VANCOUVER, BC – March 14, 2022 – Orla Mining Ltd. (TSX: OLA; NYSE: ORLA) (“Orla” or the “Company”) is pleased to provide an exploration update and overview of targets and program objectives for its Camino Rojo and Cerro Quema Projects for 2022.

“With Camino Rojo ramping up production and beginning to generate cash flow, Orla will gradually increase exploration expenditures,” said Jason Simpson, President and Chief Executive Officer of Orla. “This disciplined allocation of capital to Mexico and Panama reinforces our ambitions of driving company value through discovery”.

“2021 was focused on drilling and advancing studies at the Camino Rojo Sulphide deposit, delivering an initial mineral resource at Caballito in Panama and defining and prioritizing drill targets across the portfolio,” stated Sylvain Guerard, Senior Vice President, Exploration of Orla. “In addition to increasing reserves at the Camino Rojo Mine, efforts will be dedicated to upgrading and growing resources and drill testing priority targets with the goal of making new discoveries near existing deposits in Mexico and Panama”.

Exploration spending for 2022 is expected to total $15 million, with $10 million allocated to activities in Mexico and $5 million allocated to activities in Panama. Drilling at Camino Rojo and Cerro Quema is set to begin in the second quarter and will continue through the remainder of the year. Updates from the 2022 exploration program, including drill results and updated resource estimates, are expected during the second half of 2022 and early 2023.

MEXICO EXPLORATION:

During the first year of production at the Camino Rojo Oxide mine, near-mine and regional exploration will be focused on increasing oxide reserves, supporting advancement of the sulphide deposit development scenario options, and testing priority targets defined in 2021 in an effort to make new satellite discoveries.

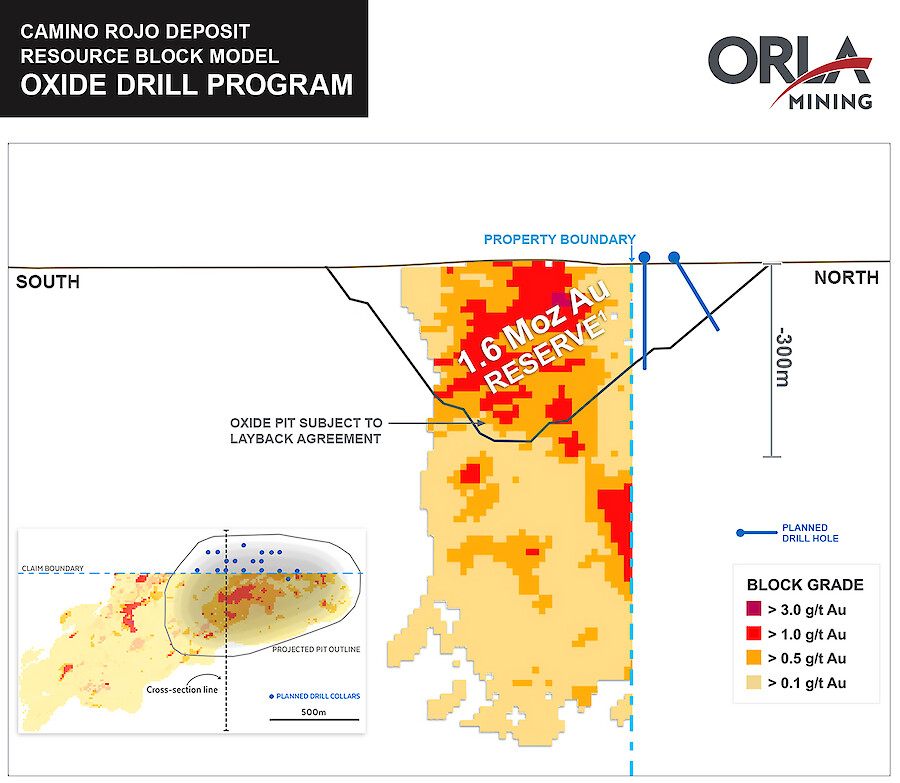

Camino Rojo Oxide Program:

The Company is seeking to define additional oxide reserves at the Camino Rojo Mine following confirmatory core drilling on the Fresnillo Plc’s (“Fresnillo”) property, located immediately north and adjacent of the Camino Rojo oxide mine open pit. While historical drilling indicates that mineralization continues across the property boundary onto the Fresnillo layback area, no ounces from this area are currently included in the Camino Rojo mineral reserve estimate. The planned 2,500m diamond drill program is designed to confirm and delineate mineralization located in the oxide pit layback and allow for a potential update of mineral resource and reserve estimations.

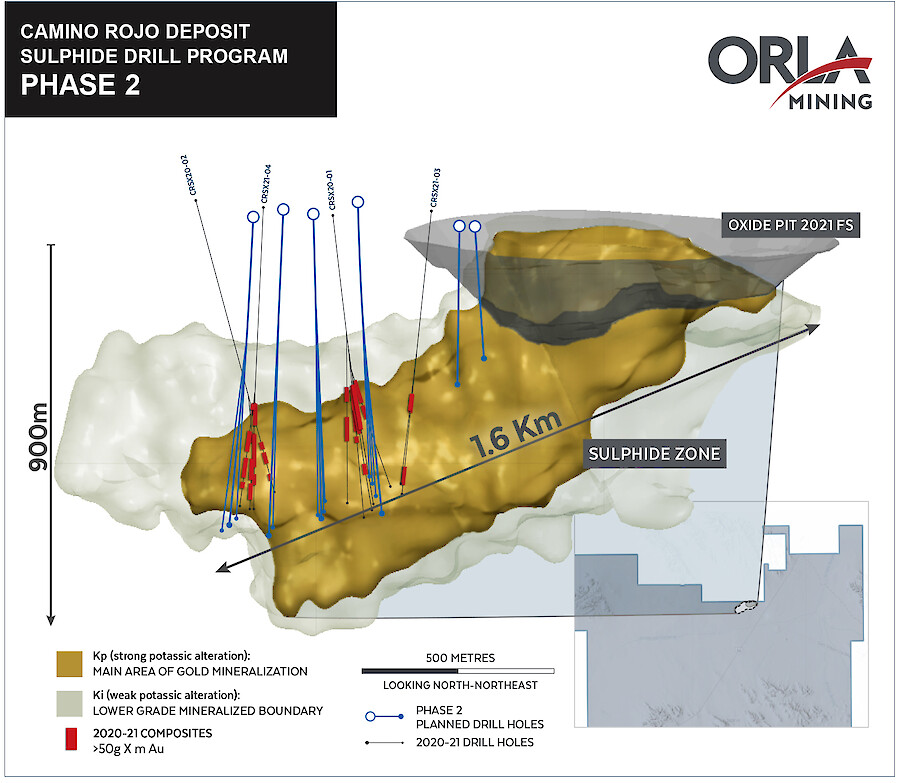

Camino Rojo Sulphide Program – Phase 2:

Following a successful core drill program in 2021, an 8,250m follow-up drilling phase is planned in 2022 on the Camino Rojo Sulphides. The 2021 program consisted of 6,079m across 14 holes on a 100-250m drill spacing at a south orientation. This program confirmed wide zones of higher-grade gold mineralization within the sulphide deposit while also providing material for new metallurgical study, which remains in progress. The 2022 program will infill drill the deposit and reduce the spacing to 50-125m. This tighter drill spacing on the more optimal south orientation, combined with the extensive south to north historical drilling, is anticipated to reinforce the geological model and confirm continuity of wide zones of higher-grade gold mineralization. This drilling is expected to support an updated resource estimate for the Camino Rojo Sulphides, and the advancement of development planning and a Preliminary Economic Assessment targeted for year end 2022.

Camino Rojo Sulphide Phase 1 (2021) drilling highlights (previously reported):[2]

- 2.38 g/t Au over 108m (Hole CRSX20-01)

- 2.63 g/t Au over 111m (Hole CRSX20-01A)

- 2.51 g/t Au over 58.5m (Hole CRSX20-01B)

- 2.11 g/t Au over 115.5m (Hole CRSX20-01C)

- 3.04 g/t Au over 64.6m (Hole CRSX20-01D)

- 4.47 g/t Au over 55.5m (Hole CRSX20-04A)

- 4.95 g/t Au over 55.5m (Hole CRSX20-04A)

- 2.10 g/t Au over 58.5m (Hole CRSX20-04B)

- 2.27 g/t Au over 87.0m (Hole CRSX20-04B)

- 3.26 g/t Au over 44.7m (Hole CRSX20-04C)

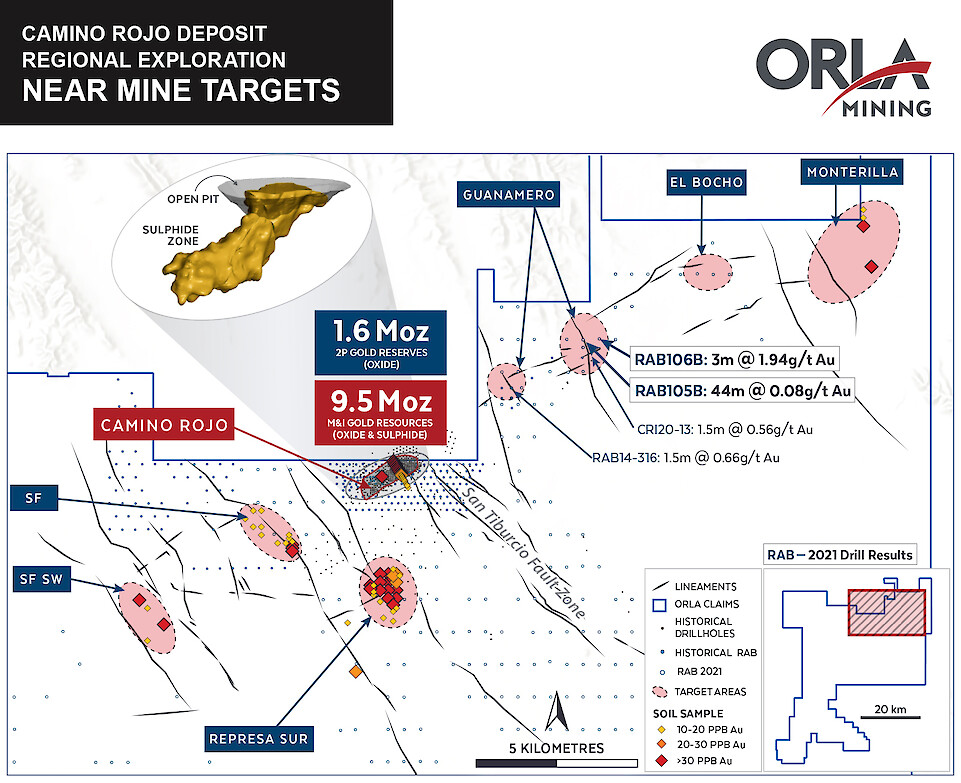

Camino Rojo Regional Exploration Program:

Prior to 2021, exploration had focused on defining and expanding the Camino Rojo deposit, with limited work outside the area of the currently defined deposit and infrastructure. In 2021, regional exploration focused on defining new exploration targets using detailed airborne magnetic drone survey, induced polarization (IP) survey, and multi-elements soil geochemistry. In addition, a 9,146m, 284-hole regional rotary air blast (RAB) Cover-Bedrock Interface (CBI) program, with drill fences spaced at 1,000m and drill holes spaced at 500m along the fence, was completed to directly sample bedrock below shallow cover. Encouraging results of anomalous gold were intercepted, including 3m at 1.94 g/t Au and 44m at 0.08 g/t Au, 7 km northeast of Camino Rojo (see Figure 3). See Appendix for a summary of the anomalous results from the RAB CBI 2021 drill program.

As a result of this work, several exploration targets were defined along the Camino Rojo trend and south of the Camino Rojo Oxide Mine. These new exploration targets are hosted in rocks of the Caracol or Indidura formations, are supported by geophysical and/or geochemical anomalies, and are located at the intersection of NW-SE structures associated with the San Tiburcio Fault Zone and NE-SW trending structures on or paralleling the Camino Rojo trend. In 2022, drilling will occur on priority targets and new target generation work will also continue. A 10,000m RC drill program is planning to test the priority targets along the Camino Rojo trend and south of the Camino Rojo Oxide Mine. New deposit discovery remains the objective and this could include oxide deposits that support extension of the mine life at the Camino Rojo Oxide Mine or be additional sulphide deposits that strengthen and expand the already impressive sulphide endowment.

Figure 3: Camino Rojo proximal priority regional targets. (Targets defined via drone magnetic survey in similar structural settings to Camino Rojo deposit, with coincident geochemical soil anomalies or historical drill results.)

PANAMA EXPLORATION

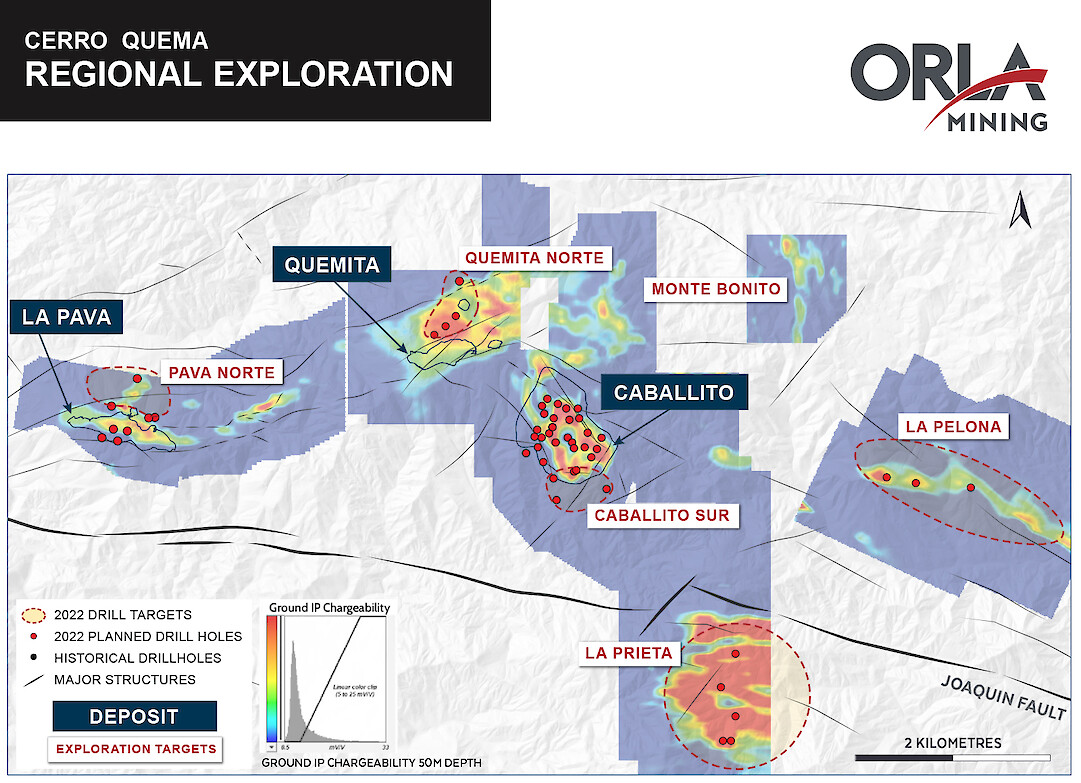

The 2022 Cerro Quema exploration program will consist of infill and expansion drilling of known deposits, drill testing exploration targets defined by recent geochemical soil sampling, geophysical Induced Polarization (IP) surveys, bedrock mapping and prospecting, and historical drilling. In total, 11,700m of drilling is planned in 2022 for Panama.

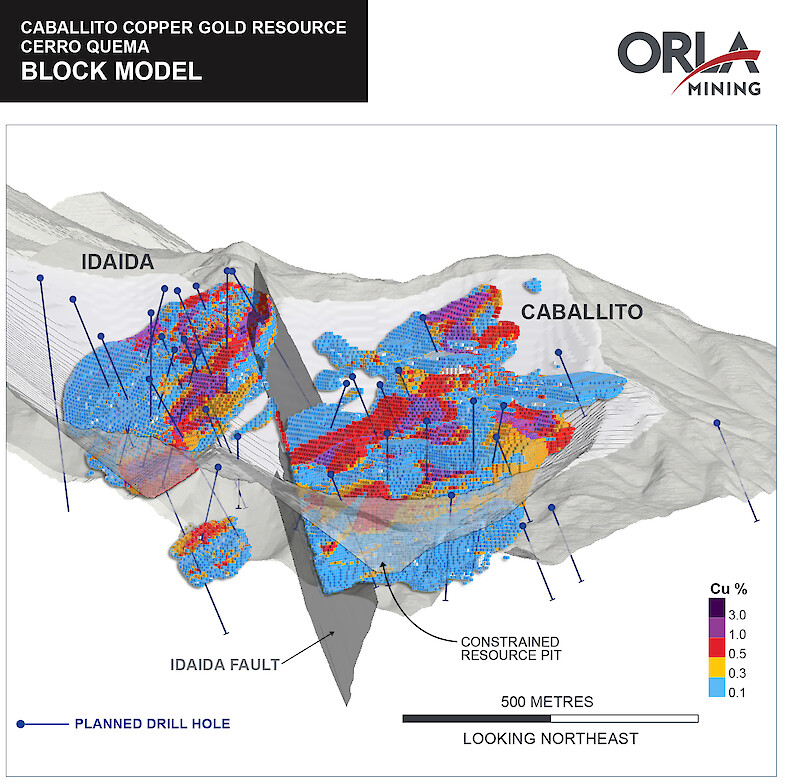

Caballito Deposit Infill and Expansion Drill Program:

Infill and expansion drilling at Caballito, and more limited drilling at La Pava and Quemita, will be directed at converting resources from the inferred resource to indicated resource category, provide material for metallurgical testing, and test the continuity of mineralization and potential extensions of these deposits. The first resource estimates of copper-gold sulphide mineralization at La Pava and Quemita is planned for late 2022.

The current mineral resource estimate for the Caballito copper-gold deposit consists of the following:[3]

| Table 1a: Caballito Sulphides | |||||||||

| Class | Tonnes | CuEq | Cu | Au | Ag | CuEq | Cu | Au | Ag |

| (000s) | (%) | (%) | (g/t) | (g/t) | (Mlbs) | (Mlbs) | (koz) | (koz) | |

| Indicated | 31,952 | 0.96 | 0.83 | 0.31 | 2.2 | 676 | 585 | 315 | 2,260 |

| Inferred | 22,569 | 0.85 | 0.77 | 0.21 | 1.2 | 425 | 381 | 155 | 856 |

| Table 1b: Caballito Oxides | |||||||||

| Class | Tonnes | Au | Ag | AuEq | Au | Ag | |||

| (000s) | (g/t) | (g/t) | (g/t) | (koz) | (koz) | ||||

| Indicated | 998 | 0.49 | 2.1 | 0.50 | 16 | 67 | |||

| Inferred | 3,619 | 0.36 | 2.3 | 0.37 | 41 | 268 |

Cerro Quema Regional Exploration:

Exploration target drill testing is planned to the north of the Quemita deposit to follow-up on hole CQDH-17-112 (previously reported), which intersected 76.5m at 0.87% Cu, 0.15 g/t Au (from 68.0m to 144.5m).[4]

Drilling is also planned at the La Pelona target, which has a similar geophysical signature and geological context to La Pava and Quemita and has limited historical drilling. Drilling will be following up on historical drilling, which intersected oxide mineralization from surface, including 0.23 g/t Au over 138m, and boulder samples which have returned assays of up to 1.8 g/t Au.[5]

South of the regional Joaquin Fault, La Prieta will also be drill tested. La Prieta is defined by a 1.4 km diameter IP chargeability anomaly with coincident Au, Cu, and Mo in-soil and in-rock geochemical anomalies which may be indicative of porphyry-style Cu-Au mineralization.

Other regional targets such as the Quemita Norte’s Cu-in-soil anomaly and Monte Bonito, which is north-east of Quemita, will also be considered for drilling in 2022.

Qualified Persons Statement

The scientific and technical information related to Camino Rojo and Cerro Quema in this presentation has been reviewed and approved by Mr. Sylvain Guerard, P Geo., SVP Exploration of the Company, who is the Qualified Persons as defined under the definitions of National Instrument 43-101 (“NI 43-101”).

To verify the information related to the 2021 RAB drilling program, Mr. Guerard visited the property in the past year; discussed logging, sampling, and sample shipping processes with responsible site staff; discussed and reviewed assay and QA/QC results with responsible personnel; and reviewed supporting documentation, including drill hole location and orientation and significant assay interval calculations.

Quality Control Protocols for 2021 RAB Program (Camino Rojo)

All gold results were obtained by ALS Minerals (Au-AA23) using fire assay fusion and an atomic absorption spectroscopy finish. All samples are also analyzed for multi-elements, including silver and copper, lead and zinc using an Aqua Regia (ME-ICP61) method at ALS Laboratories in Canada. If samples are returned with base metal values in excess of 1% by ICP analysis, samples are re-run with AA46 aqua regia and atomic absorption analysis. Drill program design, Quality Assurance/Quality Control and interpretation of results are performed by qualified persons employing a Quality Assurance/Quality Control program consistent with NI 43-101 and industry best practices. Standards were inserted at a frequency of one in every 50 samples, and blanks were inserted at a frequency of one in every 66 samples for Quality Assurance/Quality Control purposes by the Company as well as the lab. ALS Laboratories is independent of Orla. There are no known drilling, sampling, recovery, or other factors that could materially affect the accuracy or reliability of the drilling data.

About Orla Mining Ltd.

Orla is operating the Camino Rojo Oxide Gold Mine, a gold and silver open-pit and heap leach mine, located in Zacatecas State, Central Mexico. The operation is 100% owned by Orla and covers over 160,000 hectares. The technical report for the 2021 Feasibility Study on the Camino Rojo oxide gold project entitled “Unconstrained Feasibility Study NI 43-101 Technical Report on the Camino Rojo Gold Project – Municipality of Mazapil, Zacatecas, Mexico” dated January 11, 2021, is available on SEDAR and EDGAR under the Company’s profile at www.sedar.com and www.sec.gov, respectively. The technical report is also available on Orla’s website at www.orlamining.com. Orla also owns 100% of Cerro Quema located in Panama which includes a near-term gold production scenario and various exploration targets. Cerro Quema is a proposed open pit mine and gold heap leach operation. The technical report for the Pre-Feasibility Study on the Cerro Quema oxide gold project entitled “Project Pre-Feasibility Updated NI 43-101 Technical Report on the Cerro Quema Project, Province of Los Santos, Panama” dated January 18, 2022, is available on SEDAR and EDGAR under the Company’s profile at www.sedar.com and www.sec.gov, respectively. The technical report is also available on Orla’s website at www.orlamining.com.

For further information, please contact:

Jason Simpson

President & Chief Executive Officer

Andrew Bradbury

Director, Investor Relations

www.orlamining.com

info@orlamining.com

Forward-looking Statements

This news release contains certain “forward-looking information” and “forward-looking statements” within the meaning of Canadian securities legislation and within the meaning of Section 27A of the United States Securities Act of 1933, as amended, Section 21E of the United States Exchange Act of 1934, as amended, the United States Private Securities Litigation Reform Act of 1995, or in releases made by the United States Securities and Exchange Commission, all as may be amended from time to time, including, without limitation, statements regarding the Company’s exploration objectives and strategy, including: increasing company value, growing and making new satellite discoveries, exploration budgets, the timing and results of drilling and updated mineral resource and reserve estimates and economic studies, upgrading inferred mineral resources to measured mineral resources, the existence of mineralization on Fresnillo’s layback area and mine life extension. Forward-looking statements are statements that are not historical facts which address events, results, outcomes or developments that the Company expects to occur. Forward-looking statements are based on the beliefs, estimates and opinions of the Company’s management on the date the statements are made and they involve a number of risks and uncertainties. Certain material assumptions regarding such forward-looking statements were made, including without limitation, assumptions regarding price of gold, silver, and copper; the accuracy of mineral resource and mineral reserve estimations; that there will be no material adverse change affecting the Company or its properties; that all required approvals will be obtained, including concession renewals and permitting; that political and legal developments will be consistent with current expectations; that currency and exchange rates will be consistent with current levels; the impact of COVID-19 on the Company’s operations; and that there will be no significant disruptions affecting the Company or its properties. Consequently, there can be no assurances that such statements will prove to be accurate and actual results and future events could differ materially from those anticipated in such statements. Forward-looking statements involve significant known and unknown risks and uncertainties, which could cause actual results to differ materially from those anticipated. These risks include, but are not limited to: risks related to uncertainties inherent in the preparation of feasibility and pre-feasibility studies, including but not limited to, assumptions underlying the production estimates not being realized, changes to the cost assumptions, variations in quantity of mineralized material, grade or recovery rates, changes to geotechnical or hydrogeological considerations, failure of plant, equipment or processes, changes to availability of power or the power rates, ability to maintain social license, changes to interest or tax rates, changes in project parameters, risks related to mining operations, delays and costs inherent to consulting and accommodating rights of local communities, environmental risks, title and permitting risks, including concession renewal, commodity price and exchange rate fluctuations, risks relating to COVID-19, delays in or failure to receive access agreements or amended permits, risks inherent in the estimation of mineral reserves and mineral resources; and risks associated with executing the Company’s objectives and strategies, including costs and expenses, as well as those risk factors discussed in the Company’s most recently filed management’s discussion and analysis, as well as its annual information form dated March 19, 2021, available on www.sedar.com and www.sec.gov. Except as required by the securities disclosure laws and regulations applicable to the Company, the Company undertakes no obligation to update these forward-looking statements if management’s beliefs, estimates or opinions, or other factors, should change.

Cautionary Note to U.S. Readers

The disclosure contained or referenced herein uses mineral reserve and mineral resource classification terms that comply with reporting standards in Canada, and mineral reserve and mineral resource estimates are made in accordance with Canadian NI 43-101 and the Canadian Institute of Mining, Metallurgy and Petroleum — CIM Definition Standards on Mineral Resources and Mineral Reserves, adopted by the CIM Council, as amended (the “CIM Definition Standards”). Canadian NI 43-101 establishes standards for all public disclosure an issuer makes of scientific and technical information concerning mineral projects. These standards differ significantly from the mineral reserve disclosure requirements of the United States Securities Exchange Commission (the “SEC”) set forth in Industry Guide 7. Consequently, information regarding mineralization contained or referenced herein is not comparable to similar information that would generally be disclosed by U.S. companies under Industry Guide 7 in accordance with the rules of the SEC which applied to U.S. filings prior to the current SEC Modernization Rules (as defined herein). Further, the SEC has adopted amendments to its disclosure rules to modernize the mineral property disclosure requirements for issuers whose securities are registered with the SEC under the Securities Exchange Act of 1934 (“Exchange Act”). These amendments became effective February 25, 2019 (the “SEC Modernization Rules”) and, commencing for registrants with their first fiscal year beginning on or after January 1, 2021, the SEC Modernization Rules replace the historical property disclosure requirements included in SEC Industry Guide 7. As a foreign private issuer that files its annual report on Form 40-F with the SEC pursuant to the multi-jurisdictional disclosure system, the Company is not required to provide disclosure on its mineral properties under the SEC Modernization Rules and will continue to provide disclosure under NI 43-101 and the CIM Definition Standards. The SEC Modernization Rules include the adoption of terms describing mineral reserves and mineral resources that are “substantially similar” to the corresponding terms under the CIM Definition, but there are differences in the definitions under the SEC Modernization Rules and the CIM Definition Standards. Accordingly, there is no assurance any mineral reserves or mineral resources that the Company may report as “proven mineral reserves”, “probable mineral reserves”, “measured mineral resources”, “indicated mineral resources” and “inferred mineral resources” under NI 43-101 would be the same had the Company prepared the mineral reserve or mineral resource estimates under the standards adopted under the SEC Modernization Rules. U.S. investors are also cautioned that while the SEC recognizes “measured mineral resources”, “indicated mineral resources” and “inferred mineral resources” under the Modernization Rules, investors should not assume that any part or all of the mineralization in these categories will ever be converted into a higher category of mineral resources or into mineral reserves. Mineralization described using these terms has a greater amount of uncertainty as to its existence and feasibility than mineralization that has been characterized as reserves. Accordingly, investors are cautioned not to assume that any measured mineral resources, indicated mineral resources, or inferred mineral resources that the Company reports are or will be economically or legally mineable. Further, “inferred mineral resources” have a greater amount of uncertainty as to their existence and as to whether they can be mined legally or economically. Therefore, U.S. investors are also cautioned not to assume that all or any part of the “inferred mineral resources” exist. Under Canadian securities laws, estimates of “inferred mineral resources” may not form the basis of feasibility or pre-feasibility studies, except in rare cases. For the above reasons, information contained or referenced herein regarding descriptions of our mineral reserve and mineral resource estimates is not comparable to similar information made public by U.S. companies subject to reporting and disclosure requirements of the SEC under either Industry Guide 7 or SEC Modernization Rules.

Appendix: RAB CBI Drill Program Anomalous Results – Camino Rojo Regional 2021

| Drillhole | Easting | Northing | Elevation | Azimuth | Dip | Depth (m) | Depth of Overburden | From(m) | To(m) | Length(m) | Auppm | Agppm | Cuppm | Znppm | Pbppm |

| RABCR21-29 | 250006 | 2679753 | 1904 | 180 | -60 | 72 | 9 | 17 | 25 | 8 | 0.05 | 0.74 | 130 | 1098 | 784 |

| RABCR21-105B | 250000 | 2679987 | 1907 | 180 | -60 | 54 | 10 | 10 | 54 | 44 | 0.08 | 0.38 | 32 | 28 | 32 |

| RABCR21-106 | 250501 | 2680019 | 1898 | 0 | -60 | 90 | 2 | 29 | 32 | 3 | 0.05 | 1.3 | 60 | 410 | 70 |

| RABCR21-106B | 250505 | 2680015 | 1898 | 180 | -60 | 54 | 3 | 12 | 15 | 3 | 1.94 | 2.27 | 118 | 1156 | 349 |

Anomalous Result Criteria: > 1.5 m @ > 0.05 ppm Au. Significant Results Criteria: >1.5 m @ >0.5 ppm Au.

Note: All intercept widths are down hole intervals. There is insufficient geologic data to interpret true widths of mineralized intersections.

Full results to be available at https://orlamining.com/projects/camino-rojo/geology/.

[1] Total gold mineral reserves consisting of 466 koz of proven mineral reserve (18,067 kt at 0.80 g/t) and 1,123 koz of probable mineral reserve (49,296 kt at 0.71 g/t). Gold mineral resources at Camino Rojo consists of 557 koz of measured mineral resources (22,749 kt at 0.76 g/t) and 8,902 koz of indicated mineral resources (330,694 kt at 0.84 g/t). See the technical report titled “Unconstrained Feasibility Study NI 43-101 Technical Report on the Camino Rojo Gold Project Municipality of Mazapil, Zacatecas, Mexico” dated effective January 11, 2021, for additional information.

[2] See the Company’s news release dated August 3, 2021, titled “Orla Mining Confirms Higher Grade Gold Zones Within Camino Rojo Sulphide Resource and Provides Project Update”.

[3] See the technical report titled “Project Pre-Feasibility Updated NI 43-101 Technical Report on the Cerro Quema Project, Province of Los Santos, Panama” dated January 18, 2022, for additional information on the Caballito mineral resource estimate.

[4] See the Company’s August 23, 2017 news release titled “Orla Provides Update on its Projects”, for full detail on the drill program upon which this drill result was based.

[5] These drill intercepts and boulder samples are historical in nature and are not treated by the Company as current. Such results were completed by Cyprus Minerals Company, a prior owner of the Cerro Quema Project, prior to the adoption of NI 43-101. The Company is conducting drilling to verify these historical results.

Original Article: https://orlamining.com/news/orla-mining-commences-near-mine-and-regional-exploration-at-camino-rojo-and-cerro-quema/