Global Mineral Reserves More Than Replaced and Mineral Resources Grow Driven by a 40% Increase in High-Grade Inferred Mineral Resources at Island Gold

Email Print Friendly ShareFebruary 23, 2021 17:00 ET | Source: Alamos Gold Inc.photo-release

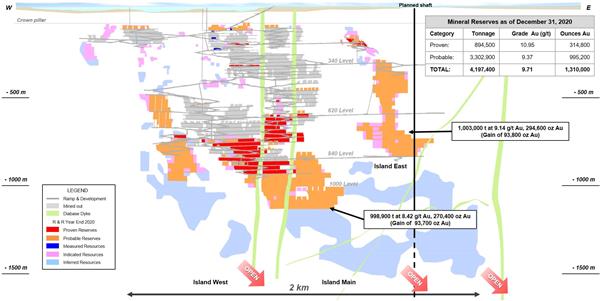

Figure 1: Island Gold Mine Main Zone Longitudinal – 2020 Mineral Reserves

Figure 1: Island Gold Mine Main Zone Longitudinal – 2020 Mineral Reserves

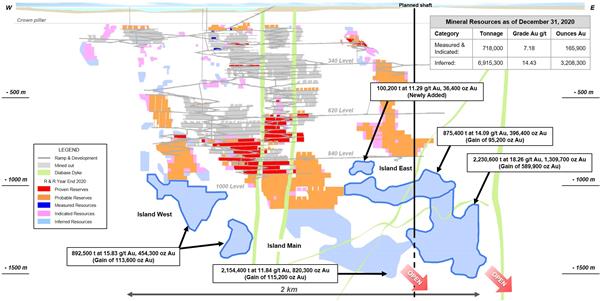

Figure 2: Island Gold Mine Main Zone Longitudinal – 2020 Mineral Resources

Figure 2: Island Gold Mine Main Zone Longitudinal – 2020 Mineral Resources

All amounts are in United States dollars, unless otherwise stated.

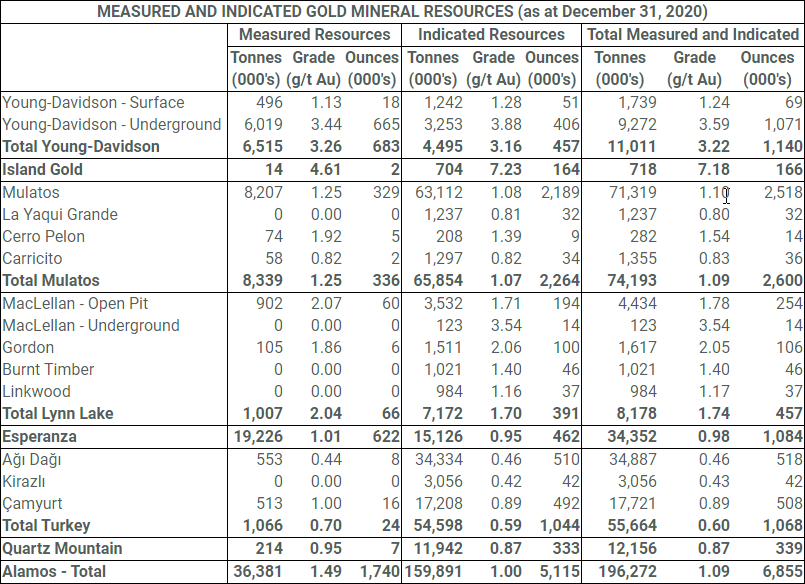

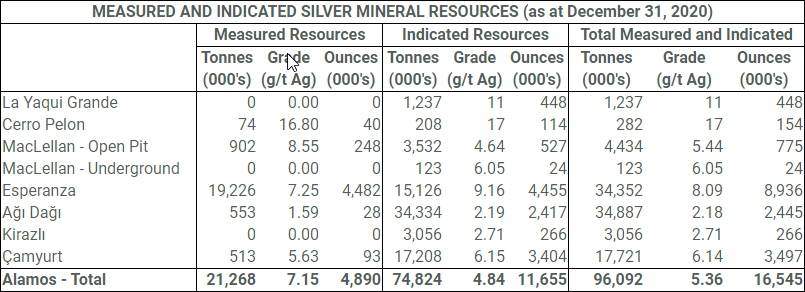

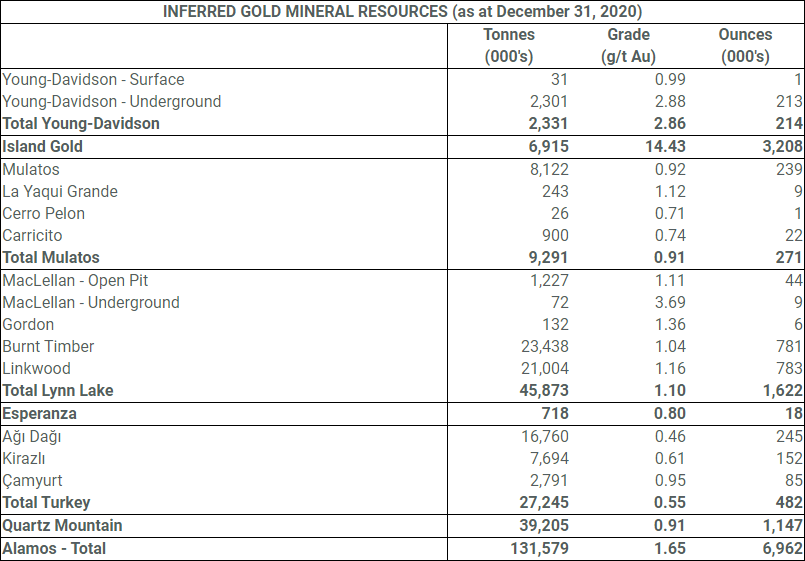

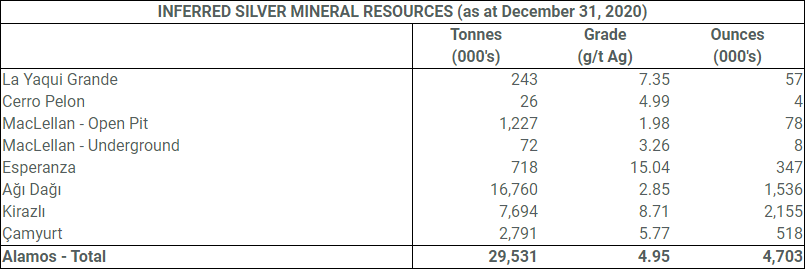

TORONTO, Feb. 23, 2021 (GLOBE NEWSWIRE) — Alamos Gold Inc. (TSX:AGI; NYSE:AGI) (“Alamos” or the “Company”) today reported its updated Mineral Reserves and Resources as of December 31, 2020. For a detailed summary by asset, refer to the tables below.

Highlights

- Island Gold’s Mineral Reserves and Resources increased a combined 1.0 million ounces, net of mining depletion, at a discovery cost of $8 per ounce, including:

° 8% increase in Proven and Probable Mineral Reserves to 1.3 million ounces (4.2 million tonnes (“mt”) grading 9.71 grams per tonne of gold (“g/t Au”)), net of mining depletion

° 40% increase in Inferred Mineral Resources to 3.2 million ounces (6.9 mt grading 14.43 g/t Au) with grades also increasing 9%, reflecting further higher grade additions in Island East

° Combined Mineral Reserves and Resources now total 4.7 million ounces, a 27% increase from the end of 2019 and 155% increase from the 1.8 million ounces at the time of acquisition in 2017, net of 508,000 ounces of mining depletion

° Growth highlights significant upside potential to Phase III Expansion Study, with the 2020 Mineral Reserve and Resource additions expected to increase already attractive economics - Global Proven and Probable Mineral Reserves of 9.9 million ounces of gold (204 mt grading 1.50 g/t Au), up from 9.7 million ounces at the end of 2019 with increases at Island Gold, Young-Davidson and Lynn Lake more than offsetting 555,000 ounces of mining depletion

- Global Measured and Indicated Mineral Resources of 6.9 million ounces of gold (196 mt grading 1.09 g/t Au), down 3% reflecting the conversion to Mineral Reserves at Young-Davidson and Lynn Lake

- Global Inferred Mineral Resources increased 16% to 7.0 million ounces of gold (132 mt grading 1.65 g/t Au), with grades also increasing 15% driven by significantly higher grade additions at Island Gold which totalled 910,000 ounces grading 18.59 g/t Au

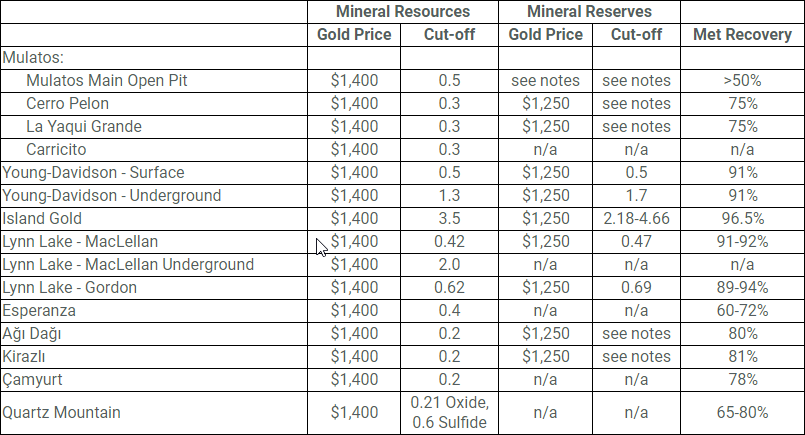

- Gold price assumptions unchanged from 2019 with $1,250 per ounce used for estimating Mineral Reserves and $1,400 per ounce used for estimating Mineral Resources

- Global exploration budget of $50 million in 2021, double the $25 million spent in 2020. Island Gold remains the primary focus with a $25 million budget, followed by $9 million budgeted at Mulatos and $7 million at each of Young-Davidson and Lynn Lake

“We had an excellent 2020 on the exploration front despite a smaller than planned program due to COVID-19. We more than replaced Global Mineral Reserves and added another million ounces of high-grade Mineral Reserves and Resources at Island Gold,” said John A. McCluskey, President and Chief Executive Officer.

“Island Gold is now approaching five million ounces of combined Mineral Reserves and Resources with excellent potential for this growth to continue with the deposit open laterally and at depth. This growth further increases the value of the operation beyond what was outlined in the Phase III Expansion Study this past year and reaffirms the decision to put in a shaft,” Mr. McCluskey added.

Mineral Reserves

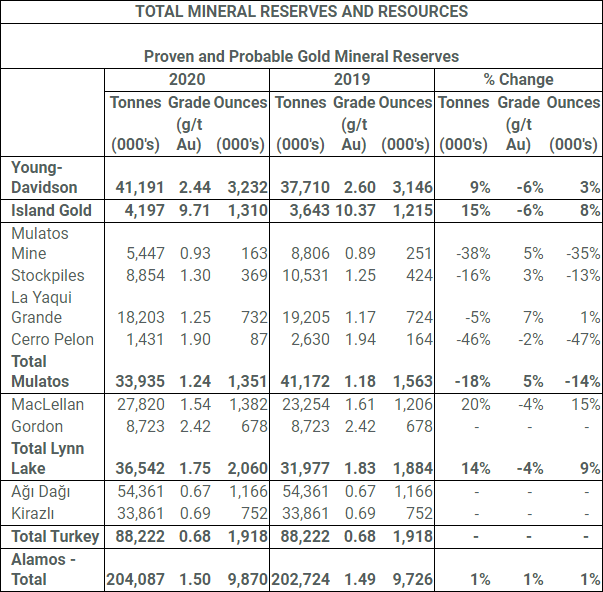

Global Proven and Probable Mineral Reserves total 9.9 million ounces of gold as of December 31, 2020, a slight increase from 9.7 million ounces at the end of 2019. This reflected increases at Island Gold, Young-Davidson, and Lynn Lake which more than offset mining depletion of 555,000 ounces in 2020.

Island Gold

Island Gold was once again the largest driver of global Mineral Reserve and Resource growth in 2020. Despite a smaller than planned drill program due to COVID-19, Island Gold more than replaced Mineral Reserves and delivered its largest annual increase in Inferred Mineral Resources to date and at significantly higher grades. Mineral Reserves increased 8% in 2020 to 1.3 million ounces, despite the primary focus in 2020 being on Mineral Resource growth. The increase in Mineral Reserves included the addition of 239,000 ounces which more than offset mining depletion of 144,000 ounces. Mineral Reserve grades decreased slightly to 9.71 g/t Au due to higher grades mined in 2020 (11.18 g/t Au) as well as a reduction in the cut-off grade reflecting lower expected costs following the completion of the Phase III Expansion in 2025. Since the acquisition of Island Gold in November 2017, Mineral Reserves have increased 74%, net of depletion, with Mineral Reserve grades increasing 6%.

Young-Davidson

Young-Davidson more than replaced mining depletion in 2020 with Mineral Reserves increasing 3% to 3.2 million ounces. The increase in Mineral Reserves, at slightly lower grades of 2.44 g/t Au, was driven by a decrease in the cut-off grade in 2020, which incorporated lower operating costs with the transition to the new lower mine infrastructure. There has not been significant exploration drilling completed at Young-Davidson since 2011. A small underground exploration program was initiated in 2020 and was successful in intersecting gold mineralization below the existing Mineral Reserves and Resources. With the deposit open at depth and improved underground access now available in the lower mine, exploration activities will be expanded in 2021 with a $7 million program planned.

Mulatos

Mineral Reserves at Mulatos decreased 212,000 ounces to 1.4 million ounces reflecting mining depletion. Combined Mineral Reserve grades increased 5% to 1.24 g/t Au primarily due to a 7% increase in grades at La Yaqui Grande to 1.25 g/t Au. Very limited drilling was completed at Mulatos in 2020 due to COVID-19 with exploration activities suspended during the second quarter and not resuming until the fourth quarter. Exploration activities are expected to ramp up in 2021 with a larger $9 million budget.

Lynn Lake

Mineral Reserves at Lynn Lake increased 9% to 2.1 million ounces at slightly lower grades of 1.75 g/t Au. The increase in Mineral Reserves reflects exploration success within and adjacent to the MacLellan deposit. A larger $7 million budget is planned for Lynn Lake with the focus on testing additional targets in proximity to the MacLellan and Gordon deposits, recently identified regional targets, and the Burnt Timber and Linkwood deposits which were not included in the 2017 Feasibility Study.

A $1,250 per ounce gold price assumption was used in estimating 2020 Mineral Reserves, unchanged from 2019. A detailed summary of Proven and Probable Mineral Reserves as of December 31, 2020 is presented in Table 1 at the end of this press release.

Mineral Resources

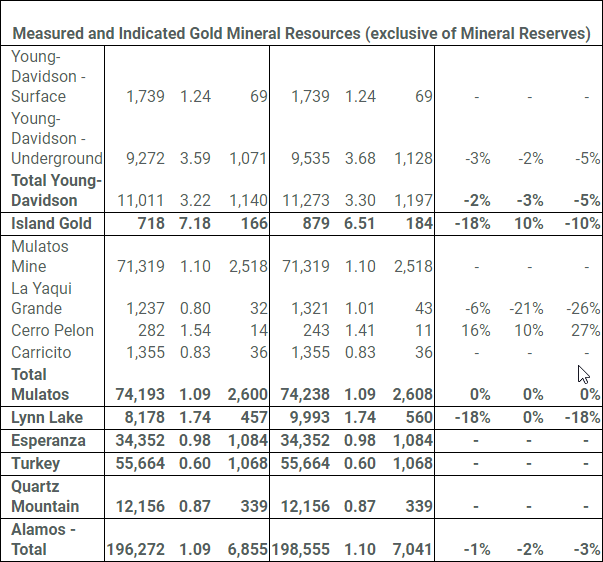

Global Measured and Indicated Mineral Resources (exclusive of Mineral Reserves) totaled 6.9 million ounces as of December 31, 2020. This is down 186,000 ounces, or 3%, from 2019 reflecting the conversion of Mineral Resources to Mineral Reserves at Lynn Lake, Young-Davidson and Island Gold.

Global Inferred Mineral Resources totaled 7.0 million ounces as of December 31, 2020 a 16% increase from 2019. Grades also increased 15% with both increases driven by the addition of 910,000 ounces at Island Gold at significantly higher grades.

The Company’s $1,400 per ounce gold price assumption for estimating Mineral Resources is unchanged from 2019. Detailed summaries of the Company’s Measured and Indicated Mineral Resources and Inferred Mineral Resources as of December 31, 2020 are presented in Tables 3 and 4, respectively, at the end of this press release.

Island Gold

Island Gold’s Mineral Reserves increased to 1.3 million ounces, an 8% increase from the end of 2019, net of mining depletion. Mineral Reserve grades decreased 6% to 9.71 g/t Au from the end of 2019 reflecting the above noted higher grades mined during 2020 and decrease in cut-off grade through the incorporation of lower costs following the completion of the Phase III Expansion. The increases in Mineral Reserves were located within Island Main and the upper portion of Island East where the advancement of exploration drifts in these areas over the past year improved access for drilling from underground. (See Figure 1 at the end of this press release.)

Measured and Indicated Mineral Resources decreased 10% to 166,000 ounces while grades increased 10% to 7.18 g/t Au from the end of 2019. The decrease reflects the conversion to Mineral Reserves in Island Main and East.

Inferred Mineral Resources increased 40% to 3.2 million ounces with grades increasing a further 9% to 14.43 g/t Au compared to the end of 2019. The average grade of the 910,000 ounce increase was 18.59 g/t Au with the majority of these higher-grade additions coming from Island East in proximity to the planned shaft location. This represents the largest annual increase in Inferred Mineral Resources to date and follows another substantial increase in 2019. Over the past two years, Inferred Mineral Resources have more than doubled with grades increasing 23%. Highlights of the 2020 increase in Inferred Mineral Resources include:

- 95,200 ounces added in the middle portion of Island East, closing what was previously a 300 metre (“m”) gap between high-grade Mineral Resources in Island Main and East between depths of 850 m and 1,100 m. This area had not seen any drilling prior to 2019. It has since grown to include 396,400 ounces grading 14.09 g/t Au and remains open both up- and down-plunge (see Figure 2)

- 589,900 ounces were added in the lower portion of Island East, significantly increasing Inferred Mineral Resources in this area to 1.3 million ounces grading 18.26 g/t Au. This included connecting the gap between it and Mineral Resources in the middle portion of Island East. High-grade Inferred Mineral Resources were also added down plunge where drilling in the second half of 2020 returned some of the best surface exploration holes to date. This large east plunging high-grade ore shoot is located in proximity to the planned shaft location and remains open laterally, and up- and down-plunge

- 113,600 ounces were also added in Island West through limited drilling with much of the 2020 focus on Island East

- Inferred Mineral Resources at Island Gold continue to convert to Mineral Reserves at a rate of more than 83% since the 2017 acquisition. These additions are all part of the same structure with consistent style of mineralization as existing Mineral Reserves. As such the Company expects this high rate of conversion to continue as exploration drifts are advanced into these areas allowing for additional drilling from underground

- Discovery costs averaged an attractive $8 per ounce in 2020 and have averaged $11 per ounce over the past three years

A total of $25 million is budgeted for exploration at Island Gold in 2021, up from $13 million spent in 2020. The focus remains on continuing to define new near mine Mineral Resources across the two-kilometre long Island Gold Main Zone which remains open laterally and down-plunge. Additionally, a significantly larger regional exploration program is planned which includes 25,000 m of drilling with the objective of evaluating and advancing targets within the recently expanded 15,000 hectare land package.

As outlined in the Phase III Expansion Study in July 2020, Island Gold has a 16-year mine life based on Mineral Reserves and Resources as of the end of 2019. The increase in Mineral Reserves and Resources in 2020 represents upside to the Phase III mine plan and is expected to significantly extend the mine life and further increase the value of the operation.

Since the acquisition of Island Gold in 2017,

- Mineral Reserves have increased 1.1 million ounces before mining depletion, or 0.6 million ounces net of mining depletion, with Mineral Reserve grades increasing 6%

- Measured and Indicated Mineral Resources have increased 82% or 75,000 ounces, with grades increasing 21%

- Inferred Mineral Resources have increased 222%, or 2.2 million ounces, with grades increasing 42%

Young-Davidson

Mineral Reserves at Young-Davidson increased 85,000 ounces to 3.2 million ounces of gold with additions of 231,000 ounces more than offsetting depletion of 146,000 ounces. As noted above, the increase in Mineral Reserves at slightly lower grades of 2.44 g/t Au was driven by a decrease in the cut-off grade, reflecting lower costs with the transition to the more productive lower mine infrastructure.

Based on expected underground mining rates of 8,000 tonnes per day, the Mineral Reserve life of the Young-Davidson mine has increased one year to approximately 14 years as of December 31, 2020.

Measured and Indicated Mineral Resources of 1.1 million ounces decreased slightly from a year ago, reflecting the conversion of Mineral Resource to Mineral Reserves. Inferred Mineral Resources increased to 0.2 million ounces with grades increasing to 2.86 g/t Au.

With the completion of the lower mine expansion, an initial exploration drilling program was completed in 2020, yielding encouraging results below the 1,500 m level and in proximity to the new lower mine infrastructure. In addition to defining mineralization within the Young-Davidson syenite, drilling also intersected higher-grade gold mineralization in both the footwall and hanging wall of the syenite. Additional drilling will be required in 2021 to confirm the geometry of these structures and to further evaluate the potential continuity of gold mineralization within the structures.

The planned 2021 underground drilling program will test several target areas in proximity to the existing underground infrastructure with the deposit open at depth and to the west. A total of $7 million is budgeted for 2021, representing the first significant exploration program at Young-Davidson since 2011.

Mulatos

Total Mulatos District Mineral Reserves (including La Yaqui Grande and Cerro Pelon) decreased 212,000 ounces to 1.4 million ounces, reflecting mining depletion. Combined Mineral Reserve grades increased 5% to 1.24 g/t Au, reflecting a 7% increase in grades at La Yaqui Grande to 1.25 g/t Au.

The remaining Mineral Reserve life of the Mulatos District is approximately seven years as of December 31, 2020.

Measured and Indicated Mineral Resources of 2.6 million ounces and Inferred Mineral Resources of 0.3 million ounces at Mulatos are largely unchanged from the end of 2019.

A total of $9 million is budgeted for exploration at Mulatos in 2021 focusing on the Mulatos near-mine area as well as regional targets including Carricito and Halcon.

Lynn Lake

Mineral Reserves at Lynn Lake increased 9%, or 176,000 ounces, to 2.1 million ounces with grades decreasing slightly to 1.75 g/t Au. The additions were driven by exploration success in proximity to the MacLellan deposit, one of two deposits that were included in the 2017 Feasibility Study.

Measured and Indicated Mineral Resources decreased 103,000 ounces to 460,000 ounces, reflecting the conversion to Mineral Reserves with grades unchanged at 1.74 g/t Au. Inferred Mineral Resources were largely unchanged at 1.6 million ounces grading 1.10 g/t Au with the bulk of this residing in the Burnt Timber and Linkwood deposits which were not included in the 2017 Feasibility Study and represent potential upside.

Kirazlı, Ağı Dağı, Çamyurt, Esperanza and Quartz Mountain

Mineral Reserves and Resources for the Kirazlı, Ağı Dağı, Çamyurt, Esperanza and Quartz Mountain projects are unchanged from a year ago.

Qualified Persons

Chris Bostwick, FAusIMM, Alamos Gold’s Vice President, Technical Services, has reviewed and approved the scientific and technical information contained in this news release. Chris Bostwick is a Qualified Person within the meaning of Canadian Securities Administrator’s National Instrument 43-101 (“NI 43-101”). The Qualified Persons for the National Instrument 43-101 compliant Mineral Reserve and Resource estimates are detailed in the following table.

| Resources | ||

| Jeffrey Volk, CPG, FAusIMM | Director – Reserves and Resource, Alamos Gold Inc. | Young-Davidson, Lynn Lake |

| Raynald Vincent, P.Eng., M.G.P. | Chief Geologist – Island Gold | Island Gold |

| Marc Jutras, P.Eng | Principal, Ginto Consulting Inc. | Mulatos Pits, Cerro Pelon, La Yaqui, Carricito, Esperanza, Ağı Dağı, Kirazlı, Çamyurt, Quartz Mountain |

| Reserves | ||

| Chris Bostwick, FAusIMM | VP Technical Services, Alamos Gold Inc. | Young-Davidson, Lynn Lake |

| Nathan Bourgeault, P.Eng | Chief Engineer – Island Gold | Island Gold |

| Herb Welhener, SME-QP | VP, Independent Mining Consultants Inc. | Mulatos Pits, Cerro Pelon, La Yaqui, Ağı Dağı, Kirazlı |

With the exception of Mr. Volk, Mr. Bostwick, Mr. Vincent, and Mr. Bourgeault each of the foregoing individuals are independent of Alamos Gold.

About Alamos

Alamos is a Canadian-based intermediate gold producer with diversified production from three operating mines in North America. This includes the Young-Davidson and Island Gold mines in northern Ontario, Canada and the Mulatos mine in Sonora State, Mexico. Additionally, the Company has a significant portfolio of development stage projects in Canada, Mexico, Turkey, and the United States. Alamos employs more than 1,700 people and is committed to the highest standards of sustainable development. The Company’s shares are traded on the TSX and NYSE under the symbol “AGI”.

FOR FURTHER INFORMATION, PLEASE CONTACT:

| Scott K. Parsons |

| Vice President, Investor Relations |

| (416) 368-9932 x 5439 |

The TSX and NYSE have not reviewed and do not accept responsibility for the adequacy or accuracy of this release.

Cautionary Note regarding Forward-Looking Statements

This news release includes certain statements that constitute forward-looking information within the meaning of applicable Canadian and U.S. securities laws (“forward-looking statements”). All statements other than statements of historical fact, which address events, results, outcomes or developments that Alamos expects to occur are forward-looking statements. Forward-looking statements are generally, but not always, identified by the use of forward-looking terminology such as “continue”, “expect”, “plan”, “estimate”, “target”, “budget” or “potential” or variations of such words and phrases and similar expressions or statements that certain actions, events or results “may”, “could”, “would”, “might” or “will” be taken, occur or be achieved or the negative connotation of such terms. Such statements in this news release include statements with respect to planned exploration programs, costs and expenditures, project economics, changes in mineral resources and conversion of mineral resources to proven and probable reserves, expected mine life and potential extensions thereof, expected increases in the value of operations, and other information that is based on forecasts of future operational or financial results, estimates of amounts not yet determinable and assumptions of management.

Exploration results that include geophysics, sampling, and drill results on wide spacings may not be indicative of the occurrence of a mineral deposit. Such results do not provide assurance that further work will establish sufficient grade, continuity, metallurgical characteristics and economic potential to be classed as a category of Mineral Resource. A Mineral Resource that is classified as “inferred” or “indicated” has a great amount of uncertainty as to its existence and economic and legal feasibility. It cannot be assumed that any or part of an “Indicated Mineral Resource” or “Inferred Mineral Resource” will ever be upgraded to a higher category. Investors are cautioned not to assume that all or any part of mineral deposits in these categories will ever be converted into Proven and Probable Reserves.

Alamos cautions that forward-looking statements are necessarily based upon several factors and assumptions that, while considered reasonable by the Company at the time of making such statements, are inherently subject to significant business, economic, legal, political and competitive uncertainties and contingencies. Known and unknown factors could cause actual results to differ materially from those projected in the forward-looking statements. These factors and assumptions include, but are not limited to: changes to current estimates of mineral reserves and resources; conclusions of economic and geological evaluations; changes in project parameters as plans continue to be refined; changes to production estimates (which assume accuracy of projected ore grade, mining rates, recovery timing and recovery rate estimates and may be impacted by unscheduled maintenance, labour and contractor availability and other operating or technical difficulties); fluctuations in the price of gold; changes in foreign exchange rates (particularly the Canadian dollar, Mexican peso, Turkish Lira and U.S. dollar); the impact of inflation; employee and community relations (including maintaining social license to operate in Turkey); litigation and administrative proceedings; disruptions affecting operations; availability of and increased costs associated with mining inputs and labour; expansion delays with the Phase III Expansion Project at the Island Gold mine; inherent risks associated with mining and mineral processing; the risk that the Company’s mines may not perform as planned; uncertainty with the Company’s ability to secure additional capital to execute its business plans; the speculative nature of mineral exploration and development, the renewal of the Company’s mining concessions in Turkey; timely resumption of construction and development at the Kirazlı project; the risks of obtaining and maintaining necessary licenses, permits and authorizations for the Company’s development and operating assets; labour and contractor availability (and being able to secure the same on favourable terms); contests over title to properties; expropriation or nationalization of property; inherent risks and hazards associated with mining including environmental hazards, industrial accidents, unusual or unexpected formations, pressures and cave-ins; changes in national and local government legislation (including tax and employment legislation), controls or regulations in Canada, Mexico, Turkey, the United States and other jurisdictions in which the Company does or may carry on business in the future; risk of loss due to sabotage, protests and other civil disturbances; the impact of global liquidity and credit availability and the values of assets and liabilities based on projected future cash flows; risks arising from holding derivative instruments; business opportunities that may be pursued by the Company; operations may be exposed to new diseases, epidemics and pandemics, including the effects and potential effects of the global COVID-19 widespread pandemic; the impact of the COVID-19 pandemic on the broader market and the trading price of the Company’s shares; provincial and federal orders or mandates (including with respect to mining operations generally or auxiliary businesses or services required for our operations) in Canada, Mexico, the United States and Turkey; the duration of regulatory responses to the COVID-19 pandemic; and government’s and the Company’s attempts to reduce the spread of COVID-19 which may affect many aspects of the Company’s operations including the ability to transport personnel to and from site, contractor and supply availability and the ability to sell or deliver gold dore bars.

For a more detailed discussion of such risks and other factors that may affect the Company’s ability to achieve the expectations set forth in the forward-looking statements contained in this news release, see the Company’s latest 40-F/Annual Information Form and MD&A, each under the heading “Risk Factors”, available on the SEDAR website at www.sedar.com or on EDGAR at www.sec.gov. The foregoing should be reviewed in conjunction with the information found in this news release.

The Company disclaims any intention or obligation to update or revise any forward-looking statements whether as a result of new information, future events or otherwise, except as required by applicable law.

Note to U.S. Investors – Mineral Reserve and Resource Estimates

All resource and reserve estimates included in this news release or documents referenced in this news release have been prepared in accordance with Canadian National Instrument 43-101 – Standards of Disclosure for Mineral Projects (“NI 43-101”) and the Canadian Institute of Mining, Metallurgy and Petroleum (the “CIM”) – CIM Definition Standards on Mineral Resources and Mineral Reserves, adopted by the CIM Council, as amended (the “CIM Standards”). NI 43-101 is a rule developed by the Canadian Securities Administrators, which established standards for all public disclosure an issuer makes of scientific and technical information concerning mineral projects. The terms “Mineral Reserve”, “Proven Mineral Reserve” and “Probable Mineral Reserve” are Canadian mining terms as defined in accordance with NI 43-101 and the CIM Standards. Investors are cautioned not to assume that all or any part of mineral deposits in these categories will ever be converted into reserves. “Inferred Mineral Resources” have a great amount of uncertainty as to their existence, and great uncertainty as to their economic and legal feasibility. It cannot be assumed that all or any part of an Inferred Mineral Resource will ever be upgraded to a higher category. Under Canadian rules, estimates of Inferred Mineral Resources may not form the basis of feasibility or pre-feasibility studies, except in very limited circumstances. Investors are cautioned not to assume that all or any part of an Inferred Mineral Resource exists or is economically or legally mineable. Disclosure of “contained ounces” in a resource is permitted disclosure under Canadian regulations.

Table 1: Total Proven and Probable Mineral Reserves as of December 31, 2020

Table 2: Project Life-of-Mine Mineral Reserve Waste-to-Ore Ratios

as of December 31, 2020

Table 3: Total Measured and Indicated Mineral Resources as of December 31, 2020

Table 4: Total Inferred Mineral Resources as of December 31, 2020

Notes to Mineral Reserve and Resource Tables:

- The Company’s Mineral Reserves and Mineral Resources as at December 31, 2020 are classified in accordance with the Canadian Institute of Mining Metallurgy and Petroleum’s “CIM Standards on Mineral Resources and Reserves, Definition and Guidelines” as per Canadian Securities Administrator’s NI 43-101 requirements.

- Mineral Resources are not Mineral Reserves and do not have demonstrated economic viability.

- Mineral Resources are exclusive of Mineral Reserves.

- Mineral Reserve cut-off grade for the Mulatos Mine, the Cerro Pelon Pit, the La Yaqui Pit, the Kirazlı Pit and the Ağı Dağı Pit are determined as a net of process value of $0.10 per tonne for each model block.

- All Measured, Indicated and Inferred open pit Mineral Resources are pit constrained with the exception of those outside the Mulatos Main Pits on the Mulatos property which have no economic restrictions and are tabulated by gold cut-off grade.

- With the exception of the Mulatos main open pit, Mineral Reserve estimates assumed a gold price of $1,250 per ounce and Mineral Resource estimates assumed a gold price of $1,400 per ounce. As the Mulatos main open pit has a Mineral Reserve life remaining of less than two years, a gold price of $1,400 was used.

- Metal prices, cut-off grades and metallurgical recoveries are set out in the table below.

Original Article: https://www.globenewswire.com/news-release/2021/02/23/2180961/0/en/Alamos-Gold-Reports-Mineral-Reserves-and-Resources-for-the-Year-Ended-2020.html