VANCOUVER, British Columbia, July 08, 2022 (GLOBE NEWSWIRE) — Endeavour Silver Corp. (“Endeavour” or the “Company”) (NYSE: EXK; TSX: EDR) is pleased to report second quarter 2022 production of 1,359,207 silver ounces (oz) and 9,289 gold oz, for silver equivalent 1 (“AgEq”) production of 2.1 million oz. Production continues to outpace the 2022 production guidance of 6.7-7.6 million silver equivalent ounces, totaling 4.1 million AgEq oz for the six months ended June 30, 2022.

“Amid ongoing turmoil in the markets due to supply constraints, continued inflation concerns, and uncertainty from the raising of interest rates from historical lows, we had another solid quarter of production” stated Dan Dickson, Chief Executive Officer. “Despite the current macro trends, the Company and precious metals outlook remains optimistic. Given our positive view for short-term precious metal prices, we are comfortable holding back bullion inventory over the quarter for future sale.”

“First half production results exceeded plan, so we are well positioned to exceed our guidance for the year. The exceptional ore grades at Guanacevi have put us in this position. While it’s has been gratifying to see grades reach new highs, we expect grades to align with or be slightly above plan for the second half of the year.”

Q2 2022 Highlights

- Guanacevi Continued to Outperform: Silver and gold production exceeded plan driven by higher grades offset by lower tonnes milled.

- Safety Milestone Attained at Guanacevi: Employees and business partners surpassed 2 million hours worked lost-time injury free. The ICARE values program, together with the “Te Cuido” safety philosophy, keeps focus on our proactive safety orientated culture. Visit our Blog to learn more.

- Bolañitos’ Performance Remained Steady: Strong silver production, higher silver grades and increased throughput were offset by the impact of lower than expected gold production and gold grades.

- Metal Sales and Inventories : Sold 602,894 oz silver and 9,792 oz gold during the quarter. Held 1,399,355 oz silver and 2,580 oz gold of bullion inventory and 12,408 oz silver and 588 oz gold in concentrate inventory at quarter end.

- Guanacevi Delivers Exceptional Drill Results: Drilling intersected record high-grade silver-gold mineralization on the El Curso property including 5.83 gpt Au and 1,278 gpt Ag for 2,534 gpt AgEq over a 7.5 m estimated true width in hole UCM-93 (see EDR news release dated April 13, 2022 ).

- Positive Exploration Results at Parral: Drilling continued to intersect high-grade silver mineralization along the Veta Colorada structure.

- Advancing the Terronera Project : The early works program initiated last year continued, including detail engineering, critical contracts and the procurement of long lead items. Extensive due diligence work continued for project financing. The Company intends to make a formal construction decision subject to completion of a financing package and receipt of additional amended permits in the coming months.

- Published 2021 Sustainability Report Entitled “Bridge to the Future”: The report outlines Endeavour’s approach to sustainability in the areas of its People, the Planet and the Business.

Subsequent to the Quarter End

- Closed the Acquisition of the Pitarrilla Project on July 6, 2022: The addition of the Pitarrilla project enhances the company’s growth profile while maintaining a silver focus.

Q2 2022 Mine Operations

Consolidated silver production increased 27% to 1,359,207 ounces in Q2 2022 compared to Q2 2021, primarily driven by increased silver production at the Guanacevi mine. The El Curso orebody has led to significantly higher grades than planned, allowing for production targets to be met during a period of decreased plant throughput. Local third-party ores continued to supplement mine production, amounting to 17% of quarterly throughput and contributing to the higher ore grades. Guanacevi throughput was 16% lower than prior quarter and lower than plan due to installation of a new cone crusher, which will allow throughput to rise for the second half of the year. Management is reviewing alternatives to further increase throughput above the current 1,200 tpd capacity with changes in areas including grinding and leach.

Gold production decreased by 17% to 9,289 ounces primarily due lower gold grades mined at the Bolañitos mine. The increased gold production from Guanacevi offset the gold produced from the El Compas mine, which suspended operations in Q3, 2021.

Bolañitos Q2 2022 throughput was consistent with Q2 2021 with silver grades 38% higher and gold grades 17% lower. Silver production increased by 37% while gold production decreased by 17% at the Bolañitos mine. The change in grades were due to typical variations in the ore body.

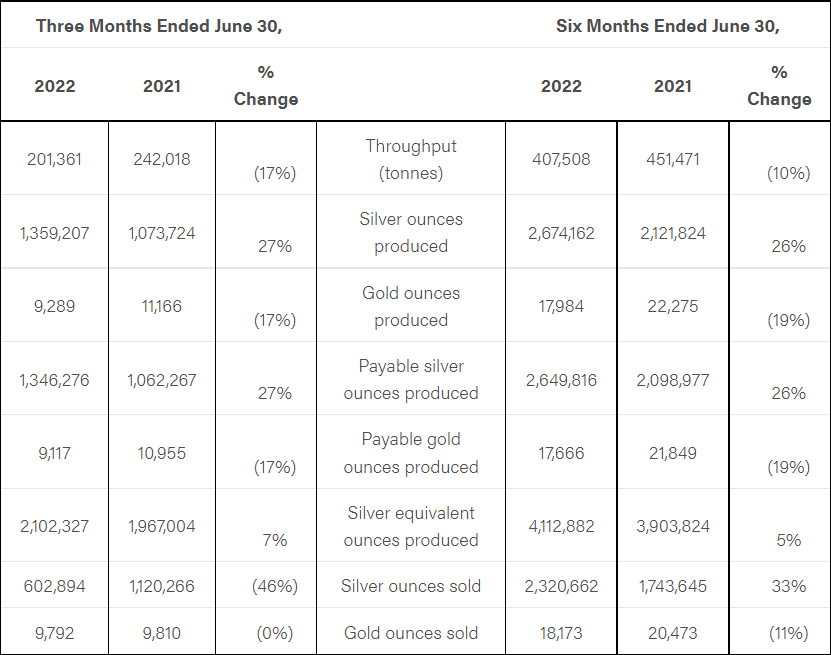

Production Highlights for the Three and Six Months Ended June 30, 2022

Production Tables for Q2 2022 by Mine

Mine-by-mine production in the second quarter and first half of 2022 was:

| Production | Tonnes | Tonnes | Grade | Grade | Recovery | Recovery | Silver | Gold |

| by mine | Processed | per day | Ag gpt* | Au gpt* | Ag % | Au % | Oz | Oz |

| Guanaceví | 94,017 | 1,045 | 465 | 1.37 | 85.0% | 88.9% | 1,194,150 | 3,680 |

| Bolañitos | 107,344 | 1,193 | 54 | 1.77 | 88.6% | 91.8% | 165,057 | 5,609 |

| Consolidated | 201,361 | 2,237 | 246 | 1.58 | 85.4% | 90.6% | 1,359,207 | 9,289 |

*gpt = grams per tonne

Production Tables for the Six Months Ended June 30, 2022 by Mine

| Production | Tonnes | Tonnes | Grade | Grade | Recovery | Recovery | Silver | Gold |

| by mine | Processed | per day | Ag gpt* | Au gpt* | Ag % | Au % | Oz | Oz |

| Guanaceví | 195,270 | 2,170 | 435 | 1.28 | 85.2% | 89.1% | 2,328,000 | 7,157 |

| Bolañitos | 212,238 | 2,358 | 57 | 1.75 | 89.0% | 90.7% | 346,162 | 10,827 |

| Consolidated | 407,508 | 4,528 | 238 | 1.52 | 85.7% | 90.0% | 2,674,162 | 17,984 |

*gpt = grams per tonne

Q2 2022 Financial Results and Conference Call

The Company’s Q2 2022 financial results will be released before markets open on Tuesday, August 9, 2022 and a telephone conference call will be held the same day at 10:00 a.m. PT / 1:00 p.m. ET. To participate in the conference call, please dial the numbers below.

| Date & Time: | Tuesday, August 9, 2022 at 10:00 a.m. PT / 1:00 p.m. ET |

| Telephone: | Toll-free in Canada and the US +1-800-319-4610 |

| Local or International +1-604-638-5340 | |

| Please allow up to 10 minutes to be connected to the conference call. | |

| Replay: | A replay of the conference call will be available by dialing (toll-free) +1-800-319-6413in Canada and the US (toll-free) or+1-604-638-9010outside of Canada and the US. The replay passcode is 9151#. The replay will also be available on the Company’s website at www.edrsilver.com . |

About Endeavour Silver – Endeavour Silver Corp. is a mid-tier precious metals mining company that operates two high-grade underground silver-gold mines in Mexico. Endeavour is currently advancing the Terronera mine project towards a development decision, pending financing and final permits and exploring its portfolio of exploration and development projects in Mexico, Chile and the United States to facilitate its goal to become a premier senior silver producer. Our philosophy of corporate social integrity creates value for all stakeholders.

Contact Information:

Galina Meleger, VP, Investor Relations

Email: [email protected]

Website: www.edrsilver.com

Follow Endeavour Silver on Facebook , Twitter , Instagram and LinkedIn .

Cautionary Note Regarding Forward-Looking Statements

This news release contains “forward-looking statements” within the meaning of the United States private securities litigation reform act of 1995 and “forward-looking information” within the meaning of applicable Canadian securities legislation. Such forward-looking statements and information herein include but are not limited to statements regarding Endeavour’s anticipated performance in 2022 including changes in mining operations and production levels, the timing and results of various activities and the impact of the COVID 19 pandemic on operations. The Company does not intend to and does not assume any obligation to update such forward-looking statements or information, other than as required by applicable law.

Forward-looking statements or information involve known and unknown risks, uncertainties and other factors that may cause the actual results, level of activity, production levels, performance or achievements of Endeavour and its operations to be materially different from those expressed or implied by such statements. Such factors include but are not limited to the ultimate impact of the COVID 19 pandemic on operations and results, changes in production and costs guidance, national and local governments, legislation, taxation, controls, regulations and political or economic developments in Canada and Mexico; financial risks due to precious metals prices, operating or technical difficulties in mineral exploration, development and mining activities; risks and hazards of mineral exploration, development and mining; the speculative nature of mineral exploration and development, risks in obtaining necessary licenses and permits, and challenges to the Company’s title to properties; as well as those factors described in the section “risk factors” contained in the Company’s most recent form 40F/Annual Information Form filed with the S.E.C. and Canadian securities regulatory authorities.

Forward-looking statements are based on assumptions management believes to be reasonable, including but not limited to: the continued operation of the Company’s mining operations, no material adverse change in the market price of commodities, mining operations will operate and the mining products will be completed in accordance with management’s expectations and achieve their stated production outcomes, and such other assumptions and factors as set out herein. Although the Company has attempted to identify important factors that could cause actual results to differ materially from those contained in forward-looking statements or information, there may be other factors that cause results to be materially different from those anticipated, described, estimated, assessed or intended. There can be no assurance that any forward-looking statements or information will prove to be accurate as actual results and future events could differ materially from those anticipated in such statements or information. Accordingly, readers should not place undue reliance on forward-looking statements or information.

1 Silver equivalent calculated using an 80:1 silver:gold ratio.

Original Article: https://edrsilver.com/news-media/news/endeavour-silver-reports-strong-q2-2022-production-4417/