Vancouver, British Columbia–(Newsfile Corp. – July 18, 2023) – First Majestic Silver Corp. (NYSE: AG) (TSX: FR) (the “Company” or “First Majestic”) is pleased to announce positive drilling results from its ongoing exploration programs at San Dimas, Santa Elena, and Jerritt Canyon. The ongoing exploration programs were designed to focus on adding new mineral resources (“Resources”), upgrading Resources to mineral reserves (“Reserves”), and further defining mineralization near current underground infrastructure. In the first half of 2023, the Company had up to 19 active drill rigs and completed a total of 78,973 metres of exploration drilling across its portfolio of mines and projects in Mexico and the United States.

“We are very encouraged with the high-grade exploration results that have been achieved to date,” stated Keith Neumeyer, President & CEO of First Majestic. “The recent drilling has accomplished multiple goals from confirming new geologically prospective areas to achieving strong intercepts for Resource to Reserve conversion. Results from the Elia and Santa Teresa veins at San Dimas highlight the potential to add new, high-grade ounces within this past-producing area. At Santa Elena, the results from the Ermitaño vein are in many cases better than expected and will provide a solid foundation for Reserve replacement. Finally, successful drilling at the Javelin target at Jerritt Canyon has identified what appears to be another large, mineralized gold pod near underground infrastructure and further showcases the strong exploration potential in the asset.”

DRILLING HIGHLIGHTS

Select highlights from the Company’s ongoing exploration program include the following high-grade intercepts:

At San Dimas,

- 8.38 g/t Au and 763 g/t Ag (1,434 g/t AgEq) over 3.88m (EL23-246)

- 14.98 g/t Au and 89 g/t Ag (1,287 g/t AgEq) over 4.12m (ST23-012)

- 5.41 g/t Au and 883 g/t Ag (1,315 g/t AgEq) over 5.69m (PE23-187)

At Santa Elena,

- 4.27 g/t Au & 127 g/t Ag (468 g/t AgEq) over 13.3m (EWUG-23-001)

- 5.98 g/t Au & 222 g/t Ag (700 g/t AgEq) over 15.55m (EWUG-23-002)

- 13.73 g/t Au & 150 g/t Ag (1,248 g/t AgEq) over 6.42m (EWUG-23-003)

At Jerritt Canyon,

- 5.61 g/t Au over 61.2m (SMI-D04-EXP22-1094)

- 4.74 g/t Au over 24.4m (SMI-230004)

- 8.04 g/t Au over 12.2m (SMI-230010)

SAN DIMAS EXPLORATION RESULTS

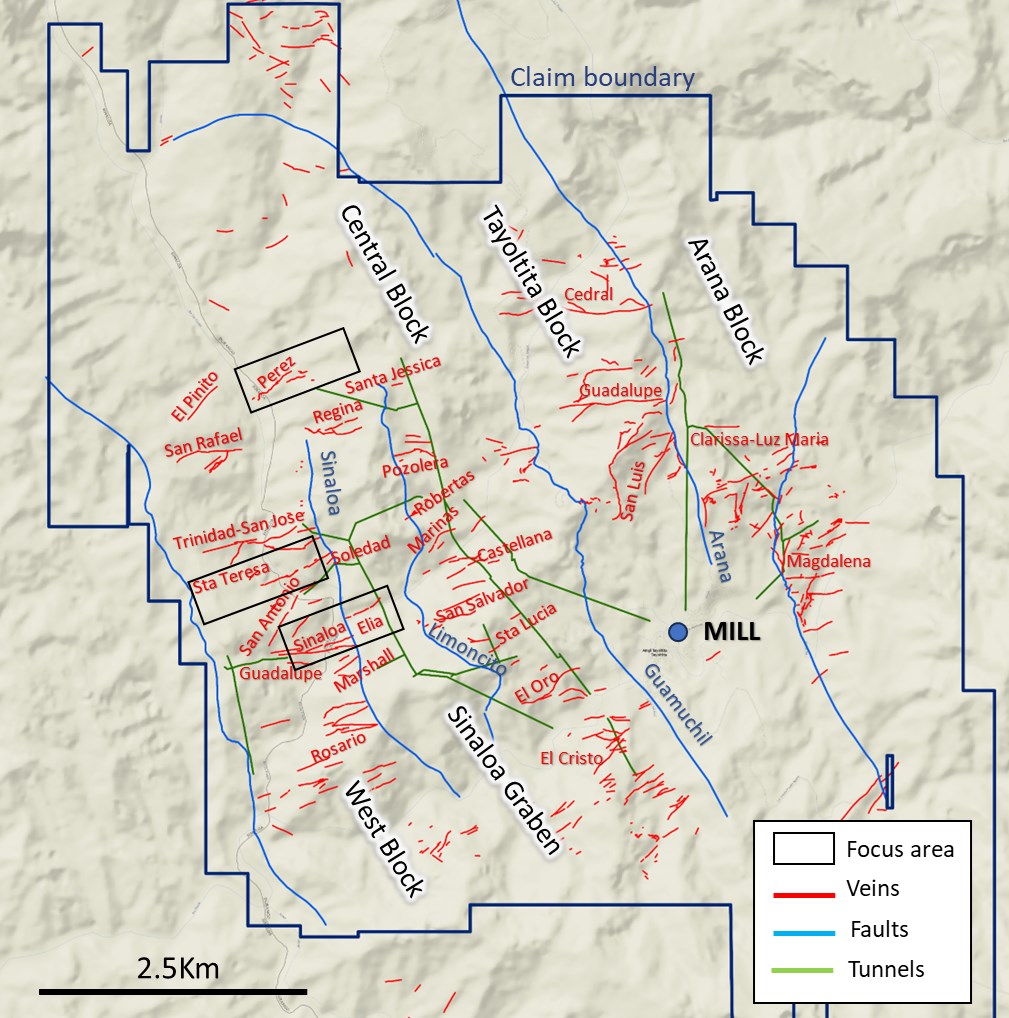

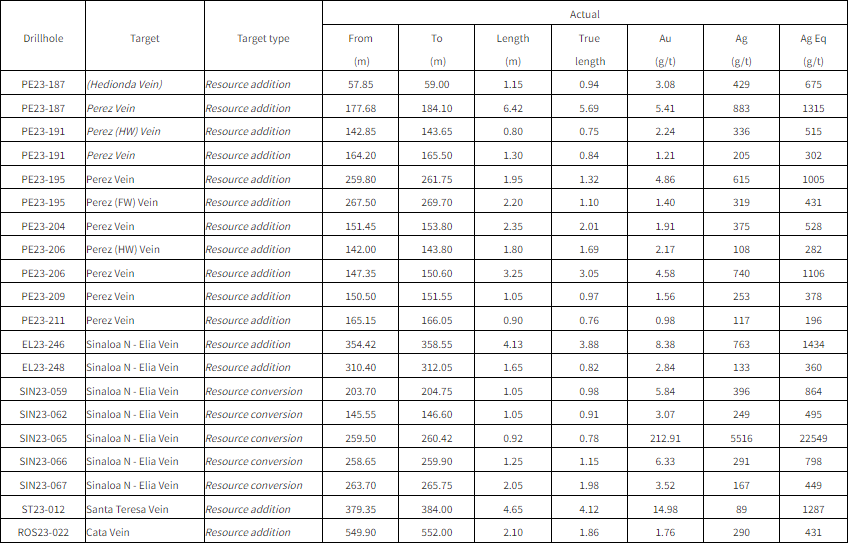

Exploration drill holes at the San Dimas property intersected significant gold and silver mineralization in three separate veins: the Sinaloa North-Elia vein, the Santa Teresa vein, and the Perez vein (Figure 1).

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/1475/173776_c02d52b424949bad_002full.jpg

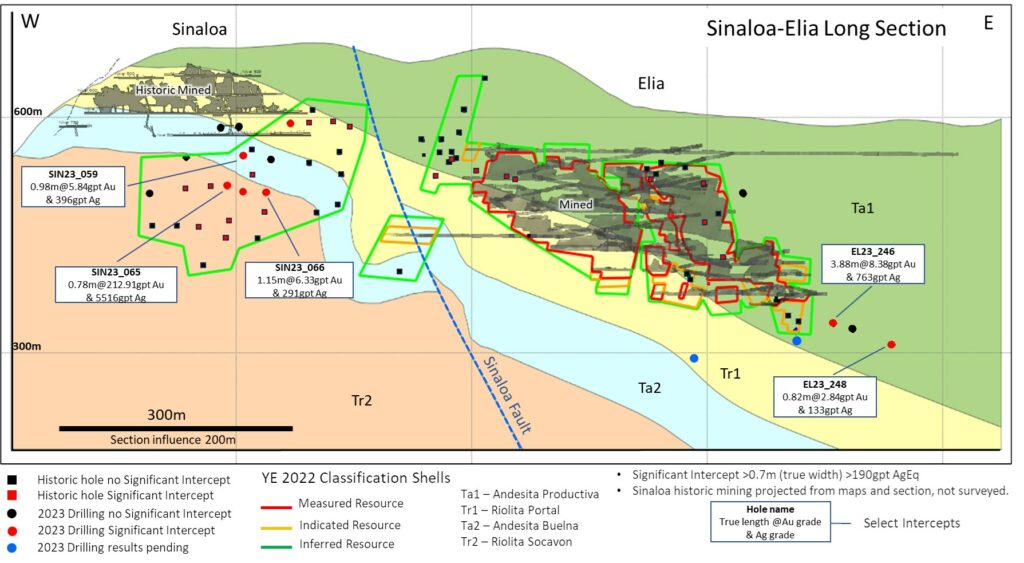

Drilling at the historic Sinaloa North-Elia mines cut multiple gold and silver mineralized intercepts. The drill holes confirmed the presence of mineralization below zones of historic mining at the Sinaloa vein and extended the Elia vein east approximately 175 meters away from historic mine stopes (Figure 2). Select drill hole assay grade and intervals (true width) of the vein intersections below:

- SIN23-059: 5.84 g/t Au and 396 g/t Ag (864 g/t AgEq) over 0.98m,

- SIN23-066: 6.33 g/t Au and 291 g/t Ag (798 g/t AgEq) over 1.15m,

- EL23-246: 8.38 g/t Au and 763 g/t Ag (1,434 g/t AgEq) over 3.88m,

- EL23-248: 2.84 g/t Au and 133 g/t Ag (360 g/t AgEq) over 0.82m

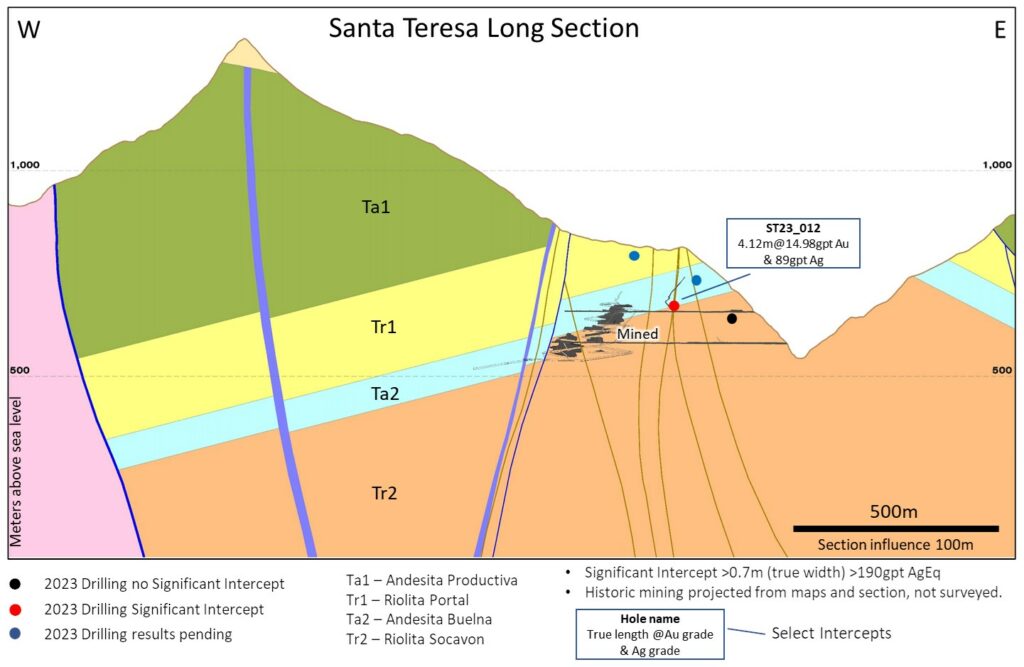

Expansionary drilling on the projection of the historic Santa Teresa vein has returned encouraging results ~110m to the east of historic mining. The vein remains open to the east and west (Figure 3). The assay grade and the true width of the vein mineralization is:

- ST23-012: 14.98 g/t Au and 89 g/t Ag (1,287 g/t AgEq) over 4.12m

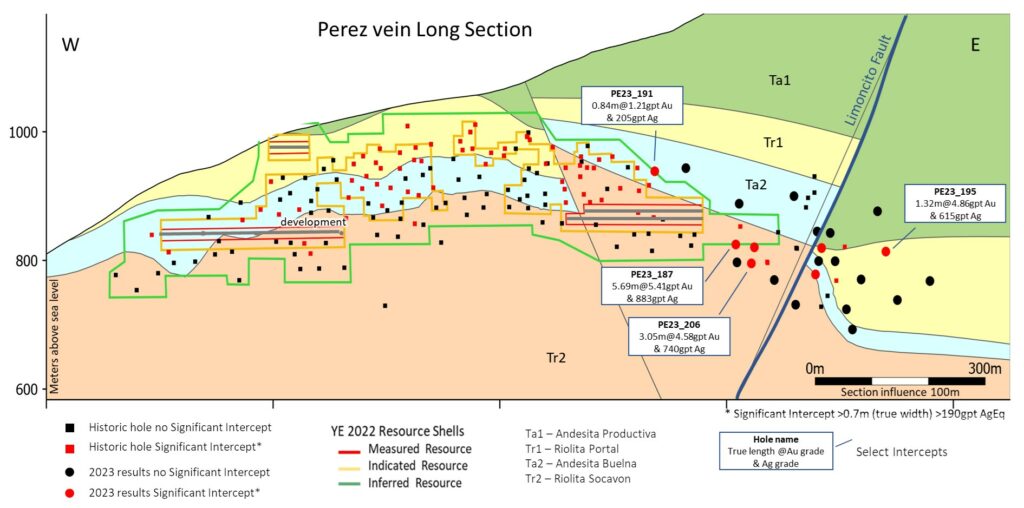

Expansionary drilling of the Perez vein tested the extension of the vein approximately 300m east of the current Inferred mineral resources. The vein in the area appears disrupted by post mineral faulting but multiple gold and silver intercepts were reported and identify a new mineralized shoot. Drill holes also cut gold and silver mineralization in the hanging wall and foot wall secondary veins. The Perez vein potential remains open to the east where it projects into an area where post-mineral faulting is anticipated to decrease (Figure 4). Select drill hole assay grade and intervals (true width) of the vein intersections.

- PE23-187: 5.41 g/t Au and 883 g/t Ag (1,315 g/t AgEq) over 5.69m,

- PE23-191: 1.21 g/t Au and 205 g/t Ag (302 g/t AgEq) over 0.84m,

- PE23-206: 4.58 g/t Au and 740 g/t Ag (1,106 g/t AgEq) over 3.05m

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/1475/173776_c02d52b424949bad_003full.jpg

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/1475/173776_c02d52b424949bad_004full.jpg

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/1475/173776_c02d52b424949bad_005full.jpg

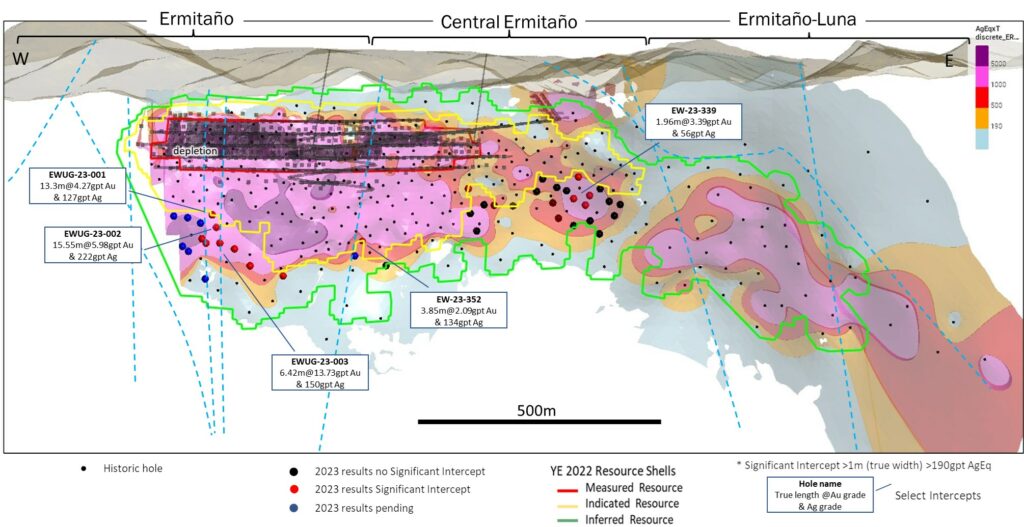

SANTA ELENA EXPLORATION RESULTS

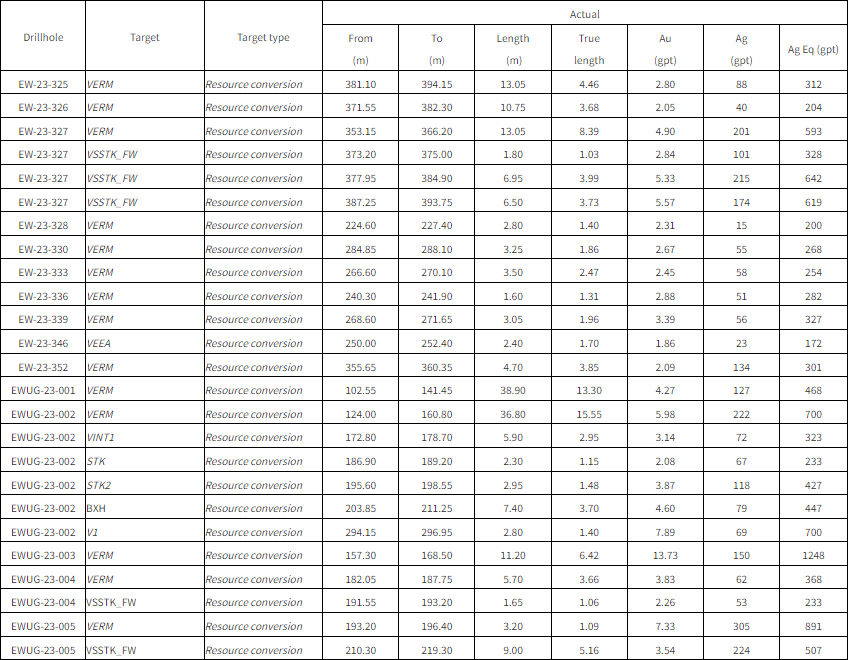

A delineation drill program designed to convert Inferred to Indicated mineral resource estimates at the Ermitaño mine cut multiple intersections of gold and silver mineralization (Figure 5). The drilling program was intended to replace Reserve estimates depleted by mining. In addition to intercepts in the Ermitaño vein, multiple holes intersected mineralization in secondary veins located in the hanging and footwall of the Ermitaño vein. Select drill hole assay grade and true width from the intersections include:

- EW-23-339: 3.39 g/t Au & 56 g/t Ag (327 g/t AgEq) over 1.96m,

- EW-23-352: 2.09 g/t Au & 134 g/t Ag (301 g/t AgEq) over 3.85m,

- EWUG-23-001: 4.27 g/t Au & 127 g/t Ag (468 g/t AgEq) over 13.3m,

- EWUG-23-002: 5.98 g/t Au & 222 g/t Ag over (700 g/t AgEq) 15.55m,

- EWUG-23-003: 13.73 g/t Au & 150 g/t Ag (1,248 g/t AgEq) over 6.42m

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/1475/173776_c02d52b424949bad_006full.jpg

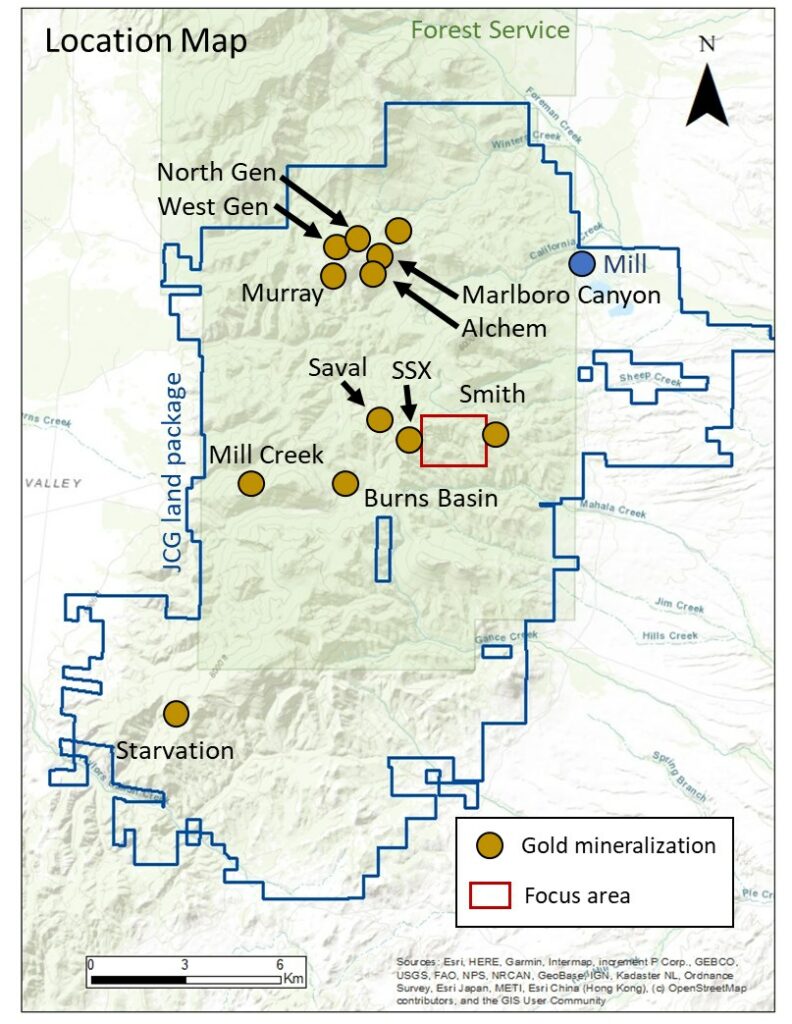

JERRITT CANYON EXPLORATION RESULTS

Recent drilling at Jerritt Canyon has returned positive results located within the SSX and Smith Mine areas (Figure 6).

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/1475/173776_c02d52b424949bad_007full.jpg

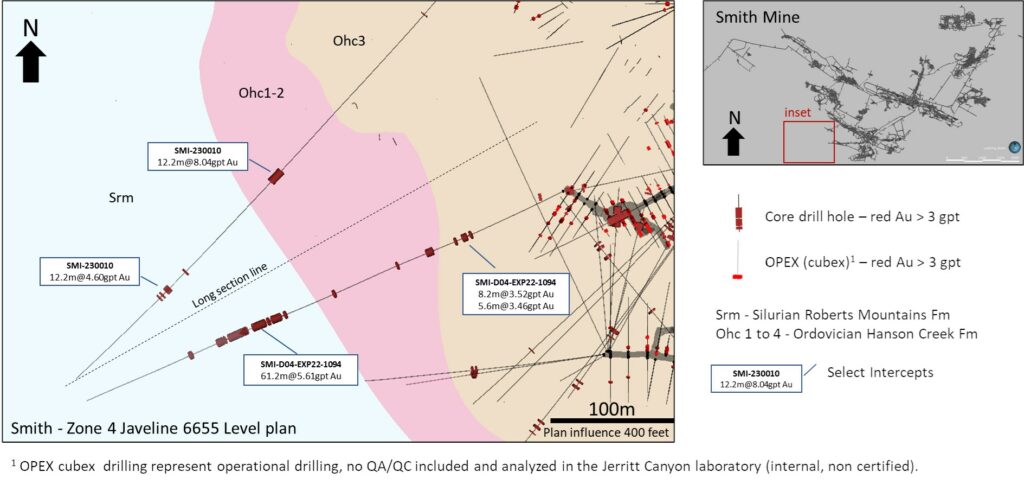

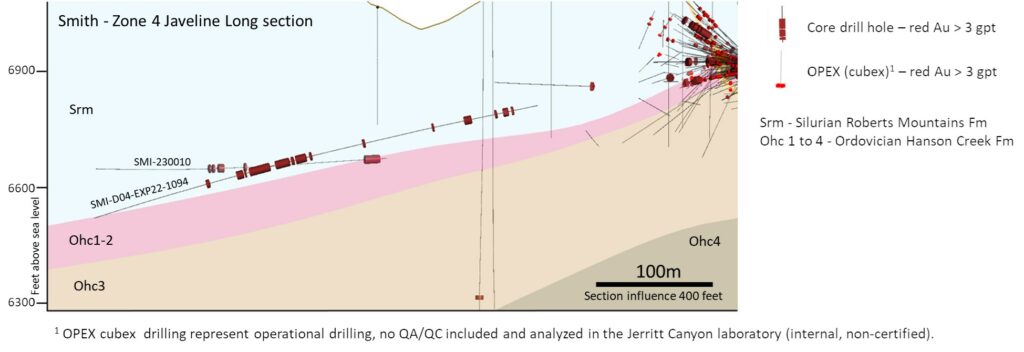

Two drill holes were completed between the Smith and SSX mines and south of the mine connection drift at the new Javelin target. The drill hole gold intercepts were located between 90m and 340m away from existing mine development, geometry and controls of the gold mineralization are interpreted to trend at a relatively low angle to the drill hole intersections, gold mineralization is open in multiple directions as depicted in Figures 7 and Figure 8.

- SMI-D04-EXP22-1094:

- 3.52 g/t Au over 8.2m,

- 3.46 g/t Au over 5.6m,

- 5.61 g/t Au over 61.2m

- SMI-230010

- 8.04 g/t Au over 12.2m,

- 4.60 g/t Au over 12.2m

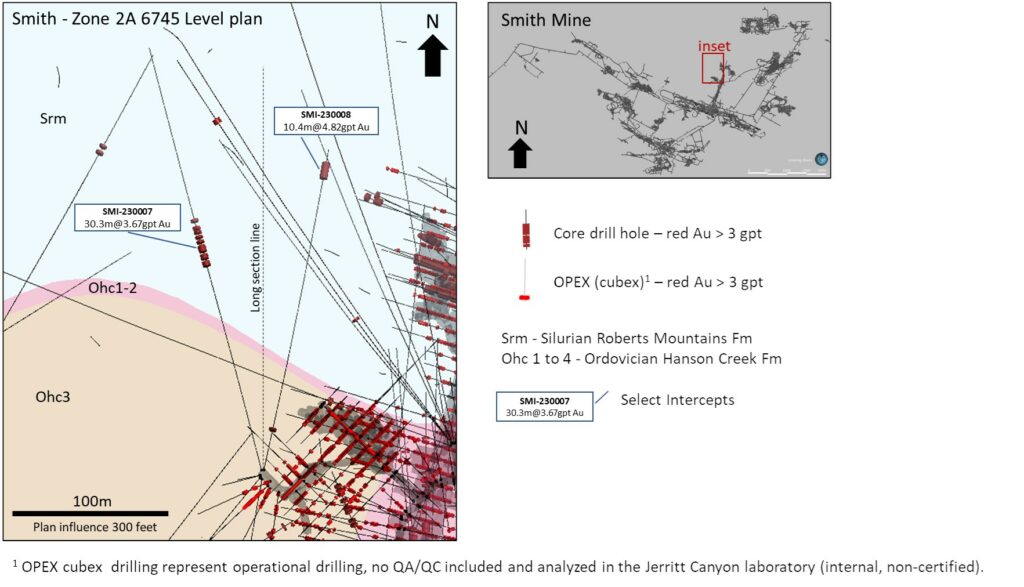

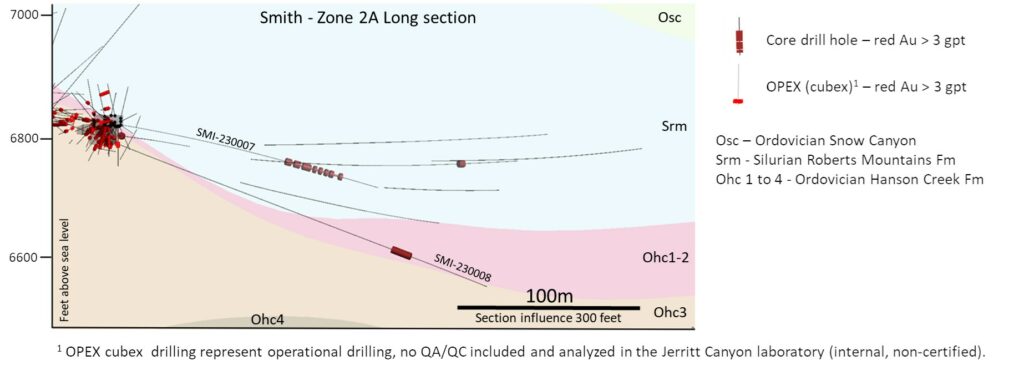

Drilling in Smith Zone 2A also returned multiple gold mineralized intercepts. Results from holes SMI-0007 and SMI-0008 intersected gold mineralization approximately 110m away from existing mine development as highlight below. The geometry and controls of the gold mineralization is interpreted to trend at a relatively low angle to the drill hole intersections as shown in Figure 9 and Figure 10.

- SMI-23007: 3.67 g/t Au over 30.3m,

- SMI-23008: 4.82 g/t Au over 10.4m

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/1475/173776_c02d52b424949bad_008full.jpg

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/1475/173776_c02d52b424949bad_009full.jpg

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/1475/173776_c02d52b424949bad_010full.jpg

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/1475/173776_c02d52b424949bad_011full.jpg

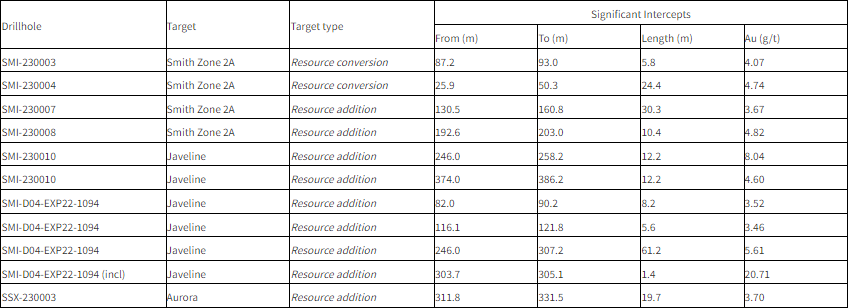

Significant Intercepts Result Tables:

Table 1: Summary of Significant Intercepts San Dimas.

All holes are Diamond Drill; AgEq grade = silver grade (g/t) + [gold grade (g/t)*80]

From, To and Length indicated in meters, true width of the intercept is estimated per drill hole and vein angles.

Table 2: Summary of Significant Intercepts Ermitaño.

All holes are Diamond Drill; AgEq grade = silver grade (g/t) + (gold grade (g/t)*80)

From, To and Length indicated in meters, true width of the intercept is estimated per drill hole and vein angles.

Table 3: Summary of Significant Gold Intercepts Jerritt Canyon Gold.

All holes are Diamond Drill;

From, To and Length indicated in meters, true thickness of the mineralized zones are unknown at this time. All results >15gpt Au are reported as “includes.”

Gold and silver drill hole intercepts at San Dimas were composited using the length weighted average of uncapped sample assays, a 190 g/t AgEq minimum grade, and a minimum composite length of 0.7m (true width). A maximum one meter below the minimum grade was allowed as internal dilution. A single sample below the minimum but above 100 g/t AgEq was allowed in the hanging or footwall to achieve minimum true width in select cases. The true width of intercepts is calculated based on current understanding of drillhole and vein angle geometry.

Gold and silver drill hole intercepts at Ermitaño were composited using the length weighted averages of uncapped sample assays, a 190 g/t AgEq minimum grade, and a minimum length of 1m (true width). A maximum one meter below the minimum grade was allowed as internal dilution. The true width of intercepts is calculated based on current understanding of drillhole and vein angle geometry.

Gold drill hole intercepts at Jerritt Canyon were composited using the length weighted averages of uncapped sample assays, a 3.0 g/t Au minimum grade, and a minimum composite length of 5m. A maximum five meters below the minimum grade was allowed as internal composite dilution. True thickness of intercepts is not known at this time.

First Majestic’s drilling programs follow established QA/QC insertion protocols with standards, blanks and duplicates introduced into the San Dimas, Santa Elena and Jerritt Canyon sample-stream. After geological logging, all drill core samples are cut in half. One half of the core is submitted to the designated laboratory for analysis and the remaining half core is retained on-site for verification and reference purposes.

Core samples from Jerritt Canyon drilling were submitted to Paragon Geochemical (ISO/IEC 17025:2017) or to First Majestic’s Central Laboratory (ISO 9001-2015). Core samples from San Dimas and Santa Elena drilling were submitted to the Central Laboratory.

Samples submitted to Paragon Geochemical and to the Central Laboratory are dried, crushed and pulverized to 85% passing a 75 μm. At Paragon Geochemical, gold is analyzed by Au by Fire Assay -Aqua Regia Digest AAS finish (Au-AA30). Samples returning gold greater than 8 ppm are analyzed by 30 g Fire Assay gravimetric finish (Au-GR30). At the Central Laboratory, gold is analyzed by fire assay with atomic absorption finish (Au-AA13). Results above 10 g/t gold are analyzed by 20 g Fire Assay gravimetric finish (ASAG-14). Silver is analyzed by 3-Acid Digest AAS finish (AAG-13). Results above 200 g/t silver are analyzed by 20 g Fire Assay gravimetric finish (ASAG-13).

See the Company’s Annual Information Form, dated March 31, 2023, available at www.sedar.com for further information concerning QA/QC and data verification matters, the key assumptions, parameters and methods used by the Company to estimate Mineral Reserves and Mineral Resources, and for a detailed description of known legal, political, environmental, and other risks that could materially affect the Company’s business and the potential development of the Company’s Mineral Reserves and Mineral Resources.

Gonzalo Mercado, Vice President Exploration and Technical Services for First Majestic, has reviewed and approved the technical information disclosed in this news release and is a “Qualified Person” as defined under NI 43-101.

ABOUT THE COMPANY

First Majestic is a publicly traded mining company focused on silver and gold production in Mexico and the United States. The Company presently owns and operates the San Dimas Silver/Gold Mine, the Santa Elena Silver/Gold Mine, and the La Encantada Silver Mine as well as a portfolio of development and exploration assets, including the Jerritt Canyon Gold project located in northeastern Nevada.

First Majestic is proud to offer a portion of its silver production for sale to the public. Bars, ingots, coins and medallions are available for purchase online at its Bullion Store at some of the lowest possible premiums.

FOR FURTHER INFORMATION contact info@firstmajestic.com, visit our website at www.firstmajestic.com or call our toll-free number 1.866.529.2807.

FIRST MAJESTIC SILVER CORP.

“signed”

Keith Neumeyer, President & CEO

Cautionary Note Regarding Forward-Looking Statements

This press release contains “forward‐looking information” and “forward-looking statements” under applicable Canadian and U.S. securities laws (collectively, “forward‐looking statements”). These statements relate to future events or the Company’s future performance, business prospects or opportunities that are based on forecasts of future results, estimates of amounts not yet determinable and assumptions of management made in light of management’s experience and perception of historical trends, current conditions and expected future developments. Forward-looking statements include, but are not limited to, statements with respect to: the Company’s business strategy; future planning processes; commercial mining operations; and exploration activities and the possible results thereof. Assumptions may prove to be incorrect and actual results may differ materially from those anticipated. As such, investors are cautioned not to place undue reliance upon forward-looking statements as there can be no assurance that the plans, assumptions or expectations upon which they are placed will occur. Statements concerning proven and probable mineral reserves and mineral resource estimates may also be deemed to constitute forward‐looking statements to the extent that they involve estimates of the mineralization that will be encountered as and if the property is developed, and in the case of measured and indicated mineral resources or proven and probable mineral reserves, such statements reflect the conclusion based on certain assumptions that the mineral deposit can be economically exploited. Any statements that express or involve discussions with respect to predictions, expectations, beliefs, plans, projections, objectives or future events or performance (often, but not always, using words or phrases such as “seek”, “anticipate”, “plan”, “continue”, “estimate”, “expect”, “may”, “will”, “project”, “predict”, “forecast”, “potential”, “target”, “intend”, “could”, “might”, “should”, “believe” and similar expressions) are not statements of historical fact and may be “forward‐looking statements.”

Actual results may vary from forward-looking statements. Forward-looking statements are subject to known and unknown risks, uncertainties and other factors that may cause actual results to materially differ from those expressed or implied by such forward-looking statements, including but not limited to: the duration and effects of the coronavirus and COVID-19, and any other pandemics or epidemics on our operations and workforce, and the effects on global economies and society; general economic conditions including inflation risks; conclusions of economic evaluations; changes in project parameters as plans continue to be refined; commodity prices; variations in ore reserves, grade or recovery rates; actual performance of plant, equipment or processes relative to specifications and expectations; accidents; labour relations; relations with local communities; changes in national or local governments; changes in applicable legislation or application thereof; delays in obtaining approvals or financing or in the completion of development or construction activities; exchange rate fluctuations; requirements for additional capital; government regulation; environmental risks ; and the failure of exploration programs or studies to deliver anticipated results or results that would justify and support continued exploration, studies, development or operations, as well as those factors discussed in the section entitled “Description of the Business – Risk Factors” in the Company’s most recent Annual Information Form, available on www.sedar.com, and Form 40-F on file with the United States Securities and Exchange Commission in Washington, D.C.. Although First Majestic has attempted to identify important factors that could cause actual results to differ materially from those contained in forward-looking statements, there may be other factors that cause results not to be as anticipated, estimated or intended.

The Company believes that the expectations reflected in these forward‐looking statements are reasonable, but no assurance can be given that these expectations will prove to be correct and such forward‐looking statements included herein should not be unduly relied upon. These statements speak only as of the date hereof. The Company does not intend, and does not assume any obligation, to update these forward-looking statements, except as required by applicable laws.

Original Article: https://www.newsfilecorp.com/release/173776