Drilling at La Soledad has intercepted multiple high-grade veins as the Target 1 resource update drilling progresses at the Copalquin silver and gold district property in Durango State, Mexico.

HIGHLIGHTS

- 3.35m @ 26.5 g/t gold, 1,046 g/t silver, from 215.15m, (MTH-LS25-16)

- 0.65m @ 12.1 g/t gold, 292 g/t silver, from 280.35m

- 0.50m @ 3.53 g/t gold, 3.2 g/t silver, from 335.0m

- 5.00m @ 5.08 g/t gold, 22.1 g/t silver, from 108.06m, (MTH-LS25-14), including

- 1.00m @ 16.7 g/t gold, 72.7 g/t silver, from 110.0m

- 0.84m @ 1.78 g/t gold, 35.6 g/t silver, from 148.66m

- 3.62m @ 9.62 g/t gold, 55.2 g/t silver, from 97.7m, (MTH-LS25-13) (incl. 0.8m void) including

- 0.72m @ 45.5 g/t gold, 221 g/t silver, from 100.6m

- 0.46m @ 4.11 g/t gold, 83.8 g/t silver, from 170.54m

- 1.99m @ 4.29 g/t gold, 72.6 g/t silver, from 98.26 m (MTH-LS25-12), including

- 0.50m @ 15.4 g/t gold, 214 g/t silver, from 98.26m,

- 2.75m @ 1.23 g/t gold, 81.2 g/t silver, from 108.75m, including

- 0.50m @ 5.16 g/t gold, 334 g/t silver, from 108.75m

- During March 2025, a further 3 holes have been completed with one in progress at La Soledad. Two deep holes at El Refugio and at least 2 holes at Refugio West are scheduled in the Target 1 resource area

- At the start of April 2025, the second drill will commence drilling at the highly prospective Target 2 area of El Peru/Las Brujas while we continue to progress the multiple target generation work in the district

Mithril Silver and Gold Limited (“Mithril” or “the Company”) (MTH:ASX, MSG:TSXV) announces drill results for the Target 1 resource expansion programme at its Copalquin District project, Mexico.

John Skeet, Mithril’s Managing Director and CEO commented:

“Drilling at La Soledad in the Target 1 resource area continues to intercept multiple high-grade silver-gold veins with grades higher than the average Target 1 mineral resource estimate (MRE) published in November 2021 (NI43-101 in August 2024). Further drill holes are scheduled in the Target 1 area at Refugio and Refugio West ahead of an update of the Target 1 resource. In April 2025, the second drill will commence the first ever holes at the Target 2 area where the 2024 LiDAR interpretation revealed a breccia pipe at the El Peru workings plus extensive historic surface workings in the area. We are on target to complete 35,000 metres of drilling throughout 2025 in an expansive program to test multiple targets and demonstrate our Copalquin District property as a major high-grade silver and gold district in Mexico’s famed Sierra Madre Trend.”

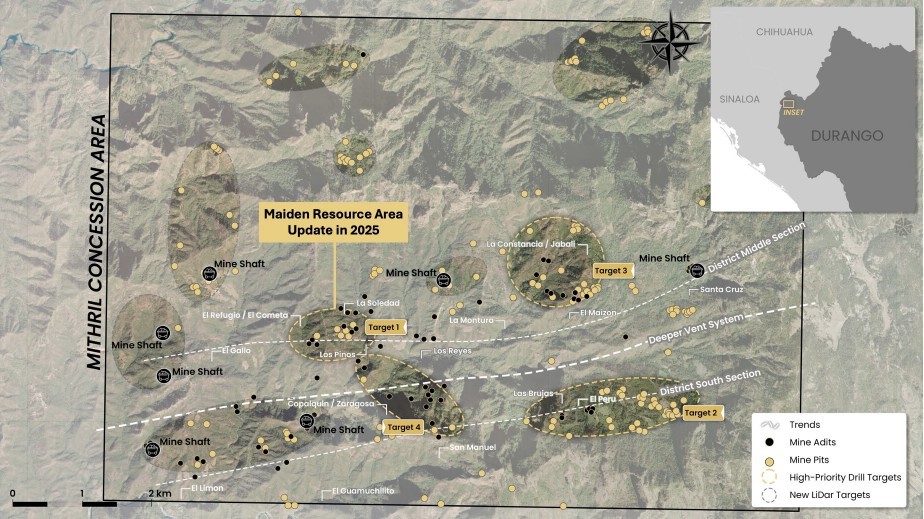

COPALQUIN GOLD-SILVER DISTRICT, DURANGO STATE, MEXICO

With 100 historic underground gold-silver mines and workings plus 198 surface workings/pits throughout 70km2 of mining concession area, Copalquin is an entire mining district with high-grade exploration results and a maiden JORC resource. To date there are several target areas in the district with one already hosting a high-grade gold-silver JORC mineral resource estimate (MRE) at El Refugio (529koz AuEq @6.81 g/t AuEq)1 and a NI 43-101 Technical Report filed on SEDAR+, supported by a conceptional underground mining study completed on the maiden resource in early 2022 (see ASX announcement 01 March 2022 and metallurgical test work (see ASX Announcement 25 February 2022). There is considerable strike and depth potential to increase the resource at El Refugio and at other target areas across the district, plus the underlying geologic system that is responsible for the widespread gold-silver mineralisation.

With the district-wide gold and silver occurrences and rapid exploration success, it is clear the Copalquin District is developing into another significant gold-silver district like the many other districts in this prolific Sierra Madre Gold-Silver Trend of Mexico.

Drilling is in progress at the Target 1 drill area where the current maiden resource drilling is scheduled to be completed by end of Q1 2025. Channel sampling work, using a diamond rock saw, has continued adjacent to the Target 1 area and immediately to the south towards the Copalquin creek. Drilling is planned to commence with the second drill rig at the Target 2 area by April 2025.

1 See ‘About Copalquin Gold Silver Project’ section for JORC MRE details and AuEq. calculation.

Drill Results Discussion

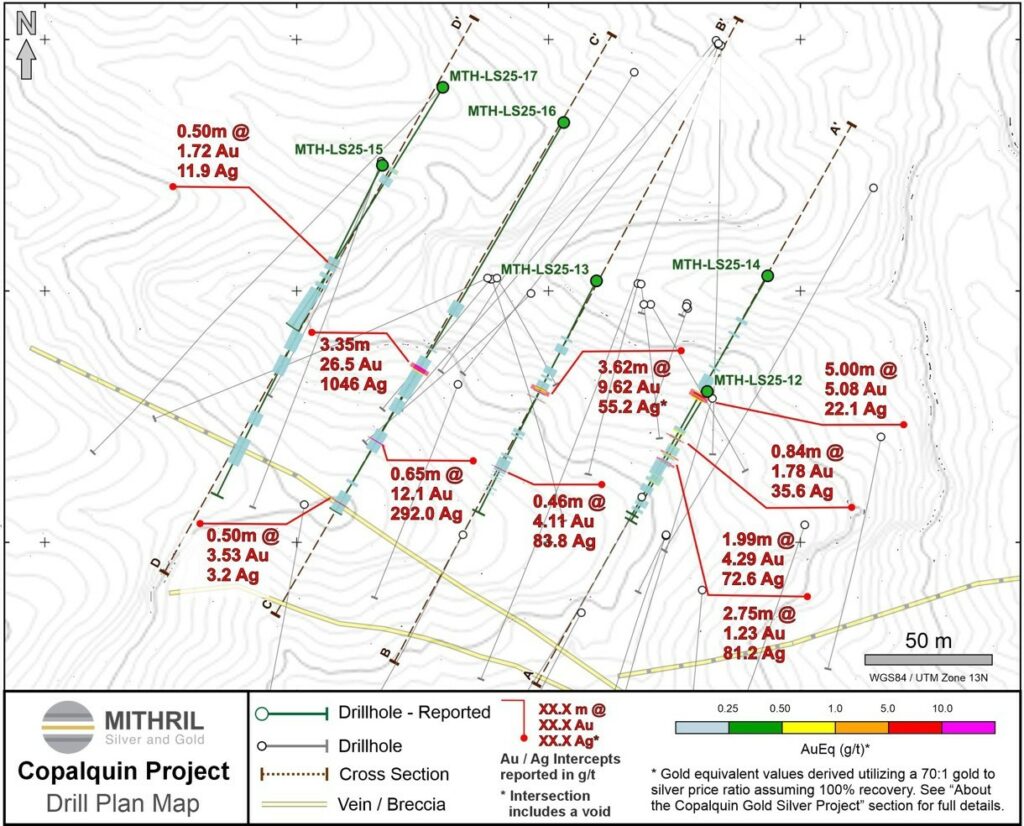

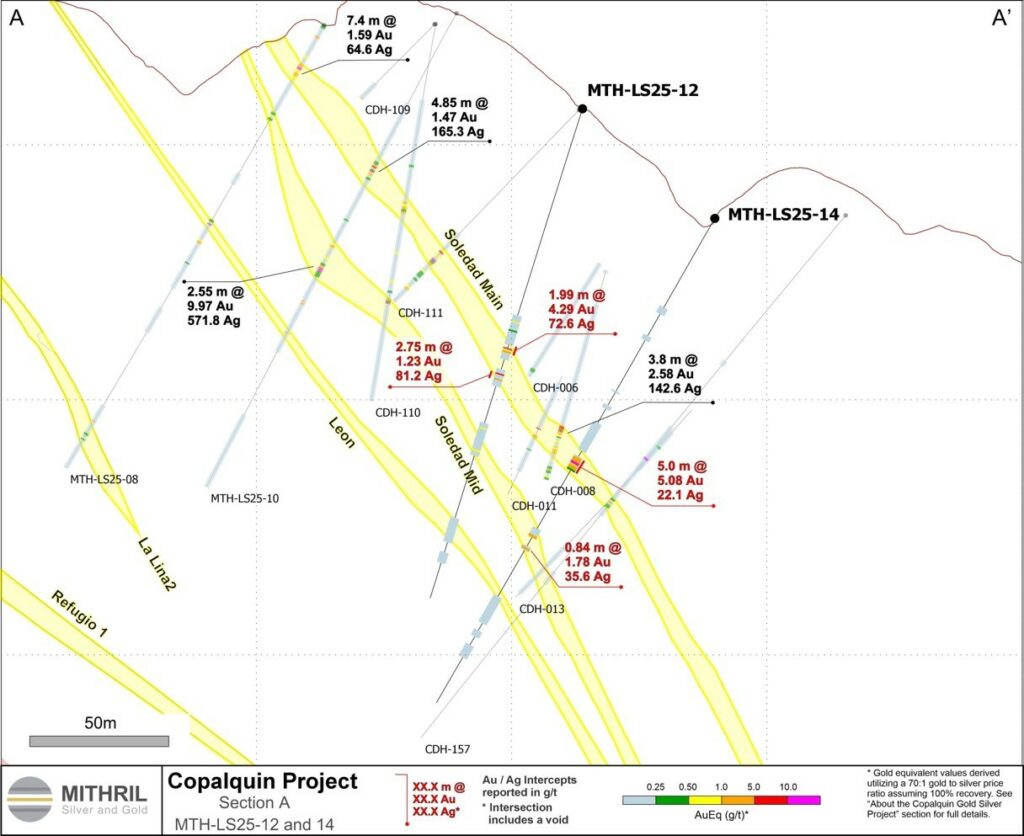

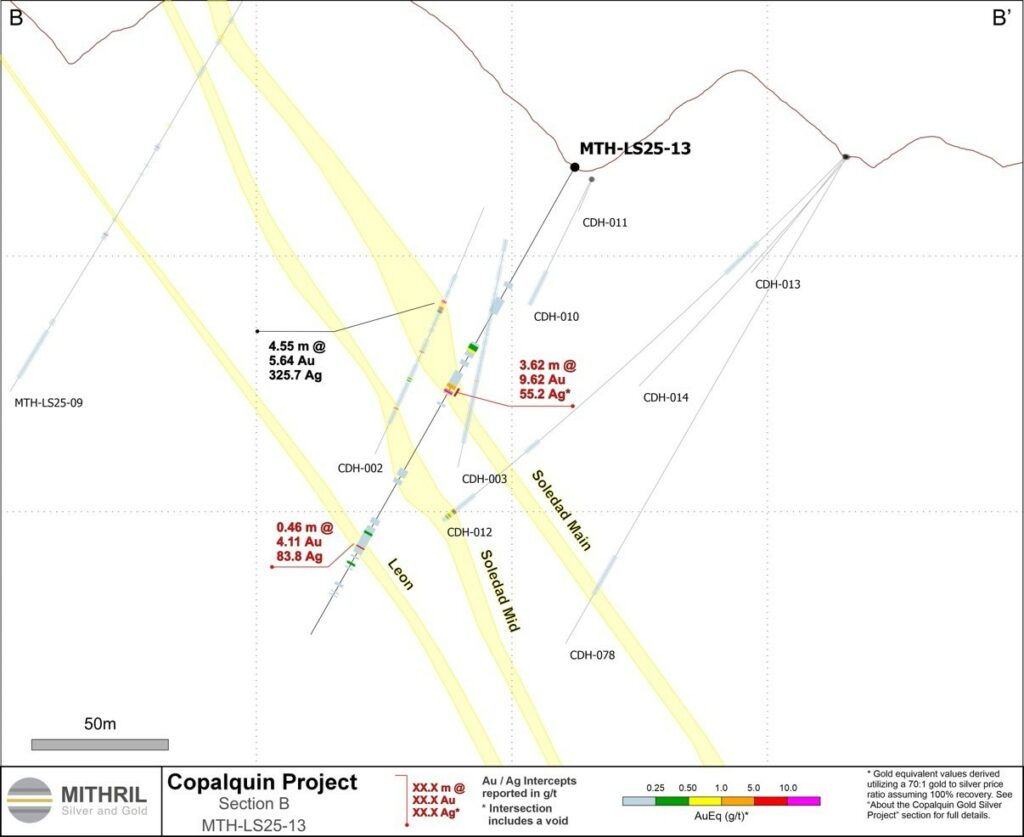

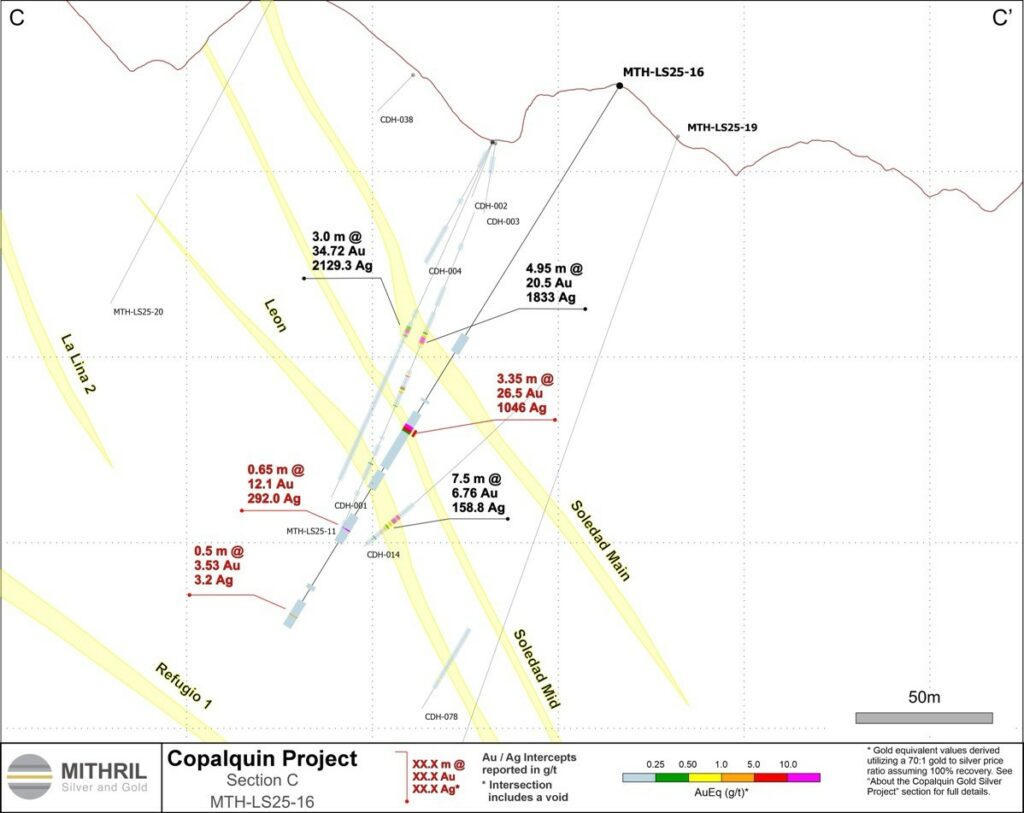

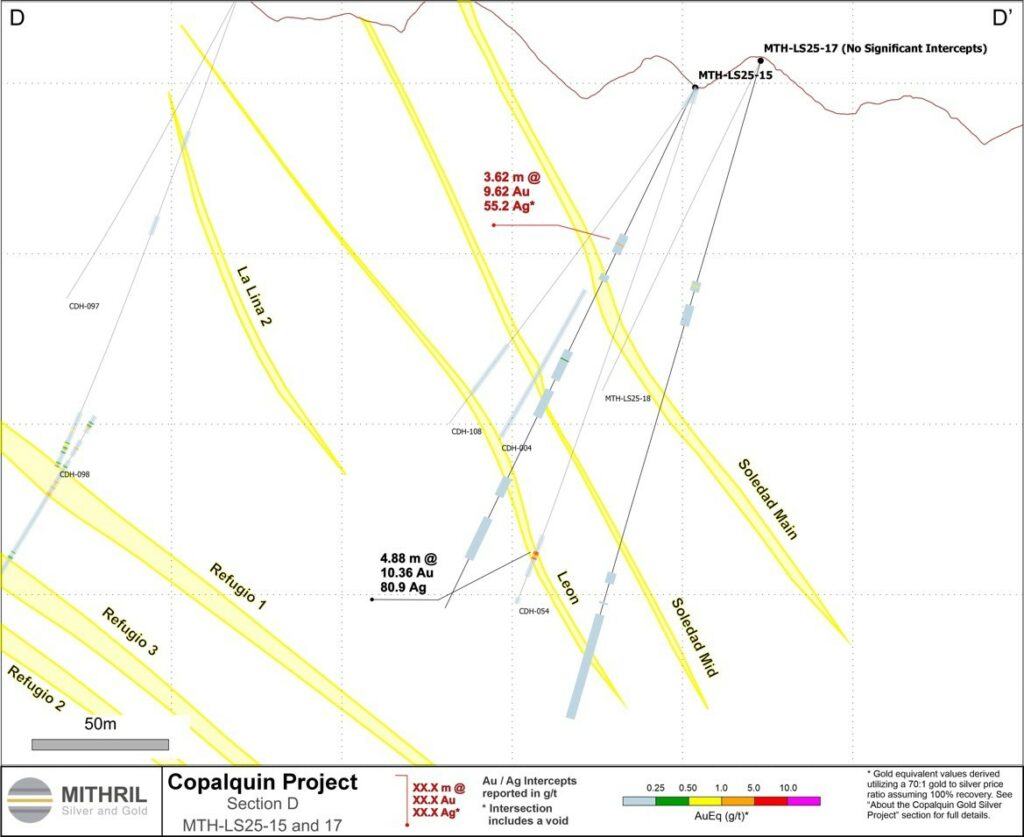

Drilling at La Soledad, the north-westerly tending structure on the north-eastern side of the Target 1 resource area, has returned excellent intercepts ahead of the planned resource update. Results for drill holes MTH- LS25-12 to MTH-LS25-17 are summarised below. Drilling is continuing at La Soledad where a further three holes have been completed with one more to complete. Drilling will move westwards to complete further drilling in the Target 1 area at Refugio and Refugio West.

- 1.99m @ 4.29 g/t gold, 72.6 g/t silver, from 98.26 m (MTH-LS25-12), including

- 0.50m @ 15.4 g/t gold, 214 g/t silver, from 98.26m,

- 2.75m @ 1.23 g/t gold, 81.2 g/t silver, from 108.75m

- 0.50m @ 5.16 g/t gold, 334 g/t silver, from 108.75m,

- 3.62m @ 9.62 g/t gold, 55.2 g/t silver, from 97.7m, (MTH-LS25-13) (incl. 0.8m void), including

- 0.72m @ 45.5 g/t gold, 221 g/t silver, from 100.6m

- 0.46m @ 4.11 g/t gold, 83.8 g/t silver, from 170.54m

- 5.00m @ 5.08 g/t gold, 22.1 g/t silver, from 108.06m, (MTH-LS25-14), including

- 1.00m @ 16.7 g/t gold, 72.7 g/t silver, from 110.0m

- 0.84m @ 1.78 g/t gold, 35.6 g/t silver, from 148.66m

- 0.50m @ 1.72 g/t gold, 11.9 g/t silver, from 102.15m, (MTH-LS25-15)

- 3.35m @ 26.5 g/t gold, 1,046 g/t silver, from 215.15m, (MTH-LS25-16)

- 0.65m @ 12.1 g/t gold, 292 g/t silver, from 280.35m

- 0.50m @ 3.53 g/t gold, 3.2 g/t silver, from 335.0m

MTH-LS25-14 returned higher AuEq grades than previously estimated in the 2021 MRE along both the Soledad main and Soledad mid veins. The first intercept represents a roughly 20m down-dip extension of high-grade mineralization from CDH-008 and CDH-011 along the Soledad main vein, with the second intercept 42m down- dip from MTH-LS-25-12 and 17m up-dip from CDH-013 along the Soledad mid vein.

MTH-LS25-16 returned higher AuEq grades than previously estimated in the 2021 MRE along the Soledad main vein, confirming a roughly 20m down-dip extension of high-grade mineralization from MTH-LS25-11. The deeper two intercepts (from 280.35m and 335m) are both in the footwall of the Leon vein, in areas which were estimated as waste in the 2021 MRE. Both intercepts are open up-dip, down-dip, and along strike, and while narrow, could represent additional targets for resource growth in the Soledad system.

MTH-LS25-12 confirmed continuity in mineralization along the Soledad vein approximately 18m southeast from historical mine workings.

MTH-LS25-13 confirmed continuity in mineralization along the Soledad vein approximately 10m west from historical mine workings and returned significantly higher grades than nearby CDH-003 (12m down-dip).

Drill hole MTH-LS25-17 did not return a reportable intercept.

ABOUT THE COPALQUIN GOLD SILVER PROJECT

The Copalquin mining district is located in Durango State, Mexico and covers an entire mining district of 70km2 containing several dozen historic gold and silver mines and workings, ten of which had notable production. The district is within the Sierra Madre Gold Silver Trend which extends north-south along the western side of Mexico and hosts many world-class gold and silver deposits.

Multiple mineralisation events, young intrusives thought to be system-driving heat sources, widespread alteration together with extensive surface vein exposures and dozens of historic mine workings, identify the Copalquin mining district as a major epithermal centre for Gold and Silver.

Within 15 months of drilling in the Copalquin District, Mithril delivered a maiden JORC mineral resource estimate demonstrating the high-grade gold and silver resource potential for the district. This maiden resource is detailed below (see ASX release 17 November 2021)^ and a NI 43-101 Technical Report filed on SEDAR+

- 2,416,000 tonnes @ 4.80 g/t gold, 141 g/t silver for 373,000 oz gold plus 10,953,000 oz silver (Total 529,000 oz AuEq*) using a cut-off grade of 2.0 g/t AuEq*

- 28.6% of the resource tonnage is classified as indicated

| Tonnes (kt) | Tonnes (kt) | Gold (g/t) | Silver (g/t) | Gold Eq.* (g/t) | Gold (koz) | Silver (koz) | Gold Eq.* (koz) | |

| El Refugio | Indicated | 691 | 5.43 | 114.2 | 7.06 | 121 | 2,538 | 157 |

| Inferred | 1,447 | 4.63 | 137.1 | 6.59 | 215 | 6,377 | 307 | |

| La Soledad | Indicated | – | – | – | – | – | – | – |

| Inferred | 278 | 4.12 | 228.2 | 7.38 | 37 | 2,037 | 66 | |

| Total | Indicated | 691 | 5.43 | 114.2 | 7.06 | 121 | 2,538 | 157 |

| Inferred | 1,725 | 4.55 | 151.7 | 6.72 | 252 | 8,414 | 372 | |

| TOTAL | 2,416 | 4.80 | 141 | 6.81 | 373 | 10,953 | 529 |

Table 1 – Mineral resource estimate El Refugio – La Soledad using a cut-off grade of 2.0 g/t AuEq*

* Gold equivalent (AuEq.) grades are calculated based on an assumed gold:silver price ratio of 70:1, using the formula: AuEq grade = Au grade + ((Ag grade/70) x (Ag recovery/Au recovery)). The metal prices used to determine the 70:1 ratio are the cumulative average prices for 2021: gold USD1,798.34 and silver: USD25.32

(actual is 71:1) from kitco.com. Metallurgical recoveries are not considered in the in-situ grade estimate and are assumed to be equal for the above AuEq grade formula. In the Company’s opinion there is reasonable potential for both gold and silver to be extracted and sold with subsequent preliminary metallurgical test work recoveries of 91% for silver and 96% for gold (ASX Announcement 25 February 2022).

^ The information in this report that relates to Mineral Resources or Ore Reserves is based on information provided in the following ASX announcement: 17 Nov 2021 – MAIDEN JORC RESOURCE 529,000 OUNCES @ 6.81G/T (AuEq*), which includes the full JORC MRE report, also available on the Mithril Resources Limited Website.

The Company confirms that it is not aware of any new information or data that materially affects the information included in the original market announcement and that all material assumptions and technical parameters underpinning the estimates in the relevant market announcement continue to apply and have not materially changed. The company confirms that the form and context in which the Competent Person’s findings are presented have not been materially modified from the original market announcement.

Mining study and metallurgical test work supports the development of the El Refugio-La Soledad resource with conventional underground mining methods indicated as being appropriate and with high gold-silver recovery to produce metal on-site with conventional processing.

Mithril is currently exploring in the Copalquin District to expand the resource footprint, demonstrating its multi-million-ounce gold and silver potential.

Mithril has an exclusive option to purchase 100% interest in the Copalquin mining concessions by paying US$10M on or any time before 7 August 2026 (option has been extended by 3 years). Mithril has reached an agreement with the vendor for an extension of the payment date by a further 2 years (bringing the payment date to 7 August 2028).

-ENDS-

Released with the authority of the Board. For further information contact:

John Skeet

Managing Director and CEO

jskeet@mithrilsilvergold.com

+61 435 766 809

+1 672 962 7112

Mark Flynn

Investor Relations

mflynn@mithrilresources.com.au

+61 416 068 733

Competent Persons Statement – JORC

The information in this announcement that relates to metallurgical test results, mineral processing and project development and study work has been compiled by Mr John Skeet who is Mithril’s CEO and Managing Director. Mr Skeet is a Fellow of the Australasian Institute of Mining and Metallurgy. This is a Recognised Professional Organisation (RPO) under the Joint Ore Reserves Committee (JORC) Code.

Mr Skeet has sufficient experience of relevance to the styles of mineralisation and the types of deposits under consideration, and to the activities undertaken, to qualify as a Competent Person as defined in the 2012 Edition of the Joint Ore Reserves Committee (JORC) Australasian Code for Reporting of Exploration Results, Mineral Resources and Ore Reserves. Mr Skeet consents to the inclusion in this report of the matters based on information in the form and context in which it appears. The Australian Securities Exchange has not reviewed and does not accept responsibility for the accuracy or adequacy of this release.

The information in this announcement that relates to sampling techniques and data, exploration results and geological interpretation for Mithril’s Mexican project, has been compiled by Mr Patrick Loury who is Mithril’s Project Consultant. Mr Loury is a member of the American Institute of Professional Geologists and a Certified Professional Geologist (CPG). This is a Recognised Professional Organisation (RPO) under the Joint Ore Reserves Committee (JORC) Code.

Mr Loury has sufficient experience of relevance to the styles of mineralisation and the types of deposits under consideration, and to the activities undertaken, to qualify as a Competent Person as defined in the 2012 Edition of the Joint Ore Reserves Committee (JORC) Australasian Code for Reporting of Exploration Results, Mineral Resources and Ore Reserves. Mr Loury consents to the inclusion in this report of the matters based on information in the form and context in which it appears.

The information in this announcement that relates to Mineral Resources is reported by Mr Rodney Webster, Principal Geologist at AMC Consultants Pty Ltd (AMC), who is a Member of the Australasian Institute of Mining and Metallurgy. The report was peer reviewed by Andrew Proudman, Principal Consultant at AMC. Mr Webster is acting as the Competent Person, as defined in the 2012 Edition of the Joint Ore Reserves Committee (JORC) Australasian Code for Reporting of Exploration Results, Mineral Resources and Ore Reserves, for the reporting of the Mineral Resource estimate. A site visit was carried out by Jose Olmedo a geological consultant with AMC, in September 2021 to observe the drilling, logging, sampling and assay database. Mr Webster consents to the inclusion in this report of the matters based on information in the form and context in which it appears

The Australian Securities Exchange has not reviewed and does not accept responsibility for the accuracy or adequacy of this release.

Qualified Persons – NI 43-101

Scientific and technical information in this Report has been reviewed and approved by Mr John Skeet (FAUSIMM, CP) Mithril’s Managing Director and Chief Executive Officer. Mr John Skeet is a qualified person within the meaning of NI 43-101.

Original Article: https://mithrilsilvergold.com/announcements/6865747