/QC results with responsible personnel; and reviewed supporting documentation, including drill hole location and orientation and significant assay interval calculations.Quality Assurance / Quality Control – 2023 Drill Program

All gold results at Camino Rojo were obtained by ALS Minerals (Au-AA23) using fire assay fusion and an atomic absorption spectroscopy finish. All samples are also analyzed for multi-elements, including silver, copper, lead and zinc using a four-acid digestion with ICP-AES finish (ME-ICP61) method at ALS Laboratories in Canada. If samples were returned with gold values in excess of 10 ppm gold, 100ppm silver or base metal values in excess of 1% by ICP analysis, samples are re-run with gold (Au-GRA21) by fire assay and gravimetric finish or silver and base metal by (OG62) four acid overlimit methods. Drill program design, Quality Assurance/Quality Control and interpretation of results were performed by qualified persons employing a Quality Assurance/Quality Control program consistent with NI 43-101 and industry best practices. Standards were inserted at a frequency of one in every 50 samples, and blanks were inserted at a frequency of one in every 50 samples for Quality Assurance/Quality Control purposes by the Company as well as the lab. ALS Laboratories is independent of Orla. There are no known drilling, sampling, recovery, or other factors that could materially affect the accuracy or reliability of the drilling data at Camino Rojo.

The initial metallurgical testing on the Camino Rojo Extension was completed by Blue Coast Research Ltd. (“Blue Coast”). Blue Coast is independent of the Company and employs an internal quality assurance-quality control program consistent with NI 43-101 and industry best practice.

For additional information on the Company’s previously reported drill results, see the Company’s press release dated January 31, 2023 (Orla Mining Continues to Intersect Wide, Higher-Grade Sulphide Zones and Expose Deeper Potential at Camino Rojo, Mexico). Historical drill results at Camino Rojo were completed by Goldcorp. Inc. (“Goldcorp”), a prior owner of the project. The Company’s independent qualified person, Independent Mining Consultants, Inc. was of the opinion that the drilling and sampling procedures for Camino Rojo drill samples by Goldcorp (and prior to its acquisition by Goldcorp, Canplats Resources Corporation) were reasonable and adequate for the purposes of the Camino Rojo Report, and that the Goldcorp QA/QC program met or exceeded industry standards. See the Camino Rojo Report (as defined below) for additional information.About Orla Mining Ltd.

Orla is operating the Camino Rojo Oxide Gold Mine, a gold and silver open-pit and heap leach mine, located in Zacatecas State, Mexico. The property is 100% owned by Orla and covers over 160,000 hectares. The technical report for the 2021 Feasibility Study on the Camino Rojo oxide gold project entitled “Unconstrained Feasibility Study NI 43-101 Technical Report on the Camino Rojo Gold Project – Municipality of Mazapil, Zacatecas, Mexico” dated January 11, 2021 (the “Camino Rojo Report”), is available on SEDAR and EDGAR under the Company’s profile at www.sedar.com and www.sec.gov, respectively. Orla also owns 100% of Cerro Quema located in Panama which includes a gold production scenario and various exploration targets. Cerro Quema is a proposed open pit mine and gold heap leach operation. The technical report for the Pre-Feasibility Study on the Cerro Quema oxide gold project entitled “Project Pre-Feasibility Updated NI 43-101 Technical Report on the Cerro Quema Project, Province of Los Santos, Panama” dated January 18, 2022, is available on SEDAR and EDGAR under the Company’s profile at www.sedar.com and www.sec.gov, respectively. Orla also owns 100% of the South Railroad Project, a feasibility-stage, open pit, heap leach project located on the Carlin trend in Nevada. The technical report for the 2022 Feasibility Study entitled “South Railroad Project, Form 43-101F1 Technical Report Feasibility Study, Elko County, Nevada” dated March 23, 2022, is available on SEDAR and EDGAR under the Company’s profile at www.sedar.com and www.sec.gov, respectively. The technical reports are available on Orla’s website at www.orlamining.com.

Forward-looking Statements

This news release contains certain “forward-looking information” and “forward-looking statements” within the meaning of Canadian securities legislation and within the meaning of Section 27A of the United States Securities Act of 1933, as amended, Section 21E of the United States Exchange Act of 1934, as amended, the United States Private Securities Litigation Reform Act of 1995, or in releases made by the United States Securities and Exchange Commission, all as may be amended from time to time, including, without limitation, statements regarding: the potential mineralization at Camino Rojo based on the 2023 drill program, including potential resource expansion and upside potential of the Camino Rojo Extensions, future processing methods based on metallurgical test results and statements regarding the Company’s 2024 drill program, including the goals thereof. Forward-looking statements are statements that are not historical facts which address events, results, outcomes or developments that the Company expects to occur. Forward-looking statements are based on the beliefs, estimates and opinions of the Company’s management on the date the statements are made and they involve a number of risks and uncertainties. Certain material assumptions regarding such forward-looking statements were made, including without limitation, assumptions regarding: the future price of gold and silver; anticipated costs and the Company’s ability to fund its programs; the Company’s ability to carry on exploration, development, and mining activities; tonnage of ore to be mined and processed; ore grades and recoveries; decommissioning and reclamation estimates; the Company’s ability to secure and to meet obligations under property agreements, including the layback agreement with Fresnillo plc; that all conditions of the Company’s credit facility will be met; the timing and results of drilling programs; mineral reserve and mineral resource estimates and the assumptions on which they are based; the discovery of mineral resources and mineral reserves on the Company’s mineral properties; that political and legal developments will be consistent with current expectations; the timely receipt of required approvals and permits, including those approvals and permits required for successful project permitting, construction, and operation of projects; the timing of cash flows; the costs of operating and exploration expenditures; the Company’s ability to operate in a safe, efficient, and effective manner; the Company’s ability to obtain financing as and when required and on reasonable terms; the impact of the COVID-19 pandemic on the Company’s operations; that the Company’s activities will be in accordance with the Company’s public statements and stated goals; and that there will be no material adverse change or disruptions affecting the Company or its properties. Consequently, there can be no assurances that such statements will prove to be accurate and actual results and future events could differ materially from those anticipated in such statements. Forward-looking statements involve significant known and unknown risks and uncertainties, which could cause actual results to differ materially from those anticipated. These risks include, but are not limited to: uncertainty and variations in the estimation of mineral resources and mineral reserves; the Company’s dependence on the Camino Rojo oxide mine; risks related to the Company’s indebtedness; risks related to exploration, development, and operation activities; risks related to natural disasters, terrorist acts, health crises, and other disruptions and dislocations, including the COVID-19 pandemic; foreign country and political risks, including risks relating to foreign operations and expropriation or nationalization of mining operations; delays in obtaining or failure to obtain governmental permits, or non-compliance with permits; environmental and other regulatory requirements; delays in or failures to enter into a subsequent agreement with Fresnillo plc with respect to accessing certain additional portions of the mineral resource at the Camino Rojo project and to obtain the necessary regulatory approvals related thereto; the mineral resource estimations for the Camino Rojo project being only estimates and relying on certain assumptions; loss of, delays in, or failure to get access from surface rights owners; uncertainties related to title to mineral properties; water rights; financing risks and access to additional capital; risks related to guidance estimates and uncertainties inherent in the preparation of feasibility and pre-feasibility studies; uncertainty in estimates of production, capital, and operating costs and potential production and cost overruns; the fluctuating price of gold and silver; unknown labilities in connection with acquisitions; global financial conditions; uninsured risks; climate change risks; competition from other companies and individuals; conflicts of interest; risks related to compliance with anti-corruption laws; volatility in the market price of the Company’s securities; assessments by taxation authorities in multiple jurisdictions; foreign currency fluctuations; the Company’s limited operating history; litigation risks; the Company’s ability to identify, complete, and successfully integrate acquisitions; intervention by non-governmental organizations; outside contractor risks; risks related to historical data; the Company not having paid a dividend; risks related to the Company’s foreign subsidiaries; risks related to the Company’s accounting policies and internal controls; the Company’s ability to satisfy the requirements of Sarbanes-Oxley Act of 2002; enforcement of civil liabilities; the Company’s status as a passive foreign investment company for U.S. federal income tax purposes; information and cyber security; gold industry concentration; shareholder activism; and risks associated with executing the Company’s objectives and strategies; as well as those risk factors discussed in the Company’s most recently filed management’s discussion and analysis, as well as its annual information form dated March 20, 2023, which are available on www.sedarplus.ca and www.sec.gov. Except as required by the securities disclosure laws and regulations applicable to the Company, the Company undertakes no obligation to update these forward-looking statements if management’s beliefs, estimates or opinions, or other factors, should change.

Cautionary Note to U.S. Readers

This news release has been prepared in accordance with Canadian standards for the reporting of mineral resource and mineral reserve estimates, which differ from the previous and current standards of the United States securities laws. In particular, and without limiting the generality of the foregoing, the terms “mineral reserve”, “proven mineral reserve”, “probable mineral reserve”, “inferred mineral resources,”, “indicated mineral resources,” “measured mineral resources” and “mineral resources” used or referenced herein and the documents incorporated by reference herein, as applicable, are Canadian mineral disclosure terms as defined in accordance with Canadian National Instrument 43-101 — Standards of Disclosure for Mineral Projects (“NI 43-101”) and the Canadian Institute of Mining, Metallurgy and Petroleum (the “CIM”) — CIM Definition Standards on Mineral Resources and Mineral Reserves, adopted by the CIM Council, as amended (the “CIM Definition Standards”).

For United States reporting purposes, the United States Securities and Exchange Commission (the “SEC”) has adopted amendments to its disclosure rules (the “SEC Modernization Rules”) to modernize the mining property disclosure requirements for issuers whose securities are registered with the SEC under the Exchange Act, which became effective February 25, 2019. The SEC Modernization Rules more closely align the SEC’s disclosure requirements and policies for mining properties with current industry and global regulatory practices and standards, including NI 43-101, and replace the historical property disclosure requirements for mining registrants that were included in SEC Industry Guide 7. Issuers were required to comply with the SEC Modernization Rules in their first fiscal year beginning on or after January 1, 2021. As a foreign private issuer that is eligible to file reports with the SEC pursuant to the multi-jurisdictional disclosure system, the Corporation is not required to provide disclosure on its mineral properties under the SEC Modernization Rules and will continue to provide disclosure under NI 43-101 and the CIM Definition Standards. Accordingly, mineral reserve and mineral resource information contained or incorporated by reference herein may not be comparable to similar information disclosed by United States companies subject to the United States federal securities laws and the rules and regulations thereunder.

As a result of the adoption of the SEC Modernization Rules, the SEC now recognizes estimates of “measured mineral resources”, “indicated mineral resources” and “inferred mineral resources.” In addition, the SEC has amended its definitions of “proven mineral reserves” and “probable mineral reserves” to be “substantially similar” to the corresponding CIM Definition Standards that are required under NI 43-101. While the SEC will now recognize “measured mineral resources”, “indicated mineral resources” and “inferred mineral resources”, U.S. investors should not assume that all or any part of the mineralization in these categories will be converted into a higher category of mineral resources or into mineral reserves without further work and analysis. Mineralization described using these terms has a greater amount of uncertainty as to its existence and feasibility than mineralization that has been characterized as reserves. Accordingly, U.S. investors are cautioned not to assume that all or any measured mineral resources, indicated mineral resources, or inferred mineral resources that the Company reports are or will be economically or legally mineable without further work and analysis. Further, “inferred mineral resources” have a greater amount of uncertainty and as to whether they can be mined legally or economically. Therefore, U.S. investors are also cautioned not to assume that all or any part of inferred mineral resources will be upgraded to a higher category without further work and analysis. Under Canadian securities laws, estimates of “inferred mineral resources” may not form the basis of feasibility or pre-feasibility studies, except in rare cases. While the above terms are “substantially similar” to CIM Definitions, there are differences in the definitions under the SEC Modernization Rules and the CIM Definition Standards. Accordingly, there is no assurance any mineral reserves or mineral resources that the Company may report as “proven mineral reserves”, “probable mineral reserves”, “measured mineral resources”, “indicated mineral resources” and “inferred mineral resources” under NI 43-101 would be the same had the Company prepared the reserve or resource estimates under the standards adopted under the SEC Modernization Rules or under the prior standards of SEC Industry Guide 7.

Appendix: Drill Results

Table 1: Camino Rojo Extension Composite Drill Results (Composites 1g/t Au cog)

| HOLE-ID | From (m) | To (m) | Core Length (m) | Estimated True Width (m) | Au g/t | Ag g/t | Cu ppm | As ppm | Pb ppm | Zn ppm | Mo ppm | AuEq* g/t | Au GXM | AuEq GXM | Au GXM (TW) | Including 10g/t Au HG | Litho | Met Code |

| CRSX23-22 | 430.60 | 435.40 | 4.8 | 3.46 | 6.23 | 8.4 | 36 | 2621 | 602 | 700 | 1.2 | 6.39 | 29.89 | 30.66 | 21.56 | 1.6m @ 15g/t Au | 430.6 – 431.25 Caracol 431.25 – 432.2 Breccia 432.2 – 435.4 Caracol | SX |

| CRSX23-22 | 471.00 | 472.50 | 1.5 | 1.08 | 2.51 | 58.2 | 90 | 1545 | 1550 | 5170 | 2.0 | 3.52 | 3.77 | 5.28 | 2.71 | Caracol | FR | |

| CRSX23-22 | 489.00 | 490.50 | 1.5 | 1.08 | 1.81 | 4.8 | 37 | 2020 | 68 | 95 | 1.0 | 1.88 | 2.72 | 2.82 | 1.95 | Caracol | FR | |

| CRSX23-22 | 535.50 | 537.00 | 1.5 | 1.08 | 1.53 | 18.1 | 92 | 1285 | 1375 | 19100 | 2.0 | 2.71 | 2.30 | 4.06 | 1.66 | Caracol | SX | |

| CRSX23-22 | 550.50 | 556.50 | 6.0 | 4.35 | 1.00 | 61.2 | 70 | 2854 | 3273 | 3721 | 0.9 | 2.03 | 6.00 | 12.21 | 4.35 | Caracol | SX | |

| CRSX23-22 | 583.50 | 586.50 | 3.0 | 2.19 | 1.79 | 26.7 | 108 | 4265 | 876 | 6880 | 0.8 | 2.48 | 5.38 | 7.45 | 3.92 | Caracol | SX | |

| CRSX23-22 | 684.00 | 690.00 | 6.0 | 4.32 | 1.77 | 5.5 | 53 | 2994 | 133 | 278 | 1.0 | 1.86 | 10.64 | 11.19 | 7.67 | Caracol | SX | |

| CRSX23-22 | 1063.50 | 1066.50 | 3.0 | 2.27 | 1.36 | 0.4 | 12 | 12 | 12 | 526 | 3.5 | 1.39 | 4.07 | 4.16 | 3.08 | Cuesta de Cura | SX | |

| CRSX23-22 | 1100.40 | 1101.50 | 1.1 | 0.83 | 2.64 | 195.0 | 4486 | 9786 | 3682 | 3264 | 1.5 | 5.88 | 2.91 | 6.47 | 2.20 | Cuesta de Cura | SX | |

| CRSX23-22 | 1106.80 | 1107.30 | 0.5 | 0.44 | 3.71 | 117.0 | 659 | 4850 | 22100 | 33900 | 1.0 | 7.58 | 1.86 | 3.79 | 1.62 | Cuesta de Cura | SX | |

| CRSX23-22 | 1112.00 | 1113.50 | 1.5 | 1.13 | 1.44 | 7.0 | 106 | 837 | 655 | 3300 | 1.0 | 1.72 | 2.16 | 2.58 | 1.63 | Cuesta de Cura | SX | |

| CRSX23-22 | 1121.00 | 1122.50 | 1.5 | 1.13 | 1.16 | 0.3 | 13 | 235 | 94 | 353 | 1.0 | 1.18 | 1.74 | 1.78 | 1.32 | Cuesta de Cura | SX | |

| CRSX23-22 | 1131.90 | 1133.50 | 1.6 | 1.39 | 2.21 | 0.3 | 137 | 51 | 3 | 51 | 0.5 | 2.23 | 3.54 | 3.57 | 3.08 | Cuesta de Cura | SX | |

| CRSX23-22 | 1138.00 | 1139.30 | 1.3 | 1.13 | 1.41 | 0.5 | 61 | 5 | 4 | 210 | 0.5 | 1.43 | 1.83 | 1.86 | 1.60 | Cuesta de Cura | SX | |

| CRSX23-22 | 1144.70 | 1147.30 | 2.6 | 2.27 | 2.01 | 48.7 | 780 | 2499 | 5872 | 32366 | 1.0 | 4.43 | 5.24 | 11.53 | 4.57 | Cuesta de Cura | SX | |

| CRSX23-22 | 1175.50 | 1179.75 | 4.3 | 3.71 | 1.33 | 70.5 | 2243 | 2356 | 2195 | 1832 | 2.3 | 2.65 | 5.66 | 11.26 | 4.94 | 1175.5 Р1177 FG Intrusives Рhdb-bi-pl 1177 Р1179.75 La Pe̱a | SX | |

| CRSX23-22 | 1226.00 | 1227.10 | 1.1 | 0.96 | 2.13 | 66.5 | 1089 | 1686 | 3906 | 55314 | 3.2 | 5.82 | 2.34 | 6.40 | 2.05 | La Peña | SX | |

| CRSX23-22A | 1033.50 | 1035.00 | 1.5 | 1.17 | 1.20 | 12.6 | 1470 | 2010 | 78 | 2500 | 14.0 | 1.67 | 1.80 | 2.51 | 1.40 | Cuesta de Cura | SX | |

| CRSX23-22A | 1047.85 | 1059.70 | 11.9 | 9.25 | 2.48 | 34.2 | 918 | 7777 | 1586 | 13400 | 4.4 | 3.70 | 29.33 | 43.82 | 22.89 | Cuesta de Cura | SX | |

| CRSX23-22A | 1066.40 | 1072.00 | 5.6 | 4.39 | 10.30 | 37.8 | 1172 | 10536 | 795 | 38088 | 2.3 | 12.73 | 57.67 | 71.29 | 45.17 | 0.7m @ 23.8g/t Au 1.7m @ 20.6g/t Au | 1066.4 – 1070.4 Cuesta de Cura 1070.4 – 1072 FG Intrusives – hdb-bi-pl | SX |

| CRSX23-22A | 1090.40 | 1096.50 | 6.1 | 5.18 | 1.06 | 4.0 | 385 | 127 | 24 | 2174 | 2.5 | 1.26 | 6.46 | 7.70 | 5.48 | 1090.4 – 1091.2 FG Intrusives – hdb-bi-pl 1091.2 – 1096.5 Cuesta de Cura | SX | |

| CRSX23-22B | 820.50 | 822.00 | 1.5 | 1.17 | 2.24 | 13.1 | 238 | 2230 | 407 | 509 | 9.0 | 2.47 | 3.36 | 3.70 | 2.62 | Indidura | SX | |

| CRSX23-22C | 1044.85 | 1056.50 | 11.7 | 8.94 | 4.86 | 43.6 | 850 | 6053 | 4438 | 12685 | 3.2 | 6.25 | 56.62 | 72.84 | 43.43 | 1.7m @ 28.6g/t Au | Cuesta de Cura | SX |

| CRSX23-22C | 1063.60 | 1068.00 | 4.4 | 3.38 | 3.02 | 27.0 | 996 | 2311 | 286 | 12811 | 3.0 | 4.10 | 13.31 | 18.03 | 10.21 | Cuesta de Cura | SX | |

| CRSX23-22C | 1084.00 | 1085.50 | 1.5 | 1.15 | 1.44 | 5.7 | 296 | 872 | 143 | 7430 | 2.0 | 1.90 | 2.15 | 2.85 | 1.65 | Cuesta de Cura | SX |

| Criteria: Cut off grade 1g/t Au, minimum length 1.5m, maximum consecutive internal waste 6m, if Au grade x length > 1.5 the composite will be added |

| Price Assumptions: Au = $1,750/oz, Ag = $21 / oz, Zn = $1.20/lb, Pb = $0.90/lb, Cu = $3.50/lb. |

| *(Au+Ag+Cu+Zn+Pb) |

Table 2: Camino Rojo Extension Drill Hole Collars

| HOLE-ID | Easting | Northing | Elevation | Azimuth | Dip | Depth (m) |

| CRSX23-22 | 243401.2 | 2675997.4 | 1955.6 | 165.5 | -76.00 | 1341.5 |

| CRSX23-22A | 243401.2 | 2675997.4 | 1955.6 | 152.3 | -63.00 | 1140.0 |

| CRSX23-22B | 243401.2 | 2675997.4 | 1955.6 | 181.9 | -64.28 | 1140.1 |

| CRSX23-22C | 243401.2 | 2675997.4 | 1955.6 | 142.0 | -63.00 | 1125.2 |

SOURCE Orla Mining Ltd.

For further information: Jason Simpson, President & Chief Executive Officer; Andrew Bradbury, Vice President, Investor Relations & Corporate Development, www.orlamining.com, info@orlamining.com