Toronto, Ontario and Vancouver, British Columbia – (November 21, 2018)

Minera Alamos Inc. (“Minera” or the “Company”) (TSXV: MAI) is pleased to announce that it has received a positive notification from the Mexican environmental authorities (Secretaria de Medio Ambiente y Recursos Naturales – “SEMARNAT”) regarding the Company’s permit application (MIA/ETJ) for the development of the La Fortuna Gold Project (“Fortuna”). The notification confirms the successful completion of the technical review phase of the Company’s application (Estudio Tecnico Justificativo – “ETJ”) for the change of land use to construct mining and processing facilities at the Fortuna project area. Following the completion of the change of land use payments, SEMARNAT will be in a position to issue the formal approval documentation for the project.

“The receipt of this notification represents a major milestone for the Company. Despite some procedural changes in the MIA/ETJ application process that caused early delays, the notice was received a little over a year following the completion of our strategic partnership with Osisko Gold Royalties and starts the transformation of the Company from a junior explorer to a growing gold producer,” stated Darren Koningen, CEO of Minera Alamos. “Our highly experienced Mexican technical team continues to demonstrate the ability to advance concurrently our full portfolio of late-stage gold development projects. Mexico remains one of the world’s premier mine development locations with respect to the timeframes required for permitting of new operations. We now eagerly await similar notifications regarding the Company’s Santana gold project which remains our first priority for construction consideration in 2019 according to the Company’s current development schedule.”

The receipt of a MIA-ETJ permits for the Fortuna project will allow the Company to initiate applications for other state/local permits that will be required in advance of any commercial mine production. These cover activities such as water use and explosives. In addition, the Company can advance discussions with potential contractors related to mining, crushing, construction, etc. The Fortuna MIA-ETJ applications were structured to provide the Company with significant flexibility to further optimize the development approach for the project and the ability to expand the project operations organically once resources are increased.

In advance of a final construction decision, the Company has also initiated discussions with a number of project finance groups that can provide debt facilities complementary to the Fortuna royalty structure arranged with strategic partner Osisko Gold Royalties. The recently completed PEA (see news release dated August 16th 2018) for the project demonstrated an after-tax internal rate-of-return in excess of 90%, a rapid payback of capital of approximately one year and low production costs for an initial 50,000 oz (AuEq) per annum operation (see La Fortuna Gold Project below).

As planning activities are refined in the coming year (2019) the Company will provide regular updates regarding ongoing advancements at the Fortuna project. The PEA identified several opportunities to further enhance the overall project economics and these are currently under review. Included in this list are the following:

- Additional metallurgical studies to further optimize the gold extraction process and improve overall metal recoveries.

- A staged plant construction plan (possibly involving earlier use of ore sorting technology) to reduce the initial start-up CAPEX and then expand the facilities once production is underway.

- Mine planning studies to evaluate opportunities to delay portions of early waste removal until later in the mine life

- Consideration of more aggressive use of ore sorting to offer additional economic benefits for the project (i.e. plant CAPEX reductions, increased mineable gold ounces, etc.)

- Trade-off studies aimed at optimizing cut-off grades (with or without ore sorting) and the incorporation of additional milling capacity – the project is permitted for a 2,000 tpd operation with the PEA based on a starting rate of 1,100 tpd.

In addition to the engineering activities, the Company is also preparing for some new exploration at the Fortuna project. The footprint of the currently drilled deposit is small compared to the overall land position (6,200 Ha) and a number of other areas of historical mining activity have been identified with most having never been evaluated using modern exploration methods.

La Fortuna Gold Project

Details of potential development plans for the Fortuna Gold project were prepared in an independent Preliminary Economic Assessment (“PEA”) completed by CSA Global Geosciences Canada Ltd (CSA Global) of Toronto, Canada. For a detailed summary of the PEA contents refer to a previous news release issued by the Company dated August 16th 2018.

(note to reader:Unless stated all currency references are in US dollars).

Table 1 – PEA Summary

| US$ | CDN$ | |

| Pre-Tax NPV (7.5%) | $103,800,000 | $134,800,000 |

| Pre-Tax IRR | 122% | 122% |

| After-Tax NPV (7.5%) | $69,800,000 | $90,600,000 |

| After-Tax IRR | 93% | |

| Pre-Tax Payback Period | 9 months | |

| After-Tax Payback Period | 11 months | |

| Average Annual Production | 43,000 oz Gold, 220,000 oz Silver, 1,000t Copper (50koz GEO1) | |

| Preproduction Capital | $26,900,000 | $34,900,000 |

| LOM Average AISC2 | $440/oz | $571/oz |

| Mine Life | 5 years | |

| Mill Throughput (avg. tpd) | 1,100 | |

| Mill Grade & Recovery | 3.68 g/t Au (90% recovery) | |

| Gold Price | $1,250/oz | |

| Silver Price | $16/oz | |

| Copper Price | $5,725/tonne | |

| FX Rate (CDN$/US$) | 0.77 | |

Notes:

- GEO – Gold Equivalent Ounces

- “AISC per ounce” is a non-GAAP financial performance measures with no standardized definition under IFRS; additional reference info at bottom of release

- Base case prices for gold, silver and copper were assessed at values approximately 2%-7% below the three-year trailing average prices for each of the metals and below the majority of the publicly available forward looking estimates available as of July 2018

PEA Cautionary Note:

Readers are cautioned that the PEA is preliminary in nature and there is no certainty that the PEA results will be realized. Mineral resources are not mineral reserves and do not have demonstrated economic viability. Additional work is needed to upgrade these mineral resources to mineral reserves.

Mr. Darren Koningen, P. Eng., Minera Alamos’ CEO, is the Qualified Person responsible for the technical content of this press release under National Instrument 43-101. Mr. Koningen has supervised the preparation of, and has approved the scientific and technical disclosures in this news release.

About Minera Alamos:

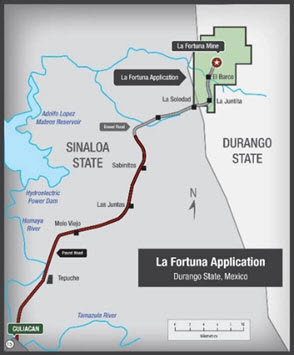

Minera Alamos is an advanced-stage exploration and development company with a growing portfolio of high-quality Mexican assets, including the La Fortuna open-pit gold project in Durango with positive PEA completed, the Santana open-pit heap-leach development project in Sonora with test mining and processing completed and the Guadalupe de Los Reyes open-pit gold-silver project in Sinaloa with mine planning in progress. The Company is awaiting the pending approval of permit applications related to the commercial production of gold at both the Santana and Fortuna projects.

The Company’s strategy is to develop low capex assets while expanding the project resources and pursue complementary strategic acquisitions.

For Further Information Please Contact:

Minera Alamos Inc.

NON-GAAP Financial Performance Measures

The Company has included certain non-GAAP performance measures (All-in Sustaining Cost – “AISC”) in this document. The Company believes that, in addition to conventional measures prepared in accordance with GAAP, certain investors and other stakeholders also use this information to evaluate the Company’s economic performance estimates; however, these non-GAAP performance measures do not have any standardized meaning. Accordingly, these performance measures are intended to provide additional information and should not be considered in isolation or as a substitute for measures of performance prepared in accordance with GAAP. The Company’s primary business is gold asset development and maximizing returns from future gold production, with other metal production being incidental to the gold production process. As a result, where applicable, the Company’s non-GAAP performance measures are disclosed on a per gold ounce basis. The Company has followed the guidance note released by the World Gold Council, which became effective January 1, 2014. The World Gold Council is a non-regulatory market development organization for the gold industry whose members comprise global senior gold mining companies.

Caution Regarding Forward-Looking Statements:

This news release may contain forward-looking information and Minera Alamos cautions readers that forward-looking information is based on certain assumptions and risk factors that could cause actual results to differ materially from the expectations of Minera Alamos included in this news release. This news release includes certain “forward-looking statements”, which often, but not always, can be identified by the use of words such as “believes”, “anticipates”, “expects”, “estimates”, “may”, “could”, “would”, “will”, or “plan”. These statements are based on information currently available to Minera Alamos and Minera Alamos provides no assurance that actual results will meet management’s expectations. Forward-looking statements include estimates and statements with respect to Minera Alamos’ future plans with respect to the Projects, objectives or goals, to the effect that Minera Alamos or management expects a stated condition or result to occur and the expected timing for release of a resource and reserve estimate on the Projects. Since forward-looking statements are based on assumptions and address future events and conditions, by their very nature they involve inherent risks and uncertainties. Actual results relating to, among other things, results of exploration, the economics of processing methods, project development, reclamation and capital costs of Minera Alamos’ mineral properties, the ability to complete a preliminary economic assessment which supports the technical and economic viability of mineral production could differ materially from those currently anticipated in such statements for many reasons. Minera Alamos’ financial condition and prospects could differ materially from those currently anticipated in such statements for many reasons such as: an inability to finance and/or complete an updated resource and reserve estimate and a preliminary economic assessment which supports the technical and economic viability of mineral production; changes in general economic conditions and conditions in the financial markets; changes in demand and prices for minerals; litigation, legislative, environmental and other judicial, regulatory, political and competitive developments; technological and operational difficulties encountered in connection with Minera Alamos’ activities; and other matters discussed in this news release and in filings made with securities regulators. This list is not exhaustive of the factors that may affect any of Minera Alamos’ forward-looking statements. These and other factors should be considered carefully and readers should not place undue reliance on Minera Alamos’ forward-looking statements. Minera Alamos does not undertake to update any forward-looking statement that may be made from time to time by Minera Alamos or on its behalf, except in accordance with applicable securities laws.

NEITHER TSX VENTURE EXCHANGE NOR ITS REGULATION SERVICES PROVIDER (AS THAT TERM IS DEFINED IN THE POLICIES OF THE TSX VENTURE EXCHANGE) ACCEPTS RESPONSIBILITY FOR THE ADEQUACY OR ACCURACY OF THIS RELEASE.

Original Article: http://www.mineraalamos.com/files/09F0715D-3ACC-4E7B-A91CE028C923B3A3.pdf