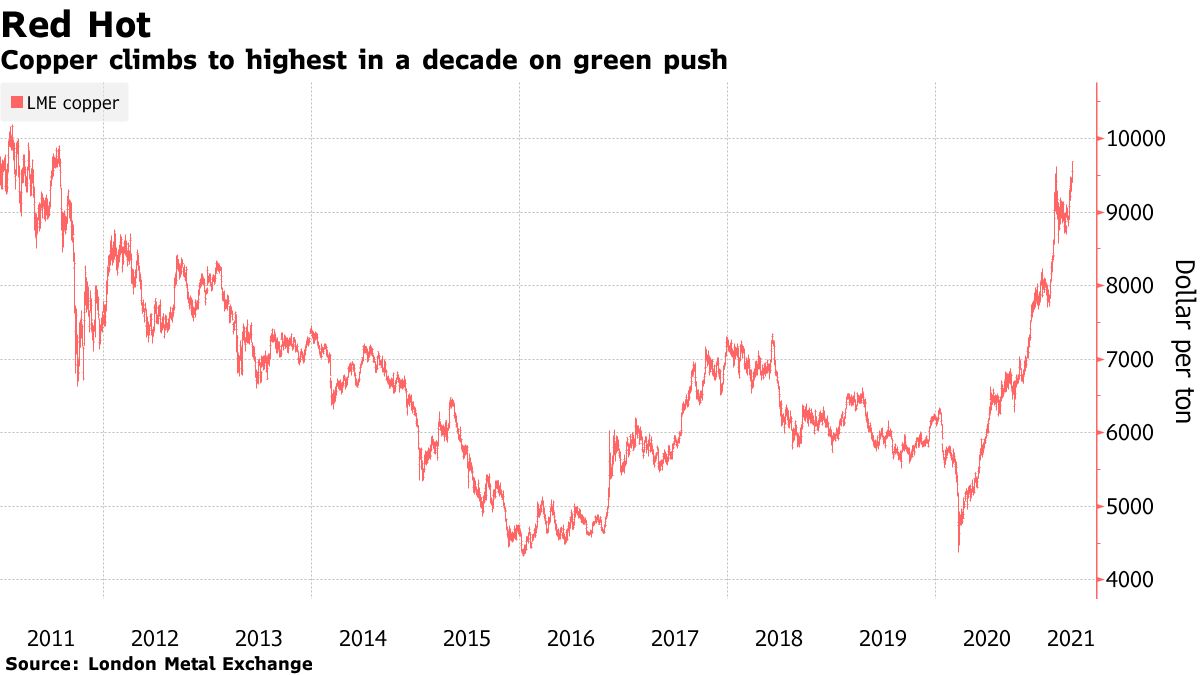

Copper climbed to the highest in almost a decade as the global recovery from the pandemic extended a rally in metals markets.

Aluminum is surging and iron ore jumped to a fresh high as commodities advance toward the highs of the last supercycle. Metals are benefiting as the world’s largest economies announce stimulus programs and climate pledges as they rebuild from the coronavirus shock.

The U.S. recovery is accelerating and President Joe Biden’s $2.25 trillion infrastructure plan will highlight sectors like electric cars, driving further gains in commodities critical to the green-energy transition. That’s coming alongside a continued economic boom in China, where a push to reduce emissions is filtering through to supply cuts for some metals just as demand is picking up.

“The super part of the copper supercycle is happening right now,” Max Layton, managing director for commodities research at Citigroup Inc., said by phone. “The bullish outlook is decarbonization-led, and I’m totally onboard with that for the next three to four years, but the super part of this cycle is actually more related to the scale of global stimulus.”

Copper — a bellwether for the global economy — rose as much as 2.2% to $9,765 a metric ton in London, the highest since 2011, and was trading at $9,739 as of 4:29 p.m. local time. The metal has gained 25% on the London Metal Exchange this year. Iron ore in Singapore jumped to the highest since contracts launched in 2013, while Chinese steel futures reached fresh highs.

Supply Squeeze

Copper’s integral role in everything from electrical wiring to motors is fanning expectations for further gains as nations roll out more aggressive climate targets. Goldman Sachs Group Inc. and trader Trafigura Group expect the metal to top 2011’s record of $10,190 and surpass $15,000 in the coming decade as demand outstrips supply.

“Copper could hardly peak and pull back with this backdrop,” said Harry Jiang, head of trading and research with Yonggang Resources Co. Tightness in markets outside China may lead to a supply squeeze, which will offset current weakness in Chinese demand, he said.

Investors are signaling appetite for metals futures. Aggregate open interest in SHFE copper is at the highest in more than a year, and positions in aluminum have climbed. Elsewhere, hedge fund managers boosted bullish Comex copper bets in the week ended April 20.

Still, risks to the industrial rally are building in the short term. A rise in coronavirus cases and new variants threaten to derail reopening plans in some regions such as India, while investors are concerned about a possible pullback in Chinese stimulus. Prices could become overly extended for industrial uses, according to Xiao Fu, head of commodities strategy at BOCI Global Commodities.

“I’m not in the $15,000 copper camp. There will be some automatic stabilizers before we approach those kinds of levels, and there will be some demand adjustment,” Xiao said by phone from London. “And let’s not forget: the pandemic is not over, and cases are still surging in many parts of the world.”