Vancouver, British Columbia–(Newsfile Corp. – May 4, 2023) – First Majestic Silver Corp. (NYSE: AG) (TSX: FR) (the “Company” or “First Majestic”) is pleased to announce the unaudited interim consolidated financial results of the Company for the first quarter ended March 31, 2023. The full version of the financial statements and the management discussion and analysis can be viewed on the Company’s website at www.firstmajestic.com or on SEDAR at www.sedar.com and on EDGAR at www.sec.gov. All amounts are in U.S. dollars unless stated otherwise.

FIRST QUARTER 2023 HIGHLIGHTS

- Production of 7.6 million silver equivalent (“AgEq”) ounces, consisting of 2.5 million silver ounces and 60,594 gold ounces, up 1% compared to the previous quarter and up 6% compared to Q1 2022.

- Quarterly revenues totalled $157.0 million; up 6% compared to the previous quarter and unchanged compared to Q1 2022.

- Operating cash flows before non-cash working capital and taxes totalled $21.9 million, compared to $35.3 million in Q1 2022.

- Consolidated cash costs were $15.16 per AgEq ounce and All-In Sustaining Costs (“AISC”) (see “Non-GAAP Financial Measures”, below) were $20.90 per AgEq ounce. Excluding Jerritt Canyon, cash costs for the three Mexican operations were $11.85 per AgEq ounce and AISC were $15.38 per AgEq ounce.

- Adjusted net earnings of $0.9 million (adjusted EPS of $0.00) (See “Non-GAAP Financial Measures”, below) after excluding non-cash and non-recurring items.

- At the end of the quarter, the Company had a cash and restricted cash balance of $235.9 million consisting of $104.8 million of cash and cash equivalents and $131.1 million of restricted cash.

- Declared a cash dividend payment of $0.0057 per common share for the first quarter of 2023 for shareholders of record as of the close of business on May 18, 2023, which will be distributed on or about June 9, 2023.

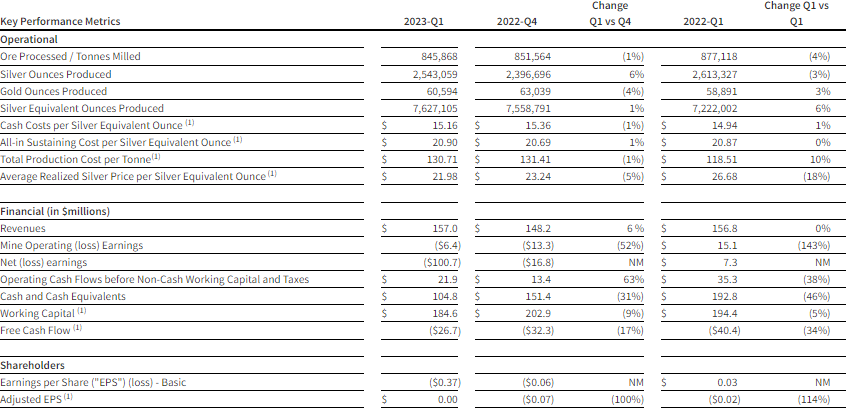

OPERATIONAL AND FINANCIAL HIGHLIGHTS

NM – Not meaningful

(1) See “Non-GAAP Measures” below for further details of these measures.

Q1 2023 FINANCIAL RESULTS

The Company realized an average silver price of $21.98 per AgEq ounce during the first quarter of 2023, representing an 18% decrease compared to the first quarter of 2022 and a 5% decrease compared to the prior quarter.

Revenues generated in the first quarter totaled $157.0 million compared to $156.8 million with the first quarter of 2022.

Cash flow from operations before movements in working capital and income taxes in the quarter was $21.9 million compared to $35.3 million in the first quarter of 2022.

The Company reported mine operating earnings of ($6.4) million compared to $15.1 million in the first quarter of 2022. The decrease in mine operating earnings is primarily attributed to lower than expected production at Jerritt Canyon resulting in higher production costs per ounce, as well as higher labour, inflation, consumables and energy costs during the quarter. The Company also incurred $5.1 million in standby costs for winding down activities at Jerritt Canyon.

The Company reported net earnings of ($100.7) million (EPS of ($0.37)) compared to $7.3 million (EPS of $0.03) in the first quarter of 2022. The Company recognized an impairment charge of $125.2 million, or $94.0 million net of tax, on the Jerritt Canyon Gold Mine following the Company’s decision to the temporarily suspend mining operations and focus on exploration activities to strengthen reserves and resources at the mine.

Adjusted net earnings for the quarter, normalized for non-cash or non-recurring items such as share-based payments, unrealized losses on marketable securities and non-recurring write-downs on mineral inventory for the quarter was $0.9 million (adjusted EPS of $0.00) compared to ($6.2) million (adjusted EPS of ($0.02)) in the first quarter of 2022.

Cash flow from operations before movements in working capital and income taxes in the quarter was $21.9 million compared to $35.3 million in the first quarter of 2022.

As of March 31, 2023, the Company had a cash and restricted cash balance of $235.9 million consisting of $104.8 million of cash and cash equivalents and $131.1 million of restricted cash.

OPERATIONAL HIGHLIGHTS

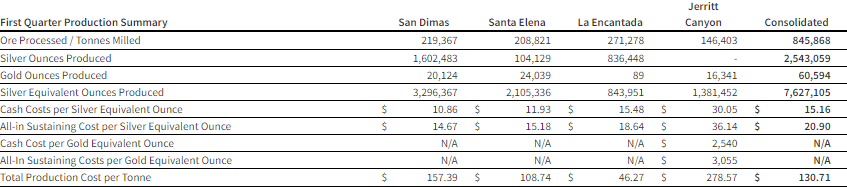

The table below represents the quarterly operating and cost parameters at each of the Company’s four producing mines during the quarter.

(1) See “Non-GAAP Financial Measures”, below for further details of these measures.

The Company produced 7.6 million AgEq ounces consisting of 2.5 million ounces of silver and 60,594 ounces of gold. Total production increased 6% when compared to the fourth quarter of 2022 primarily due to higher grades at both San Dimas and La Encantada.

Cash cost for the quarter was $15.16 per AgEq ounce, compared to $15.36 AgEq per ounce in the previous quarter. The decrease in cash costs per AgEq ounce was primarily attributable to an increase in production at San Dimas and La Encantada driven by a 10% increase of silver grades at both sites. This was partially offset by higher costs driven by a stronger Mexican Peso and slightly lower production at Santa Elena primarily due to processing lower grade silver and gold ores during the quarter. Excluding Jerritt Canyon, cash costs at the three Mexican operations were $11.85 per AgEq ounce.

AISC in the first quarter was $20.90 per AgEq ounce, compared to $20.69 per AgEq ounce in the previous quarter. The slight increase in AISC was primarily attributed to additional capital sustaining expenditures for mine development at Santa Elena and Jerritt Canyon which was offset by lower cash costs. Excluding Jerritt Canyon, AISC at the three Mexican operations were $15.38 per AgEq ounce.

Total capital expenditures in the first quarter were $46.6 million, primarily consisting of $11.9 million at San Dimas, $13.5 million at Santa Elena, $1.9 million at La Encantada, $18.8 million at Jerritt Canyon, and $0.5 million for strategic projects.

Q1 2023 DIVIDEND ANNOUNCEMENT

The Company is pleased to announce that its Board of Directors has declared a cash dividend payment in the amount of $0.0057 per common share for the first quarter of 2023. The first quarter cash dividend will be paid to holders of record of First Majestic’s common shares as of the close of business on May 18, 2023, and will be distributed on or about June 9, 2023.

Under the Company’s dividend policy, the quarterly dividend per common share is targeted to equal approximately 1% of the Company’s net quarterly revenues divided by the Company’s then outstanding common shares on the record date.

The amount and distribution dates of future dividends remain at the discretion of the Board of Directors. This dividend qualifies as an ‘eligible dividend’ for Canadian income tax purposes. Dividends paid to shareholders outside Canada (non-resident investors) may be subject to Canadian non-resident withholding taxes.

ABOUT THE COMPANY

First Majestic is a publicly traded mining company focused on silver and gold production in Mexico and the United States. The Company presently owns and operates the San Dimas Silver/Gold Mine, the Santa Elena Silver/Gold Mine, the La Encantada Silver Mine and the Jerritt Canyon Gold Mine.

First Majestic is proud to offer a portion of its silver production for sale to the public. Bars, ingots, coins and medallions are available for purchase online at its Bullion Store at some of the lowest premiums available.

FOR FURTHER INFORMATION contact info@firstmajestic.com, visit our website at www.firstmajestic.com or call our toll-free number 1.866.529.2807.

FIRST MAJESTIC SILVER CORP.

“signed”

Keith Neumeyer, President & CEO

Non-GAAP Financial Measures

This press release includes reference to certain financial measures which are not standardized measures under the Company’s financial reporting framework. These measures include cash costs per silver equivalent ounce produced, all-in sustaining cost (or “AISC”) per silver equivalent ounce produced, cash costs per gold ounce produced, AISC per gold ounce produced total production cost per tonne, average realized silver price per ounce sold, average realized gold price per ounce sold, working capital, adjusted net earnings and EPS and free cash flow. The Company believes that these measures, together with measures determined in accordance with IFRS, provide investors with an improved ability to evaluate the underlying performance of the Company. These measures are widely used in the mining industry as a benchmark for performance but do not have any standardized meaning prescribed under IFRS, and therefore they may not be comparable to similar measures disclosed by other companies. The data is intended to provide additional information and should not be considered in isolation or as a substitute for measures of performance prepared in accordance with IFRS. For a complete description of how the Company calculates such measures and a reconciliation of certain measures to GAAP terms please see “Non-GAAP Measures” in the Company’s most recent management discussion and analysis filed on SEDAR at www.sedar.com and EDGAR at www.sec.gov and which is incorporated by reference herein.

Cautionary Note Regarding Forward Looking Statements

This press release contains “forward‐looking information” and “forward-looking statements” under applicable Canadian and U.S. securities laws (collectively, “forward‐looking statements”). These statements relate to future events or the Company’s future performance, business prospects or opportunities that are based on forecasts of future results, estimates of amounts not yet determinable and assumptions of management made in light of management’s experience and perception of historical trends, current conditions and expected future developments. Forward-looking statements include, but are not limited to, statements with respect to: commercial mining operations; cash flow; the timing and amount of estimated future production; throughput capacity; ore feed and grades; and payment of dividends, if any. Assumptions may prove to be incorrect and actual results may differ materially from those anticipated. Consequently, guidance cannot be guaranteed. As such, investors are cautioned not to place undue reliance upon guidance and forward-looking statements as there can be no assurance that the plans, assumptions or expectations upon which they are placed will occur. All statements other than statements of historical fact may be forward‐looking statements. Any statements that express or involve discussions with respect to predictions, expectations, beliefs, plans, projections, objectives or future events or performance (often, but not always, using words or phrases such as “seek”, “anticipate”, “plan”, “continue”, “estimate”, “expect”, “may”, “will”, “project”, “predict”, “forecast”, “potential”, “target”, “intend”, “could”, “might”, “should”, “believe” and similar expressions) are not statements of historical fact and may be “forward‐looking statements”.

Actual results may vary from forward-looking statements. Forward-looking statements are subject to known and unknown risks, uncertainties and other factors that may cause actual results to materially differ from those expressed or implied by such forward-looking statements, including but not limited to: the duration and effects of the coronavirus and COVID-19, and any other pandemics on our operations and workforce, and the effects on global economies and society; general economic conditions including inflation risks ; the inherent risks involved in the mining, exploration and development of mineral properties; changes in project parameters as plans continue to be refined; commodity prices; variations in ore reserves, grade or recovery rates; actual performance of plant, equipment or processes relative to specifications and expectations; accidents; labour relations; relations with local communities; uninsured risks; defects in title; changes in national or local governments; changes in applicable legislation or application thereof, including, but not limited to, Mexican mining reforms; delays in obtaining approvals or financing or in the completion of development or construction activities; exchange rate fluctuations; requirements for additional capital; government regulation; environmental risks; reclamation expenses; outcomes of pending litigation; conditions in the market for the Company’s shares and the equity markets in general; as well as those factors discussed in the section entitled “Description of the Business – Risk Factors” in the Company’s most recent Annual Information Form, available on www.sedar.com, and Form 40-F on file with the United States Securities and Exchange Commission in Washington, D.C. Although First Majestic has attempted to identify important factors that could cause actual results to differ materially from those contained in forward-looking statements, there may be other factors that cause results not to be as anticipated, estimated or intended. The Company notes that changes in climate conditions could adversely affect the business and operations through shifting weather patterns, environmental incidents, and extreme weather events. This can include changes in snow and precipitation levels, extreme temperatures, changing sea levels and other weather events which can result in frozen conditions, flooding, droughts, or fires. Such conditions could directly or indirectly impact our operations by affecting the safety of our staff and the communities in which we operate, disrupting safe access to sites, damaging facilities and equipment, disrupting energy and water supply, creating labor and material shortages and can cause supply chain interruptions. There is no assurance that the Company will be able to successfully anticipate, respond to or manage risks associated with severe climate conditions. Any such disruptions could have an adverse effect on the Company’s operations, production, and financial results.

The Company believes that the expectations reflected in these forward‐looking statements are reasonable, but no assurance can be given that these expectations will prove to be correct and such forward‐looking statements included herein should not be unduly relied upon. These statements speak only as of the date hereof. The Company does not intend, and does not assume any obligation, to update these forward-looking statements, except as required by applicable laws.

Original Article: https://www.newsfilecorp.com/release/164722