All amounts are in United States dollars, unless otherwise stated.

TORONTO, April 24, 2024 (GLOBE NEWSWIRE) — Alamos Gold Inc. (TSX:AGI; NYSE:AGI) (“Alamos” or the “Company”) today reported its financial results for the quarter ended March 31, 2024.

“We delivered another strong start to the year across a number of fronts, following a record performance in 2023. Costs were in line with guidance for the quarter and production exceeded guidance led by record production from La Yaqui Grande. With the solid first quarter, we are on track to achieve our full year production and cost guidance. We also continued to demonstrate our long-term track record of value creation through exploration and M&A. Our Mineral Reserves increased for the fifth consecutive year, and we expect to unlock significant value through our acquisition of the Magino mine and its integration with Island Gold. We expect the combination to create one of Canada’s largest and lowest cost gold mines, drive significant synergies, and solidify our unique positioning as a Canadian focused intermediate gold producer, with growing production and declining costs,” said John A. McCluskey, President and Chief Executive Officer.

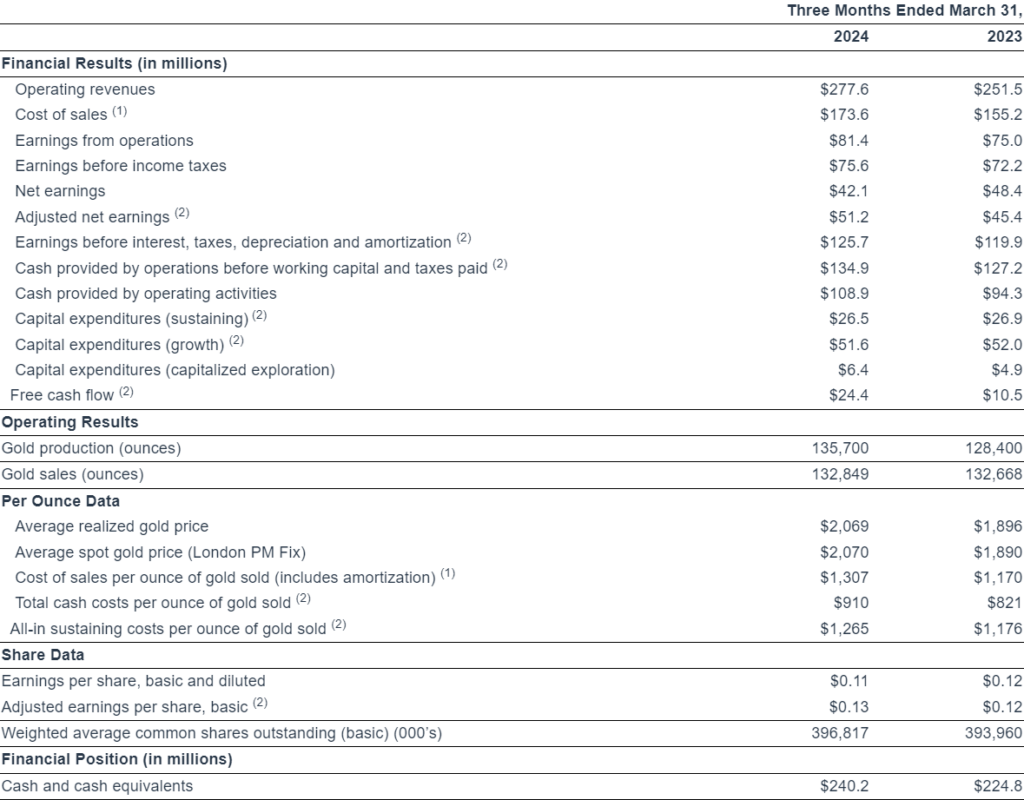

First Quarter 2024 Operational and Financial Highlights

- Produced 135,700 ounces of gold, exceeding quarterly guidance and representing a 6% increase from the first quarter of 2023. This was driven by another strong performance from the Mulatos District, including record quarterly production from La Yaqui Grande

- Sold 132,849 ounces of gold at an average realized price of $2,069 per ounce, generating record quarterly revenue of $277.6 million, a 10% increase from the first quarter of 2023

- Total cash costs1 were $910 per ounce, all-in sustaining costs (“AISC”1) were $1,265 per ounce, and cost of sales were $1,307 per ounce. As previously guided, costs were above full year guidance in the first quarter, with AISC also impacted by an increase in share-based compensation reflecting the Company’s higher share price in the quarter. Costs are expected to decrease through the remainder of the year to be consistent with full year guidance

- Strong ongoing free cash flow1 generation of $24.4 million, while funding the Phase 3+ Expansion at Island Gold, and net of $45.3 million of cash tax payments in Mexico

- Cash flow from operating activities of $108.9 million (including $134.9 million, or $0.34 per share before changes in working capital1)

- Realized adjusted net earnings1 for the first quarter of $51.2 million, or $0.13 per share1. Adjusted net earnings includes adjustments for net unrealized foreign exchange losses recorded within deferred taxes and foreign exchange of $4.5 million, and other adjustments, net of taxes totaling $4.6 million.

- Reported net earnings were $42.1 million, or $0.11 per share

- Cash and cash equivalents increased 7% from the end of 2023 to $240.2 million, with no debt and $16.3 million in equity securities

- Paid dividends of $9.8 million, or $0.025 per share for the quarter

- Reported year-end 2023 Mineral Reserves of 10.7 million ounces of gold, a 2% increase from 2022, with grades also increasing 1%. This marked the fifth consecutive year Mineral Reserves have grown for a combined increase of 10% with grades also increasing 9% over that time frame. Additionally, Measured and Indicated Mineral Resources increased 12% to 4.4 million ounces, with grades increasing 9%, and Inferred Mineral Resources increased 3% to 7.3 million ounces, at 1% higher grades

- Announced a definitive agreement to acquire Argonaut Gold Inc. (“Argonaut”) and its Magino mine, located adjacent to the Company’s Island Gold mine in Ontario, Canada. The integration of the two operations is expected to create one of the largest and lowest cost gold mines in Canada and unlock significant value with pre-tax synergies expected to total $515 million2 through the use of shared infrastructure

- On April 4, 2024, announced the closing of the previously announced non-brokered private placement for common shares of Argonaut, representing approximately 13.8% of Argonaut’s outstanding common shares for CAD $50 million

- Completed the acquisition of Orford Mining Corporation (“Orford”) on April 3, 2024, through which the Company consolidated its existing ownership of Orford shares and added the highly prospective Qiqavik Gold Project, located in Quebec, Canada

(1) Refer to the “Non-GAAP Measures and Additional GAAP Measures” disclosure at the end of this press release and associated MD&A for a description and calculation of these measures.

(2) Synergies are pre-tax and undiscounted. On a discounted basis, this represents an after-tax net present value of $250 million

Highlight Summary

(1) Cost of sales includes mining and processing costs, royalties, and amortization expense.

(2) Refer to the “Non-GAAP Measures and Additional GAAP Measures” disclosure at the end of this press release and associated MD&A for a description and calculation of these measures.

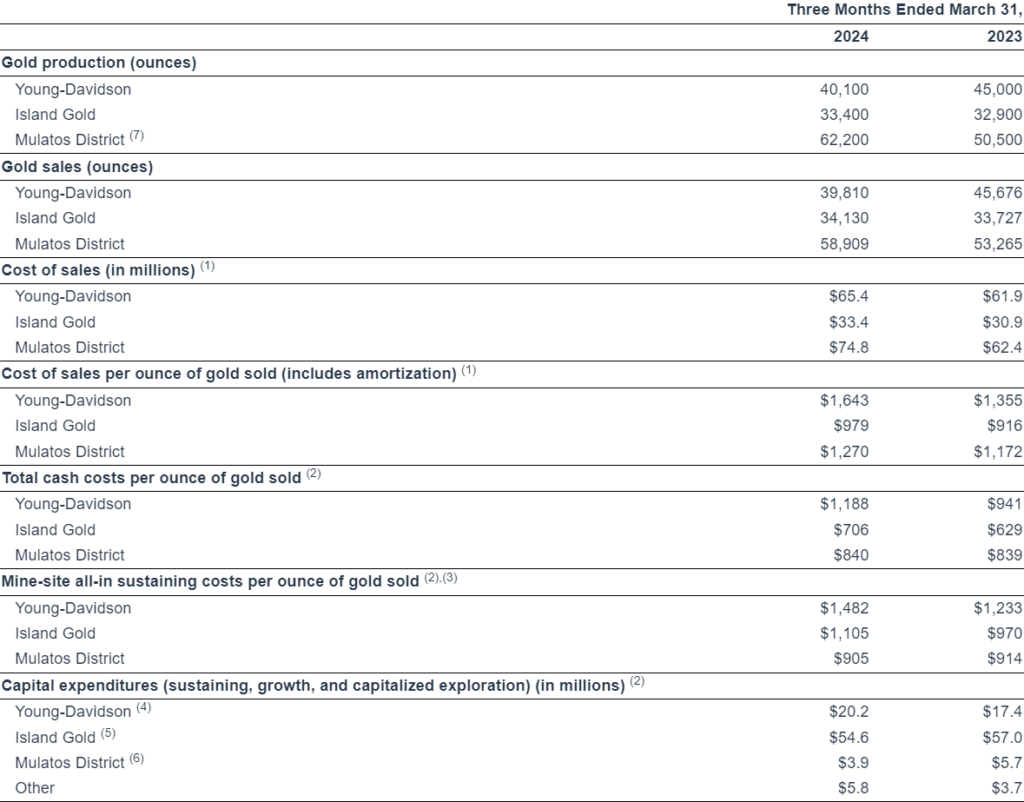

(1) Cost of sales includes mining and processing costs, royalties, and amortization expense.

(2) Refer to the “Non-GAAP Measures and Additional GAAP Measures” disclosure at the end of this press release and associated MD&A for a description and calculation of these measures.

(3) For the purposes of calculating mine-site all-in sustaining costs, the Company does not include an allocation of corporate and administrative and share based compensation expenses.

(4) Includes capitalized exploration at Young-Davidson of $1.0 million for the three months ended March 31, 2024 ($1.4 million for the three months ended March 31, 2023).

(5) Includes capitalized exploration at Island Gold of $3.5 million for the three months ended March 31, 2024 ($2.4 million for the three months ended March 31, 2023).

(6) Includes capitalized exploration at Mulatos District of $1.9 million for the three months ended March, 2024 ($1.1 million for the three months ended March 31, 2023).

(7) The Mulatos District includes the Mulatos pit and La Yaqui Grande.

Environment, Social and Governance Summary Performance

Health and Safety

- Total recordable injury frequency rate1 (“TRIFR”) of 1.79 in the first quarter of 2024, an increase from 1.45 in the fourth quarter of 2023

- Lost time injury frequency rate1 (“LTIFR”) of nil, a decrease from 0.10 in the fourth quarter of 2023

- La Yaqui Grande Mine celebrated four million hours without a lost time injury

- Alamos’ Home Safe Every Day safety leadership training was implemented at the Island Gold Mine, where it will be delivered to all employees as part of the site’s safety training. This program is now available at all Alamos operations

- During the first quarter of 2024, Alamos had 18 recordable injuries across its sites and zero lost time injuries

Alamos strives to maintain a safe, healthy working environment for all, with a strong safety culture where everyone is continually reminded of the importance of keeping themselves and their colleagues healthy and injury-free. The Company’s overarching commitment is to have all employees and contractors return Home Safe Every Day.

Environment

- Zero significant environmental incidents and zero reportable spills in the first quarter of 2024

- One externally reportable non-compliance in the first quarter that resulted in a fine. At Young-Davidson, environmental testing of treated mine water determined a toxicity failure for Daphnia magna (water fleas), resulting in an environmental penalty of $14,000. The investigation determined the cause of the failure to be algae build-up in the mine water discharge pond and remediation measures were taken. Water treatment and discharge were not impacted and the mine has been in full compliance subsequent to the event

- Finalized a fish habitat compensation project for Davidson Creek at Young-Davidson

- Reclamation work underway at Mulatos focused on the closed Cerro Pelon, El Victor and San Carlos pits

The Company is committed to preserving the long-term health and viability of the natural environment that surrounds its operations and projects. This includes investing in new initiatives to reduce our environmental footprint with the goal of minimizing the environmental impacts of our activities and offsetting any impacts that cannot be fully mitigated or rehabilitated.

Community

Ongoing donations, medical support and infrastructure investments were provided to local communities, including:

- Various sponsorships to support local youth sports teams and community events, and donations to local charities and organizations around the Company’s mines

- Partnered with a local foundation (Fundación Vamos Juntos a Ganar) to organize an entrepreneurship workshop for residents of Matarachi to increase their capacity for opening or improving local businesses

- Provided ongoing health services to local community members around the Mulatos Mine. During the quarter, free dental services, vaccinations, and Pap tests were provided to residents

- Upgraded public lighting in Matarachi with the installation of 96 solar street lights throughout the town

- Completed the annual Mi Matarachi evaluation and planning meeting with residents of Matarachi, working together to develop actions that promote education, health and infrastructure that improve the quality of life for residents

The Company believes that excellence in sustainability provides a net benefit to all stakeholders. The Company continues to engage with local communities to understand local challenges and priorities. Ongoing investments in local infrastructure, health care, education, cultural and community programs remain a focus of the Company.

Governance and Disclosure

- Completed annual fieldwork and assurance of Alamos’ compliance with the World Gold Council’s Responsible Gold Mining Principles (RGMPs). Alamos will publish its 2023 RGMP Report in the second quarter of 2024

- Prepared Alamos’ inaugural Modern Slavery Report in accordance with Canada’s Fighting Against Forced Labour and Child Labour in Supply Chains Act. Alamos will publish its 2023 Modern Slavery Report in May 2024

The Company maintains the highest standards of corporate governance to ensure that corporate decision-making reflects its values, including the Company’s commitment to sustainable development.

(1) Frequency rate is calculated as incidents per 200,000 hours worked.

Outlook and Strategy

2024 Guidance (4)

| Young- Davidson | Island Gold | Mulatos | Lynn Lake | Total | |

| Gold production (000’s ounces) | 180 – 195 | 145 – 160 | 160 – 170 | 485 – 525 | |

| Cost of sales, including amortization (in millions)(3) | $620 | ||||

| Cost of sales, including amortization ($ per ounce)(3) | $1,225 | ||||

| Total cash costs ($ per ounce)(1) | $950 – $1,000 | $550 – $600 | $925 – $975 | — | $825 – $875 |

| All-in sustaining costs ($ per ounce)(1) | $1,125 – $1,175 | ||||

| Mine-site all-in sustaining costs ($ per ounce)(1)(2) | $1,175 – $1,225 | $875 – $925 | $1,000 – $1,050 | — | |

| Capital expenditures (in millions) | |||||

| Sustaining capital(1) | $40 – $45 | $50 – $55 | $3 – $5 | — | $93 – $105 |

| Growth capital(1) | $20 – $25 | $210 – $230 | $2 – $5 | — | $232 – $260 |

| Total Sustaining and Growth Capital (1) – producing mines | $60 – $70 | $260 – $285 | $5 – $10 | — | $325 – $365 |

| Growth capital – development projects | $25 | $25 | |||

| Capitalized exploration(1) | $10 | $13 | $9 | $9 | $41 |

| Total capital expenditures and capitalized exploration(1) | $70 – $80 | $273 – $298 | $14 – $19 | $34 | $391 – $431 |

(1) Refer to the “Non-GAAP Measures and Additional GAAP” disclosure at the end of this press release and associated MD&A for a description of these measures.

(2) For the purposes of calculating mine-site all-in sustaining costs at individual mine sites, the Company does not include an allocation of corporate and administrative and share based compensation expenses to the mine sites.

(3) Cost of sales includes mining and processing costs, royalties, and amortization expense, and is calculated based on the mid-point of total cash cost guidance.

(4) 2024 Guidance does not reflect the proposed acquisition of the Magino Mine and will be updated following close of the transaction

The Company’s objective is to operate a sustainable business model that supports growing returns to all stakeholders over the long-term, through growing production, expanding margins, and increasing profitability. This includes a balanced approach to capital allocation focused on generating strong ongoing free cash flow while re-investing in high-return internal growth opportunities, and supporting higher returns to shareholders.

Following a record operational and financial performance in 2023, the Company continued to deliver across multiple fronts in the first quarter of 2024. Production of 135,700 ounces exceeded quarterly guidance, reflecting another strong performance from Mulatos driven by record quarterly production from La Yaqui Grande. Costs were in line with quarterly guidance and expected to decrease through the rest of the year to be consistent with annual guidance. With the strong operational performance, and higher gold prices, the Company generated record quarterly revenues, and solid ongoing free cash flow of $24.4 million while funding the Phase 3+ Expansion at Island Gold, and net of $45.3 million of cash tax payments in Mexico.

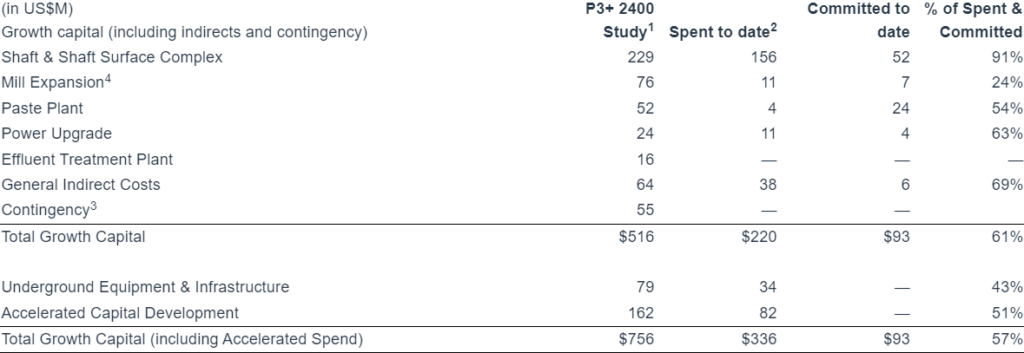

The Phase 3+ Expansion remains on track for completion during the first half of 2026 and will be a key driver of the Company’s growing production base and declining cost profile over the next several years. Work on the expansion continues to advance with shaft sinking well underway and reaching a depth of 185 metres by the end of March.

Additionally, the Company continued to demonstrate its long-term track record of value creation through exploration and M&A during the quarter. Global Mineral Reserves increased to 10.7 million ounces of gold (202 mt grading 1.65 g/t Au), a 2% increase from 2022, with a further 1% increase in grades. This marked the fifth consecutive year of growth in Mineral Reserves for a combined increase of 10% over that time frame. Grades have also increased 9% over the same timeframe as Mineral Reserves continue to grow both in size and quality. The increase in 2023 was driven by higher-grade additions at Island Gold and PDA, as well as growth at Lynn Lake.

The acquisition of Argonaut’s Magino mine is expected to unlock significant value given its proximity to Island Gold. The integration of the two operations is expected to create one of the largest and lowest cost gold mines in Canada and drive pre-tax synergies of approximately $515 million through the use of shared infrastructure. This includes immediate capital savings with the mill and tailings expansions at Island Gold no longer required, and significant ongoing operating savings through the use of the larger and more efficient Magino mill. This not only de-risks the Phase 3+ Expansion, but also creates opportunities for further expansions of the combined Island Gold and Magino operations. The addition of Magino is expected to increase company-wide gold production to over 600,000 ounces per year with longer term production potential of over 900,000 ounces per year. The transaction is expected to close in July 2024.

Additionally, the Company continues to invest in its longer-term portfolio of growth projects with the acquisition of Orford, adding the highly prospective Qiqavik Gold Project, located in Quebec, Canada.

The Company provided three-year production and operating guidance in January 2024 (excluding Magino), which outlined growing production at declining costs over the next three years. Refer to the Company’s January 10, 2024 guidance press release for a summary of the key assumptions and related risks associated with the comprehensive 2024 guidance and three-year production, cost and capital outlook. Gold production in 2024 is expected to range between 485,000 and 525,000 ounces. Total cash costs and AISC are expected to be consistent with 2023.

Production is expected to be slightly higher during the first half of 2024, reflecting higher grades at La Yaqui Grande and stronger rates of production through residual leaching at Mulatos. Second quarter gold production is expected to be between 123,000 and 133,000 ounces with costs decreasing slightly from the first quarter driven by lower costs at both Island Gold and Young-Davidson. Consistent with annual guidance, costs are expected to decrease through the remainder of the year reflecting a declining contribution of higher cost production from residual leaching at Mulatos.

Production is expected to increase 7% by 2026 to between 520,000 and 560,000 ounces, with AISC decreasing 11% to between $975 and $1,075 per ounce reflecting low-cost production growth from Island Gold with the completion of the Phase 3+ Expansion. The three year guidance excludes the higher grade PDA project which represents potential production upside at Mulatos as early as 2026. This upside is expected to be outlined in a development plan for PDA to be released during the second quarter of 2024. Looking beyond 2026, the Lynn Lake project is expected to support further potential growth as early as the end of 2027.

The majority of capital spending in 2024 remains focused on advancing the Phase 3+ Expansion at Island Gold. Following the closing of the acquisition of Argonaut in July, the Company will revise its 2024 capital guidance to reflect the addition of Magino and lower planned capital spending on the mill and tailings expansions at Island Gold.

Other areas of focus in 2024 include a larger capital budget for Lynn Lake and increased capitalized exploration. Spending at Lynn Lake will be focused on upgrades to site access and infrastructure, including early work on the power line upgrade, in advance of a construction decision anticipated in 2025. Additionally, a portion of the 2024 exploration program will be focused on converting Mineral Resources at the Burnt Timber and Linkwood satellite deposits into a smaller, higher quality Mineral Reserve. A study incorporating these deposits into the Lynn Lake project is expected to be competed in the fourth quarter of 2024, and represents potential production and economic upside to the 2023 Feasibility Study.

Given the strong profitability of the Mulatos operation in 2023, the Company expects to pay significantly higher cash tax payments in Mexico in 2024. This included $45.3 million of cash tax payments made in the first quarter, the majority of which related to the 2023 year-end tax payment. Cash tax payments in Mexico are expected to decrease to approximately $10 million in the second quarter and remain at similar levels through the remainder of the year. The Company expects stronger company-wide free cash flow starting in the second quarter of 2024 given lower cash tax burden and an expected decrease in costs.

The global exploration budget for 2024 is $62 million, a 19% increase from $52 million spent in 2023. The increase reflects expanded budgets across all key assets following up on broad-based exploration success in 2023. Island Gold and the Mulatos District account for approximately 60% of the total budget with $19 million planned for each asset. This is followed by $12 million at Young-Davidson, $9 million at Lynn Lake and $2 million at Golden Arrow.

The Company’s liquidity position remains strong, ending the quarter with $240.2 million of cash and cash equivalents, $16.3 million in equity securities, and no debt. Additionally, the Company has a $500 million undrawn credit facility, providing total liquidity of $756.5 million. Combined with strong ongoing cash flow generation, the Company remains well positioned to internally fund its organic growth initiatives including the Phase 3+ Expansion, optimization of the Magino mill, and development of PDA and Lynn Lake.

First Quarter 2024 Results

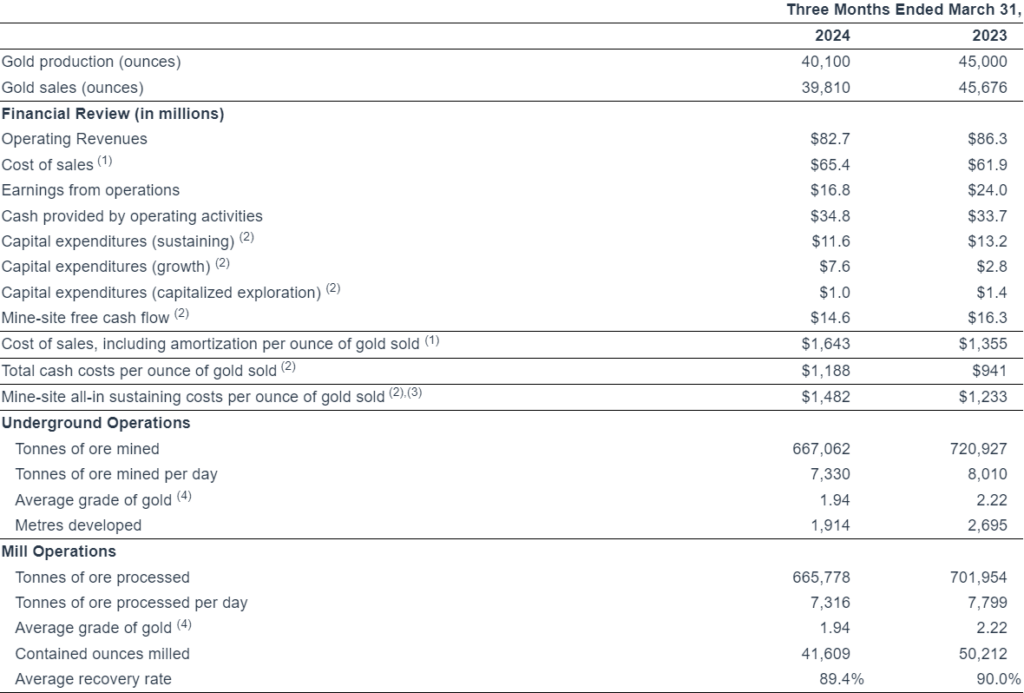

Young-Davidson Financial and Operational Review

(1) Cost of sales includes mining and processing costs, royalties and amortization.

(2) Refer to the “Non-GAAP Measures and Additional GAAP Measures” disclosure at the end of this press release and associated MD&A for a description and calculation of these measures.

(3) For the purposes of calculating mine-site all-in sustaining costs, the Company does not include an allocation of corporate and administrative and share based compensation expenses.

(4) Grams per tonne of gold (“g/t Au”).

Operational review

Young-Davidson produced 40,100 ounces of gold in the first quarter, an 11% decrease compared to the prior year period. Underground mining rates averaged 7,330 tpd in the first quarter, lower than the prior year period reflecting temporary downtime to replace the head ropes in the Northgate shaft, which had previously been scheduled in the second quarter. Additionally, delays in receiving two production scoops also impacted mining rates earlier in the quarter. Following the completion of the head rope change and receipt of two new hybrid production scoops, mining rates returned to design capacity of 8,000 tpd in March and are expected to remain at similar rates through the rest of the year. Milling rates averaged 7,316 tpd in the quarter, as a result of the lower underground mining rates.

Grades mined averaged 1.94 g/t Au in the quarter, a 13% decrease from the prior year period, and below the range of full year guidance, due to mine sequencing. Given the lower mining rates, higher grade stopes that had been planned for March were deferred into April. Grades mined are expected to increase to within the range of annual guidance in the second quarter and through the remainder of the year. Mill recoveries averaged 89% in the quarter, at the low end of the range of annual guidance.

Financial Review

First quarter revenues of $82.7 million were 4% lower than the prior year period, resulting from lower ounces sold, partially offset by a higher realized gold price.

Cost of sales of $65.4 million in the first quarter were 6% higher than the prior year period, reflecting inflationary pressures on unit costs. Underground mining costs were CAD $62 per tonne in the first quarter, reflecting the lower tonnes mined.

Total cash costs and mine-site AISC were $1,188 per ounce and $1,482 per ounce, respectively, in the first quarter. Both metrics were higher than the prior year period and annual guidance, resulting from the temporary downtime for the hoist rope changeover as well as lower grades. Costs are expected to decrease through the remainder of the year to be consistent with annual guidance, reflecting higher grades and mining rates.

Capital expenditures in the first quarter included $11.6 million of sustaining capital and $7.6 million of growth capital. Additionally, $1.0 million was invested in capitalized exploration in the quarter. Capital expenditures, inclusive of capitalized exploration, totaled $20.2 million in the first quarter, a 16% increase from the prior year period driven by timing of payments.

Young-Davidson continues to demonstrate operational and financial consistency with mine-site free cash flow of $14.6 million in the first quarter, and stronger free cash flow expected through the remainder of the year. Young-Davidson has generated over $100 million in mine-site free cash flow for three consecutive years. The operation is well positioned to generate similar free cash flow in 2024 and over the long-term, with a 15 year Mineral Reserve life.

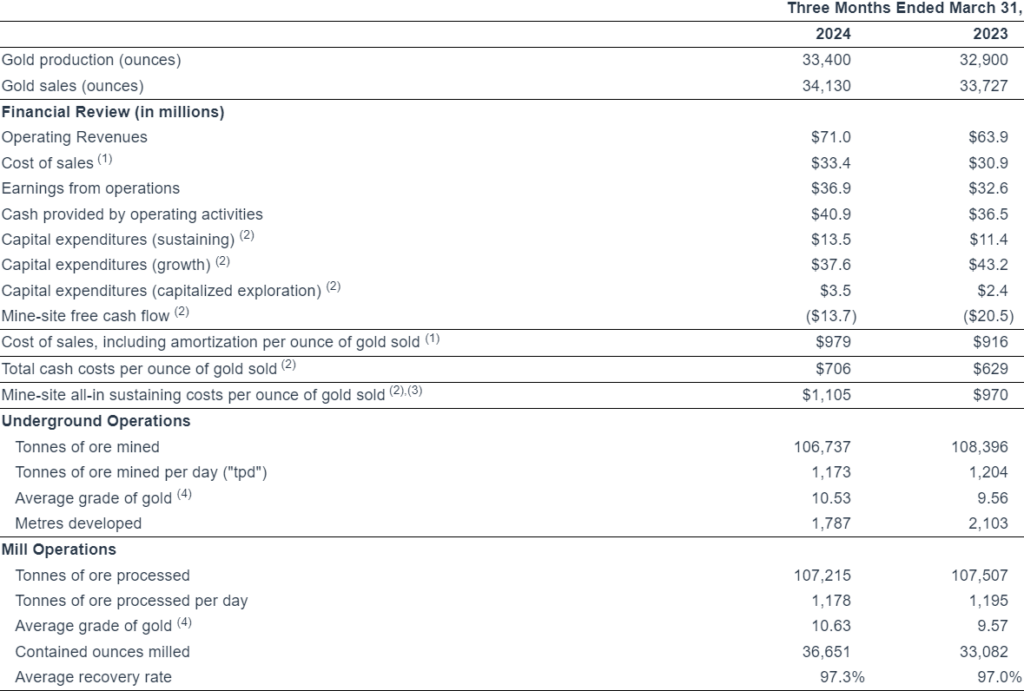

Island Gold Financial and Operational Review

(1) Cost of sales includes mining and processing costs, royalties, and amortization.

(2) Refer to the “Non-GAAP Measures and Additional GAAP Measures” disclosure at the end of this press release and associated MD&A for a description and calculation of these measures.

(3) For the purposes of calculating mine-site all-in sustaining costs, the Company does not include an allocation of corporate and administrative and share based compensation expenses.

(4) Grams per tonne of gold (“g/t Au”).

Operational review

Island Gold produced 33,400 ounces in the first quarter of 2024, consistent with the prior year period. Underground mining rates averaged 1,173 tpd in the first quarter, a 3% decrease from the prior year period and slightly below annual guidance of 1,200 tpd. Grades mined averaged 10.53 g/t Au in the quarter, consistent with annual guidance and 10% higher than in the prior year period.

Mill throughput averaged 1,178 tpd for the quarter, slightly lower than the prior year period reflecting mining rates in the quarter. Mill recoveries averaged 97% in the first quarter, consistent with guidance.

Financial Review

Revenues of $71.0 million in the first quarter were 11% higher than the prior year period, primarily driven by the higher realized gold price.

Cost of sales of $33.4 million in the first quarter was 8% higher than the prior year period, driven by inflationary pressures on mining and processing costs, driven mainly by labour and certain consumables.

Total cash costs of $706 per ounce and mine-site AISC of $1,105 per ounce in the first quarter were both higher than the prior year period, reflecting inflationary pressures. Costs are expected to decrease through the remainder of the year to be consistent with annual guidance.

Total capital expenditures were $54.6 million in the first quarter, including $37.6 million of growth capital and $3.5 million of capitalized exploration. Growth capital spending remained focused on the Phase 3+ Expansion shaft site infrastructure and shaft sinking, with the shaft reaching a depth of 185 metres by the end of the quarter. Additionally, capital spending was focused on lateral development and other surface infrastructure. Certain other capital activities planned for 2024 have been deferred as a result of the planned acquisition of Argonaut.

Mine-site free cash flow was negative $13.7 million for the first quarter given the significant capital investment related to the Phase 3+ Expansion. At current gold prices, Island Gold is expected to continue funding the majority of the Phase 3+ Expansion capital. The operation is expected to generate significant free cash flow from 2026 onward with the completion of the expansion.

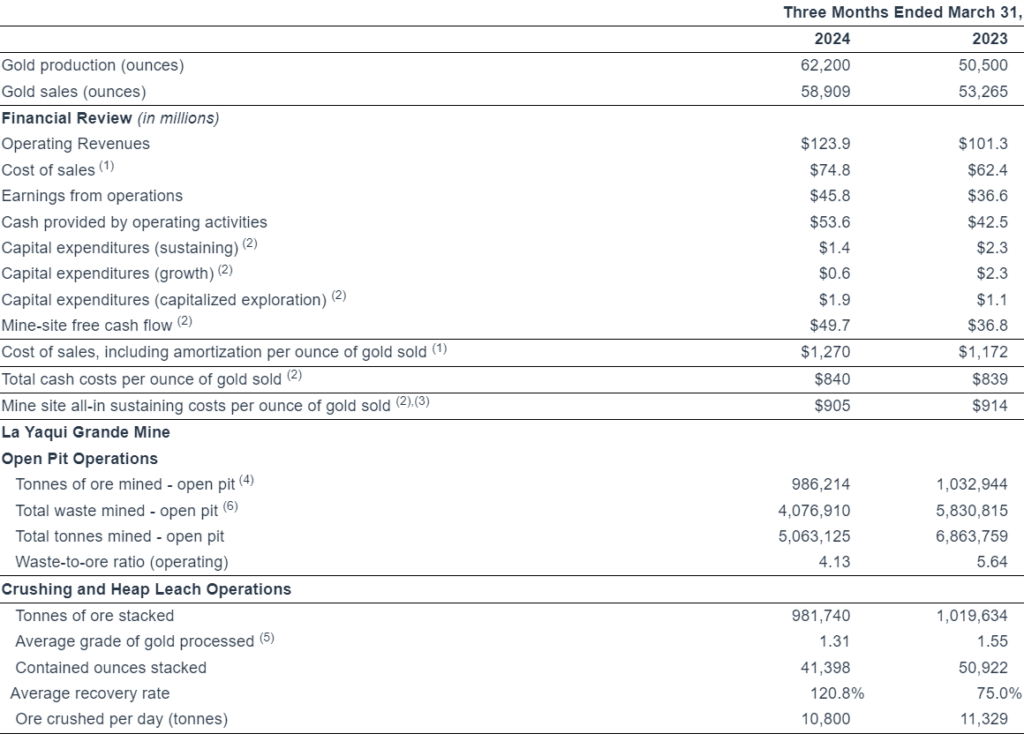

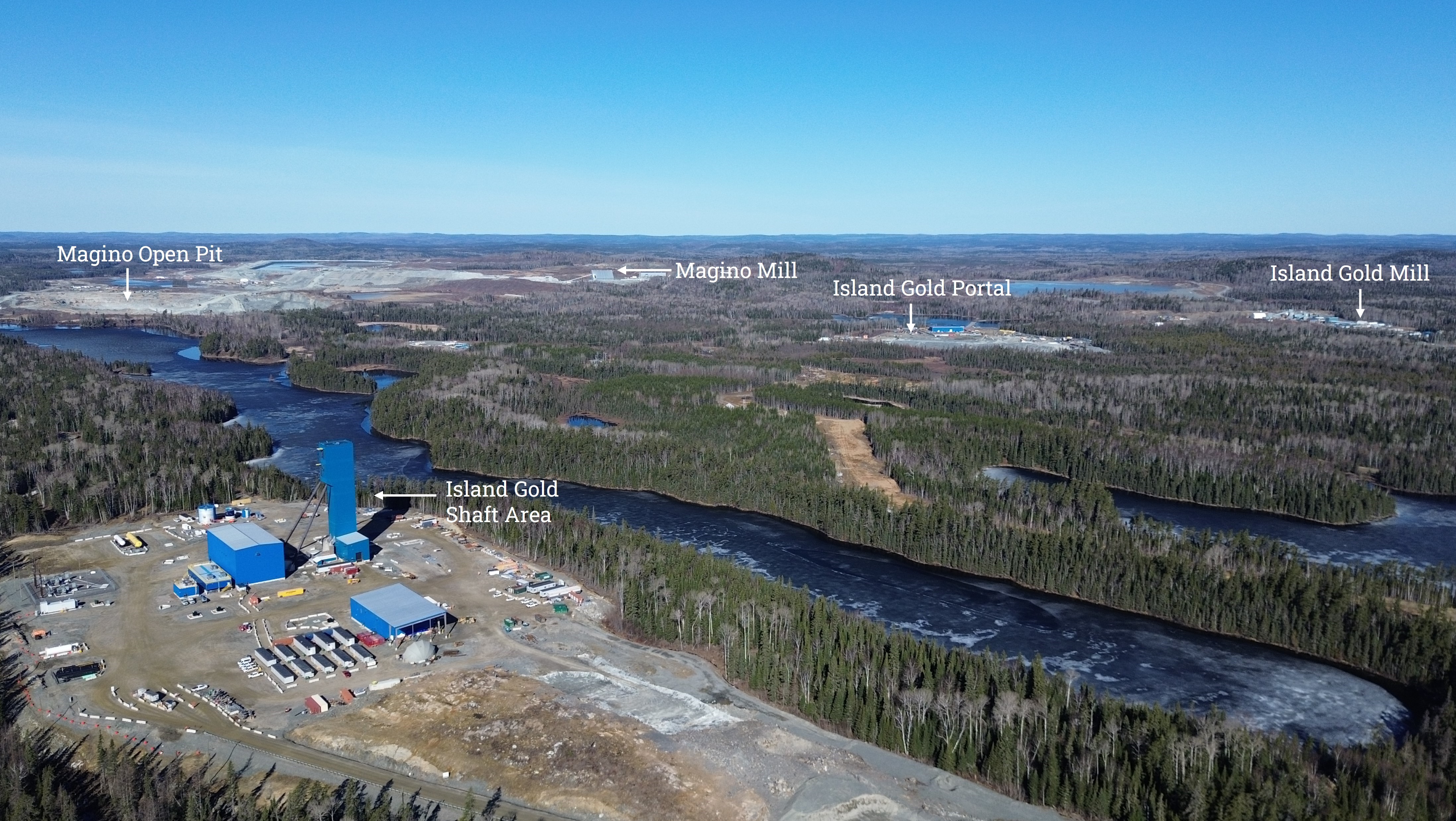

Mulatos District Financial and Operational Review

(1) Cost of sales includes mining and processing costs, royalties, and amortization expense.

(2) Refer to the “Non-GAAP Measures and Additional GAAP Measures” disclosure at the end of this press release and associated MD&A for a description and calculation of these measures.

(3) For the purposes of calculating mine-site all-in sustaining costs, the Company does not include an allocation of corporate and administrative and share based compensation expenses.

(4) Includes ore stockpiled during the quarter.

(5) Grams per tonne of gold (“g/t Au”).

(6) Total waste mined includes operating waste and capitalized stripping.

Mulatos District Operational Review

The Mulatos District produced 62,200 ounces in the first quarter, 23% higher than the prior year period, reflecting a record quarter from La Yaqui Grande.

La Yaqui Grande produced 50,000 ounces in the first quarter, exceeding expectations, and an increase of 30% compared to the prior year period. Recovery rates averaged 121%, well above annual guidance, benefiting from the recovery of higher grade ore stacked in the latter part of 2023. Grades stacked averaged 1.31 g/t Au in the quarter, in line with guidance. Stacking rates of 10,800 tpd in the first quarter were above annual guidance, but are expected to average 10,000 tpd for the remainder of the year.

Mulatos produced 12,200 ounces in the first quarter following commencement of residual leaching in December 2023. The operation is expected to benefit from ongoing gold production at decreasing rates in 2024.

Financial Review (Mulatos District)

Revenues of $123.9 million in the first quarter were 22% higher than the prior year period, reflecting higher realized gold prices and higher ounces sold.

Cost of sales of $74.8 million in the first quarter were 20% higher than in the prior year period due to the significant increase in ounces sold. On a per ounce basis, cost of sales were slightly lower than the prior year period reflecting the greater contribution of low-cost ounces at La Yaqui Grande.

Total cash costs of $840 per ounce and mine-site AISC of $905 per ounce in the first quarter were lower than the prior year period and below annual guidance due to the greater contribution of low-cost production from La Yaqui Grande, offset in part by ongoing inflationary pressures. Both total cash costs and mine-site AISC are expected to increase through the remainder of the year to be consistent with annual guidance reflecting lower rates of production due to lower grades at La Yaqui Grande.

Capital expenditures totaled $3.9 million in the first quarter, including sustaining capital of $1.4 million, and $1.9 million of capitalized exploration focused on drilling at PDA.

The Mulatos District generated mine-site free cash flow of $49.7 million for the first quarter, net of $45.3 million of cash tax payments primarily related to 2023 income and mining taxes payable given the increased profitability of the operation. The Company expects cash tax payments to decrease to approximately $10 million per quarter for the remainder of the year, related to the 2024 tax year. The 35% increase in mine-site free cash flow as compared to the prior year period was driven by record production from La Yaqui Grande, partially offset by higher cash tax payments.

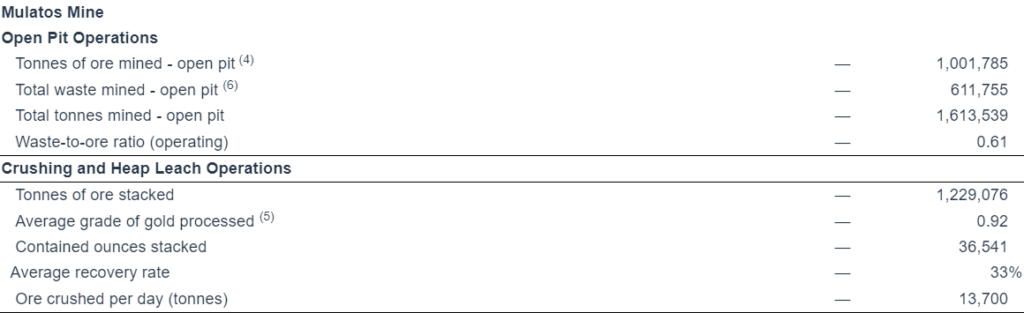

First Quarter 2024 Development Activities

Island Gold (Ontario, Canada)

Phase 3+ Expansion

On June 28, 2022, the Company reported results of the Phase 3+ Expansion Study (“P3+ Expansion Study”) conducted on its Island Gold mine, located in Ontario, Canada.

The Phase 3+ Expansion to 2,400 tpd from the current rate of 1,200 tpd will involve various infrastructure investments. These include the installation of a shaft, paste plant, expansion of the mill as well as accelerated development to support the higher mining rates. Following the completion of the expansion in 2026, the operation will transition from trucking ore and waste up the ramp to skipping ore and waste to surface through the new shaft infrastructure, driving production higher and costs significantly lower.

With the acquisition of Argonaut’s Magino mine expected to close in July, the expansion of the Island Gold mill and tailings facility will no longer be required providing immediate capital savings. Starting in 2025, ore from Island Gold is expected to be processed through the larger and more cost effective Magino mill, providing significant ongoing operating synergies.

Construction of the Phase 3+ Expansion continued through the first quarter of 2024 with progress summarized below:

- Completed the mechanical and electrical outfitting for hoist house and headframe

- Shaft sinking advanced to a depth of 185 metres (“m”) by the end of the first quarter with sinking rates increasing to 2.5 m per day in March

- Paste plant detailed engineering 85% complete; issuance of long lead time equipment procurement packages is ongoing with construction activities expected to begin in the second half of 2024

- Advanced lateral development to support higher mining rates with the Phase 3+ Expansion

The Phase 3+ Expansion remains on schedule to be completed during the first half of 2026. During the first quarter of 2024, the Company spent $37.6 million on the Phase 3+ Expansion and capital development. As of March 31, 2024, 57% of the total initial growth capital of $756 million has been spent and committed on the project. Capital spending is tracking well for work completed to date; however, continuing labour cost pressures may impact future project costs. Following the expected closing of the Magino acquisition in July 2024, the Company will provide updated capital estimates to reflect upgrades to the Magino mill and with the Island Gold mill expansion no longer required. Progress on the Expansion is detailed as follows:

(1) Phase 3+ 2400 Study is as of January 2022. Phase 3+ capital estimate based on USD/CAD exchange $0.78:1. Spent to date based on average USD/CAD of $0.75:1 since the start of 2022. Committed to date based on the spot USD/CAD rate as at March 31, 2024 of $0.75:1.

(2) Amount spent to date accounted for on an accrual basis, including working capital movements.

(3) Contingency has been allocated to the various areas.

(4) No further capital is expected to be incurred on the Island Gold mill expansion with the acquisition of Argonaut, expected to close in July 2024.

Shaft site area – April 2024

Lynn Lake (Manitoba, Canada)

On August 2, 2023, the Company reported the results of an updated Feasibility Study (“2023 Study”) conducted on the project which replaces the previous Feasibility Study completed in 2017 (“2017 Study”). The 2023 Study incorporates a 44% larger Mineral Reserve and 14% increase in milling rates to 8,000 tpd supporting a larger, longer-life, low-cost operation. The 2023 Study has been updated to reflect the current costing environment, as well as a significant amount of additional engineering, on-site geotechnical investigation work, and requirements outlined during the permitting process with the EIS granted in March 2023. Highlights of the study include:

- average annual gold production of 207,000 ounces over the first five years and 176,000 ounces over the initial 10 years

- low-cost profile: average mine-site all-in sustaining costs of $699 per ounce over the first 10-years and $814 per ounce over the life of mine

- 44% larger Mineral Reserve totaling 2.3 million ounces grading 1.52 g/t Au (47.6 million tonnes (“mt”))

- 17-year mine life, life of mine production of 2.2 million ounces

- After-tax net present value (“NPV”) (5%) of $428 million (base case gold price assumption of $1,675 per ounce and USD/CAD foreign exchange rate of $0.75:1); after-tax internal rate of return (“IRR”) of 17%

- After-tax NPV (5%) of $670 million, and an after-tax IRR of 22%, at current gold prices of approximately $1,950 per ounce

- Payback of less than four years at the base case gold price of $1,675 per ounce and less than three years at a $1,950 per ounce gold prices

Development spending (excluding exploration) was $3.6 million in the first quarter of 2024, primarily on detailed engineering, which is 80% complete. The focus in 2024 is on further de-risking and advancing the project ahead of an anticipated construction decision in 2025. This includes completion of detailed engineering, and commencement of early works, including road construction and power line upgrades. The majority of the $25 million capital budget in 2024 is spending included as initial capital in the 2023 Feasibility Study.

Kirazlı (Çanakkale, Türkiye)

On October 14, 2019, the Company suspended all construction activities on its Kirazlı project following the Turkish government’s failure to grant a routine renewal of the Company’s mining licenses, despite the Company having met all legal and regulatory requirements for their renewal. In October 2020, the Turkish government refused the renewal of the Company’s Forestry Permit. The Company had been granted approval of all permits required to construct Kirazlı including the Environmental Impact Assessment approval, Forestry Permit, and GSM (Business Opening and Operation) permit, and certain key permits for the nearby Ağı Dağı and Çamyurt Gold Mines. These permits were granted by the Turkish government after the project earned the support of the local communities and passed an extensive multi-year environmental review and community consultation process.

On April 20, 2021, the Company announced that its Netherlands wholly-owned subsidiaries Alamos Gold Holdings Coöperatief U.A, and Alamos Gold Holdings B.V. (the “Subsidiaries”) would be filing an investment treaty claim against the Republic of Türkiye for expropriation and unfair and inequitable treatment. The claim was filed under the Netherlands-Türkiye Bilateral Investment Treaty (the “Treaty”). Alamos Gold Holdings Coöperatief U.A. and Alamos Gold Holdings B.V. had their claim against the Republic of Türkiye registered on June 7, 2021 with the International Centre for Settlement of Investment Disputes (World Bank Group).

Bilateral investment treaties are agreements between countries to assist with the protection of investments. The Treaty establishes legal protections for investment between Türkiye and the Netherlands. The Subsidiaries directly own and control the Company’s Turkish assets. The Subsidiaries invoking their rights pursuant to the Treaty does not mean that they relinquish their rights to the Turkish project, or otherwise cease the Turkish operations. The Company will continue to work towards a constructive resolution with the Republic of Türkiye.

The Company incurred $1.4 million in the first quarter of 2024 related to ongoing care and maintenance and arbitration costs to progress the Treaty claim, which was expensed.

First Quarter 2024 Exploration Activities

Island Gold (Ontario, Canada)

The 2024 near mine exploration program will continue to focus on defining new Mineral Reserves and Resources in proximity to existing production horizons and underground infrastructure through both underground and surface exploration drilling.

As announced on February 13, 2024, the 2023 exploration program was successful with high-grade Mineral Reserves and Resources added across all categories to now total 6.1 million ounces, a 16% increase from the end of 2022. This included an 18% increase in Mineral Reserves to 1.7 million ounces (5.2 mt grading 10.30 g/t Au), a 146% increase in Measured and Indicated Mineral Resources to 0.7 million ounces (2.6 mt grading 8.73 g/t Au) and a 4% increase in Inferred Mineral Resources to 3.7 million ounces (7.9 mt grading 14.58 g/t Au).

The majority of these high-grade Mineral Reserve and Resource additions were in proximity to existing production horizons and infrastructure. This included additions within the main Island Gold structure as well as within the hanging wall and footwall. Given their proximity to existing infrastructure, these ounces are expected to be low cost to develop and could be incorporated into the mine plan and mined within the next several years, further increasing the value of the operation.

A total of $19 million has been budgeted for exploration at Island Gold in 2024, up from $14 million in 2023, with both a larger near mine and regional exploration program. This includes 41,000 m of underground exploration drilling, 12,500 m of near-mine surface exploration drilling, and 10,000 m of surface regional exploration drilling.

To support the underground exploration drilling program, 460 m of underground exploration drift development is planned to extend drill platforms on the 850 and 1025 m levels. In addition to the exploration budget, 32,000 m of underground delineation drilling has been planned and included in sustaining capital for Island Gold which will be focused on the conversion of the large Mineral Resource base to Mineral Reserves.

The 2024 regional exploration program will follow up on high-grade mineralization intersected at the Pine-Breccia and 88-60 targets, located 4 km and 7 km, respectively, from the Island Gold mine. Drilling will also be completed in proximity to the past-producing Cline and Edwards mines, as well as at the Island Gold North Shear target. Additionally, a comprehensive data compilation project is underway across the 40,000-hectare Manitou land package that was acquired in 2023 in support of future exploration targeting.

During the first quarter, 11,967 m of underground exploration drilling was completed in 45 holes, and 2,631 m of surface drilling was completed in two holes. Additionally, a total of 9,425 m of underground delineation drilling was completed in 37 holes, focused on in-fill drilling to convert Mineral Resources to Mineral Reserves. A total of 159 m of underground exploration drift development was also completed during the first quarter.

The regional exploration drilling program also commenced in the first quarter, with 565 m completed in one hole targeting mineralization in the North Shear, Webb Lake Stock, and up-plunge of Island West (C-zone).

Total exploration expenditures during the first quarter of 2024 were $4.2 million, of which $3.5 million was capitalized.

Young-Davidson (Ontario, Canada)

A total of $12 million has been budgeted for exploration at Young-Davidson in 2024, up from $8 million spent in 2023. This includes 21,600 m of underground exploration drilling, and 1,070 m of underground exploration development to extend drill platforms on multiple levels. The majority of the underground exploration drilling program will be focused on extending mineralization within the Young-Davidson syenite, which hosts the majority of Mineral Reserves and Resources. Drilling will also test the hanging wall and footwall of the deposit where higher grades have been previously intersected.

The regional program has been expanded with 7,000 m of surface drilling planned in 2024, up from 5,000 m in 2023. The focus will be on testing multiple near-surface targets across the 5,900 hectare Young-Davidson Property that could potentially provide supplemental mill feed.

During the first quarter, two underground exploration drills completed 7,753 m in 21 holes from the 9220 West exploration drift, 9025 East Footwall, and the 9620 hanging wall area. Drilling is targeting syenite-hosted mineralization as well as continuing to test mineralization in the hanging wall sediments and mafic-ultramafic stratigraphy.

In addition, 1,477 m of surface drilling was completed in four holes in the first quarter, in the Otisse NE target area.

Total exploration expenditures during the first quarter were $1.5 million of which $1.0 million was capitalized.

Mulatos District (Sonora, Mexico)

A total of $19 million has been budgeted at Mulatos for exploration in 2024, similar to spending in 2023. The near-mine and regional drilling program is expected to total 55,000 m. This includes 27,000 m of surface exploration drilling at PDA and the surrounding area. This drilling will follow up on another successful year of exploration at PDA in 2023, with Mineral Reserves increasing 33% to 1.0 million ounces (5.4 mt grading 5.61 g/t Au) and grades also increasing 16%. This growth in higher-grade Mineral Reserves will be incorporated into an updated development plan which is expected to be completed in the second quarter of 2024.

During the first quarter, exploration activities continued at PDA and the near-mine area with 10,130 m of drilling completed in 36 holes. Drilling was focused on infill drilling the GAP-Victor portion of the Mineral Resource.

Drilling also commenced at Cerro Pelon evaluating the high-grade sulphide potential to the north of the historical open pit. A total of 2,950 m in nine holes were completed in the first quarter. At Refugio, 2,165 m was drilled in eight holes to follow up drill holes 23REF012 (2.01 g/t Au over 82.45 m core length, including 4.81 g/t Au over 16.40 m and 5.38 g/t Au over 12.35m) and 23REF022 (2.73 g/t Au over 120.85 m core length, including 9.31 g/t Au over 29.05 m) which were intersected in 2023 (drill hole composite gold grades reported at Capulin as uncut). Drilling continues to test the geometry of the breccia unit and the extent of the gold mineralization, as well as targets across the broader Capulin area.

Additionally, 2,139 m was drilled in six holes, testing greenfields targets across the property

During the first quarter, exploration spending at Mulatos totaled $5.2 million of which $1.9 million was capitalized.

Lynn Lake (Manitoba, Canada)

A total of $9 million has been budgeted for exploration at the Lynn Lake project in 2024, up from $5 million in 2023. This includes 15,500 m of drilling focused on the conversion of Mineral Resources to Mineral Reserves at the Burnt Timber and Linkwood deposits, and to evaluate the potential for Mineral Resources at Maynard, an advanced stage greenfield target.

Burnt Timber and Linkwood contain Inferred Mineral Resources totaling 1.6 million ounces grading 1.1 g/t Au (44 million tonnes) as of December 31, 2023. The Company sees excellent potential for this to be converted into a smaller, higher quality Mineral Reserve which could be incorporated into the Lynn Lake Gold Project given its proximity to the planned mill. A study incorporating these deposits into the Lynn Lake project is expected to be competed in the fourth quarter of 2024, and represents potential production and economic upside to the 2023 Feasibility Study.

Surface exploration drilling in the first quarter focused on the infill drilling program at Linkwood, with 8,564 m completed in 46 holes. Following the expected completion of the Linkwood program in the second quarter, the focus will shift to complete the infill drilling program at Burnt Timber, and the exploration drilling program at Maynard.

Exploration spending totaled $1.9 million in the first quarter, all of which was capitalized.

Review of First Quarter Financial Results

During the first quarter of 2024, the Company sold 132,849 ounces of gold for record operating revenues of $277.6 million. This represented a 10% increase from the prior year period due primarily to a higher realized gold price.

Cost of sales (which includes mining and processing costs, royalties, and amortization expense) were $173.6 million in the first quarter, 12% higher than the prior year period. Key drivers of changes to cost of sales as compared to the prior year period were as follows:

Mining and processing costs were $121.0 million, 14% higher than the prior year period. The increase was driven by inflationary pressures, and the inclusion of silver sales as an offset to mining and processing costs in the prior year period.

Total cash costs of $910 per ounce and AISC of $1,265 per ounce were higher than the prior year period due to inflationary pressures and lower grades mined and lower mining rates at Young-Davidson.

Royalty expense was $2.6 million in the first quarter, slightly higher than the prior year period of $2.5 million, due to the higher average realized gold price.

Amortization of $50.0 million, or $376 per ounce, in the first quarter was consistent with annual guidance and higher than the prior year period.

The Company recognized earnings from operations of $81.4 million in the first quarter, 9% higher than the prior year period, primarily as a result of the higher realized gold price.

The Company reported net earnings of $42.1 million in the first quarter, compared to $48.4 million in the prior year period. Adjusted earnings(1) were $51.2 million, or $0.13 per share, which included adjustments for other losses, primarily comprised of unrealized losses on derivatives and disposals of certain plant and equipment, and unrealized net foreign exchange losses recorded within deferred taxes.

(1) Refer to the “Non-GAAP Measures and Additional GAAP Measures” disclosure at the end of this press release and associated MD&A for a description and calculation of these measures.

Associated Documents

This press release should be read in conjunction with the Company’s interim consolidated financial statements for the three-month period ended March 31, 2024 and associated Management’s Discussion and Analysis (“MD&A”), which are available from the Company’s website, www.alamosgold.com, in the “Investors” section under “Reports and Financials”, and on SEDAR+ (www.sedarplus.com) and EDGAR (www.sec.gov).

Reminder of First Quarter 2024 Results Conference Call

The Company’s senior management will host a conference call on Thursday, April 25, 2024 at 11:00 am ET to discuss the first quarter 2024 results. Participants may join the conference call via webcast or through the following dial-in numbers:

| Toronto and International: | (416) 340-2217 |

| Toll free (Canada and the United States): | (800) 806-5484 |

| Participant passcode: | 4626879# |

| Webcast: | www.alamosgold.com |

A playback will be available until May 25, 2024 by dialling (905) 694-9451 or (800) 408-3053 within Canada and the United States. The passcode is 6793309#. The webcast will be archived at www.alamosgold.com.

Qualified Persons

Chris Bostwick, FAusIMM, Alamos’ Senior Vice President, Technical Services, who is a qualified person within the meaning of National Instrument 43-101 (“Qualified Person”), has reviewed and approved the scientific and technical information contained in this press release.

About Alamos

Alamos is a Canadian-based intermediate gold producer with diversified production from three operating mines in North America. This includes the Young-Davidson and Island Gold mines in northern Ontario, Canada and the Mulatos mine in Sonora State, Mexico. Additionally, the Company has a strong portfolio of growth projects, including the Phase 3+ Expansion at Island Gold, and the Lynn Lake project in Manitoba, Canada. Alamos employs more than 1,900 people and is committed to the highest standards of sustainable development. The Company’s shares are traded on the TSX and NYSE under the symbol “AGI”.

FOR FURTHER INFORMATION, PLEASE CONTACT:

| Scott K. Parsons | |

| Senior Vice President, Investor Relations | |

| (416) 368-9932 x 5439 | |

The TSX and NYSE have not reviewed and do not accept responsibility for the adequacy or accuracy of this release.

Cautionary Note Regarding Forward-Looking Statements

This press release contains or incorporates by reference “forward-looking statements” and “forward-looking information” as defined under applicable Canadian and U.S. securities legislation. All statements, other than statements of historical fact, which address events, results, outcomes or developments that the Company expects to occur are, or may be deemed, to be, forward-looking statements and are based on expectations, estimates and projects as at the date of this press release. Forward-looking statements are generally, but not always, identified by the use of forward-looking terminology such as “expect”, “assume”, “believe”, “anticipate”, “intend”, “objective”, “estimate”, “potential”, “forecast”, “budget”, “target”, “goal”, “on track”, “on pace”, “outlook”, “continue”, “ongoing”, “plan” or variations of such words and phrases and similar expressions or statements that certain actions, events or results “may”, “could”, “would”, “might” or “will” be taken, occur or be achieved or the negative connotation of such terms.

Such statements include, but may not be limited to, guidance and expectations pertaining to: gold production, production potential, gold grades, gold prices, free cash flow, total cash costs, all-in sustaining costs, mine-site all-in sustaining costs, capital expenditures, total sustaining and growth capital, capitalized exploration, future fluctuations in the Company’s effective tax rate and other statements related to the payment of taxes, including cash tax payments in Mexico; achieving annual guidance; expected completion of the acquisition of Argonaut Gold Inc. and its Magino mine by Alamos and the expectation that the integration of the Company’s Island Gold mine with the Magino mine will create one of the largest and lowest cost gold mines in Canada, unlock significant value with pre-tax synergies, result in capital savings, operating savings and synergies and de-risking of the Phase 3+ Expansion project at Island Gold, increase Company-wide gold production and longer term production potential and create opportunities for further expansions of the combined Island Gold and Magino operations; the intended spinout of Argonaut’s assets in the United States and Mexico and the creation of a new junior gold producer (SpinCo); expected timing of closing of the Argonaut acquisition transaction; increases to production, value of operation and decreases to costs resulting from intended completion of the Phase 3+ Expansion at Island Gold; intended infrastructure investments in, method of funding for, and timing of the completion of, the Phase 3+ Expansion; timing of construction decision for the Lynn Lake project; the expectation that the Lynn Lake project will be an attractive, low-cost long-life growth project in Canada with significant exploration upside; expenditures on the development of the Lynn Lake project; exploration potential, budgets, focuses, programs, targets and projected exploration results; returns to stakeholders; potential for further growth from PDA, a new development plan for PDA and the expected timing of its completion; mine life, including an anticipated mine life extension at Mulatos; Mineral Reserve life; Mineral Reserve and Resource grades; reserve and resource estimates; mining and milling rates; the Company’s approach to reduction of its environmental footprint, community relations and governance; as well as other general information as to strategy, plans or future financial or operating performance, such as the Company’s expansion plans, project timelines, production plans and expected sustainable productivity increases, expected increases in mining activities and corresponding cost efficiencies, forecasted cash shortfalls and the Company’s ability to fund them, cost estimates, sufficiency of working capital for future commitments and other statements that express management’s expectations or estimates of future plans and performance.

Alamos cautions that forward-looking statements are necessarily based upon a number of factors and assumptions that, while considered reasonable by the Company at the time of making such statements, are inherently subject to significant business, economic, technical, legal, political and competitive uncertainties and contingencies. Known and unknown factors could cause actual results to differ materially from those projected in the forward-looking statements and undue reliance should not be placed on such statements and information.

Risk factors that may affect Alamos’ ability to achieve the expectations set forth in the forward-looking statements in this document include, but are not limited to: changes to current estimates of mineral reserves and resources; changes to production estimates (which assume accuracy of projected ore grade, mining rates, recovery timing and recovery rate estimates which may be impacted by unscheduled maintenance, weather issues, labour and contractor availability and other operating or technical difficulties); operations may be exposed to illnesses, diseases, epidemics and pandemics, including any ongoing effects and potential further effects of COVID-19; the impact of any illness, disease, epidemic or pandemic on the broader market and the trading price of the Company’s shares; provincial and federal orders or mandates (including with respect to mining operations generally or auxiliary businesses or services required for the Company’s operations) in Canada, Mexico, the United States and Türkiye; the duration of any regulatory responses to any illness, disease, epidemic or pandemic; government and the Company’s attempts to reduce the spread of any illness, disease, epidemic or pandemic which may affect many aspects of the Company’s operations including the ability to transport personnel to and from site, contractor and supply availability and the ability to sell or deliver gold doré bars; fluctuations in the price of gold or certain other commodities such as, diesel fuel, natural gas, and electricity; changes in foreign exchange rates (particularly the Canadian Dollar, Mexican peso, U.S. dollar and Turkish lira); the impact of inflation; changes in the Company’s credit rating; any decision to declare a quarterly dividend; employee and community relations; not receiving the requisite approvals for completion of the transaction pursuant to which Alamos would acquire Argonaut Gold Inc.; litigation and administrative proceedings (including but not limited to the investment treaty claim announced on April 20, 2021 against the Republic of Türkiye by the Company’s wholly-owned Netherlands subsidiaries, Alamos Gold Holdings Coöperatief U.A, and Alamos Gold Holdings B.V., the application for judicial review of the positive Decision Statement issued by the Department of Environment and Climate Change Canada commenced by the Mathias Colomb Cree Nation (MCCN) in respect of the Lynn Lake project and the MCCN’s corresponding internal appeal of the Environment Act Licenses issued by the Province of Manitoba for the project); disruptions affecting operations; risks associated with the startup of new mines; availability of and increased costs associated with mining inputs and labour; delays with the Phase 3+ expansion project at the Island Gold mine; court or other administrative decisions impacting the Company’s approved Environmental Impact Study and/or issued project permits, construction decisions and any development of the Lynn Lake project; delays in the development or updating of mine plans; changes with respect to the intended method of accessing and mining the deposit at PDA and changes related to the intended method of processing any ore from the deposit of PDA; the risk that the Company’s mines may not perform as planned; uncertainty with the Company’s ability to secure additional capital to execute its business plans; the speculative nature of mineral exploration and development, including the risks of obtaining and maintaining necessary licenses and permits, including the necessary licenses, permits, authorizations and/or approvals from the appropriate regulatory authorities for the Company’s development stage and operating assets; labour and contractor availability (and being able to secure the same on favourable terms); contests over title to properties; expropriation or nationalization of property; inherent risks and hazards associated with mining and mineral processing including environmental hazards, industrial hazards, industrial accidents, unusual or unexpected formations, pressures and cave-ins; changes in national and local government legislation, controls or regulations in Canada, Mexico, Türkiye, the United States and other jurisdictions in which the Company does or may carry on business in the future; increased costs and risks related to the potential impact of climate change; failure to comply with environmental and health and safety laws and regulations; disruptions in the maintenance or provision of required infrastructure and information technology systems; risk of loss due to sabotage, protests and other civil disturbances; the impact of global liquidity and credit availability and the values of assets and liabilities based on projected future cash flows; risks arising from holding derivative instruments; and business opportunities that may be pursued by the Company. The litigation against the Republic of Türkiye, described above, results from the actions of the Turkish government in respect of the Company’s projects in the Republic of Türkiye. Such litigation is a mitigation effort and may not be effective or successful. If unsuccessful, the Company’s projects in Türkiye may be subject to resource nationalism and further expropriation; the Company may lose any remaining value of its assets and gold mining projects in Türkiye and its ability to operate in Türkiye. Even if the litigation is successful, there is no certainty as to the quantum of any damages award or recovery of all, or any, legal costs. Any resumption of activities in Türkiye, or even retaining control of its assets and gold mining projects in Türkiye can only result from agreement with the Turkish government. The investment treaty claim described in this press release may have an impact on foreign direct investment in the Republic of Türkiye which may result in changes to the Turkish economy, including but not limited to high rates of inflation and fluctuation of the Turkish Lira which may also affect the Company’s relationship with the Turkish government, the Company’s ability to effectively operate in Türkiye, and which may have a negative effect on overall anticipated project values.

Additional risk factors and details with respect to risk factors that may affect the Company’s ability to achieve the expectations set forth in the forward-looking statements contained in this press release are set out in the Company’s latest 40-F/Annual Information Form under the heading “Risk Factors”, which is available on the SEDAR+ website at www.sedarplus.ca or on EDGAR at www.sec.gov. The foregoing should be reviewed in conjunction with the information, risk factors and assumptions found in this press release.

The Company disclaims any intention or obligation to update or revise any forward-looking statements whether as a result of new information, future events or otherwise, except as required by applicable law.

Cautionary Note to U.S. Investors Concerning Measured, Indicated and Inferred Resources

Measured, Indicated and Inferred Resources: All resource and reserve estimates included in this press release or documents referenced in this press release have been prepared in accordance with Canadian National Instrument 43-101 – Standards of Disclosure for Mineral Projects (“NI 43-101”) and the Canadian Institute of Mining, Metallurgy and Petroleum (the “CIM”) – CIM Definition Standards on Mineral Resources and Mineral Reserves, adopted by the CIM Council, as amended (the “CIM Standards”). NI 43-101 is a rule developed by the Canadian Securities Administrators, which established standards for all public disclosure an issuer makes of scientific and technical information concerning mineral projects. Mining disclosure in the United States was previously required to comply with SEC Industry Guide 7 (“SEC Industry Guide 7”) under the United States Securities Exchange Act of 1934, as amended. The U.S. Securities and Exchange Commission (the “SEC”) has adopted final rules, to replace SEC Industry Guide 7 with new mining disclosure rules under sub-part 1300 of Regulation S-K of the U.S. Securities Act (“Regulation S-K 1300”) which became mandatory for U.S. reporting companies beginning with the first fiscal year commencing on or after January 1, 2021. Under Regulation S-K 1300, the SEC now recognizes estimates of “Measured Mineral Resources”, “Indicated Mineral Resources” and “Inferred Mineral Resources”. In addition, the SEC has amended its definitions of “Proven Mineral Reserves” and “Probable Mineral Reserves” to be substantially similar to international standards.

Investors are cautioned that while the above terms are “substantially similar” to CIM Definitions, there are differences in the definitions under Regulation S-K 1300 and the CIM Standards. Accordingly, there is no assurance any mineral reserves or mineral resources that the Company may report as “proven mineral reserves”, “probable mineral reserves”, “measured mineral resources”, “indicated mineral resources” and “inferred mineral resources” under NI 43-101 would be the same had the Company prepared the mineral reserve or mineral resource estimates under the standards adopted under Regulation S-K 1300. U.S. investors are also cautioned that while the SEC recognizes “measured mineral resources”, “indicated mineral resources” and “inferred mineral resources” under Regulation S-K 1300, investors should not assume that any part or all of the mineralization in these categories will ever be converted into a higher category of mineral resources or into mineral reserves. Mineralization described using these terms has a greater degree of uncertainty as to its existence and feasibility than mineralization that has been characterized as reserves. Accordingly, investors are cautioned not to assume that any measured mineral resources, indicated mineral resources, or inferred mineral resources that the Company reports are or will be economically or legally mineable.

International Financial Reporting Standards: The consolidated financial statements of the Company have been prepared by management in accordance with International Financial Reporting Standards, as issued by the International Accounting Standards Board (note 2 and 3 to the consolidated financial statements for the year ended December 31, 2023). These accounting principles differ in certain material respects from accounting principles generally accepted in the United States of America. The Company’s reporting currency is the United States dollar unless otherwise noted.

Non-GAAP Measures and Additional GAAP Measures

The Company has included certain non-GAAP financial measures to supplement its Consolidated Financial Statements, which are presented in accordance with IFRS, including the following:

- adjusted net earnings and adjusted earnings per share;

- cash flow from operating activities before changes in working capital and taxes received;

- company-wide free cash flow;

- total mine-site free cash flow;

- mine-site free cash flow;

- total cash cost per ounce of gold sold;

- AISC per ounce of gold sold;

- Mine-site AISC per ounce of gold sold;

- sustaining and non-sustaining capital expenditures; and

- earnings before interest, taxes, depreciation, and amortization (“EBITDA”)

The Company believes that these measures, together with measures determined in accordance with IFRS, provide investors with an improved ability to evaluate the underlying performance of the Company. Non-GAAP financial measures do not have any standardized meaning prescribed under IFRS, and therefore they may not be comparable to similar measures employed by other companies. The data is intended to provide additional information and should not be considered in isolation or as a substitute for measures of performance prepared in accordance with IFRS. Management’s determination of the components of non-GAAP and additional measures are evaluated on a periodic basis influenced by new items and transactions, a review of investor uses and new regulations as applicable. Any changes to the measures are dully noted and retrospectively applied as applicable.

Adjusted Net Earnings and Adjusted Earnings per Share

“Adjusted net earnings” and “adjusted earnings per share” are non-GAAP financial measures with no standard meaning under IFRS which exclude the following from net earnings (loss):

- Foreign exchange (gain) loss

- Items included in other loss

- Certain non-recurring items

- Foreign exchange loss recorded in deferred tax expense

- The income and mining tax impact of items included in other loss

Net earnings have been adjusted, including the associated tax impact, for the group of costs in “other loss” on the consolidated statement of comprehensive income. Transactions within this grouping are: the fair value changes on non-hedged derivatives; loss on disposal of assets; and Turkish Projects care and maintenance and arbitration costs. The adjusted entries are also impacted for tax to the extent that the underlying entries are impacted for tax in the unadjusted net earnings.

The Company uses adjusted net earnings for its own internal purposes. Management’s internal budgets and forecasts and public guidance do not reflect the items which have been excluded from the determination of adjusted net earnings. Consequently, the presentation of adjusted net earnings enables shareholders to better understand the underlying operating performance of the core mining business through the eyes of management. Management periodically evaluates the components of adjusted net earnings based on an internal assessment of performance measures that are useful for evaluating the operating performance of our business and a review of the non-GAAP measures used by mining industry analysts and other mining companies.

Adjusted net earnings is intended to provide additional information only and does not have any standardized meaning under IFRS and may not be comparable to similar measures presented by other companies. It should not be considered in isolation or as a substitute for measures of performance prepared in accordance with IFRS. The measure is not necessarily indicative of operating profit or cash flows from operations as determined under IFRS. The following table reconciles this non-GAAP measure to the most directly comparable IFRS measure.

| (in millions) | ||||||

| Three Months Ended March 31, | ||||||

| 2024 | 2023 | |||||

| Net earnings | $42.1 | $48.4 | ||||

| Adjustments: | ||||||

| Foreign exchange loss | 0.9 | 0.1 | ||||

| Other loss | 4.8 | 1.3 | ||||

| Unrealized foreign exchange loss (gain) recorded in deferred tax expense | 3.6 | (4.2 | ) | |||

| Other income and mining tax adjustments | (0.2 | ) | (0.2 | ) | ||

| Adjusted net earnings | $51.2 | $45.4 | ||||

| Adjusted earnings per share – basic | $0.13 | $0.12 |

Cash Flow from Operating Activities before Changes in Working Capital and Cash Taxes

“Cash flow from operating activities before changes in working capital and cash taxes” is a non-GAAP performance measure that could provide an indication of the Company’s ability to generate cash flows from operations, and is calculated by adding back the change in working capital and taxes received to “Cash provided by (used in) operating activities” as presented on the Company’s consolidated statements of cash flows. “Cash flow from operating activities before changes in working capital” is a non-GAAP financial measure with no standard meaning under IFRS.

The following table reconciles the non-GAAP measure to the consolidated statements of cash flows.

| (in millions) | ||||

| Three Months Ended March 31, | ||||

| 2024 | 2023 | |||

| Cash flow from operating activities | $108.9 | $94.3 | ||

| Add: Changes in working capital and taxes paid | 26.0 | 32.9 | ||

| Cash flow from operating activities before changes in working capital and taxes paid | $134.9 | $127.2 |

Company-wide Free Cash Flow

“Company-wide free cash flow” is a non-GAAP performance measure calculated from the consolidated operating cash flow, less consolidated mineral property, plant and equipment expenditures. The Company believes this to be a useful indicator of our ability to operate without reliance on additional borrowing or usage of existing cash company-wide. Company-wide free cash flow is intended to provide additional information only and does not have any standardized meaning under IFRS and may not be comparable to similar measures of performance presented by other mining companies. Company-wide free cash flow should not be considered in isolation or as a substitute for measures of performance prepared in accordance with IFRS.

| (in millions) | ||||||

| Three Months Ended March 31, | ||||||

| 2024 | 2023 | |||||

| Cash flow from operating activities | $108.9 | $94.3 | ||||

| Less: mineral property, plant and equipment expenditures | (84.5 | ) | (83.8 | ) | ||

| Company-wide free cash flow | $24.4 | $10.5 |

Mine-site Free Cash Flow

“Mine-site free cash flow” is a non-GAAP financial performance measure calculated as cash flow from mine-site operating activities, less mineral property, plant and equipment expenditures. The Company believes this to be a useful indicator of our ability to operate without reliance on additional borrowing or usage of existing cash. Mine-site free cash flow is intended to provide additional information only and does not have any standardized meaning under IFRS and may not be comparable to similar measures of performance presented by other mining companies. Mine-site free cash flow should not be considered in isolation or as a substitute for measures of performance prepared in accordance with IFRS.

| Consolidated Mine-Site Free Cash Flow | Three Months Ended March 31, | |||||

| 2024 | 2023 | |||||

| (in millions) | ||||||

| Cash flow from operating activities | $108.9 | $94.3 | ||||

| Add: operating cash flow used by non-mine site activity | 20.4 | 18.4 | ||||

| Cash flow from operating mine-sites | $129.3 | $112.7 | ||||

| Mineral property, plant and equipment expenditure | $84.5 | $83.8 | ||||

| Less: capital expenditures from development projects, and corporate | (5.8 | ) | (3.7 | ) | ||

| Capital expenditure and capital advances from mine-sites | $78.7 | $80.1 | ||||

| Total mine-site free cash flow | $50.6 | $32.6 |

| Young-Davidson Mine-Site Free Cash Flow | Three Months Ended March 31, | |||||

| 2024 | 2023 | |||||

| (in millions) | ||||||

| Cash flow from operating activities | $34.8 | $33.7 | ||||

| Mineral property, plant and equipment expenditure | (20.2 | ) | (17.4 | ) | ||

| Mine-site free cash flow | $14.6 | $16.3 |

| Island Gold Mine-Site Free Cash Flow | Three Months Ended March 31, | |||||

| 2024 | 2023 | |||||

| (in millions) | ||||||

| Cash flow from operating activities | $40.9 | $36.5 | ||||

| Mineral property, plant and equipment expenditure | (54.6 | ) | (57.0 | ) | ||

| Mine-site free cash flow | ($13.7 | ) | ($20.5 | ) |

| Mulatos District Free Cash Flow | Three Months Ended March 31, | |||||

| 2023 | 2022 | |||||

| (in millions) | ||||||

| Cash flow from operating activities | $53.6 | $42.5 | ||||

| Mineral property, plant and equipment expenditure | (3.9 | ) | (5.7 | ) | ||

| Mine-site free cash flow | $49.7 | $36.8 |

Total Cash Costs per ounce

Total cash costs per ounce is a non-GAAP term typically used by gold mining companies to assess the level of gross margin available to the Company by subtracting these costs from the unit price realized during the period. This non-GAAP term is also used to assess the ability of a mining company to generate cash flow from operations. Total cash costs per ounce includes mining and processing costs plus applicable royalties, and net of by-product revenue and net realizable value adjustments. Total cash costs per ounce is exclusive of exploration costs.

Total cash costs per ounce is intended to provide additional information only and does not have any standardized meaning under IFRS and may not be comparable to similar measures presented by other mining companies. It should not be considered in isolation or as a substitute for measures of performance prepared in accordance with IFRS. The measure is not necessarily indicative of cash flow from operations under IFRS or operating costs presented under IFRS.

All-in Sustaining Costs per ounce and Mine-site All-in Sustaining Costs

The Company adopted an “all-in sustaining costs per ounce” non-GAAP performance measure in accordance with the World Gold Council published in June 2013. The Company believes the measure more fully defines the total costs associated with producing gold; however, this performance measure has no standardized meaning. Accordingly, there may be some variation in the method of computation of “all-in sustaining costs per ounce” as determined by the Company compared with other mining companies. In this context, “all-in sustaining costs per ounce” for the consolidated Company reflects total mining and processing costs, corporate and administrative costs, share-based compensation, exploration costs, sustaining capital, and other operating costs.

For the purposes of calculating “mine-site all-in sustaining costs” at the individual mine-sites, the Company does not include an allocation of corporate and administrative costs and share-based compensation, as detailed in the reconciliations below.

Sustaining capital expenditures are expenditures that do not increase annual gold ounce production at a mine site and excludes all expenditures at the Company’s development projects as well as certain expenditures at the Company’s operating sites that are deemed expansionary in nature. Non-sustaining capital expenditures are expenditures primarily incurred at development projects and costs related to major projects at existing operations, where these projects will materially benefit the mine site. Capitalized exploration expenditures are expenditures that meet the IFRS definition for capitalization, and are incurred to further expand the known Mineral Reserve and Resource at existing operations or development projects. For each mine-site reconciliation, corporate and administrative costs, and non-site specific costs are not included in the all-in sustaining cost per ounce calculation.

All-in sustaining costs per gold ounce is intended to provide additional information only and does not have any standardized meaning under IFRS and may not be comparable to similar measures presented by other mining companies. It should not be considered in isolation or as a substitute for measures of performance prepared in accordance with IFRS.

The measure is not necessarily indicative of cash flow from operations under IFRS or operating costs presented under IFRS.

Total Cash Costs and All-in Sustaining Costs per Ounce Reconciliation Tables

The following tables reconciles these non-GAAP measures to the most directly comparable IFRS measures on a Company-wide and individual mine-site basis.

| Total Cash Costs and AISC Reconciliation – Company-wide | |||||

| Three Months Ended March 31, | |||||

| 2024 | 2023 | ||||

| (in millions, except ounces and per ounce figures) | |||||

| Mining and processing | $121.0 | $106.4 | |||

| By-product credits | (2.7 | ) | — | ||

| Royalties | 2.6 | 2.5 | |||

| Total cash costs | 120.9 | 108.9 | |||

| Gold ounces sold | 132,849 | 132,668 | |||

| Total cash costs per ounce | $910 | $821 | |||

| Total cash costs | $120.9 | $108.9 | |||

| Corporate and administrative (1) | 7.9 | 6.7 | |||

| Sustaining capital expenditures (2) | 26.5 | 26.9 | |||

| Share-based compensation | 9.9 | 11.1 | |||

| Sustaining exploration | 0.8 | 0.7 | |||

| Accretion of decommissioning liabilities | 2.0 | 1.7 | |||

| Total all-in sustaining costs | $168.0 | $156.0 | |||

| Gold ounces sold | 132,849 | 132,668 | |||

| All-in sustaining costs per ounce | $1,265 | $1,176 |