Vancouver, BC, September 5, 2019 – One World Lithium Inc. (OTCQB-OWRDF) (CSE-OWLI) (the “Company” or “OWL”) announces that Mike Rosko of Montgomery & Associates (“M&A”) and operator of the Salar del Diablo exploration program will be meeting drilling companies and other service providers in Hermosillo, Mexico before touring the Salar del Diablo Property located in Baja California, Mexico. Also attending the meetings and site tour will be Doug Fulcher, OWL’s President and CEO, and Kevin Milledge, an OWL Director and manager of field operations. They will visit previous and proposed drill site locations as well as surface geological features. The field trip will be from September 09 to 12, 2019.

As previously reported in OWL’s news release of August 22, 2019, they will also sign off on protocol documentation for drilling, sampling and testing. The current proposed drilling program is planned for four holes to be drilled to a depth of 600 meters each to collect some 20 groundwater samples at specified depths using a depth specific packer system. A second exploration program will then be proposed by M&A to further define the lithium potential in the basin.

Mike Rosko is the General Manager of M&A’s Santiago office, and has extensive experience in salar environments. Mike will be heading up M&A’s team to explore the Salar del Diablo project. Mike has a Master of Science in geology, is a Certified Professional Geologist, and has been a QP (Qualified Person) as well as an operator, for similarlithium brine exploration projects, including Galaxy Lithium’s Sal de Vida Project, Millennial Lithium’s Pastos Grandes Project, and Lithium America Corporation’s Cauchari-Olaroz Project.

The Company also announces that the previous non-brokered private placement it announced on June 07, 2019 will be replaced with a non-brokered private placement of up to 10,000,000 units (the “Units”) at a price of $0.15 per Unit for gross proceeds of up to $1,500,000 (the “Offering”). All funds are stated in Canadian dollars. The Company does not need proceeds from this offering to start the four hole drill program.

Each Unit will consist of one common share in the capital of the Company (each, a “Share”) and one nontransferable common share purchase warrant (each, a “Warrant”). Each Warrant will entitle the holder thereof to acquire one additional Share (each a “Warrant Share”), at a price of $0.20 per Warrant Share for a period of 24 months from the closing of the Offering.

There is no minimum number of Units or minimum aggregate proceeds required to close the Offering and the Company may, at its discretion, elect to close the Offering in one or more closings. Management anticipates that the Company will allocate the net proceeds of the Offering as follows: Salar del Diablo Lithium Property drilling program $750,000; testing $250,000; Salar del Diablo Lithium Property southern region pre-drilling program $200,000 and $300,000 for working capital.

The Company may pay a finder’s fee on the Offering. Closing of the Offering is subject to a number of conditions, including receipt of all necessary corporate and regulatory approvals. All securities issued in connection with the Offering will be subject to a statutory hold period of four months plus a day from the closing of the Offering in accordance with applicable securities legislation.

The June 07, 2019, non-brokered private placement was up to 10,000,000 units at a price of $0.20 per Unit for gross proceeds of up to $2,000,000. On July 8, 2019 the Company announced that it had closed a portion of this private placement by raising $734,586 CDN through the issuance of 3,672,930 units. Each unit consisted of one common share and one-half of a non-transferable common share purchase warrant. Each Warrant entitled the holder thereof to purchase one common share at a price of $0.25 for a period of 24 months from the closing of the Offering.

A portion or all the Offering may be completed pursuant to Multilateral CSA Notice 45-313 – Prospectus Exemption for Distributions to Existing Security Holders (“CSA 45-313”) and the corresponding blanket orders and rules implementing CSA 45-313 in the participating jurisdictions in respect thereof (collectively with CSA 45-313, the “Existing Security Holder Exemption”). As at the date hereof, the Existing Security Holder Exemption is available in each of the provinces of Canada, with the exception of Newfoundland and Labrador.

Subject to applicable securities laws, the Company will permit each person or company who, as of June 29, 2018 (being the record date set by the Company pursuant to CSA 45-313), who holds common shares as of that date to subscribe for the Units that will be distributed pursuant to the Offering, provided that the Existing Security Holder Exemption is available to such person or company. Qualifying shareholders who wish to participate in the Offering should contact the Company at the contact information set forth below. In the event that aggregate subscriptions for Units under the Offering exceed the maximum number of securities to be distributed, then Units will be sold to qualifying subscribers on a pro rata basis based on the number of Units subscribed for. Insiders may participate in the Offering.

In addition to the Existing Security Holder Exemption, a portion or all the Offering may be completed pursuant to Multilateral CSA Notice 45-318 – Prospectus Exemption for Certain Distributions through an Investment Dealer (“CSA 45-318”) and the corresponding blanket orders and rule implementing CSA 45- 318 in the participating jurisdictions in respect thereof (collectively with CSA 45-318, the “Investment Dealer Exemption”). As at the date hereof, the Investment Dealer Exemption is available in each of Alberta, British Columbia, Saskatchewan, Manitoba and New Brunswick. Pursuant to CSA 45-318, each subscriber relying on the Investment Dealer Exemption must obtain advice regarding the suitability of the investment from a registered investment dealer.

There is no material fact or material change of the Company that has not been disclosed.

In addition to conducting the Offering pursuant to the Existing Security Holder Exemption and the Investment Dealer Exemption, the Offering will also be conducted pursuant to other available prospectus exemptions.

None of the securities issued in connection with the Offering will be registered under the United States Securities Act of 1933, as amended (the “1933 Act”), and none of them may be offered or sold in the United States absent registration or an applicable exemption from the registration requirements of the 1933 Act. This news release shall not constitute an offer to sell or a solicitation of an offer to buy nor shall there by any sale of the securities in any state where such offer, solicitation, or sale would be unlawful.

Mike Rosko, SME Registered member and a Qualified Person as defined by the Canadian National Instrument 43-101, has reviewed and approved the scientific and technical disclosure contained in this news release.

About One World Lithium Inc.

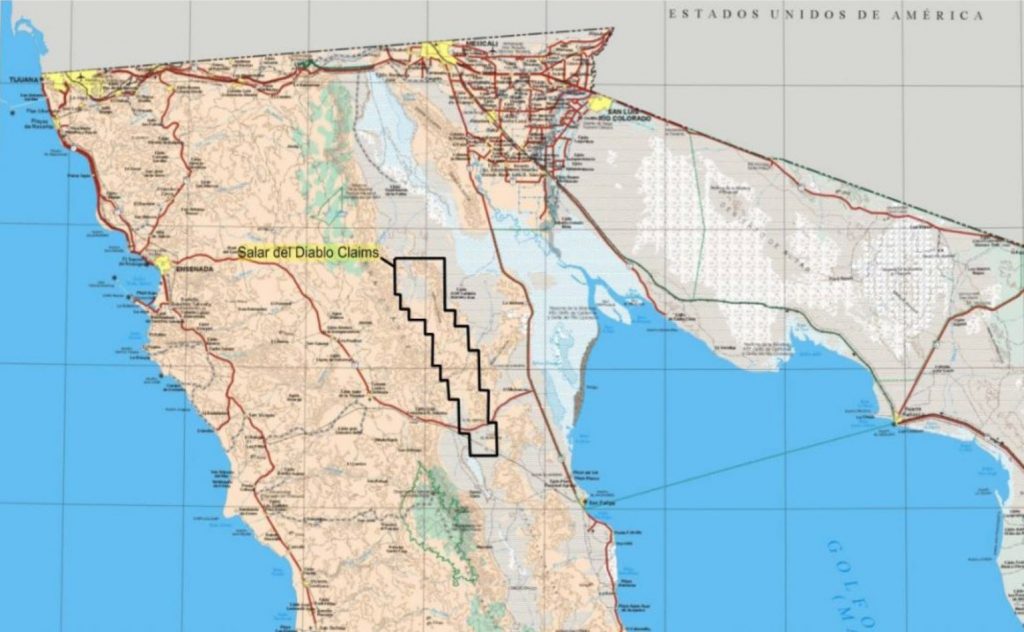

One World Lithium Inc. is an exploration company focused on lithium in brine projects. It currently has earned a 60% property interest with an option to acquire a further 30% property interest for a total of a 90% propertyinterest in the 103,430 hectare (399 square mile) Salar del Diablo lithium brine project located in the State of Baja California, Mexico.

On behalf of the Board of Directors of One World Lithium Inc.,

“Douglas Fulcher”

Douglas Fulcher, CEO and President

For further information please visit www.oneworldlitium.com or email infor@oneworldlithium.com or call 1- 888-280-8128.

Forward-Looking Information: This press release may include forward looking information within the meaning of Canadian securities legislation. Forward looking information is based on certain key expectations and assumptions made by the management of the OWL, including the intention of OWL to proceed with the advancement of the Property. Although OWL believes that the expectations and assumptions on which such forward looking information is based are reasonable, undue reliance should not be placed on the forwardlooking information because OWL can give no assurance that they will prove to be correct. Forward looking statements contained in this press release are made as of the date of this press release. OWL disclaims any intent or obligation to update publically any forwardlooking information, whether as a result of new information, future events or results or otherwise, other than as required by applicable securities laws. There can be no assurance that such statements will prove to be accurate and actual results and future events could differ materially from the those anticipated in such statements, important factors that could cause actual results to differ materially from the company’s expectations include: (I) inability of OWL to execute its business plan and raise the required financing (II) accuracy of mineral or resource exploration activity (III) continued access to mineral property and (IV) risks and market fluctuations common to the mining industry and lithium sector in particular. The reader is cautioned that assumptions used in the preparation of any forwardlooking information may prove to be incorrect. Events or circumstances may cause actual results to differ materially from those predicted, as a result of numerous known and unknown risks, uncertainties, and other factors, some of which are beyond the control of the OWL. The reader is cautioned not to place undue reliance on any forward-looking information contained in this press release.

Neither the Canadian Securities Exchange nor its Market Regulator (as that term is defined in the policies of the Canadian Securities Exchange) accepts responsibility for the adequacy or accuracy of this release.