Magino Project remains on track for first gold pour in the second half of May and commercial production in the third quarter

TORONTO, May 5, 2023 /CNW/ – Argonaut Gold Inc. (TSX: AR) (the “Company”, “Argonaut Gold” or “Argonaut”) today reported financial and operating results for the three months ended March 31, 2023 (the “first quarter”), as well as a development update for its Magino Project. All dollar amounts are expressed in United States dollars, unless otherwise specified (CA$ refers to Canadian dollars).

FIRST QUARTER HIGHLIGHTS

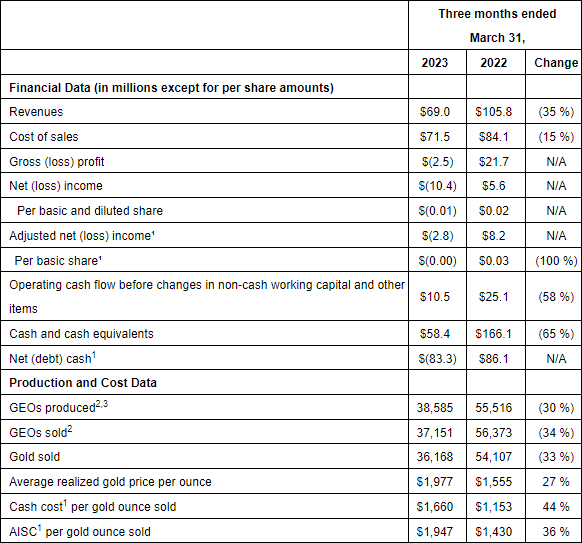

Three months ended March 31, 2023 compared to three months ended March 31, 2022

- Consolidated production of 38,585 gold equivalent ounces (“GEOs”)1, was 30% lower compared to 55,516 GEOs from the first quarter of 2022, due to lower ore tonnes mined and lower grades placed on the leach pads at the Company’s three Mexican operations as part of the wind down of those operations.

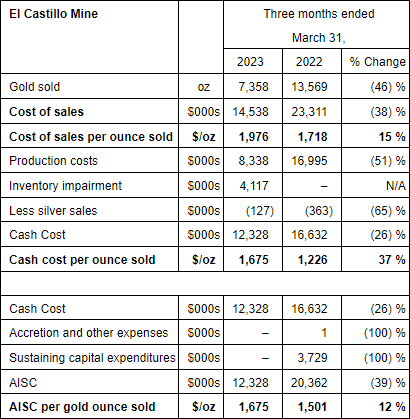

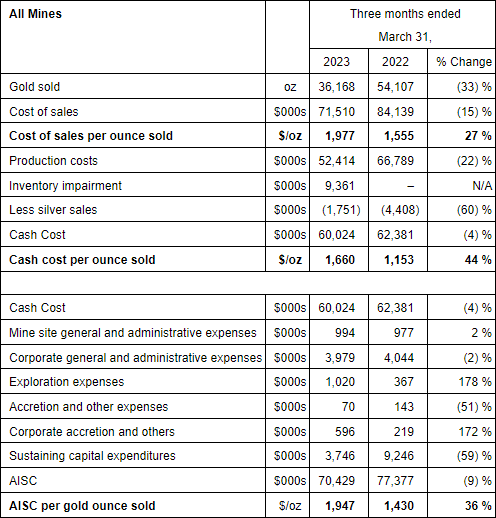

- Cost of sales2 per ounce of $1,977, cash cost2 per ounce of $1,660 and all-in-sustaining costs (“AISC2“) per ounce of $1,947 were between 27% and 44% higher than the prior year period; however, they were largely in line with 2023 full-year guidance. With the planned first gold pour of the Magino mine in the second half of May, cost of sales2, cash cost2, and AISC2 are expected to be in-line with full year 2023 guidance.

- Revenue of $69.0 million was 35% lower than $105.8 million from the first quarter of 2022, due to lower planned production from the Company’s three Mexican mines – El Castillo, La Colorada and San Agustin. El Castillo ceased mining activities in the fourth quarter of 2022 and is now in residual leaching and reclamation.

- Gross loss of $2.5 million was $24.2 million lower than gross profit of $21.7 million from the first quarter of 2022, due to planned lower revenues from lower production, higher costs at the Mexican operations and inventory impairment related to the inability to apply fuel tax credits, net realizable value, and inventory obsolescence write downs.

- Generated cash flow from operating activities before changes in non-cash working capital and other items totaling $10.5 million, a reduction of 58% due to lower gross profit.

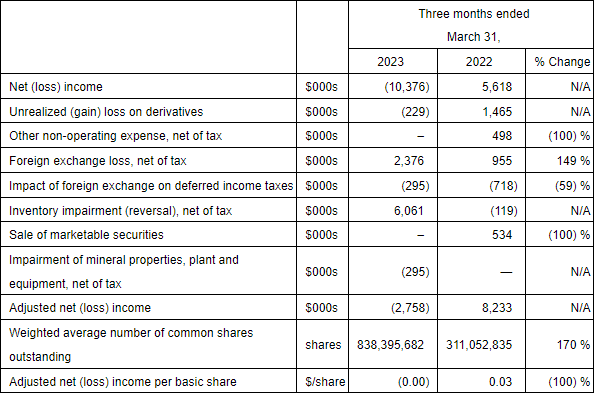

- Net loss of $10.4 million, or $0.01 per basic and diluted share, compared to net income of $5.6 million, or $0.02 per share largely due to lower gross profit.

- Adjusted net loss2 of $2.8 million, or $0.00 per basic share, compared to adjusted net income2 of $8.2 million, or $0.03 per share.

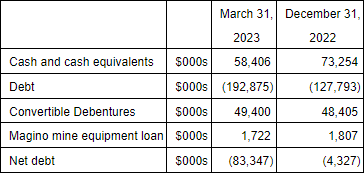

- Cash and cash equivalents of $58.4 million and net debt2 of $83.3 million.

- Undrawn debt capacity of $104.0 million at quarter-end.

- On March 28, 2023, the Company completed the sale of the Ana Paula project for $10 million cash at closing and contingent consideration totaling $20 million subject to achievement of certain milestones.

- Construction of the Company’s largest and lowest cost gold mine, the Magino Project (“Magino”), is on track for first gold pour in the second half of May, with commercial production expected during the third quarter of 2023.

“The year is off to a solid start with our four operating mines tracking well to plan, as well as Magino, our new flagship mine. We believe Magino has the potential to be one of the largest and lowest cost gold mines in Canada. To achieve that goal, we are embarking on a 12-to-15-month drill program, leveraging off of the 2022 drill program that significantly increased our open pit resource base. A portion of the drill program is designed to convert open pit resources to reserves to determine the optimal processing rates for the mine based on an expected larger reserve base. The balance of the program will test the high-grade deep potential as well as the potential west along strike,” said Richard Young, President and Chief Executive Officer.

First Quarter Financial & Operating Highlights

Three months ended March 31, 2023 and 2022

1This is a Non-IFRS Measure; please see “Non-IFRS Measures” section below.

2GEOs are based on a conversion ratio of 80:1 for silver to gold in 2023 and 2022. The silver to gold conversion ratio is based on the three-year trailing average silver to gold ratio.

3Produced ounces are calculated as ounces loaded to carbon.

“Argonaut’s first quarter financial results were in line with plan and reflect the transformation of our production base as we continue winding down our high-cost, low-grade Mexican mines, while preparing for first gold pour at our new flagship Canadian operation. Argonaut is in a solid financial position to complete the construction and ramp up of Magino with a quarter-end cash balance of $58.4 million, $104 million in undrawn debt, and approximately $103 million left to spend on project construction,” stated David Ponczoch, Chief Financial Officer.

Growth Highlights

Magino Project Update

- As at March 31, 2023, the Company had incurred approximately $652 million of the $755 million (CA$980 million) estimate at completion (“EAC”).

- Operational readiness activities continue to advance rapidly with the focus on preparing for first gold pour in the second half of May 2023.

- Workforce buildup continues but sourcing labour remains a challenge.

- Mining operations have commenced and ore is being stockpiled but at a lower rate than planned.

- Magino resources were updated based on exploration drilling in 2022; the deposit now contains 4.6 million ounces of gold in the Measured and Indicated category, with a further 0.9 million ounces contained in the inferred resource category, inclusive of 2.4 million ounces of reserves.3

“Major components critical to commissioning Magino’s mill are coming together as we prepare for first gold pour, which is now expected during the second half of May, which is marginally behind the May 15th target date. The project’s capital costs remain unchanged from our year-end update. The only operational areas behind schedule include our manpower build up and mining rates, however, we have put recovery plans in place, which are putting us back on track,” stated Marc Leduc, Chief Operating Officer.

Consolidated Financial Statements

Argonaut’s consolidated financial statements and related management’s discussion & analysis (“MD&A”) for the three months ended March 31, 2023, are available on Argonaut’s website at www.argonautgold.com and on under the Company’s issuer profile on SEDAR at www.sedar.com.

Conference Call and Webcast

Management will host a live conference call and webcast to discuss first quarter highlights with a question-and-answer session as follows:

| Date & Time: | Friday, May 5, 2023 at 10:00 a.m. ET |

| Telephone: | Toll Free (North America) 1-888-664-6392 |

| International 1-416-764-8659 | |

| Conference ID: | 54944086 |

| Webcast: | app.webinar.net/84L7gx6bdlE |

| Presentation: | Available for download at www.argonautgold.com. |

| Replay Telephone: | Toll Free Replay (North America) 1-888-390-0541 |

| International Replay 1-416-764-8677 | |

| Replay Entry Code: | 944086# |

The conference call and replay will be available from 12:00 p.m. ET on May 5, 2023 until 11:59 p.m. ET on May 12, 2023.

Endnotes

- Based on a silver to gold ratio of 80:1 in 2023 and 2022.

- This is a Non-IFRS Measure; please see “Non-IFRS Measures” section below.

- Consisting of Measured Mineral Resources of 48.8 million tonnes at 0.99 g/t gold for 1.6 million gold ounces, Indicated Mineral Resources of 102.0 million tonnes at 0.92 g/t gold for 3.0 million gold ounces, Inferred Mineral Resources of 31.6 million tonnes at 0.83 g/t gold for 843,000 gold ounces, Proven Mineral Reserves of 26.3 million tonnes at 1.24 g/t gold for 1.0 million gold ounces, and Probable Mineral Reserves at 37.0 million tonnes at 1.11 g/t gold for 1.3 gold ounces.

Non-IFRS Measures

The Company provides certain non-IFRS measures as supplementary information that management believes may be useful to investors to explain the Company’s financial results.

“Cost of sales per ounce sold” and “Cash cost per ounce sold” are common financial performance measures in the gold mining industry but have no standard meaning under IFRS. The Company reports cost of sales and cash cost per ounce on a sales basis. We believe that, in addition to conventional measures prepared in accordance with IFRS, certain investors use this information to evaluate the Company’s performance and ability to generate cash flow. Accordingly, it is intended to provide additional information and should not be considered in isolation or as a substitute for measures of performance prepared in accordance with IFRS. These measures, along with sales, are considered to be key indicators of a Company’s ability to generate operating profits and cash flow from its mining operations.

Cash cost figures are calculated in accordance with a standard developed by The Gold Institute, which was a worldwide association of suppliers of gold and gold products and included leading North American gold producers. The Gold Institute ceased operations in 2002, but the standard is considered the accepted standard of reporting cash cost of production in North America. Adoption of the standard is voluntary and the cost measures presented may not be comparable to other similarly titled measures of other companies.

The World Gold Council (“WGC”) definition of AISC seeks to extend the definition of cash cost by adding corporate, and site general and administrative costs, reclamation and remediation costs (including accretion and amortization), exploration and study costs (capital and expensed), capitalized stripping costs and sustaining capital expenditures and represents the total costs of producing gold from current operations. AISC excludes income tax payments, interest costs, costs related to business acquisitions and items needed to normalize profits. Consequently, this measure is not representative of all of the Company’s cash expenditures. In addition, the calculation of AISC does not include depreciation expense as it does not reflect the impact of expenditures incurred in prior periods. Therefore, it is not indicative of the Company’s overall profitability.

“Adjusted net (loss) income” and “adjusted net (loss) income per basic share” exclude a number of temporary or one-time items, which management believes not to be reflective of the underlying operations of the Company, including the impacts of: unrealized losses (gains) on derivatives, non-operating income, foreign exchange losses (gains), impacts of foreign exchange on deferred income taxes, inventory impairments (reversals), mineral properties, plant and equipment impairments (reversals), and other unusual or non-recurring items. Adjusted net (loss) income per basic share is calculated using the weighted average number of shares outstanding under the basic calculation of earnings per share as determined under IFRS.

“Net (debt) cash” is calculated as the sum of the cash and cash equivalents balance net of debt as at the statement of financial position date. “Net (debt) cash” calculation includes unamortized transaction costs, but excludes Convertible Debentures and equipment loans which are currently included in total debt, in order to show the nominal undiscounted debt. This measure has no standard meaning under IFRS and other companies may calculate this measure differently.

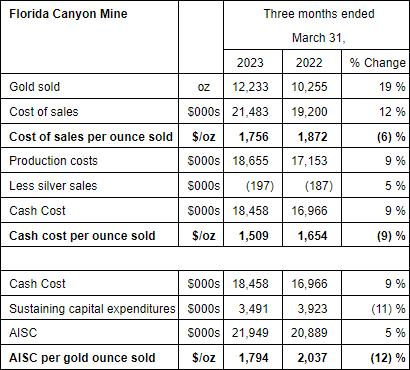

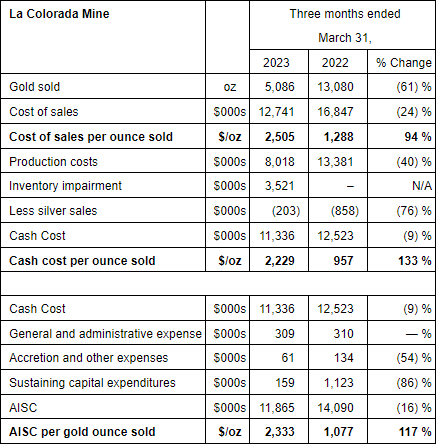

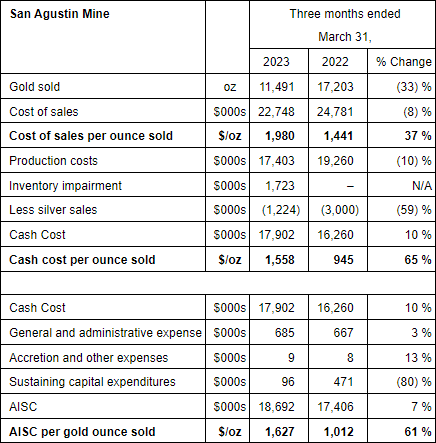

1. The following tables provide reconciliations of production costs per the financial statements to cost of sales per ounce, cash cost per ounce, and AISC per ounce for each mine:

2. Adjusted net (loss) income and adjusted net (loss) income per basic share exclude a number of temporary or one-time items detailed in the following table:

3. A reconciliation of net debt is detailed in the following table:

This press release should be read in conjunction with the Company’s unaudited interim condensed consolidated financial statements for the three months ended March 31, 2023 and associated MD&A for the same period, which are available on the Company’s website at www.argonautgold.com, in the “Investors” section under “Financial Filings”, and under the Company’s issuer profile on SEDAR at www.sedar.com.

Cautionary Note Regarding Forward-Looking Statements

This press release contains certain “forward-looking statements” and “forward-looking information” under applicable Canadian securities laws concerning the business, operations and financial performance and condition of Argonaut Gold. Forward-looking statements and forward-looking information include, but are not limited to statements with respect to: the conditions precedent for draws on the loan facilities and Argonaut’s ability to satisfy the condition precedents; the availability of undrawn debt under the loan facilities; independent engineer technical review; the availability of and changes in terms of financing; the Magino construction capital estimate; the ability to finance additional construction costs, if required, on terms acceptable to Argonaut; risks related to meeting the Magino construction project schedule; the ability of the Magino project to be one of the largest and lowest cost gold mines; the ability of Argonaut Gold to complete the drill program on Magino within 12-to-15 months (if at all); the realization of mineral reserve estimates; timing of first gold pour from the Magino Mine; the timing and amount of estimated future production; the winding down of the Mexican mines; the impact of inflation on costs of exploration, development and production; estimated production and mine life of the various mineral projects of Argonaut; risk of employee and/or contractor strike actions; Argonaut’s ability to build and maintain its workforce; timing of approval for remaining permits or modifications to existing permits; the benefits of the development potential of the properties of Argonaut; the future price of gold, copper, and silver; the estimation of mineral reserves and resources; success of exploration activities; the impact of COVID-19, the response of governments to COVID-19 and other human health concerns and the effectiveness of such responses; and currency exchange rate fluctuations. Except for statements of historical fact relating to Argonaut, certain information contained herein constitutes forward-looking statements. Forward-looking statements are frequently characterized by words such as “plan,” “expect,” “project,” “intend,” “believe,” “anticipate”, “estimate” and other similar words, or statements that certain events or conditions “may”, “should” or “will” occur. Forward-looking statements are based on the opinions and estimates of management at the date the statements are made, and are based on a number of assumptions and subject to a variety of risks and uncertainties and other factors that could cause actual events or results to differ materially from those projected in the forward-looking statements. Many of these assumptions are based on factors and events that are not within the control of Argonaut and there is no assurance they will prove to be correct.

Factors that could cause actual results to vary materially from results anticipated by such forward-looking statements include the availability and changing terms of financing, variations in ore grade or recovery rates, changes in market conditions, changes in inflation, risks relating to the availability and timeliness of permitting and governmental approvals; risks relating to international operations, fluctuating metal prices and currency exchange rates, changes in project parameters, the possibility of project cost overruns or unanticipated costs and expenses, the impact of COVID-19 and other human health concerns and the impact and effectiveness of governmental responses to them, labour disputes and other risks of the mining industry, failure of plant, equipment or processes to operate as anticipated.

These factors are discussed in greater detail in Argonaut’s most recent Annual Information Form dated March 31, 2023 and in the most recent Management’s Discussion and Analysis for the three months ended March 31, 2023, both filed under the Company’s issuer profile on SEDAR, which also provide additional general assumptions in connection with these statements. Argonaut cautions that the foregoing list of important factors is not exhaustive. Investors and others who base themselves on forward-looking statements should carefully consider the above factors as well as the uncertainties they represent and the risk they entail. Argonaut believes that the expectations reflected in those forward-looking statements are reasonable, but no assurance can be given that these expectations will prove to be correct and such forward-looking statements included in this press release should not be unduly relied upon. These statements speak only as of the date of this press release.

Although Argonaut has attempted to identify important factors that could cause actual actions, events or results to differ materially from those described in forward-looking statements, there may be other factors that cause actions, events or results not to be anticipated, estimated or intended. There can be no assurance that forward-looking statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Argonaut undertakes no obligation to update forward-looking statements if circumstances or management’s estimates or opinions should change except as required by applicable securities laws. The reader is cautioned not to place undue reliance on forward- looking statements. Statements concerning mineral reserve and resource estimates may also be deemed to constitute forward-looking statements to the extent they involve estimates of the mineralization that will be encountered if the property is developed. Comparative market information is as of a date prior to the date of this document.

Qualified Persons, Technical Information and Mineral Properties Reports

The technical information contained in this press release has been prepared under the supervision of, and has been reviewed and approved by Mr. Brian Arkell, Argonaut’s Vice President of Exploration and Mine Technical Services and Marc Leduc, Chief Operating Officer; both are Qualified Persons as defined by National Instrument 43-101 – Standards of Disclosure for Mineral Projects (“NI 43-101”). For further information on the Company’s material properties, please see the reports as listed below on the Company’s website www.argonautgold.com or on www.sedar.com:

| Magino Gold Project | Magino Gold Project, Ontario, Canada, NI 43-101 Technical Report, Mineral Resource and Mineral Reserve Update dated March 3, 2022 (effective date of February 14, 2022) |

| Florida Canyon Gold Mine | NI 43-101 Technical Report on Mineral Resource and Mineral Reserve Florida Canyon Gold Mine, Pershing County, Nevada, USA dated July 8, 2020 and with an effective date of June 1, 2020 |

| La Colorada Gold/Silver Mine | La Colorada Gold/Silver Mine, Sonora, Mexico, NI 43-101 Technical Report dated February 14, 2022 (effective date of October 1, 2021) |

| San Agustin Gold/Silver Mine | San Agustin Gold/Silver Mine, Durango, Mexico, NI 43-101 Technical Report dated February 14, 2022 (effective date of August 1, 2021) |

About Argonaut Gold

Argonaut Gold is a Canadian gold company with a portfolio of operations and multi-stage assets in North America. Focused on becoming a low-cost mid-tier gold producer, the Company is in the final stages of construction at its Magino Project, located in Ontario, Canada. Magino is expected to achieve commercial production in the third quarter of 2023 and become Argonaut’s largest and lowest cost mine. The commissioning of Magino will be the first step in transforming the Company as it enters a pivotal growth stage. The Company also has three operating mines including the Florida Canyon mine in Nevada, USA, where it is pursuing additional growth, La Colorada mine in Sonora, Mexico and San Agustin mine in Durango, Mexico. Argonaut Gold trades on the Toronto Stock Exchange (TSX) under the ticker symbol “AR”.

SOURCE Argonaut Gold Inc.

For further information: Joanna Longo, Investor Relations, Phone: 416-575-6965, Email: joanna.longo@argonautgold.com, Argonaut Gold Inc. www.argonautgold.com

Original Article: https://www.newswire.ca/news-releases/argonaut-gold-announces-first-quarter-financial-and-operating-results-provides-project-development-update-824457378.html