Key Points

Overview

- Transformative acquisition of private mineral exploration company Sun Minerals Pty Ltd remains on track to successfully complete by end May 2020.

- Sun Minerals holds an exclusive option to earn up to a 100% interest in the high-grade Copalquin Gold Silver Project located in the Sierra Madre Trend, Durango State, western Mexico.

- The Copalquin Project is prospective for high-grade gold and silver mineralisation where there are 32 known historic gold and silver underground mines and surface workings plus historic drill intercepts.

- Mithril’s exploration partners continue to advance each of its Australian exploration assets – with results awaited from a recent program of Fixed Loop Electromagnetic (FLTEM) geophysical surveying and surface geochemical sampling over nickel sulphide targets undertaken by Carnavale Resources (CAV.ASX) at Kurnalpi.

- A new exploration partner introduced for the Billy Hills Project with a Heads of Agreement executed with CBH Resources whereby CBH can earn up to 80% interest in the project by completing expenditure of $4M over 5 years.

Cash and Corporate

- During the Quarter, Mithril spent $118K on exploration activities outlined in this report and at 31 March 2020 had cash reserves of $0.10M.

- A General Meeting of shareholders to approve the Sun Minerals transaction will be held at Level 17, 500 Collins Street, Melbourne VIC 3000 on 13 May 2020 at 10:00am (Melbourne time).

- Due to restrictions applicable in Victoria as a result of COVID-19, it is not be possible to convene the Meeting physically and the Company intends to decide the outcome of voting on the resolutions in the Notice by proxy voting, submitted ahead of the Meeting.

Outlook for the next Quarter

- The Company’s primary objective for the June 2020 Quarter is the successful completion of the Sun Minerals Transaction.

Overview

Notwithstanding the challenges of the global COVID-19 pandemic outbreak during the March 2020 Quarter (the “Quarter”), Mithril Resources’ (MTH.ASX – “Mithril” or the “Company”) continued to work towards successfully completing the transformative acquisition of private mineral exploration company Sun Minerals Pty Ltd (Sun Minerals).

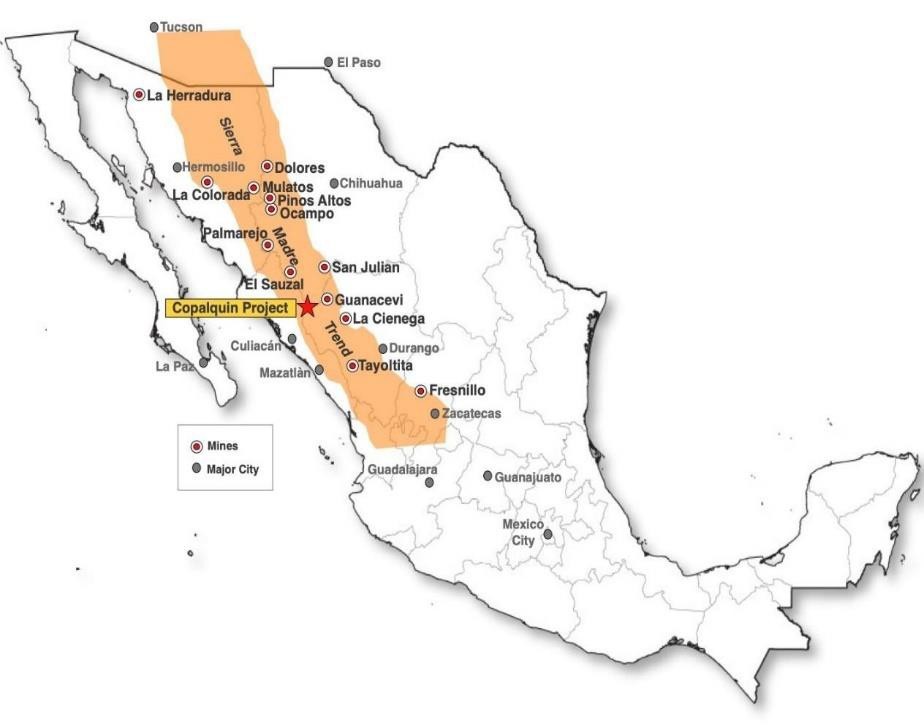

Sun Minerals holds an exclusive option to earn up to a 100% interest in the high-grade Copalquin Gold Silver Project located in the Sierra Madre Trend, Durango State, western Mexico (Figure 1).

Within the Copalquin Project boundaries there are 32 known historic gold and silver underground mines and surface workings plus historic drill intercepts.

Data compilation, geological mapping and rock chip sampling undertaken by Sun Minerals over the past two years indicates that gold-silver mineralisation previously mined at Copalquin was of very high-grade (refer to the “Cautionary Statement Regarding Historical Exploration Results” on the second last page of this Quarterly Report). Mithril successfully completed its due diligence of the Copalquin Project during the December 2019 Quarter.

At the end of the March 2020 Quarter, the Company launched a capital raising in support of the Sun Minerals Transaction.

In Australia, Mithril’s exploration partners advanced a number of the Company’s other projects – namely Great Boulder Resources (GBR.ASX) drilled a nickel sulphide target at Lignum Dam and Carnavale Resources (CAV.ASX) carried out Fixed Loop EM geophysical surveying and surface geochemical sampling over a number of nickel sulphide targets at Kurnalpi.

Mithril also entered into a Heads of Agreement with CBH Resources Limited (“CBH”) whereby CBH can earn up to an 80% interest in Mithril’s Billy Hills Zinc Project by completing expenditure of A$4M over 5 years.

Cash

During the Quarter, Mithril spent $118K on exploration activities outlined in this report and at 31 March 2020 had cash reserves of $0.10M.

In accordance with ASX Listing Rules Guidance Note 23, the aggregate amount of payments to related parties and their associates included in Appendix 5B item 1 totalled $54K (being Directors’ and Company Secretary Fees), in Appendix 5B item 2 totalled $65K (being Managing Director’s salary and superannuation payments).

Corporate

The proposed acquisition of Sun Minerals (“the Transaction”) is subject to a number of conditions precedent which have been largely satisfied. Due Diligence was satisfactorily completed on 20 December 2019, a formal Share Sale Agreement for the acquisition by Mithril of all issued share capital of Sun Minerals was executed on 24 January 2020, and shareholder approval was received at the General Meeting on 12 February 2020.

The key remaining condition precedent

was the raising of a minimum

A$4.9 million under a 1:1 entitlement issue at A$0.01 (1 cent). In light of recent market conditions

resulting from the global COVID-19 pandemic,

Mithril and Sun Minerals have now formally executed a Variation to the original Share Sale Agreement whereby Sun Minerals have agreed to Mithril raising a minimum of A$1.5 million in order to satisfy the condition precedent to the Transaction.

The consideration payable to the Sun Minerals vendors will also be reduced in the event that less than the maximum capital raising (set out below) is achieved. A summary of the key variations to the Share Sale Agreement was set out in Schedule A of an announcement to the ASX dated 1 April 2020.

Mithril now proposes to conduct a capital raising by way of an entitlement issue to shareholders with a record date of 6 April 2020, to be conducted on the basis of one (1) new fully paid ordinary Mithril share for every one (1) existing fully paid ordinary Mithril share held at an issue price of A$0.005 (0.5 cent) to raise a minimum A$1.5 million up to a maximum of A$2.46 million (before costs).

Funds raised from the capital raising will be primarily used to complete a drill programme at Copalquin.

Having consulted with ASX, Mithril will re-seek shareholder approval for all changes within the varied Share Sale Agreement at a Meeting of Shareholders to be held on 13 May 2020, and it intends to close the entitlement offer on 14 May 2020.

Assuming Shareholder approval is received and the minimum of A$1.5 million is raised, it is anticipated that the Transaction will successfully complete shortly thereafter, i.e. before end May 2020.

Sun Minerals has also agreed that approximately 97% of the shares issued to the Sun Vendors (as consideration for Mithril’s proposed acquisition of Sun Minerals) will be voluntarily escrowed for 24 months from completion of the Transaction.

The Transaction will also be the catalyst for several Board and Management changes at Mithril.

Subject to and upon completion of the Transaction, Sun Minerals has the right to nominate an individual to be appointed as a Director (Executive Chairman) of Mithril and to nominate an individual to be appointed to a lead management role in Mithril in respect of the exploration of the Copalquin Project.

Sun Minerals has indicated that it intends to nominate Mr Dudley Leitch as the Executive Chairman of the Company upon completion of the transaction. Mr Dudley Leitch has over 40 years (10 years in Mexico) developing projects and running ASX mining/exploration companies with projects in Australia, Mexico and the USA. Mr Leitch has previously been a director or managing director of Perseverance Corporation, Mogul Mining, Valdora Minerals, Kings Minerals and Bolnisi Gold.

Mithril’s current Managing Director – Mr David Hutton has served his notice of resignation with termination of his employment as Managing Director of Mithril to occur at the earlier of: 22 May 2020, being the end of the six- month notice period under Mr Hutton’s employment agreement, or upon successful completion to the transaction.

Mr Hutton and Mithril have agreed that he will continue to serve as Managing Director during the notice period until the occurrence of the earliest of the above events. Mithril wishes to thank Mr Hutton for his years of service and his continued support of Mithril in respect of the exploration of its existing exploration projects and pursuit of the transaction.

Copalquin Gold Silver Project Details

The Copalquin Gold Silver Project (6 mineral concessions – 7,005 Ha) covers the entire Copalquin Mining District within the gold-silver trend of the Sierra Madre Occidental mountain range in Durango State, western Mexico. The gold silver trend is host to numerous gold and silver deposits, with multiple producing mines including; Coeur Mining’s Palmarejo, Agnico Eagles’ Pinos Altos, Goldcorp’s El Suazal Mine (now depleted), First Majestic Silver’s San Dimas mine, Fresnillo’s San Julian and La Cienega mines and the now closed Ocampo mine.

Within the Copalquin Project boundaries there are 32 known historic gold and silver underground mines and surface workings plus historic drill intercepts. Mineralisation is typically associated with low-sulfidation epithermal veining and stockworks developed within an andesitic host rock sequence.

Data compilation, geological mapping and rock chip sampling undertaken by Sun Minerals over the past two years indicates that gold-silver mineralisation previously mined at Copalquin was of very high-grade.

Readers are referred to Mithril’s ASX Announcement entitled “Transformative high-grade gold silver project acquisition” dated 25 November 2019 for further details on the historic exploration results for the project.

Sun Minerals has advised the Company that it believes that the historic drilling at Copalquin was not carried out in a systematic manner with previous campaigns hindered by logistical difficulties and overly concentrated in areas where the first favourable intercepts were encountered.

Sun Minerals has obtained all statutory permits required to undertake

a systematic drilling

program at Copalquin and, upon satisfactory completion of the Transaction, a diamond drilling program is planned to be

undertaken.

The aim of the proposed drilling is to better understand the geological controls on mineralisation and demonstrate the potential for mineralisation beyond the limits of existing mined areas.

Importantly, Sun Minerals has strong “in-country” operating experience and has developed strong working relationships with local landowners, stakeholders, and contractors.

On 3rd April 2020, Mithril reported that the Mexican Federal Government announced a suspension of all non-essential activities in Mexico for 30 days to contain the advancement of COVID-19 virus from March 30 to April 30, 2020.

As a result of this declaration, Sun Minerals will temporarily suspend outside personnel from entering the Copalquin project area at least until April 30, 2020 to limit potential exposure of personnel and nearby communities to the virus.

Local personnel from within the Copalquin district will keep the project area secure and under care and maintenance. Sun Minerals intends to use this period to analyse recent mapping and geological data to fine tune the drill plan and plan ongoing geochemical and mapping of the Copalquin mining district.

About Mexico

Mexico has a mining history extending almost 500 years and is among the world’s largest metal producers. Mexico is the largest producer of silver in the world and a top global producer of gold, copper, zinc, amongst other minerals.

With its long mining tradition, Mexico has a largely favourable environment for the industry. The geological potential remains strong. The country’s terrain is one of the most tectonically active and complex in the world. Orogenesis has pushed up mountain chains all across Mexico, including the Sierra Madre Oriental, Sierra Madre Occidental and Sierra Madre del Sur. These three regions have formed some of the key metallogenic areas. Gold and silver mineralisation are commonly linked to the two belts of hydrothermal veins and gaps that stretch out underneath both sides of the Sierra Madre Occidental.

Mexico contains outstanding geological potential for mining, which contributes to making Mexico the world’s fourth-largest recipient of foreign direct investment (FDI) for mining and the second destination of such FDI in Latin America. The majority of this FDI is directed to mining gold, copper, zinc, and uranium. According to the Mexican Mining Chamber (Cámara Minera de México or CAMIMEX), Mexico leads the world’s production of silver. Mexico was the ninth-largest producer of gold and seventh-largest producer of copper in 2018.

Australian Project Update

Over the past six months, Mithril has extensively restructured its exploration portfolio with new exploration partners introduced to sole fund exploration activities on the Lignum Dam Project (Great Boulder Resources

– GBR.ASX), Limestone Well Project (Auteco Minerals – AUT.ASX), and the Kurnalpi Project (Carnavale Resources – CAV.ASX).

During the Quarter, Mithril executed a new binding Farm In Heads of Agreement with CBH Resources Limited (“CBH”) whereby CBH can earn up to an 80% interest in Mithril’s Billy Hills Zinc Project (EL’s 04/2503, 04/2497, and 80/5191) by completing expenditure of A$4M over 5 years.

CBH is the owner and operator of the Rasp Zinc Lead Silver Mine at Broken Hill, NSW and is a wholly owned subsidiary of Toho Zinc Co. Ltd, a Japanese

company listed on the Tokyo Stock Exchange specializing

in nonferrous metals refining.

The Billy Hills Zinc Project is located 25kms east of Fitzroy Crossing, WA and contains numerous high- grade zinc targets including the Firetail Prospect where rock chip samples previously collected by Mithril along a 300 metre – long subcropping zone of siliceous gossan and weathered colloform-banded sulphides, returned assay values up to 30.3% zinc, 127g/t silver and 3.0% lead (see Mithril’s ASX Announcement dated 1 July 2019).

The Billy Hills Agreement is conditional upon Mithril obtaining a Heritage Clearance by May 2020 to drill the Firetail Prospect. Mithril has been working with the project’s Traditional Owners to obtain the necessary clearance however due to the outbreak of COVID-19, all dealings with Aboriginal communities in the area have ceased for an indefinite period in order to protect the health of the local population.

As such there is a risk that the condition precedent will not be met by the required date however Mithril and CBH remain committed to the project and have agreed extend the period to satisfy the condition precedent if required.

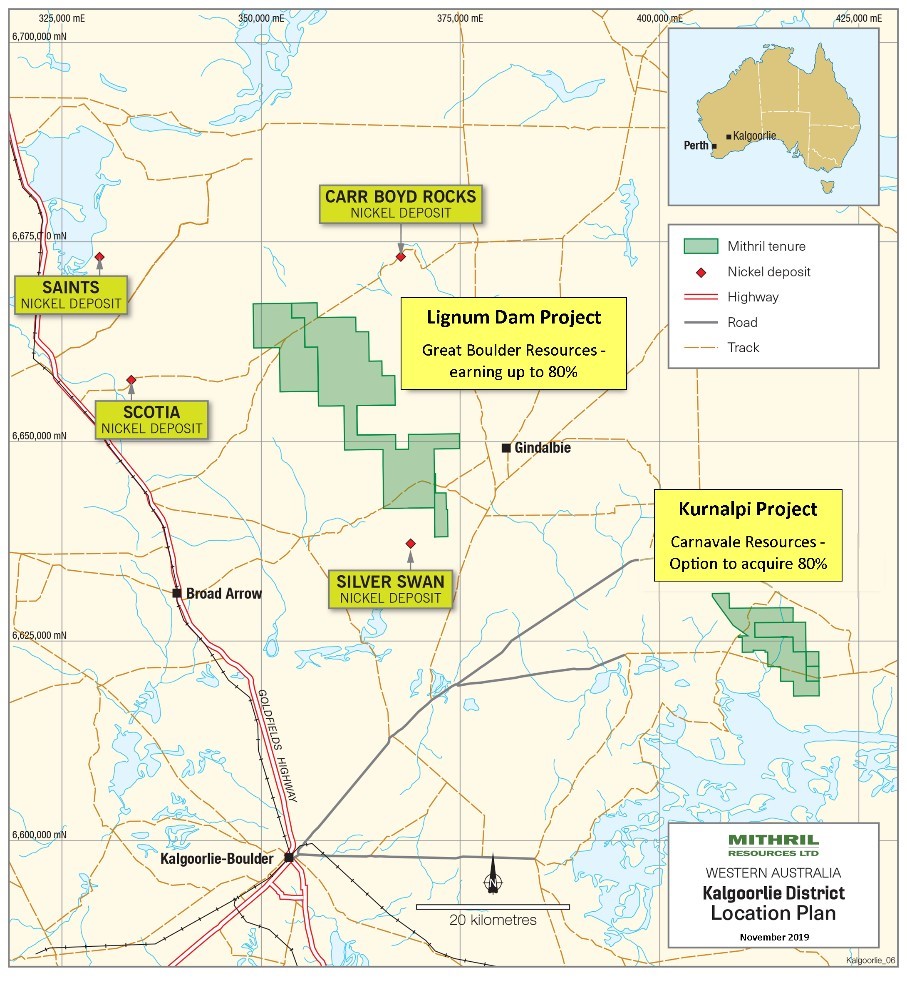

At the Kurnalpi Project (Mithril 100% and Carnavale Resources earning an initial 80% interest by keeping the tenements in good standing over three years and paying Mithril $250,000 cash), Carnavale Resources has recently undertaken a program of Fixed Loop Electromagnetic (FLTEM) geophysical surveying and surface geochemical sampling over a number of nickel sulphide targets for which the results of both programs are awaited.

At the Lignum Dam Project (Mithril 100% and Great Boulder Resources earning up to 80% by completing expenditure of $1M over four years), Great Boulder Resources undertook a small Reverse Circulation drilling program (20LDCRC001, 1A, and 20LDRC002 – 341 metres) to test an area of nickel anomalism intersected in historical drilling (e.g. 4m @ 1.23% nickel from 44 metres in HMAC021) at the Drumstick nickel prospect which is located within the central portion of the project on EL27/538 (Figure 2).

20LDRC001A intersected 12m @ 0.35% nickel from 64 metres at the base of weathering above a sequence of serpentinised ultramafic rock.

20LDRC002 was collared 140 metres to the northwest of 20LDRC001A to test an interpreted ultramafic – wall rock contact. Drilling predominantly intersected serpentinised ultramafic interfingered with felsic intrusions before reaching a barren ultramafic – granite contact at 131 metres. Minor nickel anomalism (I.e.

- 8m @ 0.20% nickel from 40 metres) was intersected at the base of weathering.

Refer to required JORC Information for the drilling at the rear of this Report.

Great Boulder Resources will continue to evaluate other nickel prospects within the project as well as generating new datasets to assist with the geological understanding of the project’s ultramafic units. The company considers Lignum Dam to be also under-explored for gold mineralisation, and further generative work will be undertaken to develop this hypothesis.

At Limestone Well, Auteco Minerals can earn up to an 80% interest in the project by completing exploration expenditure of $2.5 million over five years.

An asset review of the Limestone Well project is in progress with further exploration activities to be potentially executed through alternate funding opportunities or other transactions. Further RC drilling is proposed to follow up on intersections of significant Vanadium-Titanium results from maiden drilling in 2019, which include:

- 20m @ 0.48% V2O5 & 6.5% TiO2 from 12m and a second zone of 72m @ 0.46% V2O5 & 8.6% TiO2 from 52m (including: 16m @ 0.70% V2O5)

- 12m @ 0.72% V2O5 & 8.5% TiO2 from 12m a second zone of 24m @ 0.50% V2O5 & 6.2% TiO2 from 48m and a third zone to end of hole of 56m @ 0.46% V2O5 & 6.1% TiO2 from 164m

- 20m @ 0.50% V2O5 & 6.5% TiO2 from 64m and a second zone of 116m @ 0.36% V2O5 & 11.0% TiO2 from 104m to end of hole.

More background on the regional targets are available in the Auteco’s ASX announcement dated 14 October 2019.

Outlook for the next Quarter

The Company’s primary objective for the June 2020 Quarter is the successful completion of the Sun Minerals Transaction.

A General Meeting of shareholders to approve the Sun Minerals transaction will be held at Level 17, 500 Collins Street, Melbourne VIC 3000 on 13 May 2020 at 10:00am (Melbourne time).

Due to restrictions applicable in Victoria as a result of COVID-19, it is not be possible to convene the Meeting physically and the Company intends to decide the outcome of voting on the resolutions in the Notice by proxy voting, submitted ahead of the Meeting.

Released with the authority of the Board. Regards,

Adrien Wing

Non-Executive Director and Company Secretary Mithril Resources Limited