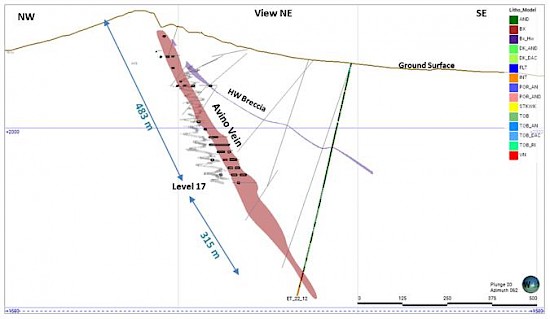

Avino Silver & Gold Mines Ltd. (ASM: TSX/NYSE American, GV6: FSE, “Avino” or “the Company”) releases the results of four drill holes from below Level 17, the current deepest workings at the mine. The Company has been mining the Avino Vein by modern bulk mining methods to a depth of 483 metres. This drilling shows the Avino Vein to extend a further 315 metres downdip. This exploration program is designed to test the continuity of the steeply dipping mineralization and to understand the source of the mineralization. As a result of this drilling, the Avino Vein is now known to be 800 metres deep downdip. Additionally, it appears that the Avino Vein is getting richer in copper as we go deeper with a grade of 1.63% copper over 16.66 metres in Hole ET 22-12.

Highlights

Selected intercepts include:

Hole ET 22-12: 248 AgEq g/t in 16.66 metres of drilling, including 371 AgEq g/t over 8.57 metres true width

Hole ET 22-13: 254 AgEq g/t including 2.46 Au g/t, over 1.10 meters true width at only 35 meters from surface, as well as 73 AgEq g/t over 23.64 metres true width, including 90 AgEq g/t over 7.95 metres true width.

Details are shown in the table and images below.

“The ET area drilling continues to build on our June and October 2022 results as we extend the area of mineralization below Level 17”, said David Wolfin, President and CEO. “We drilled to 315 metres below our current mine workings to confirm the continuity of mineralization. As we have come to expect with the Avino Vein, the drill intercept widths suggest that this area will be able to be mined by our existing low-cost bulk methods. In addition, we were delighted to discover a new veinlet closer to the surface that reported higher grade gold. Some of the current production areas contain lenses with high gold grades, and we are excited at the prospect that this would continue to other areas of the deposit not currently included in our mineral resource estimate.”

Avino is developing a geological model based on a “near porphyry” environment because of the increasing copper grades. The persistence of grade continuity from surface down a plunge distance of over 800 metres (600 metres vertical) with this copper increase supports the possibility of a deeper mineralized system and may be linked to a porphyry centre.

Geological modelling is ongoing to determine the potential geometry and controls of the mineralization. Our drill program continues into 2023 with 8000 metres planned for the year.

Geological Description

The Property contains numerous low-sulphidation epithermal veins (including the Avino vein), breccias, stockworks, and silicified zones that grade into a possible “near porphyry” environment within a large caldera setting. This caldera has been uplifted by regional north-trending block faulting (a graben structure) exposing a window of andesitic pyroclastic rocks of a lower volcanic sequence within this caldera. The lower volcanic sequence is overlain by an upper volcanic sequence consisting of rhyolite to trachyte lava flows and extensive ignimbrites. The direction of the increasing copper grade plunges towards the east in the Avino vein. The changing tenor of the mineralization could be reflecting a transition from epithermal to porphyry-style mineralization.

Below Level 17

A total of thirteen holes were drilled below level 17 in 2022. The most recent four holes, totalling 2,518 meters drilled, were completed to investigate the continuity of mineralization in the central part of the ET Area. Three of the holes intercepted the mineralization within the vein and stockwork and are reported in Table 1.

Vein-type mineralization and stockwork containing silver, gold and copper are found along the contacts between intrusive rocks and an andesite. This provides opportunities within the ET Area for the identification and delineation of additional mineral resources that remain open on strike and dip (see Figure 1 for the projections of the resource relative to the drilled holes). This recent deeper drilling confirms that the mineralization persists down dip significantly past the lowest developed mining level and may prove to add substantial mineral resources. An updated mineral resource estimate, up to hole ET-22-13, is currently scheduled for Q1 2023.

Table 1 – Summary Drill Results

| Structure | Hole Number | From (m) | To (m) | Drill Intercept Length (m) | True Width (m) | Au (g/t) | Ag (g/t) | Cu (%) | AgEq (g/t) |

| AVINO VEIN | ET-22-10 | 655.70 | 657.35 | 1.65 | 1.45 | 0.05 | 6 | 0.01 | 11 |

| HW STW | ET-22-11 | 405.25 | 408.50 | 3.25 | 3.00 | 0.38 | 13 | 0.72 | 140 |

| Including | 406.85 | 408.50 | 1.65 | 1.45 | 0.74 | 24 | 1.30 | 258 | |

| AVINO VEIN | ET-22-12 | 596.30 | 620.75 | 24.45 | 16.66 | 0.03 | 26 | 1.63 | 248 |

| Including | 598.60 | 610.65 | 12.05 | 8.57 | 0.04 | 34 | 2.49 | 371 | |

| NEW AREA | ET-22-13 | 35.80 | 37.10 | 1.30 | 1.10 | 2.46 | 9 | 0.30 | 254 |

| HW BX | 275.80 | 282.00 | 6.20 | 5.82 | 0.23 | 22 | 0.36 | 89 | |

| AVINO VEIN | and | 539.65 | 573.10 | 33.45 | 23.64 | 0.06 | 23 | 0.34 | 73 |

| Including | 553.60 | 564.85 | 11.25 | 7.95 | 0.05 | 24 | 0.47 | 90 |

- AgEq in drill results above assumes $1,800/ oz Au and $22.00 oz/ Ag, and $4.30/ lb Cu, and 100% metallurgical recovery

- HW BX = Hanging Wall Breccia and HW STW = Hanging Wall Stockworks

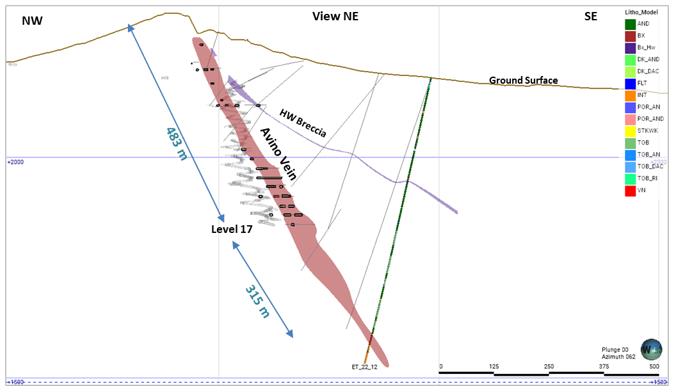

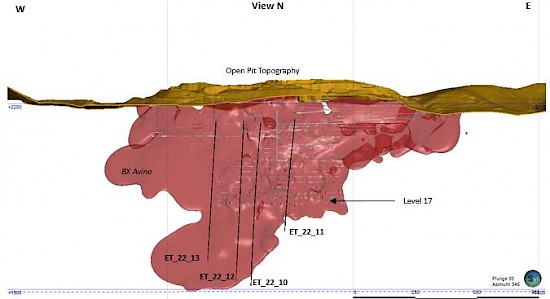

Figure 1 – Longitudinal view of the Avino Vein showing the drill hole locations and a projection of the mineralization in red.

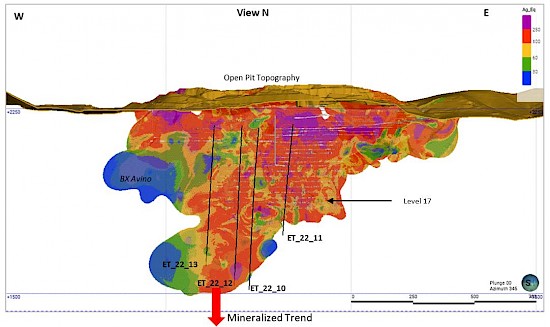

Figure 2 – Longitudinal view of the Avino Vein showing the drill hole locations and the block model in AgEq.

Figure 3 – Cross-Section of ET-22-12 and the extent of the down-dip extension from the current mine workings.

Sampling and Assay Methods

Following detailed geological and geotechnical logging, selected drill core areas were cut in half. One half of the core was submitted to the SGS Laboratory facility in Durango, Mexico, and the other half was retained on-site for verification and reference. Gold is assayed by fire assay with an AA finish. Any samples exceeding 3.0 gold grams/tonne are re-assayed and followed by a gravimetric finish. Multi-element analyses are also completed for each sample by SGS ICP14B methods. Any copper values exceeding 10,000 ppm (1%) are assayed using ICP 90Q. Silver is fire assayed with a gravimetric finish for samples assaying over 100 grams/tonne. Avino uses a series of standard reference materials, blank reference materials, and duplicates as part of their QA/QC program during assaying.

Qualified Person(s)

Avino’s projects in Durango, Mexico are under the geoscientific oversight of Michael F. O’Brien, P.Geo., Senior Principal Consultant, Red Pennant Communications, and under the supervision of Peter Latta, P.Eng, Avino’s VP, Technical Services, who are both qualified persons within the context of NI 43-101. Both have reviewed and approved the technical data in this news release.

About Avino

Avino is primarily a silver producer from its wholly owned Avino Mine near Durango, Mexico. The Company’s silver, gold and copper production remains unhedged. The Company’s mission and strategy is to create shareholder value through its focus on profitable organic growth at the historic Avino Property and the strategic acquisition of the nearby La Preciosa property. Avino currently controls 290 million silver equivalent ounces within our district scaled land package. We are committed to managing all business activities in a safe, environmentally responsible, and cost-effective manner, while contributing to the well-being of the communities in which we operate. We encourage you to connect with us on Twitter at @Avino and on LinkedIn at Avino Silver & Gold Mines. To view the Avino Mine VRIFY tour, please click here.

On Behalf of the Board

“David Wolfin”

________________________________

David Wolfin

President & CEO

Avino Silver & Gold Mines Ltd.

This news release contains “forward-looking information” and “forward-looking statements” (together, the “forward looking statements”) within the meaning of applicable securities laws and the United States Private Securities Litigation Reform Act of 1995, including the amended mineral resource estimate for the Company’s Avino Property located near Durango in west-central Mexico (the “Avino Property”) with an effective date of January 13, 2021, and as amended on December 21, 2021, and the Company’s updated mineral resource estimate for La Preciosa with an effective date of October 27, 2021, prepared for the Company, and references to Measured, Indicated, Inferred Resources referred to in this press release. These forward-looking statements are made as of the date of this news release and the dates of technical reports, as applicable. Readers are cautioned not to place undue reliance on forward-looking statements, as there can be no assurance that the future circumstances, outcomes or results anticipated in or implied by such forward-looking statements will occur or that plans, intentions or expectations upon which the forward-looking statements are based will occur. While we have based these forward-looking statements on our expectations about future events as at the date that such statements were prepared, the statements are not a guarantee that such future events will occur and are subject to risks, uncertainties, assumptions and other factors which could cause events or outcomes to differ materially from those expressed or implied by such forward-looking statements. Such factors and assumptions include, among others, the effects of general economic conditions, the price of gold, silver and copper, changing foreign exchange rates and actions by government authorities, uncertainties associated with legal proceedings and negotiations and misjudgments in the course of preparing forward-looking information. In addition, there are known and unknown risk factors which could cause our actual results, performance or achievements to differ materially from any future results, performance or achievements expressed or implied by the forward-looking statements. Known risk factors include risks associated with project development; the need for additional financing; operational risks associated with mining and mineral processing; the COVID-19 pandemic; volatility in the global financial markets; fluctuations in metal prices; title matters; uncertainties and risks related to carrying on business in foreign countries; environmental liability claims and insurance; reliance on key personnel; the potential for conflicts of interest among certain of our officers, directors or promoters with certain other projects; the absence of dividends; currency fluctuations; competition; dilution; the volatility of the our common share price and volume; tax consequences to U.S. investors; and other risks and uncertainties. Although we have attempted to identify important factors that could cause actual actions, events or results to differ materially from those described in forward-looking statements, there may be other factors that cause actions, events or results not to be as anticipated, estimated or intended. There can be no assurance that forward-looking statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on forward-looking statements. We are under no obligation to update or alter any forward-looking statements except as required under applicable securities laws. For more detailed information regarding the Company including its risk factors, investors are directed to the Company’s Annual Report on Form 20-F and other periodic reports that it files with the U.S. Securities and Exchange Commission.

References to Measured & Indicated Mineral Resources and Inferred Mineral Resources in this press release are terms that are defined under Canadian rules by National Instrument 43-101 (“NI 43-101”). On October 31, 2018, the US Securities and Exchange Commission adopted Item 1300 of Regulation S-K (“Regulation SK-1300”) to modernize the property disclosure requirements for mining registrants, and related guidance, under the Securities Act of 1933 and the Securities Exchange Act of 1934. All registrants are required to comply with Regulation SK-1300 for fiscal years ending after January 1, 2021. Accordingly, the Company must comply with Regulation SK-1300 for its fiscal year ending December 31, 2021, and thereafter, and the Company will no longer utilize Industry Guide 7. Regulation SK-1300 uses the Committee for Mineral Reserves International Reporting Standards (“CRIRSCO”) based classification scheme for mineral resources and mineral reserves, that includes definitions for inferred, indicated, and measured mineral resources. U.S. Investors are cautioned not to assume that any part of the mineral resources in these categories will ever be converted into probable or proven mineral reserves within the meaning of Regulation S-K 1300.

Original Article: https://avino.com/news/2023/avino-vein-extended-a-further-315-metres-drills-248-ageq-g-t-over-16.66-metres-including-371-ageq-g-t-over-8.57-metres/