Alien Metals Ltd (Alien Metals or the Company), a minerals exploration and development company, is pleased to announce that it has executed an Earn-in Agreement (“Agreement”) with Capstone Mining Corp (Capstone) (TSX: CS) over its Donovan 2 Copper-Gold project (the “Project”) in Mexico (Transaction). Pursuant to the Agreement, Capstone has the ability to acquire up to an 80% interest in Donovan 2 by sole funding the Project up to completion of a Prefeasibility Study.

Highlights:

- Capstone can earn

an initial 65% interest in Donovan 2 through a combination of cash payments and

committed expenditure, consisting of:

- US$290,000 in cash payments to Alien over three years; and

- US$3,600,000 in valid exploration expenditure over three years (including US$150,000 being incurred by 31 December 2020)

- Capstone can increase their interest from 65% to 75% by making a further cash payment of US$200,000 and funding the costs associated with a Preliminary Economic Assessment (PEA)

- Following delivery of the PEA, in the event Alien elects not to contribute pro-rata to its 25% interest, Capstone Mining has the ability to sole-fund the costs of a Prefeasibility Study (PFS) to earn an additional 5% in Donovan 2 (bringing their holding to 80% and Alien 20%)

- Thereafter, each party will fund their pro-rata interest in the Project or dilute according to industry standard mechanisms. In the event Alien dilutes to below 5%, it’s interest will convert to a 2% Royalty

- The Transaction with Capstone delivers the potential for immediate advancement of the Donovan 2 Copper-Gold project while allowing Alien to focus exploration activities across its project portfolio

Further to the RNS dated 9 September 2020, Alien and Capstone had entered into an Exclusivity Agreement whereby Capstone, a mid-tier North American mining company, secured a 45-day period to undertake due diligence to their satisfaction with the aim of the parties executing a joint venture agreement for Capstone to acquire an interest in Donovan 2.

Bill Brodie Good, CEO & Technical Director of Alien Metals, commented:

“The Company is extremely pleased to have executed the Agreement with Capstone Mining. This transaction sees the potential for considerable expenditure to be invested into Donovan 2 over the next few years as the project progresses through to feasibility studies. I thank the team at Capstone Mining for their efforts over the last few months and I look forward to working with them.

“Importantly, the transaction is in line with the Company’s model of unlocking value in its project portfolio; with Capstone overseeing exploration at Donovan 2, the Company’s management team can focus its exploration efforts at Hamersley and Elizabeth Hill in Western Australia and commence maiden drilling at Los Campos and San Celso.”

Transaction Terms

The key terms of the Transaction for Capstone to move to an 80% interest in Donovan 2 are as follows:

| Earn-in Stages – Donovan 2 | ||||

| Stage 1 | Period | Cash Payment to Alien | Work or Other Expenditure | % Earned |

| 1A | On the date of Execution of the Earn in Agreement | US$40,000 | US$150,000 by 31 December 2020 | – |

| 1B | By Dec 31 2021 | US$50,000 | US$450,000 by 31 December 2021 | – |

| 1C | By Dec 31 2022 | US$100,000 | US$1,000,000 by 31 December 2022 | – |

| 1D | By Dec 31 2023 | US$100,000 | US$2,000,000 by 31 December 2023 | +65% |

| TOTAL (Stage 1) | US$290,000 | US$3,600,000 | 65% | |

| Stage 2 | US$200,000 (within 90 days of 3rd Anniversary) | Delivery of Preliminary Economic Assessment (PEA) | +10% | |

| Stage 3 | – | Delivery of Prefeasibility Study (PFS) | +5% | |

| TOTAL (All stages) | US$490,000 | US$3,600,000 + cost of PEA and PFS | 80% |

Notes:

- Capstone can accelerate work expenditure at their election

- If Alien chooses not to fund its pro-rata cost of the PFS, Capstone is entitled to a further 5% interest post-delivery of PFS

- If Alien dilutes to a 2% Royalty, Capstone has the ability to buy back 1% of the Royalty for US1 million

- The estimated cost of delivery of the PEA is US$1 million

- The estimated cost of delivery of the PFS is US$5 million

Under the terms of the Earn-in Agreement, Capstone has given Alien a right of first refusal to acquire the Project should Capstone choose to dispose of its interest. Alien will remain the Operator of the Project up until the end of Stage 1A.

For further information please visit the Company’s website at www.alienmetals.uk, or contact:

| Alien Metals Limited Bill Brodie Good, CEO & Technical Director St-James’ Corporate Services, Company Secretary Tel: +44 20 7796 8644 | First Equity Limited (Joint Broker) Jason Robertson Tel +44 (0)20 7374 2212 |

| Beaumont Cornish Limited (Nomad) James Biddle/ Roland Cornish www.beaumontcornish.com Tel: +44 (0) 207 628 3396 | Novum Securities Limited (Joint Broker) Jon Belliss Tel +44 (0)20 7399 9425 |

| Blytheweigh (Financial PR) Megan Ray/Rachael Brooks Tel: +44 (0) 207 138 3204 | Turner Pope Investments (TPI) Limited (Joint Broker) Andy Thacker Tel +44 (0)20 3657 0050 |

Notes to Editors

Alien Metals Ltd is a mining exploration and development company listed on AIM of the London Stock Exchange (LSE: UFO). The Company’s focus is on precious and base metal commodities.

Alien Metals has embarked

upon an acquisition-led strategy headed by a high-quality geological team to build a strong

portfolio of diversified assets including two recent acquisitions in 2019. These

include the Brockman and Hancock Ranges high-grade (Direct Shipping Ore)

iron ore projects and the Elizabeth Hill Silver projects both located in the

Pilbara region, Western Australia.

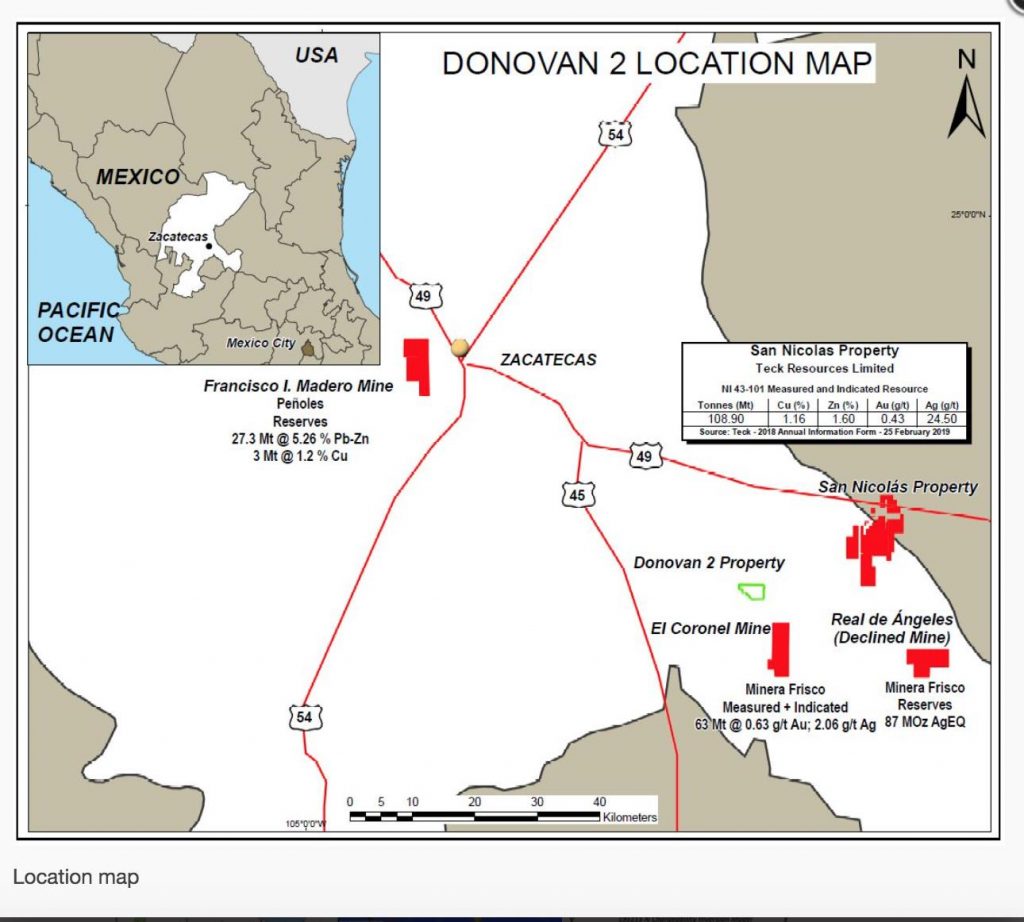

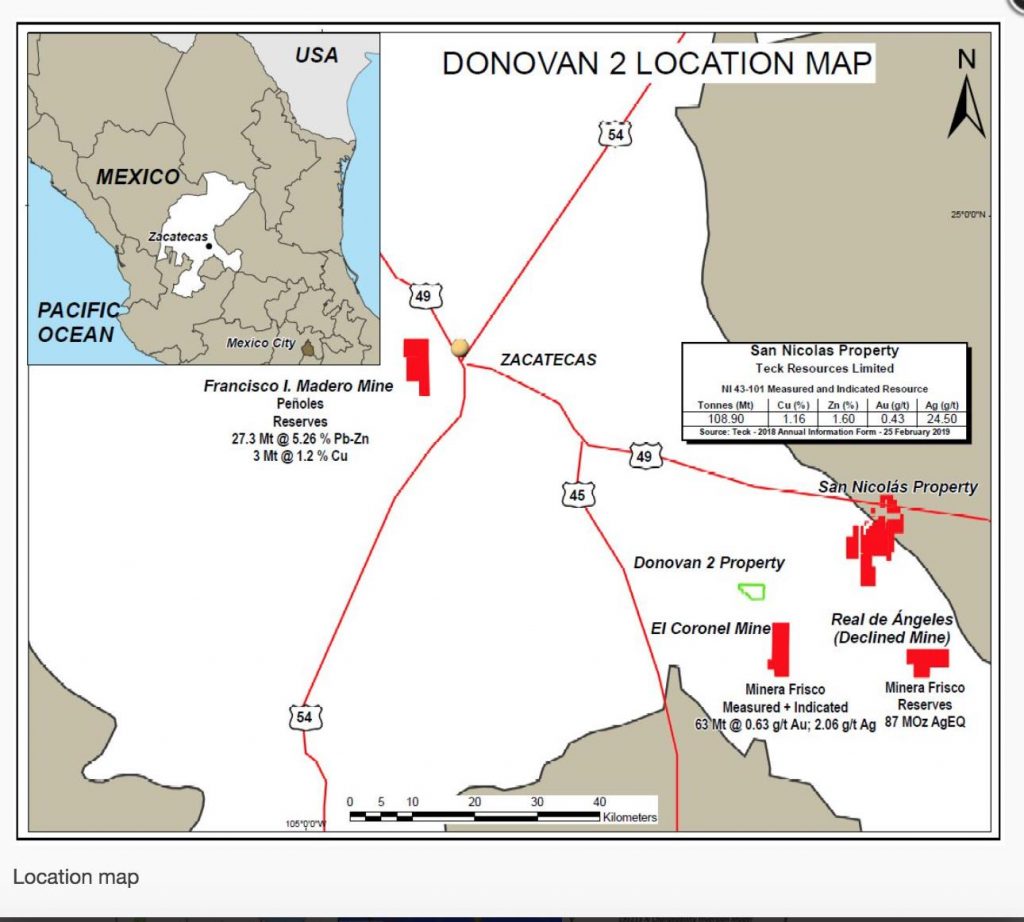

In addition to progressing and developing its portfolio of assets and following its strategic review of its portfolio of silver and precious metals projects in Mexico, Alien Metals has identified priority exploration targets within its 9 mining concessions which it is working to advance systematically. The Company’s silver projects are located in the Zacatecas State, Mexico’s largest silver producing state which produced over 190m oz of silver in 2018 alone accounting for 45% of the total silver production of Mexico for that year.

About Capstone Mining Corp.

Capstone Mining Corp. is a Canadian base metals mining company listed on the Toronto Stock Exchange, focused on copper. It has two producing mines, the Pinto Valley copper mine located in Arizona, US and the Cozamin copper-silver mine in Zacatecas State, Mexico. In addition, Capstone owns 70% of Santo Domingo, a large scale, fully-permitted, copper-iron-gold project in Region III, Chile, in partnership with Korea Resources Corporation, as well as a portfolio of exploration properties.

Original Article: https://www.alienmetals.uk/assets/docs/nr/22102020%20UFO%20-%20Capstone%20Earn-in%20Agreement%20RNS%20Final.pdf