Long-established in the Metals & Mining industry, Golden Minerals Co (AUMN, Financial) has enjoyed a stellar reputation. It has recently witnessed a surge of 14.01%, juxtaposed with a three-month change of -77.68%. However, fresh insights from the GuruFocus Score Rating hint at potential headwinds. Notably, its diminished rankings in financial strength, growth, and valuation suggest that the company might not live up to its historical performance. Join us as we dive deep into these pivotal metrics to unravel the evolving narrative of Golden Minerals Co.

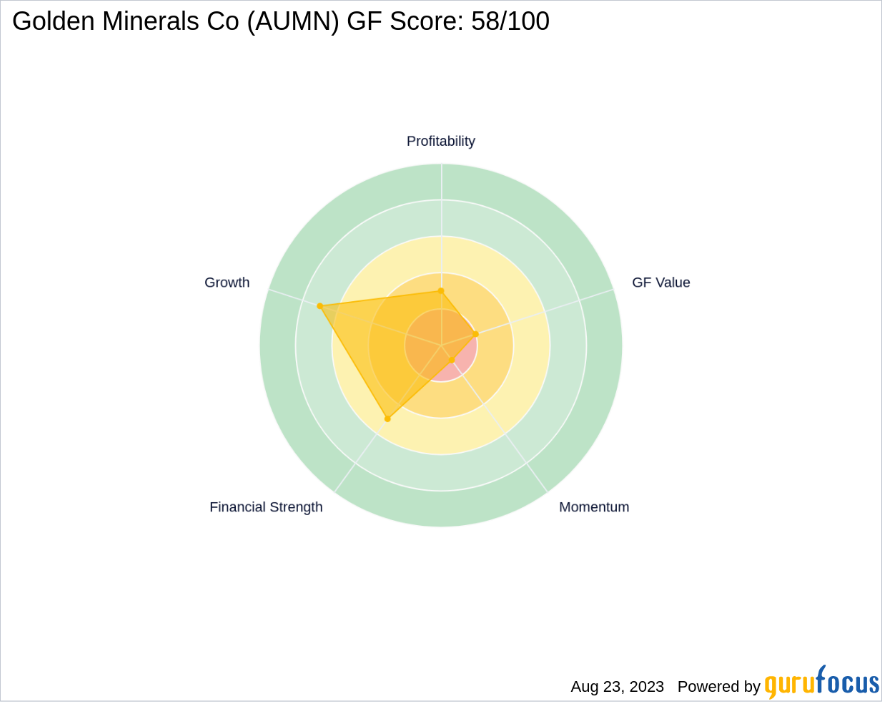

What Is the GF Score?

The GF Score is a stock performance ranking system developed by GuruFocus using five aspects of valuation, which has been found to be closely correlated to the long-term performances of stocks by backtesting from 2006 to 2021. The stocks with a higher GF Score generally generate higher returns than those with a lower GF Score. Therefore, when picking stocks, investors should invest in companies with high GF Scores. The GF Score ranges from 0 to 100, with 100 as the highest rank.

- 1. Financial strength rank: 5/10

- 2. Profitability rank: 3/10

- 3. Growth rank: 7/10

- 4. GF Value rank: 2/10

- 5. Momentum rank: 1/10

Based on the above method, GuruFocus assigned Golden Minerals Co the GF Score of 58 out of 100, which signals poor future outperformance potential.

Understanding Golden Minerals Co Business

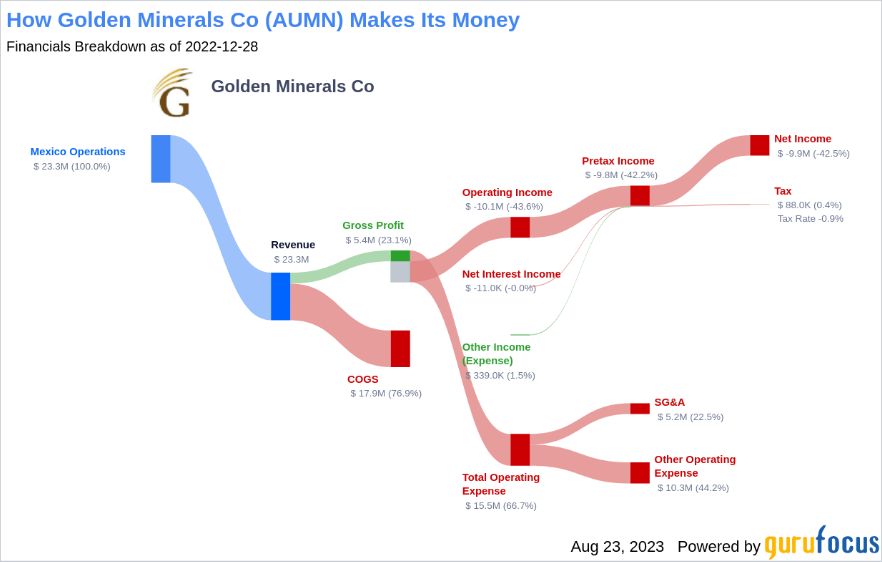

Golden Minerals Co is an exploration stage company engaged in the mining, construction, and exploration of precious metals and mineral properties. It owns and operates Velardena and Chicago precious metals mining properties and associated oxide and sulfide processing plants in the State of Durango, Mexico, the El Quevar exploration property in the province of Salta, Argentina, and a diversified portfolio of precious metals and other mineral exploration properties located in or near historical precious metals producing regions of Mexico. The company’s business is structured into two divisions, Mexico operations, and Corporate Exploration and Other.

Financial Strength Breakdown

Golden Minerals Co’s financial strength indicators present some concerning insights about the company’s balance sheet health. The company’s Altman Z-Scoreis just -50.5, which is below the distress zone of 1.81. This suggests that the company may face financial distress over the next few years.

Profitability Breakdown

Golden Minerals Co’s low Profitability rank can also raise warning signals. Golden Minerals Co’s Operating Margin has declined over the past five years ((-425,893.00%)), as shown by the following data: 2018: -0.98; 2019: -65.30; 2020: -156.11; 2021: -5.73; 2022: -43.57; .

With a Piotroski F-Score of 2, Golden Minerals Co’s financial health appears concerning. This score, rooted in Joseph Piotroski’s nine-point scale, evaluates a firm’s profitability, liquidity, and operating efficiency. Given its rating, Golden Minerals Co might be facing challenges in these areas.

Next Steps

Given the company’s financial strength, profitability, and growth metrics, the GuruFocus Score Rating highlights the firm’s unparalleled position for potential underperformance. It’s crucial for investors to consider these factors when making investment decisions. GuruFocus Premium members can find more companies with strong GF Scores using the following screener link: GF Score Screen

Original Article: https://www.gurufocus.com/news/2070879/golden-minerals-cos-rocky-road-ahead-unraveling-the-factors-limiting-growth