Newmont Generates Record Cash Flows in 2020 and Meets Full-year Guidance; Increases Quarterly Dividend to $0.55 Per Share

DENVER–(BUSINESS WIRE)– Newmont Corporation (NYSE: NEM, TSX: NGT) (Newmont or the Company) today announced full year and fourth quarter 2020 results.

2020 HIGHLIGHTS

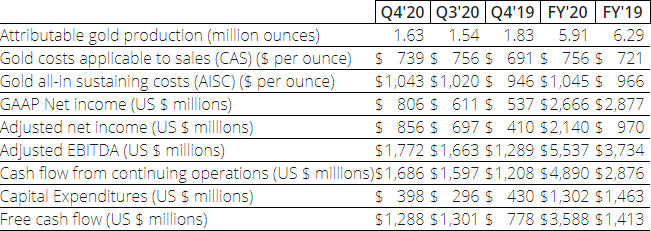

- Produced 5.9 million attributable ounces of gold and over 1 million attributable gold equivalent ounces of co-products, gold CAS* of $756 per ounce, and gold AISC* of $1,045 per ounce achieving 2020 full-year guidance

- Generated record $4.9 billion of cash from continuing operations and $3.6 billion of Free Cash Flow (97% attributable to Newmont)*

- Ended the year with $5.5 billion of consolidated cash and $8.5 billion of liquidity with a net debt to adjusted EBITDA* ratio of 0.2x

- Announced industry-leading dividend framework and declared fourth quarter dividend of $0.55 per share, an increase of 38 percent over the prior quarter and a total declared dividend for 2020 of $1.45 per share**

- Completed the 2020 $1 billion share-repurchase program and recently announced a new $1 billion share-repurchase program

- Delivered over $2.7 billion to shareholders through dividends and share buybacks in 2019 and 2020

- Achieved best safety performance in the Company’s history, focusing on fatality risks across our business

- Recognized as top-ranked gold miner for the sixth consecutive year in DJSI Index, announced industry-leading climate targets for greenhouse gas emissions and committed $500 million over 5 years to climate change initiatives

- Reported industry-leading reserves of over 94 million ounces of gold mineral reserves and 65 million ounces of gold equivalent ounces reserves

- Announced 2021 outlook of 6.5 million ounces for 2021, and between 6.2 and 6.7 million ounces through 2023 and between 6.5 and 7.0 million ounces longer-term through 2025***

“In 2020, Newmont achieved record performance including $3.6 billion of free cash flow and ending the year with over $5.5 billion of consolidated cash. These results enable Newmont to lead the industry in shareholder returns, invest in organic growth and maintain financial flexibility,” said Tom Palmer, President and Chief Executive Officer. “While generating record value for shareholders, we also achieved record safety performance with the lowest injury rate in Company history. As we complete our 100th year, we will remain focused on delivering superior operational performance whilst creating value and improving lives through sustainable, responsible mining.”

– Tom Palmer, President and Chief Executive Officer

| ________________________________________________ |

| *Non-GAAP metrics; see footnotes at the end of this release. |

| **The dividend framework is non-binding. An annualized dividend has not been declared by the Board. See cautionary statement at end of this release. The declaration of future quarterly dividends remains at the discretion of the Board. See the cautionary statement at the end of this release, including with respect to dividends and share-repurchase program. |

| ***See cautionary statement at end of release regarding forward-looking statements. |

FULL YEAR AND FOURTH QUARTER 2020 FINANCIAL AND PRODUCTION SUMMARY

Attributable gold production1 for the year decreased 6 percent to 5,905 thousand ounces from the prior year primarily due to Yanacocha and Cerro Negro being placed into care and maintenance in response to the Covid pandemic, lower ore grade mined at Ahafo and the sale of Red Lake and Kalgoorlie, partially offset by a full year of operations from assets acquired in April 2019.

Attributable gold production for the fourth quarter decreased 11 percent to 1,630 thousand from the prior year quarter primarily due to the sale of Red Lake and Kalgoorlie, lower production at Cerro Negro as the site continues to ramp up while managing COVID restrictions and lower ore grade mined at Ahafo, partially offset by higher production at Musselwhite following the completion of the conveyor and materials handling system and higher production at Peñasquito with the successful resolution of community relation issues in late-2019.

Gold CAS2 decreased 5 percent to $4.4 billion for the full year and 4 percent to $1.2 billion for the quarter, compared to the prior year, primarily due to lower ounces sold. For the full year, Gold CAS per ounce increased 5 percent to $756 per ounce primarily due to lower ore grade mined at Yanacocha, Merian and Ahafo, partially offset by lower stockpile and leach pad inventory adjustments.

For the fourth quarter, Gold CAS per ounce increased 7 percent to $739 per ounce primarily due to lower ore grade mined at Ahafo and Porcupine, lower mill throughput at Cerro Negro and higher gold price-related royalties.

Gold AISC3 for the year increased 8 percent to $1,045 per ounce from the prior year primarily due to higher CAS per ounce and Covid-related care and maintenance costs.

Gold AISC per ounce for the fourth quarter increased 10 percent to $1,043 per ounce from the prior year quarter primarily due to higher CAS per ounce and higher sustaining capital largely driven by the Autonomous Haulage System progressing ahead of schedule at Boddington.

Attributable gold equivalent ounce (GEO) production from other metals for the year increased 64 percent to 1,021 thousand ounces from the prior year primarily due to a full year of operations from Peñasquito following resolution of the community issues in late-2019, partially offset by the site being placed on care and maintenance in the second quarter of 2020.

Attributable GEO production from other metals for the quarterincreased 18 percent to 271 thousand ounces from the prior year primarily due to operations at Peñasquito receiving sustained community support following the blockade in 2019, partially offset by lower ore grade milled at Boddington.

CAS from other metals totaled $606 million for the year and $157 million for the quarter. CAS per GEO2 for the year improved 33 percent to $571 per ounce primarily due to higher sales at Peñasquito. CAS per GEO for the quarter improved 29 percent to $561 per ounce primarily due to higher sales at Peñasquito, partially offset by unfavorable foreign exchange impacts from the strengthening of the Australian dollar and lower sales at Boddington. AISC per GEO3 for the year improved 30 percent to $858 per ounce primarily due to lower CAS from other metals, partially offset by care and maintenance costs. AISC per GEO for the quarter improved 28 percent to $846 per ounce primarily due to lower CAS from other metals and lower sustaining capital spend.

Net income from continuing operations attributable to Newmont stockholders for the year was $2,666 million or $3.31 per diluted share, a decrease of $211 million from the prior year primarily due to a $2,390 million recognized gain on the formation of NGM in the prior year. After removing the gain related to NGM, net income increased $2,179 million from the prior year largely driven by higher realized gold prices, gains on asset and investment sales, lower transaction and integration costs and lower general and administrative costs, partially offset by lower sales volumes from certain sites being placed on care and maintenance, the sale of Red Lake and Kalgoorlie, and higher costs in response to the Covid pandemic.

Net income from continuing operations attributable to Newmont stockholders for the quarter was $806 million or $1.00 per diluted share, an increase of $269 million from the prior year primarily due to higher realized gold prices and gains on asset and investment sales, partially offset by lower sales volumes from the sale of Red Lake and Kalgoorlie, higher tax expense and reclamation and remediation adjustments primarily related to increased costs at Yanacocha.

Adjusted net income4 for the year was $2,140 million or $2.66 per diluted share, compared to $970 million or $1.32 per diluted share in the prior year.

Adjusted net income for the quarter was $856 million or $1.06 per diluted share, compared to $410 million or $0.50 per diluted share in the prior year. Primary adjustments to fourth quarter net income include reclamation and remediation adjustments, gains on asset and investment sales, changes in the fair value of investments, Covid-specific costs, settlement costs, asset impairments and valuation allowance and other tax adjustments.

Adjusted EBITDA5 for the year increased 48 percent to $5.5 billion, compared to $3.7 billion for the prior year. Adjusted EBITDA for the quarter increased 37 percent to $1.8 billion for the quarter, compared to $1.3 billion for the prior year quarter.

Revenue increased 18 percent to $11,497 million for the full year and 14 percent to $3,381 million for the quarter, compared to the prior year. These increases were primarily due to higher average realized gold prices and higher gold equivalent sales volumes, partially offset by lower gold sales volumes.

Average realized price6 for gold increased $376 per ounce to $1,775 per ounce for the full year and $374 per ounce to $1,852 per ounce for the quarter, compared to the prior year. For the full year, average realized gold price comprised $1,778 per ounce of gross price received, the favorable impact of $9 per ounce mark-to-market on provisionally-priced sales and $12 per ounce reductions for treatment and refining charges. For the quarter, average realized gold price comprised $1,865 per ounce of gross price received, the favorable impact of $4 per ounce favorable mark-to-market on provisionally-priced sales and $17 per ounce reductions for treatment and refining charges.

Capital expenditures7 decreased 11 percent to $1,302 million for the full year and decreased 7 percent to $398 million for the quarter, compared to prior year, primarily due to the sale of Red Lake and Kalgoorlie and reduced spending from the completion of Borden Underground, Ahafo Mill Expansion, and other sustaining projects in 2019. Development capital expenditures in 2020 primarily include advancing Tanami Expansion 2, Yanacocha Sulfides, Ahafo North, the Subika mining method change, Musselwhite Materials Handling System, Éléonore Lower Mine Material Handling System, Quecher Main, and projects associated with the Company’s ownership interest in Nevada Gold Mines.

Consolidated operating cash flow from continuing operations increased 70 percent to $4.9 billion for the full year and increased 40 percent to $1.7 billion for the quarter, compared to the prior year, primarily due to higher realized gold prices, partially offset by lower sales volumes. Free Cash Flow8 also increased to $3.6 billion for the full year and $1.3 billion for the quarter primarily due to higher operating cash flow and lower capital expenditures.

Balance sheet strengthened in 2020 ending the year with $5.5 billion of consolidated cash and approximately $8.5 billion of liquidity; reported net debt to adjusted EBITDA of 0.2x9.

Portfolio improvements achieved during the year: Completed divestment of the Red Lake Complex in Canada, the Company’s 50 percent ownership interest in Kalgoorlie Consolidated Gold Mines in Australia, investment holdings in Continental Gold, and a portfolio of eleven royalties; formed exploration joint ventures with Kirkland Lake Gold Inc. in Canada and Agnico Eagle Mines Limited in Colombia; completed materials handling projects at Musselwhite and Éléonore in Canada; progressed Autonomous Haulage System at Boddington in Australia, the Tanami Expansion 2 project in Australia, and a mining method change at Subika Underground in Ghana; advanced study work at Ahafo North and Yanacocha Sulfides with both projects expected to reach full funds approval in 2021.

Nevada Gold Mines (NGM) attributable gold production for the year was 1,334 thousand ounces with CAS of $757 per ounce and AISC of $920 per ounce. NGM attributable gold production for the quarter was 342 thousand ounces with CAS of $739 per ounce and AISC of $872 per ounce. EBITDA10 for NGM was $1,279 million for the full year and $364 million for the quarter.

Pueblo Viejo (PV) attributable gold production was 362 thousand ounces for the year and 106 thousand ounces for the quarter. Pueblo Viejo EBITDA10 was $434 million for the year and $136 million for the fourth quarter with cash distributions received for the Company’s equity method investment of $260 million for the year and $109 million for the fourth quarter.

COVID-19 UPDATE

Newmont continues to maintain wide-ranging protective measures for its workforce and neighboring communities, including screening, physical distancing, deep cleaning and avoiding exposure for at-risk individuals. The Company incurred care and maintenance costs of $178 million during 2020 and $7 million during the quarter, which included wages and direct operating costs for critical activities. The Company also recorded non-cash depreciation of $88 million during 2020 and $2 million during the quarter for sites ramping up from care and maintenance or continuing to operate at reduced levels. In addition, the Company incurred incremental Covid specific costs of $92 million during 2020 and $25 million during the quarter for activities such as additional health and safety procedures, increased transportation and community fund contributions.

PROJECTS UPDATE

Newmont’s capital-efficient project pipeline supports improving production, lower costs and extending mine life. Funding for the current development capital project Tanami Expansion 2 has been approved and the project is in execution stage. The Company has included the Ahafo North and Yanacocha Sulfides projects in its long-term outlook as the projects are scheduled to be approved for full funding in 2021. Additional projects, not listed below, represent incremental improvements to the Company’s outlook.

- Tanami Expansion 2 (Australia) secures Tanami’s future as a long-life, low-cost producer with potential to extend mine life beyond 2040 through the addition of a 1,460 meter hoisting shaft and supporting infrastructure to achieve 3.5 million tonnes per year of production and provide a platform for future growth. The expansion is expected to increase average annual gold production by approximately 150,000 to 200,000 ounces per year for the first five years and is expected to reduce operating costs by approximately 10 percent. Capital costs for the project are estimated to be between $850 million and $950 million with a commercial production date in the first half of 2024.

- Ahafo North (Africa) expands our existing footprint in Ghana with four open pit mines and a stand-alone mill located approximately 30 kilometers from the Company’s Ahafo South operations. An investment decision is expected in the first half of 2021 and the project is expected to add 300,000 ounces per year with all-in sustaining costs between $600 to $700 per ounce for the first five full years of production (2024-2028), with estimated capital costs of between $700 and $800 million. Ahafo North is the best unmined gold deposit in West Africa with approximately 3.5 million ounces of Reserves and more than 1 million ounces of Measured and Indicated and Inferred Resource11 and significant upside potential to extend beyond Ahafo North’s current 13-year mine life.

- Yanacocha Sulfides (South America)12 will develop the first phase of sulfide deposits and an integrated processing circuit, including an autoclave to process gold, copper and silver feedstock. The project is expected to add 500,000 gold equivalent ounces per year with all-in sustaining costs between $700 to $800 per ounce for the first five full years of production (2026-2030). An investment decision is expected in the second half of 2021 with a three year development period and estimated capital costs of approximately $2 billion. The first phase focuses on developing the Yanacocha Verde and Chaquicocha deposits to extend Yanacocha’s operations beyond 2040 with second and third phases having the potential to extend life for multiple decades.

1 Attributable gold production includes 362 thousand ounces and 106 thousand ounces from the Company’s equity method investment in Pueblo Viejo (40%) in 2020 and the fourth quarter, respectively.

2 Non-GAAP measure. See end of this release for reconciliation to Costs applicable to sales.

3 Non-GAAP measure. See end of this release for reconciliation to Costs applicable to sales.

4 Non-GAAP measure. See end of this release for reconciliation to Net income (loss) attributable to Newmont stockholders.

5 Non-GAAP measure. See end of this release for reconciliation to Net income (loss) attributable to Newmont stockholders.

6 Non-GAAP measure. See end of this release for reconciliation to Sales.

7 Capital expenditures refers to Additions to property plant and mine development from the Consolidated Statements of Cash Flows.

8 Non-GAAP measure. See end of this release for reconciliation to Net cash provided by operating activities.

9 Non-GAAP measure. See end of this release for reconciliation.

10 Non-GAAP measure See end of this release for reconciliation.

11 See note to U.S. Investors at the end of this release; such resource estimate for Ahafo North is comprised of 610,000 ounces of Measured and Indicated Resource and 410,000 ounces of Inferred Resource as at December 31, 2020.

12 Consolidated basis.

STRATEGIC DEVELOPMENT LEADERSHIP TRANSITION

Randy Engel, Executive Vice President of Strategic Development has elected to retire from Newmont in the second quarter. Randy has made many significant contributions to Newmont over his distinguished 27-year career with the company which have positioned Newmont as the world’s leading gold company. Randy’s responsibilities will be assumed by Blake Rhodes who is currently serving as Senior Vice President of Strategic Development. Blake joined Newmont in 1996 and has held a variety of roles, including General Counsel and Senior Vice President in charge of our Indonesian business.

OUTLOOK

Newmont’s outlook reflects increasing gold production and ongoing investment in its operating assets and most promising growth prospects. The Company has included Ahafo North and Yanacocha Sulfides in its outlook for the first time as the development projects are expected to reach execution stage in 2021. Additional development projects that have not reached execution stage represent upside to guidance. All production, cost and capital figures assume a $1,200/oz gold price.

Newmont’s 2021 and longer-term outlook assumes operations continue without major Covid-related interruptions. If at any point the Company determines that continuing operations poses an increased risk to our workforce or host communities, it will reduce operational activities up to, and including, care and maintenance and management of critical environmental systems. Please see cautionary statement in the end notes for additional information.

For a more detailed discussion, see the Company’s 2021 and Longer-Term Outlook released on December 8, 2020, available on www.newmont.com.

Original Article: https://www.newmont.com/investors/news-release/news-details/2021/Newmont-Delivers-Record-Full-Year-and-Fourth-Quarter-Results/default.aspx