Highlights

- Firm commitments received for A$3.5M share placement (before costs) at A$0.01 per share

- Participants will receive one free attaching option for every two shares subscribed for under the Placement exercisable at A$0.015 up to 2 years from date of issue

- The Company remains funded to continue diamond core drilling in the Copalquin District to expand the high-grade gold-silver resource at El Refugio and test other target areas in the district

- Directors of the Company have committed to subscribe for $100,000 in the Placement

Mithril Resources Ltd (ASX: MTH) (Mithril or the Company) is pleased to announce it has received firm commitments from sophisticated and professional investors to raise A$3.5M (before costs) through a Share Placement (Placement). The Placement was strongly supported by existing and new institutional and high net worth investors.

Mithril Managing Director and CEO, John Skeet, commented:

“Following on from the excellent high-grade maiden JORC resource at El Refugio, dry season work has expanded drill targets along strike from El Refugio and in other parts of the district. Diamond core drilling will focus on expansion of the El Refugio resource which is open at depth and to the west as well as testing targets further along strike. I thank all participants of the capital raising for their continued support and welcome our new investors. We look forward to reporting continued success at our Copalquin Gold-Silver District in Mexico.”

Capital Raising Details

Mithril has received binding commitments for a Placement to sophisticated and professional investors, comprising 350,000,000 new fully paid ordinary shares in the Company (Placement Securities) at an issue price of 1 cent ($0.01) to raise approximately $3.5M (before costs). An applicable Appendix 3B pertaining to this Placement follows this announcement.

Participants in Placement will receive one free attaching option for every two shares subscribed for under the Placement. The options will be unlisted, have an exercise price of A$0.015 and an exercise period of 2 years from date of issue (Attaching Options).

The Directors of the Company have committed to subscribe for $100,000 in the Placement. Securities to be issued to the Directors in the Placement will be subject to shareholder approval to be obtained at an EGM to be held as soon as practicable following the competition of the Placement.

The Placement was conducted by Taylor Collison Limited and Morgans Corporate Limited as joint lead managers and within the Company’s placement capacity under ASX Listing Rule 7.1 (100,000,000 shares and 175,000,000 options) and 7.1A (250,000,000 shares). Settlement of the Placement is expected to occur on 22 April 2022, with Placement shares expected to be allotted (pursuant to Listing Rules 7.1 and 7.1A) and to commence trading on 26 April 2022. An Appendix 2A confirming the exact allotments will be issued on the same date.

The Capital Raising price of A$0.01 (1 cents) per New Share represents:

- 9.1% discount to the last traded price on Friday 8 April 2022 (A$0.011)

- 12.0% discount to the 5 day VWAP price (A$0.014)

- 13.1% discount to the 15 day VWAP price (A$0.0115)

Funds raised will be used to continue diamond core drilling in the Copalquin District to expand the high-grade gold- silver maiden JORC resource at El Refugio and drill test targets along strike and continue exploration target development within the Copalquin District.

Workplan for remainder of 2022

- Continue diamond core drilling in the Copalquin District to expand the high-grade gold-silver maiden JORC resource at El Refugio and drill test targets along strike

- Continue exploration target development within the 70km2 Copalquin District

Copalquin Mining District – Sierra Madre Trend, Durango, Mexico – Mithril earning 100% interest

The Copalquin District mining concessions cover 70 km2 and include several multi-level historic gold-silver mines and dozens of workings plus a recent maiden high-grade JORC resource at the first target area of El Refugio.

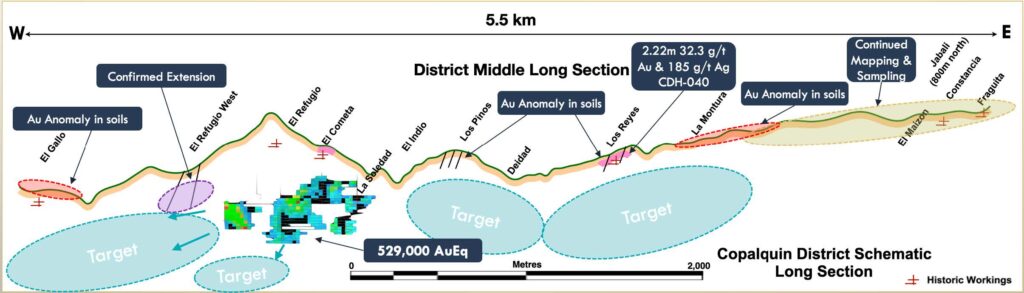

Copalquin District Middle Trend El Refugio-La Soledad

- Maiden JORC high-grade resource – 373,000oz gold + 10.9 million oz silver @ 4.80 g/t gold and 141 g/t silver. 529,000 oz gold equivalent using 70:1 gold:silver price ratio

- Expansion at El Refugio below intercept 8.26m @ 80.3 g/t Au, 705 g/t Ag from 468.34m (CDH-077) and west of 18.67m @ 9.64 g/t Au, 278 g/t Ag from 162.67m (CDH-094)

- High grade sheeted veins at La Soledad

- Drilling in April 2022 at El Gallo, 1km west of El Refugio

- Great potential to expand the resource via depth and western extension at this target

Los Pinos-Los Reyes-La Montura

- High-grade gold in soils anomaly at Los Pinos – high-grade in scout dill hole 0.60m @ 9.91 g/t Au, 161 g/t Ag from 78.6m (CDH-113)

- Gold and silver in soils at Los Reyes and drilling – 2.22m @ 32.3 g/t Au, 185 g/t Ag from 91.55m (CDH-040)

- Extensive quartz vein mapped at surface at La Montura over 500m. Drilling scheduled for Q2 2022

- Total strike length at this target area is over 2.5km

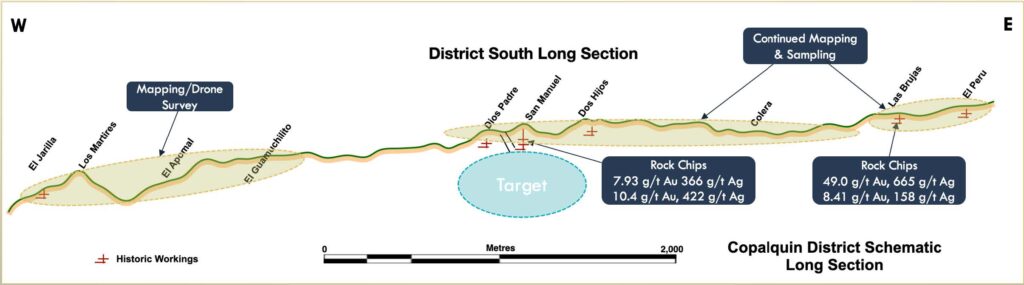

Copalquin District South

Las Brujas-El Peru-San Manuel

- Developing as a primary drill target area. High-grade rock chip sampling up to 49 g/t Au, 665 g/t Ag at Las Brujas.

- Soil sampling completed, awaiting assays.

Multilevel San Manuel Mine Area

- Continued mapping and sampling for future drill target

Copalquin District North Area

- Three large areas of surface alteration possibly indicative of further district hydrothermal activity for gold- silver deposits. Mapping and sampling to be conducted in these areas

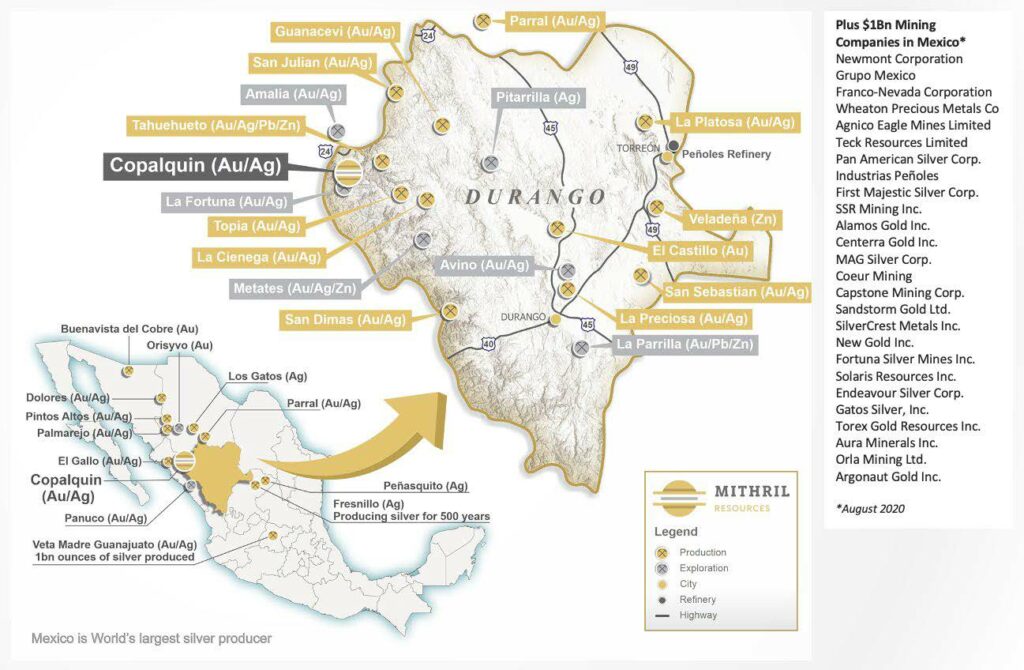

ABOUT ABOUT THE COPALQUIN GOLD SILVER PROJECT

The Copalquin mining district is located in Durango State, Mexico and covers an entire mining district of 70km2 containing several dozen historic gold and silver mines and workings, ten of which had notable production. The district is within the Sierra Madre Gold Silver Trend which extends north-south along the western side of Mexico and hosts many world-class gold and silver deposits.

Multiple mineralisation events, young intrusives thought to be system-driving heat sources, widespread alteration together with extensive surface vein exposures and dozens of historic mine workings, identify the Copalquin mining district as a major epithermal centre for Gold and Silver.

Within 15 months of drilling in the Copalquin District, Mithril delivered a maiden JORC mineral resource estimate demonstrating the high-grade gold and silver resource potential for the district. This maiden resource is detailed below.

- 2,416,000 tonnes @ 4.80 g/t gold, 141 g/t silver for 373,000 oz gold plus 10,953,000 oz silver (Total 529,000 oz AuEq*) using a cut-off grade of 2.0 g/t AuEq*

- 28.6% of the resource tonnage is classified as indicated

| Tonnes (kt) | Tonnes (kt) | Gold (g/t) | Silver (g/t) | Gold Equiv.* (g/t) | Gold (koz) | Silver (koz) | Gold Equiv.* (koz) | |

| El Refugio | Indicated | 691 | 5.43 | 114.2 | 7.06 | 121 | 2,538 | 157 |

| Inferred | 1,447 | 4.63 | 137.1 | 6.59 | 215 | 6,377 | 307 | |

| La Soledad | Indicated | – | – | – | – | – | – | – |

| Inferred | 278 | 4.12 | 228.2 | 7.38 | 37 | 2,037 | 66 | |

| Total | Indicated | 691 | 5.43 | 114.2 | 7.06 | 121 | 2,538 | 157 |

| Inferred | 1,725 | 4.55 | 151.7 | 6.72 | 252 | 8,414 | 372 | |

| TOTAL | 2,416 | 4.80 | 141 | 6.81 | 373 | 10,953 | 529 |

*AuEq. = gold equivalent calculated using and gold:silver price ratio of 70:1. That is, 70 g/t silver = 1 g/t gold. The metal prices used to determine the 70:1 ratio are the cumulative average prices for 2021: gold USD1,798.34 and silver: USD25.32 (actual is 71:1) from kitco.com

Mining study and metallurgical test work supports the development of the El Refugio-La Soledad resource with conventional mining methods indicated as being appropriate and with high gold-silver recovery to produce metal on-site with conventional processing.

Mithril is currently exploring in the Copalquin District to expand the resource footprint in 2022 to demonstrate its multi-million ounce gold and silver potential.

Mithril Resources is earning 100% interest in the Copalquin District mining concessions via a purchase option agreement detailed in ASX announcement dated 25 November 2019.

-ENDS-

Released with the authority of the Board.

For further information contact:

| John Skeet Managing Director and CEO jskeet@mithrilresources.com.au +61 435 766 809 | Mark Flynn Investor Relations mflynn@mithrilresources.com.au +61 416 068 733 |

Original Article: https://www.investi.com.au/api/announcements/mth/b851d554-ac2.pdf