Key Information:

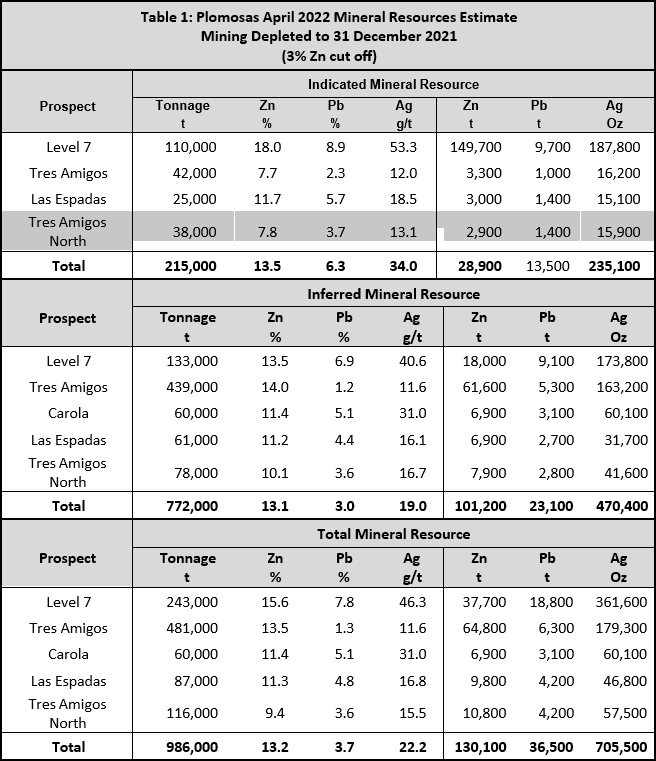

- Updated Mineral Resource estimate after mining depletion for Plomosas mine totals 986,000 tonnes @ 13.2% Zn and 3.7% Pb for 166,500 tonnes of contained metal in Indicated and Inferred categories.

- Represents a 5% increase in total tonnes and 40% increase in Indicated categories.

- New model developed to address the ore found outside of the previous mineral resource model

Consolidated Zinc Limited (ASX: CZL; “Consolidated Zinc” or “the Company”) advises that the resource reconciliation and Mineral Resource model for the Plomosas mine has been updated to incorporate the 2021 ore mined, the new areas identified as old workings and incorporating the new mineralised envelopes that better reflect the actual mineralisation.

The resource estimate, independently completed by Ashmore Advisory Pty Ltd (“ASH”) in compliance with the JORC (2012) reporting guidelines, contains 986,000 tonnes @ 13.2% Zn and 3.7% Pb for 166,500 tonnes of contained metal in Indicated and Inferred categories.

This estimate was after mining depletion during 2021 of 27,724 tonnes @ 17.4% zinc, 8.7% lead and 52.16g/t silver.

The new model represents a 5% increase in tonnes after mining depletion over the 2021 resource model. Significantly this also includes an upgrade of the classification of Mineral Resources with the Indicated category increasing by 40% in tonnes, 43% zinc increase and 48% lead increase.

The new model better represents the Plomosas mineralisation than the 2021 Mineral Resource estimate because it considers all grade control data from commencement of mining in 2018 to the end of 2021

During 2021 over 75% of ore mined was sourced from outside of the 2021 Mineral Resource Model demonstrating the need to incorporate all grade control information, drilling and exploration into a new interpretation of the Plomosas mineralisation. The good news is that the Mineral Resource has grown with the inclusion of the grade control data and mineralised envelopes.

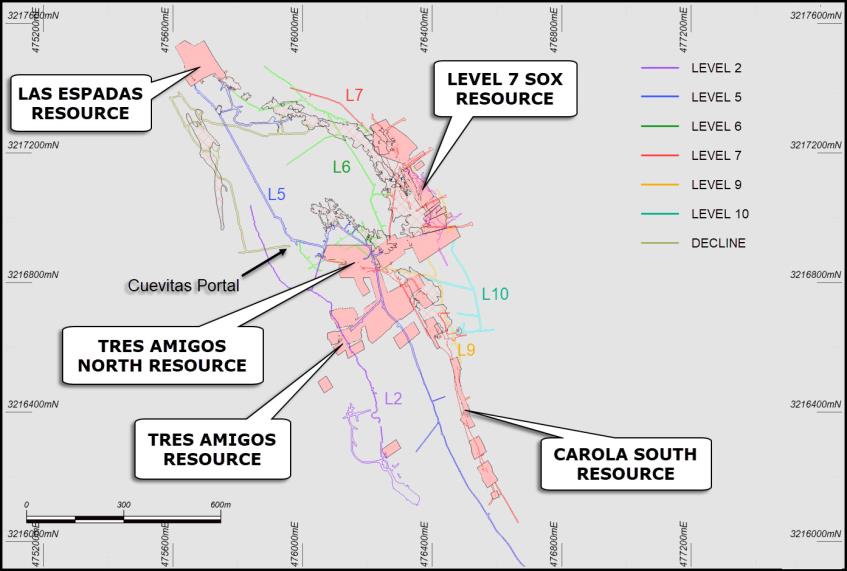

Table 1 details the Mineral Resources by area and category, the locations of which are illustrated in Figure 2.

Mineral Resource Details and Parameters

Results of the independent Mineral Resource estimate by ASH for the Project are tabulated in the Statement of Mineral Resources in Table 1. The Statement of Mineral Resources is reported in accordance with the requirements of the 2012 JORC Code and is therefore suitable for public reporting.

The Mineral Resource is reported above a cut-off grade of 3% Zn which was based on the mining cut-off grade for the operation.

Note: The Mineral Resource has been compiled under the supervision of Mr. Shaun Searle who is a full-time employee of ASH and a Member of the AIG. Mr. Searle has sufficient experience that is relevant to the style of mineralisation and type of deposit under consideration and to the activity that he has undertaken to qualify as a Competent Person as defined in the JORC Code.

All Mineral Resources figures reported in the table above represent estimates in April 2022. Mineral Resource estimates are not precise calculations, being dependent on the interpretation of limited information on the location, shape, and continuity of the occurrence and on the available sampling results. The totals contained in the above table have been rounded to reflect the relative uncertainty of the estimate. Rounding may cause some computational discrepancies.

The Mineral Resource has been estimated in accordance with the 2012 Edition of the ‘Australasian Code for Reporting of Exploration Results, Mineral Resources and Ore Reserves’ prepared by the Joint Ore Reserves Committee of The Australasian Institute of Mining and Metallurgy, Australian Geoscientists and Minerals Council of Australia (The JORC Code 2012).

A detailed discussion of the methodology and parameters used in estimating the Mineral Resources is provided in sections below along with an analysis of drilling, sampling and laboratory procedures and QA/QC protocols.

In summary:

- Ordinary Kriging (OK) was used to estimate average block grades using SURPAC software and parameters derived from modelled variograms. Parent block sizes were 10m x 5m x 2.5m;

- Linear grade estimation was deemed suitable due to the geological control on mineralisation. Maximum extrapolation of wireframes from drilling was 20m along strike and 30m down dip.

- The Mineral Resource estimate has been constrained by the wireframed mineralised envelope, is undiluted by external waste and reported above a Zn cut-off grade of 3%.

- The Mineral Resource was classified as Indicated and Inferred Mineral Resource based on data quality, sample spacing, and lode continuity. The Indicated Mineral Resource was defined within areas of close spaced diamond drilling of less than 20m by 20m, and where the continuity and predictability of the mineralised units was assisted with development drives, along with mapping and channel sampling to assist with structural interpretation. The Inferred Mineral Resource was assigned to areas where drill hole spacing was greater than 20m by 20m and less than 40m by 40m; where small, isolated pods of mineralisation occur outside the main mineralised zones, and to geologically complex zones.

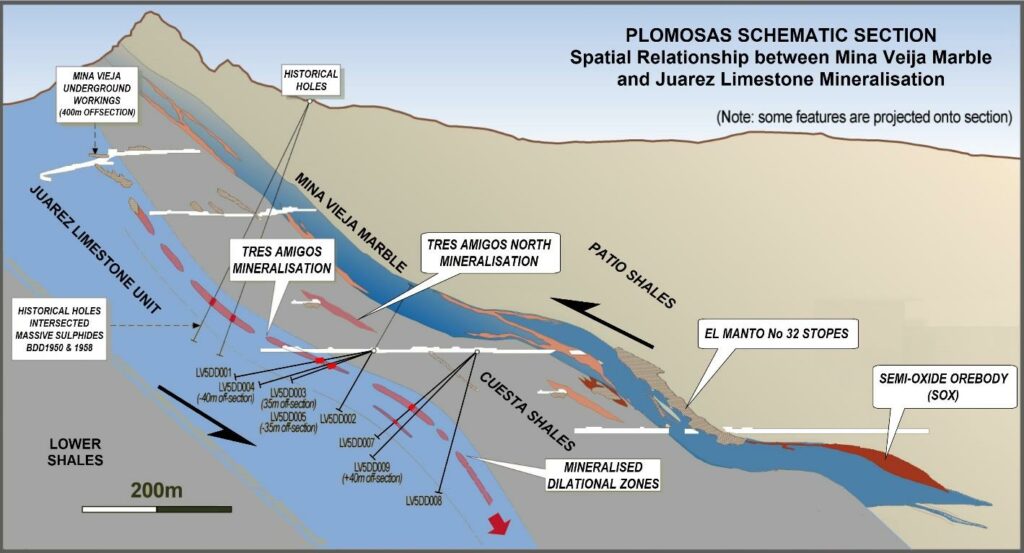

Geology and Geological Interpretation

During 2021 mining was undertaken at Tres Amigos, Tres Amigos North, Las Espadas, Carola and Carola South and Level 7 (SOX). While mining, it became clear that the mineralised envelopes of the 2021 Mineral Resource did not always follow the mineralisation at the local scale. The site based geological team prepared new mineralised envelopes based on the mineralisation defined during routine grade control. The result was an increase of resources at Plomosas with the changes to the mineralised envelopes mostly positive which enhanced the resources.

The dewatering allowed mapping of the deeper levels with greater accuracy than the old working plans previously available. This allowed the identification of historical workings below Level 7, at Level 8, 900m RL sub-level and at the Level 9. These mined out areas were surveyed, and the mined-out areas incorporated into the new 2022 resource model.

Additional Work Program

The definition of the cross-cut fault La Cata Canon has been mapped at Levels 2,5 & 7. Further mapping is to be undertaken at Levels 9, 10, 11 and 12. Once completed the Mineral Resource model will be revised to incorporate any mineralisation identified on the north and south side of La Cata Canon. This work will provide a better understanding of the extension of mineralisation to the north at Plomosas.

Detailed Discussion of Resource Estimation Methodology and Parameters

Sampling and Sub-Sampling Techniques

Sampling of cut channels was conducted by locating a one metre sampling line across mineralisation. Where mineralisation was thicker than one metre, the line was adjusted accordingly. As much representative sample was taken from the length of the line to produce a two to four-kilogram sample. For this level of grade control, the sample size and method of sampling was deemed adequate to represent in-situ material.

Sampling techniques employed at the Plomosas underground drilling program include saw cut NQ drill core samples. Diamond NQ3 core was sampled on geological intervals/contacts, with the minimum sample size of

0.5m and max 1.2m. Core was cut in half, with one half to be sent for analysis at an accredited laboratory, while the remaining half was stored in appropriately marked core boxes and stowed in a secure core shed. Duplicates were quarter core, sampled from the half sent for analysis.

Drilling Techniques

NQ triple tube core (NQ3) was used to drill out the geological sequences and identify zones of mineralisation that may or may not be used in any Mineral Resource estimations, mining studies or metallurgical testwork. No new drilling was completed in 2021.

Sample Analysis Method

All drill samples were submitted to ALS Laboratories in Chihuahua City for sample preparation with sample pulps sent to ALS in Toronto, Canada for multi-element analysis using a 30g charge with a multi-acid digest and ICP-MS or AAS finish (ME-ICP61). Over the limit results were routinely re-assayed by ore grade analysis assay method OG62. Over the limit results for the ore grade material were re-assayed by titration methods Cu-VOL61, Pb-VOL50 or Zn-VOL50.

Analyses include 51 elements and include Ag, Au, Cu, Pb, Zn as the main elements of economic interest. The methods and procedures are appropriate for the type of mineralisation and the techniques are total.

Estimation Parameters

Using parameters derived from modelled variograms, Ordinary Kriging (OK) was used to estimate average block grades in three passes using SURPAC software. Linear grade estimation was deemed suitable for the Plomosas Mineral Resource due to the geological control on mineralisation. Maximum extrapolation of wireframes from drilling was 20m along strike and 30m down-dip. This was equal to the drill hole spacing in these regions of the Project. Maximum extrapolation was generally half drill hole spacing.

The parent block dimensions used were 10m NS by 5m EW by 2.5m vertical with sub-cells of 0.625m by 0.625m by 0.625m. The model was rotated to align with the strike of the mineralisation on a bearing of 330°. The parent block size dimension was selected on the results obtained from Kriging Neighbourhood Analysis that suggested this was the optimal block size for the dataset.

The deposit mineralisation was constrained by wireframe solids constructed using a nominal 2% combined Zn and Pb cut-off grade with a minimum down-hole length of 1m. The wireframes were applied as hard boundaries in the estimate.

Statistical analysis was carried out on data from 55 domains. After review of the project statistics, it was determined that high grade cuts for Ag within two domains were necessary. The cut applied was 300g/t Ag resulting in two composites being cut.

An orientated ‘ellipsoid’ search was used to select data and adjusted to account for the variations in lode orientations, however all other parameters were taken from the variography derived from Domain 1. Up to three passes were used for each domain. The first pass had a range of 30m, with a minimum of 6 samples. For the second pass, the range was extended to 50m, with a minimum of 4 samples. For the final pass, the range was extended to 100m, with a minimum of 2 samples. A maximum of 16 samples was used for all three passes.

It is assumed that the bulk density will have some variation within the mineralised material types due to the host rock lithology and sulphide minerals present. Therefore, a regression equation for Zn and density was used to calculate density in the block model.

Validation of the model included detailed comparison of composite grades and block grades by strike panel and elevation. Validation plots showed good correlation between the composite grades and the block model grades.

Mineral Resource Classification Criteria

The Mineral Resource estimate is reported here in compliance with the 2012 Edition of the ‘Australasian Code for Reporting of Exploration Results, Mineral Resources and Ore Reserves’ by the Joint Ore Reserves Committee (JORC). The Mineral Resource was classified as Indicated and Inferred Mineral Resource based on data quality, sample spacing, and lode continuity. The Indicated Mineral Resource was defined within areas of close spaced diamond drilling of less than 20m by 20m, and where the continuity and predictability of the mineralised units was assisted with development drives, along with mapping and channel sampling to assist with structural interpretation. The Inferred Mineral Resource was assigned to areas where drill hole spacing was greater than 20m by 20m and less than 40m by 40m; where small, isolated pods of mineralisation occur outside the main mineralised zones, and to geologically complex zones

Cut-off Grade, Mining and Metallurgy Methods and Parameters Considered to Date

The Statement of Mineral Resources has been constrained by the mineralisation solids and reported above a Zn cut-off grade of 3%. The cut-off grade was estimated based on current mining cut-off grades for the operation. Long term average zinc prices were used in the estimation of cut-off grades rather than the current all-time high zinc prices.

This announcement was authorised for issue to the ASX by the Directors of the Company. For further information please contact:

Brad Marwood

Managing Director

08 6400 6222

ABOUT CONSOLIDATED ZINC

Consolidated Zinc Limited (ASX: CZL) owns 100% of the historic Plomosas Mine, located 120km from Chihuahua City, Chihuahua State, Mexico. Chihuahua State has a strong mining sector with other large base and precious metal projects in operation within the state. Historical mining at Plomosas between 1945 and 1974 extracted over 2 million tonnes of ore grading 22% Zn+Pb and over 80g/t Ag. Only small-scale mining continued to the present day and the mineralised zones remain open at depth and along strike.

The Company has recommenced mining at Plomosas and is committed to exploit the potential of the high-grade Zinc, Lead and Silver Mineral Resource through the identification and exploration of new zones of mineralisation within and adjacent to the known mineralisation with a view to identify new mineral resources that are exploitable.

Competent Persons’ Statement

The information in this report that relates to exploration results, data collection and geological interpretation is based on information compiled by Duncan Greenaway (Hons), Mr Greenaway is a Member of the Australasian Institute of Mining and Metallurgy (AusIMM). Mr. Greenaway has sufficient experience that is relevant to the style of mineralisation and type of deposit under consideration and to the activity that is being undertaken to qualify as Competent Person as defined in the 2012 edition of the ‘Australasian Code for Reporting of Exploration Results, Minerals Resources and Ore Reserves’ (JORC Code). Mr. Greenaway consents to the inclusion in the report of the matters based on his information in the form and context in which it appears.

The information in this report that relates to Mineral Resources is based on information compiled by Mr Shaun Searle who is a Member of the Australasian Institute of Mining and Metallurgy. Mr Searle is a full-time employee of Ashmore Advisory Pty Ltd. Mr Searle has sufficient experience which is relevant to the style of mineralisation and type of deposit under consideration and to the activity which he has undertaken to qualify as a Competent Person as defined in the 2012 Edition of the ‘Australasian Code for the Reporting of Exploration Results, Mineral Resources and Ore Reserves’. Mr Searle consents to the inclusion in this report of the matters based on his information in the form and context in which it appears.

Caution Regarding Forward Looking Statements and Forward-Looking Information:

This report contains forward looking statements and forward-looking information, which are based on assumptions and judgments of management regarding future events and results. Such forward-looking statements and forward-looking information involve known and unknown risks, uncertainties, and other factors which may cause the actual results, performance, or achievements of the Company to be materially different from any anticipated future results, performance or achievements expressed or implied by such forward- looking statements. Such factors include, among others, the actual market prices of zinc and lead, the actual results of current exploration, the availability of debt and equity financing, the volatility in global financial markets, the actual results of future mining, processing and development activities, receipt of regulatory approvals as and when required and changes in project parameters as plans continue to be evaluated.

Except as required by law or regulation (including the ASX Listing Rules), Consolidated Zinc undertakes no obligation to provide any additional or updated information whether because of new information, future events, or results or otherwise. Indications of, and guidance or outlook on, future earnings or financial position or performance are also forward-looking statements.

Original Article: https://www.consolidatedzinc.com.au/wp-content/uploads/2022/04/20220426-Plomosas-Mineral-Resource-Update-FINAL-ASX-LODGEMENT.pdf