Highlights – Copalquin Gold-Silver, Mexico

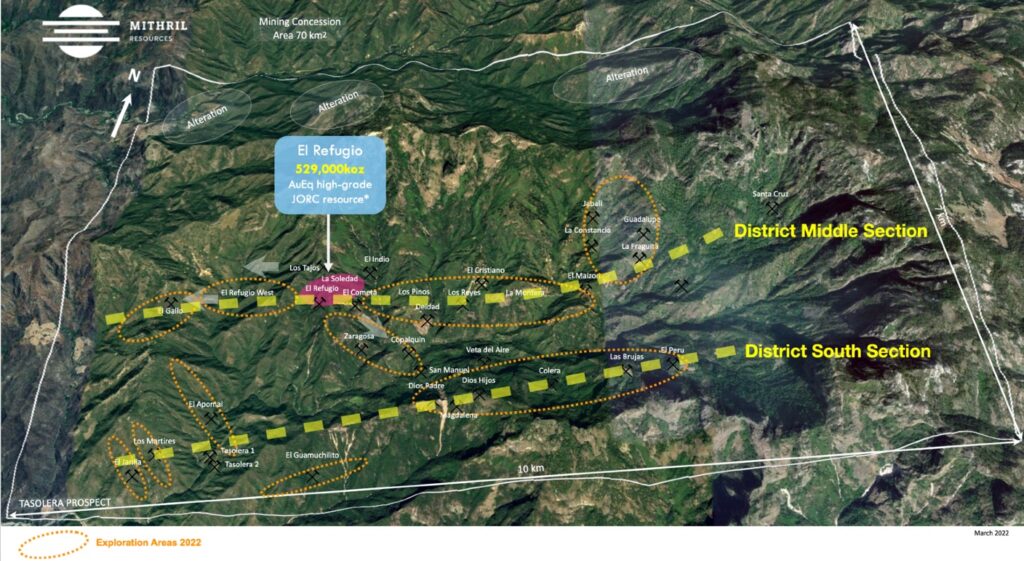

- Exploration activities continued at the Copalquin Mining District, Mexico with diamond drilling and taking advantage of the dry season to progress mapping and soil sampling programmes

- Drilling peripheral to the maiden JORC MRE (529koz AuEq)1 area at El Refugio was completed 1km west and along trend at El Gallo intercepting high-grade gold and silver veins within 8 – 16 metre wide and shallow mineralised zones. Further drilling down dip and along strike is scheduled to develop this westerly target area

- 0.54m @ 4.48 g/t gold, 412 g/t silver from 21.37m, (CDH-127), plus

- 1.00m @ 2.69 g/t gold, 179 g/t silver from 25.50m,

- 2.00m @ 2.55 g/t gold, 184 g/t silver from 50.0m, (CDH-128), including

- 1.00m @ 4.72 g/t gold, 326 g/t silver from 51.0m, plus

- 1.00m @ 1.64 g/t gold, 5.0 g/t silver from 43.0m

- 0.54m @ 4.48 g/t gold, 412 g/t silver from 21.37m, (CDH-127), plus

- During the quarter drilling commenced at El Refugio, aiming to fill gaps in the maiden MRE area and target the projected location of the main upwelling feeder zone for this high-grade deposit. Drill results from this drilling received and reported in July 2022 after the quarter end

- 5.67m @ 4.37 g/t gold, 174 g/t silver from 331.33m, (CDH-137), including

- 1.67m @ 9.64 g/t gold, 399 g/t silver from 331.33m, plus

- 1.00m @ 1.68 g/t gold, 67.2 g/t silver from 367.0m, plus

- 1.00m @ 1.27 g/t gold, 46.1 g/t silver from 370.0m

- 0.50m @ 2.13 g/t gold, 118 g/t silver from 368.5m, (CDH-136), plus

- 0.60m @ 0.66 g/t gold, 42.8 g/t silver from 375.5m, plus

- 0.50m @ 0.39 g/t gold, 45.4 g/t silver from 377.9m, plus

- 0.90m @ 1.04 g/t gold, 11.3 g/t silver from 431.85m

- 5.83m @ 15.7 g/t gold, 474 g/t silver from 91.77m, (CDH-140), including

- 1.81m @ 45.5 g/t gold, 1,387 g/t silver from 93.77m

- 5.49m @ 2.54 g/t gold, 23.8 g/t silver from 292.51m, (CDH-141), including

- 1.00m @ 7.09 g/t gold, 60.5 g/t silver from 292.51m, and including

- 1.00m @ 4.04 g/t gold, 20.2 g/t silver from 297.00m,

- 4.00m @ 1.35 g/t gold, 47.6 g/t silver from 276.00m, plus

- 2.00m @ 0.82 g/t gold, 27.7 g/t silver from 317.00m, plus

- 2.00m @ 0.98 g/t gold, 30.5 g/t silver from 325.00m, plus

- 1.00m @ 0.94 g/t gold, 22.8 g/t silver from 331.00m, plus

- 1.80m @ 1.67 g/t gold, 54.8 g/t silver from 292.51m

- 5.67m @ 4.37 g/t gold, 174 g/t silver from 331.33m, (CDH-137), including

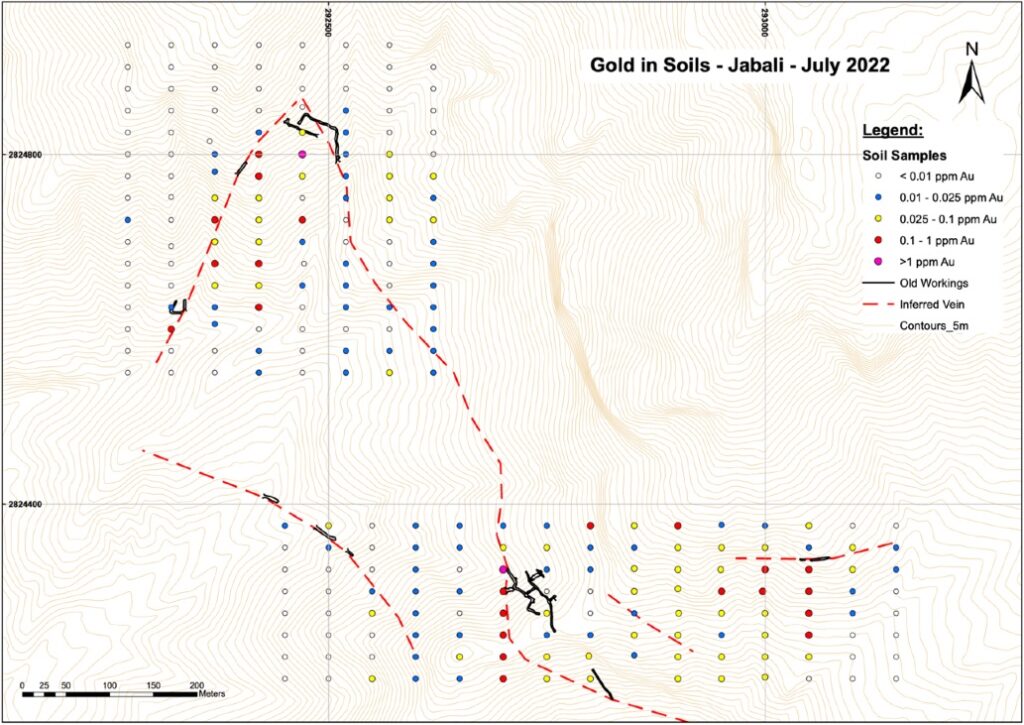

- Mapping and sampling at El Jabali and Las Brujas returned excellent results elevating these two targets in the district rankings for future drilling

- First line of drill holes at the La Montura target returned anomalous gold and silver values from this recently identified broad 700m long quartz vein structure east of Los Reyes

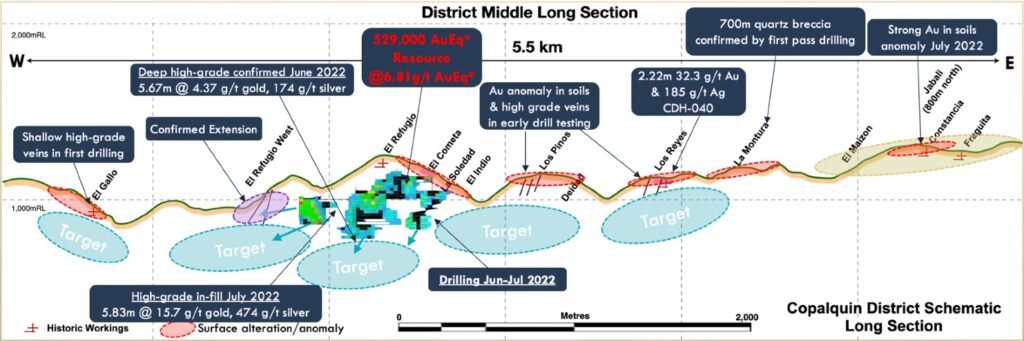

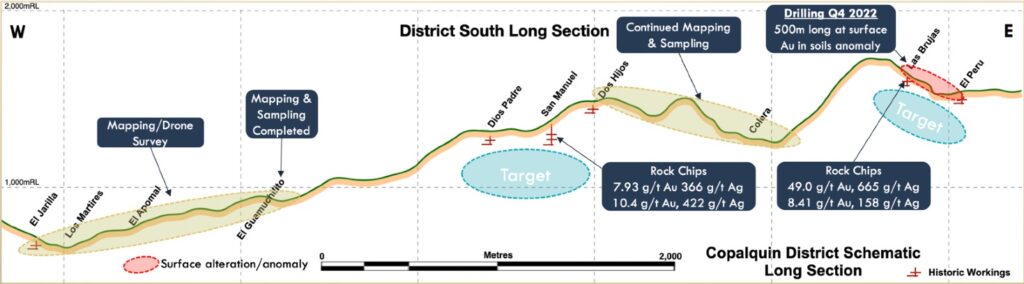

- Continued exploration work in the middle section of the district confirms a 5.5km long E – W corridor of gold-silver mineralisation from El Gallo to La Constancia including the Refugio-La Soledad MRE area.

Highlights – Corporate

- A$3.5M was raised (before costs) through a share placement in April 2022.

- At end of the June quarter, the Company has total cash of A$2.3M and remains funded to continue exploration activities in the district and prepare for the next campaign of drilling at the El Refugio- La Soledad resource area upon receipt of assays and assessment of the recently completed drill campaign (July 2022).

- Mexican value added tax (VAT) refunds continued throughout the quarter with a total of ~A$75k received. Eleven months of 2021 VAT have now been refunded and one month from 2022. Refunds of ~A$800k are pending from the Mexican tax office with good expectation for receipt of these refunds.

- The Company continues with its community relations in the Copalquin district via support of three district schools and environmental activities/education.

- Amendments have been agreed with the Copalquin mining concession vendor to extend the purchase option period by 3 years until August 2026. Having invested over US$8m in direct exploration costs on the concessions, Mithril via its Mexican subsidiary now holds 50% interest in the mining concessions and can purchase 100% by paying USD10m in cash, shares or a combination of both to the vendor at any time up to August 2026. (see announcement for details 25 Nov 2019 Transformative high-grade gold silver project acquisition)

Mithril Resources Ltd (ASX: MTH) (Mithril or the Company) is pleased to provide a quarterly update for the period ending 30 June 2022, for activities at its 100% optioned Copalquin Gold Silver Project in Mexico where a maiden 529koz gold equivalent1 high-grade gold-silver JORC resource has been defined at El Refugio-La Soledad (see ASX Announcement 17 November 2021).

Mithril Managing Director and CEO, John Skeet, commented:

“Exploration work in this high-grade gold-silver district continues to deliver results that highlight the significance of the El Refugio hydrothermal system first identified in 2020. Drilling at El Refugio and peripheral to the maiden resource area identifies this as a major upwelling feeder zone in the district with drill core observations providing indications of significant additional depth potential. Next quarter, relogging of drill core together and data from the recently completed drill campaign will drive the next stage of drilling at El Refugio and La Soledad. Study work is continuing to optimise a future development in the Copalquin District.”

COPALQUIN DISTRICT, MEXICO

During the June quarter, Mithril continued to advance its exploration work in the Copalquin District, successfully expanding its drill targets and the district’s resource potential. (ASX Announcement 5 May 2022)

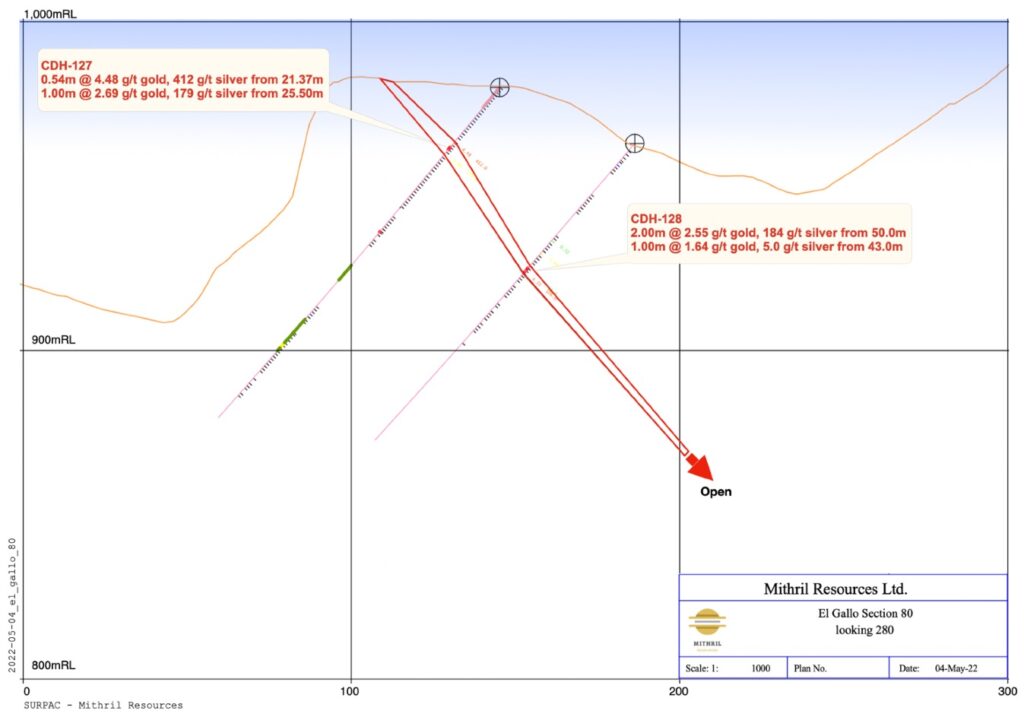

Drilling at El Gallo

The first diamond core drilling at the El Gallo target 1km west of the El Refugio resource has produced multiple shallow intercepts with high-grade gold and silver mineralisation. (Refer to Figure 3 below.) Of particular note is the silver sulphide ginguro banding coincident with high-grade silver assay values. The drilling follows soil sampling and mapping, that identified El Gallo as a high-priority drill target. These excellent first round drill results support further drilling along strike and deeper as we develop this target.

- 0.54m @ 4.48 g/t gold, 412 g/t silver from 21.37m, (CDH-127), plus

- 1.00m @ 2.69 g/t gold, 179 g/t silver from 25.50m,

- 2.00m @ 2.55 g/t gold, 184 g/t silver from 50.0m, (CDH-128), including

- 1.00m @ 4.72 g/t gold, 326 g/t silver from 51.0m, plus

- 1.00m @ 1.64 g/t gold, 5.0 g/t silver from 43.0m

This area of the district and to the east and north, feature high-grade gold and silver at El Refugio, La Soledad, Los Pinos, Los Reyes and now at El Gallo. As can be seen in Figure 2 above, there is widespread gold and silver now proven over a large part of the district.

Post end of the June quarter, the Company provided additional exploration results completed during the quarter. (ASX Announcement 5 July 2022) and (ASX Announcement 27 July 2022)

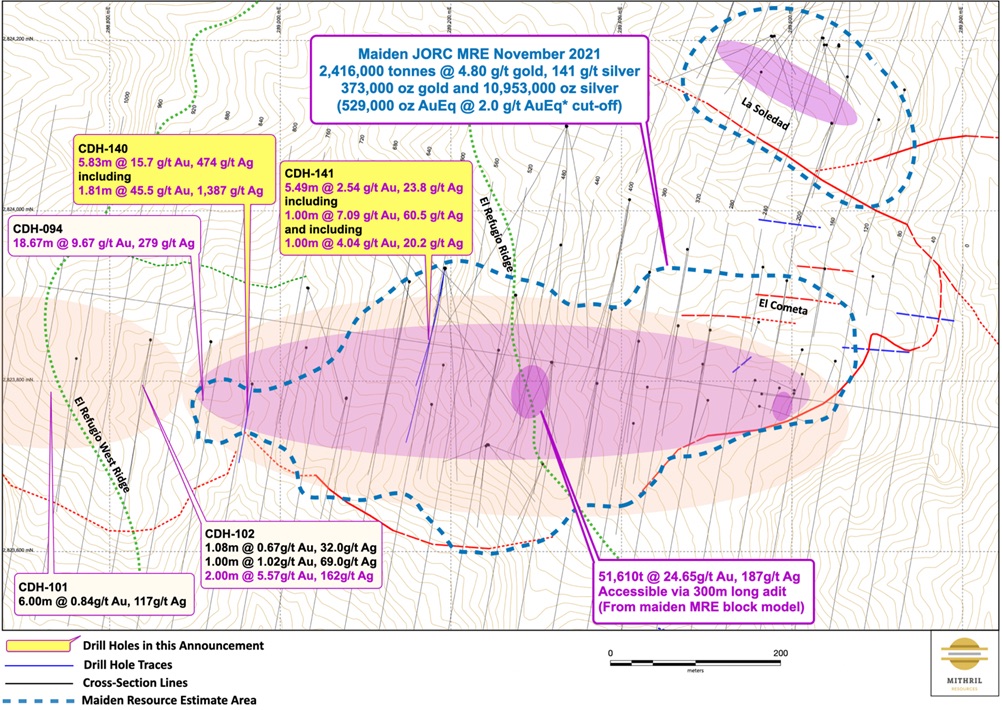

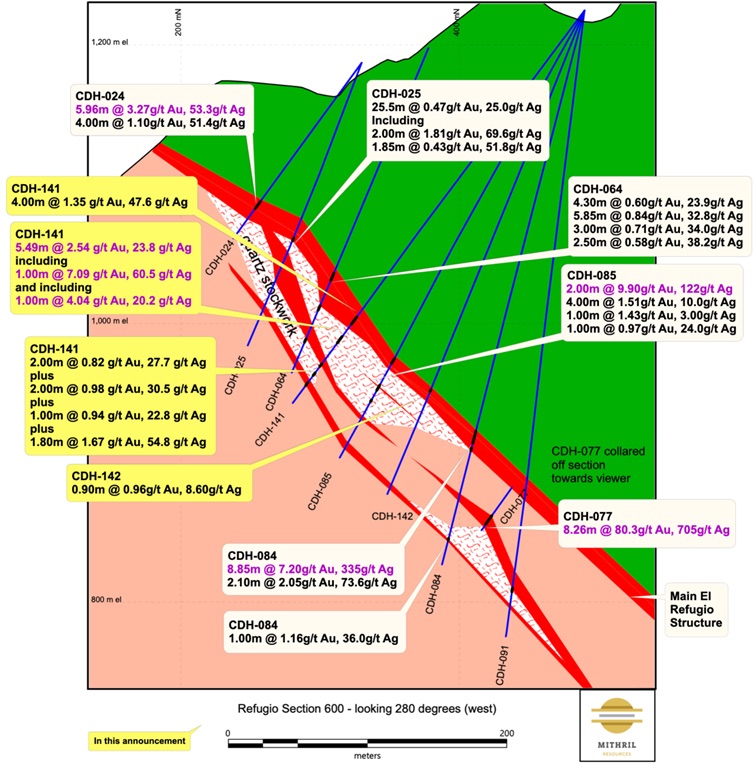

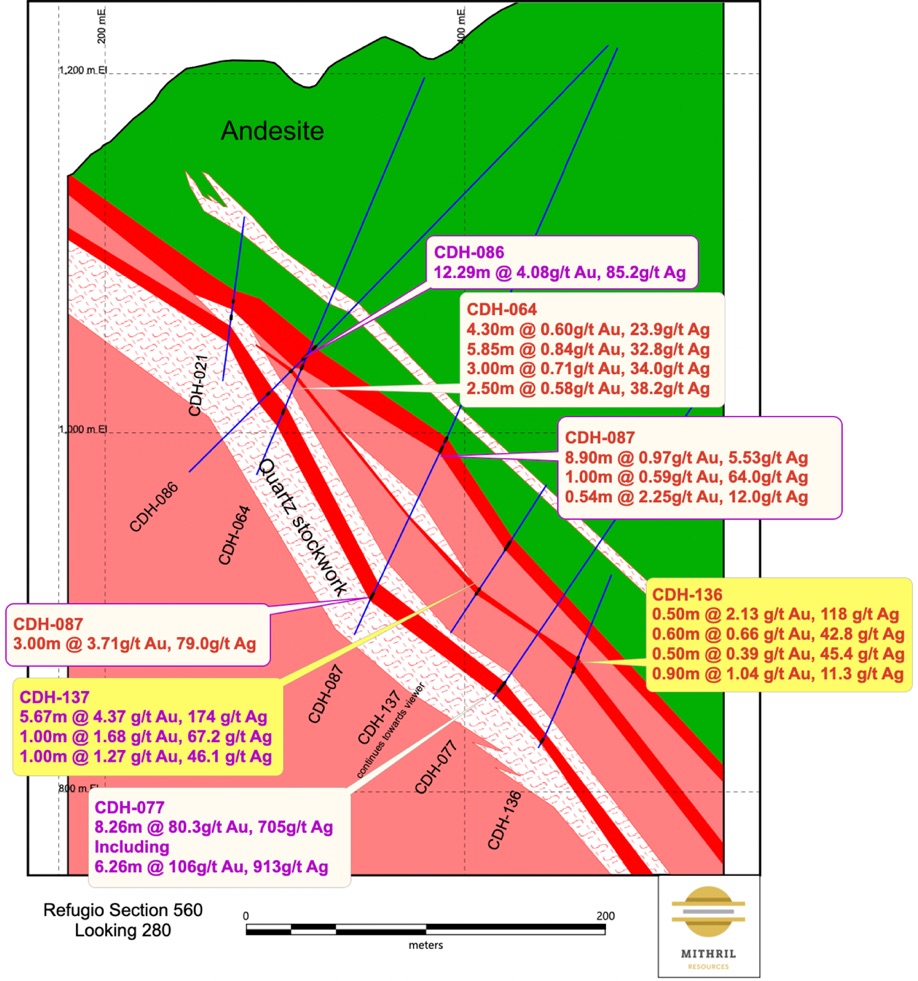

El Refugio Drilling May-June 2022

Drilling recommenced at El Refugio in May 2022 with a program of six deep holes, three drilled from a location slightly oblique to the main structure, in order to reduce the length of the drill holes to reach the targeted depth. Assays have been received for all drill holes. The program successfully achieved the objective of locating the main structure and confirming high-grade gold and silver on the western side of the El Refugio resource area while providing additional information for the location of the upwelling feeder zone. The previously reported intercept in hole CDH-137 of 5.67m @ 4.37 g/t gold, 174g/t silver from 331.33m, (CDH-137), including 1.67m @ 9.64 g/t gold, 399 g/t silver from 331.33 plus 1.00m @ 1.68 g/t gold, 67.2 g/t silver from 367.0m and 1.00m @ 1.27 g/t gold, 46.1 g/t silver from 370.0m filled a gap down dip on section 560 and drill hole CDH-136 confirms the downdip extension with some further high-grade gold and silver mineralisation and multiple intercepts.

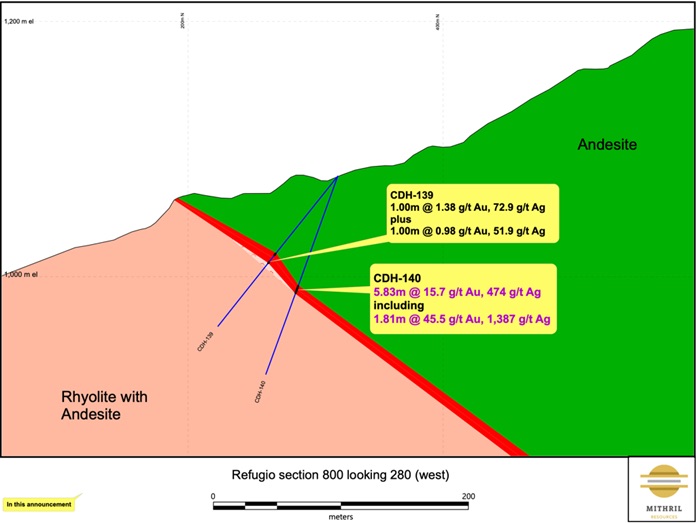

The first drill holes on section 800 are reported with exceptional high-grade gold and silver intercepts in this western side of the El Refugio resource area with 5.83m @ 15.7 g/t gold, 474 g/t silver from 91.77m, (CDH-140), including 1.81m @ 45.5 g/t gold, 1,387 g/t silver from 93.77m down dip of hole CDH-139 (Figure 6). This supports the high- grade previously intercepted 40m west by drill hole CDH-094 with 18.87m @ 9.67g/t gold, 279g/t silver.

El Refugio Drilling June-July 2022

A drill programme has recently been completed on the eastern side of El Refugio targeting deep and near to where the main El Refugio upwelling zone is projected.

Core from the most recent holes have the first observed occurrences of platy quartz after calcite, a texture indicative of boiling and gold deposition. Late amethyst is also observed filling what was open space at the time of mineralization. This texture is indicative of boiling. Visible silver minerals are commonly observed in the mineralized veins. All drill core samples have been dispatched for assay.

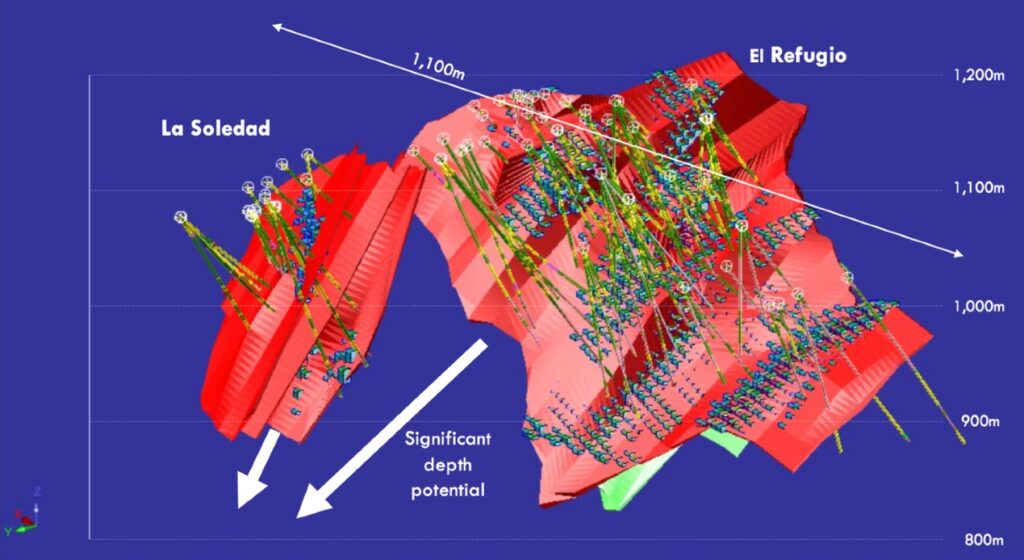

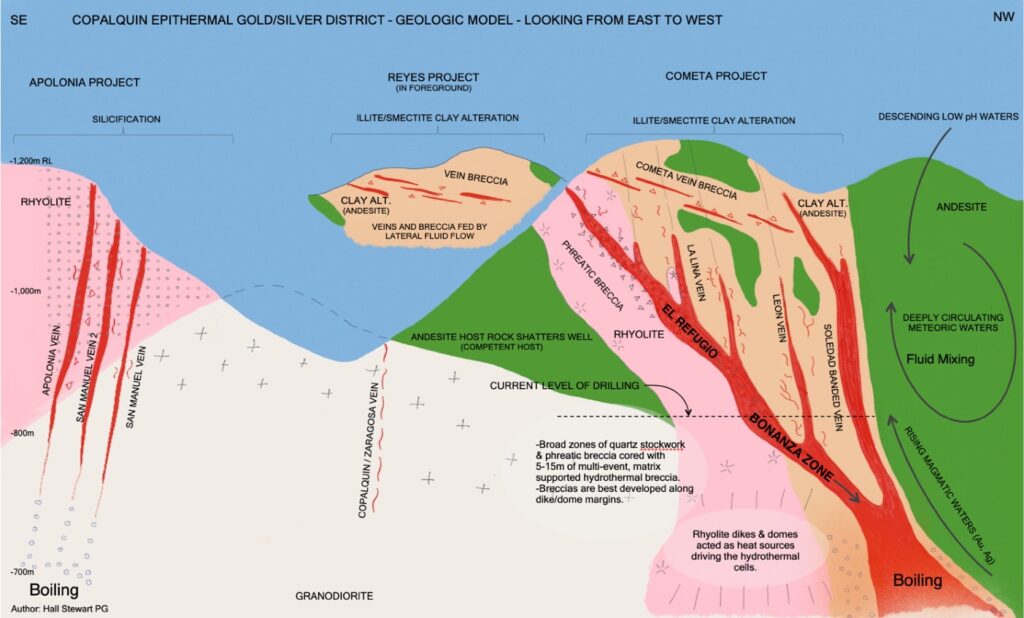

elevations are approximate

Figure 8 above shows an oblique view of the La Soledad-El Refugio vein and block models with traces of drill holes to date. Recent drill logs and results show significant depth potential of this major system and also indicate the general location of the El Refugio upwelling feeder zone and this is consistent with the epithermal gold-silver model shown in the Figure 9 below.

Drilling at La Montura

La Montura is a recently discovered drill target along the District Middle Trend and features a 700m wide quartz vein at the surface and a gold in soils anomaly over this area. The first round of drilling returned anomalous gold and silver values. Further work required to assess this structure for future exploration drilling.

Soil Sampling Results – Constancia Area

Results from the soil sampling program at the La Constancia area on the eastern end of the Copalquin District Middle Section are given below in Figure 14. The results highlight gold in soils values which are generally consistent with mapped surface veins and historic workings (shown in black on the map below). These results support further work to progress the area for exploration drilling in the future.

District South Section

The Las Brujas-El Peru target is drill ready following positive results from the rock chip sampling program from within the historic mine working and the soils sampling program that revealed a good gold and silver anomaly. The historic mine workings at Las Brujas and at El Peru are connected by a 500m long surface trace of quartz vein.

Mapping and rock chip sampling of a north-south oriented structure at El Guamuchilito has been completed. Aerial drone surveying was completed in June.

Scoping Study Work

Work is progressing to assess the first stage development options to optimally exploit the high-grade El Refugio resource. Recent drilling has been spaced across the strike of the mineralized zone to infill strategic areas. There are options to reduce the mine development meterage and to take advantage of topography and high-grade zones within the El Cometa-El Refugio resource on the eastern side of the deposit to potentially produce attractive development economics including low initial capital requirements and short payback period.

Mithril’s relationship with the local community

Mithril has developed excellent relations with the communities that live in the Copalquin district. The majority of Mithril’s employees are from these communities. The Company supports three local schools at La Maquina, Los Reyes and El Platano and helps promote environmental awareness and support for children’s education.

AUSTRALIAN PROJECTS

To ensure the Company maintains its focus on the Copalquin Gold Silver Project, Mithril has exploration partners to farm-in, sole fund and operate exploration activities on its Australian assets. These include:

- Great Boulder Resources (GBR.ASX) at the Lignum Dam Project;

- Auteco Minerals (AUT.ASX) at the Limestone Well Project;

- Carnavale Resources (CAV.ASX) at the Kurnalpi Project; and

- CBH Resources Limited (“CBH”) at the Billy Hills Zinc Project.

Having farm-in exploration partners solely fund all exploration costs, ensures that the Mithril tenements are kept in good standing for the duration of the respective partnership agreements with the potential to benefit from prospectivity and exploration upside.

Billy Hills Zinc (Billy Hills)

- Mithril 100%; and

- CBH Resources Limited earning up to 80% interest by completing expenditure of A$4M over 5 years.

- Native title clearance for the first phase of drilling has been granted, scheduled to commence H2 2022.

Kurnalpi Project (Kurnalpi)

- Mithril 100%; and

- Carnavale Resources earning an initial 80% interest by keeping the tenements in good standing over three years and paying Mithril A$250,000 cash.

Lignum Dam Project (Lignum)

- Mithril 100%; and

- Great Boulder Resources earning up to 80% by completing expenditure of A$1M over four years.

- Great Boulder carried out a program of auger geochemical sampling over nickel and gold prospective rock types.

Limestone Well Project (Limestone)

- Mithril 10%, Auteco Minerals 90%

- In October 2021, Mithril announced the execution of a binding term sheet for the sale of 90% interest in the Limestone Well tenements to its farm-in partner, Auteco Minerals for a payment of A$500,000 in cash. For details of the term sheet please refer to the ASX Announcement 12 October 2021

CORPORATE

In April, the Company completed a A$3.5m Share Placement (before costs) comprising 350,000,000 new fully paid ordinary shares in the Company at an issue price of 1 cent ($0.01). Participants received one free attaching option for every two shares subscribed for under the Placement exercisable at 1.5 cents ($0.015) up to 2 years from date of issue. The capital raising was supported by sophisticated and professional investors. (ASX Announcement 13 April 2022)

Funds raised for continued diamond core drilling in the Copalquin District to expand the high-grade gold-silver maiden JORC resource at El Refugio and drill test targets along strike and continue exploration target development within the Copalquin District.

Amendments have been agreed with the Copalquin mining concession vendor to extend the purchase option period by 3 years until August 2026. Having invested over USD8m in direct exploration costs on the concessions, Mithril via its Mexican subsidiary now holds 50% interest in the mining concessions and can purchase 100% by paying USD10m in cash, shares or a combination of both to the vendor. (see announcement for details 25 Nov 2019 Transformative high-grade gold silver project acquisition)

CASH

Total cash reserves of A$2.3M and remains funded to continue exploration activities in the district and prepare for the next campaign of drilling at the El Refugio-La Soledad resource area upon receipt of assays and assessment of the recently completed drill campaign (July 2022).

Mexican value added tax (VAT) refunds continued throughout the quarter with a total of ~A$70k received. Eleven months of 2021 VAT have now been refunded and one month from 2022. Refunds of ~A$800k are pending from the Mexican tax office with good expectation for receipt of these refunds

RELATED PARTY PAYMENTS

In line with its obligations under ASX Listing Rule 5.3.5, Mithril Resources Limited notes that the only payments to related parties of the Company, as advised in the Appendix 5B for the period ended 30 June 2022, pertain to payments to directors and consultants for fees, salary and superannuation.

Original Article: file:///D:/Pictures/Press%20Releases/084660e7-d37.pdf