TORONTO, Feb. 19, 2019 (GLOBE NEWSWIRE) — Alamos Gold Inc. (TSX:AGI; NYSE:AGI) (“Alamos” or the “Company”) today reported its updated Mineral Reserves and Resources as of December 31, 2018. For a detailed summary of Mineral Reserves and Resources by project, refer to the tables below.

| ||||||||||

Highlights

- Global Proven and Probable Mineral Reserves of 9.7 million ounces of gold, (199 million tonnes (“mt”) grading 1.51 grams per tonne of gold (“g/t Au”)), down slightly from 9.8 million ounces at the end of 2017 with mining depletion largely offset by increases at Island Gold and Lynn Lake

- Island Gold’s Proven and Probable Mineral Reserves increased 14% to 1.0 million ounces of gold, (3.0 mt grading 10.28 g/t Au) net of mining depletion with Mineral Reserve grades also increasing

- Lynn Lake’s Proven and Probable Mineral Reserves increased 16% to 1.9 million ounces of gold, (32.0 mt grading 1.83 g/t Au) with the Mineral Reserve additions being incorporated into an optimized Feasibility Study to be published in the second quarter of 2019

- Global Measured and Indicated Mineral Resources of 7.2 million ounces of gold, (202 mt grading 1.11 g/t Au) down 2% reflecting decreases at Mulatos and El Chanate, partially offset by additions at Island Gold and Lynn Lake

- Global Inferred Mineral Resources increased 13% to 5.4 million ounces of gold, (129 mt grading 1.31 g/t Au) with grades also increasing 12% driven by substantial additions at Island Gold

- Island Gold’s Inferred Mineral Resources increased 73% to 1.6 million ounces of gold, (4.2 mt grading 11.71 g/t Au) with grades increasing 23%

- Global exploration budget of $33 million in 2019, including $19 million at Island Gold focused on defining additional near mine Mineral Resources and $6 million budgeted at each of Mulatos and Lynn Lake

“Since its acquisition in November 2017, the Island Gold mine has outperformed in every regard and validated our views on the quality of the asset. During 2018, we added one million ounces across all mineral reserve and resource categories at Island Gold, before mining depletion. The Island Gold deposit is approaching three million ounces in all categories, production is hitting new records and the operation is generating strong free cash flow, even with our continued aggressive investment in exploration. We look forward to continuing to grow both mineral reserves and resources and production at Island Gold,” said John A. McCluskey, President and Chief Executive Officer.

| TOTAL MINERAL RESERVES AND RESOURCES (as at December 31, 2018) | |||||||||

| Proven and Probable Gold Mineral Reserves | |||||||||

| 2018 | 2017 | % Change | |||||||

| Tonnes | Grade | Ounces | Tonnes | Grade | Ounces | Tonnes | Grade | Ounces | |

| (000’s) | (g/t Au) | (000’s) | (000’s) | (g/t Au) | (000’s) | (000’s) | (g/t Au) | (000’s) | |

| Young-Davidson – Surface | 219 | 0.83 | 6 | 857 | 0.98 | 27 | -74% | -15% | -78% |

| Young-Davidson – Underground | 37,720 | 2.69 | 3,256 | 40,011 | 2.67 | 3,440 | -6% | 0% | -5% |

| Total Young-Davidson | 37,939 | 2.67 | 3,262 | 40,868 | 2.64 | 3,467 | -7% | 1% | -6% |

| Island Gold | 3,047 | 10.28 | 1,007 | 2,703 | 10.20 | 887 | 13% | 1% | 14% |

| Mulatos Mine | 15,443 | 0.87 | 434 | 21,944 | 0.88 | 624 | -30% | -1% | -30% |

| Stockpiles | 10,663 | 1.25 | 429 | 8,855 | 1.30 | 370 | 20% | -4% | 16% |

| La Yaqui | 786 | 0.90 | 23 | 1,444 | 1.39 | 65 | -46% | -35% | -65% |

| La Yaqui Grande | 15,945 | 1.26 | 643 | 14,325 | 1.40 | 644 | 11% | -10% | 0% |

| Cerro Pelon | 3,121 | 1.88 | 189 | 3,253 | 1.63 | 170 | -4% | 16% | 11% |

| Open Pit, Heap Leach | 45,958 | 1.16 | 1,717 | 49,821 | 1.17 | 1,872 | -8% | -1% | -8% |

| Underground | – | – | – | 39 | 12.05 | 15 | -100% | -100% | -100% |

| Total Mulatos | 45,958 | 1.16 | 1,717 | 49,860 | 1.18 | 1,888 | -8% | -1% | -9% |

| El Chanate – Open Pit | – | – | – | 2,700 | 0.63 | 54 | -100% | -100% | -100% |

| El Chanate – Leach Pad Inv. | – | – | – | – | – | 80 | – | – | -100% |

| Total El Chanate | – | – | – | 2,700 | 1.55 | 135 | -100% | -100% | -100% |

| MacLellan | 23,254 | 1.61 | 1,206 | 18,080 | 1.63 | 947 | 29% | -1% | 27% |

| Gordon | 8,723 | 2.42 | 678 | 8,723 | 2.42 | 678 | – | – | – |

| Total Lynn Lake | 31,977 | 1.83 | 1,884 | 26,803 | 1.89 | 1,625 | 19% | -3% | 16% |

| Agi Dagi | 54,361 | 0.67 | 1,166 | 54,361 | 0.67 | 1,166 | – | – | – |

| Kirazli | 26,104 | 0.79 | 665 | 26,104 | 0.79 | 665 | – | – | – |

| Total Turkey | 80,465 | 0.71 | 1,831 | 80,465 | 0.71 | 1,831 | – | – | – |

| Alamos – Total | 199,386 | 1.51 | 9,702 | 203,399 | 1.50 | 9,832 | -2% | 1% | -1% |

| Measured and Indicated Gold Mineral Resources (exclusive of Mineral Reserves) | |||||||||

| Young-Davidson – Surface | 1,739 | 1.24 | 69 | 1,739 | 1.24 | 69 | – | – | – |

| Young-Davidson – Underground | 11,374 | 3.53 | 1,291 | 11,374 | 3.53 | 1,291 | – | – | – |

| Total Young-Davidson | 13,113 | 3.23 | 1,361 | 13,113 | 3.23 | 1,361 | – | – | – |

| Island Gold | 696 | 8.77 | 196 | 591 | 5.86 | 111 | 18% | 50% | 76% |

| Mulatos Mine | 70,944 | 1.11 | 2,521 | 69,467 | 1.10 | 2,461 | 2% | 0% | 2% |

| Underground | – | – | – | 519 | 4.68 | 78 | -100% | -100% | -100% |

| La Yaqui Grande | 1,101 | 0.93 | 33 | 3,045 | 1.11 | 109 | -64% | -16% | -70% |

| Cerro Pelon | 179 | 1.56 | 9 | 572 | 2.56 | 47 | -69% | -39% | -81% |

| Carricito | 1,355 | 0.83 | 36 | 1,355 | 0.83 | 36 | – | – | – |

| Total Mulatos | 73,579 | 1.10 | 2,599 | 74,958 | 1.13 | 2,731 | -2% | -3% | -5% |

| El Chanate | – | – | – | 5,757 | 0.72 | 134 | -100% | -100% | -100% |

| Lynn Lake | 9,993 | 1.74 | 560 | 7,972 | 1.91 | 490 | 25% | -9% | 14% |

| Esperanza | 34,352 | 0.98 | 1,083 | 34,352 | 0.98 | 1,083 | – | – | – |

| Turkey | 58,574 | 0.59 | 1,108 | 58,574 | 0.59 | 1,108 | – | – | – |

| Quartz Mountain | 12,156 | 0.87 | 339 | 12,156 | 0.87 | 339 | – | – | – |

| Alamos – Total | 202,463 | 1.11 | 7,247 | 207,472 | 1.10 | 7,357 | -2% | 1% | -2% |

| Inferred Gold Mineral Resources | |||||||||

| Young-Davidson – Surface | 31 | 0.99 | 1 | 31 | 0.99 | 1 | – | – | – |

| Young-Davidson – Underground | 3,498 | 2.75 | 310 | 3,498 | 2.75 | 310 | – | – | – |

| Total Young-Davidson | 3,528 | 2.74 | 311 | 3,528 | 2.74 | 311 | – | – | – |

| Island Gold | 4,178 | 11.71 | 1,573 | 2,958 | 9.55 | 908 | 41% | 23% | 73% |

| Mulatos Mine | 8,369 | 0.92 | 248 | 8,804 | 0.92 | 261 | -5% | 0% | -5% |

| Underground | – | – | – | 162 | 4.93 | 26 | -100% | -100% | -100% |

| La Yaqui Grande | 229 | 0.90 | 7 | 303 | 0.97 | 9 | -24% | -7% | -22% |

| Cerro Pelon | 70 | 0.70 | 2 | 109 | 1.23 | 4 | -36% | -43% | -50% |

| Carricito | 900 | 0.74 | 22 | 900 | 0.74 | 22 | – | – | – |

| Total Mulatos | 9,568 | 0.91 | 279 | 10,278 | 0.97 | 322 | -7% | -7% | -13% |

| El Chanate | – | – | – | 52 | 0.79 | 1 | -100% | -100% | -100% |

| Lynn Lake | 46,466 | 1.11 | 1,663 | 45,923 | 1.11 | 1,646 | 1% | 0% | 1% |

| Esperanza | 718 | 0.80 | 18 | 718 | 0.80 | 18 | – | – | – |

| Turkey | 25,240 | 0.54 | 438 | 25,240 | 0.54 | 438 | – | – | – |

| Quartz Mountain | 39,205 | 0.91 | 1,147 | 39,205 | 0.91 | 1,147 | – | – | – |

| Alamos – Total | 128,903 | 1.31 | 5,429 | 127,903 | 1.17 | 4,791 | 1% | 12% | 13% |

Mineral Reserves

Global Proven and Probable Mineral Reserves total 9.7 million ounces of gold as of December 31, 2018. This is consistent with 9.8 million ounces at the end of 2017, reflecting additions at Island Gold and Lynn Lake largely replacing mining depletion of 578,000 ounces in 2018.

Island Gold was again the driver of Mineral Reserve and Resource growth across the Company as the deposit continues to grow in size and quality. Despite not being the focus of exploration drilling in 2018, Mineral Reserves increased 14% in 2018 to 1.0 million ounces. This included Mineral Reserve additions of 230,000 ounces, more than offsetting mining depletion of 110,000 ounces. Mineral Reserve grades also increased slightly to 10.28 g/t Au. Since the acquisition of Island Gold in 2017, Mineral Reserves have increased 34%, (net of depletion), while Mineral Reserve grades have increased 12%.

At Lynn Lake, Mineral Reserves increased 16% to 1.9 million ounces driven by exploration success during 2017 and 2018 which was not included in the December 2017 Feasibility Study, as well as an optimization of the pit slopes. The increase in Mineral Reserves, along with other improvements to the project identified through value engineering will be incorporated into an optimized Feasibility Study, expected to be released in the second quarter of 2019.

Minimal exploration drilling was undertaken at Young-Davidson, Mulatos or El Chanate in 2018. Accordingly, production from these assets represents the majority of mining depletion for the year. No exploration drilling was conducted at Young-Davidson given the existing long-life Mineral Reserve base of 13 years and focus on completing the lower mine expansion. The exploration focus at Mulatos was on earlier stage targets and no drilling was undertaken at El Chanate with the operation having transitioned to residual leaching in the fourth quarter of 2018.

A $1,250 per ounce gold price assumption was used in estimating 2018 Mineral Reserves, unchanged from 2017. A detailed summary of Proven and Probable Mineral Reserves as of December 31, 2018 is presented in Table 1 at the end of this press release.

Mineral Resources

Global Measured and Indicated Mineral Resources (exclusive of Mineral Reserves) totaled 7.2 million ounces as of December 31, 2018. This is down 110,000 ounces, or 2%, from 2017 reflecting the write-down of remaining Mineral Resources at El Chanate, partially offset by higher grade additions at Island Gold.

Global Inferred Mineral Resources totaled 5.4 million ounces as of December 31, 2018, a 13% increase from 2017. This was driven by a 665,000 ounce increase at Island Gold.

The Company’s $1,400 per ounce gold price assumption for estimating Mineral Resources is unchanged from 2017. Detailed summaries of the Company’s Measured and Indicated, and Inferred Mineral Resources as of December 31, 2018 are presented in Tables 3 and 4 respectively, at the end of this press release.

Island Gold

The focus of the 2018 exploration program was on expanding the down-plunge and lateral extensions of the Island Gold deposit with the objective of adding near mine Mineral Resources across the Main, Eastern and Western Extensions. The program was highly successful on all fronts, most notably in the Western and Main Extensions.

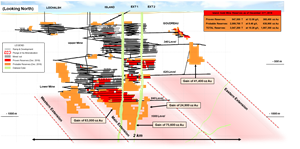

Island Gold’s Mineral Reserves increased to 1.0 million ounces, a 14% increase from the end of 2017 and 5% increase from the June 30, 2018 update, net of mining depletion. This included a 230,000 ounce increase in Mineral Reserves, or 120,000 ounce increase net of mining depletion of 110,000 ounces in 2018. Approximately 70% of the new Mineral Reserves came from gains in the Main C Zone with the bulk of the remainder in the Eastern Extension (see Figure 1 at the end of this press release). Mineral Reserve grades increased slightly to 10.28 g/t Au, from 10.20 g/t Au at the end of 2017.

Since the acquisition of Island Gold in 2017,

- Mineral Reserves have increased 467,000 ounces before mining depletion, or 255,000 ounces net of mining depletion, with Mineral Reserve grades increasing 12%

- Measured and Indicated Mineral Resources have increased 115% or 105,000 ounces, with grades increasing 48%

- Inferred Mineral Resources have increased 58%, or 577,000 ounces, with grades increasing 15%

Based on throughput rates of 1,100 tonnes per day (“tpd”), Island Gold has a current Mineral Reserve life of approximately eight years. Given the significantly larger Mineral Resource base, strong track record of conversion to Mineral Reserves, and ongoing exploration success, the Company expects Island Gold’s mine life will more than double the current Mineral Reserve life.

Measured and Indicated Mineral Resources increased 76% to 196,000 ounces with grades also increasing 50% to 8.77 g/t Au from the end of 2017. The majority of the increase came in the Eastern Extension. This was down slightly from 221,000 ounces in the June 30, 2018 update (see press release dated September 5, 2018) reflecting the conversion to Mineral Reserves.

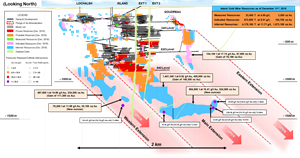

Inferred Mineral Resources increased 73%, or 665,000 ounces, to 1.6 million ounces with grades also increasing 23% to 11.71 g/t Au compared to the end of 2017. This included a 393,000 ounce increase from the June 30, 2018 update based on drilling success in the second half of the year.

In the Main Extension, 673,000 ounces of new Inferred Mineral Resources were identified in different blocks averaging 12.57 g/t Au, down-plunge from existing Mineral Reserves (see Figure 2). Inferred Mineral Resources extend approximately one kilometre from existing mine workings in the Main Extension and this east-plunging high-grade ore shoot remains open both laterally and down-plunge.

In the Western Extension, drilling was successful in connecting and expanding two existing Inferred Mineral Resource blocks, adding 111,000 ounces. A new Mineral Resource block containing 30,000 ounces was also added further down-plunge and in proximity to hole MH16-03 which intersected 152.07 g/t Au (35.74 g/t cut) over 5.00 metres (previously released). This was completed after the year end cut off for inclusion into Mineral Resources and is the best surface directional hole drilled to date in the Western Extension. With this located 50 metres below and outside of this new Mineral Resource block and with high-grade mineralization open both laterally and down-plunge, this area hosts excellent potential for further Mineral Resource growth.

A total of $19 million has been budgeted for exploration at Island Gold in 2019. The focus will remain on continuing to define new near-mine Mineral Resources and extend high-grade mineralization laterally and down-plunge across each of the Western, Main and Eastern Extensions.

Young-Davidson

Mineral Reserves at Young-Davidson decreased 0.2 million ounces to 3.3 million ounces of gold, reflecting mining depletion. With a large existing Mineral Reserve base and the near-term focus on completing the lower mine expansion, exploration has not been a priority over the last several years. Following completion of the lower mine expansion in 2020, the Company expects to recommence exploration activities from underground drilling platforms at depth. With the deposit open at depth and to the west, Young-Davidson has excellent exploration potential.

Measured and Indicated Mineral Resources of 1.4 million ounces and Inferred Mineral Resources of 0.3 million ounces were unchanged from a year ago. The Company expects a strong conversion rate of these Mineral Resources to Mineral Reserves through additional stope definition and infill drilling with further potential to add to the Mineral Resource base.

Young-Davidson also has 0.2 million tonnes of surface stockpiles grading 0.83 g/t Au. These will be used to supplement higher grade underground ore until depleted in the third quarter of 2019. Based on expected underground mining rates, the remaining Mineral Reserve life of the Young-Davidson mine is approximately 13 years as of December 31, 2018.

Mulatos

Total Mulatos District Mineral Reserves (including La Yaqui Grande and Cerro Pelon) decreased 170,000 ounces to 1.7 million ounces grading 1.16 g/t Au with mining depletion partially offset by higher grade additions at Cerro Pelon.

Mineral Reserves at Cerro Pelon increased 11%, to 189,000 ounces, with the Mineral Reserve grade also increasing 16% to 1.88 g/t Au. The increase in ounces and grade was driven by the conversion of higher grade Measured and Indicated Mineral Resources through additional drilling. With a Mineral Reserve grade more than double the Mulatos Mine Mineral Reserve grade of 0.87 g/t Au, Cerro Pelon is expected to be a low capital, low cost, high return project with an after-tax internal rate of return of approximately 70%. Full scale construction of Cerro Pelon is underway with initial production expected in 2020.

Mineral Reserves at La Yaqui Grande were unchanged at 643,000 with the grade decreasing to 1.26 g/t Au. The decrease reflects the conversion of some blocks previously modeled as waste within the pit to ore which has contributed to a significant reduction in the La Yaqui Grande waste-to-ore ratio to 5.6:1, from 7.3:1 at the end of 2017. Similar to Cerro Pelon, La Yaqui Grande’s higher grades (relative to the Mulatos Mine) are expected to support lower cost production than currently from the Mulatos Mine.

The remaining Mineral Reserve life of the Mulatos District is approximately seven years, as of December 31, 2018.

Measured and Indicated Mineral Resources at Mulatos decreased 132,000 ounces to 2.6 million ounces reflecting the conversion of Mineral Resources at Cerro Pelon to Mineral Reserves and declines at San Carlos Underground and La Yaqui Grande, partially offset by gains in the Mulatos Mine. Inferred Mineral Resources were largely unchanged at 0.3 million ounces.

A total of $6 million has been budgeted for exploration at Mulatos in 2019, including 10,000 metres of drilling, with the main areas of focus being the near mine area. A property-wide VTEM geophysical survey completed during the last few weeks of 2018 and ongoing mapping will form the basis for developing regional targets in 2019. Interpretation from the 2018 exploration program at El Carricito and other prospects is ongoing and is expected to produce targets for future drill testing.

Lynn Lake

Mineral Reserves at Lynn Lake increased 16%, or 259,000 ounces, to 1.9 million ounces with grades decreasing slightly to 1.83 g/t Au. The increase reflects exploration success adjacent to the MacLellan pit following the 2017 Feasibility Study, as well as an optimization of the MacLellan pit slopes. This Mineral Reserve growth will be incorporated into an updated Feasibility Study along with other changes identified through value engineering initiatives. The optimized Feasibility Study is expected to be completed in the second quarter of 2019.

Measured and Indicated Mineral Resources also increased 14% to 560,000 ounces reflecting the above noted pit slope optimization. Combined with the Burnt Timber and Linkwood deposits, Lynn Lake also hosts Inferred Mineral Resources totalling 1.6 million ounces, largely unchanged from the end of 2017.

A total of $6 million has been budgeted for exploration at the Lynn Lake project in 2019, including 19,000 m of drilling. The key focus of the 2019 exploration program will be to test exploration targets within and in proximity to the Gordon and MacLellan deposits with the goal of adding to Mineral Resources. An additional area of focus is to establish a pipeline of prospective exploration targets within the 58,000-hectare Lynn Lake Property.

El Chanate

With the end of mining activities in 2018, El Chanate no longer hosts any Mineral Reserves and Resources. The decrease in Mineral Reserves reflects mining depletion and a write-down of the leach pad inventory. El Chanate has transitioned to residual leaching and is expected to produce between 15,000 and 25,000 ounces in 2019.

Kirazl?, A?? Da??, Çamyurt, Esperanza and Quartz Mountain

Mineral Reserves and Resources for the Kirazl?, A?? Da??, Çamyurt, Esperanza and Quartz Mountain projects were unchanged from a year ago.

Qualified Persons

Chris Bostwick, FAusIMM, Alamos Gold’s Vice President, Technical Services, has reviewed and approved the scientific and technical information contained in this news release. Chris Bostwick is a Qualified Person within the meaning of Canadian Securities Administrator’s National Instrument 43-101 (“NI 43-101”). The Qualified Persons for the National Instrument 43-101 compliant Mineral Reserve and Resource estimates are detailed in the following table.

| Resources | ||

| Jeffrey Volk, CPG, FAusIMM | Director – Reserves and Resource, Alamos Gold Inc. | Young-Davidson, Lynn Lake |

| Raynald Vincent, P.Eng., M.G.P. | Chief Geologist – Island Gold | Island Gold |

| Marc Jutras, P.Eng | Principal, Ginto Consulting Inc. | Mulatos Pits, Cerro Pelon, La Yaqui, Carricito, Esperanza, A?? Da??, Kirazl?, Çamyurt, Quartz Mountain |

| Reserves | ||

| Chris Bostwick, FAusIMM | VP Technical Services, Alamos Gold Inc. | Young-Davidson, Lynn Lake |

| Nathan Bourgeault, P.Eng | Chief Engineer – Island Gold | Island Gold |

| Herb Welhener, SME-QP | VP, Independent Mining Consultants Inc. | Mulatos Pits, Cerro Pelon, La Yaqui, A?? Da??, Kirazl? |

With the exception of Mr. Volk, Mr. Bostwick, Mr. Vincent, and Mr. Bourgeault each of the foregoing individuals are independent of Alamos Gold.

About Alamos

Alamos is a Canadian-based intermediate gold producer with diversified production from four operating mines in North America. This includes the Young-Davidson and Island Gold mines in northern Ontario, Canada and the Mulatos and El Chanate mines in Sonora State, Mexico. Additionally, the Company has a significant portfolio of development stage projects in Canada, Mexico, Turkey, and the United States. Alamos employs more than 1,700 people and is committed to the highest standards of sustainable development. The Company’s shares are traded on the TSX and NYSE under the symbol “AGI”.

FOR FURTHER INFORMATION, PLEASE CONTACT:

Scott K. Parsons

Vice President, Investor Relations

(416) 368-9932 x 5439

The TSX and NYSE have not reviewed and do not accept responsibility for the adequacy or accuracy of this release.

All amounts are in United States dollars, unless otherwise stated.

Cautionary Note regarding Forward-Looking Statements

This News Release includes certain “forward-looking statements”. All statements other than statements of historical fact included in this release are forward-looking statements that involve various risks and uncertainties. These forward-looking statements include, but are not limited to, statements with respect to planned exploration programs, costs and expenditures, changes in mineral resources and conversion of mineral resources to proven and probable reserves, and other information that is based on forecasts of future operational or financial results, estimates of amounts not yet determinable and assumptions of management.

These forward-looking statements include, but are not limited to, statements with respect to future exploration potential, project economics, timing and scope of future exploration, anticipated costs and expenditures, changes in mineral resources and conversion of mineral resources to proven and probable reserves, and other information that is based on forecasts of future operational or financial results, estimates of amounts not yet determinable and assumptions of management.

Any statements that express or involve discussions with respect to predictions, expectations, beliefs, plans, projections, objectives, assumptions or future events or performance (often, but not always, using words or phrases such as “expects” or “does not expect”, “is expected”, “anticipates” or “does not anticipate”, “plans”, “estimates” or “intends”, or stating that certain actions, events or results “may”, “could”, “would”, “might” or “will” be taken, occur or be achieved) are not statements of historical fact and may be “forward-looking statements.” Forward-looking statements are subject to a variety of risks and uncertainties that could cause actual events or results to differ from those reflected in the forward-looking statements.

Exploration results that include geophysics, sampling, and drill results on wide spacings may not be indicative of the occurrence of a mineral deposit. Such results do not provide assurance that further work will establish sufficient grade, continuity, metallurgical characteristics and economic potential to be classed as a category of mineral resource. A mineral resource that is classified as “inferred” or “indicated” has a great amount of uncertainty as to its existence and economic and legal feasibility. It cannot be assumed that any or part of an “indicated mineral resource” or “inferred mineral resource” will ever be upgraded to a higher category of resource. Investors are cautioned not to assume that all or any part of mineral deposits in these categories will ever be converted into proven and probable reserves.

There can be no assurance that forward-looking statements will prove to be accurate and actual results and future events could differ materially from those anticipated in such statements. Important factors that could cause actual results to differ materially from Alamos’ expectations include, among others, risks related to international operations, risks related to obtaining the permits required to carry out planned exploration or development work, the actual results of current exploration activities, conclusions of economic evaluations and changes in project parameters as plans continue to be refined as well as future prices of gold and silver, as well as those factors discussed in the section entitled “Risk Factors” in Alamos’ Annual Information Form and other disclosures of “Risk Factors” by Alamos and its predecessors, available on SEDAR and EDGAR. Although Alamos has attempted to identify important factors that could cause actual results to differ materially, there may be other factors that cause results not to be as anticipated, estimated or intended. There can be no assurance that such statements will prove to be accurate as actual results and future events could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on forward-looking statements.

Cautionary Note to U.S. Investors – Mineral Reserve and Resource Estimates

All resource and reserve estimates included in this news release or documents referenced in this news release have been prepared in accordance with Canadian National Instrument 43-101 – Standards of Disclosure for Mineral Projects (“NI 43-101”) and the Canadian Institute of Mining, Metallurgy and Petroleum (the “CIM”) – CIM Definition Standards on Mineral Resources and Mineral Reserves, adopted by the CIM Council, as amended (the “CIM Standards”). NI 43-101 is a rule developed by the Canadian Securities Administrators, which established standards for all public disclosure an issuer makes of scientific and technical information concerning mineral projects. The terms “mineral reserve”, “proven mineral reserve” and “probable mineral reserve” are Canadian mining terms as defined in accordance with NI 43-101 and the CIM Standards. These definitions differ materially from the definitions in SEC Industry Guide 7 (“SEC Industry Guide 7”) under the United States Securities Act of 1933, as amended, and the Exchange Act. Under SEC Industry Guide 7 standards, a “final” or “bankable” feasibility study is required to report reserves, the three-year historical average price is used in any reserve or cash flow analysis to designate reserves and the primary environmental analysis or report must be filed with the appropriate governmental authority.

In addition, the terms “mineral resource”, “measured mineral resource”, “indicated mineral resource” and “inferred mineral resource” are defined in and required to be disclosed by NI 43-101 and the CIM Standards; however, these terms are not defined terms under SEC Industry Guide 7 and are normally not permitted to be used in reports and registration statements filed with the U.S. Securities and Exchange Commission (the “SEC”). Investors are cautioned not to assume that all or any part of mineral deposits in these categories will ever be converted into reserves. “Inferred mineral resources” have a great amount of uncertainty as to their existence, and great uncertainty as to their economic and legal feasibility. It cannot be assumed that all or any part of an inferred mineral resource will ever be upgraded to a higher category. Under Canadian rules, estimates of inferred mineral resources may not form the basis of feasibility or pre-feasibility studies, except in very limited circumstances. Investors are cautioned not to assume that all or any part of an inferred mineral resource exists or is economically or legally mineable. Disclosure of “contained ounces” in a resource is permitted disclosure under Canadian regulations; however, the SEC normally only permits issuers to report mineralization that does not constitute “reserves” by SEC standards as in place tonnage and grade without reference to unit measures.

Table 1: Total Proven and Probable Mineral Reserves as of December 31, 2018

| PROVEN AND PROBABLE MINERAL GOLD RESERVES (as at December 31, 2018) | |||||||||

| Proven Reserves | Probable Reserves | Total Proven and Probable | |||||||

| Tonnes | Grade | Ounces | Tonnes | Grade | Ounces | Tonnes | Grade | Ounces | |

| (000’s) | (g/t Au) | (000’s) | (000’s) | (g/t Au) | (000’s) | (000’s) | (g/t Au) | (000’s) | |

| Young-Davidson – Surface | 219 | 0.83 | 6 | 0 | 0.00 | 0 | 219 | 0.83 | 6 |

| Young-Davidson – Underground | 12,636 | 2.79 | 1,133 | 25,084 | 2.63 | 2,123 | 37,720 | 2.69 | 3,256 |

| Total Young-Davidson | 12,855 | 2.76 | 1,139 | 25,084 | 2.63 | 2,123 | 37,939 | 2.67 | 3,262 |

| Island Gold | 948 | 12.09 | 368 | 2,100 | 9.46 | 639 | 3,047 | 10.28 | 1,007 |

| Mulatos Main Pits | 2,268 | 0.97 | 71 | 13,175 | 0.86 | 363 | 15,443 | 0.87 | 434 |

| Stockpiles | 10,663 | 1.25 | 429 | 0 | 0.00 | 0 | 10,663 | 1.25 | 429 |

| La Yaqui | 215 | 0.99 | 7 | 571 | 0.87 | 16 | 786 | 0.90 | 23 |

| La Yaqui Grande | 0 | 0.00 | 0 | 15,945 | 1.26 | 643 | 15,945 | 1.26 | 643 |

| Cerro Pelon | 998 | 2.02 | 65 | 2,123 | 1.82 | 124 | 3,121 | 1.88 | 189 |

| Total Mulatos | 14,144 | 1.26 | 571 | 31,814 | 1.12 | 1,146 | 45,958 | 1.16 | 1,717 |

| MacLellan | 11,604 | 1.89 | 705 | 11,650 | 1.34 | 500 | 23,254 | 1.61 | 1,206 |

| Gordon | 2,311 | 2.82 | 210 | 6,412 | 2.27 | 468 | 8,723 | 2.42 | 678 |

| Total Lynn Lake | 13,916 | 2.05 | 915 | 18,061 | 1.67 | 968 | 31,977 | 1.83 | 1,884 |

| Agi Dagi | 1,450 | 0.76 | 36 | 52,911 | 0.66 | 1,130 | 54,361 | 0.67 | 1,166 |

| Kirazli | 700 | 1.25 | 28 | 25,404 | 0.78 | 637 | 26,104 | 0.79 | 665 |

| Total Turkey | 2,150 | 0.93 | 64 | 78,315 | 0.70 | 1,767 | 80,465 | 0.71 | 1,831 |

| Alamos – Total | 44,012 | 2.16 | 3,058 | 155,373 | 1.33 | 6,644 | 199,386 | 1.51 | 9,702 |

| PROVEN AND PROBABLE SILVER MINERAL RESERVES (as at December 31, 2018) | |||||||||

| Proven Reserves | Probable Reserves | Total Proven and Probable | |||||||

| Tonnes | Grade | Ounces | Tonnes | Grade | Ounces | Tonnes | Grade | Ounces | |

| (000’s) | (g/t Ag) | (000’s) | (000’s) | (g/t Ag) | (000’s) | (000’s) | (g/t Ag) | (000’s) | |

| La Yaqui | 215 | 7.42 | 51 | 571 | 5.05 | 93 | 786 | 5.70 | 144 |

| La Yaqui Grande | 0 | 0.00 | 0 | 15,945 | 16.63 | 8,525 | 15,945 | 16.63 | 8,525 |

| Cerro Pelon | 998 | 17.20 | 552 | 2,123 | 15.05 | 1,027 | 3,121 | 15.74 | 1,579 |

| MacLellan | 11,604 | 4.94 | 1,844 | 11,650 | 3.93 | 1,471 | 23,254 | 4.43 | 3,315 |

| A?? Da?? | 1,450 | 6.22 | 290 | 52,911 | 5.39 | 9,169 | 54,361 | 5.41 | 9,459 |

| Kirazli | 700 | 15.90 | 358 | 25,404 | 11.90 | 9,720 | 26,104 | 12.01 | 10,078 |

| Alamos – Total | 14,968 | 6.43 | 3,095 | 108,603 | 8.59 | 30,005 | 123,571 | 8.33 | 33,100 |

Table 2: Project Life-of-Mine Mineral Reserve Waste-to-Ore Ratios

as of December 31, 2018

| Project Life-of-Mine Mineral Reserve Waste-to-Ore Ratios as of December 31, 2018 | |

| Project | Waste-to-Ore Ratio |

| Mulatos Mine | 1.40 |

| Cerro Pelon Pit | 2.02 |

| La Yaqui Phase I Pit | 1.06 |

| La Yaqui Grande Pit | 5.57 |

| A?? Da?? Pits | 1.03 |

| Kirazl? Pit | 1.45 |

| Lynn Lake Pits | 7.59 |

Table 3: Total Measured and Indicated Mineral Resources as of December 31, 2018

| MEASURED AND INDICATED GOLD MINERAL RESOURCES (as at December 31, 2018) | |||||||||

| Measured Resources | Indicated Resources | Total Measured & Indicated | |||||||

| Tonnes | Grade | Ounces | Tonnes | Grade | Ounces | Tonnes | Grade | Ounces | |

| (000’s) | (g/t Au) | (000’s) | (000’s) | (g/t Au) | (000’s) | (000’s) | (g/t Au) | (000’s) | |

| Young-Davidson – Surface | 496 | 1.13 | 18 | 1,242 | 1.28 | 51 | 1,739 | 1.24 | 69 |

| Young-Davidson – Underground | 7,411 | 3.30 | 785 | 3,964 | 3.97 | 506 | 11,374 | 3.53 | 1,291 |

| Total Young-Davidson | 7,907 | 3.16 | 803 | 5,206 | 3.33 | 557 | 13,113 | 3.23 | 1,361 |

| Island Gold | 23 | 4.69 | 4 | 673 | 8.91 | 193 | 696 | 8.77 | 196 |

| Mulatos | 8,074 | 1.26 | 328 | 62,870 | 1.08 | 2,193 | 70,944 | 1.11 | 2,521 |

| La Yaqui | 0 | 0.00 | 0 | 1,101 | 0.93 | 33 | 1,101 | 0.93 | 33 |

| Cerro Pelon | 33 | 1.83 | 2 | 146 | 1.46 | 7 | 179 | 1.56 | 9 |

| Carricito | 58 | 0.82 | 2 | 1,297 | 0.82 | 34 | 1,355 | 0.83 | 36 |

| Total Mulatos | 8,165 | 1.26 | 332 | 65,414 | 1.08 | 2,267 | 73,579 | 1.10 | 2,599 |

| MacLellan – Open Pit | 1,986 | 1.65 | 105 | 4,700 | 1.46 | 221 | 6,686 | 1.52 | 326 |

| MacLellan – Underground | 0 | 0.00 | 0 | 843 | 4.52 | 122 | 843 | 4.52 | 122 |

| Gordon | 9 | 1.72 | 0 | 451 | 1.96 | 28 | 460 | 1.95 | 29 |

| Burnt Timber | 0 | 0.00 | 0 | 1,021 | 1.40 | 46 | 1,021 | 1.40 | 46 |

| Linkwood | 0 | 0.00 | 0 | 984 | 1.16 | 37 | 984 | 1.17 | 37 |

| Total Lynn Lake | 1,994 | 1.65 | 106 | 7,999 | 1.77 | 455 | 9,993 | 1.74 | 560 |

| Esperanza | 19,226 | 1.01 | 622 | 15,126 | 0.95 | 462 | 34,352 | 0.98 | 1,083 |

| A?? Da?? | 553 | 0.44 | 8 | 34,334 | 0.46 | 510 | 34,887 | 0.46 | 518 |

| Kirazli | 118 | 0.50 | 2 | 5,848 | 0.43 | 80 | 5,966 | 0.43 | 82 |

| Çamyurt | 513 | 1.00 | 16 | 17,208 | 0.89 | 492 | 17,721 | 0.89 | 508 |

| Total Turkey | 1,184 | 0.68 | 26 | 57,390 | 0.59 | 1,082 | 58,574 | 0.59 | 1,108 |

| Quartz Mountain | 214 | 0.95 | 7 | 11,942 | 0.87 | 333 | 12,156 | 0.87 | 339 |

| Alamos – Total | 38,714 | 1.53 | 1,899 | 163,749 | 1.02 | 5,348 | 202,463 | 1.11 | 7,247 |

| MEASURED AND INDICATED SILVER MINERAL RESOURCES (as at December 31, 2018) | |||||||||

| Measured Resources | Indicated Resources | Total Measured & Indicated | |||||||

| Tonnes | Grade | Ounces | Tonnes | Grade | Ounces | Tonnes | Grade | Ounces | |

| (000’s) | (g/t Ag) | (000’s) | (000’s) | (g/t Ag) | (000’s) | (000’s) | (g/t Ag) | (000’s) | |

| La Yaqui Grande | 0 | 0.00 | 0 | 1,101 | 9 | 324 | 1,101 | 9 | 324 |

| Cerro Pelon | 33 | 17.05 | 18 | 146 | 19 | 91 | 179 | 19 | 109 |

| MacLellan – Open Pit | 1,986 | 3.66 | 234 | 4,700 | 3.65 | 551 | 6,686 | 3.65 | 785 |

| MacLellan – Underground | 0 | 0.00 | 0 | 843 | 5.98 | 162 | 843 | 5.98 | 162 |

| Esperanza | 19,226 | 7.25 | 4,482 | 15,126 | 9.16 | 4,455 | 34,352 | 8.09 | 8,936 |

| A?? Da?? | 553 | 1.59 | 28 | 34,334 | 2.19 | 2,417 | 34,887 | 2.18 | 2,445 |

| Kirazli | 118 | 2.73 | 10 | 5,848 | 2.17 | 408 | 5,966 | 2.18 | 418 |

| Çamyurt | 513 | 5.63 | 93 | 17,208 | 6.15 | 3,404 | 17,721 | 6.14 | 3,497 |

| Alamos – Total | 22,429 | 6.75 | 4,864 | 79,306 | 4.63 | 11,812 | 101,734 | 5.10 | 16,677 |

Table 4: Total Inferred Mineral Resources as of December 31, 2018

| INFERRED GOLD MINERAL RESOURCES (as at December 31, 2018) | |||

| Tonnes | Grade | Ounces | |

| (000’s) | (g/t Au) | (000’s) | |

| Young-Davidson – Surface | 31 | 0.99 | 1 |

| Young-Davidson – Underground | 3,498 | 2.75 | 310 |

| Total Young-Davidson | 3,528 | 2.74 | 311 |

| Island Gold | 4,178 | 11.71 | 1,573 |

| Mulatos | 8,369 | 0.92 | 248 |

| La Yaqui | 229 | 0.90 | 7 |

| Cerro Pelon | 70 | 0.70 | 2 |

| Carricito | 900 | 0.74 | 22 |

| Total Mulatos | 9,568 | 0.91 | 279 |

| MacLellan – Open Pit | 1,292 | 1.36 | 56 |

| MacLellan – Underground | 116 | 3.82 | 14 |

| Gordon | 615 | 1.30 | 29 |

| Burnt Timber | 23,438 | 1.04 | 781 |

| Linkwood | 21,004 | 1.16 | 783 |

| Total Lynn Lake | 46,466 | 1.11 | 1,663 |

| Esperanza | 718 | 0.80 | 18 |

| A?? Da?? | 16,760 | 0.46 | 245 |

| Kirazli | 5,689 | 0.59 | 108 |

| Çamyurt | 2,791 | 0.95 | 85 |

| Total Turkey | 25,240 | 0.54 | 438 |

| Quartz Mountain | 39,205 | 0.91 | 1,147 |

| Alamos – Total | 128,903 | 1.31 | 5,429 |

| INFERRED SILVER MINERAL RESOURCES (as at December 31, 2018) | |||

| Tonnes | Grade | Ounces | |

| (000’s) | (g/t Ag) | (000’s) | |

| La Yaqui Grande | 228 | 4.01 | 29 |

| Cerro Pelon | 70 | 15.91 | 36 |

| MacLellan – Open Pit | 1,292 | 2.43 | 101 |

| MacLellan – Underground | 116 | 3.13 | 12 |

| Esperanza | 718 | 15.04 | 347 |

| A?? Da?? | 16,760 | 2.85 | 1,534 |

| Kirazli | 5,689 | 8.96 | 1,638 |

| Çamyurt | 2,791 | 5.77 | 518 |

| Alamos – Total | 27,664 | 4.74 | 4,215 |

Notes to Mineral Reserve and Resource Tables:

- The Company’s mineral reserves and mineral resource as at December 31, 2018 are classified in accordance with the Canadian Institute of Mining Metallurgy and Petroleum’s “CIM Standards on Mineral Resources and Reserves, Definition and Guidelines” as per Canadian Securities Administrator’s NI 43-101 requirements.

- Mineral resources are not mineral reserves and do not have demonstrated economic viability.

- Mineral resources are exclusive of mineral reserves.

- Mineral reserve cut-off grade for the Mulatos Mine, the Cerro Pelon Pit, the La Yaqui Pits, the Kirazl? Pit and the A?? Da?? Pit are determined as a net of process value of $0.10 per tonne for each model block

- All Measured, Indicated and Inferred open pit mineral resources are pit constrained with the exception of those outside the Mulatos Main Pits on the Mulatos property which have no economic restrictions and are tabulated by gold cut-off grade.

- Mineral reserve estimates assumed a gold price of $1,250 per ounce and mineral resource estimates assumed a gold price of $1,400 per ounce. Metal prices, cut-off grades and metallurgical recoveries are set out in the table below.

| Resources | Reserves | ||||

| Gold Price | Cut-off | Gold Price | Cut-off | Met Recovery | |

| Mulatos: | |||||

| Mulatos Main Open Pit | $1,400 | 0.5 | $1,250 | see notes | >50% |

| Cerro Pelon | $1,400 | 0.5 | $1,250 | see notes | 75% |

| La Yaqui | $1,400 | 0.5 | $1,250 | see notes | 75% |

| Carricito | $1,400 | 0.3 | n/a | n/a | n/a |

| Young-Davidson – Surface | $1,400 | 0.5 | $1,250 | 0.5 | 91% |

| Young-Davidson – Underground | $1,400 | 1.3 | $1,250 | 1.9 | 91% |

| Island Gold | $1,400 | 4.0 | $1,250 | 3.45-4.24 | 96.5% |

| Lynn Lake – MacLellan | $1,400 | 0.42 | $1,250 | 0.47 | 91-92% |

| Lynn Lake – MacLellan Underground | $1,400 | 2.0 | n/a | n/a | n/a |

| Lynn Lake – Gordon | $1,400 | 0.62 | $1,250 | 0.69 | 89-94% |

| Esperanza | $1,400 | 0.4 | n/a | n/a | 60-72% |

| A?? Da?? | $1,400 | 0.2 | $1,250 | see notes | 80% |

| Kirazl? | $1,400 | 0.2 | $1,250 | see notes | 81% |

| Çamyurt | $1,400 | 0.2 | n/a | n/a | 78% |

| Quartz Mountain | $1,400 | 0.21 Oxide, 0.6 Sulfide | n/a | n/a | 65-80% |

Figure 1: Island Gold Mine Main Zone Longitudinal – 2018 Mineral Reserves

http://www.globenewswire.com/NewsRoom/AttachmentNg/d5c261a9-1f17-4dcc-aaf9-e2e1a18c583e

Figure 2: Island Gold Mine Main Zone Longitudinal – 2018 Mineral Resources

http://www.globenewswire.com/NewsRoom/AttachmentNg/8eb172ba-219f-482c-8f61-8aa106fbb57a

Source: Alamos Gold Inc.