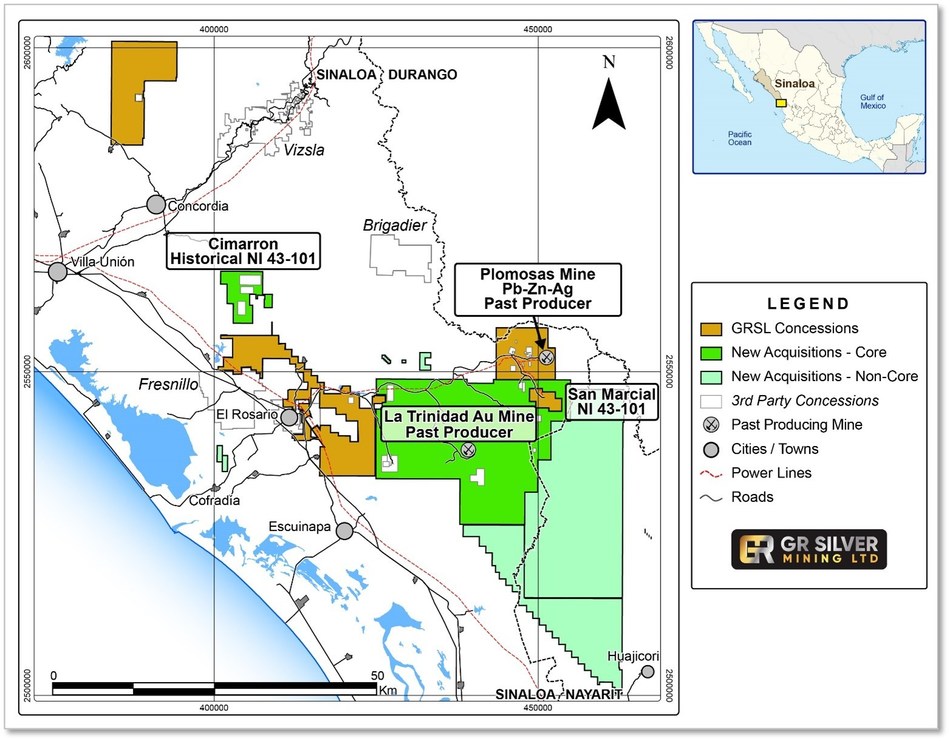

VANCOUVER, BC, April 1, 2021 /CNW/ – GR Silver Mining Ltd. (TSXV: GRSL) (FRANKFURT: GPE) (OTCQB: GRSLF) (“GRSilver Mining” or the “Company”) – Further to its news release of February 1, 2021 the Company is pleased to announce it has now completed the acquisition of 100% of Marlin Gold Mining Ltd. (“Marlin”) from Mako Mining Corp. (“Mako“). Marlin owns 100% of Oro Gold de Mexico, S.A. de C.V. (“Oro Gold“), a Mexican company, that owns the past-producer La Trinidad open pit Au mine (“La Trinidad“), that ceased operating in 2019, and 12 highly prospective concessions totalling 107,392.5 ha located adjacent to GR Silver’s existing portfolio of properties. This gives the Company control of 75 km of prospective trend with known mineralization including three zones and over 24 shallow gold-silver old workings, which are all strategically located on the western edge of the prolific Sierra Madre Occidental gold-silver belt in Sinaloa, Mexico (Figure 1).

Highlights

- Inexpensive Marlin acquisition adds 1,074 km2 of highly prospective ground, including past-producers as well as invaluable data, to GR Silver Mining’s portfolio.

- Consistent with GR Silver Mining’s business plan to consolidate the historic Rosario Mining District.

- Ongoing drilling is identifying and expanding multiple zones of mineralization with different styles indicative of an extensive regional system or systems.

- Initial mineral resource estimates incorporating current and validated historical data are expected for the Plomosas and San Juan Areas in Q2/2021, incremental to the existing mineral resource estimate for the San Marcial Project.

- GR Silver intends to aggressively accelerate its exploration program commensurate with the scale of this historic district.

- Development of multiple 3D deposit models at Plomosas, San Juan, and San Marcial, in addition to the Company’s regional exploration model and information from La Trinidad, will lead to a fully integrated Preliminary Economic Assessment targeting early 2022 completion.

The acquisition of Marlin is the third significant transaction completed by GR Silver Mining since listing on the TSX-V in March 2018. In accordance with the Company’s long-term strategy, GR Silver Mining now controls two past-producing mines (Plomosas and La Trinidad) that are fully permitted for future production, a current resource at San Marcial, as well as the most prospective Ag-Au exploration ground in the Rosario Mining District. This is the first time in modern history that one company has held all of these key assets under single ownership, whereas previously each had been controlled by separate companies. GR Silver Mining continues to achieve significant corporate milestones and to deliver on its stated objective to continue to add shareholder value.

Advanced Targets

The main exploration focus on the 12 Marlin concessions has historically been on La Trinidad (Taunus Pit) which produced over 164,000 oz of gold1,2,3 until its closure in 2019. Another advanced stage project within the acquired portfolio is the Cimarron Project, located to the NW of La Trinidad (Figure 1). A number of targets have been identified at Cimarron including Calerita, El Prado, Huanacaxtle, Betty and Veteranos. The Calerita gold-(copper) deposit at Cimarron, is the only target to have been drilled to date, and represents an intrusive related gold deposit for which Marlin released a historical gold resource estimate in 20114 (refer to details in the ‘About GR Silver Mining Ltd.’ section of this current News Release).

Exploration Prospectivity

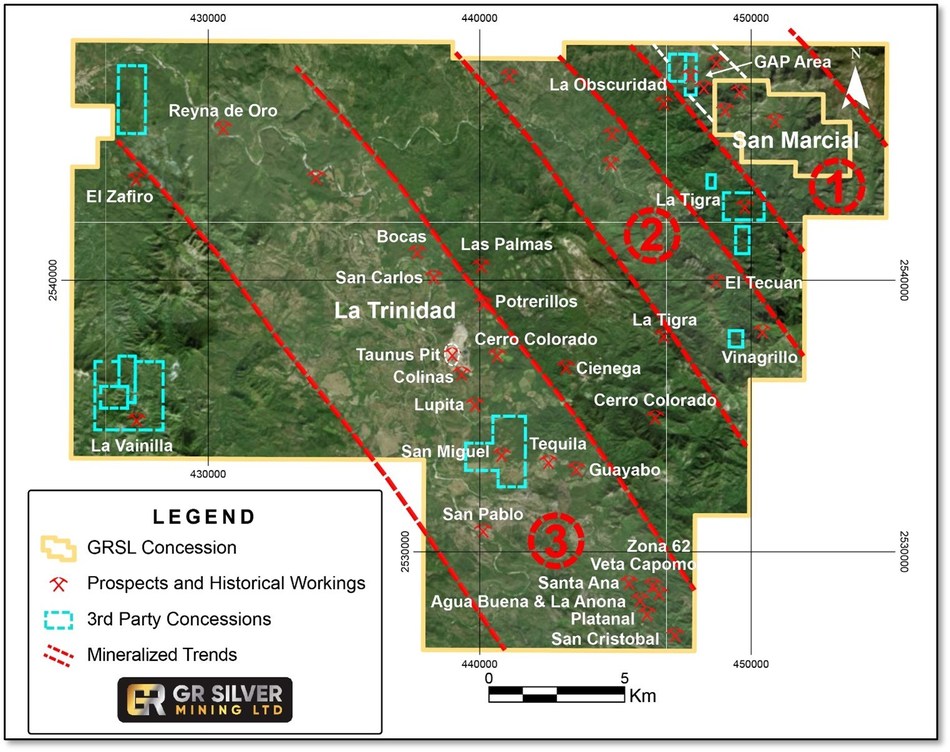

Extensive regional geochemical datasets were compiled by Oro Gold covering a large portion of the concessions with over 700 stream sediment samples, 500 rock and channel samples5, as well as over 9,000 soil samples1. Key exploration targets that were generated and initially drilled are aligned along one of three highly prospective NW-SE trending corridors, with this 12 km long section connecting the Taunus Pit with the San Carlos, Colinas, San Miguel, Guayabo and San Cristobal targets (Figure 2). A total of 40,500 m of diamond, RC and sonic drilling were completed by Oro Gold. This extensive drill database will be incorporated into GR Silver Mining’s growing regional database to further advance the Company’s exploration model. The La Trinidad concessions together with the Cimarron concession (“core concessions”) represent areas for future exploration in the Rosario Mining District.

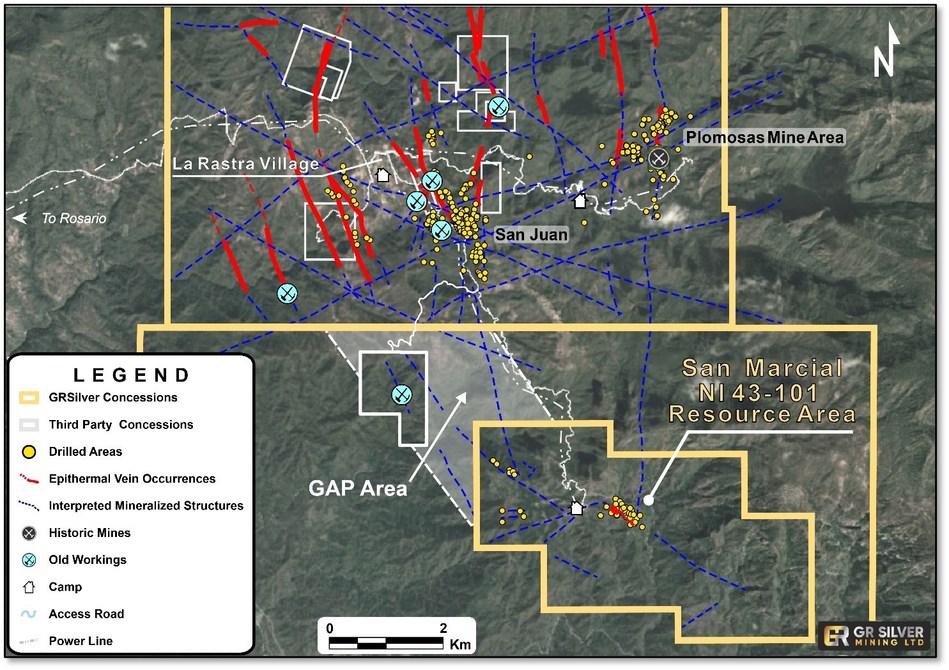

GAP Area

During the 2020 due diligence period for this acquisition, GR Silver Mining identified an area of the La Trinidad concession wedged between the Company’s two flagship projects – San Marcial and Plomosas – as a key area to investigate structural links between mineralization in the two projects. The area, known as the “GAP Area”, is a 6 km2 section of the La Trinidad concession connecting the NW-SE mineralization trends at both San Marcial and Plomosas (Figure 3). Over 2,000 rock samples were collected on grid lines and analysed by pXRF for multi-element geochemistry. Two anomalous NW-SE trending Au-Ag mineralized zones, along with a number of shallow underground workings, were identified which connect with known mineralized vein and breccia structures in the San Marcial and the Plomosas concessions. Preliminary channel and chip sampling was completed, but the structures remain to be drill tested.

Initial Work Plans

GR Silver Mining is currently organizing and evaluating the data generated from the historical regional datasets, as well as specific targets that were previously drilled. The Company believes that there is significant Au and Ag exploration potential in the La Trinidad concession, with more than 24 known and under-explored mineral occurrences, as well as historic workings.

Following the success of the Company’s initial due diligence work in the GAP Area, GR Silver Mining is planning to extend the current San Marcial IP and ground magnetic survey (see News Release dated February 22, 2021) into the GAP Area to investigate further the continuity of the mineralized trends and define drill targets.

GR Silver Mining President and CEO, Marcio Fonseca, commented, “With this exciting acquisition, GR Silver Mining becomes the first company in the history of the Rosario Mining District to control 100% of the key Ag-Au assets, including two past-producing mines – Plomosas and La Trinidad – as well as the San Marcial Project. I encourage everyone to read the section below that describes in detail the assets under acquisition and the opportunities that they represent. Acquisition of the Marlin portfolio strengthens our position in the region and our control of the mineralized trends on the eastern border of the Rosario Mining District. We now control three highly prospective, regional mineralized trends totalling 75 km combined length with at least 24 old workings/shallow mines already identified for future drilling. This acquisition is in line with our long-term strategy, as presented to investors since listing just three years ago, and is consistent with our desire to control 100% of the most important silver and gold assets in the Rosario Mining District, Sinaloa, Mexico. This acquisition continues our objective to deliver significant shareholder value through new discoveries and continuous resource expansion.”

As consideration for all the issued and outstanding shares of Marlin, GR Silver Mining will pay CDN$50,000 to Mako, and Oro Gold will grant Mako a 1% net smelter return (“NSR“) royalty on the concessions owned by Oro Gold. GR Silver Mining and/or Oro Gold will be granted the right to purchase the NSR at any time upon making a one-time payment of US$2,000,000. Mako shall be responsible for and shall pay all costs related to the Closure Plan Activities at La Trinidad and all other matters that may be required to obtain the Closure Plan Certification. All proceeds from the lawsuit Mako and Oro Gold have filed against their insurers and reinsurers related to damages from Hurricane Willa will be for the benefit of Mako, and Mako will be responsible for the costs of this litigation. Oro Gold will take on the responsibility of all outstanding mining duties owed on the concessions.

Figure 1 Location of Acquired Oro Gold Concessions

The “core concessions”, which include La Trinidad, currently being decommissioned, and Cimarron, as well as the ground between GR Silver Mining’s own San Marcial and Plomosas Projects, represent strategic ground for future drilling (Figure 1). Oro Gold, going forward, intends to maintain all concession taxes in good standing. The concession taxes owed due to previous non-payment by Oro Gold, from 2016, on the core concessions total approximately CDN$6.6 million. Oro Gold can request a Payment Agreement by instalments from the Mexican Government, once an official communication for payment has been received on outstanding concession taxes. Currently Oro Gold has the right to re-pay outstanding concession taxes on a monthly basis over five years. The details of any future payment arrangements will be disclosed when completed.

The “non-core concessions” are shown in Figure 1 and are currently of secondary priority due to their relatively early stages of exploration. GR Silver Mining will be reviewing all non-core concessions and will be considering the potential for future business opportunities to reduce concession tax obligations. Concession taxes owed on the non-core concessions due to previous non-payment by Oro Gold, from 2016, total approximately CDN$5.7 million and payment arrangements will be made with the Mexican Government as outlined above, if necessary.

Geologic Setting of the Acquired Concessions

The geology of the Rosario Mining District, and specifically the Oro Gold concessions, is characterized by volcanic sequences of the Sierra Madre Occidental dating from the Cretaceous to Miocene. Volcanic rocks of the older Lower Volcanic Series are typically of andesitic to dacitic, and tuffaceous to volcaniclastic compositions with frequent mafic volcanic flows. The younger and overlying Upper Volcanic Series is characterized by thick rhyolite and ignimbrite sequences, with bimodal mafic volcanic flows. Regional extensional faulting with NW-SE trends is common and produces horst and graben-style fault blocks. Similar sequences and structural settings are seen further to the north in the San Dimas Mining District.

The Eocene-aged Sinaloa batholith is exposed in parts of the concessions and there is evidence of monzonitic to granodioritic intrusions. In addition to the past-producing La Trinidad, there are numerous occurrences and old mine workings on the large newly acquired concessions, with epithermal Ag, Ag-Au and Au-Ag vein-type mineralization, which is typically hosted in volcanic sequences of the Lower Volcanic Series, and less commonly developed in the felsic units of the Upper Volcanic Series. Occurrences of porphyry-type Cu-Mo mineralization have been described in several areas and is associated with the monzonitic to granodioritic intrusive bodies. The relationship of Ag-Au epithermal and Au-Ag-Cu porphyry-related mineral occurrences is not well understood at this time, but also opens up the potential for systematic exploration for porphyry Cu mineralization.

Core Concessions Exploration History

The main focus of exploration activities on the Oro Gold concessions has historically been on the La Trinidad mine (Taunus Pit).

Historical exploration has been sporadic on the majority of the areas being acquired. Regional geochemical datasets have been collected across many of the concessions however only limited follow up and drilling has occurred, given the key objective of gold production from Taunus. Nonetheless, a number of highly prospective targets have been identified in the past and GR Silver Mining plans to further investigate them with additional surface drilling if results support the potential for attractive near surface mineral deposits

Exploration targets

Numerous exploration targets with precious metal focus have been identified on the La Trinidad concessions, of which some have been advanced to drill stage. Exploration work has been completed at the Cerro Colorado, Tequila and Las Palmas targets. Other notable exploration targets are listed below:

- Colinas and Bocas: The Colinas and Bocas targets are the southern and northern extensions, respectively, of the Taunus open pit. Several RC and core drilling campaigns (over 120 drill hole) outline a 1 km trend from the open pit in a SE direction to the Colinas target. Due to the shallow extent of drilling the target remains underexplored.

- San Carlos: Located approximately 3 km NW of the Trinidad mine, the San Carlos target is covered by a ground magnetic survey, with trenching, sampling and mapping programs. Drill results reporting 1.87 g/t Au over 36 m and 4.6 g/t Au over 13 m6.

Figure 2 La Trinidad Concession – Mineralized Trends and Historical Workings

- Guayabo: The Guayabo target is located about 8 km SE of the Trinidad mine, and consists of three prospects (La Viguita, Los Otates, Guayabo). Guayabo is a small historic tungsten mine (W-Mo veins). Drill targets were identified following a soil sampling program, and an intercept of 2.3 g/t Au and 94 g/t Ag over 10 m is reported1.

- San Cristobal: Located in the southern-most section of the NW-SE corridor, the San Cristobal target is approximately 12 km SE of the Trinidad Au mine. A total of 4,841 soil samples cover an area of 30 km2 and outline a 500 m wide zone of Au-bearing quartz veins and stockwork structures that extends for 1.5 km. Over 1,600 chip and channel samples were taken, complementing geologic mapping, identifying five individual prospects. Initial RC and diamond drilling (1,200 m) tested the area confirming Au mineralisation with reported intercepts of 1.19 g/t Au over 17.65 m, including 3.44 g/t Au over 4.35 m5. Significant exploration upside remains at San Cristobal, representing one of the most attractive areas for potential drilling in 2021.

- Potrerillos: Located approximately 2 km NE of the Trinidad mine, Potrerillos is a prospect that was identified by mapping and chip/channel sampling (700 samples), with 7.8 g/t Au over 5 m reported from channel sampling1.

Figure 3 GAP Area – Structural Links Between San Marcial and Plomosas Projects

Qualified Person

The scientific and technical data contained in this News Release related to the Plomosas Project was reviewed and/or prepared under the supervision of Marcio Fonseca, P.Geo. He has approved the disclosure herein.

About GR Silver Mining Ltd.

GR Silver Mining Ltd. is a Mexico-focused company engaged in cost-effective silver-gold resource expansion on its key assets which lie on the eastern edge of the Rosario Mining District, Sinaloa, Mexico.

Plomosas Silver Project

GR Silver Mining owns 100% of the Plomosas Silver Project located near the historic mining village of La Rastra, within the Rosario Mining District. The Project is a past-producing asset where only one mine, the Plomosas silver-gold-lead-zinc underground mine, operated a 600 tpd crush milling flotation circuit from 1986 to 2001, producing approximately 8 million ounces of silver, 73 million pounds of lead and 28 million pounds of zinc.

The Project has an 8,515-hectare property position and is strategically located within 5 km of the Company’s San Marcial Silver Project in the southeast of Sinaloa State, Mexico.

The March 2020 acquisition of the Plomosas Silver Project included 563 historical and recent drill holes from both surface and underground locations. These drill holes represent an extensive database allowing the Company to advance towards resource estimation and potential project development in the near future.

The Company is carrying out a drilling program with surface holes focused on expanding known mineralization along strike in two initial areas, the Plomosas Mine Area and the San Juan Area. Underground drilling included in the program will target the extension of recent Au-rich discoveries at the lowest level (775 m RL, or ~250 m below surface) of the Plomosas Mine Area and six low sulphidation epithermal veins at the San Juan Area. Both areas will be the subject of NI 43-101 resource estimations following completion of this drill program.

The 100%-owned assets include all facilities and infrastructure including: access roads, surface rights agreement, water use permit, 8,000 m of underground workings, water access, 60 km – 33 KV power line, offices, shops, 120-person camp, infirmary, warehouses and assay lab representing approximately US$30 million of previous capital investments. The previous owners invested approximately US$18 million in exploration, including extensive geophysics and geochemistry programs.

The silver-gold mineralization on this Project displays the alteration, textures, mineralogy and deposit geometry characteristics of a low sulphidation epithermal silver-gold-base metal mineralized vein/breccia system. Previous exploration was focused on polymetallic (Pb-Zn-Ag-Au) shallow mineralization, hosted in NW-SE structures in the vicinity of the Plomosas mine. The E-W portion of the mineralization and extensions of the main N-S Plomosas Fault remain under-explored.

In addition to the resource potential at Plomosas, a review of the existing drill hole database, geophysical surveys and geochemical data covering most of the concession, has defined 16 new exploration targets from which 11 have high priority for future exploration programs.

San Marcial Project

San Marcial is a near-surface, high-grade silver-lead-zinc open pit-amenable project. The Company filed a National Instrument 43-101 (“NI 43-101”) report entitled “San Marcial Project Resource Estimation and Technical Report, Sinaloa, Mexico” having an effective date of March 18, 2019 and an amended date of June 10, 2020 (the “Report”), which contains a 36 Moz AgEq (Indicated) and 11 Moz AgEq (Inferred) resource estimate. The Report was prepared by Todd McCracken and Marcelo Filipov of WSP Canada Inc. and is available on SEDAR. The company recently completed over 320 m of underground development in the San Marcial Resource Area, from which underground drilling is planned to expand the high-grade portions of the resource down-dip. The Company recently discovered additional mineralization in the footwall, outside of the existing resource, and will also be drilling this area. GR Silver Mining is the first company to conduct exploration at San Marcial in over 10 years.

Recent exploration has identified silver and gold mineralization in areas previously defined as non-mineralized, discovering evidence of pervasively altered rocks with intense silicification, veining and associated wide, silver and gold mineralized zones on the footwall of the NI 43-101 resource area. Plomosas and San Marcial collectively represent a geological setting resembling the multimillion-ounce San Dimas Mining District which has historically produced more than 600 Moz Ag and 11 Moz Au over a period of more than 100 years.

La Trinidad Project

The La Trinidad Project was acquired in March 2021. While La Trinidad has been the focus of artisanal mining activity over many decades, commercial operations began late in the 20th century. Anaconda Minerals Corp. was first to drill the project in the mid-late 1980s. After initially taking up an option on the Project in 1993, Eldorado Gold Corp. then commenced an open pit gold mine at La Trinidad in 1995, known as the Taunus Pit, with ore being processed via a heap leach operation. The mine operated until 1998, producing approximately 52,000 ounces of gold1.

Exploration undertaken by Oro Gold from 2006 identified additional resources below the Taunus Pit and operations recommenced late in 2014. Gold output from the heap leach pads continued until late 2019 for a total cumulative production by Oro Gold of 112,000 oz gold2,3.

In addition to La Trinidad, the portfolio acquired by GR Silver Mining includes an extensive regional database of geological, geochemical and geophysical information resulting from historical exploration expenditure by Oro Gold of more than CDN$18.6 million since 2006.

Cimarron Project

Cimarron is another advanced stage project that was acquired along with the La Trinidad Project in March 2021 and is located 40 km to the NW of La Trinidad (Figure 1). A number of targets have been identified at Cimarron including Calerita, El Prado, Huanacaxtle, Betty and Veteranos, however Calerita is the only target to have been drilled to date. The near surface historical NI 43-101 Inferred Resource at the Calerita prospect contains 3.7 Mt at 0.65 g/t Au for approximately 77,000 oz of gold4, which is considered to be open along strike and down dip.

Whilst the 2011 resource is considered by GR Silver Mining to be a historical resource, the Company considers the resource estimate as being relevant and reliable, considering a lack of significant additional exploration work since its release. A key parameter in the historical resource is the usage of a US$1,200/oz gold price compared to a much higher current spot gold price. A Qualified Person (QP) would be required to review the historical resource report and make recommendations in order to verify and upgrade it to a current resource. A QP has not done sufficient work to classify the historical estimate as current mineral resources. The Company is not treating the historical estimate as a current mineral resource. The company plans to re-assess the work completed by previous owners and define the feasibility of additional drilling, aiming at identifying additional near-surface mineralization.

Other Projects

GR Silver Mining’s other projects are situated in areas attractive for future discoveries and development in the same vicinity of Plomosas and San Marcial in the Rosario Mining District. Following the acquisition of Marlin, GR Silver Mining controls a concession portfolio of over 1,000 km2, two previously producing mines fully permitted for future developments and a total combined 75 km of structures with field evidence of 24 Ag-Au veins in historic old workings.

Mr. Marcio Fonseca

P. Geo, President & CEO GR Silver Mining Ltd.

- Refer to Marlin NI 43-101 News Release dated February 1, 2013

- Refer to Marlin MD&A Releases dated 30 April 2015, 29 April 2016, 1 May 2017, 30 April 2018, 29 August 2018

- Refer to Mako MD&A Releases dated 28 August 2019, 29 April 2020

- Refer to Marlin NI 43-101 News Release dated March 18, 2011

- Refer to Marlin News Release dated August 14, 2017

- Refer to Marlin News Release dated February 2, 2016

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accept responsibility for the adequacy or accuracy of this press release.

Disclaimer for Forward-Looking Information

This press release contains forward-looking statements and information that are based on the beliefs of management and reflect the Company’s current expectations. When used in this press release, the words “estimate”, “project”, “belief”, “anticipate”, “intend”, “expect”, “plan”, “predict”, “may” or “should” and the negative of these words or such variations thereon or comparable terminology are intended to identify forward-looking statements and information. Such statements and information reflect the current view of the Company. Risks and uncertainties may cause actual results to differ materially from those contemplated in those forward-looking statements and information. By their nature, forward-looking statements involve known and unknown risks, uncertainties and other factors which may cause our actual results, performance or achievements, or other future events, to be materially different from any future results, performance or achievements expressed or implied by such forward-looking statements.

SOURCE GR Silver Mining Ltd.

For further information: +1 (604) 202 3155, Email: info@grsilvermining.com