VANCOUVER, Oct. 25, 2017 /CNW/ – GOLDCORP INC. (TSX: G, NYSE: GG) ("Goldcorp" or the "Company") is pleased to provide an update to the Company's Mineral Reserve and Mineral Resource estimates as of June 30, 2017.

Highlights:

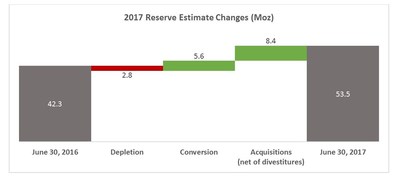

- Proven and Probable Gold Mineral Reserves Increased by 26% to 53.5 Million Ounces. The increase is primarily due to the successful conversion of 4.7 million ounces into mineral reserves at Century and the acquisition, net of non-core divestitures, of 8.4 million ounces of gold mineral reserves. The company is on track to achieve a targeted 60 million ounces of gold reserves by 2021 as part of its 20/20/20 growth plan.

- Inaugural Gold Mineral Reserve of 4.7 Million Ounces at Porcupine's Large-Scale Century Project and Completion of the Base Case Pre-feasibility Study. The Base Case Pre-Feasibility Study was positive and Goldcorp believes that exploration drilling and the upcoming optimization study could continue to add value to this organic project with low execution risk in a proven mining district.

- Strong Portfolio of Exploration Projects, Led by Cerro Negro and Coffee, to Provide Pipeline of Opportunities for Continued Future Reserve Growth. At the Silica Cap vein, gold and silver mineralization has been confirmed over a strike length of more than 1,300m and vertical depths of 350m. At Coffee, the new AmeriKona zone is delineated over a 200m strike of mineralization, and is undergoing further drill testing to connect to the Kona North zone with the potential to form a 950m contiguous mineralized zone.

"With the initial gold reserve estimate at Century completed, we are now more than one third of the way toward reaching our target of 60 million ounces of gold reserves by 2021. The continued exploration success at Coffee and Cerro Negro is a direct result of our new, systematic approach to exploration and is expected to contribute toward that goal," said Paul Harbidge, Senior Vice-President Exploration. "Our exploration strategy for the coming year will continue to focus on brownfield targets at or near our existing camps where we have demonstrated a high rate of success. We are excited by the exploration potential of our newly acquired Cerro Casale/Caspiche Project where, in addition to the two main deposits, there are numerous satellite and early stage targets for evaluation."

June 30, 2017

Goldcorp's proven and probable gold mineral reserves as of June 30, 2017 totaled 53.5 million ounces compared to 42.3 million ounces as of June 30, 2016, an increase of 26%. The addition of 11.2 million ounces of gold mineral reserves during the period includes 5.6 million ounces converted from successful exploration and mine design optimization, primarily driven by the inaugural gold mineral reserves of 4.7 million ounces at Porcupine's Century Project. The balance of the increase in reserves comes as result of the acquisition of 50% of Cerro Casale which resulted in the addition of 8.4 million ounces, net of non-core divestments including Los Filos and Camino Rojo1. Goldcorp reported 2.8 million ounces of attributable gold production during the twelve month period ended June 30, 2017, which after excluding the effects of Los Filos and Marlin, resulted in 2.8 million ounces of depletion.

Measured and Indicated gold mineral resources remained relatively unchanged after giving effect to the impact of the successful conversion of indicated mineral resources into proven and probable mineral reserves at Century, the addition of 50% of Caspiche and Cerro Casale, which added 13.3 million ounces, mainly offset by the sales of Los Filos and Camino Rojo1, which together removed 17.5 million ounces. The sale of Cerro Blanco and San Nicolas also contributed to a reduction in measured and indicated mineral resources of 1.1 million ounces. Inferred mineral resources decreased to 20.0 million ounces from 22.5 million ounces, primarily as a result of the sale of Los Filos.

Mineral reserve estimates were based on a gold price of $1,200 per ounce while mineral resources were estimated using a gold price of $1,400 per ounce. Gold price assumptions were unchanged from last year's estimates. Complete mineral reserve and mineral resource information, including tonnes and grades for all metals and details of the assumptions used in the calculations, can be found in the table and associated notes below or on the Company website here.

_____________________________ |

1 The sale of Camino Rojo remains pending and subject to the satisfaction of customary conditions precedent. Goldcorp has removed Camino Rojo from its Mineral Reserve and Mineral Resource Estimates as of June 30, 2017. The sale is expected to close in the fourth quarter of 2017. |

Porcupine

Proven and probable gold mineral reserves as of June 30, 2017 totaled 8.1 million ounces, compared to 2.3 million ounces as of June 30, 2016. The significant increase in gold mineral reserves is a result of the conversion of 4.7 million ounces from the indicated category at the Century Project. Borden mineral reserves remained unchanged at 0.95 million ounces and are now included into the June 30, 2017 Porcupine estimate. Excluding Century and Borden, mineral reserve additions at Porcupine are exceeding mine depletion and are a result of exploration success and engineering.

At Century, the base case pre-feasibility study was based on the following:

Century Project – Base Case Pre-feasibility Study | |

Mine Life | 14 years |

Contained Gold Ounces | 5,710,000 |

Plant Size | 50,000 t/d |

Gold Grade (diluted) | 0.87 g/t |

Gold Recovery | 88% |

Strip Ratio (waste to ore) | 4.5:1 |

Operating Costs (Mining, Process, G&A) | US$17 to US$18/tonne processed |

Initial Capex1 | US$950 to US$1,050 million |

Sustaining Capital and Tailings Expansion | US$350 to US$400 million |

1 Includes 10% contingency | |

The base case pre-feasibility study is based on a total mineral reserve estimate of 5.7 million ounces of gold, including 1.0 million ounces of previously reported mineral reserves from the Pamour pit, which have been integrated into the proposed Century project. However, the study excludes approximately 1.0 million ounces of inferred mineral resources within the existing Dome reserve pit design, which the Company expects a portion to be converted following additional exploration drilling. Over the course of the next year, Goldcorp will conduct a series of tradeoff studies to further optimize the project with a focus on evaluating the latest technologies to reduce project footprint and improve mining and processing efficiencies. Ore sorting technologies, co-mingling of tailings with waste rock (Eco-Tails) to reduce water use, conveying of rock from the pit, electrical and/or autonomous equipment, and optimized process plant design will all be studied as part of this process. The optimized pre-feasibility is expected to be completed in the second half of 2018.

In 2018, reserve replacement will be focused on the evaluation of the down plunge extension of the mineralized veins at Hoyle Pond and the conversion of a portion of the inferred resources contained within the Century's Dome pit design.

Exploration efforts will be focused on following up on the results of the prospectivity analysis completed over the Timmins district. Core drilling commenced on the first priority target, Ethier. The first two holes cut quartz tourmaline veins hosted by mafic volcanics, confirming the geological model and indicating similarities to Hoyle Pond. Gold assay results are pending. During the course of 2018, drilling is also planned for Snowy Owl and the Coniaurum-McIntyre mineralized trend.

At Borden, exploration will continue to focus on developing the geological model for the deposit as well as completing reconnaissance work over the greater claim block to provide a portfolio of early stage targets for testing in 2018.

Musselwhite

Proven and probable gold mineral reserves as of June 30, 2017 totaled 1.9 million ounces, compared to 1.7 million ounces as of June 30, 2016. Exploration success and mine design optimization resulted in the addition of 0.4 million ounces, more than offsetting depletion of 0.3 million ounces.

Drill programs continued to test and confirm the down plunge continuity of mineralization in the west limb of the deposit, which is expected to account for the majority of reserve replacement in 2018.

The surface drill program on the north shore of Opapamiskin Lake, which is a 1.1km step out from known reserves, continued during the third quarter. The initial pilot hole (17-NSD-001) was completed in late July 2017 to a depth of 2,130m. The hole drilled steeper than planned and intersected a zone of mineralization below the planned PQ Deeps returning 3.2 g/t over 2.7m from 2,036.3m within the Northern Iron Formation. A first wedge hole (17-NSD-002) was also completed and intersected the PQ Deeps mineralization returning 2.0 g/t over 4.5m from 2,042.5m associated with shearing, quartz flooding and pyrrhotite mineralization. A third wedge hole commenced to further test the PQ Deeps lode 100m up plunge. While the initial gold grades are low, the Company believes this demonstrates the extension of the WEL mineralization more than 1km from known mineral reserves and will be the focus of further drilling going forward.

Work is progressing on the property scale exploration and plans are underway to drill test the first target away from the main deposit, Karl Zeemal, during the winter season.

Red Lake

Proven and probable gold mineral reserves as of June 30, 2017 totaled 2.2 million ounces, compared to 2.0 million ounces as of June 30, 2016. Mine depletion was fully offset by the combination of resource conversion as a result of successful exploration and more favorable economic parameters used in the estimate.

The 10% increase in gold reserves is primarily a result of the initial mineral reserve estimate of 0.15 million ounces at Cochenour. The test stope mined at Upper Cochenour earlier this year performed as expected and in combination with a positive outcome of the pre-feasibility study, the development focus will shift from drill platforms to lateral development in 2018. The block model updated as part of the pre-feasibility study provided enough confidence resulting in the conversion of ounces into the reserve category.

The new mine plan at Cochenour is expected to contribute 5,000 to 10,000 ounces in 2018 and approximately 30,000 to 50,000 ounces annually to the overall production at the Red Lake camp once in production, which is expected in 2019. As the understanding of the Cochenour deposit continues to advance, the aim is to maintain resource conversion and perpetuate a constant production level in future years. The production profile remains based on a starter mine approach and Cochenour continues to have potential through expansion at depth and laterally to further increase annual production. Cochenour has 0.3 million ounces of measured and indicated mineral resources and 2.0 million ounces of inferred mineral resources already defined.

At the HG Young Complex, during the third quarter of 2017, the Company completed a study evaluating the trade-off for the preferred method for accessing the deposit, updated the geological interpretation with additional drilling data, and evaluated the project economics to determine whether further investment was warranted. The study concluded that the preferred access has shifted from a surface decline to underground access from the Campbell mine on either the 14 level and/or 21 level based primarily on the favorable drilling results obtained between 11 and 21 levels and the potential for continuity at lower levels as the deposit is open at depth. The updated mineral resource estimate provided 0.2 million ounces of measured and indicated mineral resources and 0.3 million ounces of inferred mineral resources.

Based on the positive overall results of the study, the Company will invest in a further study with the goal to double and upgrade the current resource by 2019, primarily through infill drilling and extending the deposit at depth. Expenditures will primarily be related to development on the 14 and 21 levels to provide drilling platforms and additional drilling. In the event of a positive outcome of the further study, the Company would commence the development of the preferred material handling system in order to facilitate production. Goldcorpexpects the HG Young Complex could become an integral part of the Red Lake mine plan in the future.

As well as advancing Cochenour, HG Young and other targets within the Red Lake deposit to further convert resources into reserves, exploration embarked on a complete review of the Red Lake belt. The first step in this exercise is the collation, scanning, digitization and layering of more than 60 years of historical data. Once completed, this data will be incorporated into a prospectivity analysis that will drive exploration through 2018 and beyond.

Cerro Negro

Proven and probable gold mineral reserves as of June 30, 2017 totaled 4.9 million ounces, relatively unchanged compared to June 30, 2016. Depletion was fully offset by exploration success at Mariana Norte Este B and Eureka and by mine design optimization leading to lower cut-off grade and dilution assumptions in certain areas of the mine.

The exploration program ramped up this year with the aim of increasing resources to outpace reserve depletion. The current strategy is to outline the economic potential of at least three new veins for infill drilling. The first vein system to achieve this status is Silica Cap, where 33 diamond holes totaling 15,876m were drilled during the third quarter of 2017.

The exploration program at Silica Cap identified two main, parallel and south/south-west dipping, quartz veins named Silica Cap (500 vein) and Gato Salvaje (600 vein). At the Silica Cap vein, gold and silver mineralization has been confirmed over a strike length of more than 1,300m and vertical depths of 350m, while the Gato Salvaje vein was traceable for at least 800m along the strike and a vertical extension of 350m. The veins show classic epithermal textures as banded quartz and brecciation with hematite and jarosite. Drill core assay results received during the quarter are summarized below:

Mineralized intervals from the Silica Cap 500 vein.

HOLE ID | From (m) | To (m) | True Width (m) | Au (g/t) | Ag (g/t) |

SCDD-17014 | 221.20 | 229.25 | 5.10 | 5.72 | 49.84 |

SCDD-17016 | 391.40 | 395.00 | 3.36 | 6.13 | 54.80 |

SCDD-17020 | 579.25 | 583.15 | 3.59 | 2.07 | 4.04 |

SCDD-17023 | 302.20 | 314.00 | 10.29 | 3.31 | 7.94 |

SCDD-17029 | 80.50 | 112.50 | 30.69 | 19.10 | 76.40 |

SCDD-17027 | 209.75 | 210.25 | 0.45 | 0.93 | 2.03 |

SCDD-17040 | 362.95 | 365.00 | 1.83 | 4.16 | 19.35 |

Mineralized intervals from the Silica Cap 600 (Gato Salvaje) vein.

HOLE ID | From (m) | To (m) | True Width (m) | Au (g/t) | Ag (g/t) |

SCDD-17017 | 471.40 | 487.30 | 14.87 | 1.88 | 5.77 |

SCDD-17020 | 360.80 | 365.60 | 4.48 | 2.62 | 7.97 |

SCDD-17021 | 248.00 | 255.70 | 7.55 | 9.09 | 43.64 |

SCDD-17040 | 109.70 | 116.60 | 5.66 | 9.38 | 54.10 |

Notes: | |

1. | True widths are estimated based on drill angle and interpreted geometry of mineralization |

2. | Details of analytical procedures including quality assurance / quality control can be found in the 2016 Technical Report filed on Sedar |

3. | Drill results were reviewed and approved by Cesar Riveros-MAusIMM (CP Geo), Exploration Superintendant, Cerro Negro |

4. | Selected data is for the quarter ended September 30, 2017 |

In the greater Vein Zone area, which includes the deposits of Bajo Negro, Vein Zone and advanced target of Silica Cap, a fence line of drill holes was completed across the geological strike of the mineralized trend to explore the potential occurrence of additional veins between known deposits of Vein Zone and Bajo Negro based on similar occurrences in other districts both at Cerro Negro and around the world. Hole VBDD017008 intersected a new vein named 'Alpha' returning 2.65m at 7.16 g/t gold and 95.79 g/t silver from 92.10m confirming the prospectivity of this district. Further drilling is being planned.

Exploration drilling commenced on the second vein target of Eureka SE, a 600m exposed quartz vein complex at surface with total target length of 4km. The near surface portion of the vein was drill tested in 2011 confirming continuity of the silica structure but did not encounter significant mineralization. Deeper holes drilled at the western limit of target in 2013, below the 500m level, returned higher values up to 7.54 g/t gold over 14.30m and 3.88 g/t gold over 12.75m. The geometry of this shoot was not defined and remained open to the southeast.

The current drill program is designed to evaluate the Eureka SE system, initially through a wide spacing drill program along its prospective strike, but at a lower vertical elevation. The first hole intersected broad, low grade gold mineralization 300m to the southeast of the previous intercepts (1.22 g/t gold over 10.85m in EDD-17001). In order to accelerate the program, a reverse circulation drill rig was used for pre-collaring of the holes. Drilling of this target will continue during the fourth quarter of 2017.

Peñasquito

Proven and probable gold mineral reserves as of June 30, 2017 totaled 9.0 million ounces, compared to 10.0 million ounces as of June 30, 2016. Mine depletion accounted for 0.7 million ounces, while higher input costs and updated metallurgical recoveries lead to a change in cut-off grade resulting in the reclassification of approximately 0.4 million ounces into the measured and indicated mineral resource category.

Exploration at Peñasquito is now focused on the evaluation of a portfolio of 23 early stage targets which were highlighted through generative work in 2017 and which the Company expects will drive the future success of the district.

Eleonore

Proven and probable gold mineral reserves as of June 30, 2017 totaled 3.8 million ounces, compared to 4.6 million ounces as of June 30, 2016. Mine depletion and resource model variance accounted for a decrease of 0.3 million ounces and 0.2 million ounces respectively, while engineering changes resulted in the reclassification of 0.3 million ounces into the measured and indicated mineral resource category.

While further drilling and production results continue to define the geological complexity of the orebody, in 2017, Goldcorp continued its efforts to improve the geological understanding and the reliability of its reserve and resource estimates and optimized production profile. As part of a broader program of generative exploration, efforts at the Eleonore Mine have been refocused on opportunities in the upper part of the mine and in the broader geological district. The summer exploration field season resulted in mapping, sampling and data integration over 9 early stage target areas, the first field work on the property in more than 10 years. The data is currently being interpreted to define and prioritize drill targets for the winter program.

Coffee

Proven and probable gold mineral reserves as of June 30, 2017 remained unchanged at 2.2 million ounces. The seasonal nature of the drill program at Coffee did not allow time to incorporate all recent results into an updated mineral reserve estimate. As the program concludes in the upcoming weeks, the complete results of the program will be incorporated into the geological model and Goldcorp will provide an update during the first quarter of 2018.

During the third quarter, a total of 22,073m were drilled, taking the 2017 season total to 58,879m drilled on the property.

As outlined recently in Goldcorp's September 25, 2017 new release, drilling in the western area of Coffee discovered new mineralization located between the Kona North deposit and the Americano zones. This new zone, named AmeriKona, currently comprises 200m strike delineated on 50m spaced drill centers, and wholly to partially oxidized mineralization which extends to 75m below surface. AmeriKona lies directly along strike of Kona North, separated by approximately 250m, which is currently undergoing drill testing in order to link the two zones into a contiguous mineralized zone. If connected, the zones could have up to 950m strike. In addition, AmeriKona and Kona North lie at the eastern end of a 4km strike length mineralized corridor defined by semi-contiguous gold-in-soil geochemistry and a coincident linear magnetic low. Exploration drilling is also underway to link AmeriKona with the previously defined Americano zone located 1.1km west, along strike. Additional drill results were received from this target since the September 25, 2017 news release and are presented in the table below.

Mineralized intervals from the AmeriKona target

HOLE ID | From (m) | To (m) | Drilled Width (m) | True width (m) | Au (g/t) |

Diamond drill holes | |||||

CFD0681 | 35.0 | 46.0 | 11.0 | 7.3 | 1.01 |

and | 64.0 | 75.0 | 11.0 | 7.3 | 0.95 |

and | 131.0 | 132.0 | 1.0 | 0.7 | 1.22 |

RC drill holes | |||||

CFR1462 | No Significant Value | ||||

CFR1463 | 65.5 | 82.3 | 16.8 | 11.2 | 2.17 |

and | 96.0 | 108.2 | 12.2 | 8.1 | 1.74 |

CFR1464 | 21.3 | 22.9 | 1.5 | 1.0 | 1.08 |

CFR1465 | 106.7 | 125.0 | 18.3 | 12.2 | 1.39 |

CFR1466 | 56.4 | 79.3 | 22.9 | 15.2 | 1.58 |

and | 99.1 | 105.2 | 6.1 | 4.1 | 1.38 |

CFR1467 | No Significant Value | ||||

CFR1468 | 88.4 | 115.8 | 27.4 | 18.3 | 1.37 |

CFR1469 | 36.6 | 65.5 | 29.0 | 19.3 | 1.65 |

CFR1470 | 152.4 | 164.6 | 12.2 | 8.1 | 2.79 |

and | 187.5 | 199.6 | 12.2 | 8.1 | 1.14 |

CFR1471 | No Significant Value | ||||

Notes. RC holes are sampled per 5' drill rod and the 'From/To' meters are subsequently converted to metric; the converted depth measurements quoted at 2 decimal places does not indicate centimeter accuracy of sampling. True width of intersected mineralized zones averages 2/3 of downhole width. |

Goldcorp recognizes the potential for the Coffee deposit to host significant transitional and sulphide resources given all the mineralized structures extend over several kilometers strike. Those mineralized structures have however only been tested to relatively shallow depths of approximately 200m below the surface and remain open down dip. In addition to recent high grade sulphide intercepts at West Coffee, Goldcorp embarked upon a first phase of deep drilling to test the sulphide potential of the project at the Latte and Supremo T3 targets. Three holes were completed during the third quarter of 2017 and intersected the structures as modelled. All gold assay results are pending.

Cerro Casale & Caspiche Project

The acquisition of 50% of the Cerro Casale and Caspiche Projects provided 11.6 million ounces of gold mineral reserves, 13.3 million ounces of measured and indicated gold mineral resources and 3.9 million ounces of inferred gold mineral resources. Together, the Cerro Casale and Caspiche Projects are part of a large multi-million ounce district with numerous underexplored and untested targets.

Goldcorp commenced an aggressive exploration program which includes three areas of focus:

- Validation of the geological models of the two main deposits, Cerro Casale and Caspiche, through a re-log of approximately 140,000m of drill core;

- An initial 16,000m diamond drill program is due to commence on December 1, 2017 to increase the geological confidence of both deposits as well as providing samples for metallurgical testwork and geotechnical data; and

- Data evaluation of four satellite targets which Goldcorp believes demonstrate strong exploration potential.

Exploration Outlook

Goldcorp's $100 million exploration budget in 2017 has been almost entirely allocated to brownfield projects in existing camps with the primary focus to leverage exploration potential in known and proven mining districts. The Company continues to focus on target generation in those same districts to ensure a constant supply of new targets to support the Company's goal to grow gold reserves to 60 million ounces by 2021. The road map to achieving this goal is predicated on continued exploration success at Coffee and Cerro Negro, the potential to add and convert mineral resources into reserves at Caspiche and Pueblo Viejo and other exploration successes across the portfolio as exploration targets systematically move up the Resource Triangle.

Goldcorp Mineral Reserves | ||||||||||||||

PROVEN | PROBABLE | PROVEN & PROBABLE | As of | |||||||||||

Ownership | Tonnage | Grade | Contained | Tonnage | Grade | Contained | Tonnage | Grade | Contained | Contained | ||||

Gold | mt | g/t | m oz | mt | g/t | m oz | mt | g/t | m oz | m oz | ||||

Alumbrera | 37.5% | 15.11 | 0.39 | 0.19 | 1.43 | 0.37 | 0.02 | 16.54 | 0.39 | 0.21 | 0.12 | |||

Cerro Casale | 50.0% | 114.85 | 0.65 | 2.39 | 483.95 | 0.59 | 9.23 | 598.80 | 0.60 | 11.62 | – | |||

Cerro Negro | 100.0% | 4.46 | 8.79 | 1.26 | 12.67 | 8.85 | 3.60 | 17.13 | 8.83 | 4.86 | 4.85 | |||

Coffee | 100.0% | – | – | – | 46.36 | 1.45 | 2.16 | 46.36 | 1.45 | 2.16 | 2.16 | |||

El Morro | 50.0% | 160.91 | 0.56 | 2.91 | 138.62 | 0.35 | 1.55 | 299.53 | 0.46 | 4.46 | 4.46 | |||

Éléonore | 100.0% | 2.73 | 6.94 | 0.61 | 16.88 | 5.87 | 3.19 | 19.61 | 6.02 | 3.80 | 4.57 | |||

Musselwhite | 100.0% | 3.94 | 7.22 | 0.91 | 4.91 | 5.92 | 0.93 | 8.84 | 6.50 | 1.85 | 1.69 | |||

Peñasquito | 100.0% | 361.18 | 0.59 | 6.80 | 163.57 | 0.41 | 2.14 | 524.75 | 0.53 | 8.95 | 10.02 | |||

Porcupine | 100.0% | 13.55 | 1.91 | 0.83 | 214.86 | 1.04 | 7.21 | 228.41 | 1.10 | 8.05 | 3.22 | |||

Pueblo Viejo | 40.0% | 40.45 | 2.82 | 3.67 | 16.77 | 3.19 | 1.72 | 57.21 | 2.93 | 5.39 | 5.97 | |||

Red Lake | 100.0% | 1.50 | 11.01 | 0.53 | 7.34 | 6.97 | 1.64 | 8.84 | 7.65 | 2.17 | 2.03 | |||

Other Assets | – | – | – | – | – | – | – | – | – | – | 3.19 | |||

Totals | 718.67 | 0.87 | 20.11 | 1,107.35 | 0.94 | 33.40 | 1,826.02 | 0.91 | 53.51 | 42.29 | ||||

Silver | mt | g/t | m oz | mt | g/t | m oz | mt | g/t | m oz | m oz | ||||

Cerro Casale | 50.0% | 114.85 | 1.91 | 7.04 | 483.95 | 1.43 | 22.30 | 598.80 | 1.52 | 29.34 | – | |||

Cerro Negro | 100.0% | 4.46 | 75.52 | 10.83 | 12.67 | 61.02 | 24.86 | 17.13 | 64.80 | 35.69 | 35.73 | |||

Peñasquito | 100.0% | 361.18 | 35.06 | 407.16 | 163.57 | 26.32 | 138.40 | 524.75 | 32.34 | 545.56 | 576.67 | |||

Pueblo Viejo | 40.0% | 40.45 | 18.68 | 24.29 | 16.77 | 14.07 | 7.58 | 57.21 | 17.33 | 31.87 | 36.10 | |||

Other Assets | – | – | – | – | – | – | – | – | – | – | 45.46 | |||

Totals | 520.94 | 26.83 | 449.32 | 676.96 | 8.87 | 193.14 | 1,197.90 | 16.68 | 642.47 | 693.96 | ||||

Copper | mt | % | m lbs | mt | % | m lbs | mt | % | m lbs | m lbs | ||||

Alumbrera | 37.5% | 15.11 | 0.24 | 79.13 | 1.43 | 0.17 | 5.29 | 16.54 | 0.23 | 84.42 | 83.09 | |||

Cerro Casale | 50.0% | 114.85 | 0.19 | 480.87 | 483.95 | 0.23 | 2,408.87 | 598.80 | 0.22 | 2,889.73 | – | |||

El Morro | 50.0% | 160.91 | 0.55 | 1,938.29 | 138.62 | 0.43 | 1,313.18 | 299.53 | 0.49 | 3,251.48 | 3,251.48 | |||

Pueblo Viejo | 40.0% | 40.45 | 0.09 | 83.25 | 16.77 | 0.10 | 36.83 | 57.21 | 0.10 | 120.08 | 130.40 | |||

Relincho | 50.0% | 217.65 | 0.38 | 1,807.95 | 401.91 | 0.37 | 3,279.24 | 619.57 | 0.37 | 5,087.19 | 5,087.19 | |||

Totals | 548.97 | 0.36 | 4,389.49 | 1,042.68 | 0.31 | 7,043.41 | 1,591.65 | 0.33 | 11,432.90 | 8,552.16 | ||||

Lead | mt | % | m lbs | mt | % | m lbs | mt | % | m lbs | m lbs | ||||

Peñasquito | 100.0% | 352.66 | 0.35 | 2,697.06 | 162.36 | 0.24 | 862.95 | 515.03 | 0.31 | 3,560.00 | 3,683.84 | |||

Totals | 352.66 | 0.35 | 2,697.06 | 162.36 | 0.24 | 862.95 | 515.03 | 0.31 | 3,560.00 | 3,683.84 | ||||

Zinc | mt | % | m lbs | mt | % | m lbs | mt | % | m lbs | m lbs | ||||

Peñasquito | 100.0% | 352.66 | 0.75 | 5,868.13 | 162.36 | 0.51 | 1,842.24 | 515.03 | 0.68 | 7,710.38 | 8,927.24 | |||

Totals | 352.66 | 0.75 | 5,868.13 | 162.36 | 0.51 | 1,842.24 | 515.03 | 0.68 | 7,710.38 | 8,927.24 | ||||

Molybdenum | mt | % | m lbs | mt | % | m lbs | mt | % | m lbs | m lbs | ||||

Relincho | 50.0% | 217.65 | 0.016 | 77.01 | 401.91 | 0.018 | 161.88 | 619.57 | 0.017 | 238.90 | 238.90 | |||

Totals | 217.65 | 0.016 | 77.01 | 401.91 | 0.018 | 161.88 | 619.57 | 0.017 | 238.90 | 238.90 | ||||

Note: Totals may not add up due to rounding |

Note: "Other Assets" refers to the assets removed from this year's estimate which were either divested or announced to be divested between June 30, 2016 and June 30, 2017, which include Los Filo, Camino Rojo, Cerro Blanco and San Nicolas. Marlin was also removed from this year's estimate as it transitioned into closure as of June 1, 2017. |

Goldcorp Mineral Resources | ||||||||||||||

MEASURED | INDICATED | MEASURED & INDICATED | As of | |||||||||||

Ownership | Tonnage | Grade | Contained | Tonnage | Grade | Contained | Tonnage | Grade | Contained | Contained | ||||

Gold | mt | g/t | m oz | mt | g/t | m oz | mt | g/t | m oz | m oz | ||||

Alumbrera | 37.5% | 14.89 | 0.28 | 0.14 | 1.05 | 0.21 | 0.01 | 15.94 | 0.28 | 0.14 | 0.78 | |||

Caspiche | 50.0% | 310.05 | 0.57 | 5.65 | 391.75 | 0.47 | 5.97 | 701.80 | 0.51 | 11.62 | – | |||

Cerro Casale | 50.0% | 11.48 | 0.30 | 0.11 | 136.85 | 0.36 | 1.57 | 148.32 | 0.35 | 1.69 | – | |||

Cerro Negro | 100.0% | 0.99 | 5.82 | 0.18 | 5.27 | 5.86 | 0.99 | 6.26 | 5.85 | 1.18 | 1.37 | |||

Coffee | 100.0% | 3.78 | 1.30 | 0.16 | 16.20 | 1.18 | 0.62 | 19.98 | 1.21 | 0.78 | 0.69 | |||

El Morro | 50.0% | 9.90 | 0.53 | 0.17 | 36.28 | 0.38 | 0.44 | 46.18 | 0.41 | 0.61 | 0.61 | |||

Éléonore | 100.0% | 3.67 | 7.65 | 0.90 | 3.48 | 3.87 | 0.43 | 7.16 | 5.81 | 1.34 | 0.93 | |||

Musselwhite | 100.0% | 0.29 | 5.55 | 0.05 | 1.73 | 4.68 | 0.26 | 2.02 | 4.81 | 0.31 | 0.46 | |||

Noche Buena | 100.0% | – | – | – | 55.00 | 0.37 | 0.65 | 55.00 | 0.37 | 0.65 | 0.65 | |||

Peñasquito | 100.0% | 126.07 | 0.29 | 1.16 | 149.25 | 0.25 | 1.20 | 275.32 | 0.27 | 2.35 | 2.81 | |||

Porcupine | 100.0% | 28.70 | 1.30 | 1.20 | 226.11 | 0.99 | 7.19 | 254.81 | 1.02 | 8.39 | 9.08 | |||

Pueblo Viejo | 40.0% | 6.79 | 2.33 | 0.51 | 63.64 | 2.33 | 4.76 | 70.43 | 2.33 | 5.27 | 5.15 | |||

Red Lake | 100.0% | 1.52 | 19.28 | 0.94 | 3.80 | 14.63 | 1.79 | 5.31 | 15.96 | 2.73 | 2.71 | |||

Other Assets | – | – | – | – | – | – | – | – | – | – | 18.73 | |||

Totals | 518.11 | 0.67 | 11.17 | 1,090.42 | 0.74 | 25.88 | 1,608.53 | 0.72 | 37.05 | 43.98 | ||||

Silver | mt | g/t | m oz | mt | g/t | m oz | mt | g/t | m oz | m oz | ||||

Caspiche | 50.0% | 310.05 | 1.20 | 11.98 | 391.75 | 1.20 | 15.15 | 701.80 | 1.20 | 27.12 | – | |||

Cerro Casale | 50.0% | 11.48 | 1.19 | 0.44 | 136.85 | 1.06 | 4.66 | 148.32 | 1.07 | 5.10 | – | |||

Cerro Negro | 100.0% | 0.99 | 59.15 | 1.88 | 5.27 | 43.01 | 7.29 | 6.26 | 45.55 | 9.17 | 11.48 | |||

Noche Buena | 100.0% | – | – | – | 55.00 | 12.35 | 21.84 | 55.00 | 12.35 | 21.84 | 21.84 | |||

Peñasquito | 100.0% | 126.07 | 29.12 | 118.02 | 149.25 | 24.90 | 119.51 | 275.32 | 26.83 | 237.53 | 258.27 | |||

Pueblo Viejo | 40.0% | 6.79 | 14.53 | 3.17 | 63.64 | 11.22 | 22.97 | 70.43 | 11.54 | 26.14 | 29.77 | |||

Other Assets | – | – | – | – | – | – | – | – | – | – | 180.43 | |||

Totals | 455.37 | 9.25 | 135.49 | 801.76 | 7.43 | 191.41 | 1,257.13 | 8.09 | 326.90 | 501.78 | ||||

Copper | mt | % | m lbs | mt | % | m lbs | mt | % | m lbs | m lbs | ||||

Alumbrera | 37.5% | 14.89 | 0.28 | 92.42 | 1.05 | 0.23 | 5.42 | 15.94 | 0.28 | 97.84 | 340.44 | |||

Caspiche | 50.0% | 277.10 | 0.23 | 1,405.07 | 363.95 | 0.18 | 1,444.27 | 641.05 | 0.20 | 2,849.34 | – | |||

Cerro Casale | 50.0% | 11.48 | 0.13 | 33.40 | 136.85 | 0.16 | 495.87 | 148.32 | 0.16 | 529.27 | – | |||

El Morro | 50.0% | 9.90 | 0.51 | 111.67 | 36.28 | 0.39 | 315.00 | 46.18 | 0.42 | 426.67 | 426.67 | |||

Pueblo Viejo | 40.0% | 6.79 | 0.09 | 13.43 | 63.64 | 0.09 | 119.77 | 70.43 | 0.09 | 133.20 | 118.93 | |||

Relincho | 50.0% | 39.95 | 0.27 | 240.43 | 158.54 | 0.34 | 1,180.79 | 198.50 | 0.32 | 1,421.22 | 1,421.22 | |||

Other Assets | – | – | – | – | – | – | – | – | – | – | 526.53 | |||

Totals | 360.10 | 0.24 | 1,896.42 | 760.31 | 0.21 | 3,561.12 | 1,120.41 | 0.22 | 5,457.54 | 2,833.80 | ||||

Lead | mt | % | m lbs | mt | % | m lbs | mt | % | m lbs | m lbs | ||||

Peñasquito | 100.0% | 117.47 | 0.26 | 677.80 | 132.93 | 0.20 | 592.71 | 250.40 | 0.23 | 1,270.51 | 1,469.11 | |||

Other Assets | – | – | – | – | – | – | – | – | – | – | 259.59 | |||

Totals | 117.47 | 0.26 | 677.80 | 132.93 | 0.20 | 592.71 | 250.40 | 0.23 | 1,270.51 | 1,728.70 | ||||

Zinc | mt | % | m lbs | mt | % | m lbs | mt | % | m lbs | m lbs | ||||

Peñasquito | 100.0% | 117.47 | 0.57 | 1,469.52 | 132.93 | 0.47 | 1,388.60 | 250.40 | 0.52 | 2,858.13 | 3,600.29 | |||

Other Assets | – | – | – | – | – | – | – | – | – | – | 1,589.19 | |||

Totals | 117.47 | 0.57 | 1,469.52 | 132.93 | 0.47 | 1,388.60 | 250.40 | 0.52 | 2,858.13 | 5,189.48 | ||||

Molybdenum | mt | % | m lbs | mt | % | m lbs | mt | % | m lbs | m lbs | ||||

Relincho | 50.0% | 39.95 | 0.009 | 7.79 | 158.54 | 0.012 | 40.46 | 198.50 | 0.011 | 48.25 | 48.25 | |||

Totals | 39.95 | 0.009 | 7.79 | 158.54 | 0.012 | 40.46 | 198.50 | 0.011 | 48.25 | 48.25 | ||||

Goldcorp Mineral Resources | ||||||

INFERRED | As of | |||||

Ownership | Tonnage | Grade | Contained | Contained | ||

Gold | mt | g/t | m oz | m oz | ||

Alumbrera | 37.5% | 1.50 | 0.26 | 0.01 | 0.24 | |

Caspiche | 50.0% | 99.05 | 0.29 | 0.92 | – | |

Cerro Casale | 50.0% | 247.72 | 0.38 | 3.00 | – | |

Cerro Negro | 100.0% | 0.88 | 5.03 | 0.14 | 0.28 | |

Coffee | 100.0% | 25.93 | 1.37 | 1.15 | 2.21 | |

El Morro | 50.0% | 339.03 | 0.30 | 3.23 | 3.23 | |

Éléonore | 100.0% | 8.45 | 7.31 | 1.99 | 2.35 | |

Musselwhite | 100.0% | 6.46 | 5.65 | 1.17 | 1.20 | |

Noche Buena | 100.0% | 4.94 | 0.22 | 0.03 | 0.03 | |

Peñasquito | 100.0% | 23.67 | 0.29 | 0.22 | 0.27 | |

Porcupine | 100.0% | 111.95 | 1.02 | 3.69 | 2.78 | |

Pueblo Viejo | 40.0% | 1.90 | 2.05 | 0.12 | 0.10 | |

Red Lake | 100.0% | 8.53 | 15.86 | 4.35 | 4.76 | |

Other Assets | – | – | – | – | 5.09 | |

Totals | 880.01 | 0.71 | 20.02 | 22.54 | ||

Silver | mt | g/t | m oz | m oz | ||

Caspiche | 50.0% | 99.05 | 0.91 | 2.91 | – | |

Cerro Casale | 50.0% | 247.72 | 1.04 | 8.25 | – | |

Cerro Negro | 100.0% | 0.88 | 29.98 | 0.85 | 2.19 | |

Noche Buena | 100.0% | 4.94 | 8.08 | 1.28 | 1.28 | |

Peñasquito | 100.0% | 23.67 | 18.73 | 14.25 | 17.58 | |

Pueblo Viejo | 40.0% | 1.90 | 9.76 | 0.60 | 0.70 | |

Other Assets | – | – | – | – | 55.48 | |

Totals | 378.15 | 2.31 | 28.14 | 77.23 | ||

Copper | mt | % | m lbs | m lbs | ||

Alumbrera | 37.5% | 1.50 | 0.15 | 5.04 | 70.19 | |

Caspiche | 50.0% | 97.80 | 0.12 | 258.73 | – | |

Cerro Casale | 50.0% | 247.72 | 0.19 | 1,046.80 | – | |

El Morro | 50.0% | 339.03 | 0.35 | 2,595.00 | 2,595.00 | |

Pueblo Viejo | 40.0% | 1.90 | 0.02 | 0.91 | 1.43 | |

Relincho | 50.0% | 305.41 | 0.38 | 2,549.68 | 2,549.68 | |

Other Assets | – | – | – | – | 62.25 | |

Totals | 993.36 | 0.29 | 6,456.16 | 5,278.54 | ||

Lead | mt | % | m lbs | m lbs | ||

Peñasquito | 100.0% | 23.53 | 0.16 | 85.21 | 127.63 | |

Other Assets | – | – | – | – | 15.40 | |

Totals | 23.53 | 0.16 | 85.21 | 143.03 | ||

Zinc | mt | % | m lbs | m lbs | ||

Peñasquito | 100.0% | 23.53 | 0.59 | 306.74 | 193.00 | |

Other Assets | – | – | – | – | 101.63 | |

Totals | 23.53 | 0.59 | 306.74 | 294.64 | ||

Molybdenum | mt | % | m lbs | m lbs | ||

Relincho | 50.0% | 305.41 | 0.013 | 88.20 | 88.20 | |

Totals | 305.41 | 0.013 | 88.20 | 88.20 | ||

Goldcorp June 30, 2017 Reserve and Resource Reporting Notes: | |||||||

1 | All Mineral Reserves and Mineral Resources have been estimated in accordance with the CIM Definition Standards, and in the case of the Alumbrera mine, the Ore Reserves have been estimated in accordance with the JORC Code. The JORC Code has been accepted for current disclosure rules in Canada under NI 43-101 (see below for definition). Except for properties or projects listed in note 4 below, all Mineral Reserves, Ore Reserves and Mineral Resources set out in the tables above or elsewhere in this press release have been reviewed and approved by Dan Redmond, Director, Reserves & Mine Planning, Goldcorp, who is a qualified person as defined under NI 43-101. | ||||||

2 | All Mineral Resources are reported exclusive of those Mineral Resources that were converted to Mineral Reserves. | ||||||

3 | Mineral Resources which are not Mineral Reserves do not have demonstrated economic viability. | ||||||

4 | Mineral Reserves and Mineral Resources are reported effective June 30, 2017, with the following conditions or exceptions: | ||||||

(i) | Mineral Reserves and Mineral Resources for Pueblo Viejo are as per public information provided by Barrick Gold Corporation in its 2016-year end report and fourth quarter results report dated February 15th, 2017 with an effective date of December 31, 2016 and were estimated under the supervision of Rick Sims, Senior Director, Resources and Reserves, of Barrick, Steven Haggarty, Senior Director, Metallurgy, of Barrick and Patrick Garretson, Senior Director, Life of Mine Planning, of Barrick. For additional information, see the technical report entitled "Technical Report on the Pueblo Viejo Project, Sanchez Ramirez province, Dominican Republic" dated March 27, 2014, which is available under the Company's profile on SEDAR at www.sedar.com. | |||||||||

(ii) | Mineral Reserves and Mineral Resources for the Cerro Casale Project are as per public information provided by Barrick Gold Corporation in its 2016-year end report and fourth quarter results report dated Febuary15th, 2017 but have been adjusted to reflect Goldcorp's 50% ownership in a new joint venture announced in a Goldcorp press release dated June 9th, 2017, have an effective date of December 31, 2016 and were estimated under the supervision of Rick Sims, Senior Director, Resources and Reserves, of Barrick, Steven Haggarty, Senior Director, Metallurgy, of Barrick and Patrick Garretson, Senior Director, Life of Mine Planning, of Barrick. | |||||||||

(iii) | Mineral Resources for the Caspiche Project are as per public information provided by Exeter Resource Corporation in its 2016 Annual Information Form dated March 24th, 2017 but have been adjusted to reflect Goldcorp's 50% ownership in a new joint venture announced in a Goldcorp press release dated June 9th, 2017. The Mineral Resource Estimate for the Caspiche Project with an effective date of April 11, 2012 was prepared by Mr. Ted Coupland, MAusIMM(CP), at the time, Director and Principal Geostatistician of Cube Consulting Pty Ltd. | |||||||||

(iv) | Mineral Reserves and Mineral Resources for Relincho are as per public information provided by Teck Resources Limited in its 2016 Annual Information Form dated February 23, 2017 with an effective date of December 31, 2016 and have been prepared under the general supervision of Rodrigo Marinho, P.Geo., who is an employee of Teck Resources Limited. | |||||||||

(v) | Mineral Reserves and Mineral Resources for Alumbrera are as per public information provided by Glencore plc in its 2016 year end Resources and Reserves Report with an effective date of December 31, 2016 and have been prepared under the supervision of Flavio Montini who is an employee of Glencore plc. | |||||||||

(vi) | Mineral Reserves for Coffee are as per information provided by Kaminak Gold Corporation effective the transaction date of July 19, 2016. | |||||||||

(vii) | For additional information on the 2016 mineral reserves and mineral resources (MRMR), refer to the MRMR tables that can be found at www.goldcorp.com. | |||||||||

5 | Mineral Reserves are estimated using appropriate recovery rates and US$ commodity prices of $1,200 per ounce of gold, $18.00 per ounce of silver, $2.75 per pound of copper, $0.90 per pound of lead, and $1.05 per pound of zinc, unless otherwise noted below: | ||||||

(i) | Pueblo Viejo and Cerro Casale | Gold – US$1,000/oz. to 2020, and a long-term price of US$1,200/oz. from 2021 onwards Silver – US$13.75/oz. to 2020 and a long-term price of US$16.50/oz. from 2021 onwards Copper – US$2.25/lb. to 2020 and a long-term price of US$2.75/lb. from 2021 onwards | |||||

(ii) | Alumbrera | Gold – US$1,300/oz; Copper – US$2.31/lb | |||||

(iii) | Relincho | Copper – US$2.80/lb; Molybdenum – US$13.70/lb | |||||

6 | Mineral Resources are estimated using US$ commodity prices of $1,400 per ounce of gold, $20 per ounce of silver, $3.00 per pound of copper, $1.00 per pound of lead, and $1.10 per pound of zinc, unless otherwise noted below: | ||||||

(i) | Pueblo Viejo and Cerro Cale | Gold – US$1,500/oz; Silver – US$16.50/oz; Copper – US$2.75/lb | |||||

(ii) | Caspiche | Gold – US$1,250/oz; Silver – US$15.00/oz; Copper – US$2.75/lb | |||||

(iii) | El Morro | Gold – US$1,200/oz; Copper – US$2.75/lb | |||||

(iv) | Alumbrera | Gold – US$1,300/oz; Copper – US$3.06/lb | |||||

(v) | Relincho | Copper – US$2.80/lb; Molybdenum – US$13.70/lb | |||||

About Goldcorp

Goldcorp is a senior gold producer focused on responsible mining practices with safe, low-cost production from a high-quality portfolio of mines.

Cautionary Note Regarding Reserves and Resources:

Scientific and technical information contained in this press release relating to Mineral Reserves and Mineral Resources was reviewed and approved by Dan Redmond, P.Geo., Director, Reserves & Mine Planning for Goldcorp, and a "qualified person" as defined by National Instrument 43-101 – Standards of Disclosure for Mineral Projects ("NI 43-101"). Scientific and technical information in this press release relating to exploration results was reviewed and approved by Sally Goodman, PhD, P.Geo., Director, Generative Geology for Goldcorp, and a "qualified person" as defined by NI 43-101. All Mineral Reserves and Mineral Resources have been estimated in accordance with the standards of the Canadian Institute of Mining, Metallurgy and Petroleum ("CIM") and NI 43-101, or the Australasian Code for Reporting of Exploration Results, Mineral Resources and Ore Reserves equivalent. All Mineral Resources are reported exclusive of Mineral Reserves. Mineral Resources that are not Mineral Reserves do not have demonstrated economic viability. Additional information on the mineral properties mentioned in this news release that are considered to be material mineral properties to the Company are contained in Goldcorp's annual information form for the year ended December 31, 2016 and the following technical reports for each of those properties, all of which are available under the Company's profile at www.sedar.com:

- Technical report entitled "Red Lake Operations, Ontario Canada, NI 43-101 Technical Report" dated effective December 31, 2015.

- Technical report entitled "Cerro Negro Operations, Santa Cruz Province, Argentina, NI 43-101 Technical Report" dated effective December 31, 2015.

- Technical report entitled "Peñasquito Polymetallic Operations, Zacatecas State, Mexico, NI 43-101 Technical Report" dated effective December 31, 2015.

- Technical report entitled "Éléonore Operations, Quebec, Canada, NI 43-101 Technical Report" dated effective December 31, 2015.

Cautionary Note to United States investors concerning estimates of measured, indicated and inferred resources:The Mineral Reserve and Mineral Resource estimates contained in this press release have been prepared in accordance with the requirements of the Canadian securities laws, which differ from the requirements of United States securities laws and use terms that are not recognized by the United States Securities and Exchange Commission ("SEC"). Canadian reporting requirements for disclosure of mineral properties are governed by NI 43-101. The definitions used in NI 43-101 are incorporated by reference from the CIM Definition Standards adopted by CIM Council on May 10, 2014 (the "CIM Definition Standards"). U.S. reporting requirements are governed by the SEC Industry Guide 7 ("Industry Guide 7") under the United States Securities Act of 1933, as amended. These reporting standards have similar goals in terms of conveying an appropriate level of confidence in the disclosures being reported, but embody different approaches and definitions. For example, the terms "Mineral Reserve", "Proven Mineral Reserve" and "Probable Mineral Reserve" are Canadian mining terms as defined in NI 43-101, and these definitions differ from the definitions in Industry Guide 7. Under Industry Guide 7 standards, a "final" or "bankable" feasibility study is required to report reserves or cash flow analysis to designate reserves and the primary environmental analysis or report must be filed with the appropriate governmental authority. Further, under Industry Guide 7, mineralization may not be classified as a "reserve" unless the determination has been made that the mineralization could be economically and legally produced or extracted at the time the reserve determination is made.

While the terms "Mineral Resource", "Measured Mineral Resource", "Indicated Mineral Resource" and "Inferred Mineral Resource" are defined in and required to be disclosed by NI 43-101, these terms are not defined terms under Industry Guide 7 and are normally not permitted to be used in reports and registration statements filed with the SEC. United Statesinvestors are cautioned not to assume that any part or all of mineral deposits in these categories will ever be converted into reserves. "Inferred Mineral Resources" have a great amount of uncertainty as to their existence and their economic and legal feasibility. A significant amount of exploration must be completed in order to determine whether an Inferred Mineral Resource may be upgraded to a higher category. Under Canadian regulations, estimates of Inferred Mineral Resources may not form the basis of feasibility or pre-feasibility studies, except in rare cases. United States investors are cautioned not to assume that all or any part of an Inferred Mineral Resource exists or is economically or legally mineable. Disclosure of "contained ounces" in a resource is permitted disclosure under Canadian regulations if such disclosure includes the grade or quality and the quantity for each category of Mineral Resource and Mineral Reserve; however, the SEC normally only permits issuers to report mineralization that does not constitute "reserves" by SEC standards as in place tonnage and grade without reference to unit measures.

Accordingly, information contained in this press release containing descriptions of the Company's mineral deposits may not be comparable to similar information made public by United States companies subject to the reporting and disclosure requirements under the United States federal securities laws and the rules and regulations thereunder.

Cautionary Statement Regarding Forward Looking Statements

This press release contains "forward-looking statements", within the meaning of Section 27A of the United States Securities Act of 1933, as amended, Section 21E of the United States Exchange Act of 1934, as amended, or the United States Private Securities Litigation Reform Act of 1995, or in releases made by the SEC, all as may be amended from time to time, and "forward-looking information" under the provisions of applicable Canadian securities legislation, concerning the business, operations and financial performance and condition of Goldcorp. Forward-looking statements include, but are not limited to, statements with respect to the future price of gold, silver, copper, lead and zinc, the estimation of Mineral Reserves (as defined above) and Mineral Resources (as defined above), the realization of Mineral Reserve estimates, the timing and amount of estimated future production, costs of production, targeted cost reductions, capital expenditures, free cash flow, costs and timing of the development of new deposits, success of exploration activities, permitting time lines, hedging practices, currency exchange rate fluctuations, requirements for additional capital, government regulation of mining operations, environmental risks, unanticipated reclamation expenses, timing and possible outcome of pending litigation, title disputes or claims and limitations on insurance coverage. Generally, these forward-looking statements can be identified by the use of words such as "plans", "expects", "is expected", "budget", "scheduled", "estimates", "forecasts", "intends", "anticipates", "believes" or variations of such words and phrases or statements that certain actions, events or results "may", "could", "would", "might" or "will", "occur" or "be achieved" or the negative connotation thereof.

Forward-looking statements are necessarily based upon a number of factors and assumptions that, if untrue, could cause the actual results, performances or achievements of Goldcorpto be materially different from future results, performances or achievements expressed or implied by such statements. Such statements and information are based on numerous assumptions regarding present and future business strategies and the environment in which Goldcorp will operate in the future, including the price of gold, anticipated costs and ability to achieve goals. Certain important factors that could cause actual results, performances or achievements to differ materially from those in the forward-looking statements include, among others, gold price volatility, discrepancies between actual and estimated production, Mineral Reserves and Mineral Resources and metallurgical recoveries, mining operational and development risks, litigation risks, regulatory restrictions (including environmental regulatory restrictions and liability), changes in national and local government legislation, taxation, controls or regulations and/or change in the administration of laws, policies and practices, expropriation or nationalization of property and political or economic developments in Canada, the United States and other jurisdictions in which the Company carries on business, or may carry on business in the future, delays, suspension and technical challenges associated with capital projects, higher prices for fuel, steel, power, labour and other consumables, currency fluctuations, the speculative nature of gold exploration, the global economic climate, dilution, share price volatility, competition, loss of key employees, additional funding requirements and defective title to mineral claims or property. Although Goldcorp believes its expectations are based upon reasonable assumptions and has attempted to identify important factors that could cause actual actions, events or results to differ materially from those described in forward-looking statements, there may be other factors that cause actions, events or results not to be as anticipated, estimated or intended.

Forward-looking statements are subject to known and unknown risks, uncertainties and other important factors that may cause the actual results, level of activity, performance or achievements of Goldcorp to be materially different from those expressed or implied by such forward-looking statements, including but not limited to: risks related to international operations, including economic and political instability in foreign jurisdictions in which Goldcorp operates; risks related to current global financial conditions; risks related to joint venture operations; actual results of current exploration activities; actual results of current reclamation activities; environmental risks; conclusions of economic evaluations; changes in project parameters as plans continue to be refined; future prices of gold, silver, copper, lead and zinc; possible variations in ore reserves, grade or recovery rates; failure of plant, equipment or processes to operate as anticipated; risks related to the integration of acquisitions; mine development and operating risks; accidents, labour disputes and other risks of the mining industry; delays in obtaining governmental approvals or financing or in the completion of development or construction activities, and risks related to indebtedness and the service of such indebtedness, as well as those factors discussed in the section entitled "Risks and Uncertainties" in Goldcorp's most recent Management's Discussion and Analysis, and "Description of the Business – Risk Factors" in Goldcorp's most recent annual information form, both of which are available on SEDAR at www.sedar.com and on EDGAR at www.sec.gov. Although Goldcorp has attempted to identify important factors that could cause actual results to differ materially from those contained in forward-looking statements, there may be other factors that cause results not to be as anticipated, estimated or intended. There can be no assurance that such statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on forward-looking statements. Forward-looking statements are made as of the date hereof and, accordingly, are subject to change after such date. Except as otherwise indicated by Goldcorp, these statements do not reflect the potential impact of any non-recurring or other special items or of any dispositions, monetizations, mergers, acquisitions, other business combinations or other transactions that may be announced or that may occur after the date hereof. Forward-looking statements are provided for the purpose of providing information about management's current expectations and plans and allowing investors and others to get a better understanding of the Company's operating environment. Goldcorp does not intend or undertake to publicly update any forward-looking statements that are included in this document, whether as a result of new information, future events or otherwise, except in accordance with applicable securities laws.

SOURCE Goldcorp Inc.