(All amounts expressed in U.S. dollars unless otherwise noted)

TORONTO, Feb. 13, 2025 /PRNewswire/ – Agnico Eagle Mines Limited (NYSE:AEM) (TSX:AEM) (“Agnico Eagle” or the “Company”) today reported financial and operating results for the fourth quarter and full year 2024, as well as future operating guidance.

“I’m pleased to report another year of record operational and financial performance, achieving our production and cost guidance. We are very proud of our team’s work to control costs, which, coupled with a favourable gold price environment, has resulted in record operating margins. This success, along with capital discipline, has enabled us to reduce net debt by $1.3 billion since the beginning of the year and return close to $1.0 billion dollars to our shareholders,” said Ammar Al-Joundi, Agnico Eagle’s President and Chief Executive Officer. “Looking ahead, we will remain laser focused on cost control and capital discipline. Our updated three-year production guidance forecasts stable production at peer leading costs. Our exploration program continues to yield positive results, replacing mineral reserves and increasing our mineral resource base. Given our solid track record of execution, we believe we are well positioned to continue to generate strong returns while we advance our pipeline projects and build the foundations for profitable future growth,” added Mr. Al-Joundi.

Fourth quarter and full year 2024 highlights:

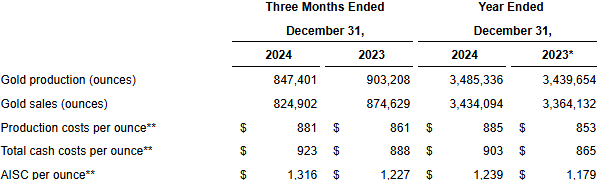

- Solid quarterly gold production and cost performance – Payable gold production1 was 847,401 ounces at production costs per ounce of $881, total cash costs per ounce2 of $923 and all-in sustaining costs (“AISC”) per ounce2 of $1,316

- Record quarterly adjusted net income and strong free cash flow generation – The Company reported quarterly net income of $509 million or $1.02 per share and record adjusted net income3 of $632 million or $1.26 per share. The Company generated record cash provided by operating activities of $1,132 million or $2.26 per share ($1,090 million or $2.17 per share of cash provided by operating activities before changes in non-cash working capital balances4) and free cash flow4 of $570 million or $1.14 per share ($528 million or $1.05 per share of free cash flow before changes in non-cash working capital balances4)

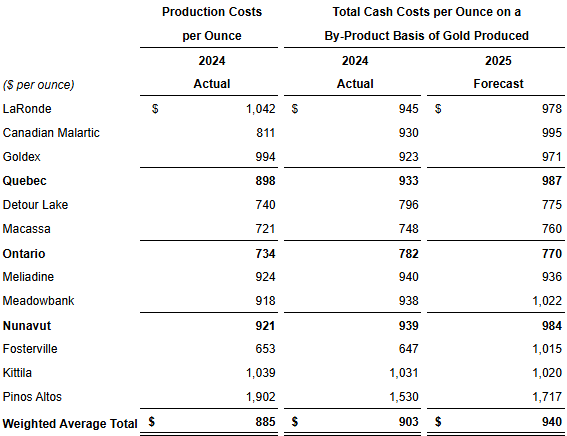

- Record annual gold production and free cash flow driven by solid operational performance – Payable gold production in 2024 was 3,485,336 ounces at production costs per ounce of $885, total cash costs per ounce of $903 and AISC per ounce of $1,239. Production for 2024 was slightly above the midpoint of the Company’s 2024 guidance range of 3.35 million ounces to 3.55 million ounces. Total cash costs per ounce were in-line with the midpoint of the Company’s 2024 guidance and AISC per ounce were within the range of the Company’s 2024 guidance. Cash provided by operating activities for the full year 2024 was $3,961 million and free cash flow was $2,143 million ($2,063 million before changes in non-cash components of working capital). The Company’s continued focus on operational efficiencies resulted in several annual throughput and mining rate records during the year

- Increase in gold mineral reserves and inferred mineral resources – Year-end 2024 gold mineral reserves increased by 0.9% to a record of 54.3 million ounces of gold (1,277 million tonnes grading 1.32 grams per tonne (“g/t”) gold). The year-over-year increase of mineral reserves is in part due to technical evaluations completed for the Upper Beaver project and the declaration of initial mineral reserves at the Wasamac project. At year-end 2024, measured and indicated mineral resources decreased by 2.3% to 43.0 million ounces (1,167 million tonnes grading 1.14 g/t gold) and inferred mineral resources increased by 9.5% to 36.2 million ounces (451 million tonnes grading 2.49 g/t gold). For further details, see the Company’s exploration news release dated February 13, 2025

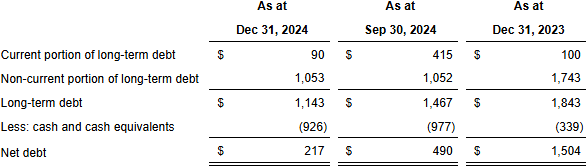

- Strengthened financial position with further debt repayment – The Company continued to reduce debt in the fourth quarter of 2024, repaying the $325 million outstanding balance on the $600 million unsecured term loan facility drawn in 2023 as part of the acquisition of Yamana Gold Inc.’s Canadian assets. Total debt outstanding was $1,143 million as at December 31, 2024. Net debt5 was reduced by $1,287 million in 2024, from $1,504 million at the beginning of the year to $217 million as at December 31, 2024

- Continued focus on shareholder returns – In the fourth quarter of 2024, the Company’s Board of Directors declared a quarterly dividend of $0.40 per share. Additionally, the Company repurchased 248,700 common shares at an average share price of $80.39 for an aggregate of $20 million through its normal course issuer bid (“NCIB”)

- New three-year guidance shows stable production outlook – Payable gold production is forecast to remain stable at approximately 3.3 to 3.5 million ounces annually from 2025 to 2027. While the 2025 and 2026 gold production guidance is slightly lower than the prior three-year guidance issued on February 15, 2024 (“Previous Guidance”) (primarily as a result of the deferral of processing low margin ore), the outlook for 2027 has improved as expected contributions in 2027 from East Gouldie at Canadian Malartic, LaRonde and Macassa are expected to offset lower gold grade sequences at Detour Lake and a decline in production at Meadowbank

- Peer leading total cash costs and AISC reflect stabilized rate of inflation – Total cash costs per ounce and AISC per ounce in 2025 are forecast to be in the range of $915 to $965 and $1,250 to $1,300, respectively. When compared to the full year 2024 total cash costs per ounce of $903 and AISC per ounce of $1,239, the midpoints of these ranges represent an approximate 4% and 3% increase, respectively. The expected cost increases in 2025 are mostly related to lower grade sequence at Fosterville, Canadian Malartic and Meadowbank, along with relatively modest forecast cost increases in labour, spare parts and maintenance

- Increased investment in pipeline projects, with potential to support future production growth – Capital expenditures in 2025 (excluding capitalized exploration) are expected to be between $1.75 billion and $1.95 billion, compared to capital expenditures of $1.66 billion in 2024. Capitalized exploration is forecast to be between $290 million and $310 million, compared to capitalized exploration of $184 million in 2024. The expected increases in 2025 are mostly attributable to additional capital expenditures to advance pipeline projects, including Odyssey, the Detour Lake underground project, the Upper Beaver project and Hope Bay, which the Company believes have the potential to drive profitable growth and generate strong returns in the medium-term

- Enhancing key value drivers and pipeline projects, with a focus on Detour Lake, Canadian Malartic and Hope Bay – Further details on exploration results in 2024 are included in the Company’s exploration news release dated February 13, 2025. The Company expects to provide updates on these initiatives and additional opportunities that are being evaluated throughout 2025

- Detour Lake – In the fourth quarter of 2024, the mill successfully achieved the targeted throughput of 77,000 tonnes per day (“tpd”) (or an equivalent rate of 28 million tonnes per annum (“Mtpa”)), setting a quarterly record for tonnes milled. This success was driven by a stable run-time of 93% and continuous optimization efforts. The Company will continue to advance various optimization initiatives, with a target to increase mill throughput to 79,450 tpd (or an equivalent 29 Mtpa) by 2028. The Company completed site preparation for the excavation of the underground exploration ramp, which is expected to commence in the first half of 2025, following the receipt of the permit to take water. The Company’s exploration program continued to attempt to de-risk the underground project, with conversion drilling resulting in an upgrade of the underground mineral resource at year-end 2024

- Odyssey – In the fourth quarter of 2024, ramp development, shaft sinking activities and surface construction progressed on schedule. At December 31, 2024, the shaft had reached a depth of 1,026 metres at level 102, the top of the mid-shaft loading station. The Company continues to focus on additional upside potential at Odyssey. A successful exploration program in 2024 resulted in the expansion of the East Gouldie mineral resource, which will be used in the continued technical evaluation of a potential second shaft at Odyssey. In the fourth quarter of 2024, the Company also commenced a take-over bid to acquire all of the issued and outstanding common shares (the “O3 Shares”) of O3 Mining Inc. (“O3 Mining”). As at February 3, 2025, the Company had taken up 115,842,990 O3 Shares for aggregate consideration of C$194 million, representing approximately 96.5% of the outstanding O3 Shares on an undiluted basis. The Company expects to complete the acquisition of 100% of the common shares of O3 Mining in the first quarter of 2025, consolidating its land package at Canadian Malartic. O3 Mining owns the Marban deposit, which has the potential to become a satellite open pit to feed the Canadian Malartic mill in the medium-term as part of the Company’s “fill-the-mill” strategy

- Patch 7 at Hope Bay – Exploration drilling in 2024 focused mainly on resource expansion and conversion on the Madrid deposit following the strong drilling intercepts obtained at the Patch 7 zone. An initial indicated mineral resource estimate was declared as at December 31, 2024 for Patch 7 of 0.9 million ounces of gold (4.3 million tonnes grading 6.64 g/t gold). The Company believes these results suggest the potential for a larger production scenario and they are being integrated in the internal technical evaluation of the Hope Bay project, which is expected to be completed in the first half of 2026

- Payable production of a mineral means the quantity of a mineral produced during a period contained in products that have been or will be sold by the Company whether such products are shipped during the period or held as inventory at the end of the period.

- Total cash costs per ounce and all-in sustaining costs per ounce or AISC per ounce are non-GAAP ratios that are not standardized financial measures under IFRS and, in this news release, unless otherwise specified, are reported on (i) a per ounce of gold production basis, and (ii) a by-product basis. For a description of the composition and usefulness of these non-GAAP ratios and reconciliations of total cash costs per ounce and AISC per ounce to production costs on both a by-product and a co-product basis, see “Note Regarding Certain Measures of Performance” below.

- Adjusted net income and adjusted net income per share are non-GAAP measures or ratios that are not standardized financial measures under IFRS. For a description of the composition and usefulness of these non-GAAP measures and a reconciliation to net income see “Note Regarding Certain Measures of Performance” below.

- Cash provided by operating activities before changes in non-cash working capital balances, free cash flow and free cash flow before changes in non-cash working capital balances and their related per share measures are non-GAAP measures or ratios that are not standardized financial measures under IFRS. For a description of the composition and usefulness of these non-GAAP measures and a reconciliation to cash provided by operating activities see “Note Regarding Certain Measures of Performance” below.

- Net debt is a non-GAAP measure that is not a standardized financial measure under IFRS. For a description of the composition and usefulness of this non-GAAP measure and a reconciliation to long-term debt, see “Note Regarding Certain Measures of Performance” below.

Fourth Quarter and Full Year 2024 Results Conference Call and Webcast Tomorrow

Agnico Eagle’s senior management will host a conference call on Friday, February 14, 2025, at 11:00 AM (E.S.T.) to discuss the Company’s financial and operating results.

Via Webcast:

To listen to the live webcast of the conference call, you may register on the Company’s website at www.agnicoeagle.com, or directly via the link here.

Via Phone:

To join the conference call by phone, please dial 416.945.7677 or toll-free 1.888.699.1199 to be entered into the call by an operator. To ensure your participation, please call approximately five minutes prior to the scheduled start of the call.

To join the conference call by phone without operator assistance, you may register your phone number here 30 minutes prior to the scheduled start of the call to receive an instant automated call back.

Replay Archive:

Please dial 289.819.1450 or toll-free 1.888.660.6345, access code 93737#. The conference call replay will expire on March 14, 2025.

The webcast, along with presentation slides, will be archived for 180 days on the Company’s website.

Fourth Quarter and Full Year 2024 Production and Cost Results

Production and Cost Results Summary

* Production and Cost Results Summary reflects Agnico Eagle’s 50% interest in Canadian Malartic up to and including March 30, 2023 and 100% thereafter.

** Production costs per ounce, total cash costs per ounce and AISC per ounce are reported on a per ounce of gold produced basis.

Gold Production

- Fourth Quarter of 2024 – Gold production decreased when compared to the prior-year period primarily due to lower production from Canadian Malartic, La India, Detour Lake and Fosterville, partially offset by higher production at Macassa and Meadowbank

- Full Year 2024 – Gold production increased when compared to the prior year primarily due to higher production from Meadowbank, Canadian Malartic and Macassa, partially offset by lower production at Fosterville and La India

Production Costs per Ounce

- Fourth Quarter of 2024 – Production costs per ounce increased when compared to the prior-year period primarily due to higher royalties arising from higher gold prices and lower production, partially offset by the benefit of the weaker Canadian dollar during the period

- Full Year 2024 – Production costs per ounce increased when compared to the prior year primarily due to higher royalties arising from higher gold prices and higher production costs at Canadian Malartic related to underground mining operations, partially offset by overall higher production and the benefit of the weaker Canadian dollar during the period

Total Cash Costs per Ounce

- Fourth Quarter and Full Year 2024 – Total cash costs per ounce increased when compared to the prior-year periods primarily due to the reasons described above for the increase in production costs per ounce during the respective periods

AISC per Ounce

- Fourth Quarter of 2024 – AISC per ounce increased when compared to the prior-year period due to the factors causing higher total cash costs per ounce during the period as well as higher sustaining capital expenditures, primarily at Canadian Malartic and Detour Lake, partially offset by lower general and administrative expenses during the period

- Full Year 2024 – AISC per ounce increased when compared to the prior year due to the factors causing higher total cash costs per ounce during the year, as well as higher sustaining capital expenditures, primarily at Canadian Malartic, Goldex and Kittila

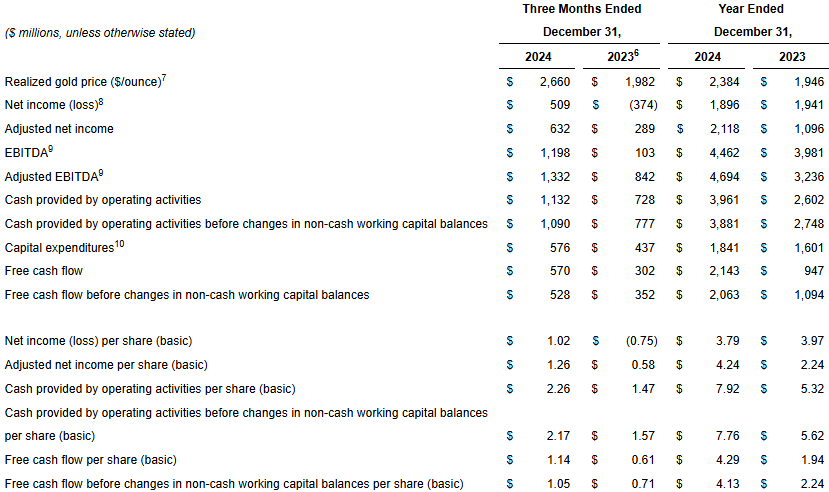

Fourth Quarter and Full Year 2024 Financial Results

Financial Results Summary

| 6 | Certain previously reported line items have been restated to reflect the final purchase price allocation related to the acquisition of the Canadian assets of Yamana Gold Inc. (the “Yamana Transaction”) including the 50% of Canadian Malartic that the Company did not then own. Reflects Agnico Eagle’s 50% interest in Canadian Malartic up to and including March 30, 2023 and 100% thereafter. |

| 7 | Realized gold price is calculated as gold revenues from mining operations divided by the number of ounces sold. |

| 8 | For the first quarter of 2023, includes a $1.5 billion revaluation gain on the 50% interest the Company owned in Canadian Malartic prior to the Yamana Transaction on March 31, 2023. |

| 9 | “EBITDA” means earnings before interest, taxes, depreciation, and amortization. EBITDA and adjusted EBITDA are non-GAAP measures or ratios that are not standardized financial measures under IFRS. For a description of the composition and usefulness of these non-GAAP measures and a reconciliation to net income see “Note Regarding Certain Measures of Performance” below. |

| 10 | Includes capitalized exploration. Capital expenditures is a non-GAAP measure that is not a standardized financial measure under IFRS. For a discussion of the composition and usefulness of this non-GAAP measure and a reconciliation to additions to property, plant and mine development as set out in the consolidated statements of cash flows, see “Note Regarding Certain Measures of Performance” below. |

Net Income

- Fourth Quarter of 2024

- Net income was $509 million ($1.02 per share). This result includes the following items (net of tax): derivative losses on financial instruments of $76 million ($0.15 per share), non-recurring tax adjustments and foreign currency translation losses on deferred tax liabilities of $21 million ($0.04 per share), net asset disposal losses of $12 million ($0.02 per share), foreign exchange losses of $10 million (0.02 per share) and other adjustments of $4 million (0.01 per share)

- Excluding the above items results in adjusted net income of $632 million or $1.26 per share

- Net income of $509 million in the fourth quarter of 2024 increased compared to net loss of $374 million in the prior-year period primarily due to impairment losses recognized in the prior-year period and stronger mine operating margins resulting from higher realized gold prices in the current period, partially offset by losses on derivative financial instruments and higher income and mining tax expenses in the current period

- Full Year 2024 – Net income of $1,896 million decreased compared to the prior year net income of $1,941 million primarily due to the remeasurement gain at Canadian Malartic in the prior year and higher income and mining tax expenses and losses on derivative financial instruments in the current period, partially offset by higher operating margins from higher realized gold prices and higher sales volumes in the current period. The remeasurement gain in the prior year is from the application of purchase accounting relating to a business combination attained in stages, which required the remeasurement of the Company’s previously held 50% interest in Canadian Malartic to fair value

Adjusted EBITDA

- Fourth Quarter of 2024 – Adjusted EBITDA increased when compared to the prior-year period primarily due to stronger mine operating margins from higher realized gold prices and lower general and administrative expenses

- Full Year 2024 – Adjusted EBITDA increased when compared to the prior year primarily due to stronger mine operating margins from higher realized gold prices and higher gold sales

Cash Provided by Operating Activities

- Fourth Quarter and Full Year 2024 – Cash provided by operating activities and cash provided by operating activities before changes in non-cash working capital balances increased when compared to the prior-year periods primarily due to the reasons described above related to the increases in adjusted EBITDA

Free Cash Flow Before Changes in Non-cash Working Capital Balances

- Fourth Quarter and Full Year 2024 – Free cash flow before changes in non-cash working capital balances increased when compared to the prior-year periods due to the reasons described above related to cash provided by operating activities, partially offset by higher additions to property, plant and mine development

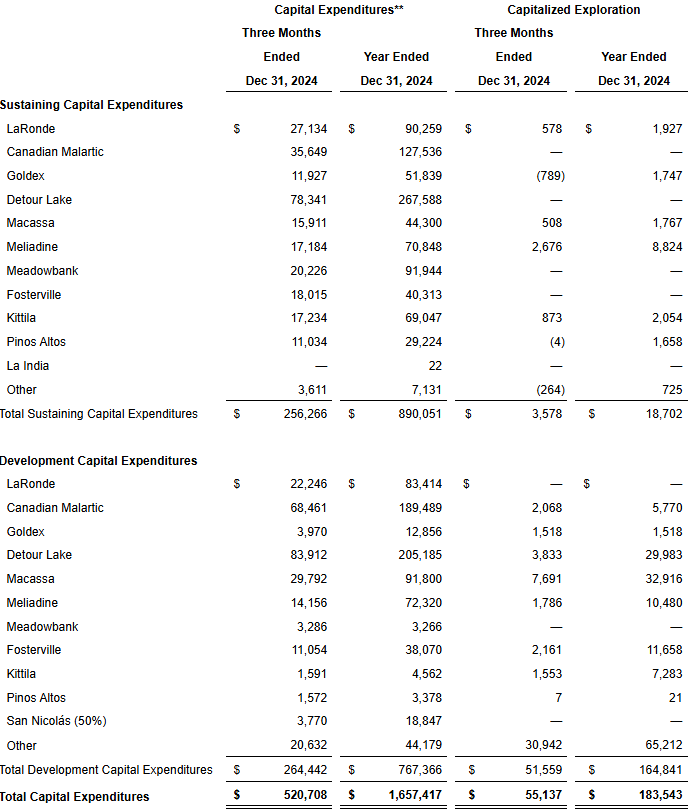

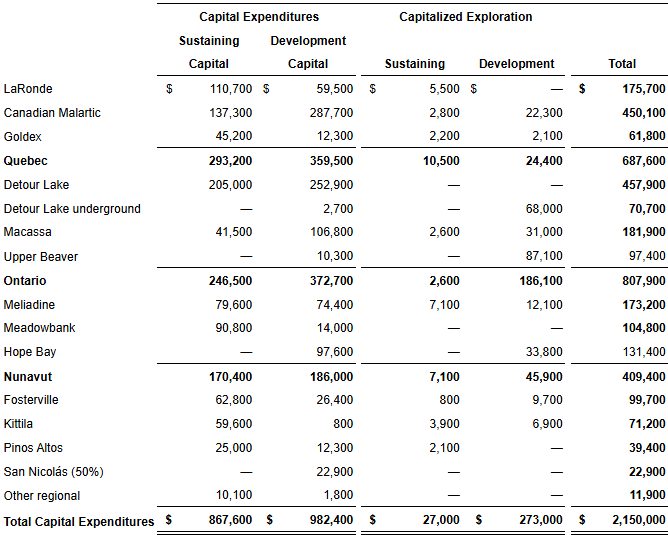

Capital Expenditures

The following table sets out a summary of capital expenditures (including sustaining capital expenditures and development capital expenditures) and capitalized exploration in the fourth quarter and the full year 2024.

Summary of Capital Expenditures*

*Capital expenditures is a non-GAAP measure that is not a standardized financial measure under IFRS. For a discussion of the composition and usefulness of this non-GAAP measure and a reconciliation to additions to property, plant and mine development as set out in the consolidated statements of cash flows, see “Note Regarding Certain Measures of Performance” below.

**Excludes capitalized exploration

Strong Free Cash Flow Generation Enabled Debt Repayment Ahead of Maturity to Continue Strengthening the Balance Sheet

Cash and cash equivalents decreased by $51 million when compared to the prior quarter primarily due to $325 million repayment of debt and higher cash used in investing activities resulting from higher capital expenditures, partially offset by higher cash provided by operating activities as a result of higher revenues from higher realized gold prices.

As at December 31, 2024, the Company’s total long-term debt was $1,143 million, a reduction of $324 million from the third quarter of 2024. The outstanding balance of $325 million on the $600 million term loan facility was repaid during the quarter in advance of scheduled maturity in April 2025, further strengthening the Company’s investment grade balance sheet. For the full year 2024, a total of $700 million of debt was repaid. No amounts were outstanding under the Company’s unsecured revolving bank credit facility as at December 31, 2024, and available liquidity under the facility remained at approximately $2 billion, not including the uncommitted $1 billion accordion feature.

The following table sets out the calculation of net debt, which decreased by $273 million when compared to the prior quarter as a result of the early debt repayment, partially offset by a decrease in cash and cash equivalents. For the full year 2024, net debt decreased by $1,287 million, from $1,504 million at the beginning of the year to $217 million as at December 31, 2024.

Net Debt Summary

($ millions)

Hedges

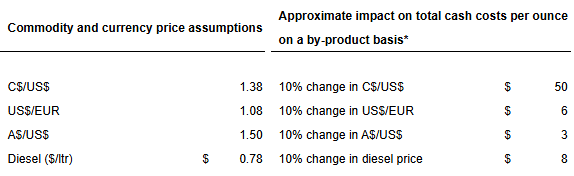

Based on the Company’s currency assumptions used for 2025 cost estimates: approximately 54% of the Company’s total estimated Canadian dollar exposure for 2025 is hedged at an average floor price providing protection in respect of exchange rate movements below 1.37 C$/US$, while allowing for participation in respect of exchange rate movements up to an average of 1.42 C$/US$, approximately 30% of the Company’s total estimated Euro exposure for 2025 is hedged at an average floor price providing protection in respect of exchange rate movements above 1.09 US$/EUR, while allowing for participation in respect of exchange rate movements down to an average of 1.05 US$/EUR, approximately 43% of the Company’s total estimated Australian dollar exposure for 2025 is hedged at an average floor price providing protection in respect of exchange rate movements below 1.49 A$/US$, while allowing for participation in respect of exchange rate movements up to an average of 1.62 A$/US$, and approximately 33% of the Company’s total estimated Mexican peso exposure for 2025 is hedged at an average floor price providing protection in respect of exchange rate movements below 19.50 MXP/US$, while allowing for participation in respect of exchange rate movements up to an average of 23.00 MXP/US$. The Company’s full year 2025 cost guidance is based on assumed exchange rates of 1.38 C$/US$, 1.08 US$/EUR, 1.50 A$/US$ and 20.00 MXP/US$.

Including the diesel purchased for the Company’s Nunavut operations that was delivered as part of the 2024 sealift, approximately 61% of the Company’s estimated diesel exposure for 2025 is hedged at an average benchmark price of $0.73 per litre (excluding transportation and taxes), which is expected to reduce the Company’s exposure to diesel price volatility in 2025. The Company’s full year 2025 cost guidance is based on an assumed diesel benchmark price of $0.78 per litre (excluding transportation and taxes).

Based on these 2025 hedge positions, the Company expects to continue to benefit from the positive foreign exchange impact on all its operating currencies when compared to 2025 cost guidance. The Company will continue to monitor market conditions and anticipates continuing to opportunistically add to its operating currency and diesel hedges to strategically support its key input costs for the balance of 2025. Current hedging positions are not factored into 2025 or future guidance.

Shareholder Returns

Dividend Record and Payment Dates for the First Quarter of 2025

Agnico Eagle’s Board of Directors has declared a quarterly cash dividend of $0.40 per common share, payable on March 14, 2025 to shareholders of record as of February 28, 2025. Agnico Eagle has declared a cash dividend every year since 1983.

Expected Dividend Record and Payment Dates for the 2025 Fiscal Year

| Record Date | Payment Date |

| February 28, 2025* | March 14, 2025* |

| May 30, 2025 | June 16, 2025 |

| September 2, 2025 | September 15, 2025 |

| December 1, 2025 | December 15, 2025 |

*Declared

Dividend Reinvestment Plan

For information on the Company’s dividend reinvestment plan, see: Dividend Reinvestment Plan.

International Dividend Currency Exchange

For information on the Company’s international dividend currency exchange program, please contact Computershare Trust Company of Canada by phone at 1.800.564.6253 or online at www.investorcentre.com or www.computershare.com/investor.

Normal Course Issuer Bid

The Company believes that its NCIB is a flexible and complementary tool that, together with its quarterly dividend, is part of the Company’s overall capital allocation program and generates value for shareholders. The Company can purchase up to $500 million of its common shares under the NCIB, subject to a maximum of 5% of its issued and outstanding common shares. Purchases under the NCIB may continue for up to one year from the commencement day on May 4, 2024. In the fourth quarter of 2024, the Company repurchased 248,700 common shares for an aggregate of $20 million through the NCIB. During the year ended December 31, 2024, the Company repurchased 1,749,086 common shares for an aggregate of $120 million under the NCIB and the Company’s NCIB for the prior period, at an average share price of $68.54.

Fourth Quarter 2024 Sustainability Highlights

- Sean Boyd Inducted into the Canadian Mining Hall of Fame – In January 2025, Sean Boyd, Chair of the Board and retired long-time CEO, was recognized for his role in growing Agnico Eagle from a market capitalization of C$0.4 billion to C$55 billion, and for his notable contributions to the mining sector and communities

- Health and Safety – The Company strives to maintain high health and safety standards. In 2024, multiple sites, and the global exploration team, achieved records for safety performance resulting in a strong global safety performance and an annual Global Combined Injury Frequency Rate of 2.45 (employees and contractors per 1 million hours worked)

- Employee Engagement – The Company continued to see year-over-year increases in employee satisfaction as measured in the Great Place to Work ® survey. The Company believes employee satisfaction and engagement are key drivers of its high employee retention rate across the regions where it operates

- Province of Ontario’s Skills Development Fund – The Company received a C$10 million grant to provide a comprehensive skills development program to support the availability of a qualified workforce in the mining industry. Agnico Eagle will use this funding to continue leading workforce development initiatives in Northern Ontario

- Matachewan First Nation Health Care Centre Grand Opening – The Company was proud to join the Matachewan First Nation as a sponsor as they celebrated the grand opening of their new health care centre Mino-Bimaadiziwin, meaning “a good life”

- Impact Benefit Agreement with Beaverhouse First Nation – The Company signed the Macassa-Amalgamated Kirkland Impact Benefit Agreement with Beaverhouse First Nation, formalizing a sustainable partnership built on collaboration, respect and shared progress. This agreement reflects the Company’s commitment by fostering genuine partnerships that benefit both the community and its operations

- Recognized as a Socially Responsible Company for the 9th consecutive year – The Sonoran Business Foundation honored Agnico Sonora, which operates La India, for achieving the Socially Responsible Company distinction for the ninth consecutive year. The La India mine has been an integral part of the community since 2011

- Forbes’ Canada’s Best Employers – The Company was recognized on the list for the 3rd consecutive year, which is an annual ranking based on employees and other professionals recommending the Company as a desirable employer

Gold Mineral Reserves – Up 1% Year-Over-Year to Record 54.3 Moz at Year-End 2024

At December 31, 2024, the Company’s proven and probable mineral reserve estimate totalled 54.3 million ounces of gold (1,277 million tonnes grading 1.32 g/t gold). This represents a 0.9% (0.47 million ounce) increase in contained ounces of gold compared to the proven and probable mineral reserve estimate of 53.8 million ounces of gold (1,287 million tonnes grading 1.30 g/t gold) at year-end 2023 (see the Company’s news release dated February 15, 2024 for details regarding the Company’s December 31, 2023 proven and probable mineral reserve estimate).

The year-over-year increase in mineral reserves at December 31, 2024 is largely due to a substantial mineral reserve addition at Upper Beaver and Wasamac and an aggregate replacement of approximately 70% of mineral reserves at Fosterville, Macassa, Meliadine, Amaruq and LaRonde.

Mineral reserves were calculated using a gold price of $1,450 per ounce for most operating assets, with exceptions that include: Detour Lake open pit using $1,400 per ounce; Amaruq using $1,650 per ounce; Pinos Altos using $1,800 per ounce; and variable assumptions for some other pipeline projects, including Wasamac using $1,650 per ounce. See “Assumptions used for the December 31, 2024 mineral reserve and mineral resource estimates reported by the Company” below for more details.

Gold Mineral Resources – Increase in Inferred Mineral Resources

At December 31, 2024, the Company’s measured and indicated mineral resource estimate totalled 43.0 million ounces of gold (1,167 million tonnes grading 1.14 g/t gold). This represents a 2.3% (1.0 million ounce) decrease in contained ounces of gold compared to the measured and indicated mineral resource estimate at year-end 2023 (see the Company’s news release dated February 15, 2024 for details regarding the Company’s December 31, 2023 measured and indicated mineral resource estimate).

The year-over-year decrease in measured and indicated mineral resources is primarily due to the upgrade of mineral resources at Upper Beaver and Wasamac to mineral reserves, largely offset by the successful conversion of inferred mineral resources into measured and indicated mineral resources at Detour Lake underground, East Malartic, Upper Beaver, Hope Bay and other sites.

At December 31, 2024, the Company’s inferred mineral resource estimate totalled 36.2 million ounces of gold (451 million tonnes grading 2.49 g/t gold). This represents a 9.5% (3.1 million ounce) increase in contained ounces of gold compared to the inferred mineral resource estimate a year earlier (see the news release dated February 15, 2024 for details regarding the Company’s December 31, 2023 inferred mineral resource estimate).

The year-over-year increase in inferred mineral resources is primarily due to exploration drilling success at Detour Lake underground, East Gouldie, Hope Bay, Meliadine, Fosterville and Macassa.

For detailed mineral reserves and mineral resources data, including the economic parameters used to estimate the mineral reserves and mineral resources, see “Detailed Mineral Reserve and Mineral Resource Data (as at December 31, 2024)” and “Assumptions used for the December 31, 2024 mineral reserve and mineral resource estimates reported by the Company” below, as well as the Company’s exploration news release dated February 13, 2025.

Update on Key Value Drivers and Pipeline Projects

Odyssey

In the fourth quarter of 2024, ramp development continued to progress ahead of schedule, and as at December 31, 2024, the main ramp reached a depth of 912 metres and the ramp towards the mid-shaft loading station reached a depth of 945 metres. Additionally, the Company continued to develop the main ventilation system on Level 54 between Odyssey South and East Gouldie and expects to begin excavating the first air raise for East Gouldie in the second quarter of 2025.

In the fourth quarter of 2024, shaft sinking activities set a record quarterly performance, progressing at a rate of 2.15 metres per day, and, as at December 31, 2024, the shaft reached level 102, the top of the mid-shaft loading station, at a depth of 1,026 metres. The design of the mid-shaft loading station between levels 102 and 114 is in progress. This station will include a crushing and material handling circuit for ore and waste, along with support infrastructure, including a maintenance shop. Excavation of the mid-shaft loading station is expected to begin in the first quarter of 2025 and continue through the remainder of the year.

Construction progressed on schedule and on budget in the fourth quarter of 2024. At the main hoist building, the rope installation for the service hoist was completed in the fourth quarter of 2024. The construction of the temporary loading station on Level 64 progressed according to plan and the service hoist is now expected to be commissioned in the first quarter of 2025, providing a hoisting capacity of 3,500 tpd. In the fourth quarter, the foundations of the main office and service building were completed and the structural steel installation is ongoing. The construction of the main office building is expected to be finished by the first quarter of 2026.

At Odyssey, the pace of construction is expected to increase in 2025, with the focus areas including the expansion of the paste plant to 20,000 tpd, the installation of the mid-shaft material handling infrastructure and the construction of the main underground ventilation system.

Opportunities for growth at Canadian Malartic

Once the Canadian Malartic complex transitions fully to underground, expected in 2029, the mill will have excess capacity of approximately 40,000 tpd. The Company is working on several opportunities to fill the mill, with a vision to potentially reach annual gold production of one million ounces in the 2030s. Some of these opportunities are set out below.

At Odyssey, exploration drilling in 2024 continued to infill the Odyssey North and Odyssey South zones and the adjacent Odyssey internal zones. The East Gouldie deposit continued to grow both westward and eastward, resulting in additional inferred mineral resources. New drill intercepts in the Eclipse Zone established continuity of mineralization and the potential for additional future mineral resource growth in the area located between the East Gouldie and Odyssey deposits. Following these positive exploration results, the Company is evaluating the potential for a second shaft at Odyssey.

In December 2024, the Company commenced a take-over bid to acquire all of the issued and outstanding common shares of O3 Mining, which owns the Marban project adjacent to Canadian Malartic. As at February 3, 2025, the Company had taken up 115,842,990 O3 Shares for aggregate consideration of C$194 million, representing approximately 96.5% of the outstanding O3 Shares on an undiluted basis. The Company expects to complete the acquisition of 100% of the O3 Shares in the first quarter of 2025. The Marban project is an advanced exploration project that could potentially support an open pit mining operation similar to the Company’s Barnat open pit operations at Canadian Malartic. It is expected to contribute approximately 15,000 tpd and an average of approximately 130,000 ounces per year to the Canadian Malartic complex over a span of 9 years, starting as early as 2033. For details on the offer to acquire O3 Mining see the Company’s news release dated December 12, 2024.

At Wasamac, a technical evaluation was completed during the fourth quarter of 2024, based on a 3,000 tpd underground mine with ore transported to the Canadian Malartic mill for processing. The study resulted in the declaration of initial mineral reserves of 1.38 million ounces of gold (14.8 million tonnes grading 2.9 g/t gold). In 2025, the Company will continue to assess various scenarios regarding optimal mining rates and transportation for possible mine construction at the project, while also advancing permitting and community engagement.

Detour Lake

In June 2024, the Company released the results of a technical study reflecting the potential for a concurrent underground operation at Detour Lake that would accelerate access to higher grade ore and increase average annual production to approximately one million ounces over 14 years starting in 2030 (see the Company’s news release dated June 19, 2024). This project is expected to generate strong returns, combined with significant exploration growth upside. On this basis, in June 2024, the Company approved a 2.0 kilometre exploration ramp to a depth of approximately 270 metres, which will provide access for underground conversion and expansion drilling and to collect a bulk sample from the shallow mineralized zone west of the pit.

In the fourth quarter of 2024, the Company completed the site preparation for the excavation of the underground exploration ramp. The permit to take water for this initial phase is now expected to be received in the first half of 2025. Upon receipt of the permit, the Company will commence the excavation of the ramp.

The Company’s continuing exploration program attempts to de-risk the underground project in the western plunge of the main orebody hosting the producing open pits. Conversion drilling continues to confirm the project with underground indicated mineral resources reaching 1.87 million ounces of gold (27.7 million tonnes grading 2.10 g/t gold) at year end. Underground inferred mineral resources continued to grow in 2024 below and to the west of the open pit, and totalled 3.68 million ounces of gold (59.3 million tonnes grading 1.93 g/t gold) at year end. For further details on exploration results at Detour Lake, see the Company’s exploration news release dated February 13, 2025.

Upper Beaver

A positive internal evaluation was completed in June 2024 for a standalone mine and mill scenario at Upper Beaver (see the Company’s news release dated July 31, 2024). This project has the potential to produce an annual average of approximately 210,000 ounces of gold and 3,600 tonnes of copper over a 13-year mine life, with initial production possible as early as 2030. In July 2024, the Company approved a $200.0 million investment over approximately three years to further attempt to de-risk the project. With this investment, the Company intends to develop an exploration ramp and an exploration shaft to depths of 160 metres and 760 metres, respectively, to establish underground drilling platforms and to collect bulk samples from the two most representative geological zones of the Upper Beaver deposit.

In the second half of 2024, project construction progressed on schedule. The road access, main earthworks for the site and the temporary infrastructure, including offices and temporary water treatment plant, were completed. The power line was commissioned and energized in October 2024. The shaft collar was excavated, the Galloway was installed and the foundations for the headframe were completed. Sinking of the exploration shaft is expected to commence in the fourth quarter of 2025. At the exploration ramp, the excavation of the box cut for the portal is ongoing and is expected to be completed in the first quarter of 2025.

The Upper Beaver technical evaluation was completed during the fourth quarter, bringing the mineral reserves at December 31, 2024 to 2.77 million ounces of gold and 54,930 tonnes of copper (23.2 million tonnes grading 3.71 g/t gold and 0.24% copper). The Company is advancing permitting and conducting several studies for the preparation of the impact assessment. The Company expects to submit the impact assessment late in 2025.

Hope Bay – Initial indicated mineral resource declared for Patch 7; advancing the potential for a larger production scenario

Exploration drilling in 2024 totalled more than 119,000 metres, focused mainly on mineral resource expansion and conversion on the Madrid deposit following the strong drilling intercepts obtained at the Patch 7 zone during the fourth quarter of 2023. An initial indicated mineral resource estimate was declared as at December 31, 2024 for Patch 7 of 0.9 million ounces of gold (4.3 million tonnes grading 6.64 g/t gold). These evaluation results are being integrated in an internal evaluation for a potential larger production scenario at Hope Bay, which is expected to be completed in the first half of 2026.

Following these exploration results in 2024, the Company has gained confidence on the potential for a larger production scenario and, having regard to the logistics of operating in Nunavut, is planning to invest approximately $97 million in 2025 to upgrade existing infrastructure and advance site preparedness for a potential redevelopment, including expanding the existing camp, dismantling the existing mill, extending the air strip and completing early earthworks. The Company has also approved a $20 million investment for an exploration ramp at Madrid. The 2.1-km exploration ramp is expected to be developed to a depth of 100 metres to facilitate infill and expansion drilling along the Madrid zones. The exploration ramp is expected to be extended towards Suluk and Patch 7 in 2026 to facilitate infill and expansion drilling along those zones and potentially collect a bulk sample.

For further details on exploration results at Hope Bay, see the Company’s exploration news release dated February 13, 2025.

San Nicolás Copper Project (50/50 joint venture with Teck Resources Limited)

In the fourth quarter of 2024, Minas de San Nicolás continued working on a feasibility study and execution strategy development, with completion expected in the second half of 2025. Project approval is expected to follow, subject to receipt of permits and the results of the feasibility study.

New Three Year Guidance – Stable Gold Production Through 2027; Total Cash Costs and AISC for 2025 Remain Peer Leading; Increased Investment to Build Foundations for Future Growth

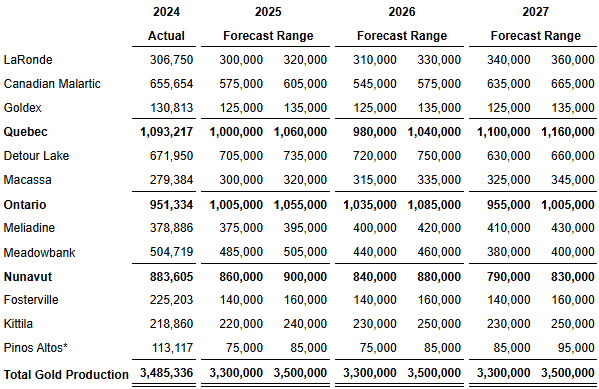

Gold production is forecast to remain stable at approximately 3.30 to 3.50 million ounces annually in 2025 to 2027, consistent with gold production in 2024, and approximately 3% lower than Previous Guidance in years 2025 and 2026. The outlook for 2027 has improved as contributions in 2027 from East Gouldie at Canadian Malartic, LaRonde and Macassa are expected to offset lower gold grade sequences at Detour Lake and the decline in production at Meadowbank.

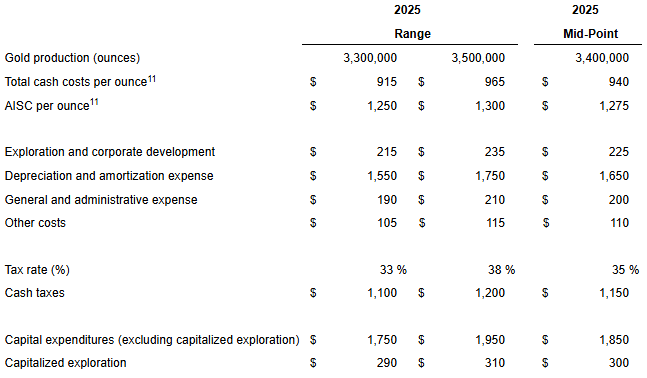

Total cash costs per ounce and AISC per ounce guidance for 2025 increased by approximately 4% and 3%, respectively, compared to the full year 2024 results. The 2025 production and cost guidance summary and a detailed description of the three-year guidance plan is set out below.

On February 1, 2025, an executive order was signed by the President of the United States, which introduced tariffs on imports from countries including Canada. In response, the Canadian government announced retaliatory tariffs on imports from the United States. Subsequently, both countries postponed their previously announced tariffs for 30 days. The Company believes its revenue structure will be largely unaffected by the tariffs as its gold production is mostly refined in Canada, Australia or Europe. The Company is reviewing its exposure to the potential tariffs and alternatives to inputs sourced from suppliers that may be subject to the tariffs, if implemented. However, approximately 60% of the Company’s cost structure relates to labour, contractors, energy and royalties, which are not expected to be directly affected by any of the tariffs. While there is uncertainty as to whether the tariffs or retaliatory tariffs will be implemented, the quantum of such tariffs, the goods on which they may be applied and the ultimate effect on the Company’s supply chains, the Company will continue to monitor developments and may take steps to limit the impact of any tariffs as may be appropriate in the circumstances. The costs guidance set out below does not factor any potential impact from such tariffs.

2025 Guidance Summary

($ millions, unless otherwise stated)

| 11 | The Company’s guidance for total cash costs per ounce and AISC per ounce is forward-looking non-GAAP information. For a description of the composition and usefulness of these non-GAAP measures and ratios, see “Note Regarding Certain Measures of Performance” below. |

Updated Three-Year Guidance Plan

Mine by mine production and cost guidance for 2025 and mine by mine gold production forecasts for 2026 and 2027 are set out in the tables below. The Company continues to evaluate opportunities to further optimize and improve gold production and unit cost forecasts from 2025 through 2027.

Estimated Payable Gold Production (ounces)

*2024 actual figure includes production from La India and Creston Mascota mines.

Gold production for 2025 and 2026, forecast to be 3.30 to 3.50 million ounces annually, is approximately 3% lower than Previous Guidance, primarily as a result of the deferral of processing low margin ore to later years.

The slight decrease in gold production forecast for 2025 compared to Previous Guidance reflects (i) a reduced mining rate at Pinos Altos to accommodate more challenging ground conditions at Santo Nino and increased ore sourcing from satellite deposits, (ii) a deferral of the restart of pre-crushing lower grade ore at Canadian Malartic allowing for a slower ramp-up of in-pit tailings disposal and (iii) a deferral of the processing of Amalgamated Kirkland (“AK”) ore at the LaRonde mill to the fourth quarter of 2025.

The slight decrease in gold production in 2026 reflects primarily (i) the reduced mining rate at Pinos Altos, (ii) an adjustment to the mining sequence at LaRonde, resulting in increased sourcing from the shallower, lower grade zones combined with a slower mining rate at the deep mine, (iii) an adjustment to the mill ramp-up and mining sequence at Detour Lake, in line with the mining profile update set out in the Company’s news release dated June 19, 2024 and (iv) a slight adjustment to the mining sequence at Macassa.

The gold production outlook for 2027 has improved and is forecast to remain stable at 3.30 to 3.50 million ounces. This improvement is related to additional production from Canadian Malartic (production ramp-up at East Gouldie), from LaRonde (higher gold grade sequence and increased contributions from new zones) and from Macassa and Meliadine (operational improvements). The additional production in 2027 is expected to offset lower production from Detour Lake (lower gold grades in the mining sequence) and from Meadowbank (operation nearing the end of its mine life).

*Forecast total cash costs per ounce are based on the mid-point of 2025 production guidance as set out in the table above.

Total cash costs per ounce in 2025 are expected to increase 4% compared to 2024 and are largely a result of a lower grade sequence at Fosterville, Canadian Malartic and Meadowbank, and modest inflation expected on labour, spare parts and maintenance costs. The increase in costs remains below the rate of inflation for the mining sector. The Company expects stable unit costs through 2026 and 2027, excluding inflation.

AISC per ounce in 2025 are expected to increase 3% compared to 2024 costs and are largely a result of the same reasons for the expected higher total cash costs per ounce. AISC per ounce are expected to remain stable through 2026 and 2027, excluding inflation.

The Company remains focused on attempting to reduce costs through productivity improvements and innovation initiatives at all of its operations and the realization of additional operational synergies is not currently factored into the cost guidance.

Currency and commodity price assumptions used for 2025 cost estimates and sensitivities are set out in the table below.

Currency and commodity price assumptions used for 2025 cost estimates and sensitivities

*Excludes the impact of current hedging positions

Exploration and Corporate Development Expense Guidance

Exploration and corporate development expenses in 2025 are expected to be between $215 million and $235 million, based on a mid-point forecast of $153 million for expensed exploration and $72 million in project technical evaluations and other expenses. The guidance for 2025 is consistent with 2024 exploration and corporate development expenses.

Depreciation Expense Guidance

Depreciation and amortization expense in 2025 is expected to be between $1.55 and $1.75 billion.

General and Administrative Expense Guidance

General and administrative expenses in 2025 are expected to be between $190 and $210 million, including share-based compensation, which is expected to be between $55 and $65 million.

Other Expenses Guidance

Additional other expenses in 2025 are expected to be approximately $105 to $115 million. This includes $82 to $85 million related to site maintenance costs primarily at Hope Bay, La India and Northern Territory in Australia and $23 to $30 million related to remediation expenses and other miscellaneous costs.

Tax Guidance

For 2025, the Company expects its effective tax rates to be:

- Canada – 35% to 40%

- Mexico – 35% to 40%

- Australia – 30%

- Finland – 20%

The Company’s overall effective tax rate is expected to be approximately 33% to 38% for the full year 2025.

The Company estimates consolidated cash taxes of approximately $1.1 to $1.2 billion in 2025 at prevailing gold prices, compared to $474 million in 2024. The increase in cash taxes from 2024 reflects both expected higher operating margins and approximately $400 million for the remaining cash tax liability related to the 2024 taxation year, which is to be paid in the first quarter of 2025. The remaining cash taxes in 2025 are expected to be paid equally over the 12 months in the year.

Capital Expenditures Guidance

In 2025, estimated capital expenditures (excluding capitalized exploration) are expected to be between $1.75 billion and $1.95 billion, with a mid-point of $1.85 billion, which includes approximately $868 million of sustaining capital expenditures at the Company’s operating mines and approximately $982 million of development capital expenditures. In 2025, estimated capitalized exploration expenditures are expected to be between $290 million and $310 million.

This compares to the full year 2024 capital expenditures of $1.66 billion (which included $890 million of sustaining capital expenditures and $767 million of growth capital expenditures) and capitalized exploration of $184 million.

Sustaining capital expenditures remain largely in line year-over-year. The overall increase in capital expenditures when compared to 2024 reflects reinvestment in the business to lay the groundwork for future growth through both development capital expenditures and capitalized exploration.

The increase of $215 million in development capital expenditures in 2025 when compared to 2024 is primarily at Canadian Malartic, Hope Bay and Macassa. At Canadian Malartic, 2025 is expected to be the most intensive year for the construction of the Odyssey mine. At Hope Bay, with the exploration results in 2024, the Company has gained confidence in the potential for a larger production scenario and, having regard to the logistics of operating in Nunavut, is planning to upgrade existing infrastructure and advance site preparedness for potential redevelopment. At Macassa, with the operation switching from being mine constrained to mill constrained in 2024, the Company is planning to upgrade the crushing circuit to optimize the mill throughput in coming years.

The increase of $116 million in capitalized exploration in 2025 when compared to 2024 is largely a result of the measured investments for the exploration ramp at the Detour Lake underground project and the exploration ramp and shaft at the Upper Beaver project, as announced in mid-2024. The Company has also approved a $20 million investment for an exploration ramp at Madrid. The 2.1-km exploration ramp is expected to be developed to a depth of 100 metres to facilitate infill and expansion drilling along the Madrid zones. The exploration ramp is expected to be extended towards Suluk and Patch 7 in 2026 to facilitate infill and expansion drilling along those zones and potentially collect a bulk sample.

Estimated 2025 Capital Expenditures

($ thousands)

Updated Three-Year Operational Guidance Plan

Since the Previous Guidance, there have been several operating developments resulting in changes to the updated three-year production profile. Descriptions of these changes as well as initial 2027 guidance are set out below.

ABITIBI REGION, QUEBEC

| LaRonde Forecast | 2024 | 2025 | 2026 | 2027 | |

| Previous Guidance (mid-point) (oz) | 295,000 | 310,000 | 340,000 | n.a. | |

| Current Guidance (mid-point) (oz) | 306,750 (actual) | 310,000 | 320,000 | 350,000 | |

| LaRonde Forecast 2025 | Ore Milled(‘000 tonnes) | Gold (g/t) | Gold MillRecovery (%) | Silver (g/t) | Silver MillRecovery (%) |

| 2,789 | 3.69 | 93.7 % | 8.5 | 72.6 % | |

| Production and Minesite Costs per Tonne12 | Zinc (%) | Zinc MillRecovery (%) | Copper (%) | Copper MillRecovery (%) | |

| C$167 | 0.40 % | 69.1 % | 0.12 % | 81.1 % |

At LaRonde, the production forecast aligns with Previous Guidance in 2025 and is slightly lower in 2026, primarily due to an adjustment to the mining sequence resulting in lower gold grades. The Company has integrated new sources of ore to the LaRonde production profile, including the Fringe, Dumagami and 11-3 zones, and has adjusted the mining rate in the deep mine. These new zones enhance mine production flexibility, which is expected to help manage seismicity at depth.

Gold production is expected to increase to 350,000 ounces of gold in 2027, primarily due to higher gold grades at the LaRonde mine, an increase in the mining rate at the LaRonde Zone 5 (“LZ5”) mine to 3,800 tpd and the addition of the new zones.

LaRonde has planned a shutdown of 10 days in the second quarter of 2025 in order to replace the liners at the SAG mill and overall maintenance of the drystack filtration plant.

| __________ | |

| 12 | Minesite costs per tonne is a non-GAAP measure that is not standardized under IFRS and is reported on a per tonne of ore milled basis. For a description of the composition and usefulness of this non-GAAP measure and a reconciliation to production costs see “Note Regarding Certain Measures of Performance” below. |

| Canadian Malartic Forecast | 2024 | 2025 | 2026 | 2027 |

| Previous Guidance (mid-point) (oz) | 630,000 | 615,000 | 560,000 | n.a. |

| Current Guidance (mid-point) (oz) | 655,654 (actual) | 590,000 | 560,000 | 650,000 |

| Canadian Malartic Forecast 2025 | Ore Milled(‘000 tonnes) | Gold (g/t) | Gold MillRecovery (%) | Production and Minesite Costs per Tonne |

| 21,076 | 0.96 | 90.7 % | C$39 |

At Canadian Malartic, the production forecast is lower in 2025 when compared to Previous Guidance primarily due to the Company’s decision to defer the reintroduction of pre-crushed low-grade ore, to accommodate modifications to the in-pit tailings approach and ramp-up.

Production is forecast to be in line with Previous Guidance in 2026 and increase by approximately 95,000 ounces of gold to 650,000 ounces of gold in 2027, with the contribution from East Gouldie at Odyssey.

From 2025 to 2027, production is expected to be sourced from the Barnat pit and increasingly complemented by ore from Odyssey and low-grade stockpiles. Odyssey is expected to contribute approximately 85,000 ounces of gold in 2025, approximately 120,000 ounces of gold in 2026 and approximately 240,000 ounces of gold in 2027.

In 2025, Canadian Malartic has planned quarterly shutdowns of four to five days for the regular maintenance at the mill.

| Goldex Forecast | 2024 | 2025 | 2026 | 2027 |

| Previous Guidance (mid-point) (oz) | 130,000 | 130,000 | 130,000 | n.a. |

| Current Guidance (mid-point) (oz) | 130,813 (actual) | 130,000 | 130,000 | 130,000 |

| Goldex Forecast 2025 | Ore Milled(‘000 tonnes) | Gold (g/t) | Gold MillRecovery (%) | |

| 3,205 | 1.49 | 84.7 % | ||

| Production and Minesite Costs per Tonne | Copper (%) | Copper Mill Recovery (%) | ||

| C$61 | 0.08 % | 85.4 % |

At Goldex, the production forecast is in line with Previous Guidance, with Akasaba West contributing approximately 12,000 ounces of gold and approximately 2,300 tonnes of copper per year.

ABITIBI REGION, ONTARIO

| Detour Lake Forecast | 2024 | 2025 | 2026 | 2027 |

| Previous Guidance (mid-point) (oz) | 690,000 | 725,000 | 760,000 | n.a. |

| Current Guidance (mid-point) (oz) | 671,949 (actual) | 720,000 | 735,000 | 645,000 |

| Detour Lake Forecast 2025 | Ore Milled(‘000 tonnes) | Gold (g/t) | Gold MillRecovery (%) | Production and Minesite Costs per Tonne |

| 28,000 | 0.88 | 90.9 % | C$28 |

At Detour Lake, the production forecast is lower in 2025 and 2026 when compared to Previous Guidance. The lower production in 2025 and 2026 is primarily due to lower grades from a slight adjustment to the mining sequence and an adjusted mill ramp-up to 29 Mtpa, as described in the June 2024 Detour Lake update (see the Company’s news release dated June 19, 2024). In 2027, the production forecast is lower when compared to 2026 as the mine enters into a lower grade phase.

From 2025 to 2027, the Detour Lake open pit will enter into a higher strip ratio phase, ranging from 3.0 to 4.0, compared to a strip ratio of 1.3 in 2024.

Detour Lake has scheduled three major shutdowns, each lasting seven days, for regular mill maintenance in the first, second and fourth quarters of 2025.

| Macassa Forecast | 2024 | 2025 | 2026 | 2027 |

| Previous Guidance (mid-point) (oz) | 275,000 | 330,000 | 340,000 | n.a. |

| Current Guidance (mid-point) (oz) | 279,385 (actual) | 310,000 | 325,000 | 335,000 |

| Macassa Forecast 2025 | Ore Milled(‘000 tonnes) | Gold (g/t) | Gold MillRecovery (%) | Production and Minesite Costs per Tonne |

| 700 | 14.15 | 97.3 % | C$464 |

At Macassa, the production forecast in 2025 and 2026 is lower when compared to Previous Guidance, primarily due to the deferral of production from the AK deposit. The Company initially planned to start trucking and processing ore from AK at the LZ5 processing facility at LaRonde in the fourth quarter of 2024. Due to delays in the modifications at the LZ5 processing facility to accommodate the AK ore, the Company now expects to begin processing the AK ore at the LZ5 mill in the fourth quarter of 2025. Production from the AK deposit is forecast to be approximately 10,000 ounces of gold in 2025, and approximately 50,000 to 60,000 ounces of gold in 2026 and in 2027.

The higher production in 2027 when compared to 2026 reflects the optimization of the Macassa mill.

The Company continues to see geological potential at Macassa along strike and at depth of the South Mine Complex and Main Break. These geological structures are prospective for ongoing expansion of the mineral resource base at the site. Overall, the Company believes that Macassa has the potential to maintain production in excess of 300,000 ounces of gold per year based on expected exploration results.

Macassa has scheduled a major shutdown of five days in the fourth quarter of 2025, for the primary grinding mill liner replacement, the annual overhaul of the crusher and other regular mill maintenance.

NUNAVUT

| Meliadine Forecast | 2024 | 2025 | 2026 | 2027 |

| Previous Guidance (mid-point) (oz) | 370,000 | 385,000 | 410,000 | n.a. |

| Current Guidance (mid-point) (oz) | 378,886 (actual) | 385,000 | 410,000 | 420,000 |

| Meliadine Forecast 2025 | Ore Milled(‘000 tonnes) | Gold (g/t) | Gold MillRecovery (%) | Production and Minesite Costs per Tonne |

| 2,280 | 5.46 | 96.2 % | C$218 |

At Meliadine, the production forecast for 2025 and 2026 aligns with Previous Guidance. The Processing Plant expansion was completed and commissioned in the second half of 2024. Mill throughput is expected to increase to approximately 6,250 tpd in 2025, then to approximately 6,500 tpd in subsequent years, driving the higher gold production forecast in 2025, 2026 and 2027.

Meliadine has scheduled quarterly shutdowns lasting three to six days for regular mill maintenance.

| Meadowbank Forecast | 2024 | 2025 | 2026 | 2027 |

| Previous Guidance (mid-point) (oz) | 490,000 | 495,000 | 450,000 | n.a. |

| Current Guidance (mid-point) (oz) | 504,719 (actual) | 495,000 | 450,000 | 390,000 |

| Meadowbank Forecast 2025 | Ore Milled(‘000 tonnes) | Gold (g/t) | Gold MillRecovery (%) | Production and Minesite Costs per Tonne |

| 4,174 | 4.05 | 91.1 % | C$167 |

At Meadowbank, the production forecast in 2025 and 2026 aligns with Previous Guidance. Production in 2027 is expected to decline as the open pit depletes, with Amaruq’s end of mine life currently expected to be in 2028. With the operational improvements realized over the last two years, the contribution from Amaruq underground has increased and is now forecast to be approximately 160,000 ounces of gold in 2025, and approximately 130,000 ounces of gold in 2026 and 2027. The Company is exploring the possibility of extending the mine’s operational life beyond 2028, focusing solely on underground production. Preliminary findings from this evaluation are expected in the first half of 2026.

The Company continues to account for the caribou migration in its production plan as this migration can affect the ability to move materials on the road between Amaruq and the Meadowbank processing facility and between the Meadowbank processing facility and Baker Lake. Wildlife management is an important priority and the Company is working with Nunavut stakeholders to optimize solutions to safeguard wildlife and reduce production disruptions.

Meadowbank has scheduled two major shutdowns, each lasting five days, to replace the SAG and ball mill liners and complete other regular mill maintenance in the second and fourth quarters of 2025.

AUSTRALIA

| Fosterville Forecast | 2024 | 2025 | 2026 | 2027 |

| Previous Guidance (mid-point) (oz) | 210,000 | 150,000 | 150,000 | n.a. |

| Current Guidance (mid-point) (oz) | 225,203 (actual) | 150,000 | 150,000 | 150,000 |

| Fosterville Forecast 2025 | Ore Milled(‘000 tonnes) | Gold (g/t) | Gold MillRecovery (%) | Production and Minesite Costs per Tonne |

| 850 | 5.83 | 94.1 % | A$268 |

At Fosterville, the production forecast in 2025 and 2026 is in line with Previous Guidance and is expected to remain stable in 2027. The declining production in 2025 when compared to 2024 reflects the depletion of the high-grade Swan zone in 2024. With the commencement of operations in Robbins Hill and site operational improvements, the mining and milling rate is forecast to increase by approximately 5% in 2025, partially offsetting the lower average gold grade of approximately 5.83 g/t.

An initial assessment shows the potential to increase production to an average of approximately 175,000 ounces of gold per year, with a gradual increase in production starting as early as 2027. The Company is conducting further technical evaluations and drilling to confirm the feasibility of this scenario, with a target to incorporate the results as part of its 2025 life of mine update.

Fosterville has scheduled quarterly shutdowns of five days for regular mill maintenance in 2025.

FINLAND

| Kittila Forecast | 2024 | 2025 | 2026 | 2027 |

| Previous Guidance (mid-point) (oz) | 230,000 | 230,000 | 240,000 | n.a. |

| Current Guidance (mid-point) (oz) | 218,860 (actual) | 230,000 | 240,000 | 240,000 |

| Kittila Forecast 2025 | Ore Milled(‘000 tonnes) | Gold (g/t) | Gold MillRecovery (%) | Production and Minesite Costs per Tonne |

| 2,050 | 4.15 | 84.1 % | € 106 |

At Kittila, the production forecast in 2025 and 2026 is in line with Previous Guidance and is expected to remain stable in 2027.

Kittila has planned a major shutdown in the second quarter of 2025 lasting 12 days for regular maintenance on the autoclave.

MEXICO

| Pinos Altos Forecast | 2024 | 2025 | 2026 | 2027 |

| Previous Guidance (mid-point) (oz) | 102,500 | 130,000 | 120,000 | n.a. |

| Current Guidance (mid-point) (oz) | 88,433 (actual) | 80,000 | 80,000 | 90,000 |

| Pinos Altos Forecast 2025 | Total Ore(‘000 tonnes) | Gold (g/t) | GoldRecovery (%) | |

| 1,350 | 1.96 | 94.0 % | ||

| Production and Minesite Costs per Tonne | Silver (g/t) | Silver MillRecovery (%) | ||

| $118 | 44.53 | 44.8 % |

At Pinos Altos, the production forecast is lower than the Previous Guidance by 50,000 ounces and 40,000 ounces in 2025 and 2026, respectively. The lower production reflects an adjustment to the mining rate at the Santo Nino deposit to accommodate for more challenging ground conditions, the deferral of the Reyna de Plata East open pit and increased ore sourcing from satellite deposits as the mine nears its end of mine life. Production in 2027 is expected to increase when compared to 2026, driven by the expected start of the Reyna de Plata East open pit in late 2026.

2025 Exploration Program and Budget – Continued Focus on Exploration Programs to Advance Pipeline Projects which are Expected to be Significant Future Contributors to Mineral Reserve Growth

In 2025, the Company’s total exploration expenditures and project expenses are expected to be between $505 million and $545 million, with a mid-point of $525 million. The total exploration expenditures include estimated capitalized exploration of $300 million and estimated exploration and corporate development expenses of $225 million, which are comprised of $153 million for expensed exploration and $72 million for project technical evaluations, technical services and other corporate expenses.

The Company’s exploration focus remains on extending mine life at existing operations, testing near-mine opportunities and advancing key value driver projects. Exploration priorities for 2025 include mineral resource conversion and expansion at the Detour Lake underground project and East Gouldie at Canadian Malartic, and advancing Hope Bay.

The Company’s exploration and corporate development guidance and plans for individual mines and projects for 2025 are presented in the Company’s exploration news release dated February 13, 2025.

ABITIBI REGION, QUEBEC

LaRonde – Eight Million Ounce Milestone Achieved; Record Gold Production at LZ5

| LaRonde – Operating Statistics | Three Months Ended December 31, | Year Ended December 31, | ||||||

| 2024 | 2023 | 2024 | 2023 | |||||

| Tonnes of ore milled (thousands of tonnes) | 802 | 663 | 2,849 | 2,658 | ||||

| Tonnes of ore milled per day | 8,717 | 7,207 | 7,784 | 7,282 | ||||

| Gold grade (g/t) | 3.78 | 4.33 | 3.62 | 3.83 | ||||

| Gold production (ounces) | 90,447 | 85,765 | 306,750 | 306,648 | ||||

| Production costs per tonne (C$) | C$ 118 | C$ 137 | C$ 153 | C$ 152 | ||||

| Minesite costs per tonne (C$) | C$ 146 | C$ 157 | C$ 154 | C$ 153 | ||||

| Production costs per ounce | $ 751 | $ 779 | $ 1,042 | $ 977 | ||||

| Total cash costs per ounce | $ 834 | $ 845 | $ 945 | $ 911 |

Gold Production

- Fourth Quarter of 2024 – Gold production increased when compared to the prior-year period primarily due to higher volumes of ore mined and milled at LZ5, partially offset by lower gold grades as expected under the planned mining sequence

- Full Year 2024 – Gold production increased slightly when compared to the prior year due to higher volumes of ore mined and milled at LZ5 as part of the mining plan, offset by lower gold grades as expected from the mining sequence and lower recovery

Production Costs

- Fourth Quarter of 2024 – Production costs per tonne decreased when compared to the prior-year period due to the higher volume of ore milled in the current period, partially offset by increased production costs from the consumption of stockpiles, which results in the incurrence of re-handling costs, and higher underground maintenance and service costs. Production costs per ounce decreased when compared to the prior-year period due to more ounces of gold being produced in the period, partially offset by higher production costs as explained in the costs per tonne analysis

- Full Year 2024 – Production costs per tonne increased when compared to the prior year primarily due to the consumption of stockpiles, which results in the incurrence of re-handling costs, and higher underground maintenance and service costs, partially offset by the higher volume of ore milled in the current period. Production costs per ounce increased when compared to the prior year primarily due to the higher production costs per tonne

Minesite and Total Cash Costs

- Fourth Quarter of 2024 – Minesite costs per tonne decreased when compared to the prior-year period due to the same reasons outlined above regarding the decrease in production costs per tonne. Total cash costs per ounce decreased when compared to the prior-year period for the same reasons outlined above for the decrease in production costs per ounce.

- Full Year 2024 – Minesite costs per tonne increased when compared to the prior year primarily due to the reasons outlined above regarding the increase in production costs per tonne. Total cash costs per ounce increased when compared to the prior year primarily for the same reasons as the increase in production costs per ounce.

Highlights

- In November 2024, LaRonde achieved the significant milestone of eight million ounces of gold poured since the mine began production in 1988

- Gold production in the fourth quarter of 2024 was positively affected by higher grades from increased production from the deep mine area compared to the prior quarter. Production from the higher-grade West mine area stabilized following the completion of rehabilitation work in the third quarter of 2024

- LZ5 achieved record throughput and gold production of approximately 24,300 ounces during the fourth quarter of 2024. The higher throughput was driven by the processing of stockpiles accumulated prior to the restart of the LZ5 mill in August 2024, as well as the Company’s continued automation initiatives at the LZ5 mine. Approximately 1,725 tpd were moved in full year 2024 through automated scoops and trucks, which contributed to the strong overall site throughput performance of an average 3,425 tpd

- At the LaRonde mill, the focus remained on improving mill recoveries by optimizing the blending of ore from the LaRonde mine, 11-3 Zone, LZ5, Goldex and Akasaba West

Canadian Malartic – Development of Odyssey Continues to Advance on Schedule; Shaft Sinking Reached the Mid-Shaft Loading Station Level

| Canadian Malartic – Operating Statistics | Three Months Ended December 31, | Year Ended December 31, | ||||||

| 2024 | 2023 | 2024 | 2023* | |||||

| Tonnes of ore milled (thousands of tonnes) | 5,100 | 5,278 | 20,317 | 19,595 | ||||

| Tonnes of ore milled per day | 55,435 | 57,370 | 55,511 | 53,685 | ||||

| Gold grade (g/t) | 0.97 | 1.08 | 1.09 | 1.17 | ||||

| Gold production (ounces) | 146,485 | 168,272 | 655,654 | 603,955 | ||||

| Production costs per tonne (C$) | C$ 36 | C$ 36 | C$ 36 | C$ 36 | ||||

| Minesite costs per tonne (C$) | C$ 41 | C$ 40 | C$ 41 | C$ 39 | ||||

| Production costs per ounce | $ 902 | $ 825 | $ 811 | $ 771 | ||||

| Total cash costs per ounce | $ 1,014 | $ 913 | $ 930 | $ 824 |

| *Gold production reflects Agnico Eagle’s 50% interest in Canadian Malartic up to and including March 30, 2023 and 100% interest thereafter. Tonnage of ore milled is reported on a 100% basis for both periods. |

Gold Production

- Fourth Quarter of 2024 – Gold production decreased when compared to the prior-year period due to lower grades resulting from a higher portion of ore processed being sourced from the low-grade stockpiles than planned, combined with lower throughput to accommodate adjustments to the in-pit tailings disposal approach

- Full Year 2024 – Gold production increased when compared to the prior year due to the increase in the Company’s ownership of Canadian Malartic between periods from 50% to 100% as a result of the closing of the Yamana Transaction on March 31, 2023 and higher throughput, partially offset by lower gold grades resulting from increased ore sourced from the low-grade stockpile

Production Costs

- Fourth Quarter of 2024 – Production costs per tonne remained the same when compared to the prior-year period primarily due to the decrease in open pit mining costs combined with a higher deferred stripping ratio being offset by the decrease in the volume of ore milled in the period and higher royalty costs. Production costs per ounce increased when compared to the prior-year period due to fewer ounces of gold produced in the current period and higher royalty costs, partially offset by lower open pit mining costs

- Full Year 2024 – Production costs per tonne remained the same when compared to the prior year as the higher royalty costs and higher underground production costs associated with the ramp-up of operations at the Odyssey mine were offset by a higher volume of ore milled. Production costs per ounce increased when compared to the prior year primarily due to higher royalty costs and higher underground production costs associated with the ramp-up of operations at Odyssey, partially offset by more ounces of gold produced in the current period

Minesite and Total Cash Costs

- Fourth Quarter of 2024 – Minesite costs per tonne increased when compared to the prior-year period due to higher royalty costs during the quarter and a lower volume of ore milled. Total cash costs per ounce increased when compared to the prior-year period primarily due to fewer ounces of gold produced in the current period

- Full Year 2024 – Minesite costs per tonne increased when compared to the prior year due to higher royalty costs in the current period partially offset by a higher volume of ore milled. Total cash costs per ounce increased when compared to the prior year for the same reasons outlined above for the increased production costs per ounce

Highlights

- At Odyssey South, total development during the quarter was ahead of plan at approximately 3,630 metres. Gold production was in line with target at approximately 21,500 ounces of gold supported by record performance in December at approximately 3,838 tpd. The increased use of tele-operated and automated equipment, including scoops, trucks, jumbos and cable bolters, were the main drivers for exceeding the development and production targets in the fourth quarter of 2024

- The Company began in-pit tailings disposal in July 2024. During the ramp-up in the fourth quarter of 2024, the Company made adjustments to the process to address the migration of fine materials through the central berm. The adjustments include installing a filtering layer on the central berm. It is expected that in-pit tailings deposition will resume in the first quarter of 2025 and ramp-up to design capacity in the second quarter of 2025

- An update on the Odyssey development and construction highlights is set out in the Update on Key Value Drivers and Pipeline Projects section above. An update on the exploration results is set out in the Company’s exploration news release dated February 13, 2025

Goldex – Record Quarterly Tonnes Milled; Exceeded Target Milling Rate from Akasaba West

| Goldex – Operating Statistics | Three Months Ended December 31, | Year Ended December 31, | ||||||

| 2024 | 2023 | 2024 | 2023 | |||||

| Tonnes of ore milled (thousands of tonnes) | 812 | 672 | 3,076 | 2,887 | ||||

| Tonnes of ore milled per day | 8,826 | 7,304 | 8,404 | 7,910 | ||||

| Gold grade (g/t) | 1.45 | 1.79 | 1.55 | 1.74 | ||||

| Gold production (ounces) | 32,341 | 33,364 | 130,813 | 140,983 | ||||

| Production costs per tonne (C$) | C$ 51 | C$ 55 | C$ 58 | C$ 52 | ||||

| Minesite costs per tonne (C$) | C$ 56 | C$ 58 | C$ 59 | C$ 53 | ||||

| Production costs per ounce | $ 910 | $ 816 | $ 994 | $ 795 | ||||

| Total cash costs per ounce | $ 859 | $ 877 | $ 923 | $ 820 |

Gold Production

- Fourth Quarter of 2024 – Gold production decreased when compared to the prior-year period primarily due to lower gold grades resulting from increased ore sourced from Akasaba West, partially offset by a higher volume of ore processed

- Full Year 2024 – Gold production decreased when compared to the prior year primarily due to lower gold grades resulting from increased ore sourced from Akasaba West and lower recovery, partially offset by a higher volume of ore processed

Production Costs

- Fourth Quarter of 2024 – Production costs per tonne decreased when compared to the prior-year period primarily due a higher volume of ore milled in the current period and a build-up in stockpiles, partially offset by a lower stripping ratio associated with Akasaba West. Production costs per ounce increased when compared to the prior-year period due to the same factors that resulted in higher production costs per tonne and lower gold grades