Southern Silver Exploration Corp. (TSX.V: SSV) (“Southern Silver”) reported today that additional metallurgical test work on the Skarn Front deposit from the Cerro Las Minitas Project has resulted in both the successful separation of a potential “saleable grade” copper concentrate as well as the generation of a cleaner zinc concentrate grading above 50% zinc without sacrificing zinc, lead or silver recoveries.

This most recent test work conducted on behalf of Southern Silver by Blue Coast Research of Parksville, British Columbia, complements and improves on earlier batch work tests (see NR-06-18, May 14, 2018) that generated high-grade lead and zinc concentrates from the Blind-El Sol deposits and a high-grade lead concentrate from the Skarn Front deposit. However, heavy dilution of the zinc concentrate by chalcopyrite resulted in lower than optimal recoveries and grades of zinc concentrate generated from the Skarn Front composite.

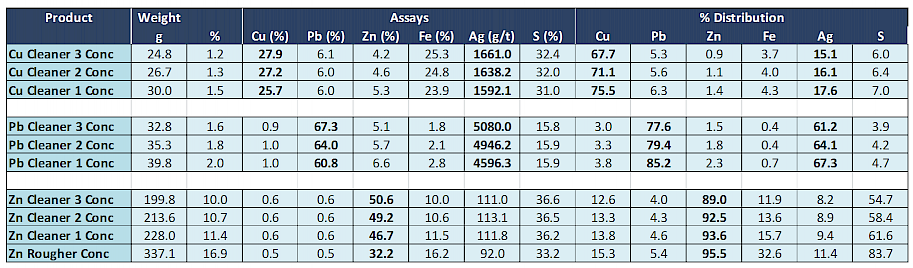

The focus of this new test work was to optimize the flotation sequence, upgrade the zinc concentrate by removing the chalcopyrite and if possible, create a separate copper concentrate. The best results were achieved using a sequential float of Cu-Pb-Zn followed by subsequent cleaning of each concentrate. The test work on the Skarn Front composite recovered:

- 67.7% Cu and 15.1% Ag into the copper concentrate assaying 27.9% Cu and 1661g/t Ag respectively after three stages of cleaning;

- 85.2% Pb and 67.3% Ag into the lead concentrate assaying 60.8% Pb and 4596g/t Ag respectively after one stage of cleaning; and

- 89% Zn and 8.2% Ag into the zinc concentrate assaying 50.7% Zn and 111g/t Ag respectively after three stages of cleaning.

These test results are significant in that they produced a saleable copper concentrate and increased both the recovery of zinc and the grade of the zinc concentrate by approximately 10% over the earlier flotation test results (see NR-06-18). Silver strongly partitions into the lead and copper concentrates for a combined 82.4% Ag recovery in concentrates that traditionally receive favourable payable terms.

These latest test results complement previously reported recoveries from the Blind – El Sol sulphide composite (see NR-06-18) which recovered:

- 82% Ag, 90% Pb and 4% Zn into a lead concentrate assaying 2880ppm Ag, 68% Pb and 2% Zn; and

- 78% Zn into a zinc concentrate assaying 52% Zn.

The combined results from the Blind – El Sol and the Skarn Front deposits provide very favorable recoveries and grades of silver, lead and zinc which form the initial basis for a metallurgical processing flowsheet which in turn, can be used in the further evaluation and scoping of the CLM project. More advanced metallurgical test work should include variability tests of different parts of the CLM deposits and lock cycle tests to better define the processing flowsheet and will proceed with the acquisition of further data from the current 2018 and subsequent drill programs.

Table 1: Cleaner test results from the Skarn Front deposit test work

Cerro Las Minitas Project

The Cerro Las Minitas project is an advanced exploration stage polymetallic Ag-Pb-Zn-Cu Skarn/CRD project located in southern Durango, Mexico. Approximately 5,200 metres of drilling has been completed of an anticipated 12,000 core hole 2018 exploration program. Drilling continues with one core drill focused on systematic resource expansion in the Area of the Cerro which contains the existing Mineral Resource Estimate and the second core drill rig focused on new Ag-Au epithermal vein targets in the recently staked CLM West claim group. The company continues refining the CLM West drill targets through surface sampling and VLF-EM surveys over specific target areas.

The Cerro Las Minitas project as of January 8th , 2018 contains an estimated Indicated Resource, at a 175g/t AgEq cut-off, of 33.6Mozs silver and 319Mlbs of lead and 813Mlbs zinc (116.1Mozs AgEq) and an estimated Inferred Resource of 20.7Mozs silver, 131Mlbs lead and 870Mlbs zinc (92.7Mozs AgEq).(1)

A total of 119 drill holes for 54,800 metres have now been completed on the Cerro Las Minitas project with exploration expenditures of approximately US$15.5 million equating to exploration discovery costs of approximately $0.07 per AgEq ounce to the end of 2017. A further US$3.0 million is budgeted for the current 2018 exploration program.

The Cerro Las Minitas project operates on a joint venture basis by Southern Silver at a 40% interest and Electrum Global Holdings LP at a 60% interest. Southern Silver is operator of the project. Since formation of the Joint Venture in September, 2017, the partners have approved over US$3.5 Million in exploration on the project.

About Southern Silver Exploration Corp.

Southern Silver Exploration Corp. is a precious metal exploration and development company with a focus on the discovery of world-class mineral deposits in north-central Mexico and the southern USA. Our specific emphasis is the Cerro Las Minitas silver-lead-zinc project located in the heart of Mexico’s Faja de Plata, which hosts multiple world-class mineral deposits such as Penasquito, San Martin and Los Gatos. We have assembled a team of highly experienced technical, operational and transactional professionals to support our exploration efforts with the objective of developing, along with our partner, Electrum Global Holdings LP, the Cerro Las Minitas project into a premier, silver-lead-zinc mine.

The Company engages in the acquisition, exploration and development either directly or through joint-venture relationships in mineral properties in major jurisdictions. Our property portfolio also includes the Oro porphyry copper-gold project located in southern New Mexico, USA. The Oro property consists of patented land, State leases and BLM located mineral claims which cover a highly prospective quartz-sericite-pyrite alteration zone, interpreted to overlie an unexposed porphyry centre and distal sediment-hosted, oxide-gold target.

- The 2018 Cerro Las Minitas Resource Estimate was prepared following CIM definitions for classification of Mineral Resources. Resources are constrained using mainly geological constraints and approximate 10g/t AgEq grade shells. The block models are comprised of an array of blocks measuring 10m x 2m x 10m, with grades for Au, Ag, Cu, Pb, Zn and AgEq values interpolated using ID2 weighting. The models identified at a 175g/t AgEq cut-off, an indicated resource of 10,135,000 tonnes averaging 102g/t Ag, 0.1g/t Au, 1.4% Pb, 3.6% Zn and 0.15% Cu and a cumulative inferred resource of 8,685,000 tonnes averaging 74g/t Ag, 0.04g/t Au, 0.7% Pb, 4.5% Zn and 0.15% Cu. Mineral Resource cut-offs are estimated using an average long-term price of $16/oz silver, $1,200/oz gold, $2.75/lb Cu, $1.00/lb lead and $1.10/lb zinc and metal recoveries of 82% silver, 86% lead 80% copper and 80% zinc. AgEq calculations did not account for relative metallurgical recoveries of the metals. All prices are stated in $USD. Mineral Resources are conceptual in nature and as such do not have demonstrated economic viability.

The current Resource Estimate was prepared by Garth Kirkham, P.Geo. of Kirkham Geosciences Ltd. who is the Independent Qualified Person responsible for presentation and review of the Mineral Resource Estimate.

Robert Macdonald, MSc. P.Geo, is a Qualified Person as defined by National Instrument 43-101 and responsible for the supervision of the exploration on the Cerro Las Minitas Project and for the preparation of the technical information in this disclosure.

On behalf of the Board of Directors

“Lawrence Page”

Lawrence Page, Q.C.

President & Director, Southern Silver Exploration Corp.

For further information, please visit Southern Silver’s website at southernsilverexploration.com or contact us at 604.641.2759 or by email at ir@mnxltd.com.

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

This news release may contain forward-looking statements. Forward-looking statements address future events and conditions and therefore involve inherent risks and uncertainties. Actual results may differ materially from those currently anticipated in such statements. Factors that could cause actual results to differ materially from those in forward looking statements include the timing and receipt of government and regulatory approvals, and continued availability of capital and financing and general economic, market or business conditions. Southern Silver Exploration Corp. does not assume any obligation to update or revise its forward-looking statements, whether as a result of new information, future events or otherwise, except to the extent required by applicable law.