TORONTO, ONTARIO – March 9, 2020 – Americas Gold and Silver Corporation (TSX: USA) (NYSE American: USAS) (“Americas” or the “Company”), a growing North American precious metals producer, today reported consolidated financial and operational results for the year ended December 31, 2019 and provided a general update on the operations.

This earnings release should be read in conjunction with the Company’s Management’s Discussion and Analysis, Financial Statements and Notes to Financial Statements for the corresponding period, which have been posted on the Americas Gold and Silver Corporation SEDAR profile at www.sedar.com, on its EDGAR profile at www.sec.gov, and are also available on the Company’s website at www.americas-gold.com. All figures are in U.S. dollars unless otherwise noted.

Year-End and Operational Highlights

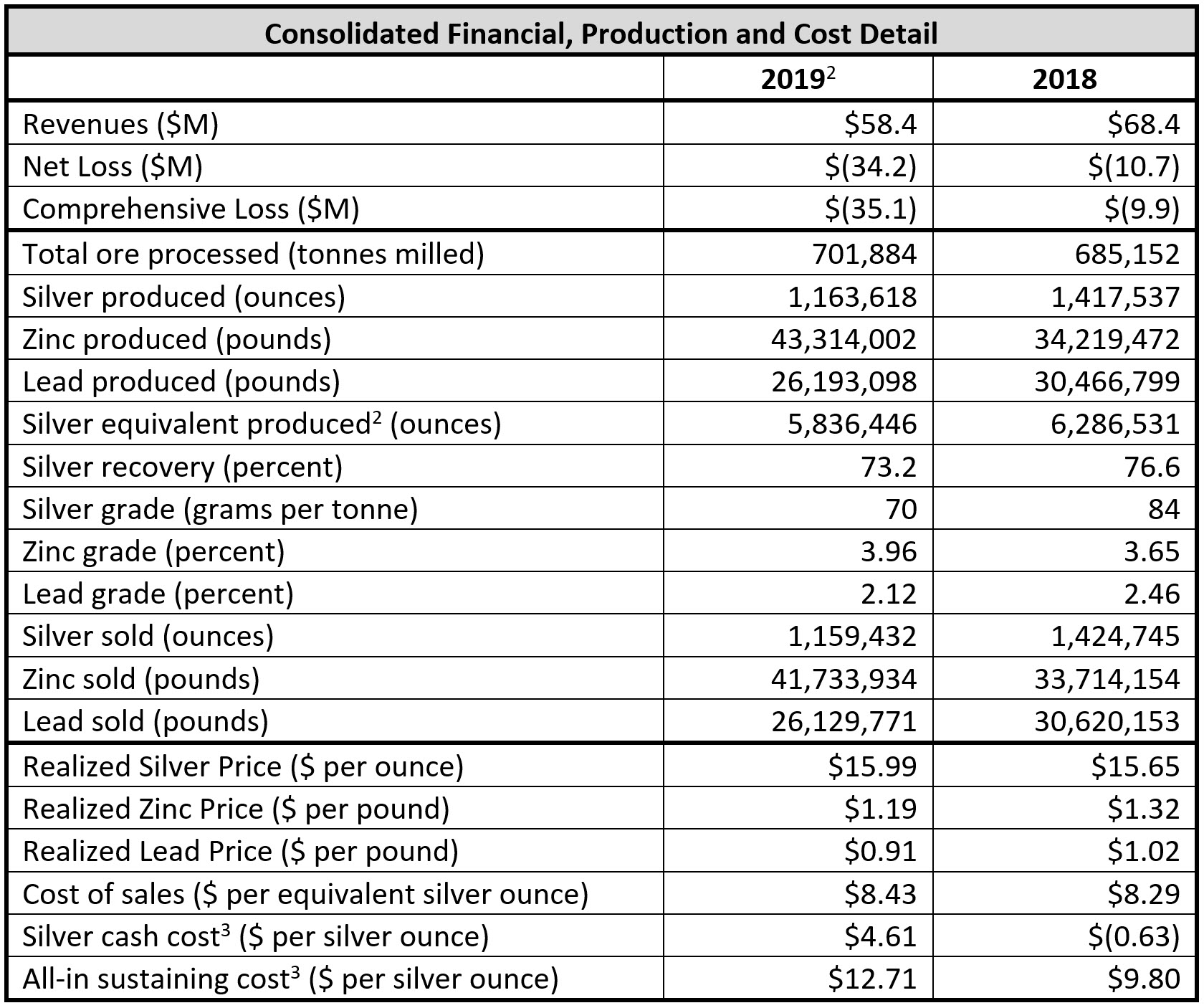

- Revenue of $58.4 million and net loss of $34.2 million for the full-year of 2019 or ($0.46) per share, a decrease of $10.0 million in revenue and an increase in net loss of $23.5 million compared to year-end of 2018. Adjusted net income[1] was $23.3 million prior to one-time adjustments or ($0.30) per share

- Previously reported year-end consolidated production[2] of approximately 5.8 million silver equivalent ounces[3] and 1.2 million silver ounces, representing decreases of 7% and 18% year-over-year to both silver equivalent ounces and silver ounces, respectively. Galena silver production for the fourth quarter was not included as a result of the start of the Recapitalization Plan accounting for the majority of the production decreases year-over-year.

- Previously reported year-end consolidated cash costs[4] of $4.61 per silver ounce and all-in sustaining costs[4] of $12.71 per silver ounce, both representing increases year-over-year.

- Successfully poured first gold in February 2020 at the Company’s Relief Canyon mine in Nevada and completed initial construction estimated to be within the guidance of $28 – $30 million.

- Mined tonnage at Relief Canyon is tracking ahead of schedule and the ore stacking rate is ramping up. To date, the operation has over 250,000 tonnes of ore placed on the leach pad with commercial production expected before the end of Q2-2020.

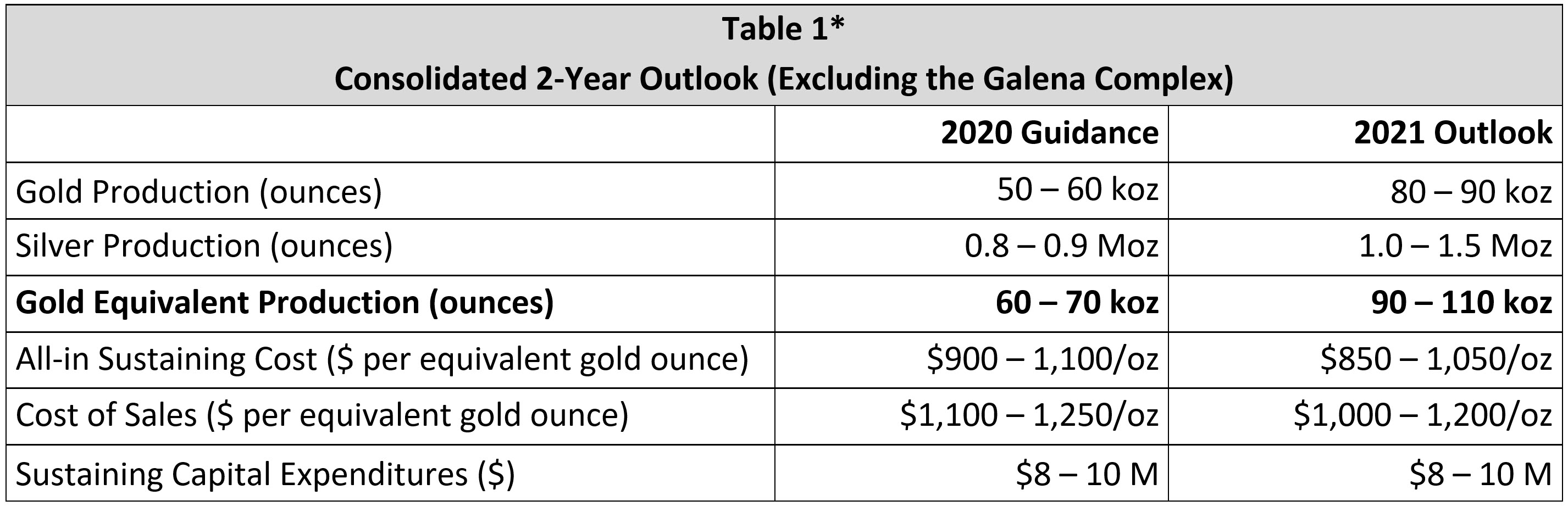

- With the addition of Relief Canyon, precious metals production is expected to increase by over 300% in 2020 to 60,000 – 70,000 Gold Equivalent Ounces[5] (“GEO”) and by over 500% in 2021 to 90,000 – 110,000 GEOs compared to approximately 14,000 GEOs produced in 2019.

- The Company has tremendous support from employees and contractors at the Cosalá Operations following the illegal blockade of the operations. The Company continues to actively engage with all levels of Government regarding the illegal blockade and hopes to resolve the dispute by the end of Q1-2020.

- The Galena Complex Recapitalization Plan began in mid Q4-2019 and continues into 2021. The joint venture has purchased new equipment, refurbished existing equipment and completed extensive re-development in the 4300 and 5500 Levels. Over 10,000 feet of new drilling has been completed with several promising targets being evaluated. The operation has already begun to experience an increase in production rates over 2019.

- The Company had a cash balance of approximately $20.0 million as at December 31, 2019.

“The Company delivered Relief Canyon to first gold pour within nine months from the commencement of construction; an impressive accomplishment for our team in a short period of time,” said Americas President & CEO Darren Blasutti. “Relief Canyon is expected to significantly increase precious metal exposure by 500% by fiscal 2021 and increase the overall profitability of the Company as we deliver full production into a rising gold price environment after successfully acquiring the gold asset when gold was trading at less than $1,200 per ounce in early 2019. The Cosalá Operations successfully executed its production plans for the year increasing mill tonnage to over 1,750 per operating day, and increasing production of precious and by-product metals. The Galena Recapitalization Plan is being executed as planned with the purchase and delivery of essential equipment and drilling commencement. The Company is well positioned for the continued transition to a profitable, high-growth, precious metals producer as Relief Canyon ramps up.”

Consolidated Financial and Operational Results

The Company’s San Rafael mine in Mexico had continued success during fiscal 2019 as mill tonnage increased by 13% and sustained an average milling rate of approximately 1,750 tonnes per operating day during the year. Silver grade and recovery both increased by approximately 6% and 8%, respectively, with base metal grades and recoveries also increasing. These improvements resulted in increases of 28%, 27% and 27% in silver, zinc and lead production when compared to 2018. Despite the Cosalá Operation’s strong performance, consolidated silver equivalent production decreased 7% to approximately 5.8 million ounces compared to production of 6.3 million ounces during 2018. Consolidated silver production for 2019 was approximately 1.2 million silver ounces, a decrease of 18% compared to 2018. The decrease in metal production was due to lower tonnage, and silver and lead grades at the Galena Complex prior to commencement of the Recapitalization Plan in Q4-2019, partially offset by strong results at the Cosalá Operations.

Gross revenue decreased by $1.4 million compared to 2018 primarily due to a decrease in silver equivalent production despite increases in realized silver prices during the year. The silver spot price increased to an average of $16.21 per ounce in 2019 from an average of $15.71 per ounce in 2018 as uncertainty in global markets increased during the year with further increases in precious metal prices generally continuing into fiscal 2020. Net revenues were further negatively impacted by an increase in concentrate treatment and refining charges of $8.5 million or 32% over 2018 for a net total decrease in revenue of $9.9 million.

The Company’s profitability was negatively impacted in fiscal 2019 by: the lower tonnage and grades at the Galena Complex without a corresponding decrease in costs; lower by-product metal prices; higher zinc treatment charges at the Cosalá Operations lowering net revenues; higher cost of sales primarily at the Cosalá Operations due to higher tonnage mined and milled; higher depletion and amortization due to higher production; and higher non-cash items such as share-based payments and loss on derivative instruments. Consolidated cash costs increased during the year primarily due to higher industry-wide zinc concentrate treatment charges, as well as lower production and lower grades at the Galena Complex.

Further information concerning the consolidated and individual mine operations is included in the Company’s year-end Consolidated Financial Statements for the year ended December 31, 2019 and Management’s Discussion and Analysis for the year ended December 31, 2019.

Consolidated 2-Year Production Outlook

* Forecasts for 2020 and 2021 include only Relief Canyon and the Cosalá Operations. 2020 Guidance assumes 11 months of production from the Cosalá Operations. Continuation of the blockade may impact guidance further.

The Company reiterates the forecasted production for the next two years and expects to significantly increase precious metals production with the gold contribution from Relief Canyon. This represents a significant transition from a silver/base metal producer to a predominantly precious metals producer. Precious metal production is expected to increase by over 300% in 2020 and by over 500% in 2021 when compared with production in 2019. For additional detail regarding our production outlook, please refer to the Company’s press release on February 18, 2020.

Relief Canyon

Relief Canyon poured first gold in February and has over 250,000 tonnes of ore placed on the leach pad. Ore crushing and stacking is steadily improving with the addition of the night shift and is now operating on a 24-hour basis. Heap leach permeability and leaching characteristics of the ore are meeting expectations. The operation has a significant ore stockpile of over 200,000 tonnes ahead of the crusher and waste stripping is ahead of schedule. Commercial production continues to be expected before the end of Q2-2020.

Cosalá Operations

The Company continues to have discussions with government authorities at both the state and federals levels. The operation also continues to have tremendous support from its workers, local community, ejidos and small businesses in the Cosalá area which have all been negatively impacted by the illegal blockade. The Company appreciates this support.

The Company will not negotiate with representatives of this illegal blockade and is exploring all legal channels to resolve this dispute in a peaceful and timely fashion.

Galena Complex

The Galena Complex is benefiting from the Recapitalization Plan that commenced in October 2019. Equipment has arrived on site and additional equipment will continue to mobilize over the next couple of months. Productivity has improved to start the year as well as worker morale. Most importantly, there has been a steady improvement in worker safety. There has been extensive repair to the 5500 level and 4300 level drifts which will allow the operation to establish diamond drill stations to test for deep mineralization below the current workings. Finally, shaft repair at the 5500 level is also progressing which will allow the operation to re-establish the deepest loading pocket. This will reduce the need to haul ore and waste by ramp to higher levels of the mine. The Company is confident that the Recapitalization Plan will provide the Galena Complex with the intended benefits of lower costs, higher production and a longer mine life.

Year-End 2019 Conference Call

President & CEO Darren Blasutti will be hosting a year-end 2019 conference call on Monday, March 9th, 2020 at 4:30pm EST. A copy of the presentation will be made available on the company’s website at www.americas-gold.com.

Step 1: Dial-In

Canada and USA Toll-Free: 1-800-750-5861

International Toll Number: 1 416-981-9007

Step 2: Online Login

Callers are advised to dial-in 10-15 minutes prior to the call. As there is no audio on the participant URL, please dial-in to follow along with the presentation.

About Americas Gold and Silver Corporation

Americas Gold and Silver Corporation is a high-growth precious metals mining company with multiple assets in North America. The Company’s newest asset, Relief Canyon in Nevada, USA, has poured first gold and is expected to ramp up to full production over the course of 2020. The Company also owns and operates the Cosalá Operations in Sinaloa, Mexico and manages the 60%-owned Galena Complex in Idaho, USA. The Company also holds an option on the San Felipe development project in Sonora, Mexico. For further information, please see SEDAR or www.americas-gold.com

For more information:

Stefan Axell

VP, Corporate Development & Communications

Americas Gold and Silver Corporation

416-874-1708

Darren Blasutti

President and CEO

Americas Gold and Silver Corporation

416‐848‐9503

Cautionary Statement on Forward-Looking Information:

This news release contains “forward-looking information” within the meaning of applicable securities laws. Forward-looking information includes, but is not limited to, Americas Gold and Silver’s expectations, intentions, plans, assumptions and beliefs with respect to, among other things, estimated production rates and results for gold, silver and other precious metals, as well as the related costs, expenses and capital expenditures, the Company’s construction, production, development plans and performance expectations at the Relief Canyon Mine, including the anticipated timing of commercial production at Relief Canyon, the resolution and removal of the illegal blockade at the Company’s Cosalá Operations and the resumption of mining and processing operations. Often, but not always, forward-looking information can be identified by forward-looking words such as “anticipate”, “believe”, “expect”, “goal”, “plan”, “intend”, “potential’, “estimate”, “may”, “assume” and “will” or similar words suggesting future outcomes, or other expectations, beliefs, plans, objectives, assumptions, intentions, or statements about future events or performance. Forward-looking information is based on the opinions and estimates of Americas Gold and Silver as of the date such information is provided and is subject to known and unknown risks, uncertainties, and other factors that may cause the actual results, level of activity, performance, or achievements of Americas Gold and Silver to be materially different from those expressed or implied by such forward-looking information. With respect to the business of Americas Gold and Silver, these risks and uncertainties include interpretations or reinterpretations of geologic information; unfavorable exploration results; inability to obtain permits required for future exploration, development or production; general economic conditions and conditions affecting the industries in which the Company operates; the uncertainty of regulatory requirements and approvals; fluctuating mineral and commodity prices; the ability to obtain necessary future financing on acceptable terms or at all; the ability to develop, complete construction, bring to production and operate the Relief Canyon Project; and risks associated with the mining industry such as economic factors (including future commodity prices, currency fluctuations and energy prices), ground conditions and other factors limiting mine access, failure of plant, equipment, processes and transportation services to operate as anticipated, environmental risks, government regulation, actual results of current exploration and production activities, possible variations in ore grade or recovery rates, permitting timelines, capital and construction expenditures, reclamation activities, labor relations or disruptions, social and political developments and other risks of the mining industry. Although the Company has attempted to identify important factors that could cause actual results to differ materially from those contained in forward-looking information, there may be other factors that cause results not to be as anticipated, estimated, or intended. Readers are cautioned not to place undue reliance on such information. Additional information regarding the factors that may cause actual results to differ materially from this forward‐looking information is available in Americas filings with the Canadian Securities Administrators on SEDAR and with the SEC. Americas does not undertake any obligation to update publicly or otherwise revise any forward-looking information whether as a result of new information, future events or other such factors which affect this information, except as required by law. Americas does not give any assurance (1) that Americas will achieve its expectations, or (2) concerning the result or timing thereof. All subsequent written and oral forward‐looking information concerning Americas are expressly qualified in their entirety by the cautionary statements above.

Cautionary Note to U.S. Investors:

The terms “proven and probable reserve”, “resource”, “measured resource”, “indicated resource”, and “inferred resource” used in the press release are mining terms used in accordance with Canadian National Instrument 43-101 – Standards of Disclosure for Mineral Projects under the guidelines set out in the Canadian Institute of Mining, Metallurgy and Petroleum Standards. Mineral resources which are not mineral reserves do not have demonstrated economic viability.

While the terms “mineral resource”, “measured mineral resource”, “indicated mineral resource”, and “inferred mineral resource” are recognized and required by Canadian regulations, they are not defined terms under standards in the United States and normally are not permitted to be used in reports and registration statements filed with the Securities & Exchange Commission (“SEC”). Moreover, the definitions of proven and probable reserves used in NI 43-101 differ from the definitions in the United States Securities and Exchange Commission’s Industry Guide 7. As such, information contained in the Company’s disclosure concerning descriptions of mineralization, reserves and resources under Canadian standards may not be comparable to similar information made public by U.S companies in SEC filings. With respect to “inferred mineral resource” there is a great amount of uncertainty as to their existence and a great uncertainty as to their economic and legal feasibility. It cannot be assumed that all or any part of an “inferred mineral resource” will ever be upgraded to a higher category. Investors are cautioned not to assume that any part or all of the mineral deposits in these categories will ever be converted into reserves.

[1] The Company’s profitability was negatively impacted in 2019 by non-reoccurring and non-cash charges, specifically transaction costs associated with the Pershing Gold acquisition ($3.5 million), incremental interest and financing costs related to the convertible loans payable and convertible debenture ($1.2 million), net loss on derivative instruments ($2.5 million), and non-cash share-based payments ($3.7 million). Adjusting for the non-reoccurring and non-cash charges, the net loss would have been approximately $23.3 million. Other variances, such as non-cash items in depletion and amortization ($13.3 million) and increased concentrate treatment charges and related costs ($10.3 million).

[2] Throughout this press release, 2019 production results exclude Q4-2019 from the Galena Complex due to commencement of the Recapitalization Plan.

[3] Silver equivalent production throughout this press release was calculated based on silver, zinc, and lead realized prices during each respective period.

[4] Cash cost per ounce and all-in sustaining cost per ounce are non-IFRS performance measures with no standardized definition. For further information and detailed reconciliations, please refer to the Company’s 2019 year-end and quarterly MD&A.

[5] Gold equivalent production was calculated based on an 80:1 silver to gold ratio

Original Article: https://www.americas-gold.com/news-releases/2020/americas-gold-and-silver-corporation-reports-full-year-2019-financial-results/