Toronto, Ontario and Vancouver, British Columbia— (CNW – November 1st, 2018)Minera Alamos Inc. (the “Company” or “Minera Alamos”) (TSX VENTURE:MAI) is pleased to report additional results from its Phase 1 drill program at the Santana gold project, Sonora, Mexico. Phase 1 Exploration Highlights:

- Latest Hole S18-123 – 127 m of 0.81 g/t Au – Along with S18-123/124, holes S18- 116/117/118/119 (previously reported) delineated broad zones of near surface mineralized extensions of the Nicho Main deposit trending southwest of previous historical drilling. Other highlights included 93.5 m of 0.63 g/t Au (S18-116) and 80.4 m of 1.05 g/t Au (S18-117).

- Holes S18-123/124 which tested the SW limits of the Nicho Main zone both ended within the mineralized horizon (approximately 150m down hole at 45-degree dip) and indicate potential for deep mineralization extensions that were not considered in previous exploration programs.

- New Discovery Hole S18-121 – 96 m of 1.47 g/t AuEq – First hole drilled into a new zone of gold/silver/copper mineralization (Divisadero Zone) located approximately 200m north of the previously known limits at the Nicho Main/Norte Zones. Subsequent surface mapping has confirmed that the new area appears to be open for expansion in all directions.

- Discovery of New Nicho-Style Gold Structure (Zata Zone) – Over a surface area of approximately 400m x 400m, sixty-six (66) rock samples were assayed with 50% exhibiting grades suitable for heap leaching (>0.10 g/t Au).

“The Phase 1 program at the Santana gold project has been an overwhelming success” state Darren Koningen, CEO of Minera Alamos. “With the first significant exploration activity on the project since 2011 we have been able to demonstrate that the Nicho Main zone remains open for further expansion. In addition, our ongoing efforts to better understand the geological controls on gold mineralization that occur throughout the property have already been validated by the discovery of the new Divisadero and Zata zones. It is becoming increasingly evident that the mineralizing events that occurred in the Nicho area are present at shallow depths elsewhere on our extensive property holdings. Once we complete the final compilation of the current data we look forward to the initiation of a Phase 2 drilling program.”

Table 1 –Nicho Zone Drilling Results Summary Table

| Mineralized Intervfal 1,2 | Composite Interval3 | |||||||

| Drill Hole | From (m) | To (m) | Width (m) | Gold (g/t) | Width (m) | Gold (g/t) | Area | |

| S18-114 | 14.0 | 29.5 | 15.5 | 0.27 | Nicho Satellite | |||

| And | 66.2 | 81.1 | 14.9 | 1.40 | ||||

| And | 107.2 | 117.0 | 9.8 | 0.65 | ||||

| And | 145.5 | 172.0 | 26.5 | 0.21 | ||||

| S18-115 | 8.2 | 26.0 | 17.8 | 0.73 | Nicho Satellite | |||

| And | 61.0 | 73.8 | 12.8 | 0.17 | ||||

| And | 123.9 | 129.5 | 5.6 | 0.24 | ||||

| S18-116 | 2.0 | 95.5 | 93.5 | 0.65 | 60.0 | 0.97 | Nicho | |

| S18-117 | 19.3 | 99.7 | 80.4 | 1.05 | 42.0 | 1.96 | Nicho | |

| S18-118 | 2.5 | 10.5 | 8.0 | 1.0 | Nicho | |||

| And | 48.5 | 73.0 | 24.5 | 0.81 | ||||

| And | 90.0 | 103.6 | 13.6 | 0.29 | ||||

| S18-119 | 1.3 | 10.7 | 9.4 | 0.14 | Nicho | |||

| And | 20.5 | 34.9 | 14.4 | 0.33 | ||||

| And | 77.9 | 82.5 | 4.6 | 0.25 | ||||

| S18-120 | Hole abandoned due to faulting | Nicho Norte | ||||||

| S18-1225 | No significant mineralization | Nicho Norte | ||||||

| S18-1234 | 23.2 | 150.5 | 127.3 | 0.81 | 63.7 | 1.55 | Nicho | |

| S18-1244 | 8.5 | 38.5 | 30.0 | 0.23 | Nicho | |||

| And | 85.5 | 160.0 | 74.5 | 0.32 | ||||

Notes:

- Grades/widths of mineralized intervals represent complete “from” “to” drill depths as shown.

- All holes (with the exception of S18-122 which was drilled vertically) were drilled at 45-70 degree inclinations designed to be roughly perpendicular to the understood dip of mineralized structures based on the current understanding of the geological structures. The true widths of the mineralized zones in these areas are currently unknown.

- Grade/width of composite intervals is a total of all mineralized intervals that have gold grades equal to or in excess of “typical” open-pit mining heap leach cut-off grades of 0.15 g/t gold.

- Hole ended in mineralization

- Hole S18-122 was redrilled vertically in the same location as S18-120 which was abandoned.

Table 2 – Divisadero Porphyry Discovery Hole

| Mineralized Interval1,2 | |||||||||

| Drill Hole | From (m) | To (m) | Width (m) | Gold (g/t) | Silver (g/t) | Copper (%) | Gold Eq3 (g/t) | Area | |

| S18-121 | 32.0 | 127.7 | 95.7 | 0.85 | 9.8 | 0.33 | 1.47 | Divisadero | |

| Incl | 55.0 | 125.0 | 70.0 | 1.10 | 11.8 | 0.56 | 1.88 | ||

Notes:

- Grades/widths of mineralized intervals represent complete “from” “to” drill depths as shown.

- The hole was drilled at a 70-degree inclination. The true width of the mineralized zone in this new area is currently unknown.

- Gold Equivalent calculated using the following metal prices – $1250/oz gold, $16/oz silver and $2.85/lb copper.

Figure 1 – Drill Hole Location Map

All diamond drill samples were collected by Minera Alamos personnel including the Company’s exploration geologists. Drill core samples were cut in half and divided into 1-2 m intervals. One half of the sample was bagged for analysis and the remaining half was logged by Minera Alamos personnel and stored for future reference. Blanks, duplicates, and standards were randomly inserted with the samples sent for analysis as part of the normal QA/QC procedures.

All samples were prepared and analyzed for gold using fire assaying with AA/gravimetric finish. All samples were sent for sample preparation at the ALS-Chemex facility in Hermosillo, Mexico.

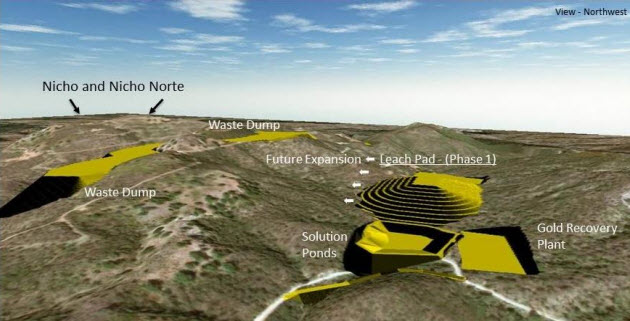

Figure 2 – Santana Overview Map

Mr. Darren Koningen, P. Eng., Minera Alamos’ CEO, is the Qualified Person responsible for the technical content of this press release under National Instrument 43-101. Mr. Koningen has supervised the preparation of, and has approved the scientific and technical disclosures in this news release.

For further information please contact:

About Minera Alamos

Minera Alamos is an advanced-stage exploration and development company with a growing portfolio of high-quality Mexican assets, including the La Fortuna open-pit gold project in Durango with positive PEA completed, the Santana open-pit heap-leach development project in Sonora with test mining and processing completed and the Guadalupe de Los Reyes open-pit gold-silver project in Sinaloa with mine planning in progress. The Company is awaiting the pending approval of permit applications related to the commercial production of gold at both the Santana and Fortuna projects.

The Company’s strategy is to develop low capex assets while expanding the project resources and pursue complementary strategic acquisitions.

Caution Regarding Forward-Looking Statements

This news release may contain forward-looking information and Minera Alamos cautions readers that forward-looking information is based on certain assumptions and risk factors that could cause actual results to differ materially from the expectations of Minera Alamos included in this news release. This news release includes certain “forward-looking statements”, which often, but not always, can be identified by the use of words such as “believes”, “anticipates”, “expects”, “estimates”, “may”, “could”, “would”, “will”, or “plan”. These statements are based on information currently available to Minera Alamos and Minera Alamos provides no assurance that actual results will meet management’s expectations. Forward-looking statements include estimates and statements with respect to Minera Alamos’ future plans with respect to the Projects, objectives or goals, to the effect that Minera Alamos or management expects a stated condition or result to occur and the expected timing for release of a resource and reserve estimate on the Projects. Since forward-looking statements are based on assumptions and address future events and conditions, by their very nature they involve inherent risks and uncertainties. Actual results relating to, among other things, results of exploration, the economics of processing methods, project development, reclamation and capital costs of Minera Alamos’ mineral properties, the ability to complete a preliminary economic assessment which supports the technical and economic viability of mineral production could differ materially from those currently anticipated in such statements for many reasons. Minera Alamos’ financial condition and prospects could differ materially from those currently anticipated in such statements for many reasons such as: an inability to finance and/or complete an updated resource and reserve estimate and a preliminary economic assessment which supports the technical and economic viability of mineral production; changes in general economic conditions and conditions in the financial markets; changes in demand and prices for minerals; litigation, legislative, environmental and other judicial, regulatory, political and competitive developments; technological and operational difficulties encountered in connection with Minera Alamos’ activities; and other matters discussed in this news release and in filings made with securities regulators. This list is not exhaustive of the factors that may affect any of Minera Alamos’ forward-looking statements. These and other factors should be considered carefully and readers should not place undue reliance on Minera Alamos’ forward-looking statements. Minera Alamos does not undertake to update any forward-looking statement that may be made from time to time by Minera Alamos or on its behalf, except in accordance with applicable securities laws.

NEITHER TSX VENTURE EXCHANGE NOR ITS REGULATION SERVICES PROVIDER (AS THAT TERM IS DEFINED IN THE POLICIES OF THE TSX VENTURE EXCHANGE) ACCEPTS RESPONSIBILITY FOR THE ADEQUACY OR ACCURACY OF THIS RELEASE.

Original Article: http://www.mineraalamos.com/files/3CCDAEDC-2BE5-4A3F-95F72E4BCC58DC8A.pdf