COLORADO SPRINGS – May 5, 2020 – Gold Resource Corporation (NYSE American: GORO) (the “Company” or “GRC”) reported consolidated production results for the first quarter ended March 31, 2020 of 10,142 ounces of gold and 407,625 ounces of silver. In addition to precious metals, the Company produced base metals resulting in net revenue of $28 million and $5 million operating cash flow for the quarter. At the end of the quarter the Mexican government declared a country-wide health emergency and mandatory non-essential business suspension due to the novel coronavirus (COVID-19) global pandemic. The Company was required by the Mexican government to suspend its Mexico operations and the Company subsequently withdrew its 2020 production outlook. Gold Resource Corporation is a gold and silver producer, developer and explorer with operations in Oaxaca, Mexico and Nevada, USA. The Company has returned $114 million to its shareholders in consecutive monthly dividends since July 2010 and offers its shareholders the option to convert their cash dividends into physical gold and silver and take delivery.

Q1 2020 HIGHLIGHTS

- Strong balance sheet with $18.4 million cash and cash equivalents;

- $28.0 million net sales;

- Operating cash flow of $5 million;

- Precious metal quarterly production on target with 10,142 gold ounces and 407,625 silver ounces produced;

- $4.1 million gold and silver bullion inventory; and

- $0.01 per share dividend distribution for quarter.

Overview of Q1 2020 Results

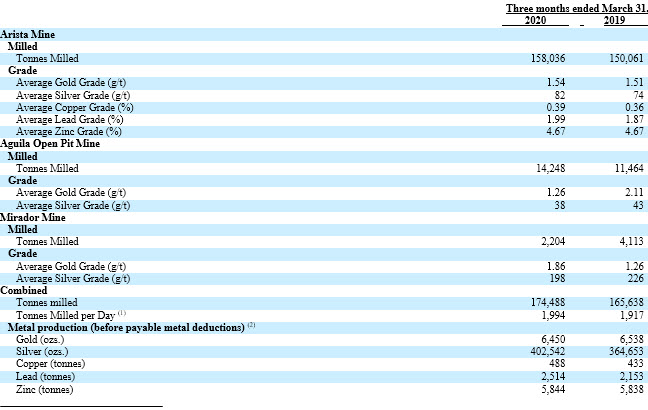

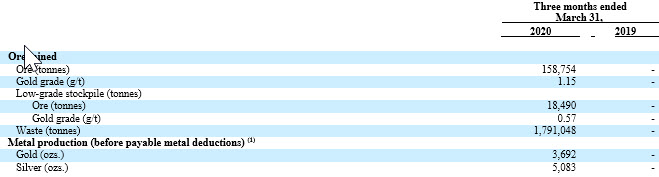

Production from both mining units were within targeted ranges prior to the Company withdrawing its 2020 production outlook due to the pandemic. First quarter Oaxaca Mining Unit (OMU) production totaled 6,450 ounces of gold, 402,542 ounces of silver, 488 tonnes of copper, 2,514 tonnes of lead and 5,844 tonnes of zinc. First quarter production from the Company’s Nevada Mining Unit (NMU) totaled 3,692 ounces of gold.

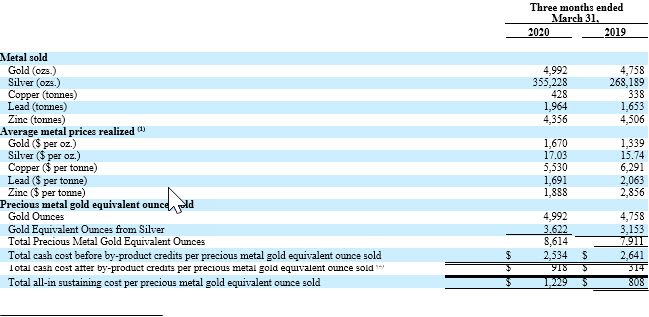

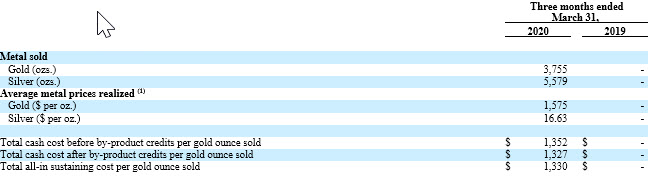

The Company sold 8,614 precious metal gold equivalent ounces at a total cash cost of $918 per ounce (after by-product credits) at its OMU. Falling base metal markets and record high treatment charges negatively impacted revenues and costs during the quarter. OMU average realized metal prices during the quarter included $1,670 per ounce gold and $17.03 per ounce silver*. The Company sold 3,755 gold ounces from its Isabella Pearl mine at a total cash cost of $1,327 per ounce (after by-product credits) at an average realized price of $1,575 per gold ounce*. The Company recorded a net loss of $3.1 million, or $0.05 per share because of lower revenues and higher non-cash depreciation and amortization. The Company generated $5 million in operating cash flow, and paid $0.7 million to its shareholders in dividends, or $0.01 per share during the quarter. Cash and cash equivalents at quarter end totaled $18.4 million.

Oaxaca Mining Unit operations were suspended on April 1, 2020 when the Mexican government declared a national emergency due to the COVID-19 global pandemic. At that time, the Company put its OMU operations into care and maintenance and withdrew its 2020 production outlook. The national emergency declaration is currently set to expire on May 30, 2020. Based on government signaling of potential early business restarts for less COVID-19 impacted zones, the Company has recently submitted its early-start proposal to the Mexican federal government due to Oaxaca being one of zones least impacted by the virus.

*Average realized metal prices include final settlement adjustments for previously unsettled provisional sales. Provisional sales may remain unsettled from one quarter into the next. Realized prices will therefore vary from average spot metal market prices upon final settlement.

COVID-19

With the NMU continuing to operate, and in preparation for restarting our OMU, the Company strives to mitigate the spread of COVID-19 and protect the health and safety of our employees, contractors, and communities in which we operate. The Company has taken precautionary measures including specialized training, social distancing, a work-from-home mandate where possible, and close monitoring of national and regional COVID-19 impacts and governmental guidelines. To date, the Company is not aware of any cases of COVID-19 at its operations. With the ever changing and fluid nature of the pandemic impact, Company management analyzed various scenarios whereby a forced and/or prolonged suspension of one or both mining units were sustained.

“First quarter production at both our mining units were within expected production ranges,” stated Mr. Jason Reid, President and CEO of Gold Resource Corporation. “While the mandated business suspension at the end of the quarter isn’t ideal for business, I was pleased to see Mexico join in global efforts to combat the COVID-19 virus. During these unprecedented times, we have taken the precautionary measure of raising additional capital just shy of $12 million in part to put the Company in a much stronger financial position to weather an extended suspension of one or both of our operations, if need be. Like much of the rest of the world, we look forward to getting back to work in Mexico in the safest manner and as soon as possible.”

Mr. Reid continued, “We continue to revise, where possible, our Oaxaca mine plan in an effort to target zones with higher precious metal values in the Arista mine to help offset lower base metal market prices experienced thus far in 2020. We are also contemplating additional cost cutting measures.”

“Our Isabella Pearl operations in Nevada continued to make good progress during the quarter removing overburden at the high-grade Pearl zone in the deposit,” stated Mr. Reid. “We are pleased to report that we have recently exposed the top portion of this high grade Pearl zone and have had several days mining grades up to 2.7 grams per tonne gold where the block model indicated 1.5 grams per tonne gold. While there is still significant overburden to remove at Pearl before getting into larger tonnages of this high grade zone, we remain on schedule to access significant portions of this material by mid-year 2020. We continue to be on track for our targeted gold production ramp up by the end of Q3 and more so in Q4. Eighty percent of the ore in the Isabella Pearl deposit is located in the Pearl zone and it’s great to have mined down to bench levels where the top of the Pearl zone is now exposed.”

The following Production Statistics tables summarize certain information about our Oaxaca and Nevada Mining Unit operations for the three months ended March 31, 2020 and 2019:

Oaxaca Mining Unit

(2) The difference between what we report as “ounces/tonnes produced” and “payable ounces/tonnes sold” is attributable to the difference between the quantities of metals contained in the concentrates we produce versus the portion of those metals actually paid for according to the terms of our sales contracts. Differences can also arise from inventory changes incidental to shipping schedules, or variances in ore grades and recoveries which impact the amount of metals contained in concentrates produced and sold.

Nevada Mining Unit

The following Sales Statistics tables summarize certain information about our Oaxaca and Nevada Mining Unit operations for the three months ended March 31, 2020 and 2019:

Oaxaca Mining Unit

(2) Total cash cost after by-product credits are significantly affected by base metals sales during the periods presented.

Nevada Mining Unit

See Accompanying Tables

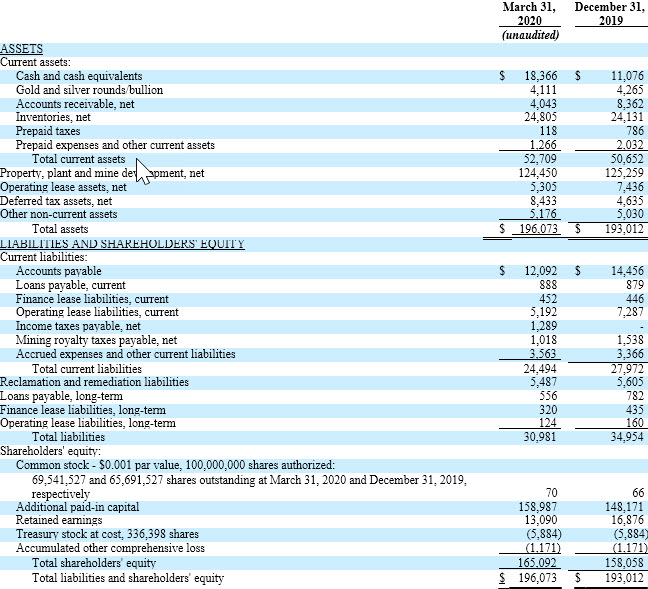

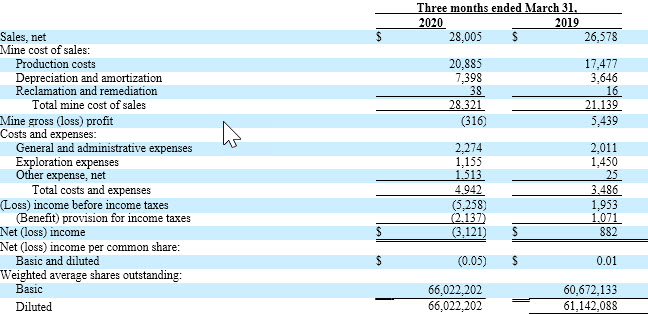

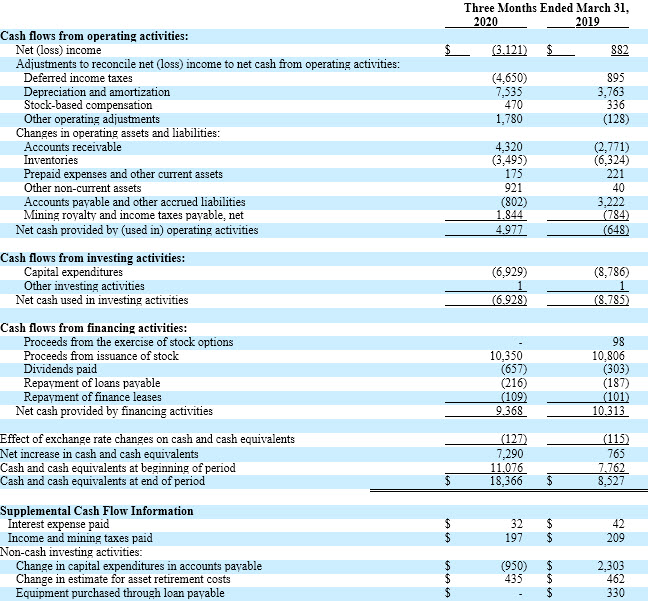

The following information summarizes the results of operations for Gold Resource Corporation for the three months ended March 31, 2020 and 2019, its financial condition at March 31, 2020 and December 31, 2019, and its cash flows for the three months ended March 31, 2020 and 2019. The summary data as of March 31, 2020 and for the three months ended March 31, 2020 and 2019 is unaudited; the summary data as of December 31, 2019 is derived from our audited financial statements contained in our annual report on Form 10-K for the year ended December 31, 2019, but do not include the footnotes and other information that is included in the complete financial statements. Readers are urged to review the Company’s Form 10-K in its entirety, which can be found on the SEC’s website at www.sec.gov.

The calculation of our cash cost per

precious metal gold equivalent per ounce, total all-in sustaining cost per

precious metal gold equivalent per ounce and total all-in cost per precious

metal gold equivalent per ounce contained in this press release are non-GAAP

financial measures. Please see “Management’s Discussion and Analysis and

Results of Operations” contained in the Company’s most recent Form 10-K

for a complete discussion and reconciliation of the non-GAAP measures.

GOLD RESOURCE CORPORATION

CONSOLIDATED BALANCE SHEETS

(U.S. dollars in thousands, except share and per share amounts)

GOLD RESOURCE CORPORATION

CONSOLIDATED STATEMENTS OF OPERATIONS

(U.S. dollars in thousands, except share and per share amounts)

Unaudited

GOLD RESOURCE CORPORATION

CONSOLIDATED STATEMENTS OF CASH FLOWS

(U.S. dollars in thousands, except share and per share amounts)

Unaudited

About GRC:

Gold Resource Corporation is a gold and silver producer, developer and explorer with operations in Oaxaca, Mexico and Nevada, USA. The Company targets low capital expenditure projects with potential for generating high returns on capital. The Company has returned $114 million back to its shareholders in consecutive monthly dividends since July 2010 and offers its shareholders the option to convert their cash dividends into physical gold and silver and take delivery. For more information, please visit GRC’s website, located at www.goldresourcecorp.com and read the Company’s 10-K for an understanding of the risk factors involved.

Cautionary Statements:

This press release contains forward-looking statements that involve risks and uncertainties. The statements contained in this press release that are not purely historical are forward-looking statements within the meaning of Section 27A of the Securities Act and Section 21E of the Exchange Act. When used in this press release, the words “plan”, “target”, “anticipate,” “believe,” “estimate,” “intend” and “expect” and similar expressions are intended to identify such forward- looking statements. Such forward-looking statements include, without limitation, the statements regarding Gold Resource Corporation’s strategy, future plans for production, future expenses and costs, future liquidity and capital resources, and estimates of mineralized material. All forward- looking statements in this press release are based upon information available to Gold Resource Corporation on the date of this press release, and the company assumes no obligation to update any such forward-looking statements. Forward looking statements involve a number of risks and uncertainties, and there can be no assurance that such statements will prove to be accurate. The Company’s actual results could differ materially from those discussed in this press release. In particular, the scope, duration, and impact of the COVID-19 pandemic on mining operations, Company employees, and supply chains as well as the scope, duration and impact of government action aimed at mitigating the pandemic may cause the actual results and future events to differ materially from those expressed or implied by such forward-looking information. Also, there can be no assurance that production will continue at any specific rate. Factors that could cause or contribute to such differences include, but are not limited to, those discussed in the Company’s 10- K filed with the SEC.

Contacts:

Corporate Development

Greg Patterson

303-320-7708

www.Goldresourcecorp.com

Original Article: https://www.goldresourcecorp.com/releases/GRC-2020-05-05-1.pdf