November 24, 2022, Toronto, Ontario – Discovery Silver Corp. (TSX-V: DSV, OTCQX: DSVSF) (“Discovery” or the “Company”) is pleased to announce its financial results for the three months ended September 30, 2022 (“Q3 2022”) and provide a summary of key events for the quarter, and subsequent to quarter-end. All amounts are presented in Canadian dollars (“C$”) unless otherwise stated.

Discovery’s flagship project is our 100%-owned Cordero silver project (“Cordero” or the “Project”) located in Chihuahua State, Mexico. Following the completion of a Preliminary Economic Assessment (“PEA”) in 2021 that demonstrated Cordero is a large-scale, high-margin asset with a long mine life, our focus now is the delivery of a Pre-Feasibility Study (“PFS”) on the Project in early 2023.

HIGHLIGHTS FROM Q3 2022 & SUBSEQUENT EVENTS:

- The Company released its 2021 Environmental, Social and Governance (“ESG”) Report during the quarter and subsequent to quarter end received its official ESR Distinction, which is issued by the Mexican Center for Philanthropy to organizations that have demonstrated they operate in a socially and environmentally responsible manner, and its Great Place to Work Certification, which recognizes companies that create an outstanding employee experience through building a workplace culture of trust, credibility, respect, pride and collaboration.

- Results from the PFS metallurgical testwork program highlighting the exceptional metallurgical performance at Cordero with recoveries typically ranging from 90-95% for Ag, Pb and Zn from the tests completed so far. On average recoveries came in higher than what was assumed in our PEA and were achieved at significantly reduced reagent consumption highlighting the potential for reduced operating costs in the PFS.

- Phase 2 drilling, consisting of close to 80,000 m in over 250 drill holes, was completed in the quarter. Drill results will be used to support the upcoming PFS. Recent highlight results include 388 g/t AgEq over 33 m intercepted more than 700 m outside the current resource and 201 g/t AgEq over 42 m approximately 20 m below the resource pit shell.

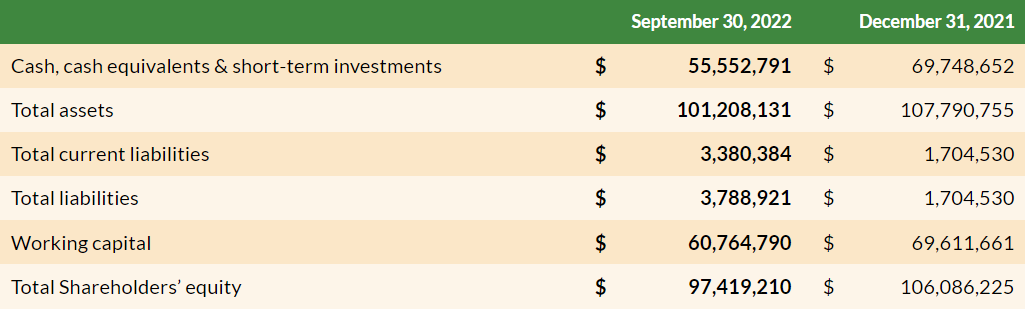

- Discovery’s balance sheet remains exceptionally strong with a cash and cash equivalents balance of $55 million and no debt as at September 30, 2022.

LOOKING AHEAD:

Tony Makuch, Interim CEO, states: “We recently wrapped up our Phase 2 drill program with results exceeding expectations. Of note, mineralized intercepts at depth and to the northeast highlight the potential to expand the size of the open pit in our upcoming PFS. The additional drilling should also further increase the confidence of the underlying resource estimate with the supporting drill dataset now consisting of close to 300,000 m of drilling in over 730 drill holes.

We also completed our PFS metallurgical test program in the quarter which demonstrated improved metallurgical recoveries at a very coarse grind size and significantly lower reagent consumption. This has allowed for an improved process design with metal production and operating costs expected to benefit from mill throughput rates that are approximately 25% higher than what was assumed in our 2021 PEA. Geotechnical evaluation has confirmed favourable ground conditions throughout the project footprint including the proposed locations for the process facility, tailings storage facility and rock storage facility. Additional geotechnical drilling of the proposed pit walls is also now complete and has resulted in pit slope assumptions that are mostly in-line or improved versus what was assumed in the PEA. Other scope items for our PFS continue to progress well and we look forward to the delivery of the study in the first quarter of 2023.

“We continue to deliver on key milestones within our ESG program receiving our official ESR Distinction and Great Place to Work certification subsequent to quarter end. We are also targeting the receipt of our Safe Industry and Clean Industry certifications by early 2023. We have recently made investments to support social services for vulnerable groups within the local population of Hidalgo del Parral, the nearest town to Cordero, including the donation of a mobile medical unit and assistance with the construction of a local medical clinic. As we look ahead to 2023 these and similar initiatives will continue to be a core part of our ESG efforts as we focus on having a positive influence on local communities and stakeholders.

“Our balance sheet remains strong with a current cash balance of over $50 million and no debt. This will allow us to complete all our remaining work in 2022 as well as our planned Feasibility Study work in 2023 as we systematically progress Cordero toward development and ultimately its transformation into one of the biggest silver mines globally.”

REVIEW OF Q3 2022 & SUBSEQUENT EVENTS:

PFS Metallurgical Test program:

The results from the PFS metallurgical test program on representative samples from its Cordero were released during the quarter. This program represents the most comprehensive test work completed on Cordero to date. Highlights from the locked-cycle flotation test work include:

- Silver recoveries of 94-98%, lead recoveries of 89-97% and zinc recoveries of 92-96% on high grade samples of all major rock types.

- Silver recoveries of 83-92%, lead recoveries of 85-92% and zinc recoveries of 81-89% on medium grade samples of blended rock types.

- Oxide-sulphide blend testwork establish oxide-specific recoveries of ~60% for silver, ~40% for lead and ~85% for zinc via flotation; co-processing oxide mineralized material via flotation eliminates the need for heap leach processing at Cordero.

- Test work overall confirmed higher recoveries than what was assumed in the 2021 PEA.

- All tests were completed at a coarse grind size of p80 passing ~210 micron and demonstrated significantly lower reagent consumption than assumed in the PEA.

- Saleable concentrate grades confirmed and levels of penalty elements for concentrates were insignificant.

Phase 2 drilling:

Final results from our Phase 2 drill program were received in 3Q 2022 and will be incorporated in a resource update and PFS scheduled for completion in the first quarter of 2023. This drill program along with all previous drilling is summarized in the table below. Feasibility study drilling has already commenced and will consist of engineering drilling, resource upgrade drilling and drilling targeting the expansion of the PFS open pit. The total metres to be drilled in the feasibility study drill program will be finalised following the completion of the PFS.

| Drill Program | Period | Drill Metres | Drill Holes |

|---|---|---|---|

| Historic | 2009 – 2017 | 123,000 m | 253 |

| Discovery Silver – Phase 1 | 2019 – 2021 | 92,000 m | 225 |

| Discovery Silver – Phase 2 | 2021 – 2022 | 78,000 m | 257 |

| TOTAL | 293,000 m | 735 |

Recent highlight intercepts from Phase 2 drilling include:

- C22-614 intercepted 58 m averaging 208 g/t AgEq1 (99 g/t Ag, 0.33 g/t Au, 1.6% Pb and 1.0% Zn) from 78 m and 48 m averaging 231 g/t AgEq1 (100 g/t Ag, 0.63 g/t Au, 1.8% Pb and 0.8% Zn) from 148 m in hole C22-614. These intercepts were from upgrade drilling within the PEA starter pit.

- C22-605 intercepted 38.6 m averaging 265 g/t AgEq1 from 27.2 m (89 g/t Ag, 0.13 g/t Au, 1.8% Pb and 3.0% Zn) within an area previously modeled as low grade/waste.

- C22-609, the northeasternmost hole drilled by the Company, intercepted 33.1 m averaging 150 g/t AgEq1 from 233.7 m (54 g/t Ag, 0.08 g/t Au, 0.5% Pb and 1.3% Zn) and 17.7 m averaging 115 g/t AgEq1 (35 g/t Ag, 0.01 g/t Au, 0.9% Pb and 1.4% Zn) from 198.2 m.

- C22-610 intercepted 32.6 m averaging 388 g/t AgEq1 (115 g/t Ag, 0.05 g/t Au, 3.7% Pb and 4.1% Zn) from 226.6 m, including 17.8 m averaging 660 g/t AgEq1 (187 g/t Ag, 0.05 g/t Au, 6.5% Pb and 7.2% Zn); the intercept was more than 700 m outside the current resource and approximately 180 m below historic workings at surface.

- C22-634 intercepted 42 m averaging 201 g/t AgEq1 (76 g/t Ag, 0.06 g/t Au, 1.0% Pb and 2.4% Zn) from 453 m. This interval is located approximately 20 m below the resource pit.

- C22-644 intercepted 125 m averaging 111 g/t AgEq1 (37 g/t Ag, 0.04 g/t Au, 0.4% Pb and 1.6% Zn) from 265 m. This intercept was directly below the 2021 resource pit in an area previously modeled as waste.

Feasibility Study drilling:

Initial Feasibility Study drilling has been focused on two key areas: 1) further upgrading the resource classification within the PEA pit and 2) expanding and upgrading resource blocks between the PEA pit and the Resource constraining pit shells. Highlight intercepts from this drilling includes:

- C22-656 intercepted 77 m averaging 126 g/t AgEq1 (46 g/t Ag, 0.08 g/t Au, 0.7% Pb and 1.4% Zn) from 218 m and 22 m averaging 265 g/t AgEq1 (83 g/t Ag, 0.10 g/t Au, 1.8% Pb and 3.2% Zn) from 374 m.

- C2-654 intercepted 96 m averaging 124 g/t AgEq1 (33 g/t Ag, 0.03 g/t Au, 0.7% Pb and 1.8% Zn) from 464 m including 36 m averaging 190 g/t AgEq1 (44 g/t Ag, 0.04 g/t Au, 0.9% Pb and 3.1% Zn).

- C22-648 intercepted 42 m averaging 179 g/t AgEq1 (62 g/t Ag, 0.11 g/t Au, 1.4% Pb and 1.7% Zn) from 228 m.

For further details on all drill results noted above refer to our news releases dated July 13, September 28, and November 21, 2022. Supporting Technical Disclosure for drill results can be found at the end of this release.

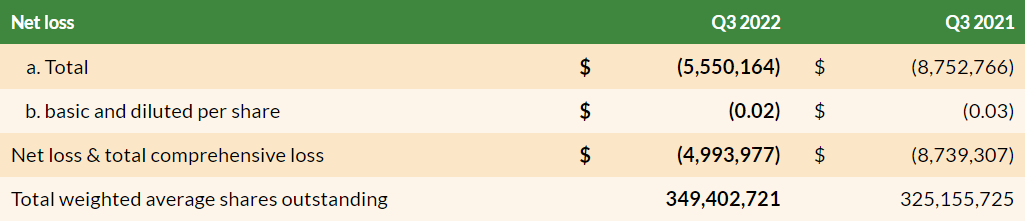

SELECTED FINANCIAL DATA:

The following selected financial data is summarized from the Company’s unaudited condensed interim consolidated financial statements and related notes thereto for the three months ended September 30, 2022 (the “Interim Financial Statements”), and the Management’s Discussion and Analysis for the three months ended September 30, 2022 (“MD&A”).

A copy of the Financial Statements and MD&A is available at www.discoverysilver.com or on SEDAR at www.sedar.com.

About Discovery

Discovery’s flagship project is its 100%-owned Cordero project, one of the world’s largest silver deposits. The PEA completed in November 2021 demonstrates that Cordero has the potential to be developed into a highly capital efficient mine that offers the combination of margin, size and scaleability. Cordero is located close to infrastructure in a prolific mining belt in Chihuahua State, Mexico.

On Behalf of the Board of Directors,

Tony Makuch, P.Eng

Interim CEO

For further information contact:

Forbes Gemmell, CFA

VP Corporate Development

Phone: 416-613-9410

Email: forbes.gemmell@discoverysilver.com

Website: www.discoverysilver.com

TECHNICAL NOTES & REFERENCES:

Drill results: all drill results in this news release are rounded. Assays are uncut and undiluted. Widths are drilled widths, not true widths, as a full interpretation of the actual orientation of mineralization is not complete. As a guideline, intervals with disseminated mineralization were chosen based on a 25 g/t AgEq cutoff with no more than 10 m of dilution. AgEq calculations are used as the basis for total metal content calculations given Ag is the dominant metal constituent as a percentage of AgEq value in approximately 70% of the Company’s mineralized intercepts. AgEq calculations for reported drill results are based on USD $22.00/oz Ag, $1,600/oz Au, $1.00/lb Pb, $1.20/lb Zn. The calculations assume 100% metallurgical recovery and are indicative of gross in-situ metal value at the indicated metal prices. Refer to notes below for metallurgical recoveries assumed in the 2021 PEA completed on Cordero.

Sample analysis and QA/QC Program: True widths of reported drill intercepts have not been determined. Assays are uncut except where indicated. All core assays are from HQ drill core unless stated otherwise. Drill core is logged and sampled in a secure core storage facility located at the project site 40km north of the city of Parral. Core samples from the program are cut in half, using a diamond cutting saw, and are sent to ALS Geochemistry-Mexico for preparation in Chihuahua City, Mexico, and subsequently pulps are sent to ALS Vancouver, Canada, which is an accredited mineral analysis laboratory, for analysis. All samples are prepared using a method whereby the entire sample is crushed to 70% passing -2mm, a split of 250g is taken and pulverized to better than 85% passing 75 microns. Samples are analyzed for gold using standard Fire Assay-AAS techniques (Au-AA24) from a 50g pulp. Over limits are analyzed by fire assay and gravimetric finish. Samples are also analyzed using thirty three-element inductively coupled plasma method (“ME-ICP61”). Over limit sample values are re-assayed for: (1) values of zinc > 1%; (2) values of lead > 1%; and (3) values of silver > 100 g/t. Samples are re-assayed using the ME-OG62 (high-grade material ICP-AES) analytical package. For values of silver greater than 1,500 g/t, samples are re-assayed using the Ag-CON01 analytical method, a standard 30 g fire assay with gravimetric finish. Certified standards and blanks are routinely inserted into all sample shipments to ensure integrity of the assay process. Selected samples are chosen for duplicate assay from the coarse reject and pulps of the original sample. No QAQC issues were noted with the results reported herein.

Qualified Person: Gernot Wober, P.Geo, VP Exploration, Discovery Silver Corp., is the Company’s designated Qualified Person for this news release within the meaning of National Instrument 43-101 Standards of Disclosure for Mineral Projects (“NI 43-101”) and has reviewed and validated that the information contained in this news release is accurate.

Technical Report: The most recent technical report for the Cordero Project is the 2021 Preliminary Economic Assessment (PEA). The PEA was completed by Ausenco Engineering Canada Inc. with support from AGP Mining Consultants Inc. and Knight Piésold and Co. (USA). The full technical report supporting the PEA is available on Discovery’s website and on SEDAR under Discovery Silver Corp.

The PEA assumed average life-of-mine recovery assumptions for sulphide material of 84% for Ag, 19% for Au, 86% for Pb and 85% for Zn. The PEA assumed oxide recovery assumptions of 56% for Ag and 63% for Au for crushed feed and 36% for Ag and 35% for Au for uncrushed ROM feed.

RISKS AND UNCERTAINTIES:

The operations of the Company are speculative due to the high-risk nature of its business, which is the acquisition, financing, exploration, and development of mining properties, primarily in Mexico. Additional risks not currently known to the Company, or that the Company currently deems immaterial, may also impair the Company’s operations. If any of these risks occur, including financial risks (liquidity, credit, market (interest rate, foreign currency, price)), the Company’s business, financial condition, and operating results could be adversely affected.

For a detailed discussion of risks, refer to the Company’s MD&A and Annual Information Form (“AIF”) for the year ended December 31, 2021 available on the Company’s website at www.discoverysilver.com.

FORWARD-LOOKING STATEMENTS:

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

This news release is not for distribution to United States newswire services or for dissemination in the United States.

This news release does not constitute an offer to sell or a solicitation of an offer to buy nor shall there be any sale of any of the securities in any jurisdiction in which such offer, solicitation or sale would be unlawful, including any of the securities in the United States of America. The securities have not been and will not be registered under the United States Securities Act of 1933, as amended (the “1933 Act”) or any state securities laws and may not be offered or sold within the United States or to, or for account or benefit of, U.S. Persons (as defined in Regulation S under the 1933 Act) unless registered under the 1933 Act and applicable state securities laws, or an exemption from such registration requirements is available.

Cautionary Note Regarding Forward-Looking Statements

This news release may include forward-looking statements that are subject to inherent risks and uncertainties. All statements within this news release, other than statements of historical fact, are to be considered forward looking. Although Discovery believes the expectations expressed in such forward-looking statements are based on reasonable assumptions, such statements are not guarantees of future performance and actual results or developments may differ materially from those described in forward-looking statements. Such statements include but are not limited to: the timeline for the execution and completion of the Phase 2 drill program including the impacts and benefits; the timeline and anticipated results to be included in the Resource update including the impact and benefits; the timeline and anticipated results to be included in the Preliminary Economic Assessment including the impact and benefits; Factors that could cause actual results to differ materially from those described in forward-looking statements include fluctuations in market prices, including metal prices, continued availability of capital and financing, and general economic, market or business conditions. There can be no assurances that such statements will prove accurate and, therefore, readers are advised to rely on their own evaluation of such uncertainties. Discovery does not assume any obligation to update any forward-looking statements except as required under applicable laws. For a detailed discussion on the risks faced by the Company, refer to the documents incorporated by reference herein, the Company’s MD&A for the year ended December 31, 2021 and the Company’s 2021 Annual Information Form available on the Company’s website at www.discoverysilver.com or under Discovery’s profile on SEDAR at www.sedar.com.

Original Article: https://discoverysilver.com/news/discovery-reports-q3-2022-financial-results-and-update/