Record Quarterly Production Generates $9.1 Million in Revenues;

Company Continues to Control Cash Costs

VANCOUVER, BC, Nov. 9, 2022 /CNW/ – Avino Silver & Gold Mines Ltd. (TSX: ASM) (NYSE American: ASM) (FSE: GV6) (“Avino” or “the Company”) released today its consolidated financial results for the Company’s third quarter 2022. The Financial Statements and Management’s Discussion and Analysis (MD&A) can be viewed on the Company’s website at www.avino.com, on SEDAR at www.sedar.com and on EDGAR at www.sec.gov.

“We delivered our strongest quarterly production in recent history and increased our mill throughput by 37% from the previous quarter to over 160,000 tonnes. This reflects our steady ramp up at the Avino mine,” said David Wolfin, President and CEO. “We have demonstrated resilient operational achievements at Avino that have generated $9.1 million in quarterly revenues, $2.1 million in quarterly mine operating income, and another consecutive quarter of positive operational cash flows with $1.6 million generated from operations, even while metal prices declined in third quarter. Thanks to our resilience and strong cost management, and the recent trend upward in metal prices, we remain well-positioned to manage through any near-term pressures arising from an overall economic slowdown, while remaining focused on our clear path to transformational growth and becoming Mexico’s next intermediate producer.”

3rd Quarter 2022 Highlights

Record Quarterly Production at Avino

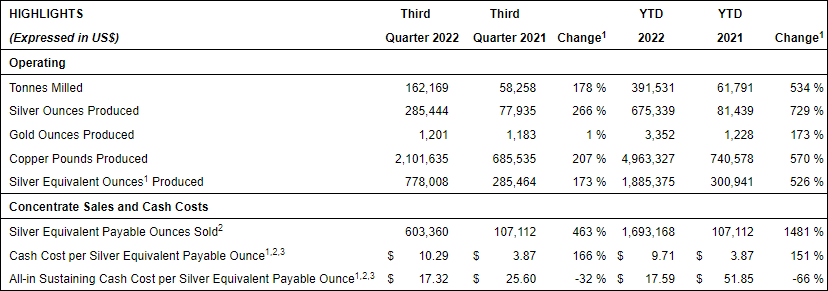

- A record 778,008 silver equivalent ounces were produced in Q3 2022, marking a 20% increase over Q2 2022. Q3 2022 marks the fourth full quarter following the restart of operations in August 2021.

Avino ET Area Drills High Grade Silver and Copper in Multiple Holes

- On October 11, 2022, Avino announced further drill results from the Avino Elena Tolosa (“ET”) area below the current Level 17 mining area. These drill results continue to confirm the downdip continuity of widths and grades of the Avino vein extending significant potential to a depth of at least 290 metres down dip below the deepest levels of development. The results confirm the mineralization continues and also contains significantly higher copper mineralization in the ET area.

Commissioning of Dry-Stack Tailings Facility

- During Q3 2022, the Company completed construction of the dry-stack tailings facility and is currently processing 100% of its tailings through the facility.

Working Capital & Liquidity at September 30, 2022

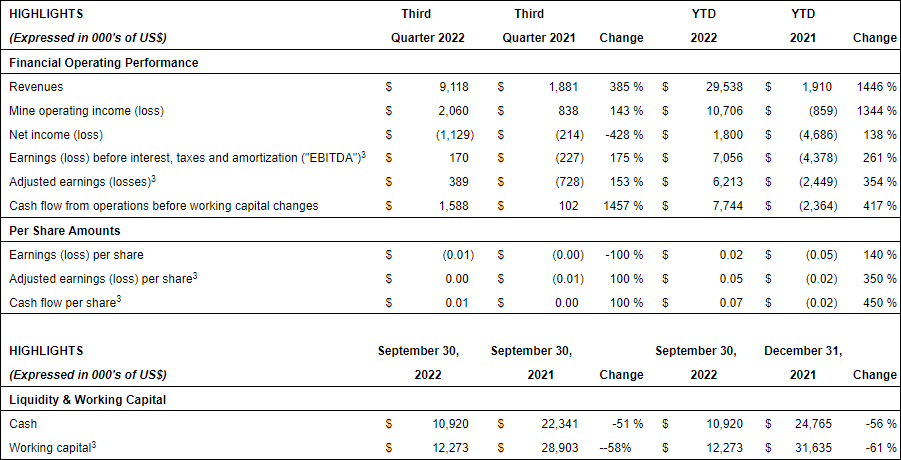

- The Company’s cash balance at September 30, 2022, totaled $10.9 million compared to $24.8 million at December 31, 2021 and $22.3 million at September 30, 2021. Working capital totaled $12.3 million at September 30, 2022, compared to $31.6 million at December 31, 2021 and $28.9 million at September 30, 2021.

Third Quarter 2022 Financial Highlights

- Revenues of $9.1 million

- Mine operating income of $2.1 million, $2.6 million net of non-cash depreciation and depletion

- Net loss of $1.1 million, or $0.01 per share

- Cash costs per silver equivalent payable ounce sold1,2 – $10.29 per ounce

- All in sustaining cash cost per silver equivalent payable ounce sold1,2 – $17.32 per ounce

- Earnings before interest, taxes, depreciation and amortization (“EBITDA”)3 of $0.2 million

- Adjusted earnings3 of $0.4 million, or $0.003 per share

- Operating cash flows (before working capital changes) of $1.6 million, or $0.01 per share3

Operating Highlights and Overview

During Q3 2022, underground mining operations continued to ramp up with consolidated production for the quarter of 778,008 silver equivalent ounces consisting of 285,444 ounces of silver, 1,201 ounces of gold, and 2,101,635 pounds of copper.

Capital Expenditure Update

Third quarter cash capital expenditures company-wide were $2.7 million, bringing the year-to-date total to $6.1 million, compared to $2.1 million during the nine month period in 2021. Expenditures for Q3 2022 primarily relate to dry-stack tailings plant commissioning, as well as the conveyor projects and underground works performed in the production area of the Avino Mine.

The Company expects to be within its range of $7.0 to $9.0 million in capital expenditures for the year, which was previously disclosed in the Avino 2022 Outlook press release which can be found here on the Company’s website.

Exploration Update – 2022 Drill Program

On October 11, 2022, Avino announced further drill results from the Avino Elena Tolosa (“ET”) area below the current Level 17 mining area. These drill results continue to confirm the downdip continuity of widths and grades of the Avino vein extending significant potential to a depth of at least 290 metres down dip below the deepest levels of development.. Avino is advancing geological modelling to determine the potential geometry and controls of the mineralization. Currently, three drills are turning to include a further 14 drill holes for 7,000 metres. For full news release, visit our website here.

At the end of Q3 2022, the Company has completed 11,253 metres of drilling in 2022. The Company has budgeted 15,000 metres of drilling in 2022, with a focus on the area at depth below the current Elena Tolosa production area.

ESG Initiatives

Avino continues to create value for all stakeholders and supports the communities that host the Avino mine, with the new dry-stack tailings project, the acquisition of La Preciosa, the continued replacement of mineral resources, and the strengthening of local partnerships as part of our long-term commitment to the country. In line with Avino’s policy of local employment, Mexican nationals account for 100% of the mine work force. In addition, Avino is actively increasing its workforce diversification by hiring more women for historically male-dominated roles through targeted recruitment and development programs. Currently at site, 10 – 15% of our labor force is female.

We continue to invest in sustainable economic community projects such as water irrigation work, a reforestation campaign of native species, by providing school supplies and by hosting its first event for employees to bring their children to work to learn about the mine operations and jobs, to name only a few of the initiatives currently ongoing.

Qualified Person(s)

Peter Latta, P.Eng, MBA, VP Technical Services, Avino who is a qualified person within the context of National Instrument 43-101 has reviewed and approved the technical data in this news release.

Non-IFRS Measures

The financial results in this news release include references to cash flow per share, cash cost per silver equivalent ounce, all-in sustaining cash cost per silver equivalent ounce, EBITDA, and adjusted earnings/losses, all of which are non-IFRS measures. These measures are used by the Company to manage and evaluate operating performance of the Company’s mining operations, and are widely reported in the silver and gold mining industry as benchmarks for performance, but do not have standardized meanings prescribed by IFRS, and are disclosed in addition to the prescribed IFRS measures provided in the Company’s MD&A.

Conference Call and Webcast

In addition, the Company will be holding a conference call and webcast on Thursday, November 10, 2022, at 9:30 am PST (12:30 pm EST). Shareholders, analysts, investors, and media are invited to join the webcast and conference call by logging in here Avino Third Quarter 2022 Webcast and Conference Call or by dialing the following numbers five to ten minutes prior to the start time.

Toll Free Canada & USA: 1-800-319-4610

Outside of Canada & USA: 1-604-638-5340

About Avino

Avino is primarily a silver producer from its wholly owned Avino Mine near Durango, Mexico. The Company’s silver, gold and copper production remains unhedged. The Company’s mission and strategy is to create shareholder value through its focus on profitable organic growth at the historic Avino Property and the strategic acquisition of the La Preciosa property. Avino currently controls mineral resources, as per NI 43-101, that total 290 million silver equivalent ounces, within our district scaled land package. We are committed to managing all business activities in a safe, environmentally responsible, and cost-effective manner, while contributing to the well-being of the communities in which we operate. We encourage you to connect with us on Twitter at @Avino_ASM and on LinkedIn at Avino Silver & Gold Mines. To view the Avino Mine VRIFY tour, please click here.

ON BEHALF OF THE BOARD

“David Wolfin”

________________________________

David Wolfin

President & CEO

Avino Silver & Gold Mines Ltd.

This news release contains “forward-looking information” and “forward-looking statements” (together, the “forward looking statements”) within the meaning of applicable securities laws and the United States Private Securities Litigation Reform Act of 1995, including the amended mineral resource estimate for the Company’s Avino Property located near Durango in west-central Mexico (the “Avino Property”) with an effective date of January 13, 2021, and as amended on December 21, 2021, and the Company’s updated mineral resource estimate for La Preciosa with an effective date of October 27, 2021, prepared for the Company, and references to Measured, Indicated, Inferred Resources referred to in this press release.. These forward-looking statements are made as of the date of this news release and the dates of technical reports, as applicable. Readers are cautioned not to place undue reliance on forward-looking statements, as there can be no assurance that the future circumstances, outcomes or results anticipated in or implied by such forward-looking statements will occur or that plans, intentions or expectations upon which the forward-looking statements are based will occur. While we have based these forward-looking statements on our expectations about future events as at the date that such statements were prepared, the statements are not a guarantee that such future events will occur and are subject to risks, uncertainties, assumptions and other factors which could cause events or outcomes to differ materially from those expressed or implied by such forward-looking statements. Such factors and assumptions include, among others, the effects of general economic conditions, the price of gold, silver and copper, changing foreign exchange rates and actions by government authorities, uncertainties associated with legal proceedings and negotiations and misjudgments in the course of preparing forward-looking information. In addition, there are known and unknown risk factors which could cause our actual results, performance or achievements to differ materially from any future results, performance or achievements expressed or implied by the forward-looking statements. Known risk factors include risks associated with project development; the need for additional financing; operational risks associated with mining and mineral processing; the COVID-19 pandemic; volatility in the global financial markets; fluctuations in metal prices; title matters; uncertainties and risks related to carrying on business in foreign countries; environmental liability claims and insurance; reliance on key personnel; the potential for conflicts of interest among certain of our officers, directors or promoters with certain other projects; the absence of dividends; currency fluctuations; competition; dilution; the volatility of the our common share price and volume; tax consequences to U.S. investors; and other risks and uncertainties. Although we have attempted to identify important factors that could cause actual actions, events or results to differ materially from those described in forward-looking statements, there may be other factors that cause actions, events or results not to be as anticipated, estimated or intended. There can be no assurance that forward-looking statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on forward-looking statements. We are under no obligation to update or alter any forward-looking statements except as required under applicable securities laws. For more detailed information regarding the Company including its risk factors, investors are directed to the Company’s Annual Report on Form 20-F and other periodic reports that its files with the U.S. Securities and Exchange Commission.

Neither the TSX nor its Regulation Services Provider (as that term is defined in the policies of the TSX) accepts responsibility for the adequacy or accuracy of this release.

Cautionary Note Regarding Non-GAAP Measures

This news release includes certain terms or performance measures commonly used in the mining industry that are not defined under International Financial Reporting Standards (“IFRS”). Non-GAAP measures do not have any standardized meaning prescribed under IFRS and, therefore, they may not be comparable to similar measures reported by other companies. We believe that, in addition to conventional measures prepared in accordance with IFRS, certain investors use this information to evaluate our performance. The data presented is intended to provide additional information and should not be considered in isolation or as a substitute for measures of performance prepared in accordance with IFRS. Readers should also refer to our management’s discussion and analysis available under our corporate profile at www.sedar.com or on our website at www.avino.com.

Footnotes:

1. In Q3 2022, AgEq was calculated using metals prices of $19.32 oz Ag, $1,734 oz Au and $3.51 lb Cu. In Q3 2021, AgEq was calculated using metals prices of $24.36 oz Ag, $1,789 oz Au and $4.25 lb Cu. For YTD 2022, AgEq was calculated using metal prices of $22.05 oz Ag, $1,856 oz Au, and $4.10 lb Cu. For YTD 2021, AgEq was calculated using metals prices of $24.36 oz Ag, $1,789 oz Au and $4.25 lb Cu.

2. “Silver equivalent payable ounces sold” for the purposes of cash costs and all-in sustaining costs consists of the sum of payable silver ounces, gold ounces and copper tonnes sold, before penalties, treatment charges, and refining charges, multiplied by the ratio of the average spot gold and copper prices to the average spot silver price for the corresponding period.

3. The Company reports non-IFRS measures which include EBITDA, adjusted earnings, adjusted earnings per share, cash flow per share and working capital . These measures are widely used in the mining industry as a benchmark for performance, but do not have a standardized meaning and the calculation methods may differ from methods used by other companies with similar reported measures. See Non-IFRS Measures section for further information.

SOURCE Avino Silver & Gold Mines Ltd.

For further information: T (604) 682 3701, F (604) 682 3600, www.avino.com

Original Article: https://www.newswire.ca/news-releases/avino-reports-q3-2022-financial-results-889302857.html