VANCOUVER, British Columbia – Capstone Mining Corp. (“Capstone” or the “Company”) (TSX:CS) announces updated Proven and Probable Mineral Reserves and positive results of an updated Technical Report for its Cozamin Mine in Zacatecas, Mexico.HIGHLIGHTS

- Proven and Probable Mineral Reserves increased by 97% relative to December 31, 2019, to 10.2 million tonnes grading 1.79% copper.

- Ramp-up to 1.35 million tonnes milled per annum (“tpa”) by Q2 2021 is on time and budget. A new section of ramp to complete a one-way traffic circuit remains on schedule for completion in Q4 2020.

- Updated life of mine plan (“LOMP”) released. For the three years post-expansion (2021-2023) when compared to the three years pre-expansion (2018-2020), annual average copper and silver production increases by 70% to 61.4 million pounds and 43% to 1.75 million ounces, respectively. Additionally, average annual C1 costs (net of by-products) are expected to move 23% lower to $0.67 per payable pound of copper.

- Tailings management transformation activities are progressing on schedule, including design and permitting of a filtered (dry stack) tailings storage facility. This strategy aligns with industry leading environmental best practice for tailings management.

- A pre-feasibility study (“PFS”) of an underground paste backfill system is underway to assess the potential for increasing the extraction ratio from Vein 20 in the Mala Noche Footwall Zone (“MNFWZ”). The updated LOMP currently excludes these pillars and assumes an extraction ratio of 74%, leaving 3.5 million tonnes of Indicated Mineral Resources grading 1.89% copper and 42 g/t silver in unmined pillars that will be the subject of the PFS. This pillar extraction PFS is targeted for completion in Q4 2020 and assuming positive economics, it will include updated capital and net present value estimates and changes to the LOMP presented herein.

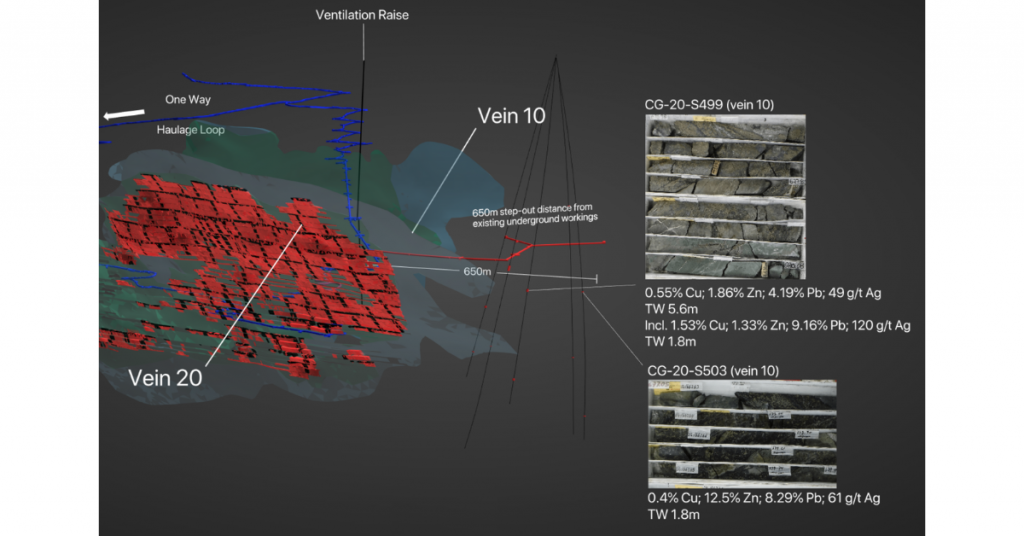

- A new step-out hole drill program totalling 80 holes targeting the down dip extension to the southeast of both Vein 10 and Vein 20 is underway. Hole S499 and S503 intersected high grade polymetallic copper, zinc, lead and silver in a 650-meter step-out from the current mineral resource. A 1 km exploration drift is being considered to provide a drilling platform to target this new area.

- An updated Mineral Resource Estimate is expected to be released with the pillar extraction PFS results. Drilling on the outer edges of the current resource is ongoing and will include all new drill holes with assay data received since April 30, 2020 (see Table 5 for current Mineral Resource Estimate).

Brad Mercer, Capstone’s SVP Exploration and Operations said, “We decided to take a two-phase approach and release the Mineral Reserves ahead of our 2021 budgeting cycle, allowing us to greenlight key projects by year-end. The second phase of this work, targeted for completion in Q4 2020, will focus on opportunities we have identified, such as the feasibility of high-grade pillar extraction using paste backfill, updating the block model with ongoing exploration results and ongoing metallurgical and geotechnical work on Vein 10 not in Reserve.”

Darren Pylot, Capstone’s President and CEO said, “I’m pleased to see Cozamin evolving into a safer and more productive mine with the one-way ramp in service and the potential for truckless headings as we look to add ore passes in our mine design. Additionally, it will be a more socio-environmentally responsible operation with the transition to dry-stack tailings and potentially a paste backfill plant that could return up to 60% of our tailings underground, so we can safely recover high grade pillars. This plan reinforces my view that Cozamin is a Tier 1 asset that will continue to generate exceptional value for all stakeholders.”

MINERAL RESERVE ESTIMATE

Table 1 presents the Mineral Reserve estimate for all zones as of April 30, 2020. Estimated Reserves have increased by 97% relative to December 31, 2019, and average copper grade of these Reserves has increased from 1.50% to 1.79%. Contained copper and silver have increased by 134% and 102%, respectively. Approximately 92% of current Reserves are in Vein 20, the principal vein in the MNFWZ.

TABLE 1 – Mineral Reserve Estimate as of April 30, 2020 at a US$52.29/t Net Smelter Return Cut-off

| Category | Tonnes(kt) | Copper(%) | Silver(g/t) | Zinc(%) | Lead(%) | Copper Metal (kt) | Silver Metal (koz) | Zinc Metal (kt) | Lead Metal (kt) |

| Proven | – | – | – | – | – | – | – | – | – |

| Probable | 10,178 | 1.79 | 41 | 0.36 | 0.05 | 182 | 13,527 | 36 | 5 |

| Proven + Probable | 10,178 | 1.79 | 41 | 0.36 | 0.05 | 182 | 13,527 | 36 | 5 |

| Compared to Dec 31, 2019 | +97% | +19% | +2% | -45% | -63% | +134% | +102% | +9% | -27% |

| NOTES: Tucker Jensen, P.Eng., Superintendent Mine Operations at Capstone Mining Corp., is the Qualified Person for this Cozamin Mineral Reserve update. Disclosure of the Cozamin Mineral Reserves as of April 30, 2020 was completed using fully diluted mineable stope shapes generated by the Maptek Vulcan Mine Stope Optimizer software and estimated using the 2020 MNFWZ resource block model created by Garth Kirkham, P.Geo., FGC and the 2017 MNV resource block model created by J. Vincent, P.Geo., formerly of Capstone Mining Corp. Mineral Reserves are reported at a US$52.29/t net smelter return (“NSR”) cut-off using the NSR20CuRSV formula: ($50.762*%Cu + $0.412*Ag ppm)*(1-NSRRoyalty%) for copper zones based on metal price assumptions (in US$) of Cu = $2.75/lb and Ag = $17.00/oz, and metal recoveries of 96% Cu, 86% Ag and the NSR20ZnRSV formula: ($49.756*%Cu + $0.381*Ag ppm + $8.035*%Pb + $11.820*%Zn)*(1-NSRRoyalty%) for zinc zones based on metal price assumptions (in US$) of Cu = $2.75/lb, Ag = $17.00/oz, Pb = $0.90/lb, Zn = $1.00/lb and metal recoveries of 94% Cu, 78% Ag, 47% Pb and 67% Zn. Mineral reserve calculations consider mining by long-hole stoping and mineral processing by flotation. Tonnage and grade estimates include dilution and mining losses and do not include unmined pillars as described in Table 4. The NSR royalty rate applied varies between 1% and 3% depending on the mining concession, and royalties are treated as costs in mineral reserve estimation. An exchange rate of MX$20 per US$1 is assumed. All metals are reported as contained. Figures may not sum exactly due to rounding. |

LIFE OF MINE PLAN AS OF APRIL 30, 2020

Cozamin’s LOMP has been updated based on the Mineral Reserves presented in Table 1 above. The LOMP should be considered interim as it is subject to change should the pillar extraction PFS prove positive in Q4 2020 (see Short-Term Opportunities section below for details). This interim plan includes full throughput rates of approximately 1.35 to 1.38 million tonnes per annum from 2021 through 2026, followed by declining rates to early 2029. See Table 3 below for a detailed year-by-year mine plan.

For the three years post-expansion (2021-2023) when compared to the three years pre-expansion (2018-2020), annual average copper and silver production increases by 70% and 43%, respectively, and copper grades increase by 31% with recoveries increasing for copper to 96.1% from 95.0% and silver to 85.5% from 78.0%. Silver recoveries are expected to benefit from improved metallurgical performance by processing copper-silver ore only versus a blend of copper-silver and lead-zinc-silver ore. Economies of scale and mining productivity improvements helped by one-way ramp completion have moved the three-year (2021-2023) average per tonne mining costs, milling costs and G&A costs by -14%, -4%, and -13%, respectively, relative to 2018-2020. See Table 2 below for detailed pre- and post-expansion comparisons on an annual average basis.

TABLE 2 – Comparison of Three Years Average Annual Pre- and Post-Expansion

| 3 Years Annual Average Pre-Expansion (1.07 Mtpa) 2018-20201 | 3 Years Annual Average Post-Expansion2 (1.36 Mtpa) 2021-2023 | % Difference | |

| Cu Production (M lbs) | 36.2 | 61.4 | 70% |

| Ag Production (M troy ozs) | 1.22 | 1.75 | 43% |

| Pb Production (M lbs) | 2.5 | – | -100% |

| Zn Production (M lbs) | 15 | – | -100% |

| Tonnes milled (M t) | 1.07 | 1.36 | 28% |

| Cu Grade (%) | 1.62% | 2.12% | 31% |

| Cu Recovery (%) | 95.0% | 96.1% | 1% |

| Ag Grade (g/t) | 45.2 | 46.5 | 3% |

| Ag Recovery (%) | 78.0% | 85.5% | 10% |

| Mining Cost ($/t milled) | $29.34 | $25.13 | -14% |

| Milling Cost ($/t milled) | $10.46 | $10.00 | -4% |

| G&A Cost ($/t milled) | $7.25 | $6.33 | -13% |

| C1 Costs3($/lb payable Cu) | $0.87 | $0.67 | -23% |

| Sustaining CAPEX (M$) | $23.0 | $26.0 | 14% |

| AISC3($/lb payable Cu) | $1.69 | $1.16 | -31% |

| NOTES: | ||

| 1. | 2020E figures are for 12 months and are a combination of actual results and estimates for the remainder of the year. | |

| 2. | Weighted average of the updated LOMP based on the April 30, 2020 reserve update. Operating and Capital costs assume an exchange rate of MXN$21 per USD$1. C1 Costs3 and AISC3 assume by-product pricing for Ag of $22.00/oz. The updated LOMP is subject to change pending results of the pillar extraction PFS, targeted for completion in Q4 2020. | |

| 3. | This is an alternative performance measure; please see “Alternative Performance Measures” at the end of this release. C1 Costs and AISC are net of by-products. |

TABLE 3 – Updated LOMP Subject to Change Pending Results of Pillar Extraction PFS1 Targeted for Completion in Q4 2020

| Pre-Expansion (1.07 million tpa) | Post-Expansion2 (up to 1.38 million tpa) | |||||||||||

| 2018A | 2019A | 2020E3 | 2021E | 2022E | 2023E | 2024E | 2025E | 2026E | 2027E | 2028E | 2029E | |

| Cu Production (M lbs) | 36.2 | 35.8 | 36.5 | 47.7 | 65.6 | 70.9 | 61.2 | 47.2 | 43.8 | 19.9 | 1.3 | 0.1 |

| Ag Production (M troy ozs) | 1.164 | 1.366 | 1.125 | 1.344 | 1.883 | 2.010 | 1.629 | 1.299 | 1.297 | 0.809 | 0.164 | 0.018 |

| Pb Production (M lbs) | 3.2 | 3.4 | 0.9 | – | – | – | – | – | – | 0.6 | 1.3 | 0.3 |

| Zn Production (M lbs) | 14.9 | 18.5 | 11.8 | – | – | – | – | – | – | – | 9.4 | 1.9 |

| Tonnes milled (M tonnes) | 0.986 | 1.146 | 1.071 | 1.345 | 1.371 | 1.374 | 1.378 | 1.375 | 1.376 | 0.937 | 0.245 | 0.03 |

| Cu Grade (%) | 1.75 | 1.50 | 1.62 | 1.68 | 2.25 | 2.43 | 2.10 | 1.63 | 1.52 | 1.05 | 0.36 | 0.16 |

| Cu Recovery (%) | 95.0 | 94.4 | 95.6 | 95.6 | 96.3 | 96.4 | 96.2 | 95.5 | 95.1 | 91.6 | 67.1 | 49.8 |

| Ag Grade (g/t) | 47.5 | 46.7 | 41.4 | 37.5 | 49.4 | 52.3 | 42.8 | 35.7 | 36.2 | 36.1 | 37.0 | 33.3 |

| Ag Recovery (%) | 77.2 | 77.7 | 79.1 | 82.9 | 86.5 | 87.0 | 85.8 | 82.4 | 81.0 | 72.5 | 45.0 | 32.4 |

| Mining Cost ($/t milled) | 31.04 | 30.62 | 26.40 | 25.23 | 25.07 | 25.09 | 24.83 | 27.21 | 26.86 | 26.66 | 29.04 | 23.62 |

| Milling Cost ($/t milled) | 10.56 | 10.96 | 9.82 | 9.30 | 9.28 | 11.40 | 11.40 | 11.40 | 11.40 | 12.36 | 12.25 | 12.25 |

| G&A Cost ($/t milled) | 7.79 | 6.92 | 7.10 | 6.37 | 6.32 | 6.31 | 6.31 | 6.31 | 6.31 | 6.72 | 6.32 | 6.32 |

| C1 Costs4($/lb payable Cu) | 0.75 | 0.90 | 0.96 | 0.89 | 0.60 | 0.58 | 0.75 | 1.11 | 1.16 | 1.71 | 2.64 | -0.57 |

| Sustaining CAPEX (M$) | 20.1 | 26.8 | 21.9 | 32.8 | 29.0 | 16.3 | 8.4 | 4.2 | 2.9 | 1.5 | 0.5 | 0.3 |

| AISC4($/lb payable Cu) | 1.50 | 1.84 | 1.74 | 1.67 | 1.11 | 0.87 | 0.95 | 1.26 | 1.31 | 1.87 | 3.35 | 5.94 |

| NOTES: | ||

| 1. | Internal analysis supports Capstone’s decision to proceed with a PFS to assess the use of underground paste backfill to increase the mineral extraction ratio of 74% assumed in this updated LOMP. This study is targeted for completion in Q4 2020. | |

| 2. | Cozamin’s LOMP has been updated based on the Mineral Reserves as of April 30, 2020. Operating and Capital costs assume an exchange rate of MXN$21 per USD$1. C1 Costs4 and AISC4 assume by-product pricing of Ag = $22.00/oz, Pb = $0.90/lb and Zn = $1.00lb. | |

| 3. | 2020E figures are for 12 months and are a combination of actual results and estimates for the remainder of the year. | |

| 4. | This is an alternative performance measure; please see “Alternative Performance Measures” at the end of this release. C1 Costs and AISC are net of by-products. |

TAILINGS MANAGEMENT

Due to increased tailings storage requirements of the updated LOMP, Cozamin intends to convert from the current slurry tailings facility that has been safely operated for over 15 years to a filtered (dry stack) tailings facility. Preliminary design of two filtered tailings storage facility options has been completed, and feasibility-level engineering in support of permitting of these two options is in progress. It is expected that this conversion to filtered tailings will significantly decrease the mine’s socio-environmental, geotechnical and water supply risks, while decreasing water consumption and make-up water costs.

SHORT-TERM OPPORTUNITIES

Cozamin is advancing several initiatives with the potential to extend mine life, increase safety standards and improve operational efficiencies. The following short-term opportunities are not included in this updated LOMP or the Mineral Reserve estimate as of April 30, 2020.

Underground Paste Backfill

Cozamin’s updated LOMP assumes a mineral extraction ratio of 74% from the MNFWZ, leaving 3.5 million tonnes of Indicated Mineral Resources grading 1.89% copper and 42 g/t silver in pillars (see Table 4) for geotechnical stability. Internal analysis supports Capstone’s decision to proceed with a PFS to assess the potential for using underground paste backfill to increase this mineral extraction ratio. This study is targeted for completion in Q4 2020. A potential advantage to both capital and operating expenditures of paste backfill is the use of up to 60% of the tailings produced by the mine, rather than mining or purchasing aggregate. The use of filtered tailings for paste backfill reduces the mine’s surface tailings management costs and socio-environmental risk. Figure 1 below illustrates the design location of Indicated Mineral Resources locked up in pillars in Vein 20.

TABLE 4 – MNFWZ Pillars Excluded from Mineral Reserve Estimate as of April 30, 2020

| Classification | Tonnes(kt) | Copper(%) | Silver(g/t) | Zinc(%) | Lead(%) | Copper Metal(kt) | Silver Metal(koz) | Zinc Metal(kt) | Lead Metal(kt) |

| Measured Resources in MNFWZ Pillars | – | – | – | – | – | – | – | – | – |

| Indicated Resources in MNFWZ Pillars | 3,503 | 1.89 | 42 | 0.24 | 0.02 | 66 | 4,726 | 8 | 1 |

| Total Measured and Indicated Resources in MNFWZ Pillars | 3,503 | 1.89 | 42 | 0.24 | 0.02 | 66 | 4,726 | 8 | 1 |

| Inferred Resources in MNFWZ Pillars | – | – | – | – | – | – | – | – | – |

| NOTES: Refer to Table 1 for details of Mineral Reserve estimate and Table 5 for details of Mineral Resource estimate. Material in MNFWZ pillars is included in the Indicated Mineral Resource in Table 5 but is not included in the updated LOMP. |

FIGURE 1 – MNFWZ Vein 20 Resource with Updated LOMP Stopes and Pillars

NOTE: View looking north-northeast at 15°. Indicated Mineral Resources are shown in green. Inferred Mineral Resources are shown in light blue. Mineral Reserves are shown in red. Pillars left unmined in the updated LOMP, comprising Indicated Mineral Resources, are illustrated in black.

Stope Dilution

Stope dilution in the deeper areas of the NW end of the MNFWZ have been high compared to other longhole open stope mines, driven by narrow veins and local geotechnical conditions. As mining progresses away from this area, an initiative is underway to reduce dilution site-wide through improved engineering, planning, long-hole drill control and optimized explosives design guided by a team of consultants and site experts.

Truckless Headings

An initiative is underway to redesign the upper areas of Cozamin Reserves to ore pass use, increasing safety and efficiency, while increasing air quality, thereby decreasing ventilation requirements in these areas.

Further Resource to Reserve Conversion (MNFWZ)

The Indicated Mineral resource in the MNFWZ copper-silver zones exclusive of the pillars and the Mineral Reserves totals 7,248 kt of 1.74% copper, 39 g/t silver and 0.57% zinc, containing 278 million pounds of copper, 9.2 million ounces of silver and 92 million pounds of zinc remaining. Additionally, the Indicated Mineral Resource in the MNFWZ zinc-lead-silver zones exclusive of the pillars and the Mineral Reserves totals 3,704 kt of 0.21% copper, 36 g/t silver, 3.12% zinc and 1.48% lead, containing 17 million pounds of copper, 4.3 million ounces of silver, 255 million pounds of zinc, and 121 million pounds of lead remaining. In addition to the pillar extraction study, Capstone intends to initiate work to evaluate alternative mining techniques capable of lower costs and decreased dilution to determine if further mineral resources can be converted to mineral reserves.

MINERAL RESOURCE ESTIMATE

Table 5 presents the Mineral Resource estimate for all zones as of April 30, 2020. Estimated Measured and Indicated (“M+I”) Resources have increased by 60% relative to December 31, 2019. Contained copper, silver, zinc and lead have increased by 83%, 74%, 58% and 92%, respectively, relative to December 31, 2019. Mineral Resource estimates do not account for mining loss and dilution.

Capstone previously announced a total M+I Mineral Resource as of April 30, 2020 of 26,458 kt on June 11, 2020. The current Mineral Resource estimate is an increase of 3.8% from this previous estimate. This change is the result of an updated net smelter return (“NSR”) formula adopted for the cut-off applied, that includes long-term metals prices in line with current industry norms, updated recovery curves, royalties and other operational considerations.

TABLE 5 – Mineral Resource Estimate as of April 30, 2020 at a US$50/t NSR Cut-Off

| Classification | Tonnes (kt) | Copper (%) | Silver (g/t) | Zinc (%) | Lead (%) | Copper Metal (kt) | Silver Metal (koz) | Zinc Metal (kt) | Lead Metal (kt) |

| Measured (M) | 409 | 1.23 | 53 | 1.23 | 0.40 | 5 | 699 | 5 | 2 |

| Indicated (I) | 27,050 | 1.57 | 44 | 1.14 | 0.31 | 425 | 38,509 | 309 | 85 |

| Total M + I | 27,459 | 1.57 | 44 | 1.14 | 0.32 | 430 | 39,209 | 314 | 87 |

| Inferred | 16,558 | 0.64 | 36 | 2.26 | 0.61 | 106 | 18,983 | 375 | 101 |

| NOTES: Mineral Resources are classified according to CIM (2014) definitions, estimated following CIM (2019) guidelines and have an effective date of April 30, 2020. Mineral Resources are reported inclusive of Mineral Reserves. Mineral Resources that are not Mineral Reserves do not have demonstrated economic viability. The independent Qualified Person for the estimates is Mr. Garth D. Kirkham, P. Geo., FGC., of Kirkham Geosystems Ltd. Mineral Resources are reported using NSR20RES formula: (Cu*$60.535 + Ag*$0.472 + Zn*14.865 + Pb*$9.147)*(1-Royalty%) based on metal price assumptions (in US$) of Cu = $3.25/lb, Ag = $20.00/oz, Zn = $1.20/lb, Pb = $1.00/lb, metal recoveries of 95% Cu, 82% Ag, 70% Zn, 48% Pb, confidential current smelter contract terms, transportation costs and royalty agreements from 1 to 3%, as applicable, are incorporated. An exchange rate of MX$20 per US$1 is assumed. Totals may not sum exactly due to rounding. The NSR cut-off of US$50/tonne is based on historical mining and milling costs plus general and administrative costs. The Mineral Resource Estimate encompasses both the MNFWZ and the MNV. Drilling campaigns from 2018 have focused on the MNFWZ and no drilling has been performed on the MNV since 2017. The Mineral Resource considers underground mining by longhole stoping and mineral processing by flotation. No dilution is incorporated in the Mineral Resource. All metals are reported as contained. Mineral Resource estimates do not account for mining loss and dilution. These Mineral Resource estimates include Inferred Mineral Resources considered too speculative geologically to apply economic considerations for categorization as Mineral Reserves. However, it is reasonably expected that the majority of Inferred Mineral Resources could be upgraded to Indicated Resources. |

NATIONAL INSTRUMENT 43-101

A National Instrument 43-101 (“NI 43-101”) Technical Report will be prepared to summarize the Mineral Resource and Mineral Reserve estimates by the Qualified Persons and will be filed on SEDAR within 45 days of this news release.

Readers are cautioned that the conclusions, projections and estimates set out in this news release are subject to important qualifications, assumptions and exclusions, all of which will be detailed in the 2020 Technical Report. To fully understand the summary information set out above, the 2020 Technical Report that will be filed on SEDAR at www.sedar.com should be read in its entirety.

QUALIFIED PERSONS

The following Qualified Persons, as defined by NI 43-101, are independent from Capstone (except as noted below) and have reviewed and approved the content of this news release that is based on content from their respective portions of the 2020 Technical Report:

- Gregg Bush, P.Eng. (Non-independent)

- Jenna Hardy, P.Geo., FGC, Nimbus Management Ltd.

- Tucker Jensen, P.Eng., Capstone Mining Corp. (Non-independent)

- Garth Kirkham, P.Geo., FGC, Kirkham Geosystems Ltd.

- Chris Martin, CEng MIMMM, Blue Coast Metallurgy Ltd.

- Vivienne McLennan, P.Geo., Capstone Mining Corp. (Non-independent)

- Josh Moncrieff, P.Geo., Capstone Mining Corp. (Non-independent)

- Humberto Preciado, PhD, P.E., Wood Environment & Infrastructure Solutions, Inc.

EXPLORATION UPDATE AND NEW 80-HOLE DRILL PROGRAM

Results from five step-out drill holes released today demonstrate the expansion potential to the southeast, both within and external to the last Mineral Resource estimate. Drill results from Cozamin’s MNFWZ are summarized in Table 6 below and Figure 2 shows the location of holes S499 and S503 relative to the current Resource. Holes S499 and S503 intersected high grade polymetallic copper, zinc, lead and silver in a 650-meter step-out from the outer resource boundary.

“Both Vein 10 and Vein 20 are showing very interesting results in the step-out program targeting an area southeast of the last Mineral Resource estimate on June 11, 2020,” said Brad Mercer, SVP Exploration and Operations. “The holes released today point to a potential expansion of silver-lead-zinc resources in Vein 10. I am also excited to see the continuation of copper mineralization on the down-dip side of an inferred fault that appears to cut off the current high-grade mineral resource. Interestingly, Vein 20 is present on the other side of this break and is copper bearing, which gives us great reason to continue drilling along strike and down dip.”

FIGURE 2 – Location of Step-Out Holes S499 and S503 Relative to Current Resource of Vein 10 and Vein 20

NOTE: View looking north.

TABLE 6 – Selected MNFWZ Drilling Results – September 9, 2020

| Section ID # | Drill hole ID | Vein ID | In Resource | From (m) | To (m) | Width (m) | True Width* (m) | Cu (%) | Zn (%) | Pb (%) | Ag (g/t) |

| 1 | CG-20-S499 | 10 | no | 672.8 | 681.0 | 8.2 | 5.6 | 0.55 | 1.86 | 4.19 | 49 |

| including | 675.5 | 678.2 | 2.7 | 1.8 | 1.53 | 1.33 | 9.16 | 120 | |||

| 20 | no | 930.6 | 936.4 | 5.8 | 5.6 | 0.40 | 0.62 | 0.02 | 16 | ||

| including | 930.6 | 932.6 | 2.0 | 1.9 | 0.60 | 1.41 | 0.02 | 18 | |||

| 2 | CG-20-S503 | 10 | no | 677.3 | 679.7 | 2.4 | 1.8 | 0.40 | 12.50 | 8.29 | 61 |

| 20 | no | 1031.5 | 1033.5 | 2.0 | 1.6 | 0.26 | 1.31 | 0.09 | 195 | ||

| 3 | CG-19-S400 | 10 | no | 742.1 | 747.6 | 5.5 | 3.6 | 0.06 | 3.17 | 2.26 | 14 |

| including | 742.1 | 744.6 | 2.5 | 1.6 | 0.07 | 3.44 | 3.42 | 18 | |||

| 20** | yes | 877.4 | 879.3 | 1.9 | 1.7 | 1.49 | 1.61 | 0.03 | 31 | ||

| 4 | CG-17-S302 | 10 | no | 634.8 | 649.3 | 14.4 | 10.8 | 0.04 | 3.02 | 2.02 | 15 |

| including | 634.8 | 639.9 | 5.1 | 3.8 | 0.07 | 5.48 | 3.80 | 28 | |||

| 20 | yes | 867.4 | 868.1 | 0.7 | 0.7 | 0.90 | 4.74 | 0.21 | 64 | ||

| 5 | CG-17-S303 | 10 | no | 386.9 | 388.0 | 1.1 | 0.8 | 0.02 | 0.44 | 0.46 | 5 |

| 20 | no | 799.4 | 801.3 | 1.9 | 1.7 | 0.39 | 1.38 | 0.03 | 34 | ||

| NOTES:*estimated true width of vein intercept for inclined drill holes**intercept previously released |

For drill hole location and context, please view the long-sections of the MNFWZ for Vein 10 here: https://capstonemining.com/files/images/maps/MNFWZ-Vein-10-PR-Long-Section-09Sept2020.pdf and Vein 20 here: https://capstonemining.com/files/images/maps/MNFWZ-Vein-20-PR-Long-Section-09Sept2020.pdf.

New 80-Hole Drill Program and 1 km Exploration Drift

Capstone also announces today a new 80-hole drill program. Results from the five step-out drill holes released demonstrate the expansion potential to the southeast, both within and external to the last Mineral Resource estimate. Figure 3 below shows the proposed targets for the new drill program.

FIGURE 3 – Proposed Target Zones for New 80-Hole Drill Program

NOTE: View looking north.

MINERAL RESOURCE ESTIMATE METHODOLOGY

The Mineral Resource estimate reported herein was prepared by Garth Kirkham of Kirkham Geosystems Ltd. of Burnaby, BC, Canada, an Independent Qualified Person under Canadian Securities Administrators’ National Instrument 43-101. The Mineral Resources presented herein have been estimated in conformity with generally accepted CIM best practice guidelines and are reported in accordance with NI 43-101. The estimate was completed using MineSightTM software using a three-dimensional block model (12 metre by 5 metre by 10 metre block size with 4 metre by 0.5 metre by 5 metre sub-blocks). The MNFWZ model is comprised of eight interpreted three-dimensional wireframes which were the primary estimation domains and hard boundaries were used to constrain the interpolation of grades into the block model. Interpolation parameters have been derived based on geostatistical analysis conducted on 1 metre composited drill holes. Block grades have been estimated using Ordinary Kriging (OK) methodology and the mineral resources have been classified based on proximity to sample data and the continuity of mineralization in accordance with the categories in CIM Definition Standards (May 10, 2014) along with CIM Estimation of Mineral Resources and Mineral Reserves Best Practice Guidelines (November 29, 2019). The MNFWZ resource has been estimated using a total of 1,128 diamond drill holes with 4,371 sample composites.

ABOUT CAPSTONE MINING CORP.

Capstone Mining Corp. is a Canadian base metals mining company, focused on copper. Our two producing mines are the Pinto Valley copper mine located in Arizona, US and the Cozamin copper-silver mine in Zacatecas State, Mexico. In addition, Capstone owns 70% of Santo Domingo, a large scale, fully-permitted, copper-iron-gold project in Region III, Chile, in partnership with Korea Resources Corporation, as well as a portfolio of exploration properties. Capstone’s strategy is to focus on the optimization of operations and assets in politically stable, mining-friendly regions, centred in the Americas. We are committed to the responsible development of our assets and the environments in which we operate. Our headquarters are in Vancouver, Canada and we are listed on the Toronto Stock Exchange (TSX). Further information is available at www.capstonemining.com.

CAUTIONARY NOTE REGARDING FORWARD-LOOKING INFORMATION

This news release, and the documents incorporated by reference herein, contains “forward-looking information” within the meaning of Canadian securities legislation and “forward-looking statements” within the meaning of the United States Private Securities Litigation Reform Act of 1995 (collectively, “forward-looking statements”). These forward-looking statements are made as of the date of this document and Capstone Mining Corp. (“Capstone” or the “Company”) does not intend, and does not assume any obligation, to update these forward-looking statements, except as required under applicable securities legislation. Forward-looking statements relate to future events or future performance and reflect our expectations or beliefs regarding future events. Forward-looking statements include, but are not limited to, statements with respect to the continuing success of mineral exploration, Capstone’s ability to fund future exploration activities, the estimation of mineral resources and mineral reserves, the expected success of the underground paste backfill system study, the realization of mineral reserve estimates, the timing and amount of estimated future production, costs of production and capital expenditures, the success of our mining operations, the estimations for potential quantities and grade of inferred resources and exploration targets, environmental risks, unanticipated reclamation expenses and title disputes. In certain cases, forward-looking statements can be identified by the use of words such as “plans”, “expects”, “aiming”, “approximately”, “guidance”, “scheduled”, “target”, “estimates”, “forecasts”, “extends”, “convert”, “potential”, “intends”, “anticipates”, “believes” or variations of such words and phrases, or statements that certain actions, events or results “may”, “could”, “should”, “would”, “will”, “might” or “will be taken”, “occur” or “be achieved” or the negative of these terms or comparable terminology. By their very nature, forward-looking statements involve known and unknown risks, uncertainties and other factors that may cause our actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by the forward-looking statements. Such factors include, amongst others, risks related to inherent hazards associated with mining operations and closure of mining projects, the inherent uncertainty of mineral exploration and estimations of exploration targets, potential delays in exploration due to COVID-19 or governmental action, increase to operating costs directly or indirectly related to due to COVID-19 including but not limited to supply chain issues, future prices of copper and other metals, compliance with financial covenants, surety bonding, our ability to raise capital or fund explorations, Capstone’s ability to acquire properties for growth, counterparty risks associated with sales of our metals, foreign currency exchange rate fluctuations, changes in general economic conditions, accuracy of mineral resource and mineral reserve estimates, operating in foreign jurisdictions with risk of changes to governmental regulation, compliance with governmental regulations, compliance with environmental laws and regulations, reliance on approvals, licences and permits from governmental authorities, impact of climatic conditions on our operations, aboriginal title claims and rights to consultation and accommodation, land reclamation and mine closure obligations, uncertainties and risks related to the potential development of the Cozamin project, increased operating and capital costs, challenges to title to our mineral properties, maintaining ongoing social license to operate, dependence on key management personnel, potential conflicts of interest involving our directors and officers, corruption and bribery, limitations inherent in our insurance coverage, labour relations, increasing energy prices, competition in the mining industry, risks associated with joint venture partners, our ability to integrate new acquisitions into our operations, cybersecurity threats, legal proceedings, and other risks of the mining industry as well as those factors detailed from time to time in the Company’s interim and annual financial statements and MD&A of those statements, all of which are filed and available for review under the Company’s profile on SEDAR at www.sedar.com. Although the Company has attempted to identify important factors that could cause our actual results, performance or achievements to differ materially from those described in our forward-looking statements, there may be other factors that cause our results, performance or achievements not to be as anticipated, estimated or intended. There can be no assurance that our forward-looking statements will prove to be accurate, as our actual results, performance or achievements could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on our forward-looking statements.

ALTERNATIVE PERFORMANCE MEASURES

Alternative performance measures are furnished to provide additional information. These non-GAAP performance measures are included in this News Release because these statistics are key performance measures that management uses to monitor performance, to assess how the Company is performing, and to plan and assess the overall effectiveness and efficiency of mining operations. These performance measures do not have a standard meaning within International Financial Reporting Standings (“IFRS”) and, therefore, amounts presented may not be comparable to similar data presented by other mining companies. These performance measures should not be considered in isolation as a substitute for measures of performance in accordance with IFRS.

C1 Cash Costs Per Payable Pound of Copper Produced

C1 cash costs per payable pound of copper produced is a key performance measure that management uses to monitor performance. Management uses this measure to assess how well the Company’s producing mines are performing and to assess overall efficiency and effectiveness of the mining operations.

All-in Sustaining Costs Per Payable Pound of Copper Produced

All-in sustaining costs per payable pound of copper produced is an extension of C1 cash costs measure discussed above and is also a key performance measure that management uses to monitor performance. Management uses this measure to analyze margins achieved on existing assets while sustaining and maintaining production at current levels.

NATIONAL INSTRUMENT 43-101 COMPLIANCE

Unless otherwise indicated, Capstone has prepared the technical information in this news release (“Technical Information”) based on information contained in the technical reports, news releases and MD&A’s (collectively the “Disclosure Documents”) available under Capstone Mining Corp.’s company profile on SEDAR at www.sedar.com. Each Disclosure Document was prepared by, or under the supervision of, a qualified person (a “Qualified Person”) as defined in National Instrument 43-101 Standards of Disclosure for Mineral Projectsof the Canadian Securities Administrators (“NI 43-101”). Readers are encouraged to review the full text of the Disclosure Documents which qualifies the Technical Information. Readers are advised that mineral resources that are not mineral reserves do not have demonstrated economic viability. The Disclosure Documents are each intended to be read as a whole, and sections should not be read or relied upon out of context. The Technical Information is subject to the assumptions and qualifications contained in the Disclosure Documents.

The following Qualified Persons, as defined by NI 43-101, are independent from Capstone (except as noted below) and have reviewed and approved the content of this news release that is based on content from their respective portions of the 2020 Technical Report: Gregg Bush, P.Eng. (Non-independent), Jenna Hardy, P.Geo., FGC, Nimbus Management Ltd., Tucker Jensen, P.Eng., Capstone Mining Corp. (Non-independent), Garth Kirkham, P.Geo., FGC, Kirkham Geosystems Ltd., Chris Martin, CEng MIMMM, Blue Coast Metallurgy Ltd., Vivienne McLennan, P.Geo., Capstone Mining Corp. (Non-independent), Josh Moncrieff, P.Geo., Capstone Mining Corp. (Non-independent) and Humberto Preciado, PhD, P.E., Wood Environment & Infrastructure Solutions, Inc.

The Technical Information in this news release has been prepared in accordance with definitions and best practices referenced in NI 43-101 and reviewed and approved by Brad Mercer, P. Geol., Capstone’s Senior Vice President, Operations and Exploration, a Qualified Person and the person who oversees exploration activities on the Cozamin Mine property.

FOR FURTHER INFORMATION PLEASE CONTACT:

Jerrold Annett, VP, Strategy and Capital Markets

647-273-7351

jannett@capstonemining.com

Virginia Morgan, Manager, IR and Communications

604-674-2268

vmorgan@capstonemining.com

Original Article: https://capstonemining.com/news/news-details/2020/Capstone-Cozamin-Mine-to-Average-61.4-MIbs-Cu-and-1.75-Mozs-Ag-Annually-for-2021-2023-Pillar-Extraction-Pre-Feasibility-Study-Underway/default.aspx