Highlights:

Azure to regain 100% ownership and full control of the Alacrán Project

Teck Resources to become a substantial shareholder of Azure

The Alacrán Project hosts Mineral Resources (ASX: 1 December 2016 & 21 December 2016) in two deposits:

Mesa de Plata: 10.5Mt @ 82g/t Ag for 27.4Mozs of silver, including a high-grade zone of:

1.8Mt @ 275g/t Ag for 15.5Mozs of silver

Loma Bonita: 5.4Mt @ 0.9g/t Au & 28g/t Ag for 150,000oz of gold & 4.8Mozs of silver

Azure Minerals Limited (“Azure” or the “Company”) (ASX: AZS) is pleased to advise that it has accepted a right of first offer proposal (the “Offer”) from Minera Teck S.A. de C.V. (“Teck”), a 100%-owned subsidiary of Canada’s largest diversified resource company, Teck Resources Limited, to consolidate ownership of the Alacrán Project.

Subject to the finalisation of a definitive sale agreement, Azure will retain 100% ownership of the project by issuing to Teck a number of common shares that would result in Teck, and its affiliates, owning 19.9% of Azure’s outstanding shares on a post-issuance basis, a 0.5% NSR royalty on the project, and a participation right on the proceeds of any sale of the project within a five year period (see Appendix 1 for full details). Execution of a definitive sale agreement is expected to occur within the next two months.

Commenting on Azure’s full ownership and control of the Alacrán Project, Azure’s Managing Director, Mr. Tony Rovira, said: “Azure is very pleased to have reached this agreement with Teck. We welcome them as a substantial shareholder of the Company and we look forward to further progressing the Alacrán Project for the benefit of both our companies and all shareholders.

“I believe the Alacrán Project holds significant potential in addition to the Mesa de Plata and Loma Bonita silver and gold deposits, discovered within the first two years of our exploration and which together contain over 32 million ounces of silver and 150,000 ounces of gold.

“The work undertaken by Teck on the Alacrán Project focused on areas away from Mesa de Plata and Loma Bonita and leaves us with a very valuable database and several high priority targets to follow up. Further exploration has the potential to discover significantly more gold and silver mineralisation and add further value to the project.

“Our work on this project will now recommence by revisiting its economic potential while further progressing exploration.”

BACKGROUND

In December 2014, Azure and Teck entered into an agreement whereby Azure could acquire 100% ownership of the Alacrán Project from Teck by sole-funding US$5 million of exploration expenditure over a four-year period. Teck would retain a back-in right which could be exercised within two months of Azure reaching the earn-in milestone.

Within two years, in October 2016, Azure announced that the Company had met the expenditure requirements and thereby earned 100% ownership of the Alacrán Project. During this period, Azure discovered two precious metal deposits: the high-grade Mesa de Plata silver deposit and the Loma Bonita gold-silver deposit.

In December 2016, Teck exercised its right to earn back a 51% interest in the project by sole-funding US$10 million of exploration expenditure over a four-year period between 2017 to 2020. Azure believes Teck’s focus since exercising its back-in right was mainly to explore for significant copper deposits and, while copper mineralisation was encountered at Cerro Alacrán (refer ASX: 6 May 2019), it did not meet expectations for further testing.

PROJECT SUMMARY

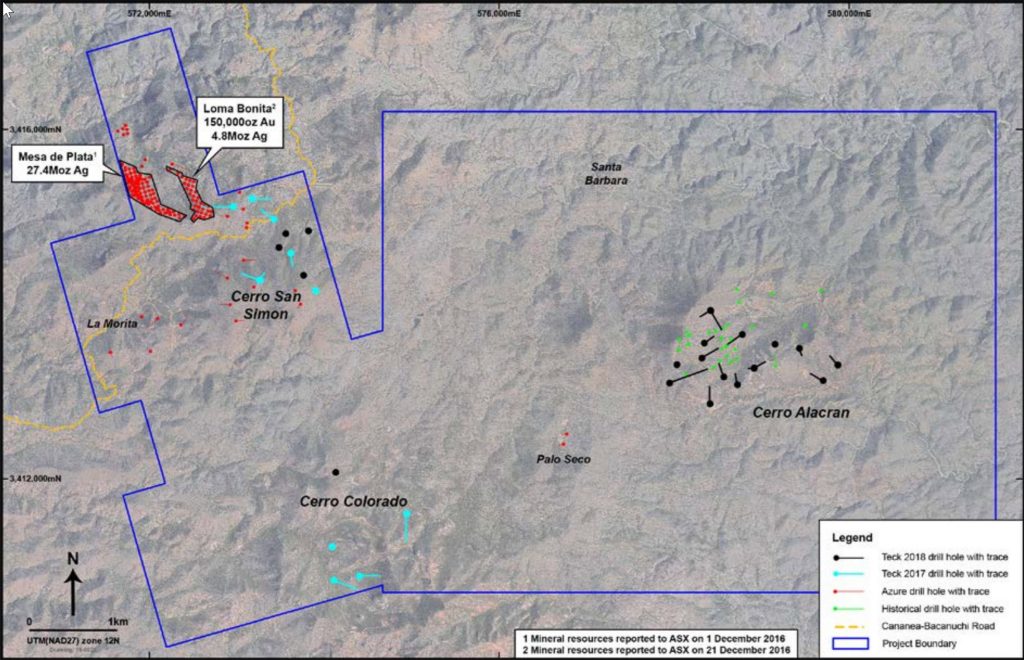

During Azure’s exploration campaign in 2015 and 2016, the Company discovered the near-surface, high-grade Mesa de Plata silver deposit (refer to Table 1 for Mineral Resource) and the adjacent Loma Bonita gold-silver deposit (refer to Table 2 for Mineral Resource) (see Figure 1).

Figure 1: Locations of Mesa de Plata and Loma Bonita deposits and exploration drilling

Azure believes that, in addition to Mesa de Plata and Loma Bonita, Alacrán has the potential to host additional high-grade precious and base metal deposits, and further exploration specifically targeting this style of mineralisation and these commodities will be a high priority.

Mesa De Plata

Silver mineralisation in the Mesa de Plata deposit is hosted in a flat-lying horizon which forms a prominent ridge capping. Mineralisation starts at surface with a true thickness of up to 60m which extends throughout the ridge with excellent internal continuity.

| Zone | Measured Mineral Resource | Indicated Mineral Resource | Total Mineral Resource | ||||||

Tonnes (Mt) | Silver | Tonnes (Mt) | Silver | Tonnes (Mt) | Silver | ||||

| (g/t Ag) | (Moz) | (g/t Ag) | (Moz) | (g/t Ag) | (Moz) | ||||

| High Grade | 1.21 | 307.4 | 12.0 | 0.54 | 201.7 | 3.5 | 1.75 | 274.7 | 15.5 |

| Mid-Grade | 8.43 | 13.0 | 11.7 | 0.28 | 36.2 | 0.3 | 8.71 | 42.8 | 12.0 |

| Total | 9.64 | 76.2 | 23.6 | 0.82 | 145.4 | 3.8 | 10.46 | 81.6 | 27.4 |

| Note: for details refer to ASX announcement dated December 1, 2016 | |||||||||

The Mesa de Plata High Grade Zone contains more than 15 million ounces of silver at an average grade of greater than 270g/t Ag. The High Grade Zone forms the uppermost part of the deposit which makes it very attractive from a mining economics point of view. It has a vertical thickness of approximately 20m and extends over an area of approximately 400m x 150m.

With 85% of the total Mesa de Plata deposit classified within the Measured Resource category, and the remainder classified as Indicated resources, there is a high degree of confidence in the internal continuity and distribution of silver grades throughout the mineralised zone.

Metallurgical and mineral processing testwork was undertaken to test the Mesa de Plata mineralisation, as well as commencing mining, infrastructure, power, water, community and environmental studies as part of an overall project development study. Results demonstrated good potential for a simple and relatively low-cost mining and processing operation. This study was suspended in late-2016 due to Teck’s back-in decision, and Azure will consider recommencing these studies now that the Company has resumed full ownership and operational control.

Loma Bonita

The Loma Bonita gold-silver deposit is situated approximately 200m to the east of the Mesa de Plata silver deposit. Mineralisation extends over 600m north-south and up to 200m east-west with true widths in some places exceeding 100m. The mineralised zone is constrained to the east and west by erosion into arroyos (valleys), but remains open to the northwest along the ridgeline and to the southeast where the topography increases in elevation. Drilling has not closed off the mineralised body either laterally or at depth and further drilling has the potential to expand the current mineral resource.

Table 2: Loma Bonita Mineral Resource (in accordance with the 2012 JORC Code)

| Cut-Off Grade (g/t Au) | JORC Code Classification | Tonnes (Mt) | Gold | Silver | ||

| (g/t) | (kOz) | (g/t) | (Moz) | |||

| ≥ 0.5 | Indicated Mineral Resource | 2.87 | 1.25 | 115.7 | 33.9 | 3.14 |

| Inferred Mineral Resource | 0.5 | 1.0 | 15 | 18 | 0.3 | |

| Total | 3.4 | 1.2 | 131 | 32.0 | 3.4 | |

| ≥ 0.21 | Indicated Mineral Resource | 4.2 | 0.95 | 128.5 | 30.1 | 4.07 |

| Inferred Mineral Resource | 1.2 | 0.6 | 22 | 18 | 0.7 | |

| Total | 5.4 | 0.9 | 150 | 28 | 4.8 | |

| Note: for details refer to ASX announcement dated December 21, 2016 | ||||||

-ENDS-

For enquiries, please contact:

Tony Rovira Managing Director Azure Minerals Limited Ph: +61 8 9481 2555 | Media & Investor Relations Michael Weir / Cameron Gilenko Citadel-MAGNUS Ph: +61 8 6160 4903 |

or visit www.azureminerals.com.au

Competent Person Statement:

The information in this report that relates to Mineral Resources for the Mesa de Plata and Loma Bonita deposits on the Alacrán Project are extracted from the respective reports “Mesa de Plata Mineral Resource Upgraded” and “Loma Bonita Mineral Resource” created and released to the ASX on 1 December 2016 and 21 December 2016 respectively and are available to view on www.asx.com.au . Azure Minerals Limited confirms that it is not aware of any new information or data that materially affects information included in the relevant market announcement, and that all material assumptions and technical parameters underpinning the estimates in the announcement continue to apply and have not materially changed.

APPENDIX 1

1. EQUITY ISSUANCE

Azure will issue to Teck a number of common shares that would result in Teck, and its affiliates, owning 19.9% of Azure’s outstanding shares on a post-issuance basis. Based on the current share count, and subject to any future issuance, this would be 27,545,566 Azure shares.

Based on the closing price on the offer date of A$0.11 per share, this new equity issuance has a value of A$3,030,012.

2. NSR ROYALTY

Teck will be granted a 0.5% NSR royalty on the property.

3. PARTICIPATION ON FUTURE SALE OF PROPERTY

If Azure sells or options all or a portion of the property to a third party at any time during a 60-month period commencing from the date of the definitive sale agreement, Azure will pay Teck a percentage of the sale proceeds calculated, on an incremental basis, as follows:

| All amounts in US$ millions | |

| Aggregate Proceeds | % Sales Participation due to Teck |

| Amounts less than $3.0M | Nil |

| Amounts between $3.0M and $4.0M | 10.0% |

| Amounts between $4.0M and $5.0M | 15.0% |

| Amounts between $5.0M and $7.5M | 17.5% |

| Amounts between $7.5 and $10.0M | 20.0% |

| Amounts between $10.0 and $15.0M | 22.5% |

| Amounts more than $15.0M | 25.0% |

Original Article: https://azureminerals.com.au/wp-content/uploads/2019/05/190516.pdf