Highlights – Copalquin Gold-Silver, Mexico

- High gold and silver extractions achieved in in metallurgical test work on El Refugio core sample composite utilising conventional processing methods

- At La Soledad, first round of drilling on eastern side of clavo intercepted sheeted vein system at relatively shallow downhole depths

- 6.00m @ 1.84g/t gold, 23.0 g/t silver from 41.0m, (CDH-109), plus

- 1.00m @ 1.79 g/t gold, 25.0 g/t silver from 55.0m,

- plus 1.70m @ 1.77 g/t gold, 117 g/t silver from 59.3m,

- plus 2.14m @ 0.89 g/t gold, 63.9 g/t silver from 78.5m

- 4.80m @ 0.91 g/t gold, 56.8 g/t silver from 70.75m (CDH-110),

- plus 2.30m @ 1.75 g/t gold, 135 g/t silver from 109.0m, including

- 0.55m @ 5.89 g/t gold, 474 g/t silver from 110.75m

- 8.10m @ 1.64 g/t gold, 106 g/t silver from 77.3m (CDH-111),

- including 0.80m @ 4.59 g/t gold, 212 g/t silver from 78.3m, and including

- 0.95m @ 7.99 g/t gold, 526 g/t silver from 82.45m, plus

- 1.00m @ 1.50 g/t gold, 30.0 g/t silver from 98.0m, plus

- 0.75m @ 1.59 g/t gold, 220 g/t silver from 107m, plus

- 0.50m @ 2.21 g/t gold, 61.0 g/t silver from 140m, plus

- 1.00m @ 1.20 g/t gold, 2.00 g/t silver from 190m

- At Los Pinos strong alteration, gold in soils and now narrow, high-grade veins in early-stage drilling for development of this target along strike of El Refugio-La Soledad

- 0.60m @ 9.91 g/t gold, 161 g/t silver from 78.1m (CDH-113)

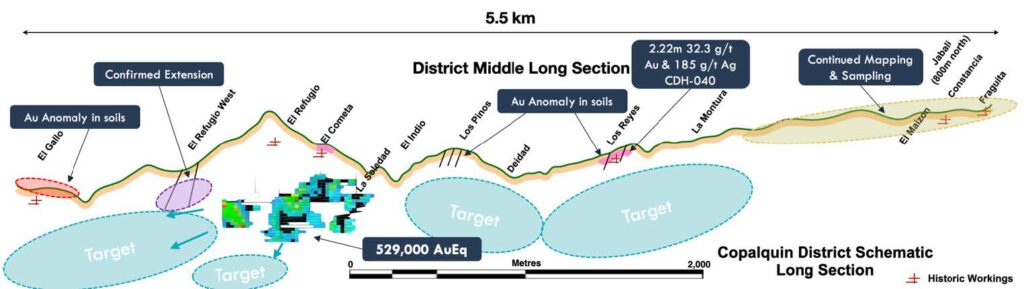

- Major target area identified at La Montura, 2km east and along strike of El Refugio-La Soledad maiden resource area (373koz Au + 10.9Moz Ag see page 13 for maiden resource details)*

- Conceptual exploration access – mine design indicates El Refugio-La Soledad has potential as an underground project utilising common contemporary mechanised mining methods suited to narrow to moderate mining widths

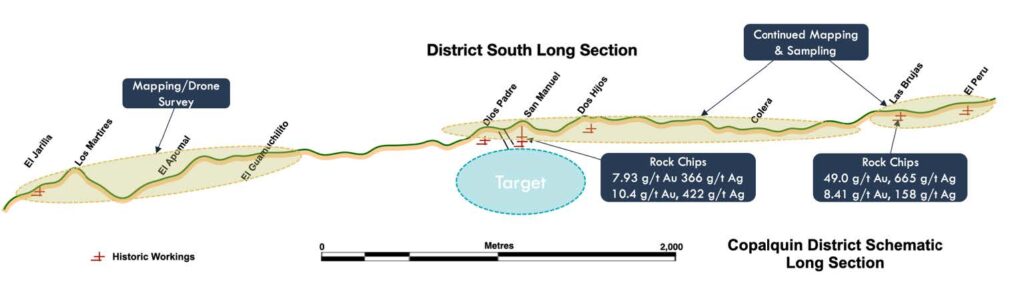

- District mapping, and geochemical sampling has developed new drill targets at Copalquin

Highlights – Corporate

- Total cash of A$4.3M including inflow of A$0.5M from Limestone Well sale and A$3.5M (before costs) from share placement, both completed post end of quarter

- Mexican value added tax refunds continued throughout the quarter with a total of ~A$0.27M received

Mithril Resources Ltd (ASX: MTH) (Mithril or the Company) is pleased to provide a quarterly update on activities at its Copalquin Gold Silver Project in Mexico for the period ending 31 March 2022.

Mithril Managing Director and CEO, John Skeet, commented:

“The work completed during the quarter has laid the groundwork for exploration drilling to develop the resource potential of the Copalquin District as well as drilling to expand the maiden resource which is already substantial due to its high-grades for gold and silver. Pre-development study work for metallurgy and mining indicate a simple and conventional development scenario. The recently completed share placement puts the Company in a strong financial position to carry out then next phase of work in the Copalquin District to further demonstrate the potential for significant gold and silver production.”

COPALQUIN DISTRICT, MEXICO

HIGH GOLD AND SILVER RECOVERIES – EL REFUGIO COMPOSITE SAMPLE

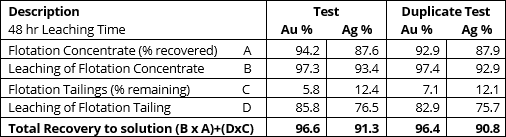

A metallurgical test work program following the maiden mineral resource estimate (MRE) was completed by SGS Laboratories. (ASX Announcement 25 February 2022) Building on Mithril’s excellent high-grade gold and silver maiden mineral resource estimate (ASX Announcement 17 November 2021), the high recoveries of gold and silver from the flotation and leaching test work reinforce attractive project metrics for the district.

The high-grade maiden MRE released 17 November 2021 is given at the end of this report in Table 4. The full report can be found here – Copalquin District – Maiden Mineral Resource Estimate.

The sample used for the test work is a composite sample from El Refugio crushed drill core. The average grade of the composite is similar to the average grade of the maiden resource estimate. The calculated composite grade from the flotation test work is 4.52 g/t gold and 124 g/t silver.

Flotation test work has been completed using the same reagent scheme determined for the Palmarejo deposit (located in the Sierra Madre Trend and north of the Copalquin District) test work, due to the similarities in geology and mineralogy between Palmarejo and El Refugio at Copalquin.

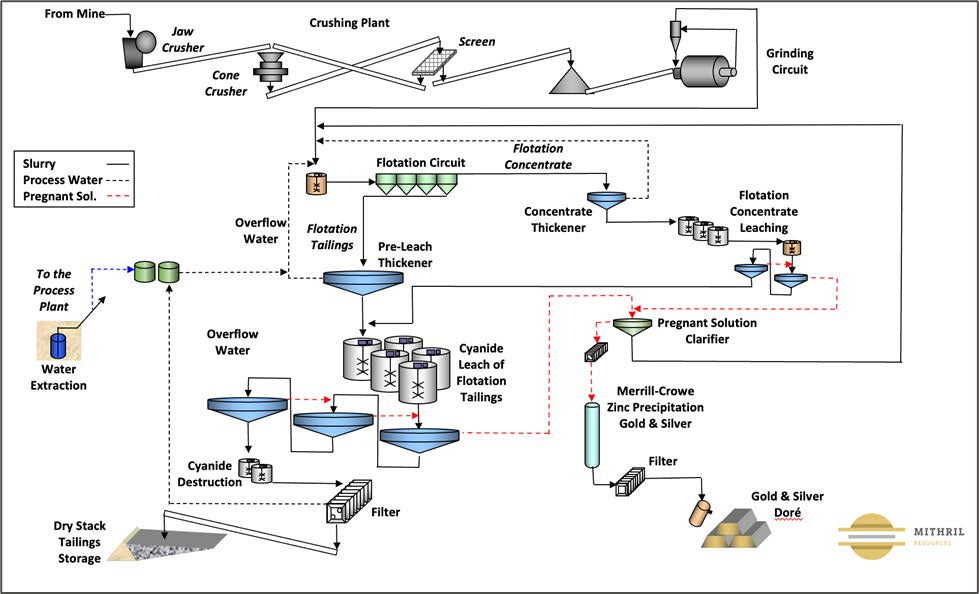

Intensive cyanide leaching of the flotation concentrate and low-level cyanide leaching of the flotation tailings allows high recovery of silver to be achieved. Cyanide leaching of silver is slower under the typical conditions used for gold only leaching. Recovering a high proportion of the silver into a concentrate (by flotation or gravity) allows the concentrate to leached under intensive conditions resulting in higher silver recovery. The overall recovery to solution is 96.5% for gold and 91% for silver. Gold and silver would be extracted from solution using the widely used Merrill- Crowe zinc precipitation method and then smelted to produce metal gold-silver ingots.

The process flowsheet for El Refugio-La Soledad resource material being tested is as shown below in Figure 1. This is the same flowsheet is used at similar deposits in the Sierra Madre Trend, Mexico including Palmarejo and SilverCrest Metals’ Las Chispas (under construction).

Further metallurgical test work will allow the crushing, grinding, thickening, flotation and filtration equipment sizes to be determined.

HIGH-GRADE MULTIPLE VEIN INTERCEPTS AND TARGET EXPANSION

Copalquin is well positioned for significant gold-silver resource growth throughout 2022, with planned deep drilling at El Refugio and confirmed extension at Refugio West (ASX Announcement 17 March 2022). The Company’s expansive exploration program across the district has delivered excellent results ahead of resource development drilling along strike from the high-grade maiden resource at El Refugio.

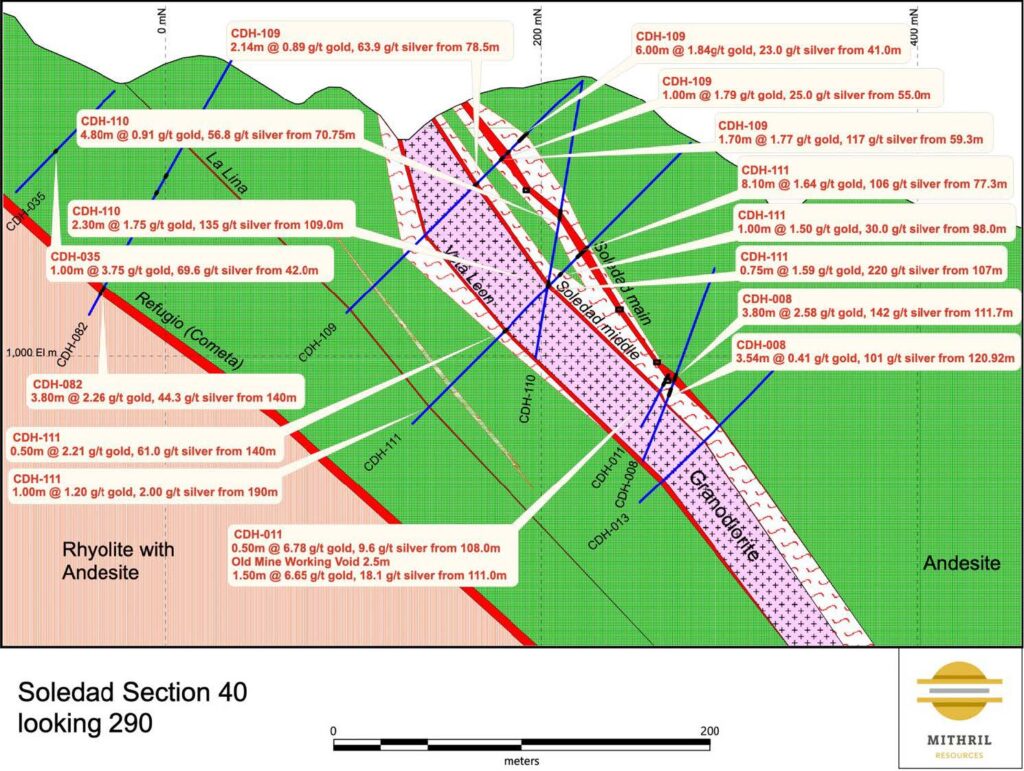

Drilling at La Soledad and East at Los Pinos

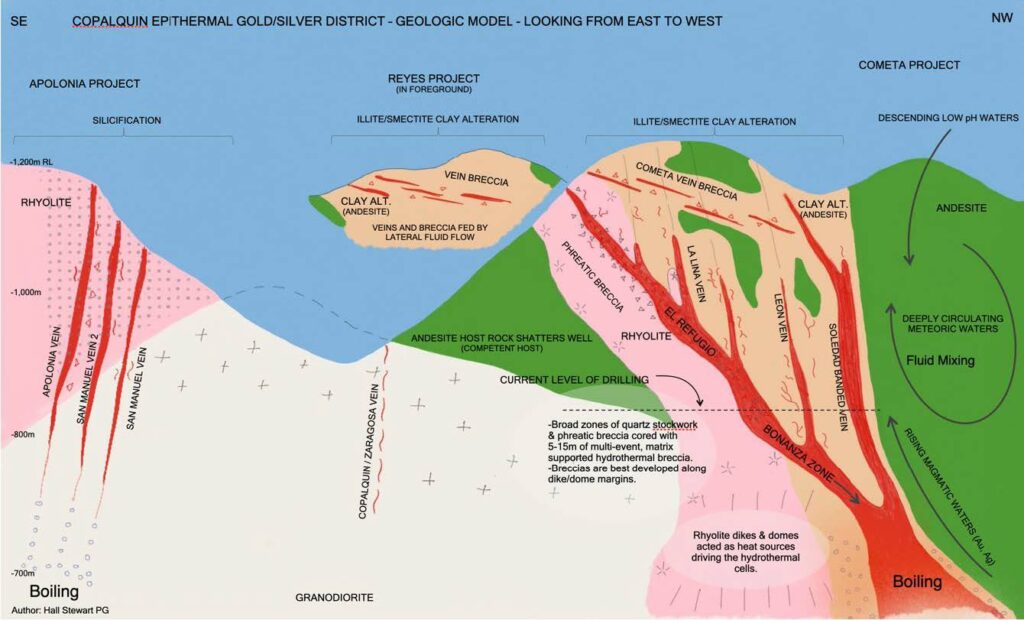

The series of holes completed at La Soledad have clearly shown the existence of a sheeted vein system and association with a granodiorite pre-mineral intrusion. The intrusion of the granodiorite into the favourably-fracturing andesite rock unit, created cracks and voids that later became sites for mineralised deposits. Where there are voids along the gold-silver veins, favourable conditions lead to the formation of high-grade ‘clavos’ (oreshoots) such as the one mined historically at La Soledad and discovered at El Refugio, as part of the maiden resource drilling. The recent drilling and interpretation at La Soledad are guiding the discovery of further clavos and veins along strike and deeper at La Soledad, with highly encouraging results to date.

At Los Pinos, the ridge just to the east of El Refugio-La Soledad, the extensive surface alteration and the strong gold in soils anomaly rank this area as a high-priority target. To date, only a handful of exploration holes have been completed at Los Pinos and importantly, drill hole CDH-113 has intercepted a narrow, high-grade vein only 78 metres down hole. Locating this high-grade vein allows planning of further drilling at Los Pinos as we continue to search of the main source of the alteration and strong surface gold anomaly. The angle and orientation of the vein suggest it may be on the same

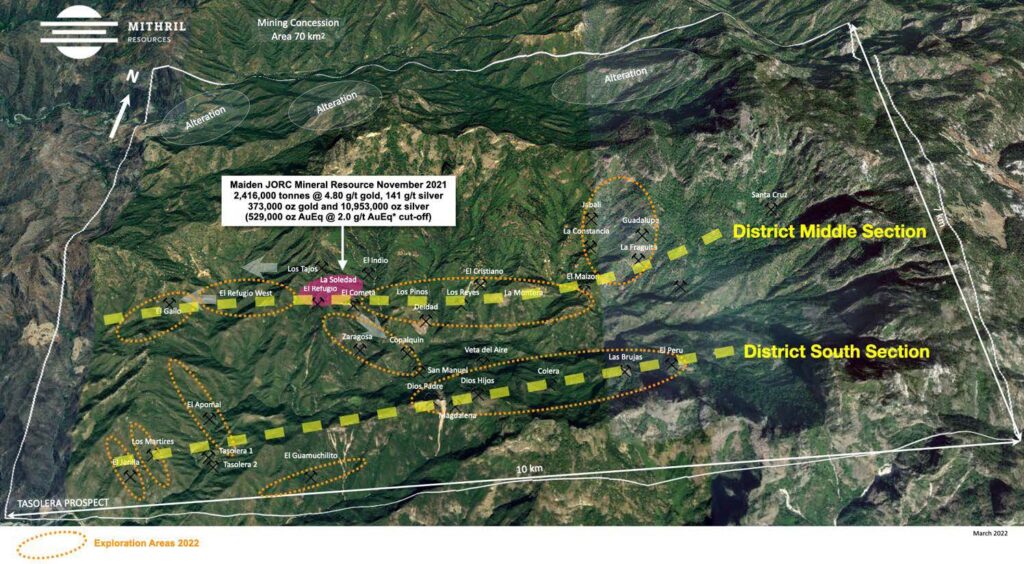

District Middle Section – Target Expansion

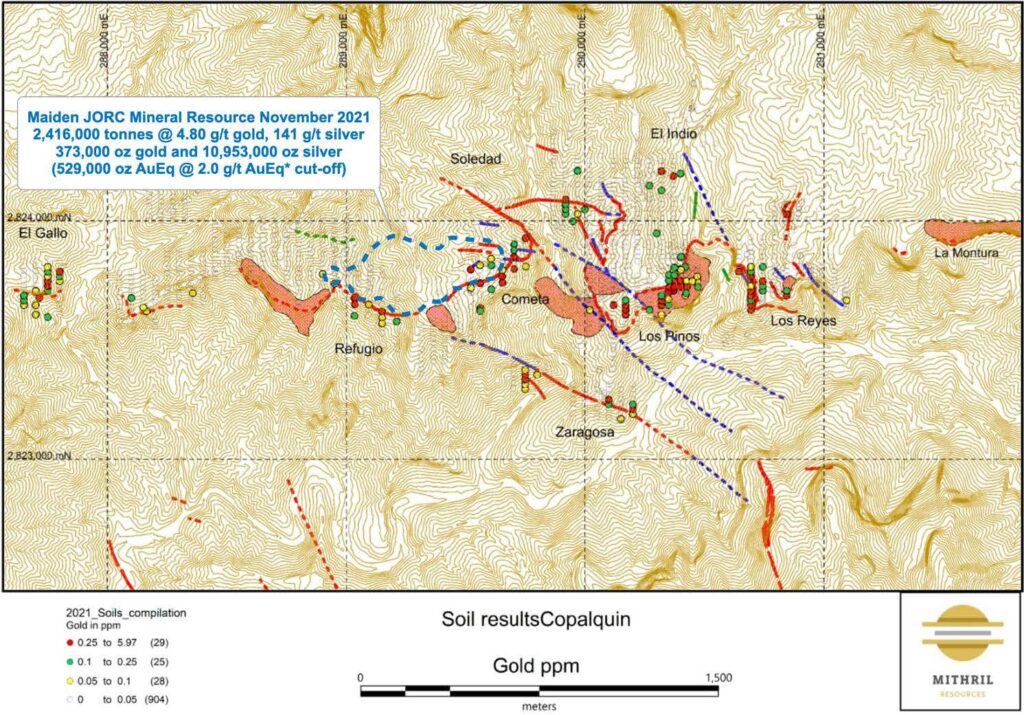

The dry season mapping program (January-May) in the Copalquin District further strengthens data supporting the high prospectivity of the district. Already we have demonstrated the high-quality resource potential of the district with the excellent maiden resource with high-grade gold and silver at El Refugio-La Soledad delivered after only 15 months of drilling. New targets to the east and to the west of Refugio along the trend of rhyolite intrusives are being developed towards being drill-ready for expansion of the resource footprint. The best of these new targets to-date is the La Montura (the saddle) area which has over 500 meters of strike length of silicified rhyolite (highlighted in green, in the figure below. Soil sampling is underway at La Montura in preparation for drilling.

La Montura location is highlighted above in Figure 3 and Figure 4.

MINING CONCEPTS STUDY COMPLETED

In early March, the Company released details on the recently completed conceptual mining study by AMC Consulting. (ASX Announcement 1 March 2022) This study and the recently reported high metallurgical recoveries (ASX Announcement 18 January 2022) are seen as positive steps towards development in the district for production of gold and silver from high-grade resources.

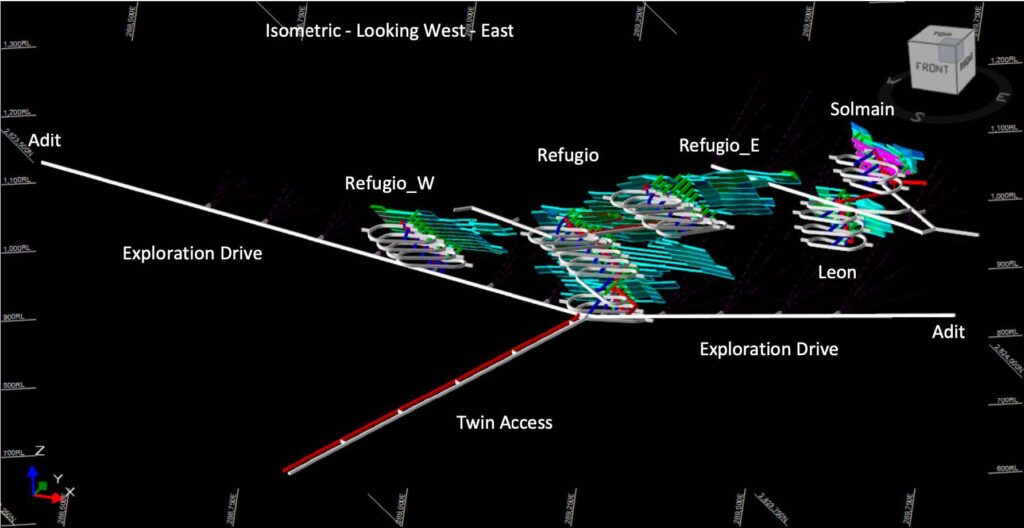

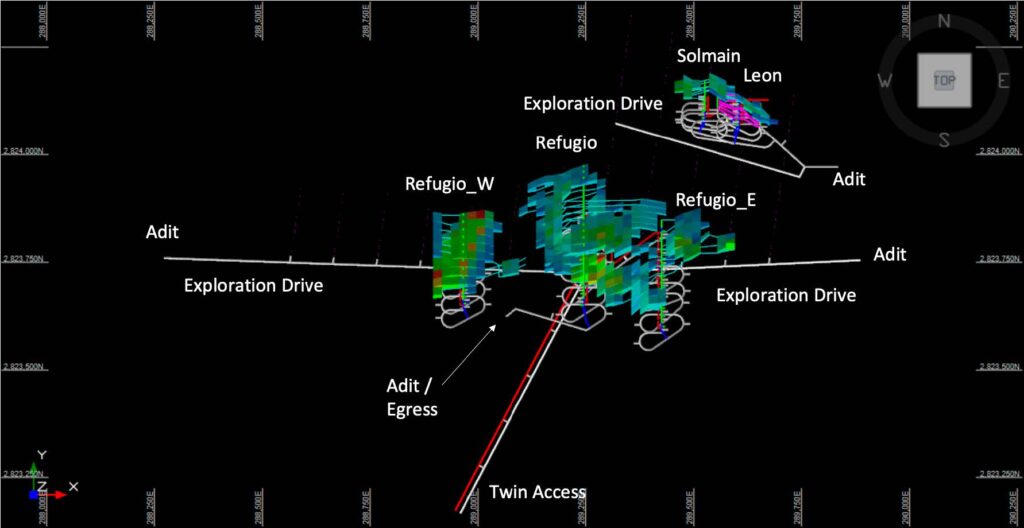

Conceptual Exploration Access – Mining Design

AMC Consultants commenced and completed a mining concepts design study for the El Refugio-La Soledad maiden JORC mineral resource estimate in 1Q 2022. The study considered open pit potential and various underground mining techniques. The positioning of the underground mine development was also assessed.

The study work shows that there is some open pit potential requiring further drilling work to better define near surface high-grade material at El Cometa. The most likely scenario from the study indicates that the resource would be most effectively mined by underground methods.

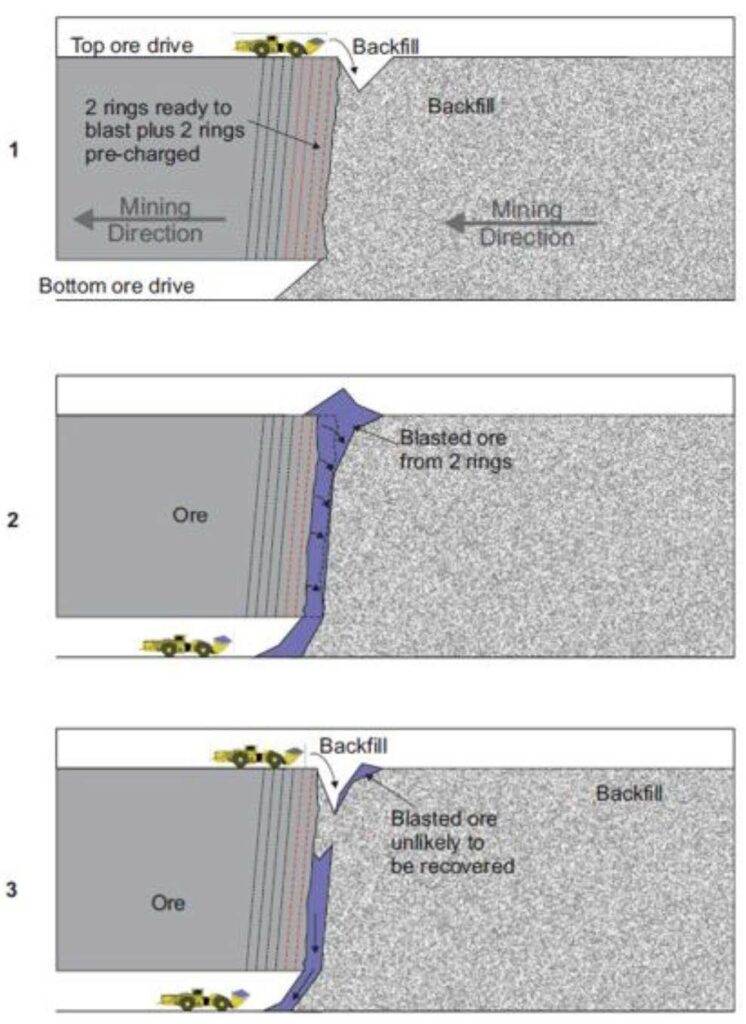

For the underground mining, the preferred mining method recommended is mechanised Avoca bench (a variant of long hole open stope benching with rockfill) using a bottom-up extraction sequence as shown in the schematic below.

Geotechnical

Some geotechnical logging of exploration holes has been undertaken and historical workings are present. AMC notes that rock mass conditions indicate “good” to “very good” rock but can generally be categorised as “fair” until recommended geotechnical assessment work has been undertaken. AMC has recommended geotechnical work, which includes geotechnical logging of existing drill core on site, geotechnical diamond core drilling, structural modelling and structure confirmation drilling (to coincide with resource infill drilling) to be completed prior to further mining study work.

Preferred conceptual exploration access – mine design

The preferred conceptual exploration access – mine design was constructed, and sequence animated based on:

- Twin mine area accesses from twin southern adits connected to a valley-to-valley exploration access developed in the footwall of the El Refugio orebody. A separate eastern adit exploration access is developed in the footwall of the Soledad orebodies with maximum access gradient reduced to 1:8,

- Primary infrastructure developed off the exploration access, with primary infrastructure positioned within the footwall.

- Mine access layout based on Avoca benching with rockfill.

- Mine design to avoid ventilation raises to surface, provide a cost-efficient flow-through primary ventilation circuit as soon as possible and provide emergency secondary egress as soon as possible within the mine plan.

Figure 9 provides an isometric view of the mechanised Avoca bench with rockfill mine design.

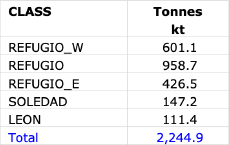

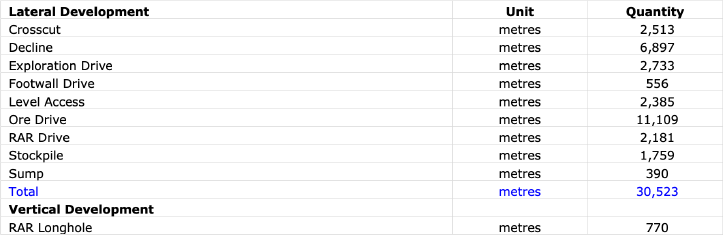

Table 2 – Conceptual mine design inventory El Refugio – La Soledad using a cut-off grade of 3.0 g/t AuEq*. The concept inventory is not a resource or a reserve.

Maximum re-use of development for other activities is assumed when a level is depleted. For example, stockpiles are used for mobile sub-station or mobile skid-mounted pumps or magazine or materials storage. The design makes notional allowances for miscellaneous infrastructure such as pump station sumps at the end of each decline leg and stripping of the backs above the raise bore machine position. At this time there is no allowance for additional development for underground drilling sites located off primary infrastructure routes.

AMC Study Recommendations

If ongoing exploration drilling identifies significant additional near surface mineralisation adjacent to the current understanding of the El Refugio mineral resources, then Mithril should consider re-assessing the project for open pit mining potential.

The key recommendations for the next phase of data collection include:

- Assess where infill and extensional drilling is required to upgrade Inferred Mineral Resources and unclassified mineralisation.

- Once target areas are identified, assess what can be achieved more cost effectively from an underground drilling platform, taking into consideration ease of access, timing, drilling accuracy and usage of hole wedging methods.

- Undertake a geotechnical data collection programme which will be critical to better understand mine design parameters like potential stope and pillar sizes, development offsets to stoping voids, mine modifying factors (overbreak), open pit wall angles and the impact of these on the project economics.

AMC makes the following underground planning recommendations:

- Undertake next-study-level geotechnical assessments to understand the geotechnical constraints to establish the largest practical unsupported spans to maximise extraction (less rib and sill pillars) and/or to improve development efficiency via taller level intervals. This requires careful balancing of the development efficiency against the plan dilution.

- Critically assess inclusion of incremental stoping resources.

- Obtain indicative contractor rates to conduct the conceptualised project works, confirm the processing cost and assumed site administration costs, to then confirm project viability accounting for capital estimates. There may be opportunities to rent the infrastructure, with the contractor to take on these items as part of their rates or to enter into other contracting agreements.

- Identify local contractors with small profile equipment to ascertain the smallest on-lode sill development profile possible with trackless equipment, and based on this, re-assess the impact of on-lode sill development dilution on the inventory head grade.

- Enquire about acquiring specialist narrow vein equipment.

- If a suitable narrow vein development jumbo cannot be sourced, investigate the option to use traditional handheld airleg miners for the on-lode sill drive development and then use mechanised production drilling for the stope production.

- Conduct next stage mine plan optimisation potentially using a combination of mining methods to address narrow versus wider lode areas, waste rock availability, delaying of capital development using a top-down extraction sequence in selected areas, etc.

- Conduct ventilation simulation analysis to e diesel dilution volumes and fan pressure requirements and required airway sizes to practically balance operating costs against capital costs.

AUSTRALIAN PROJECTS

To ensure the Company maintains its focus on the Copalquin Gold Silver Project, Mithril has exploration partners to farm-in, sole fund and operate exploration activities on its Australian assets. These include:

- Great Boulder Resources (GBR.ASX) at the Lignum Dam Project;

- Auteco Minerals (AUT.ASX) at the Limestone Well Project;

- Carnavale Resources (CAV.ASX) at the Kurnalpi Project; and

- CBH Resources Limited (“CBH”) at the Billy Hills Zinc Project.

Having farm-in exploration partners solely fund all exploration costs, ensures that the Mithril tenements are kept in good standing for the duration of the respective partnership agreements with the potential to benefit from prospectivity and exploration upside.

Billy Hills Zinc (Billy Hills)

- Mithril 100%; and

- CBH Resources Limited earning up to 80% interest by completing expenditure of A$4M over 5 years.

- Native title clearance for the first phase of drilling has been granted, scheduled to commence Q2 2022.

Kurnalpi Project (Kurnalpi)

- Mithril 100%; and

- Carnavale Resources earning an initial 80% interest by keeping the tenements in good standing over three years and paying Mithril A$250,000 cash.

- No work was undertaken during the quarter.

Lignum Dam Project (Lignum)

- Mithril 100%; and

- Great Boulder Resources earning up to 80% by completing expenditure of A$1M over four years.

- Great Boulder carried out a program of auger geochemical sampling over nickel and gold prospective rock types.

Limestone Well Project (Limestone)

- Mithril 100% reducing to 10% (see below)

- In October 2021, Mithril announced the execution of a binding term sheet for the sale of 90% interest in the Limestone Well tenements to its farm-in partner, Auteco Minerals for a payment of A$500,000 in cash. For details of the term sheet please refer to the ASX Announcement 12 October 2021

CORPORATE

In March, Managing Director and CEO John Skeet presented at The Melbourne Mining Club’s Cutting-Edge Event, held at the Melbourne Town Hall. (ASX Announcement 8 March 2022) The presentation entitled, “High Grade Gold and Silver Opportunity at Copalquin,” was well-received by the audience.

CASH

Total cash reserves of A$4.3M including A$0.5M for the sale of 90% interest in the Limestone Well tenements and A$3.5M (before costs) from a share placement, both completed post end of the March quarter.

Mexican value added tax refunds continued throughout the quarter with a total of ~A$0.27M received.

RELATED PARTY PAYMENTS

In line with its obligations under ASX Listing Rule 5.3.5, Mithril Resources Limited notes that the only payments to related parties of the Company, as advised in the Appendix 5B for the period ended 31 March 2022, pertain to payments to directors and consultants for fees, salary and superannuation.

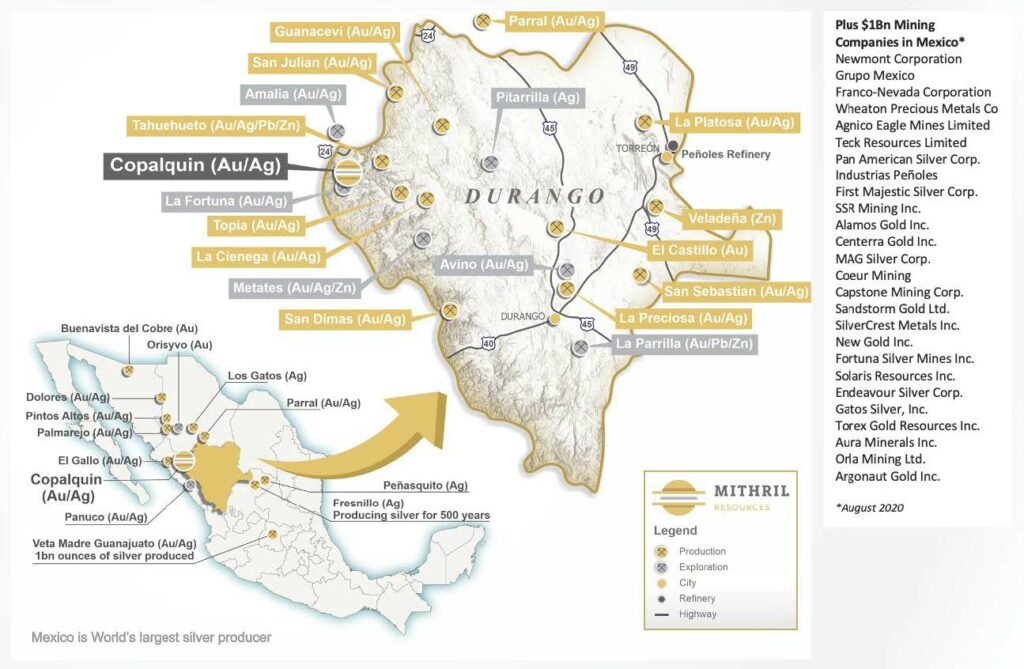

ABOUT THE COPALQUIN GOLD SILVER PROJECT

The Copalquin mining district is located in Durango State, Mexico and covers an entire mining district of 70km2 containing several dozen historic gold and silver mines and workings, ten of which had notable production. The district is within the Sierra Madre Gold Silver Trend which extends north-south along the western side of Mexico and hosts many world-class gold and silver deposits.

Multiple mineralisation events, young intrusives thought to be system-driving heat sources, widespread alteration together with extensive surface vein exposures and dozens of historic mine workings, identify the Copalquin mining district as a major epithermal centre for Gold and Silver.

Within 15 months of drilling in the Copalquin District, Mithril delivered a maiden JORC mineral resource estimate demonstrating the high-grade gold and silver resource potential for the district. This maiden resource is detailed below.

- 2,416,000 tonnes @ 4.80 g/t gold, 141 g/t silver for 373,000 oz gold plus 10,953,000 oz silver (Total 529,000 oz AuEq*) using a cut-off grade of 2.0 g/t AuEq*

- 28.6% of the resource tonnage is classified as indicated

*AuEq. = gold equivalent calculated using and gold:silver price ratio of 70:1. That is, 70 g/t silver = 1 g/t gold. The metal prices used to determine the 70:1 ratio are the cumulative average prices for 2021: gold USD1,798.34 and silver: USD25.32 (actual is 71:1) from kitco.com

Mining study and metallurgical test work supports the development of the El Refugio-La Soledad resource with conventional mining methods indicated as being appropriate and with high gold-silver recovery to produce metal on- site with conventional processing.

Mithril is currently exploring in the Copalquin District to expand the resource footprint in 2022 to demonstrate its multi-million ounce gold and silver potential.

Mithril Resources is earning 100% interest in the Copalquin District mining concessions via a purchase option agreement detailed in ASX announcement dated 25 November 2019.

-ENDS-

Released with the authority of the Board. For further information contact:

| John Skeet Managing Director and CEO skeet@mithrilresources.com.au +61 435 766 809 | Mark Flynn Investor Relations mflynn@mithrilresources.com.au +61 416 068 733 |

Competent Persons Statement

The information in this report that relates to sampling techniques and data, exploration results and geological interpretation has been compiled by Mr Hall Stewart who is Mithril’s Chief Geologist. Mr Stewart is a certified professional geologist of the American Institute of Professional Geologists. This is a Recognised Professional Organisation (RPO) under the Joint Ore Reserves Committee (JORC) Code.

Mr Stewart has sufficient experience of relevance to the styles of mineralisation and the types of deposits under consideration, and to the activities undertaken, to qualify as a Competent Person as defined in the 2012 Edition of the Joint Ore Reserves Committee (JORC) Australasian Code for Reporting of Exploration Results, Mineral Resources and Ore Reserves. Mr Stewart consents to the inclusion in this report of the matters based on information in the form and context in which it appears.

The information in this report that relates to metallurgical test results, mineral processing and project development has been compiled by Mr John Skeet who is Mithril’s CEO and Managing Director. Mr Skeet is a Fellow of the Australasian Institute of Mining and Metallurgy. This is a Recognised Professional Organisation (RPO) under the Joint Ore Reserves Committee (JORC) Code.

Mr Skeet has sufficient experience of relevance to the styles of mineralisation and the types of deposits under consideration, and to the activities undertaken, to qualify as a Competent Person as defined in the 2012 Edition of the Joint Ore Reserves Committee (JORC) Australasian Code for Reporting of Exploration Results, Mineral Resources and Ore Reserves. Mr Skeet consents to the inclusion in this report of the matters based on information in the form and context in which it appears. The Australian Securities Exchange has not reviewed and does not accept responsibility for the accuracy or adequacy of this release.

The Australian Securities Exchange has not reviewed and does not accept responsibility for the accuracy or adequacy of this release.

Original Article: https://investi.com.au/api/announcements/mth/965ec3f8-636.pdf