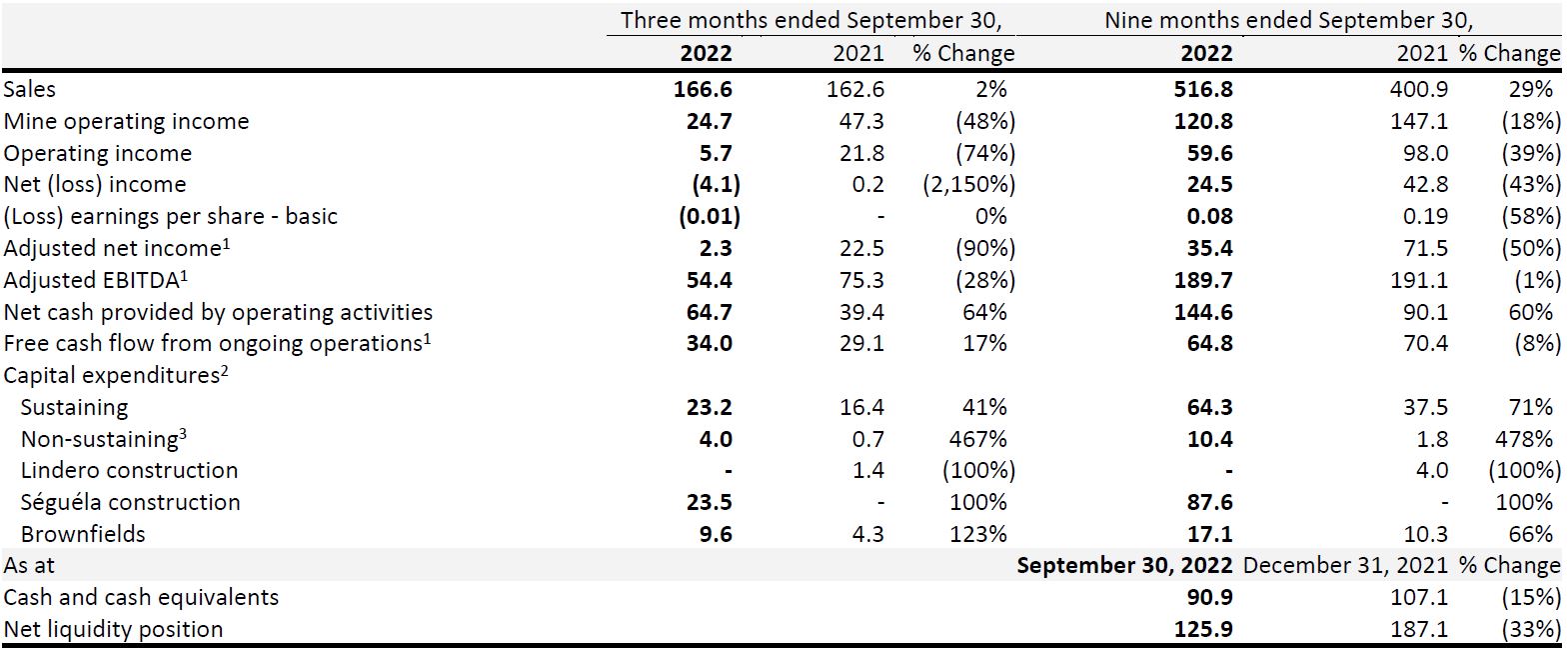

(All amounts expressed in US dollars, tabular amounts in millions, unless otherwise stated)

Vancouver, November 9, 2022: Fortuna Silver Mines Inc. (NYSE: FSM) (TSX: FVI) (“Fortuna” or the “Company”) today reported its financial and operating results for the third quarter of 2022.

Third Quarter 2022 Highlights

Operational

- Gold and silver production of 66,344 ounces and 1,837,506 ounces, respectively. An increase of 1% and 7% respectively compared to the third quarter of 2021 (“Q3 2021”). Gold equivalent production of 101,8403

- Cash costs1 per ounce of gold of $772 for the Lindero Mine and $934 for the Yaramoko mine. Cash costs1,2 per silver equivalent ounce of payable silver sold of $9.70 for the San Jose Mine and $11.32 for the Caylloma mine.

- AISC1 per ounce of gold sold of $1,159 for the Lindero Mine and $1,630 for the Yaramoko Mine. AISC1,2 per silver equivalent ounce of payable silver sold of $14.23 and $15.66 for the San Jose Mine and Caylloma Mine, respectively.

- The Company confirms it is tracking to meet production and the top end of cost guidance for the year.

- Total recordable injury frequency rate of 2.36 per million hours worked and zero lost time injuries in over 3.3 million hours worked.

Financial

- Free cash flow from ongoing operations1 of $34.0 million, after operating mine capital, corporate overhead, taxes and interest paid, compared to $29.1 million reported in Q3 2021.

- Adjusted EBITDA1 of $54.4 million compared to $75.3 million reported in Q3 2021.

- Net loss of $4.1 million or $0.01 per share, compared to $0.2 million or $0 net income per share reported in Q3 2021. Adjusted net income1 of $2.3 million or $0.01 per share compared to $22.5 million reported in Q3 2021.

- As at September 30, 2022, the Company had available liquidity of $125.9 million.

- Returned $2.9 million of capital to shareholders during the quarter through the share repurchase program.

Growth and Development

- Séguéla construction 83% complete as of the end of October. On-time and on-budget for first gold pour in mid-2023.

- Fortuna continued to expand mineralization at the Sunbird discovery at Séguéla outside of the current reported inferred mineral resource (refer to Fortuna news release dated September 12, 2022: “Fortuna extends gold mineralization at Sunbird and identifies new regional prospects at Séguéla, Cote d´Ivoire”).

1 Refer to Non-IFRS financial measures

2 AISC/oz Ag Eq calculated at realized metal prices, refer to mine site results for realized prices and Non-IFRS Financial Measures for silver equivalent ratio

3 Gold equivalent production includes gold, silver, lead and zinc and is calculated using the following metal prices: US$1,718/oz Au, US$19.16/oz Ag, US$1,989/t Pb and US$3,268/t Zn or Au:Ag = 1:89.65, Au:Pb = 1:0.90, Au:Zn = 1:0.53

Jorge A. Ganoza, President and CEO, commented, “Our four mines had steady production of gold and silver in the quarter, which places us in a comfortable position at the end of the nine months of the year to meet our annual guidance estimates. Price inflation on key consumable products has driven cost at our operations to the upper range of annual cost guidance, but at this stage in the year we anticipate that the risk for significant cost deviations beyond guidance has diminished.” Mr. Ganoza continued, “Free cash flow for the period remained strong, underpinned by robust production performance at our operating sites.” Mr. Ganoza concluded, “Construction of our flagship Séguéla mine is 83% complete as of the end of October, remaining on-time and on-budget. We continue to successfully de-risk construction at a steady pace. All components of the SAG mill, a major equipment in the critical path of the project, have been shipped removing the last supply chain concerns on major equipment deliveries. Another milestone coming soon is the project connection to the national power grid, which is planned for December.”

1 Refer to Non-IFRS Financial Measures section of this news release and to the MD&A accompanying the Company’s financial statements filed on SEDAR at www.sedar.com for a description of the calculation of these measures.

2 Capital expenditures are presented on a cash basis

3 Non-sustaining expenditures include greenfields exploration

Figures may not add due to rounding

Third Quarter 2022 Results

Net loss for the period was $4.1 million compared to net income of $0.2 million in Q3 2021. Operating income was $5.7 million compared to $21.8 million in the comparative period. Higher cash costs quarter over quarter were approximately $16.0 million due to continued inflationary pressures and higher processed tonnes at Yaramoko and San Jose. Management estimates that if realized gold and silver prices had stayed consistent with the previous year operating income would have been $13.0 million higher.

Additional items impacting net income in the quarter were a $3.4 million write off of the Tlamino project in Serbia, and $1.7 million of unrealized derivative losses.

Adjusted net income for the period was $2.3 million compared to $22.5 million in Q3 2021. Adjusted EBITDA was $54.4 million compared to $75.3 million in Q3 2021. The reduction in EBITDA was consistent with the drivers of lower operating income described above, namely lower silver and gold prices and inflationary cost pressures.

Net cash provided by operating activities was $64.7 million, compared to $39.4 million in Q3 2021, as the comparative quarter was impacted by $23.1 million of non-recurrent expenses ($12.6 million payment including taxes for the settlement of the disputed royalty claim with the Mexican Geological Survey and $10.5 million of transaction costs related to the Roxgold acquisition).

Free cash flow from ongoing operations in the quarter was $34.0 million after deducting operating mine capital, corporate overhead, taxes and interest paid. Year to date free cash flow from on-going operations was $64.8 million compared to $70.4 million in 2021.

Sales for the three months ended September 30, 2022 were $166.6 million, an increase of 2% from the $162.6 million over the same period in 2021. Sales by mine in the three months ended September 30, 2022 were as follows:

- Lindero recognized adjusted sales of $51.9 million, a 25% increase from the $41.6 million reported in Q3 2021. Higher sales were the result of a 28% increase in volume of gold sold, partially offset by lower realized gold price of 3%.

- Yaramoko recognized adjusted sales of $46.4 million, a 5% decrease from the $49.0 million reported in Q3 2021. Lower sales were the result of a 2% decrease in volume of gold sold and lower realized gold price of 4%.

- San Jose recognized adjusted sales of $42.2 million, a 4% decrease from the $43.7 million reported in Q3 2021. Lower sales were driven by a 21% and 3% decrease in provisional silver and gold prices, respectively, partially offset by an increase of 7% and 2% in the volume of silver and gold ounces, respectively, sold.

- Caylloma recognized adjusted sales of $26.1 million, a 7% decrease from the $28.0 million reported in Q3 2021. The decrease in sales was driven by 22% lower realized prices for silver as well as no gold sales compared to 1,466 ounces sold in the comparative period.

Outlook on Cost and Inflation

Inflationary pressures continued in the third quarter of 2022 as a result of geopolitical events, supply chain constraints and increases in the cost of energy and commodities. These inflationary pressures were realized in the Company’s cost structure as prices increased for several key commodities including diesel, reagents, explosives and steel.

The inflation situation remains dynamic and the Company expects higher input costs to remain for the last quarter of the year and beyond. To mitigate inflationary pressure on its cost structure the Company will continue to focus on operational efficiencies and cost optimization across all mining operations. However, even with these efforts it is expected the continued inflationary pressures will push costs towards the upper end of our cost guidance.

Liquidity

Total liquidity available to the Company as at September 30, 2022 was $125.9 million, comprised of $90.9 million of cash and cash equivalents and $35.0 million undrawn on the Company’s revolving $200 million credit facility.

The Company has secured credit approval from its banking syndicate to increase the existing senior secured revolving credit facility by $50.0 million to $250.0 million. The upsized facility will include a $50.0 million accordion feature, and is expected to close in the fourth quarter of 2022, subject to the completion of definitive documentation between the parties.

Séguéla Construction

As of September 30, 2022, the Séguéla Project had approximately $54.8 million in remaining spend of the project’s $173.5 million construction budget, and the project remains on time and on budget. The Company’s cash and cash equivalents balance, free cash flow from ongoing operations and undrawn amounts of the credit facility are expected to be sufficient to fund the construction of the Séguéla Project.

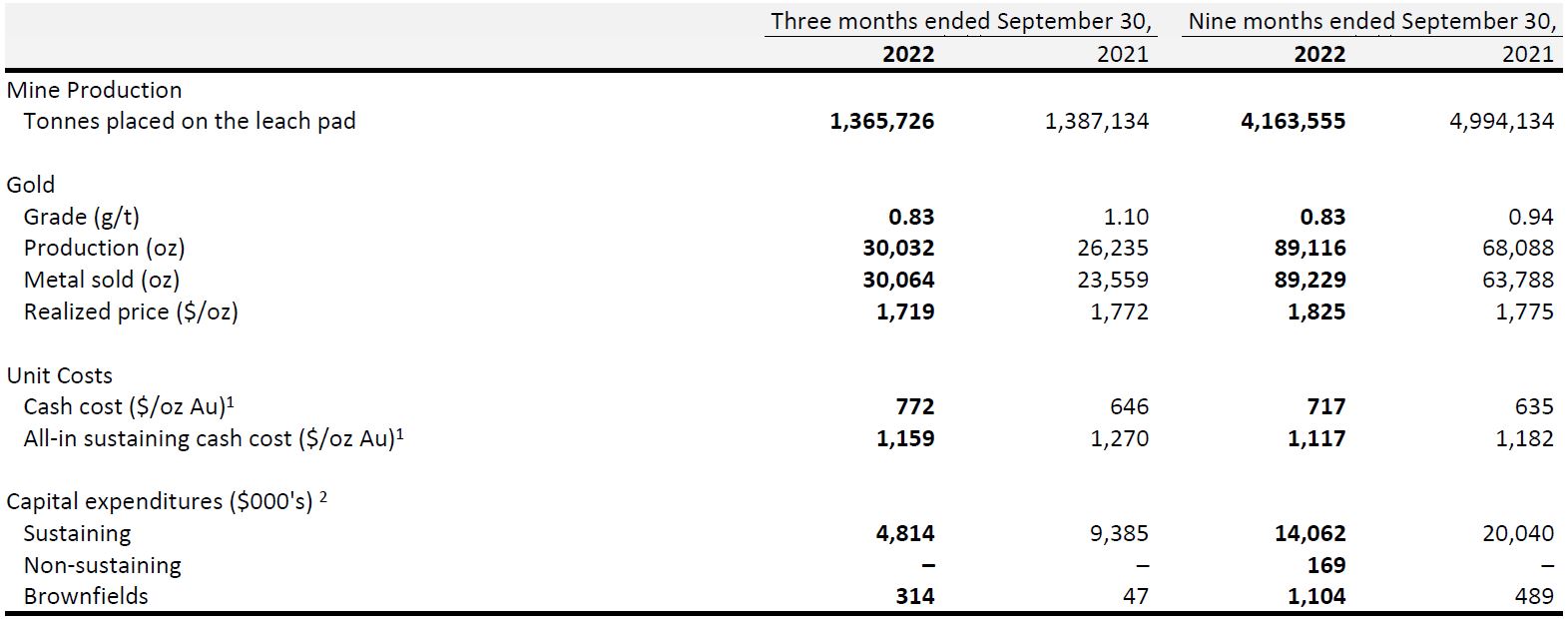

Lindero Mine, Argentina

1 Cash cost and AISC are non-IFRS financial measures. Refer to Non-IFRS Financial Measures.

Quarterly Operating and Financial Highlights

In the third quarter of 2022, a total of 1,365,726 tonnes of ore were placed on the heap leach pad, averaging 0.83 g/t gold, containing an estimated 36,501 ounces of gold. Gold production for Q3 2022 totaled 30,032 ounces, representing a 14% increase year-over-year. Higher gold production is mainly explained by an increase in performance of the three-stage crushing and stacking circuits, which delivered 100% of the 1.37 million tonnes of ore placed on the pad in the quarter, compared to 89% or 1.2 million tonnes of the 1.39 million tonnes placed during the comparable quarter a year ago. Mine production was 2.2 million tonnes of mineralized material with a lower strip ratio of 0.83:1 when compared to the second quarter of 2022. The reduction in the stripping ratio was a result of optimizing the mine plan sequence during the period. The operation experienced a positive reconciliation for ore sent to the leach pad during the third quarter, with grades sampled at the plant being 5.6% higher than estimated from the reserve model.

Cash cost per ounce of gold for the three months ended September 30, 2022 was $772 compared to $646 in the third quarter of 2021. Cash cost per ounce of gold was higher due to higher consumable prices, mainly related to diesel, explosives and reagents, higher service costs related to maintenance equipment rentals and higher maintenance contractor expenses, partially offset by lower labor cost.

All-in sustaining cash cost per gold ounce sold was $1,159 during Q3 2022 compared with $1,270 in the third quarter of 2021. All-in sustaining cash cost for the third quarter of 2022 was impacted by the issues described above, offset by higher ounces sold, lower sustaining capital and a positive by-product effect.

Sustaining capital for the quarter primarily consisted of spending on the leach pad and mine maintenance. Construction of Phase-1B of the leach pad was completed during the quarter as planned, ensuring sufficient capacity to support the production plan through the second half of 2024. Detailed engineering work for the Phase-2 leach pad expansion was initiated in the third quarter of 2022 and is expected to be completed by year end. Construction work on Phase-2 is planned to commence in 2023. Brownfields capital primarily relates to exploration at the Arizaro project.

Yaramoko Mine Complex, Burkina Faso

1 Cash cost and AISC are non-IFRS financial measures. Refer to Non-IFRS Financial Measures.

2 The Yaramoko Mine was acquired as part of the acquisition of Roxgold which completed on July 2, 2021. Comparative figures in 2021 are included from July 2, 2021 onward.

3 Capital expenditures are presented on a cash basis

The Yaramoko Mine produced 27,130 ounces of gold in the third quarter of 2022 with an average gold head grade of 6.21g/t, which is in line with the mining sequence and Mineral Reserve estimate. The operation benefitted from higher mill throughput and operating time during the quarter offset by lower head grades when compared to the third quarter in 2021. Gold production for the first nine months of 2022 is in line with the annual guidance range.

Cash cost per gold ounce sold was $934, compared to $720 in the third quarter of 2021, primarily due to higher mining service costs related to inflation, higher processing costs due to annual mill inspection and repair moved up from November, and the processing of lower grade stockpiles during Q3 2022 as the site is currently mine constrained. This was partially offset by favorable foreign exchange rates.

All-in sustaining cash cost per gold ounce sold was $1,630 for Q3 2022, compared to $1,188 for the same period in 2021, as a result of decreased production, increased cash cost, and an increase in capital expenditures.

The operational focus remains on advancing development of the decline to maintain stope sequencing flexibility in the mine for the remainder of 2022 and into 2023. Sustaining capital for Q3 2022 was higher due to higher mine development and equipment purchases related to the QV Prime project in Bagassi South. Brownfields expenditure was higher due to greater amounts of diamond drilling as well as further development of the 109 Zone.

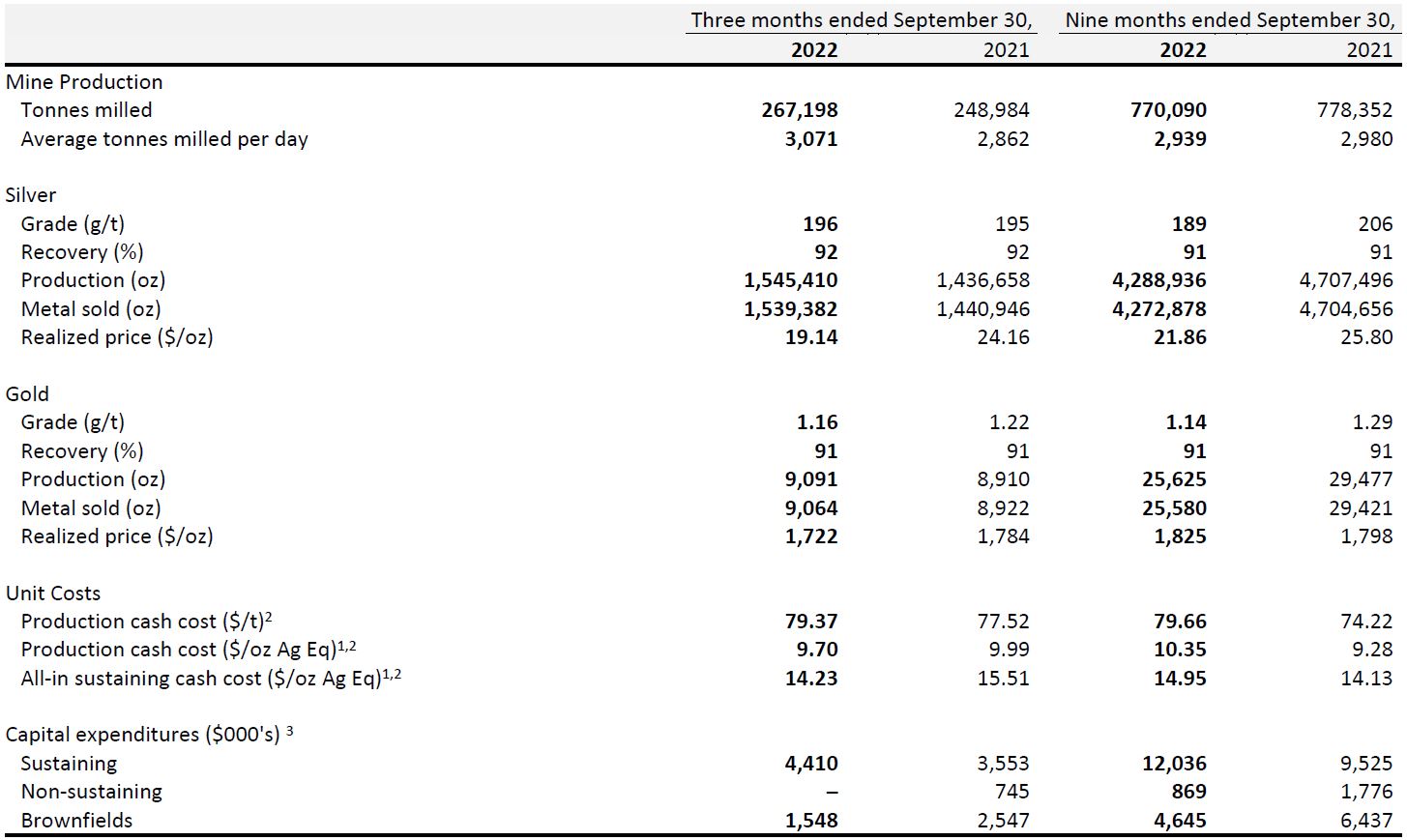

San Jose Mine, Mexico

1 Production cash cost silver equivalent and All-in sustaining cash cost silver equivalent are calculated using realized metal prices for each period respectively

2 Production cash cost, Production cash cost silver equivalent, and All-in sustaining cash cost silver equivalent are Non-IFRS Financial Measures, refer to Non-IFRS Financial Measures

3 Capital expenditures are presented on a cash basis

In the third quarter of 2022, the San Jose Mine produced 1,545,410 ounces of silver and 9,091 ounces of gold, 8% and 2% higher, respectively, when compared to the equivalent period in 2021. The result is primarily due to higher mill throughput, with grades in line with the mining sequence and Mineral Reserve estimates. Silver production is tracking to meet the upper range of annual guidance.

The cash cost per tonne for the three months ended September 30, 2022 was $79.37 compared to $77.52 in the same period in 2021 primarily due to cost increases related to inflation, offset by higher tonnes processed.

All-in sustaining cash costs of $14.23 per ounce was lower than the $15.51 per ounce for the same period in 2021 with higher silver equivalent ounces offsetting higher costs.

Capital expenditures for the quarter was lower than the previous year primarily due to lower brownfields exploration cost as the site focused on less capital-intensive exploration.

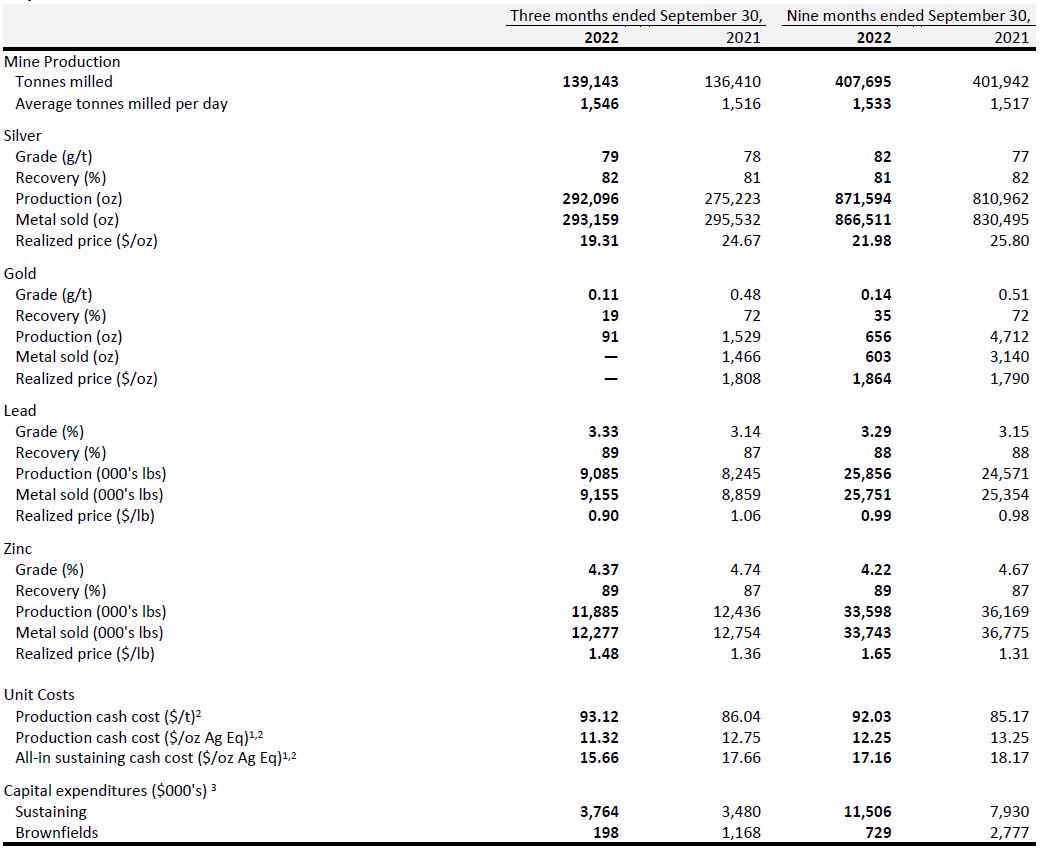

Caylloma Mine, Peru

1 Production cash cost silver equivalent and All-in sustaining cash cost silver equivalent are calculated using realized metal prices for each period respectively

2 Production cash cost, Production cash cost silver equivalent, and All-in sustaining cash cost silver equivalent are Non-IFRS Financial Measures, refer to Non-IFRS Financial Measures

3 Capital expenditures are presented on a cash basis

The Caylloma Mine produced 292,096 ounces of silver, 9.1 million pounds of lead, and 11.9 million pounds of zinc during the three months ended September 30, 2022. The operation delivered another strong quarter of operational performance and is tracking well to deliver total production in the upper range of guidance. Measured against the comparable quarter of the previous year, silver was 6% higher due to a combination of increased mill throughput, higher grades and better recoveries. Lead production was 10% higher than the comparable period as a result of higher head grades, recovery, and mill throughput. Zinc production was 4% lower than the comparable period, mainly impacted by lower head grades partially offset by higher mill throughput and recovery. Gold production totaled 91 ounces with an average head grade of 0.11 g/t.

The cash cost per tonne of processed ore for the three months ended September 30, 2022 increased 8% to $93.12 compared to $86.04 in the same period in 2021. The increase was mainly the result of higher mining costs driven by inflation and its direct impact on the price of materials, such as explosives, fuel, cement, reagents, mill balls and others.

The all-in sustaining cash cost for the three months ended September 30, 2022 decreased 11% to $15.66 per ounce compared to $17.66 per ounce for the same period in 2021 as a result of higher costs being offset by an increase in silver equivalent production.

Sustaining capital expenditures for the quarter increased primarily due to greater execution of the developments located in level 16 and level 18, offset by decreased expenditure on other levels. The decrease in brownfields capital expenditures was due to significantly lower spending on drilling and development. During the third quarter of 2022, an assessment study for a potential expansion of the mine and processing plant was commenced, with tradeoff results expected to be delivered in the first quarter of 2023.

Qualified Person

Eric Chapman, Senior Vice President of Technical Services, is a Professional Geoscientist of the Association of Professional Engineers and Geoscientists of the Province of British Columbia (Registration Number 36328), and is the Company’s Qualified Person (as defined by National Instrument 43-101). Mr. Chapman has reviewed and approved the scientific and technical information contained in this news release and has verified the underlying data.

Non-IFRS Financial Measures

The Company has disclosed certain financial measures and ratios in this news release which are not defined under the International Financial Reporting Standards (“IFRS”), as issued by the International Accounting Standards Board, and are not disclosed in the Company’s financial statements, including but not limited to: cash cost per ounce of gold sold; all-in sustaining cash cost per ounce of gold sold; all-in cash cost per ounce of gold sold; total production cash cost per tonne; cash cost per payable ounce of silver equivalent sold; all-in sustaining cash cost per payable ounce of silver equivalent sold; all-in cash cost per payable ounce of silver equivalent sold; free cash flow from ongoing operations; adjusted net income; adjusted EBITDA and working capital.

These non-IFRS financial measures and non-IFRS ratios are widely reported in the mining industry as benchmarks for performance and are used by management to monitor and evaluate the Company’s operating performance and ability to generate cash. The Company believes that, in addition to financial measures and ratios prepared in accordance with IFRS, certain investors use these non-IFRS financial measures and ratios to evaluate the Company’s performance. However, the measures do not have a standardized meaning under IFRS and may not be comparable to similar financial measures disclosed by other companies. Accordingly, non-IFRS financial measures and non-IFRS ratios should not be considered in isolation or as a substitute for measures and ratios of the Company’s performance prepared in accordance with IFRS. The Company has calculated these measures consistently for all periods presented.

To facilitate a better understanding of these measures and ratios as calculated by the Company, descriptions are provided below. In addition, see “Non-IFRS Financial Measures” in the Company’s management’s discussion and analysis for the three and nine months ended September 30, 2022 (“Q3 2022 MD&A”), which section is incorporated by reference in this news release, for additional information regarding each non-IFRS financial measure and non-IFRS ratio disclosed in this news release, including an explanation of their composition; an explanation of how such measures and ratios provide useful information to an investor and the additional purposes, if any, for which management of Fortuna uses such measures and ratio. The Q3 2022 MD&A may be accessed on SEDAR at www.sedar.com under the Company’s profile, Fortuna Silver Mines Inc.

Except as otherwise described in the Q3 2022 MD&A, the Company has calculated these measures consistently for all periods presented.

Adjusted Net Income for the Three and Nine Months Ended September 30, 2022 and 2021

1 Amounts are recorded in Cost of sales

2 Amounts are recorded in General and Administration

Figures may not add due to rounding

Adjusted EBITDA for the Three and Nine Months Ended September 30, 2022 and 2021

Figures may not add due to rounding

Free Cash Flow from ongoing operations for the Three and Nine Months Ended September 30, 2022 and 2021

In 2022, the Company changed the method for calculating Free Cash Flow from Ongoing Operations. The calculation now uses taxes paid as opposed to the previous method which used current income taxes. While this may create larger quarter over quarter fluctuations due to the timing of income tax payments, management believes the revised method is a better representation of the Free Cash Flow generated by the Company’s ongoing operations. Comparative values from 2021 have been restated using the change in the methodology.

Figures may not add due to rounding

Cash Cost per Ounce of Gold Sold for the Three and Nine Months Ended September 30, 2022 and 2021

1 September 30, 2021 restated, Sustaining leases moved to All-In Sustaining

The Yaramoko Mine was acquired as part of the acquisition of Roxgold which completed on July 2, 2021. Comparative figures in 2021 are included from July 2, 2021 onward.

All-in Sustaining Cash Cost per Ounce of Gold Sold for the Three and Nine Months Ended September 30, 2022 and 2021

1 Presented on a cash basis

The Yaramoko Mine was acquired as part of the acquisition of Roxgold which completed on July 2, 2021. Comparative figures in 2021 are included from July 2, 2021 onward.

1 Presented on a cash basis

Production Cash Cost per Tonne and Cash Cost per Payable Ounce of Silver Equivalent Sold for the Three and Nine Months Ended September 30, 2022 and 2021

1 Silver equivalent sold for Q3 2022 is calculated using a silver to gold ratio of 90.0:1 (Q3 2021: 73.8:1). Silver equivalent sold for YTD 2022 is calculated using a silver to gold ratio of 83.5:1 (YTD 2021: 69.7:1).

2 Silver equivalent is calculated using the realized prices for gold and silver. Refer to Financial Results – Sales and Realized Prices

3 September 30, 2021 restated, Sustaining leases moved to All-In Sustaining

1 Silver equivalent sold for Q3 2022 is calculated using a silver to gold ratio of 0.0:1 (Q3 2021: 72.5:1), silver to lead ratio of 1:21.4 pounds (Q3 2021: 1:23.3), and silver to zinc ratio of 1:13.0 pounds (Q3 2021: 1:18.1). Silver equivalent sold for YTD 2022 is calculated using a silver to gold ratio of 84.8:1 (YTD 2021: 69.4:1), silver to lead ratio of 1:22.2 pounds (YTD 2021: 1:26.3), and silver to zinc ratio of 1:13.3 pounds (YTD 2021: 1:19.7).

2 Silver equivalent is calculated using the realized prices for gold, silver, lead, and zinc. Refer to Financial Results – Sales and Realized Prices

3 September 30, 2021 restated, Sustaining leases moved to All-In Sustaining

All-in Sustaining Cash Cost and All-in Cash Cost per Payable Ounce of Silver Equivalent Sold for the Three and Nine Months Ended September 30, 2022 and 2021

1 Silver equivalent sold for Q3 2022 is calculated using a silver to gold ratio of 90.0:1 (Q3 2021: 73.9:1). Silver equivalent sold for YTD 2022 is calculated using a silver to gold ratio of 83.5:1 (YTD 2021: 69.7:1).

2 Silver equivalent is calculated using the realized prices for gold, silver, lead, and zinc. Refer to Financial Results – Sales and Realized Prices

3 Presented on a cash basis

4 September 30, 2021 restated, Sustaining leases moved from Cash Cost

1 Silver equivalent sold for Q3 2022 is calculated using a silver to gold ratio of 0.0:1 (Q3 2021: 72.5:1), silver to lead ratio of 1:21.4 pounds (Q3 2021: 1:23.3), and silver to zinc ratio of 1:13.0 pounds (Q3 2021: 1:18.2). Silver equivalent sold for YTD 2022 is calculated using a silver to gold ratio of 84.8:1 (YTD 2021: 69.4:1), silver to lead ratio of 1:22.2 pounds (YTD 2021: 1:26.3), and silver to zinc ratio of 1:13.3 pounds (YTD 2021: 1:19.7).

2 Silver equivalent is calculated using the realized prices for gold, silver, lead, and zinc. Refer to Financial Results – Sales and Realized Prices

3 Presented on a cash basis

4 September 30, 2021 restated, Sustaining leases moved from Cash Cost

Additional information regarding the Company’s financial results and activities underway are available in the Company’s third quarter 2022 Financial Statements and accompanying Q3 2022 MD&A, which are available for download on the Company’s website, www.fortunasilver.com, on SEDAR at www.sedar.com and on EDGAR at www.sec.gov/edgar.

Conference Call and Webcast

A conference call to discuss the financial and operational results will be held on Thursday, November 10, 2022 at 9:00 a.m. Pacific time | 12:00 p.m. Eastern time. Hosting the call will be Jorge A. Ganoza, President and CEO; Luis D. Ganoza, Chief Financial Officer; Cesar Velasco, Chief Operating Officer – Latin America and David Whittle, Chief Operating Officer – West Africa.

Shareholders, analysts, media and interested investors are invited to listen to the live conference call by logging onto the webcast at https://www.webcaster4.com/Webcast/Page/1696/46956 or over the phone by dialing in just prior to the starting time.

Conference call details:

Date: Thursday, November 10, 2022

Time: 9:00 a.m. Pacific time | 12:00 p.m. Eastern time

Dial in number (Toll Free): +1. 888.506.0062

Dial in number (International): +1.973.528.0011

Entry code: 722669

Replay number (Toll Free): +1.877.481.4010

Replay number (International): +1.919.882.2331

Replay Passcode: 46956

Playback of the earnings call will be available until Thursday, November 24, 2022. Playback of the webcast will be available until Friday, November 10, 2023. In addition, a transcript of the call will be archived on the Company’s website.

About Fortuna Silver Mines Inc.

Fortuna Silver Mines Inc. is a Canadian precious metals mining company with four operating mines in Argentina, Burkina Faso, Mexico and Peru, and a fifth mine under construction in Côte d’Ivoire. Sustainability is integral to all our operations and relationships. We produce gold and silver and generate shared value over the long-term for our stakeholders through efficient production, environmental protection and social responsibility. For more information, please visit our website.

ON BEHALF OF THE BOARD

Jorge A. Ganoza

President, CEO, and Director

Fortuna Silver Mines Inc.

Investor Relations:

Carlos Baca | info@fortunasilver.com

Forward-looking Statements

This news release contains forward-looking statements which constitute “forward-looking information” within the meaning of applicable Canadian securities legislation and “forward-looking statements” within the meaning of the “safe harbor” provisions of the Private Securities Litigation Reform Act of 1995 (collectively, “Forward-looking Statements”). All statements included herein, other than statements of historical fact, are Forward-looking Statements and are subject to a variety of known and unknown risks and uncertainties which could cause actual events or results to differ materially from those reflected in the Forward-looking Statements. The Forward-looking Statements in this news release include, without limitation, statements about the Company’s plans for its mines and mineral properties; the Company’s anticipated financial and operational performance in 2022; estimated production and costs of production for 2022, including grade and volume of metal produced and sales, revenues and cashflows, and capital costs (sustaining and non-sustaining), and operating costs, including projected production cash costs and all-in sustaining costs; the ability of the Company to mitigate the inflationary pressures on supplies used in its operations; estimated capital expenditures and estimated exploration spending in 2022, including amounts for exploration activities at its properties; the Company’s plans for the construction of the open pit mine at the Séguéla project in Cote d’Ivoire; the economics for the construction of the mine at the Séguéla project as set out in the feasibility study, the estimated construction capital expenditures for the project, the timelines and schedules for the construction and production of gold at the Séguéla project; statements regarding the Company’s liquidity, access to capital, including the proposed increase in size of the Company’s existing credit facility; the impact of COVID-19 on the Company’s operations; the Company’s business strategy, plans and outlook; the merit of the Company’s mines and mineral properties; mineral resource and reserve estimates, metal recovery rates, concentrate grade and quality; changes in tax rates and tax laws, requirements for permits, anticipated approvals and other matters. Often, but not always, these Forward-looking Statements can be identified by the use of words such as “estimated”, “expected”, “anticipated”, “potential”, “open”, “future”, “assumed”, “projected”, “used”, “detailed”, “has been”, “gain”, “planned”, “reflecting”, “will”, “containing”, “remaining”, “to be”, or statements that events, “could” or “should” occur or be achieved and similar expressions, including negative variations.

Forward-looking Statements involve known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements of the Company to be materially different from any results, performance or achievements expressed or implied by the Forward-looking Statements. Such uncertainties and factors include, among others, changes in general economic conditions and financial markets; the impact of the COVID-19 pandemic on the Company’s mining operations and construction activities; the risks relating to a global pandemic, including the COVID-19 pandemic, as well as risks associated with war or other geo-political hostilities, such as the Ukrainian – Russian conflict, any of which could continue to cause a disruption in global economic activity; the risks associated with the acquisition of Roxgold; fluctuation in currencies and foreign exchange rates; increases in the rate of inflation; the imposition of capital controls in countries in which the Company operates; any extension of the currency controls in Argentina or changes in tax laws in Argentina and the other countries in which we operate; the ability of the Company to enter into definitive documentation to increase the size of its existing credit facility, on acceptable terms or at all; changes in the prices of key supplies; technological and operational hazards in Fortuna’s mining and mine development activities; risks inherent in mineral exploration; uncertainties inherent in the estimation of mineral reserves, mineral resources, and metal recoveries; changes to current estimates of mineral reserves and resources; changes to production and cost estimates; changes in the position of regulatory authorities with respect to the granting of approvals or permits; governmental and other approvals; changes in government, political unrest or instability in countries where Fortuna is active; labor relations issues; as well as those factors discussed under “Risk Factors” in the Company’s Annual Information Form. Although the Company has attempted to identify important factors that could cause actual actions, events or results to differ materially from those described in Forward-looking Statements, there may be other factors that cause actions, events or results to differ from those anticipated, estimated or intended.

Forward-looking Statements contained herein are based on the assumptions, beliefs, expectations and opinions of management, including but not limited to the accuracy of the Company’s current mineral resource and reserve estimates; that the Company’s activities will be conducted in accordance with the Company’s public statements and stated goals; that there will be no material adverse change affecting the Company, its properties or changes to production estimates (which assume accuracy of projected ore grade, mining rates, recovery timing, and recovery rate estimates and may be impacted by unscheduled maintenance, labour and contractor availability and other operating or technical difficulties); the construction at the Séguéla gold Project will continue on the time line and in accordance with the budget as planned; the duration and impacts of COVID-19; geo-political uncertainties that may affect the Company’s production, workforce, business, operations and financial condition; that the Company will the expected trends in mineral prices and currency exchange rates; that the Company will be successful in mitigating the impact of inflation on its business and operations; that the Company will be able to enter into definitive documentation to increase the size of its existing credit facility, on terms acceptable to it; that all required approvals and permits will be obtained for the Company’s business and operations on acceptable terms; that there will be no significant disruptions affecting the Company’s operations, the ability to meet current and future obligations and such other assumptions as set out herein. Forward-looking Statements are made as of the date hereof and the Company disclaims any obligation to update any Forward-looking Statements, whether as a result of new information, future events or results or otherwise, except as required by law. There can be no assurance that these Forward-looking Statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, investors should not place undue reliance on Forward-looking Statements.

Cautionary Note to United States Investors Concerning Estimates of Reserves and Resources

Reserve and resource estimates included in this news release have been prepared in accordance with National Instrument 43-101 Standards of Disclosure for Mineral Projects (“NI 43-101”) and the Canadian Institute of Mining, Metallurgy, and Petroleum Definition Standards on Mineral Resources and Mineral Reserves. NI 43-101 is a rule developed by the Canadian Securities Administrators that establishes standards for public disclosure by a Canadian company of scientific and technical information concerning mineral projects. Unless otherwise indicated, all mineral reserve and mineral resource estimates contained in the technical disclosure have been prepared in accordance with NI 43-101 and the Canadian Institute of Mining, Metallurgy and Petroleum Definition Standards on Mineral Resources and Reserves. Canadian standards, including NI 43-101, differ significantly from the requirements of the Securities and Exchange Commission, and mineral reserve and resource information included in this news release may not be comparable to similar information disclosed by U.S. companies.