Advance has entered into a binding agreement with Serra Energy Metals Corp. (CSE: SEEM and OTCQB: ESVNF) to acquire an 80% interest via a joint venture on the high grade Myrtleford and Beaufort Gold Projects in the Victorian Goldfields, Australia.

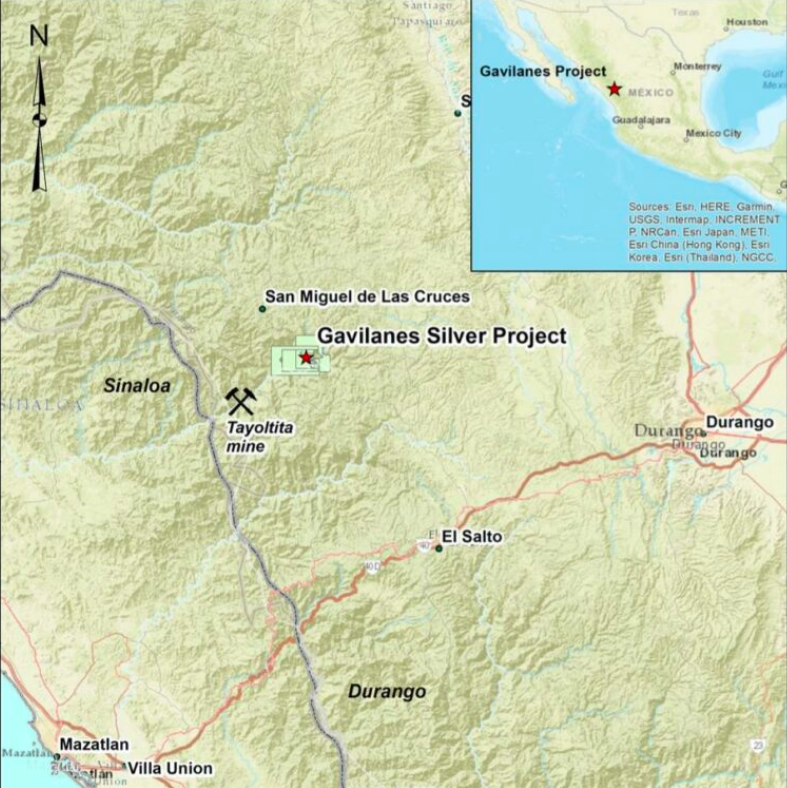

Simultaneously, Advance has entered into a binding agreement with Sailfish Royalty Corp. (TSX-V: FISH, OTCQX: SROYF) to acquire a 100% interest in the high grade Gavilanes Silver Project in Durango, Mexico.

HIGHLIGHTS – High Grade Myrtleford and Beaufort Gold Projects

- Advance secures the right to acquire an 80% interest in the Myrtleford and Beaufort Gold Projects against a backdrop of record high gold prices – from Serra Energy Metals on advantageous and low downside risk terms to Advance shareholders.

- The tenements host hundreds of mineralised workings, including over 70 past-producing high grade underground gold mines, many which remain largely unexplored with modern techniques.1

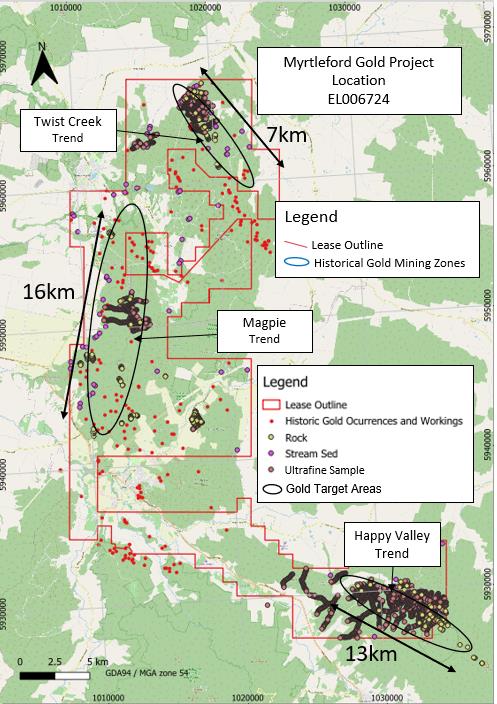

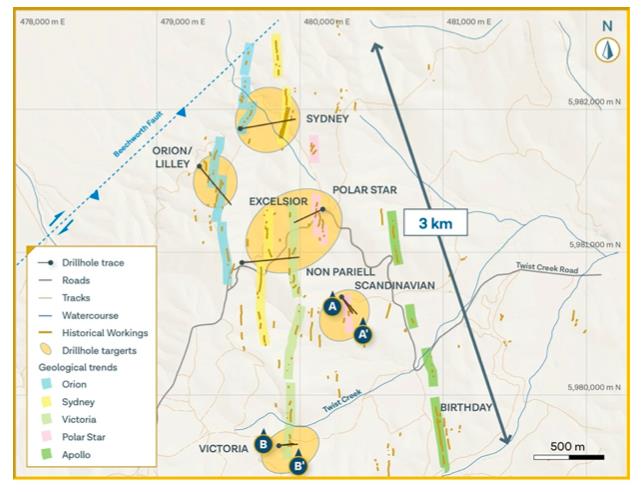

- At the Myrtleford Project, Serra has identified a 13 km-long trend of significant gold mineralisation, known as the Happy Valley Trend. This area hosts numerous historic gold mines that were only mined to shallow depths during the late 1800s and early 1900s. Many of these mines are located on mineralised structures that extend for kilometres and remain largely untested by modern exploration. Recent drilling has confirmed high grade quartz veins extending well below the historic workings, highlighting substantial exploration potential.1

- At the Myrtleford Project, 45 km strike length has been observed which co-relates to a significant number of historical gold workings and historical gold mines, evidencing district scale mineralisation including:

- Twist Creek Trend 7km strike length;

- Magpie Trend 16km strike length; and

- Happy Valley Trend 13km strike length.1

- Serra Energy Metals has reported high grade drilling intercepts of gold across its prior drilling at the Myrtleford Project, including highlights of:

- HVD003 11.5 m @ 160.4 g/t Au from 190 m, includes 0.6 m @ 2430 g/t Au

- HVD007 5.9 m @ 66.2 g/t Au from 149.8 m

- HVD006 2.3 m @ 44.8 g/t Au from 135.1 m

- HVD003 0.6 m @ 148.0 g/t Au from 165.2 m

- HVD015 7.2 m @ 10.4 g/t Au from 211.8 m

- HVD002 0.7 m @ 100.1 g/t Au from 94.9 m

- HVD010 2.5 m @ 14.9 g/t Au from 306.5 m

- HVD014 1.0 m @ 27.7 g/t Au from 139 m1

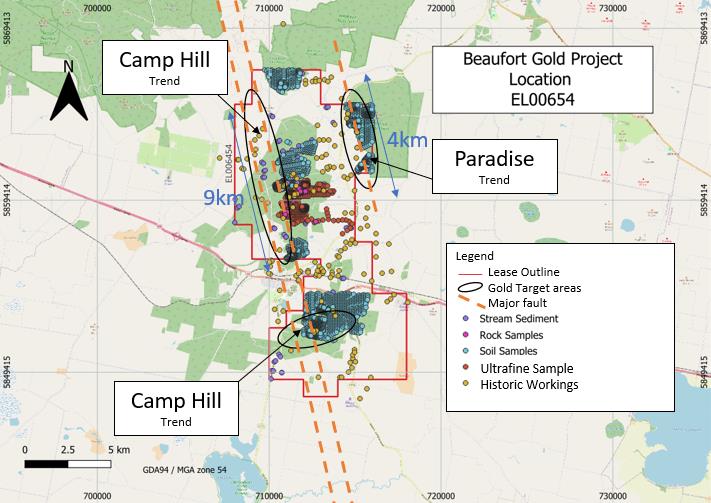

- At the Beaufort Project, Serra has identified a 20km trend which has been historically mined for alluvial gold with estimated historic production of 1.16Moz.1

- Serra has invested A$6 million in advancing the Myrtleford and Beaufort Gold Projects through extensive and successful exploration efforts. This substantial groundwork enhances the projects’ potential, providing a strong foundation for future development and discovery.

- The Myrtleford and Beaufort Projects are strategically located in the heart of Australia’s Victorian Goldfields, a region renowned for producing over 80Moz of gold. Surrounded by globally significant operations like the Fosterville Gold Mine, the Projects sit within one of the world’s premier gold-producing districts.1

HIGHLIGHTS – High Grade Gavilanes Silver Project

- The high grade Gavilanes Silver Project has an existing Foreign Estimate of 22.4 million ounces (“oz”) of silver equivalent (“AgEg”) at 245.6 g/t AgEq2

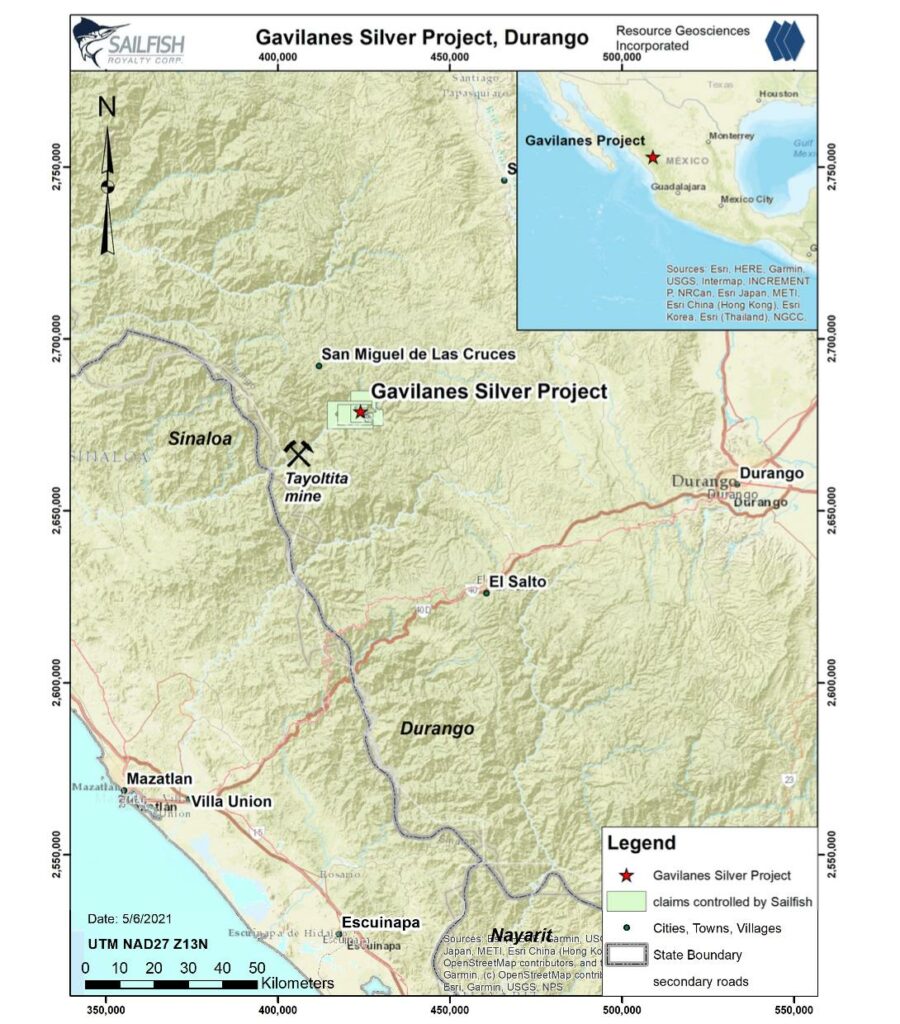

- The deposit is located in the San Dimas mining district of Durango, Mexico, ~23 km northeast of the San Dimas mine owned and operated by First Majestic Silver Corp.2

- Advance now hosts two high grade silver projects in Mexico with Foreign Estimates, comprising:

- the Yoquivo Project with a Foreign Estimate of 937Kt @ 570 g/t AgEq (2.1 g/t Au, 410 g/t Ag) for 17.23M oz AgEq; and 3

- the Gavilanes Project which has a Foreign Estimate of 22.4m oz AgEq at 245.6 g/t AgEq. 2

Table A Estimate of Inferred Foreign Estimate of Gavilanes Project2

| Cutoff Grade AgEq/t | Tonnes | Average AgEq/t | Contained oz AgEq | Ag/t | oz Ag | Au/t | oz Au | % Cu | lbs Cu | % Pb | lbs Pb | % Zn | lbs Zn |

| 75 | 3,742,000 | 206.90 | 24,898,000 | 172.4 | 20,747,000 | 0.13 | 15,500 | 0.11 | 9,046,000 | 0.56 | 45,795,000 | 0.42 | 34,288,000 |

| 100 | 2,833,000 | 245.60 | 22,368,000 | 207.3 | 18,878,000 | 0.15 | 13,700 | 0.12 | 7,772,000 | 0.61 | 37,893,000 | 0.43 | 27,152,000 |

| 125 | 2,210,000 | 283.30 | 20,131,000 | 241.3 | 17,146,000 | 0.17 | 12,100 | 0.14 | 6,753,000 | 0.66 | 32,398,000 | 0.45 | 22,011,000 |

| 150 | 1,765,000 | 320.30 | 18,174,000 | 275.1 | 15,607,000 | 0.19 | 10,500 | 0.15 | 5,745,000 | 0.73 | 28,275,000 | 0.47 | 18,421,000 |

- Current exploration has tested just approximately 0.17km2 of the main zone, while an additional 0.28 km2 of known veins remain undrilled and a remaining +130km2 remain to be explored. The deposit remains open at depth, with indications of increasing copper and gold grades.2

- Gavilanes represents a significant district scale opportunity with an additional 130km2 of similar geology to the host area, remaining to be explored.2

- The majority of the Gavilanes Project acquisition consideration is tied to milestones, including achieving a resource size of 60Moz AgEq at 300g/t AgEq or greater. Reaching this milestone would establish the project as hosting a significant silver resource.

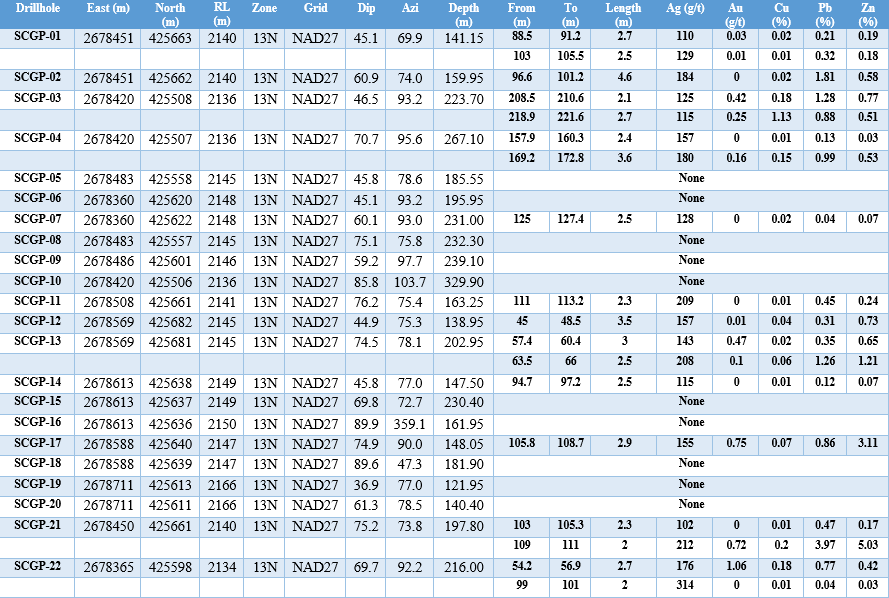

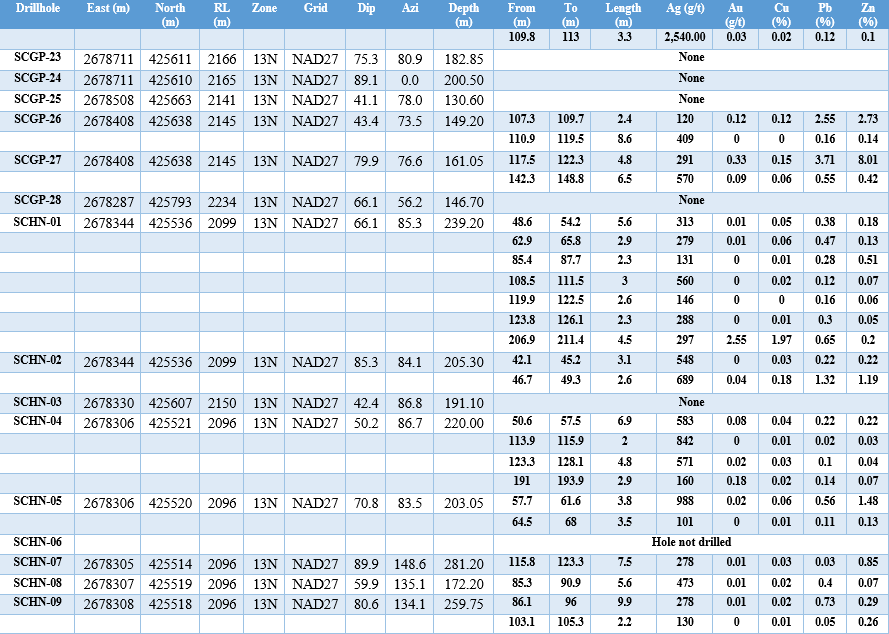

- High grade silver mineralisation has been observed in numerous core samples including historic drill intercepts of:

- SCGP-22 3.3m @ 2540 g/t Ag from 109.75m

- SCHN-04 2m @ 842 g/t Ag from 113.85m

- SCHN-05 3.8m @ 988 g/t Ag from 57.7

- SCHN-12 6.3m @ 2016 g/t Ag from 77.15m

- SCHN-12 4.3m @ 1279 g/t Ag from 109.25m2

In accordance with Listing Rule 5.12.9, the Company advises that:

- the estimates are foreign estimates and not reported in accordance with the JORC code;

- the Competent Person has not done sufficient work to classify the foreign estimates as mineral resources or ore reserves in accordance with the JORC Code; and

- it is uncertain that following evaluation and/or further exploration work that the foreign estimates will be able to be reported as mineral resources or ore reserves in accordance with the JORC Code.

High Grade Myrtleford and Beaufort Gold Projects Overview

Advance Metals Limited (‘Advance’ or ‘AVM’ or ‘the Company’) is pleased to announce it has entered into a binding joint venture agreement with Serra Energy Metals Corp. (“Serra” or “Serra Energy”) (CSE: SEEM and OTCQB: ESVNF) to acquire up to an 80% interest in the high grade Myrtleford and Beaufort Gold Projects (“E79 Joint Venture” or “E79 Project”), located in the Victorian Goldfields, Australia.

The entry into the E79 Joint Venture represents a low-cost opportunity to provide AVM shareholders exposure to a gold project which has in recent years achieved significant drilling results at a time of record high gold spot prices.

The Myrtleford and Beaufort Projects boast an extensive land position in the heart of Australia’s renowned Victorian Goldfields, a region that has produced over 80 million ounces of gold. Across the tenements, hundreds of mineralised workings remain unexplored with modern techniques, presenting exceptional opportunities for new significant discoveries.1

Key areas such as Twist Creek and Magpie at Myrtleford show strong potential for further exploration success, building on the already impressive results from the Happy Valley Prospect. Recent drilling at Happy Valley has delivered high grade intercepts, including 11.5 metres at 160 g/t Au, 5.9 metres at 66.2 g/t Au, 2.3 metres at 44.8 g/t Au, and 0.6 metres at 148 g/t Au, with mineralisation remaining open at depth, underscoring the project’s significant upside potential.1

1 E79 Resources Corporate Presentation, Precious Metals Summit Beaver Creek, September 2023.

2 CSA NI 43-101 Technical Report and Estimate of Mineral Resources, Gavilanes Silver Project, San Dimas Municipality, Durango, Mexico Prepared for Sailfish Royalty Corp. by Matthew D. Gray, Ph.D., C.P.G. #10688 Resource Geosciences Incorporated

3 AVM ASX Release Advance Metals to acquire Yoquivo High Grade Silver Project in Mexico – Update dated 28 October 2024.

Project Overview Beaufort Project

The Beaufort Gold Project is situated in the southwest of Victoria, approximately 145 km west of Melbourne, within the Victorian Goldfields. The region has produced an estimated 1.16 Moz of alluvial gold, with the primary hard rock source yet to be identified. This presents a significant opportunity to uncover large-scale, high grade gold deposits, especially given its strategic location near other world-class goldfields like Bendigo and Fosterville.1

The project spans a 20 km trend that has been extensively mined for alluvial gold, with alluvial workings closely associated with major north-south trending structures1. The structural setting features cross-cutting late structures that provide well-defined exploration targets. Despite its historical significance, modern systematic exploration to identify Bendigo- or Fosterville-style mineralisation has not been conducted, leaving the project underexplored and full of untapped upside potential.1

The Beaufort goldfield exhibits unique geological characteristics, including high ratios of alluvial to primary gold. Gold mineralisation is associated with quartz veins, pyrite, and other base metals within pyritic black shales and late tectonic quartz veins. These features suggest that Beaufort may host significant hard rock gold deposits yet to be discovered.4

The Beaufort Gold Project represents a compelling exploration proposition, combining a historic mining region with a lack of modern systematic exploration. Its favorable structural setting and proximity to major infrastructure further enhance its potential. Unlocking the primary source of the region’s substantial alluvial gold production could position the project as a significant contributor to the Victorian Goldfields’ ongoing gold resurgence.

4 NI43-101 Technical Report EL006454 Beaufort Southwest Region, Victoria, Australia Prepared for: E79 Resources Corp, Dennis Arne, MAIG (RPGeo), PGeo (British Columbia), 2020

5 NI43-101 Technical Report EL006724 Myrtleford Northeast Region, Victoria, Australia Prepared for: E79 Resources Corp, Peter de Vries, MAIG, MAusIMM, 2020

Myrtleford Project

The Myrtleford Gold Project is located in the northeastern Victorian Goldfields, approximately 290 km from Melbourne. Spanning 418 km², the project consolidates an entire historic gold mining district, encompassing over 70 past-producing high grade underground gold mines. Historically, mining operations were limited to shallow depths due to water table constraints, leaving significant potential for deeper, high grade mineralisation to be explored.5

Myrtleford hosts extensive structural trends, including the 13 km-long Happy Valley Trend, characterized by numerous historic gold mines along strike1. These mines produced gold at exceptional grades but were only mined to shallow depths during the late 19th and early 20th centuries. Modern drilling has confirmed that high grade quartz veins extend well below historic workings, with results such as 11.5 m @ 160.4 g/t Au (including 0.6 m @ 2430 g/t Au) and 5.9 m @ 66.2 g/t Au, indicating substantial untested depth potential.1

The project lies within the Lachlan Fold Belt, which hosts some of Australia’s most prolific gold deposits. Myrtleford’s geology is marked by mineralised structures extending for kilometres, often intersecting high grade quartz veins associated with historic workings. Additionally, the Twist Creek area, a 7 km trend at the northern end of Myrtleford, includes multiple historic structures mined at an average grade of 31 g/t Au, further highlighting the project’s high grade potential.1,5

The Myrtleford Gold Project offers a unique opportunity to explore and develop a district-scale high grade gold system within a Tier-1 jurisdiction. With a large land position, proven high grade mineralisation, and limited modern exploration, Myrtleford is well positioned to deliver a substantial resource. Its alignment with current record gold prices further enhances its strategic value as a cornerstone project within the Victorian Goldfields.

The Happy Valley Trend within the Myrtleford Project spans an extensive 13 km and is characterized by numerous historic gold mines distributed along strike and across the licensed area.1 These mines were predominantly active in the late 1800s and early 1900s but were only worked to shallow depths, typically ceasing at the water table due to limited technology and capital at the time. Many of these historic workings are located on mineralised structures that extend for kilometres but remain largely unexplored using modern techniques, presenting significant untapped potential.1

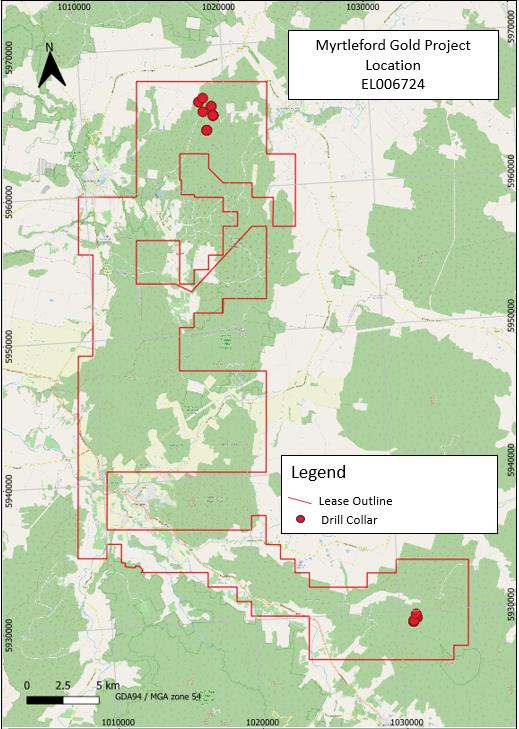

Inaugural drilling began in March 2021, focusing on areas beneath historic workings at Happy Valley. Results from this drilling confirmed that high grade quartz veins extend well below the depth of previous mining activities, validating the potential for deeper high grade mineralisation. These findings highlight the possibility of substantial growth within the Happy Valley Trend, making it a key target for further exploration.1

In addition to the main Happy Valley Trend, the northern section of the Myrtleford Project features a 7 km trend of historic workings with multiple structures mined at exceptionally high grades, averaging 31 g/t gold. This adds another promising zone within the project, underscoring its potential to host significant high grade mineralisation over a district scale.1

Drilling at the Myrtleford Project has confirmed multiple intersections of high grade gold mineralisation, including several high grade results1.

Drilling highlights from the Happy Valley area include:

- HVD003 11.5 m @ 160.4 g/t Au from 190 m; including 0.6 m @ 2430 g/t Au, and

- HVD007 5.9 m @ 66.2 g/t Au from 149.8 m;

- HVD006 2.3 m @ 44.8 g/t Au from 135.1 m;

- HVD015 7.2 m @ 10.4 g/t Au from 211.8 m; and

- HVD002 0.7 m @ 100.1 g/t Au from 94.9 m.

These results indicate significant coarse gold mineralisation at depth, extending well below historical workings.

At the northern end of the Myrtleford Project, the Twist Creek 7 km trend features multiple historically mined structures, averaging 31 g/t gold. The area remains a high priority target for further exploration due to its underexplored mineralised structures and potential for additional high grade discoveries.1

Drilling at the Scandinavian Prospect, within the Myrtleford Project, has returned impressive results, such as:

- TWD006 1.6 m @ 17.0 g/t Au from 73 m incl. 0.6 @ 43 g/t Au

- TWD003 1.1 m @ 15.3 g/t Au from 67.9 m, 1.0 m @ 3.8 g/t Au from 111 m; and

- TWD004 0.8 m @ 14.2 g/t Au from 75 m.

These results collectively highlight Myrtleford’s significant exploration upside, with both depth and strike extensions across multiple trends presenting robust opportunities for growth potential.

About Victorian Gold

Australia is one of the world’s top gold producers, consistently ranking as either the first or second largest global producer. In 2023, the state was expected to produce over 300 metric tons of gold, primarily sourced from well-established mining regions such as high grade sites like Fosterville in Victoria. The gold sector continues to make a significant economic contribution, supported by substantial exploration activities and expected to maintain growth with several expansion projects underway.6,7

Fosterville Gold Mine

The Fosterville Gold Mine, located in Victoria, Australia, has emerged as one of the country’s most prolific gold producers in recent years. Operated by Agnico Eagle, Fosterville is renowned for its exceptionally high gold grades, often exceeding 20 grams per tonne (g/t) in certain areas. In 2023, the mine continued its strong performance, producing over 300,000 ounces of gold, thanks in part to its successful underground mining operations and advanced processing technologies. Fosterville’s

high grade ore has driven its status as a leading global producer, and its exploration efforts remain focused on expanding resources in the highly prospective Swan Zone. With significant reserves and ongoing investment in expansion, Fosterville is expected to remain a key contributor to Australia’s gold output for years to come.6,7

- Australian Gold Still a Bright Spot Globally, The Assay, 2022 available at https://www.theassay.com/articles/analysis/australian-gold-still-a-bright-spot-globally/

- Australia’s gold industry shines on global scale, Gold Industry Group, 2021, available at https://www.goldindustrygroup.com.au/news/2021/4/19/australias-gold-industry-shines-on- global-scale

Geology

Beaufort Project

The Beaufort goldfield was termed “enigmatic” by Summons (1999) due to the very high ratio of alluvial to primary gold.5 This unusual Au deposit has no surface expression and is hosted within Upper Proterozoic rocks within the core of a large regional fold (Wood and Popov, 2006). The highest gold grades (4 to 9 ppm) are associated with pyritic black shale in the hinge of the fold. Late tectonic quartz veins host low-grade gold mineralisation that is interpreted to have sourced nearby alluvial deposits. 4 Gold mineralisation is associated with quartz, pyrite, carbonate, minor base metals, and platinum group metals (PGM).

Myrtleford Project

EL006724 is located mainly in the Eastern Subzone of the Tabberabbera Zone of the Lachlan Fold Belt (VandenBerg et al. 2004). Turbiditic Ordovician Pinnak Sandstone of the Adaminaby Group comprises the basement and was deformed by Benambran (Early Silurian) and Tabberabberan (Middle Devonian) orogenic events. The Adaminaby Group is of a similar age and depositional setting as the Castlemaine Group in the Bendigo Zone of central Victoria. The Castlemaine Group hosts the Bendigo, Ballarat and Fosterville deposits near the transition from Early to Late Devonian magmatism in central Victoria. The Tabberabbera Zone is thought to represent the northern extension of Bendigo Zone rocks that were wrapped around a micro-continent known as VanDieland as it became caught in the subduction zone to the east of the Australian continent during the Lachlan Orogeny (Moresi et al., 2014). This is known as the oroclinal bend model.5

E79 – Joint Venture Transaction Terms

A summary of the material terms of the E79 Joint Venture is set out below:

- (Acquisition): Subject to the satisfaction or waiver of the Conditions Precedent and the issue of each tranche of the Consideration Shares, Serra agrees to sell and Advance agrees to acquire an 80% interest in the fully paid shares of E79 Resources Pty Ltd (ACN 637 308 260) (‘E79’), the entity which is the legal and beneficial owner of 100% interest in the mining tenements comprising the Beaufort and Myrtleford Projects.

- (Conditions Precedent): Settlement of the Acquisition and the commencement of the E79 Joint Venture is conditional upon the satisfaction or waiver of the following conditions on or before 5:00pm (WST) on 30 April 2025, as well as the issue of the Consideration Shares:

- Due Diligence: completion of financial, legal and technical due diligence by Advance on Serra, E79 and the Projects;

- ASX waiver: Advance having been granted a waiver from ASX Listing Rule 7.3.4 to allow Advance to issue the Consideration Shares to Serra (or its nominees) outside of the date which is three months from the date that Advance obtains shareholder approval for their issue under ASX Listing Rule 7.1 (‘ASX Waiver’); and

- Regulatory and other Approvals: Advance and Serra obtaining all necessary shareholder and regulatory approvals or waivers, to allow the parties to lawfully complete the matters set out in the agreement.

- (Consideration): On and from the date on which the last of the Conditions Precedent is satisfied, Advance agrees to issue to Serra (or its nominees):

- that number of fully paid ordinary shares in Advance (‘AVM Shares’) that is equal to C$400,000 divided by the 20-day volume weighted average price (‘20-Day VWAP’) of the AVM Shares immediately prior to date on which the last of the Conditions is satisfied (‘Initial Share Issue’);

- that number of AVM Shares that is equal to C$500,000 divided by the 20-Day VWAP of the AVM Shares immediately prior to the date which is 18-months following the Initial Share Issue;

- that number of AVM Shares that is equal to C$1,600,000 divided by the 20-Day VWAP of the AVM Shares immediately prior to the date which is 36-months following the Initial Share Issue; and

- that number of AVM Shares that is equal to C$500,000 divided by the 20-Day VWAP of the AVM Shares immediately prior to the date which is 48-months following the Initial Share Issue (‘Final Issue’),

(collectively, the ‘Consideration Shares’).

Each tranche of the Consideration Shares will be issued subject to shareholder approval. As noted above Advance will seek the ASX Waiver to allow Advance to issue the Consideration Shares to Serra (or its nominees) outside of the date which is three months from the date that Advance obtains shareholder approval for their issue under ASX Listing Rule 7.1.

In the event that the ASX Waiver is not granted, Advance agrees to waive the Condition Precedent pertaining to the ASX Waiver and will convene general meetings in advance of each relevant issue date.

- (Royalty): On and from settlement, Advance will grant Serra a 1% net smelter return royalty in respect of any gold production from the area within the boundaries of the Projects. AVM notes that a 1% royalty is already in place in respect of the Projects to prior owners of the Projects for which such obligation will be assigned to Advance.

- (Joint Venture): On and from settlement, the parties will have established the E79 Joint Venture at the Settlement Date, the interests of the parties in the E79 Joint Venture will be:

- Serra will hold 20%; and

- Advance will hold 80%,

in proportion to their relevant interests in E79. The E79 Joint Venture will have customary terms based on the AMPLA standard agreement entitled ‘Model Mining Joint Venture Agreement’ (Approved Version 2).

- (Operator): Throughout the Free Caried Period and until Settlement, Advance will be appointed the operator of the Projects. The Operator shall on its own behalf and on behalf of E79 as the case may be, be responsible for and have full discretion over the dealings, programs and budgets for the Projects.

- (Free Carried Period): From the execution date until the earlier of settlement or termination of the agreement, Advance agrees to free carry Serra, such that Advance will be required to solely fund 100% of the expenditure made or incurred in respect of the Projects.

- (Withdrawal): At any time following the execution date and prior to Advance making the Final Issue, Advance may withdraw and terminate this Agreement through 10 business days written notice and Advance’s obligations to issue any further Consideration Shares to Serra will be at an end.

- (Advisory Fee): Advance has also agreed to pay an advisory fee to Horizon Capital Ltd which introduced Advance to the E79 Joint Venture of A$40,000 in cash at settlement (Settlement Fee), as well as a further 2.5% of the value of each tranche of Consideration Shares issued by the Company (Deferred Fees). The Advisory Fee may be paid in either cash or AVM Shares (which would be issued subject to shareholder approval). In the event that the Settlement Fee is chosen to be paid in shares, 1,212,121 Shares will be issued to Horizon Capital Ltd at a deemed value of $0.033 per share.

High Grade Gavilanes Silver Project Overview

Advance is also pleased to announce it has entered into a binding sale agreement with Sailfish Royalty Corp. (TSX-V: FISH, OTCQX: SROYF) (‘Sailfish’) to acquire a 100% interest in the high grade Gavilanes Silver Project in Durango, Mexico (‘Gavilanes Acquisition’).

Pursuant to the binding sale agreement, the Company will acquire the Gavilanes Project via the acquisition of Sailfish’s wholly owned subsidiary Swordfish Silver Corp (‘Swordfish’) an entity which is the legal and beneficial owner of 100% of the shares in Sailfish de Mexico S.A. de C.V (but for 1 share registered in the name of Sailfish Royalty MGMT Corp and 2 shares registered in the name of Sailfish Royalty Corp. which will be transferred prior to completion such that they are registered in favour of AVM) which in turn holds a legal and beneficial interest in 100% of the mining concessions that comprise the Gavilanes Project.

On completion, AVM will own 100% of the shares in both Swordfish and Sailfish de Mexico S.A. de C.V such that it acquires 100% of the mining concessions that comprise the Gavilanes Project.

The acquisition of the Gavilanes Project represents a very low-cost opportunity to increase AVM’s exposure to the silver sector, with an existing Foreign Estimate of silver endowment, as well as a project which has previously had substantial exploration and drilling over the last several years against a backdrop of record high silver prices.

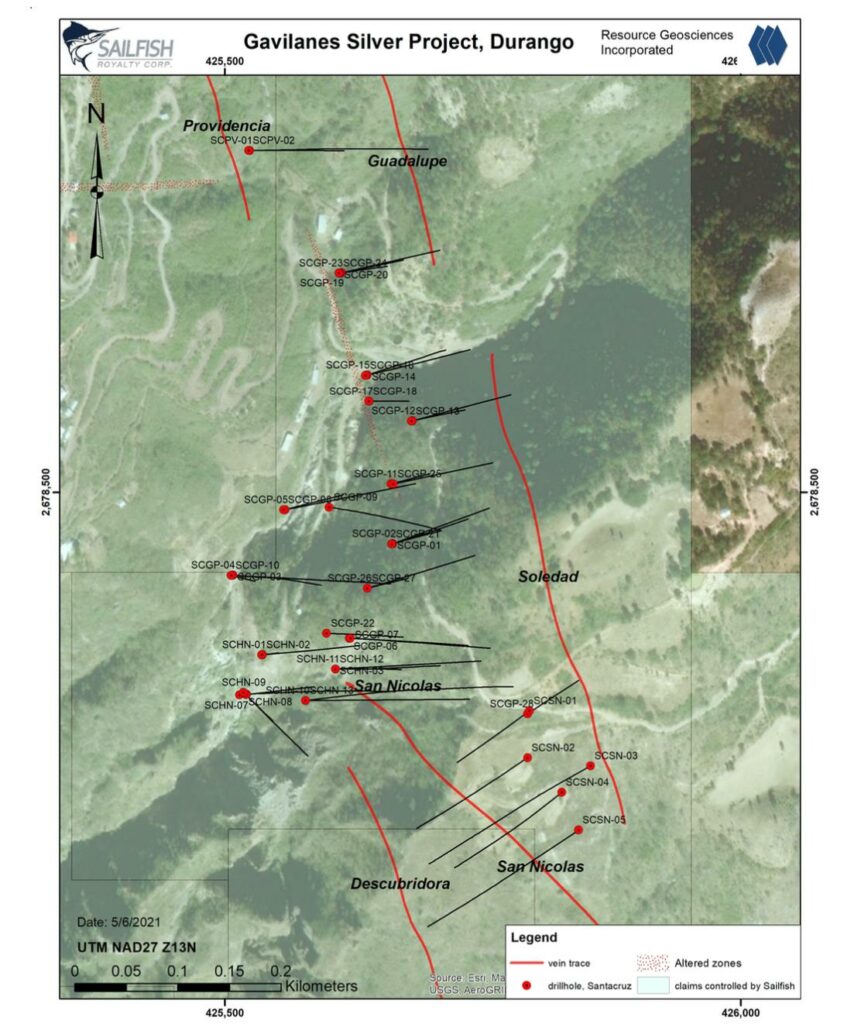

The Gavilanes Project, located in Durango, Mexico, within the prolific Sierra Madre Occidental District, is an early-stage high grade silver-gold vein system with significant exploration potential.

The project spans a 135km2 land package with low to intermediate sulfidation epithermal polymetallic veins, offering substantial room for growth and development. Current exploration has tested just 0.17km2 of the main zone, while an additional 0.28 km2 of known veins remain undrilled.2

Drilling to date has confirmed the presence of extensive untested veins and breccia zones, with veins extending over 2 km but drill coverage limited to less than 900 m along strike. Additional zones, including Central and Western Zones, show promise but require detailed mapping and sampling.

The deposit remains open at depth, with indications of increasing copper and gold grades. Recent discoveries of additional veins and alteration zones underline the project’s untapped potential. With supportive community relations, Gavilanes is positioned for expansion and advancement.2

Historic Drilling

In 2008, Hochschild Mining PLC (Hochschild) drilled 10 core holes for a total of 2,847.35m, testing the Guadalupe structure with five holes, the Providencia structure with one hole and the La Cruz structure with four holes, two of which are a pair from the same drill pad and set up, drilled because the first hole was abandoned prior to reaching the target depth. No certificates or geology logs are available for holes completed by Hochschild. Due to this lack of data, these drillholes are not used in estimation of the Foreign Estimate.2

Santacruz Silver conducted diamond drilling in 2012 and 2013 in an area of approximately 800 x 250m, testing principally the Guadalupe-Soledad, Descubridora and San Nicolas veins systems. A total of 9,623.9 metres of HQ core was drilled in 47 holes.2

Table B Santa Cruz Silver Drilling by Vein

| Vein | Holes | Metres |

| Guadalupe | 30 | 5,778.0 |

| San Nicolas | 5 | 1,141.5 |

| Descubridora | 12 | 2,704.4 |

Santacruz Silver Drilling Results

Data obtained from drillholes completed by Santacruz Silver in 2012 and 2013 was used in the creation of the Foreign Estimate presented. Anomalously silver mineralised (>20 gpt Ag) veins or structures were intersected in all 47 drillholes.2 To provide an indication of the possible economic significance of the drillhole intercepts considering an underground mining scenario, composite assays were calculated requiring downhole intercept lengths of minimum 2m, with minimum composite grade of 100 gpt Ag, using a 90 gpt Ag cutoff to define limits of the composite samples, and allowing a maximum of 1m continuous internal waste below cutoff within the composite. These composites are presented as Table C and indicate potential for mineralised zones with grades and widths consistent with narrow vein underground mining scenarios.2

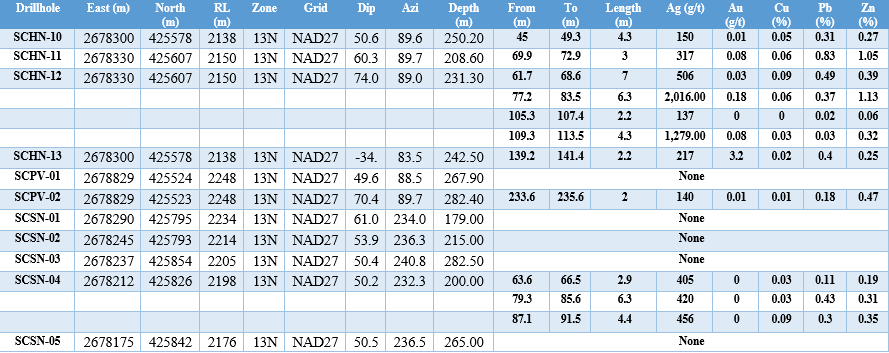

Table C Drill Results, composite assay, 2m minimum length, 100g/t Ag minimum grade, 90 g/t Ag cutoff, up to 1m internal waste2

Advance Metals’ Foreign Estimate

Following the acquisition of the Gavilanes Project, AVM shall host two high grade silver (AgEq) projects in Mexico with Foreign Estimates comprising:

- the Yoquivo Project with a Foreign Estimate of 937Kt @ 570 g/t AgEq (2.1 g/t Au, 410 g/t Ag) for 17.23M oz (AgEq). Refer to AVM Announcement dated 28 October 2024; 3 and

- the Gavilanes Project which has a Foreign Estimate of 22.4m oz AgEq @ 245.6 g/t AgEq.2 Refer to Table A above for the Inferred Foreign Estimate of Gavilanes Project.

Geology

The Gavilanes Silver Project lies within the Sierra Madre Occidental (SMO) province, a regionally extensive Tertiary volcanic field which extends southeast from the United States-Mexico border to central Mexico2. The total thickness of the volcanic sequence is approximately 2km, and it rests upon Mesozoic clastic and calcareous sedimentary rock. The volcanic field is comprised of two distinct volcanic sequences, an older andesitic and dacitic series, and a younger, pyroclastic dominated rhyolitic series. The Lower Series is approximately 1km thick and is dominated by Paleocene and Eocene intrusive and volcanic rocks, the latter comprising dominantly andesitic lavas and pyroclastic deposits, with interbedded volcaniclastic strata. Silicic volcanic units are present but are a minor component2. The volcanic strata of the Lower Series are cut by calc-alkaline intrusives. The Upper Series unconformably overlies the Lower Series with erosional disconformity and comprises a 1km thick sequence dominated by Oligocene and early-Miocene dacitic and rhyolitic pyroclastic strata and volcaniclastic strata. Most significant metal occurrences in the SMO are hosted by rocks of the Lower Series or the underlying Mesozoic strata.2

The Gavilanes Silver Project area is underlain by the Lower Series volcanic sequence comprised of Paleocene andesitic and dacitic volcanic rocks interbedded with epiclastic rocks of similar composition, capped by Upper Series Oligocene ignimbrites. Andesitic and rhyolitic dikes have intruded the volcanic strata.2

Eight mineralised structures have been identified in surface outcrop, and three, the Guadalupe- Soledad, Descubridora, and San Nicolas zones, have been drill tested by prior project owner Santacruz Silver Mining Ltd. 2 The La Cruz structure was tested by three shallow drillholes completed by Hochschild. The other four known mineralised structures or veins are untested by drilling. The mineralised structures are typically along the margins of flow banded rhyolite dikes that intrude the country rock andesites. True widths range from less than 1m to greater than 10m. The mineralised zones are not simple fissure filling veins, they comprise zones of structural and hydrothermal brecciation, with sulfidized matrix, which are crosscut by discontinuous banded quartz-carbonate- sulfide veinlets.2

Gavilanes Acquisition – Transaction Terms

A summary of the material terms of the Gavilanes Acquisition is set out below:

- (Acquisition): Subject to the satisfaction or waiver of the Conditions Precedent, Sailfish agrees to sell and Advance agrees to acquire 100% of the shares in Swordfish, Sailfish Mexico and 100% of the Gavilanes Project (‘Acquisition’).

- (Conditions Precedent): Settlement of the Acquisition is conditional upon the satisfaction or waiver of the following conditions on or before 5:00pm (WST) on 30 April 2025:

- Due Diligence by Advance: completion of financial, legal and technical due diligence by Advance on Sailfish and the Project;

- Due Diligence by Sailfish: completion of financial and legal due diligence by Sailfish on Advance;

- Regulatory and other Approvals: Advance and Serra obtaining all necessary shareholder and regulatory approvals or waivers, to allow the parties to lawfully complete the matters set out in the agreement.

- (Consideration): On the date that is within 5 days from the date all of the Conditions are satisfied, Advance agrees to acquire 100% of the shares in Swordfish, Sailfish Mexico and 100% of the Gavilanes Project, at settlement of the Acquisition by issuing/making:

- a cash payment of US$50,000 in immediately available funds (‘Cash Payment’);

- 16,800,000 AVM Shares, subject to shareholder approval; and

- 33,600,000 performance rights (‘AVM Performance Rights’), subject to shareholder approval, with the following milestones:

- 16,800,000 AVM Performance Rights shall vest and be convertible into AVM Shares on Advance achieving a 30m oz JORC resource at 300g/t AG Eq or greater from the Gavilanes Project within 5 years from the date of issue; and

- 16,800,000 AVM Performance Rights shall vest and be convertible into AVM Shares on Advance achieving a 60m oz JORC resource at 300g/t AG Eq or greater from the Gavilanes Project within 5 years from the date of issue.

- (Royalty): On and from settlement, Advance will grant Sailfish a 2% net smelter return royalty in respect of any mineral production from the area within the boundaries of the Project. AVM will also assume the following royalties which are already in place with Sailfish over the Gavilanes Project:

- to Ricardo Flores Rodríguez, on mineral substances extracted and processed from any portion of the concessions “Gavilán” (title 221108), “Nuevo Gavilanes” (title 221107), “El Gavilán 2” (title 231437), and “El Gavilán 2 Fracción Uno” (title 231438), a net smelter return (NSR) of 2%, starting from commencement of commercial production, up to US$1,000,000;

- to Minera Hochschild México S.A. de C.V., on mineral substances extracted and processed from any portion of the concessions “Gavilanes MHM Fracc. 1” (title 240541) and Gavilanes MHM Fracc. 2” (title 233289) a NSR of 3%, starting from commencement of commercial production, and a one-time payment of US$1,000,000 (in addition to the 3% NSR) upon commencement of commercial production; and

- to Jorge de la Torre Robles, on mineral substances extracted and processed from any portion of the concessions “Victoria Cuatro” (title 172309), “San José” (title 178392), and “María Luisa” (title 187678) a NSR of 3%, starting from commencement of commercial production, up to US$1,000,000.

- (Minimum Expenditure Commitment): On and from the Settlement Date, and until the date which is five years thereafter, Advance must undertake exploration expenditure of not less than US$2,000,000 on the Project. If, during this period:

- the minimum expenditure commitment is not met; and

- no AVM Performance Rights have vested in accordance with their terms and conditions, the Company agrees to immediately pay Sailfish an amount the sum of US$500,000 in cash.

- (Right to Invest): Granting the Vendor the right to invest in any capital raising which Advance conducts of whatever nature so long as the Vendor remains a shareholder in Advance.

Funding of E79 Joint Venture and Gavilanes Acquisition

AVM remains fully funded to conduct planned exploration and drilling on its existing assets as well as early-stage exploration on both the Gavilanes Project and the Myrtleford and Beaufort Gold Projects. AVM will seek to raise further capital as the Board of Directors deems appropriate on the most favorable terms to AVM shareholders feasible.

AVM Upcoming Catalysts

E79 Gold Projects –

AVM has already commenced working on securing a low impact assessment exploration permit in order to conduct non ground disturbing exploration as well as conduct a confirmatory drilling program, in order to confirm the high grade gold drilling results at the Myrtleford and Beaufort Gold Projects.

Yoquivo High Grade Silver Project –

AVM is working to secure all required permitting and approvals in order to conduct a maiden first pass confirmatory drilling program at its high grade Yoquivo Silver Project in Mexico which will then be followed by step out drilling in order to expand the foreign estimate with the intention of translating this into a maiden JORC resource.

Gavilanes High Grade Silver Project –

AVM is working with Sailfish to secure all required permitting and approvals in order to conduct a maiden first pass confirmatory drilling program at its high grade Gavilanes Silver Project in Mexico which will then be followed by step out drilling in order to expand the foreign estimate with the intention of translating this into a maiden JORC resource.

Augustus Project –

The Board remains focused on moving towards its upcoming drilling program at its Augustus Copper and Gold Project in the USA – subject to satisfaction of all requisite approvals.

Non-Executive Chair, Craig Stranger, commented “the acquisitions of the High Grade Myrtleford and Beaufort Gold Projects and the Gavilanes High Grade Silver Project each in their own respective right represents a compelling value proposition to AVM shareholders each on attractive terms. We could have acquired either project on their own however both opportunities were presented to AVM and together with the recent acquisition of the High Grade Yoquivo Silver Project in Mexico, we feel clarify AVM’s high grade precious metals exploration strategy. We look forward to commencing drilling at the Gavilanes Project and confirmatory drilling in Victoria as soon as is feasible”.

This announcement has been authorised for release by the Board of Advance Metals Limited. Ends

About Advance Metals Limited

Advance Metals Limited (ASX: AVM) is a battery and precious metals focused exploration company with a world-class portfolio of silver, copper and gold growth projects. We seek to maximise shareholder value through the acquisition, discovery, and advancement of high quality metals projects. The Company utilises the expertise of our exploration team to identify underexplored and undervalued projects with significant geological potential. The Company has 100% ownership of the Garnet Skarn Deposit, the Augustus Project, the Anderson Creek Gold Project and the Yoquivo Silver Project. More information can be found on the AVM website, www.advancemetals.com.au.

Foreign Resource Estimate – ASX Listing Rule 5.12

Additional information pursuant to the requirements of ASX Listing Rule 5.12 regarding the use of foreign estimates contained in this announcement in respect of the Gavilanes Project is as follows:

- The Foreign Estimate is sourced from a technical report on the Gavilanes Project titled ‘CSA NI 43-101 Technical Report and Estimate of Mineral Resources, Gavilanes Silver Project, San Dimas Municipality, Durango, Mexico Prepared for Sailfish Royalty Corp.’ dated 14 May 2021, completed by Matthew D. Gray, Ph.D and Derick Unger, C.P.G.

The document is available at www.sedarplus.ca.

- The Gavilanes Project Foreign Estimate has been prepared in accordance with the Canadian National Instrument 43-101 (NI 43-101).

The Foreign Estimate contains categories of NI 43-101 ‘Measured’, ‘Indicated, and ‘Inferred’, that are consistent with the terminology used under the JORC Code (2012 Edition).

- The Foreign Estimate relates to the Gavilanes Project, which AVM has entered into the binding sale agreement to acquire. The acquisition is considered material to AVM given the size of the resource reported and the existing resources forms the base of AVM’s exploration strategy at the Gavilanes Project.

- Details on the reliability of the Foreign Estimate are summarised in the JORC Table 1 below.

- The Foreign Estimate is based on 47 HQ drill holes and a total of 9,623m of drilling. The estimate assumes a price of (in USD) $19.00oz Ag, $1,600oz Au, $3.50lb Cu and $1.00lb Pb. The project considers underground mining methods, reflecting the orientation and nature of the mineralised veins. The Foreign Estimate assumes potential selective mining units that align with the narrow vein geometry observed in the deposit. Assumptions regarding processing efficiency, recoveries, and beneficiation methods are made based on industry standards for similar silver-dominant epithermal deposits.

- The Foreign Estimate is based on the latest drilling data available, which is set out at Table C of this announcement.

- No more recent NI 43-101 estimates have been completed at the Gavilanes Project or provided to Advance.

- It is anticipated that an on-site and database review will be required to verify the Foreign Estimate as a mineral resource under the 2012 JORC Code. It is also possible that further sampling and/or drilling will be required to complete the verification. This work will be scheduled as soon as practical and will be funded out of existing cash reserves.

- Cautionary Statement:

- The Foreign Estimate of mineralisation included in this announcement is not compliant with the Australasian Code for Reporting Exploration Results, Mineral Resources and Ore Reserves (2012 JORC Code) and is a “Foreign Estimate”.

- A Competent Person (under ASX Listing Rules) has not yet done sufficient work to classify the Foreign Estimate as Mineral Resources or Ore Reserves in accordance with the 2012 JORC Code.

- It is uncertain that following evaluation and/or further exploration work the Foreign Estimate will be able to be reported as Mineral Resources or ore reserves in accordance with the JORC Code 2012.

- A Competent Person’s statement is set out below.

Competent Person’s Statement

The information in this report concerning data and exploration results has been compiled by AVM and reviewed by Mr. Joel Sidoruk, a Competent Person who is a Member of the Australian Institute of Mining and Metallurgy (AusIMM), is a Member (QP) of the Mining and Metallurgical Society of America (MMSA) and is currently contracted by Advance to provide technical advice and serve as regional manager LATAM. Mr. Sidoruk possesses the relevant expertise in the style of mineralisation, type of deposit under evaluation, and the associated activities, qualifying him as a Competent Person under the guidelines of the 2012 Edition of the ‘Australasian Code for the Reporting of Exploration Results, Mineral Resources and Ore Reserves.’ Mr. Sidoruk has approved the inclusion of this information in the report in the form and context in which it appears. The information in this release relating to the Gavilanes Foreign Resource Estimate is an accurate representation of the data presented in the report titled ‘CSA NI 43-101 Technical Report and Estimate of Mineral Resources, Gavilanes Silver Project, San Dimas Municipality, Durango, Mexico Prepared for Sailfish Royalty Corp.’ The information in this release regarding the Beaufort Gold Project is considered accurate and a true representation of the early-stage exploration work carried out by previous parties on the project. Mr. Sidoruk also notes that the information in this release relating to the Myrtleford drilling postdates any independent NI 43-101 review conducted on the project however, a review conducted on the Myrtleford database, assay certificates and core photos suggest the drill intercepts for the project described in this announcement are accurate description of the data collected during the recent drilling campaigns.

With regard to references to prior announcements of exploration results and foreign estimates and in particular the ASX announcement dated 28 October 2024, “Advance Metals to acquire Yoquivo High Grade Silver Project in Mexico” (‘Announcement’), The Competent Person for the information and data contained in that Announcement was Mr Steve Lynn and JORC Table 1 disclosures are contained therein.

The Company is not aware of any new information or data that materially affects the information and data included in the Announcement. In addition, all material assumptions and technical parameters underpinning the estimates in the Announcement have not changed. The Company confirms that the form and context in which the Competent Person findings are presented have not been materially modified from the original market announcement

Competent Person

Mr. Joel I Sidoruk BSc App. Geo. MMSA (QP), AusIMM (CP)

Forward‐Looking Statements

Certain statements in this announcement relate to the future, including forward-looking statements relating to the Company and its business (including its projects). Forward‐looking statements include, but are not limited to, statements concerning Advance Metals Limited planned exploration program(s) and other statements that are not historical facts. When used in this document, words such as “could,” “plan,” “estimate,” “expect,” “intend,” “may”, “potential,” “should,” and similar expressions are forward looking statements.

These forward-looking statements involve known and unknown risks, uncertainties, assumptions, and other important factors that could cause the actual results, performance or achievements of the Company to be materially different from future results, performance or achievements expressed or implied by such statements. Actual events or results may differ materially from the events or results expressed or implied in any forward-looking statement and deviations are both normal and to be expected. Neither the Company, its officers nor any other person gives any representation, assurance or guarantee that the events or other matters expressed or implied in any forward-looking statements will actually occur. You are cautioned not to place undue reliance on those statements.

Original Article: chrome-extension://efaidnbmnnnibpcajpcglclefindmkaj/https://hotcopper.com.au/data/announcements/ASX/2A1571915_AVM.pdf