Toronto, Ontario – September 17, 2020 – Excellon Resources Inc. (TSX:EXN, EXN.WT; OTC:EXLLD and FRA:E4X2) (“Excellon” or the “Company”) is pleased to provide an updated Mineral Resource Estimate (“MRE”) for the Calvario and Lechuzas Zones on the Evolución Project in Zacatecas, Mexico as at July 31, 2020.

2020 Evolución MRE Highlights

- Updated MRE incorporates 17,120 metres of additional surface drilling completed in the resource area from June 2018 to December 31, 2019

- Indicated resource of 6,407,000 tonnes at 170 g/t silver equivalent (“AgEq”) representing 35,091,000 AgEq ounces

- Inferred resource of 14,960,000 tonnes at 135 g/t AgEq representing 64,813,000 AgEq ounces

- Expansion drilling being planned to test the strike extension of the mineralized zones and follow up on parallel structures, where grab samples taken during detailed mapping in 2020 returned values of up to 2.30 g/t Au, 203 g/t Ag and 10.4% Pb

“We discovered the Lechuzas zone adjacent to our Miguel Auza mill in late 2018 and identified a sizeable mineral resource that, when combined with the historic Calvario Vein, is similar to other deposits currently producing in the region,” stated Ben Pullinger, SVP Geology. “This MRE represents a sizeable addition to Excellon’s overall metal inventory and a foundation to further advance the project, as both Lechuzas and Calvario are open for extension along strike and at depth.”

Resource Summary for Evolución Project

The MRE will be included in an updated technical report prepared by SRK Consulting (Canada) Inc. (“SRK”) under National Instrument 43-101 (“NI 43-101”), which will be published on SEDAR (www.sedar.com) in the coming weeks.

Mineral Resource Statement, Evolución Project, Zacatecas, Mexico

| Grade | Contained Metal | |||||||||||

| Tonnes | Ag | Au | Pb | Zn | AgEq | Ag | Au | Pb | Zn | AgEq | ||

| Category | Zone | (000′ t) | (g/t) | (g/t) | (%) | (%) | (g/t) | (000′ oz) | (000′ oz) | (000′ lb) | (000′ lb) | (000′ oz) |

| Indicated | Calvario | 6,407 | 64 | 0.09 | 1.00 | 1.14 | 170 | 13,154 | 19 | 140,741 | 161,548 | 35,091 |

| Total Indicated | 6,407 | 64 | 0.09 | 1.00 | 1.14 | 170 | 13,154 | 19 | 140,741 | 161,548 | 35,091 | |

| Inferred | Calvario | 5,626 | 53 | 0.09 | 0.82 | 1.08 | 149 | 9,570 | 16 | 102,223 | 134,447 | 26,902 |

| Lechuzas | 9,335 | 30 | 0.11 | 0.71 | 1.18 | 126 | 8,953 | 33 | 145,235 | 243,300 | 37,911 | |

| Total Inferred | 14,960 | 39 | 0.10 | 0.75 | 1.15 | 135 | 18,524 | 49 | 247,459 | 377,747 | 64,813 |

Notes:

- Mineral Resources are estimated pursuant to NI 43-101 with an effective date of August 31, 2020.

- Mineral Resources are reported at a cut-off grade of 90 g/t AgEq. Cut-off grades are based on a silver price of US$17 per troy ounce and a silver recovery of 76%; a gold price of US$1,550 per troy ounce and recovery of 20%; a lead price of US$0.90 per pound and recovery of 90%; and a zinc price of US$1.15 per pound and recovery of 88%.

- Mineral Resources that are not Mineral Reserves do not necessarily demonstrate economic viability. All figures have been rounded to reflect the relative accuracy of the estimates. Composites have been capped where appropriate.

- The mineral resources were estimated in conformity with the widely accepted CIM Estimation of Mineral Resource and Mineral Reserves Best Practices Guidelines (November 2019) and are reported in accordance with the Canadian Securities Administrators’ National Instrument 43-101.

- The construction of the Mineral Resource model was a collaborative effort between Excellon and SRK personnel. Dr. Aleksandr Mitrofanov, P.Geo. (APGO#2824) is responsible for resource wireframing, geostatistical analysis, grade estimation and classification with senior review provided by Mr. Glen Cole, PGeo (APGO#1416).

The Lechuzas Zone was modelled in conjunction with a remodeling of the historical Calvario vein system. The evaluation of mineral resources for these zones on the Evolución Project involved the following:

- Validation and verification of the Excellon drill hole and analytical database and QA/QC performance;

- Construction of explicit wireframe domains for mineralization using geological indices and structural trends;

- Definition of resource domains;

- Data conditioning (compositing and capping) for geostatistical analysis and variography and determination of specific gravity;

- Definition and interpolation of a 3D block model;

- Validation, classification and tabulation;

- Assessment of “reasonable prospects for eventual economic extraction” and selection of cut-off grade and grade sensitivity analysis; and

- Preparation of the MRE.

This model incorporates data from 239 drill holes (68,361 metres) completed by previous operators at Calvario and 34 diamond holes (14,509 metres) completed by Excellon from 2018 to 2020 on the Lechuzas zone. Additional work completed and integrated into the model included structural studies completed in 2018, oriented core data, petrographic studies, re-logging and re-assaying of historical mineralized intersections and a re-interpretation of the geology and mineralization of the studied area.

Mineral resource modeling of the Evolución Project incorporates lithological and structural geology modeling and grade interpolation. SRK used the available data to create a geological model delimiting the different mineralized domains in Leapfrog Geo™. The model comprises a total of twelve high-grade veins (eight at Calvario and four at Lechuzas), and three low-grade haloes for each zone.

The high-grade vein domains were generated using a combination of geological descriptions, where they were available, and AgEq values. The high-grade domains were constrained based on economic composites greater than 10 g/t AgEq threshold and a maximum waste inclusion of 1 metre. Low-grade domains were modelled based on economic composites of 2 g/t AgEq threshold and a maximum of 3 metres waste inclusion, and further constrained using interval selections based on structural trends. The AgEq calculations are based on a silver price of US$17.00 per troy ounce (t oz) and a silver recovery of 76%; a gold price of US$1,550 per t oz and a gold recovery of 20%; a lead price of US$0.90 per lb and a lead recovery of 90%; and a zinc price of US$1.15 per lb and a zinc recovery of 88%. Recovery values are based upon the total overall recovery values documented by Roscoe Postle Associates Inc. (2008), determined by the metallurgical testwork completed by Silver Eagle Mines Inc.

Approximately 12% of the tonnage within the MRE (26% of the indicated tonnage and 6% of the inferred tonnage) is located within the La Antigua concession (part of the Evolución Project), which is the subject of litigation between a subsidiary of Excellon and a plaintiff. The initial decision in respect of this litigation does not affect Excellon’s contractual rights to this concession.

The MRE was prepared in accordance with the Canadian Institute of Mining, Metallurgy and Petroleum’s (CIM) ‘Mineral Resources and Mineral Reserves Best Practices’ guidelines (November 2019) and is classified per the CIM ‘Definition Standards for Mineral Resources and Mineral Reserves’ (May 2014).

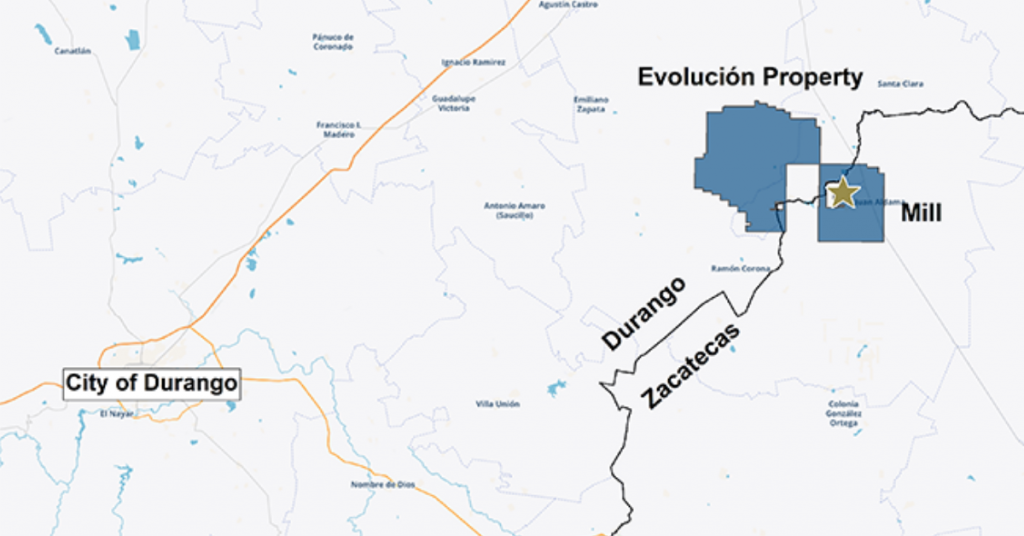

The Evolución property covers 45,000 hectares (450 km2) and 35 kilometres of strike in one of the world’s premier silver mining districts, known as the Fresnillo trend. The Lechuzas and Calvario Zones are hosted within the Caracol Formation, which hosts the most significant deposits on the Fresnillo trend. Precious and base metal mineralization is associated with structures featuring carbonate and quartz veining that crosscut the host rocks. Pyrite, sphalerite, and galena are the most commonly observed sulphide minerals. The property includes a conventional grinding and flotation mineral processing facility, through which the Company currently processes ore from its Platosa Mine. The mineral processing facility currently has nameplate capacity of approximately 800 tonnes per day (“tpd”), with a 650 tpd ball mill in operation and a second, 150 tpd ball mill on standby, with opportunities available for further expansion.

Ongoing Exploration at Evolución

Detailed mapping and surface sampling are underway on the Evolución Project. Numerous samples with anomalous geochemical signatures have been identified in the target area; these are thought to be the surface expressions of epithermal alteration and associated mineralization. The program will be used to aid in structural modeling and targeting for future drilling.

Qualified Person

Mr. Ben Pullinger, P.Geo., Senior Vice President Geology, has acted as the Qualified Person, as defined in NI 43-101, with respect to the disclosure of the scientific and technical information contained in this press release.

Update on Trading Symbols on the OTC Pink and Frankfurt Exchanges

Further to the Company’s press release on September 10, 2020 announcing the effective date of the consolidation of the Company’s common shares on a one-for-five basis, the following adjustments were made to trading symbols on the OTC Pink and Frankfurt Exchanges:

- On the OTC Pink, Excellon’s symbol was changed from “EXLLF” to “EXLLD”. The new symbol will remain in effect for a period of 20 trading days after the consolidation was effected or until the Company’s common shares start trading on the NYSE American, LLC exchange (the “NYSE American”), whichever comes first. Upon listing on the NYSE American, the common shares will trade under the symbol “EXN” and trading on the OTC Pink exchange will cease;

- On the Frankfurt Stock Exchange, Excellon’s symbol was changed from “E4X1” to “E4X2”.

About Excellon

Excellon’s vision is to create wealth by realizing strategic opportunities through discipline and innovation for the benefit of our employees, communities and shareholders. The Company is advancing a precious metals growth pipeline that includes: Platosa, Mexico’s highest-grade silver mine since production commenced in 2005; Kilgore, a high quality gold development project in Idaho with strong economics and significant growth and discovery potential; and an option on Silver City, a high-grade epithermal silver district in Saxony, Germany with 750 years of mining history and no modern exploration. The Company also aims to continue capitalizing on current market conditions by acquiring undervalued projects.

Additional details on Excellon’s properties are available at www.excellonresources.com

For Further Information, Please Contact:

Excellon Resources Inc.

Brendan Cahill, President & CEO or

Ben Pullinger, SVP Geology

(416) 364-1130

info@excellonresources.com

www.excellonresources.com

Forward-Looking Statements

The Toronto Stock Exchange has not reviewed and does not accept responsibility for the adequacy or accuracy of the content of this Press Release, which has been prepared by management. This press release contains forward-looking statements within the meaning of Section 27A of the Securities Act and Section 27E of the Exchange Act. Such statements include, without limitation, statements regarding the future results of operations, performance and achievements of the Company, including potential property acquisitions, the timing, content, cost and results of proposed work programs, the discovery and delineation of mineral deposits/resources/reserves, geological interpretations, proposed production rates, potential mineral recovery processes and rates, business and financing plans, business trends and future operating revenues. Although the Company believes that such statements are reasonable, it can give no assurance that such expectations will prove to be correct. Forward-looking statements are typically identified by words such as: believe, expect, anticipate, intend, estimate, postulate, and similar expressions, or are those, which, by their nature, refer to future events. The Company cautions investors that any forward-looking statements by the Company are not guarantees of future results or performance, and that actual results may differ materially from those in forward looking statements as a result of various factors, including, but not limited to, variations in the nature, quality and quantity of any mineral deposits that may be located, significant downward variations in the market price of any minerals produced, the Company’s inability to obtain any necessary permits, consents or authorizations required for its activities, to produce minerals from its properties successfully or profitably, to continue its projected growth, to raise the necessary capital or to be fully able to implement its business strategies. All of the Company’s public disclosure filings may be accessed via www.sedar.com and readers are urged to review these materials, including the technical reports filed with respect to the Company’s mineral properties, and particularly the September 7, 2018 NI 43-101 technical report prepared by SRK Consulting (Canada) Inc. with respect to the Platosa Property. This press release is not, and is not to be construed in any way as, an offer to buy or sell securities in the United States.

Original Article: http://www.excellonresources.com/news/details/index.php?content_id=270