HALIFAX, NS, Jan. 10, 2024 /PRNewswire/ – GoGold Resources Inc. (TSX: GGD) (OTCQX: GLGDF) (“GoGold”, “the Company”) is pleased to provide an outlook of milestones and deliverables for 2024.

“2023 was another year of significant advancements of the Los Ricos district. In less than five years, we have taken the district from having no resources to having 186 million silver equivalent (AgEq) ounces of measured & indicated resources and 87 million AgEq ounces of inferred resources. We also completed two preliminary economic assessments (“PEA”), in each of Los Ricos South and Los Ricos North which showed a combined total NPV of US$871M for the district. Additionally, in 2023 we applied for a permit to construct a mine at Los Ricos South. We’re very proud of our technical team’s ability to achieve these significant accomplishments in less than five years at Los Ricos, and now we look to the future,” Brad Langille, President and CEO stated. “In 2024, we see the following key milestones:

- Complete commissioning of SART Zinc circuit in January at Parral, as we enter our tenth year of production;

- Advancing directly from the PEA completed at Los Ricos South in 2023 to a definitive feasibility study to be completed within first six months of 2024;

- Completion of Los Ricos South mine permitting technical review process in first calendar quarter of 2024, anticipating receipt of permit by mid year pending governmental review;

- Make construction decision at Los Ricos South after completion of feasibility study and receipt of mine permit;

- Initiate construction of electrical and water infrastructure at Los Ricos South by end of 2024;

- Enter into definitive agreement on debt financing for balance of funds required for construction of Los Ricos South, initial discussions with prospective lenders have generated significant interest;

- Assess potential debt financing options that will allow flexibility to advance Los Ricos North towards a construction decision during the potential construction of Los Ricos South.

With the above and supported by our strong balance sheet including our year end cash balance of $95 million USD (see financial results PR dated December 19, 2023), 2024 is sure to be a transformational year for GoGold as it advances towards a substantial low-cost silver producer.”Parral Update

At Parral, the SART Zinc circuit was constructed on time and on budget over the previous two quarters, and the commissioning process should be completed by the end of January.

Summary of Zinc circuit effects:

- Saleable zinc precipitate to be added to the revenue stream;

- Regeneration of approximately 750 tons of cyanide per quarter;

- Anticipated to generate net increased cash flows of $1.5 million per quarter;

- Zinc circuit capital expenditure as planned at $2 million over 6 month construction period;

- Project payback expected within 6 months after construction;

- Parral up to end of its mine life will be a producer of silver, gold, copper and zinc;

- Expected to result in better precious metals recovery;

- Completed on time and on budget.

“The completion of the zinc circuit in the SART is important as it expected to generate approximately $500,000 per month for cash flow, which will pay back the $2M capex quickly. We believe it will improve the metallurgical recoveries of gold and silver on the material which we are processing currently, so we expect to see production increase once commissioning is completed,” said Brad Langille, President and CEO.

Table 1: Quarterly Production Summary

| Quarter Ended | Sep 2022 | Dec 2022 | Mar 2023 | Jun 2023 | Sep 2023 | Dec 2023 |

| Silver Production (oz) | 145,944 | 159,838 | 173,717 | 203,894 | 169,443 | 109,016 |

| Gold Production (oz) | 2,278 | 2,399 | 2,016 | 1,512 | 1,106 | 1,848 |

| Copper Production (tonnes) | 124 | 222 | 143 | 135 | 115 | 95 |

| Silver Equivalent Production (oz)1 | 400,467 | 441,217 | 400,145 | 375,112 | 300,789 | 300,260 |

- “Silver equivalent production” include gold ounces and copper tons produced and converted to a silver equivalent based on a ratio of the average market metal price for each period. The gold:silver ratio for each of the periods presented was: Sep 2022 – 90, Dec 2022 – 82, Mar 2023 – 84, Jun 2023 – 82, Sep 2023 – 83, Dec 2023 – 85. The copper:silver ratios were: Jun 2022 – 415, Sep 2022 – 398, Dec 2022 – 377, Mar 2023 – 399, Jun 2023 – 352, Sep 2023 – 356, Dec 2023 – 356.

Los Ricos South

During 2023, the Company completed an updated Mineral Resource Estimate (“MRE”) and updated PEA at Los Ricos South, with details provided below. For 2024, GoGold will work with our technical team and consultants to complete all engineering and technical work required to make a construction decision on the project in the upcoming year. As part of this work, the Company is in the process of completing a definitive feasibility study and front-end engineering design which is expected to be released in the first six months of 2024, and advancing the mine permitting application process. P&E Mining Consultants Inc. has been selected as the lead author of the study, supported by Ausenco for the process and mill design.

2023 Mineral Resource Estimate and PEA

The Los Ricos South Mineral Resource Estimate and PEA were previously announced in a news release dated September 12, 2023, with an effective date of the Report of September 12, 2023. See that news release or the 43-101 compliant technical report filed on SEDAR on October 27, 2023 for details, in addition to the following summary.

Highlights of the PEA, with a base case silver price of US$23.75/oz and gold price of US$1,850/oz are as follows (all figures in US dollars unless otherwise stated):

- After-Tax net present value (“NPV”) (using a discount rate of 5%) of US$458 Million with an After-Tax IRR of 37% (Base Case);

- 11-year mine life producing a total of 88 Million payable silver equivalent ounces (“AgEq”), consisting of 47 Million silver ounces, 493 Thousand gold ounces, and 14 Million pounds of copper;

- Initial capital costs of $148 Million, including $19 Million in contingency costs, over an expected 18 month build, additional expansion capital of $69 Million, and sustaining capital costs of $72 Million over the life of mine (“LOM”);

- Average LOM operating cash costs of $8.15/oz AgEq, and all in sustaining costs (“AISC”) of $9.02/oz AgEq

- Average annual production of 8 Million AgEq oz;

- Approximately half of LOM metal production is long hole underground (“UG”), and approximately half is open pit (“OP”) mining.

Highlights of the updated Mineral Resource:

- Increase of 55% in Measured & Indicated Silver Equivalent (“AgEq”) Ounces from initial January 2021 MRE, with 39% increase in Measured & Indicated AgEq grade;

- Inclusion of 1.9 Million tonnes Measured & Indicated at excellent grade of 516 g/t AgEq in underground Eagle Deposit;

- Measured & Indicated Mineral Resource at LRS of 98.6 Million ounces AgEq grading 276 g/t AgEq contained in 11.1 Million tonnes (“Mt”);

- Increased confidence in MRE, with conversion of approximately 9 Million ounces AgEq from initial January 2021 Inferred Mineral Resources to Measured & Indicated, resulting in 13.6 Million ounces AgEq in Inferred Mineral Resources at LRS grading 185 g/t AgEq contained in 2.3 Mt;

- Total Los Ricos Measured & Indicated Mineral Resources of 186 Million ounces AgEq, including Los Ricos North

- Total Los Ricos Inferred Mineral Resources of 84 Million ounces AgEq, including Los Ricos North

Table 2 – LRS PEA Key Economic Assumptions and Results

| Assumption / Result | Unit | Value | Assumption / Result | Unit | Value | |

| Total OP Plant Feed Mined | kt | 9,367 | Net Revenue | US$M | 2,049 | |

| Total UG Plant Feed Mined | kt | 4,325 | Initial Capital Costs | US$M | 148 | |

| Total Plant Feed Mined | kt | 13,692 | Expansion Capital Costs | US$M | 69 | |

| Operating Strip Ratio | Ratio | 7.4 | Sustaining Capital Costs | US$M | 72 | |

| Silver Grade1 | g/t | 125 | OP Mining Costs | $/t Plant Feed | 12.13 | |

| Gold Grade1 | g/t | 1.18 | UG Mining Costs | $/t Plant Feed | 43.85 | |

| AgEq Grade1 | g/t | 217 | LOM Mining Costs | $/t Plant Feed | 22.15 | |

| Silver Recovery | % | 86 | Operating Cash Cost | US$/oz AgEq | 8.15 | |

| Gold Recovery | % | 95 | All in Sustaining Cost | US$/oz AgEq | 9.02 | |

| Silver Price | US$/oz | 23.75 | Mine Life | Yrs | 11 | |

| Gold Price | US$/oz | 1,850 | Average process rate | t/day | 3,359 | |

| Copper Price | US$/lb | 4.00 | After-Tax NPV (5% discount) | US$M | 458 | |

| Payable Silver Metal | Moz | 46.8 | Pre-Tax NPV (5% discount) | US$M | 708 | |

| Payable Gold Metal | koz | 493.1 | After-Tax IRR | % | 36.6 | |

| Payable Copper | Mlb | 13.6 | Pre-Tax IRR | % | 49.1 | |

| Payable AgEq | Moz | 87.5 | After-Tax Payback Period | Yrs | 2.3 |

- Grades shown are LOM average process plant feed grades including both OP and UG sources. External dilution of approximately 10% for OP material and 28% for UG material was incorporated in the mining schedule.

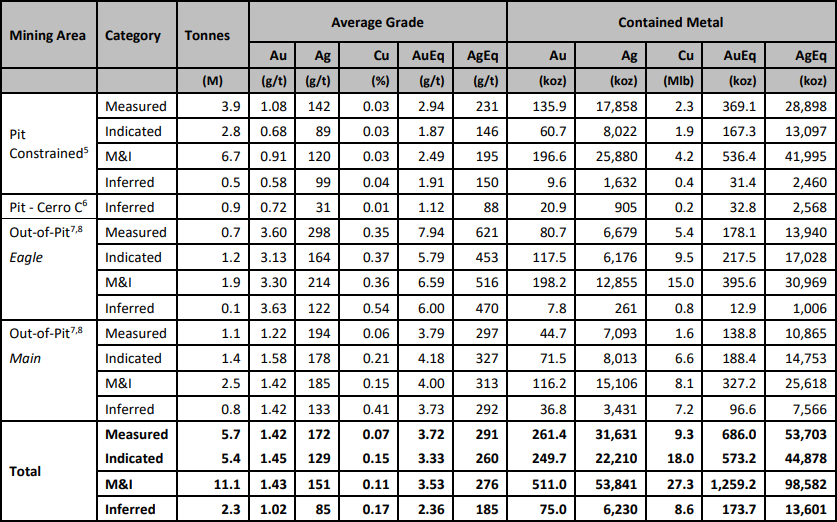

Los Ricos South Mineral Resource Estimate

The basis for the PEA is the Mineral Resource Estimate completed by P&E for the Los Ricos South Project located in Jalisco State, Mexico, which has an effective date of September 12, 2023, which is available on SEDAR. A summary of the Mineral Resource Estimate is provided in Table 3.

Table 3: Los Ricos South Mineral Resource Estimate – Pit Constrained and Out-of-Pit(1-9)

- Mineral Resources which are not Mineral Reserves do not have demonstrated economic viability. The estimate of Mineral Resources may be materially affected by environmental, permitting, legal, title, taxation, socio-political, marketing, or other relevant issues.

- The Inferred Mineral Resource in this estimate has a lower level of confidence than that applied to an Indicated Mineral Resource and must not be converted to a Mineral Reserve. It is reasonably expected that the majority of the Inferred Mineral Resource could be upgraded to an Indicated Mineral Resource with continued exploration.

- The Mineral Resources in this news release were estimated in accordance with the Canadian Institute of Mining, Metallurgy and Petroleum (CIM), CIM Standards on Mineral Resources and Reserves, Definitions and Guidelines prepared by the CIM Standing Committee on Reserve Definitions and adopted by the CIM Council.

- Historically mined areas were depleted from the Mineral Resource model.

- The pit constrained AgEq cut-off grade of 38 g/t Ag was derived from US$1,800/oz Au price, US$23.00/oz Ag price, 85% Ag and 95% Au process recovery, US$25/tonne process and G&A cost. The constraining pit optimization parameters were $2.10/t mineralized material and waste mining cost, and 45-degree pit slopes.

- Cerro Colorado Resource constrained to open pit mining methods only; out-of-pit Mineral Resources are restricted to the Eagle and Abra mineralized veins, which exhibit historical continuity and reasonable potential for extraction by cut and fill and longhole mining methods.

- The out-of-pit AgEq cut-off grade of 130 g/t Ag was derived from US$1,800/oz Au price, US$23.00/oz Ag price, 85% Ag and 95% Au process recovery, US$33/tonne process and G&A cost, and a $50/tonne mining cost. The out-of-pit Mineral Resource grade blocks were quantified above the 130 g/t AgEq cut-off, below the constraining pit shell and within the constraining mineralized wireframes. Out–of-Pit Mineral Resources are restricted to the Los Ricos and Rascadero Veins, which exhibit historical continuity and reasonable potential for extraction by cut and fill and longhole mining methods.

- AgEq and AuEq were calculated at an Ag/Au ratio of 78.2:1 for pit constrained and out-of-pit Resources.

- Totals may not sum due to rounding.

Los Ricos North

During 2023, the Company completed an updated PEA at Los Ricos North. For 2024, the Company will assess all technical and debt financing proposals that may allow the continued advancement of the project towards a construction decision, even during a potential construction phase of Los Ricos South should a construction decision be made on that project.

The highlights of the PEA were previously announced in a news release dated May 17, 2023, and the effective date of the Report is May 17, 2023. See that news release or the 43-101 compliant technical report filed on SEDAR on June 30, 2023 for details, in addition to the following summary.

Highlights of the PEA, with a base case silver price of US$23/oz and gold price of US$1,800/oz are as follows (all figures in US dollars unless otherwise stated):

- After-Tax NPV (using a discount rate of 5%) of $413 Million with an After-Tax IRR of 29% (Base Case);

- 13-year mine life producing a total of 110.3 Million payable silver equivalent ounces (“AgEq”), consisting of 68.0 Million silver ounces, 221,700 gold ounces, 22.8 Million pounds of copper, 144.1 Million pounds of lead and 242.2 Million pounds of zinc;

- Initial capital costs of $221 Million, including $29 Million in contingency costs, over an expected 18 month build, additional expansion capital of $137 Million, and sustaining capital costs of $6 Million over the life of mine (“LOM”);

- Average LOM operating cash costs of $9.50/oz AgEq, and all in sustaining costs (“AISC”) of $9.68/oz AgEq

- Average annual production of 8.8 Million AgEq oz in years one through twelve;

- Approximately 3/4 of LOM production is from four open pits containing oxide mineralization and approximately 1/4 is from a separate open pit which contains only sulphide mineralization.

Table 4 – Los Ricos North PEA Key Economic Assumptions and Results

| Assumption / Result | Unit | Value | Assumption / Result | Unit | Value | |

| Total Oxide Feed Mined | kt | 25,557 | Net Revenue | US$M | 2,307 | |

| Total Sulphide Feed Mined | kt | 9,964 | Initial Capital Costs | US$M | 221 | |

| Total Plant Feed Mined | kt | 35,521 | Expansion and Sustaining Capital Costs | US$M | 143 | |

| Total Strip Ratio | Ratio | 6.0 | Mining Costs | $/t Mined | 2.07 | |

| Mine Life | Yrs | 13 | Mining Costs | $/t Plant Feed | 12.28 | |

| Average process rate | t/day | 8,000 | Operating Cash Cost | US$/oz AgEq | 9.50 | |

| Silver Price | US$/oz | 23.00 | All in Sustaining Cost | US$/oz AgEq | 9.68 | |

| Gold Price | US$/oz | 1,800 | After-Tax NPV (5% discount) | US$M | 413 | |

| Copper Price | US$/lb | 4.00 | Pre-Tax NPV (5% discount) | US$M | 645 | |

| Lead Price | US$/lb | 1.00 | After-Tax IRR | % | 29.1 | |

| Zinc Price | US$/lb | 1.40 | Pre-Tax IRR | % | 39.8 | |

| Payable AgEq | Moz | 110.3 | After-Tax Payback Period | Yrs | 3.0 |

Table 5 – Los Ricos North PEA Summary of Physical Attributes

| Attribute | Unit | Oxide | Sulphide | Total |

| Plant Feed Mined | kt | 25,557 | 9,964 | 35,521 |

| Silver Grade1 | g/t | 83.2 | 30.1 | 68.3 |

| Gold Grade1 | g/t | 0.29 | 0.07 | 0.23 |

| Copper Grade1 | % | – | 0.12 | – |

| Lead Grade | % | – | 0.87 | – |

| Zinc Grade | % | – | 1.24 | – |

| Silver Recovery | % | 87 | 88 | 87 |

| Gold Recovery | % | 87 | 76 | 86 |

| Copper Recovery | % | – | 89 | 89 |

| Lead Recovery | % | – | 75 | 75 |

| Zinc Recovery | % | – | 89 | 89 |

| Payable Silver | Moz | 59.5 | 8.5 | 68.0 |

| Payable Gold | koz | 205.2 | 16.5 | 221.7 |

| Payable Copper | Mlb | – | 22.8 | 22.8 |

| Payable Lead | Mlb | – | 144.1 | 144.1 |

| Payable Zinc | Mlb | – | 242.2 | 242.2 |

| Payable AgEq | Moz | 75.5 | 34.8 | 110.3 |

- Grades shown are LOM average plant feed grades. Dilution of approximately 10% was used.

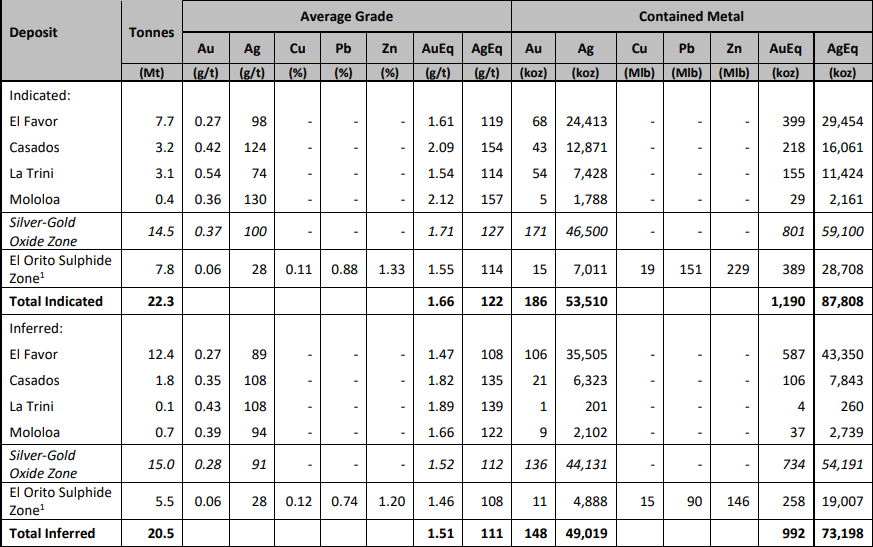

Los Ricos North – Mineral Resource Estimate

The basis for the PEA is the Mineral Resource Estimate completed by P&E in the National Instrument 43-101 Technical Report on the Initial Mineral Resource Estimate for the Los Ricos North Project located in Jalisco State, Mexico, which has an effective date of December 1, 2021. A summary of the Mineral Resource Estimate is provided in Table 6.

Table 6: Los Ricos North Mineral Resource Estimate (1-11)

- El Orito is a silver-base metal sulphide zone, all other deposits are silver-gold oxide zones.

- Mineral Resources which are not Mineral Reserves do not have demonstrated economic viability. The estimate of Mineral Resources may be materially affected by environmental, permitting, legal, title, taxation, socio-political, marketing, or other relevant issues.

- The Inferred Mineral Resource in this estimate has a lower level of confidence than that applied to an Indicated Mineral Resource and must not be converted to a Mineral Reserve. It is reasonably expected that the majority of the Inferred Mineral Resource could be upgraded to an Indicated Mineral Resource with continued exploration.

- The Mineral Resources in this news release were estimated in accordance with the Canadian Institute of Mining, Metallurgy and Petroleum (CIM), CIM Standards on Mineral Resources and Reserves, Definitions and Guidelines (2014) prepared by the CIM Standing Committee on Reserve Definitions and adopted by the CIM Council and CIM Best Practices (2019).

- Historically mined areas were depleted from the Mineral Resource model.

- Approximately 98.9% of the Indicated and 91.3% of the Inferred contained AgEq ounces are pit constrained, with the remainder out-of-pit. See tables 4 and 6 for details of the split between pit constrained and out-of-pit deposits.

- The pit constrained AgEq cut-off grade of 29 g/t Ag was derived from US$1,550/oz Au price, US$21/oz Ag price, US$3.66/lb Cu, US$0.90/lb Pb, US$1.26/lb Zn, 93% process recovery for Ag and Au, 90% process recovery for Cu, 80% process recovery for Pb and Zn, US$18/tonne process and G&A cost. The constraining pit optimization parameters were US$2.00/t mineralized mining cost, US$1.50/t waste mining cost and 50-degree pit slopes.

- The out-of-pit AuEq cut-off grade of 119 g/t Ag was derived from US$1,550/oz Au price, US$21/oz Ag price, US$3.66/lb Cu, US$0.90/lb Pb, US$1.26/lb Zn, 93% process recovery for Ag and Au, 90% process recovery for Cu, 80% process recovery for Pb and Zn, US$57/t mining cost, US$18/tonne process and G&A cost. The out-of-pit Mineral Resource grade blocks were quantified above the 119 g/t AgEq cut-off, below the constraining pit shell within the constraining mineralized wireframes and exhibited sufficient continuity to be considered for cut and fill and longhole mining

- No Mineral Resources are classified as Measured.

- AgEq and AuEq calculated at an Ag/Au ratio of 73.8:1.

- Totals may not agree due to rounding

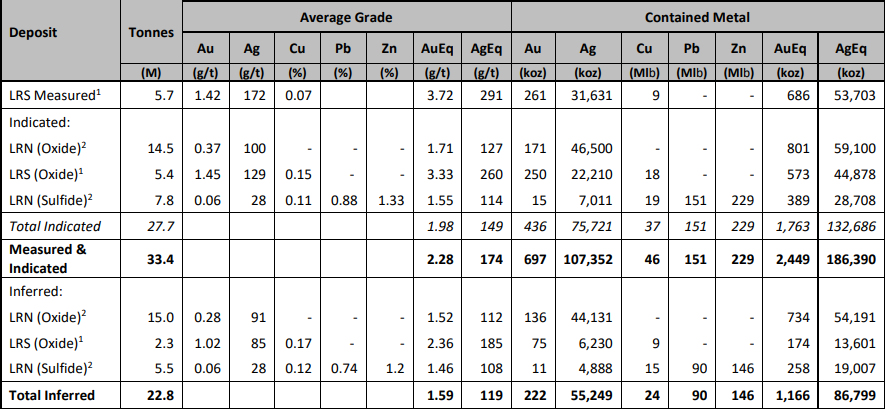

Los Ricos District – Combined Mineral Resource Estimate

The Los Ricos District, including both Los Ricos North and Los Ricos South, has a combined 186 million measured & indicated silver equivalent ounces and 84 million inferred silver equivalent ounces in Mineral Resource Estimates. See Figure 1 and Table 7 below for details.

Table 7: Los Ricos Mineral Resources – LRS & LRN(1-4)

- See Table 3 notes for assumptions

- See Table 6 notes for assumptions

- AgEq and AuEq calculated at an Ag/Au ratio of 87.5.

- Totals may not agree due to rounding.

Mr. Robert Harris, P.Eng. is the qualified person as defined by National Instrument 43-101 and is responsible for the technical information of this release related to Parral.

Mr. David Duncan, P. Geo. is the qualified person as defined by National Instrument 43-101 and is responsible for the technical information of this release related to Los Ricos North and Los Ricos South.

About GoGold Resources

GoGold Resources (TSX: GGD) is a Canadian-based silver and gold producer focused on operating, developing, exploring and acquiring high quality projects in Mexico. The Company operates the Parral Tailings mine in the state of Chihuahua and has the Los Ricos South and Los Ricos North exploration projects in the state of Jalisco. Headquartered in Halifax, NS, GoGold is building a portfolio of low cost, high margin projects. For more information visit gogoldresources.com.

CAUTIONARY STATEMENT:

The securities described herein have not been, and will not be, registered under the United States Securities Act of 1933, as amended (the “U.S. Securities Act”), or any state securities laws, and may not be offered or sold within the United States or to, or for the benefit of, U.S. persons (as defined in Regulation S under the U.S. Securities Act) except in compliance with the registration requirements of the U.S. Securities Act and applicable state securities laws or pursuant to exemptions therefrom. This release does not constitute an offer to sell or a solicitation of an offer to buy of any of GoGold’s securities in the United States.

This news release may contain “forward-looking information” as defined in applicable Canadian securities legislation. All statements other than statements of historical fact, included in this release, including, without limitation, statements regarding the Parral tailings project, the Los Ricos project, future operating margins, future production and processing, and future plans and objectives of GoGold, constitute forward looking information that involve various risks and uncertainties. Forward-looking information is based on a number of factors and assumptions which have been used to develop such information but which may prove to be incorrect, including, but not limited to, assumptions in connection with the continuance of GoGold and its subsidiaries as a going concern, general economic and market conditions, mineral prices, the accuracy of mineral resource estimates, and the performance of the Parral project There can be no assurance that such information will prove to be accurate and actual results and future events could differ materially from those anticipated in such forward-looking information.

Important factors that could cause actual results to differ materially from GoGold’s expectations include exploration and development risks associated with the GoGold’s projects, the failure to establish estimated mineral resources or mineral reserves, volatility of commodity prices, variations of recovery rates, and global economic conditions. For additional information with respect to risk factors applicable to GoGold, reference should be made to GoGold’s continuous disclosure materials filed from time to time with securities regulators, including, but not limited to, GoGold’s Annual Information Form. The forward-looking information contained in this release is made as of the date of this release.

SOURCE GoGold Resources Inc.